How We Can Raise Hundreds of Millions by Taxing Carried Interest

Across the country, states stand to gain billions of dollars in revenue by closing the carried interest loophole.

It’s a long overdue element of financial reform that the federal government has failed to enact, despite bipartisan support for tax fairness.

In last year’s Presidential campaign, Donald Trump, Hillary Clinton, Bernie Sanders, and Jeb Bush all called for closing a tax break known as the “carried interest loophole,” a legal fiction used by private equity firms and other members off the wealthy elite to lower their federal tax rates below those paid by many working Americans.[1]

Donald Trump, Hillary Clinton, Bernie Sanders, and Jeb Bush all called for closing a tax break known as the “carried interest loophole,” Share on XThese financiers charge a fee for investing other peoples’ money – and call it “carried interest” to get a lower tax rate than kindergarten teachers and truck drivers.[2]

Presidential candidates in both parties, experts, advocates and everyday Americans all agree that Wall Street millionaires and billionaires should not get preferential treatment on their taxes.[3]

It’s unfair and wrong. Smart reform can bring this practice to an end.

Closing the loophole would save the federal government an estimated $18 billion per year, according to an analysis by law professor Victor Fleischer.[4]

But huge sums of lobbying and campaign cash directed at Congress by hedge funds and private equity firms have stymied reform in Washington and fueled continued obstructionism.

Hedge fund and private equity managers gave millions of dollars to PACs and Super PACs that kept Congress in the hands of conservative Republicans, buying influence in this year’s tax policy discussions in Washington.[5]

And this same class of Wall Street billionaires are now taking high positions in the Trump cabinet and in regulatory agencies – in January Bloomberg said “private equity has the President-elect on speed dial,” [6] and predicted the new Trump Administration would not substantially close the lucrative loophole.

That’s why state action is crucial.

Across the country, legislatures can pass legislation to tax the carried interest income of private equity firms, hedge funds, and other financial entities headquartered in their respective states at the rate of ordinary income.

This report from Hedge Clippers uses hedge fund and private equity data from Preqin, to show that Connecticut could raise huge sums of revenue by acting to close the carried interest loophole.

Using a conservative methodology for estimating the potential annual revenues, the analysis in this report reveals that state action on carried interest could recapture many billions of dollars across the country, with hundreds of millions or billions for each state.

In states like New York, Massachusetts, Illinois, Connecticut and California, the estimated income to be gained by taxing carried interest at the state level is enormous.

Connecticut’s private equity and hedge funds are conservatively estimated to be earning $2.6 billion per year in under-taxed carried interest.

A state bill to recapture this revenue at the ordinary income level was introduced this month, and it would raise an estimated $520 million for schools, health care and essential public services in Connecticut.

CARRIED INTEREST LOOPHOLE: UNFAIR TAX BREAK FOR BILLIONAIRE HEDGE FUND MANAGERS

What is the carried interest loophole?

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income.

According to the New York Times, partners at private-equity firms and hedge funds typically treat a big portion of the fees they charge their clients as a capital gain — that is, as profit on the sale of an investment — so they can pay tax at the capital-gains rate of 20 percent (plus a surtax of 3.8 percent typically).

Ordinary income is taxed at a rate of up to 39.6 percent. But labeling fees as capital gains is a stretch, in part because the partners generally earn their fees by managing other people’s money, not by investing their own.[7]

Hedge fund and private equity funds are usually structured as partnerships. The fund manager is the general partner of the funds, and the investors are limited partners.

Investors often supply the majority of the capital, and the fund manager is supposed to supply investment expertise. For the services the investment manager provides, they charge certain fees.

In both hedge funds and private equity funds, the standard fee structure is “2 and 20”—two percent of the fund assets per year are taken as the management fee, which covers operating costs.

Twenty percent of all gains over a certain benchmark rate are taken by the fund manager as the performance fee.[8]

The problem comes from how that twenty percent performance fee is treated for tax purposes.

To an outsider, it may seem that this twenty percent fee is compensation for services. According to the Tax Policy Center, a joint project of the Brookings and Urban Institutes, the vast majority of tax analysts share this view.[9]

But the hedge fund and private equity industries treat “carried interest” fees as a unique type of income for tax and accounting purposes – not really service income, and definitely not investment income.

If we treated the performance fee as a fee for services, it would be federally taxed at the ordinary income level, where the highest marginal tax rate is currently 39.6%.

Instead, many fund managers treat this fee as an investment profit.

Profits on investments held longer than one year receive preferential treatment in the tax code, with the highest marginal rate on long-term capital gains set at 20%.[10]

Although fund managers using the carried interest loophole can’t take a capital loss, they do claim a capital gain.

The difference of 19.6% may not sound like a lot of money, but the academics estimate the tax revenue loss from the carried interest loophole to be $18 billion per year.[11]

State loophole-closing legislation should aim to “repatriate” the revenue lost to the loophole back to the states where “carried interest” investment fees were assessed.

States with a lot of hedge fund and private equity managers can raise hundreds of millions or billions of dollars – and all states can raise something, merely by imposing tax fairness on an out-of-control loophole.

WHO WOULD PAY IN CONNECTICUT: MEET THE BILLION-DOLLAR MEN

Connecticut is home to a small set of hedge fund and private equity managers who are among the richest human beings on the planet.

They’re benefitting from an unfair tax loophole that lets them avoid their fair share of taxes, while regular working people pay proper tax rates on their income, their property and their consumer purchases.

A fair-share state surtax on carried interest earnings would bring a measure of economic fairness to our state’s tax system – and raise hundreds of millions of dollars for public goods when we really need the money.

This report includes profiles of a few “high net worth individuals” (HNWIs, to use a financial industry term) that live and work in Connecticut while benefiting from the unfair carried interest loophole. They are among the few who would pay the proposed state surtax on carried interest.

These billionaires can afford it – and 3.5 million Connecticut residents can benefit.

STEVE COHEN

Point72 Asset Management

Net worth: $13 billion

- Cohen’s firm’s schemes to game drug trials resulted in extensive insider trading investigations and almost landed him in prison.[12]

PAUL TUDOR JONES

Tudor Investment Corporation

Net worth: $4.6 billion

- Tudor Jones is a major investor in dirty fossil fuels. In 2012, he acquired Castleton Commodities International, which owns hundreds of oil and gas wells.[16]

- Stone Lion Partners, a fund affiliated with Tudor Jones, is one of the vulture hedge funds pushing Puerto Rico into an economic and humanitarian crisis.[17]

- Tudor Jones owns not one, not two, but three private planes: a Bombardier global express jet, a Viking Air prop plane, and a French corporate jet– plus a helicopter. On top of that, Jones docks a 61-foot yacht at his house in the Florida Keys.[18]

- Tudor Jones owns at least three houses—an expensive Greenwich manse overlooking the Long Island Sound, a posh New York hunting lodge on a rolling expanse, and a Key West mansion with private cove to protect his yacht.[19]

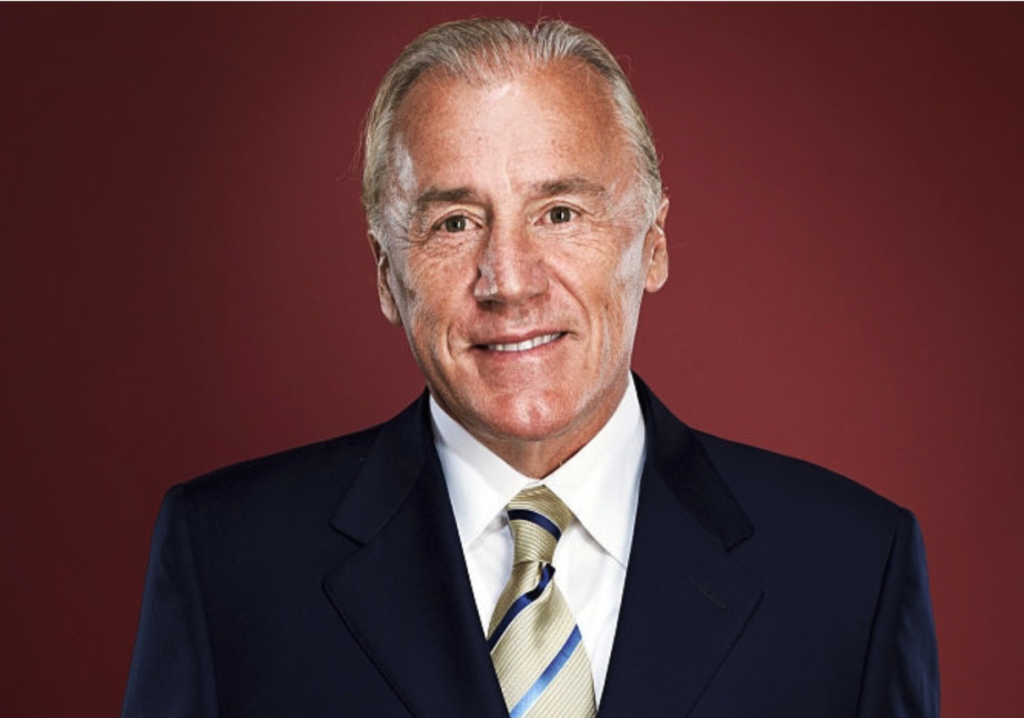

DEAN METROPOULOS

Dean Metropoulos & Co.

Net worth: $2.5 billion

- C. Dean Metropoulos is worth $2.5 billion dollars and is the 274th richest man in America.[20]

- Metropoulos bought Hostess Brand Cakes for $186 million in cash, and four years later he sold the corporation for $2.3 billion.

- While investments from Metropoulos and Apollo (another private equity firm) prevented liquidation of Hostess, the corporation now employs just 1,200 people – over 8,000 who lost their jobs during a 2012 bankruptcy.

- Under Metropoulos and Apollo, Hostess eventually cut an additional 415 jobs again — while the owners made a 1300% profit for themselves.

- Metropoulos was able to circumvent labor agreements with 18,500 unionized workers including bakers, drivers, and loaders and offload their pensions through ruthless use of bankruptcy laws.[21]

- A year after eliminating hundreds of jobs he had claimed they’d save, Metropoulos and Apollo borrowed an astounding $1.3 billion — most of which was used to pay themselves, investors, and dividend payments.

- Additionally, they set up a scheme to collect $400 million over the next 15 years from Hostess through future tax savings.[22]

- C. Dean Metropoulos’ son Daren recently purchased the Playboy Mansion for $105 million — the most expensive home sale in Los Angeles County history. Daren won’t have far to move, as he already owns the $18 million house next door to the Playboy Mansion.[23]

- The Metropoulos boys, Daren and Evan, were placed in charge of Pabst Beer by their father, and subsequently threw a party for hip-hop artist Snoop Dogg’s 41st birthday party in 2012 at the Playboy Mansion in Los Angeles.[24]

Ray Dalio

Bridgewater Associates

Net worth: $15.9 billion

- Last year, Dalio was the richest person in Connecticut with a net worth of $15.9 billion.[25]

- Bridgewater Associates is the world’s largest hedge fund, with about $150 billion under management.[26]

- Last May, Connecticut agreed to give Bridgewater $22 million in state subsidies in order to keep the firm in the state.[27]

- Bridgewater is known for its “cultish” internal culture. Dalio fancies himself as something of a philosopher and the firm is governed by 200 principles recorded in a “little white book of Mr. Dalio’s musings on life and business that some on Wall Street has likened to a religious text.”[28]

- In Principles, Dalio seems to compare Bridgewater to a pack of hyenas attacking a wildebeest, saying,“…when a pack of hyenas takes down a young wildebeest, is this good or bad? At face value, this seems terrible; the poor wildebeest suffers and dies. Some people might even say that the hyenas are evil. Yet this type of apparently evil behavior exists throughout nature through all species and was created by nature, which is much smarter than I am, so before I jump to pronouncing it evil, I need to try to see if it might be good.[29]

- Dalio says he has established a policy of “radical transparency” in the fund’s office. But last year a Bridgewater employee filed a complaint with the Connecticut Commission on Human Rights and Opportunities describing the hedge fund as a “cauldron of fear and intimidation.”[30] The employees complaint described “an atmosphere of constant surveillance by video and recording of all meetings—and the presence of patrolling security guards—that silence employees who do not fit the Bridgewater mold.”[31]

- One former Bridgewater employee who filed a complaint against the firm said employees were required to surrender and lock up their personal cell phones when arriving at work each morning. Another said his male supervisor sexually harassed him by propositioning him for sex and discussing sex during work trips.[32]

- A NLRB complaint against Bridgewater contends that the firm “has been interfering with, restraining and coercing” employees from exercising their rights through confidentiality agreements that all employees must sign when hired.[33]

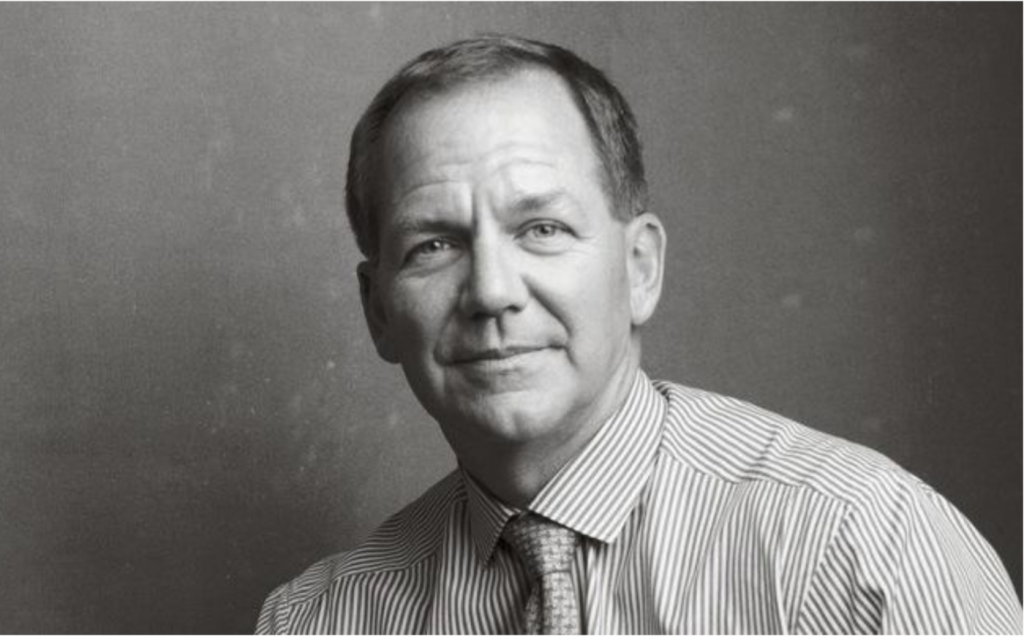

William E. Macaulay

First Reserve Corporation

Net worth: $1.3 billion

- Macaulay runs First Reserve Corporation, the world’s largest private equity firm for energy. He is worth $1.3 billion and has been listed in Forbes’ list of the 400 richest people in America.[37]

- Macaulay and First Reserve established Alpha Natural Resources in 2002. After, First Reserve’s involvement the company went on in 2014 to pay the largest fine in history to the EPA of $27.5 million plus an additionally $200 million to pay for the illegal toxic discharges the company had pumped into hundreds of waterways in five states.[38]

- In 2016, First Reserve paid $3.5 million in settlement to the SEC for conflict-of-interest charges for allocating fees, expenses, and insurance premiums without disclosing them to the funds limited partners.[39]

Cliff Asness AQR Capital

AQR Capital

- Asness is the founder of AQR Capital and a member of the Founders Council of the Managed Funds Association,[40] which lobbies to protect the carried interest loophole. [41]

- He currently manages over $132 billion in assets according to Forbes[42], although his firm lost half its money during the financial crisis in 2007-08.[43]

- AQR is a major investor in dirty energy and fossil fuels—and Asness has been one of the most outspoken hedge fund managers to play down the effects of climate change. According to their most recent SEC filings, AQR owns over $2 billion worth of equity in energy companies including a $371 million stake in ExxonMobil.[44]

- In March 2015, Asness circulated a paper entitled “It’s not the Heat, it’s the Tepidity,” which maintained climate change is not as serious as scientists say it is.[45]

- Asness lives in a 25,900 square foot mansion[46] in Greenwich’s renowned “backcountry” neighborhood.[47]

HEDGE FUNDS RIG THE SYSTEM IN WASHINGTON, DC TO KEEP THEIR TAX BREAK

Congress won’t act – because hedge funds and private equity firms are using millions of dollars in lobbying and campaign cash to keep the loophole open.

Hedge funds and banks have spent millions of dollars in campaign cash and lobbying to protect their loopholes and special treatment, blocking action in Congress.[48]

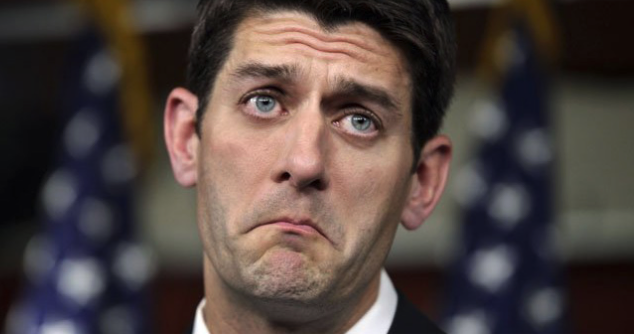

In last year’s elections, hedge fund and private equity managers were top givers to Senate Majority Leader Mitch McConnell, House Speaker Paul Ryan, and to leadership PACs and related Super PACs that kept Congress in the hands of conservative Republicans who have protected the carried interest loophole.

Tax bills originate in the House of Representatives. Hedge fund billionaires have taken care of themselves by taking care of top leadership there.

House Speaker Ryan is the number-one recipient of hedge fund and private equity donations in the House, and hedge fund billionaire Singer is his number-one donor.[49]

House Speaker Ryan is the number-one recipient of hedge fund and private equity donations in the House, and hedge fund billionaire Singer is his number-one donor.[49]

Singer, Griffin, Asness and fellow hedge fund billionaires Julian Robertson, Dan Loeb, Stanley Druckenmiller, Leon Black and multimillionaire Thomas McInerney are all in the top 25 donors to the Paul Ryan Super PAC “Congressional Leadership Fund,” giving a total of $5,217,000.[50]

And the money flows on the Senate side as well — bigly.

Hedge fund and private equity billionaires Paul Singer, Ken Griffin, Stephen Schwarzman and Cliff Asness were among the top givers to McConnell’s PACs and Super PACs giving an astounding total of $8,479,425: eight-and-a-half million dollars, just from the four of them.[51]

But fund managers are playing a long game to keep their tax breaks.

Hedge fund and private equity lobbying and political spending increased dramatically in 2007 — the same year Congress took steps to close the carried interest loophole.

That effort failed, as have subsequent efforts, due to a torrent of lobbying and campaign cash.

Lobbying spending by the hedge fund and private equity industries soared 455% in 2007, from $4.1 million in 2006 to over $23 million in 2007. It has never dropped back to pre-2007 levels.[52] [53]

Since 2007, the two industries have spent a combined average of $20 million per year on lobbying. By comparison, total lobbying spending from 2000 to 2006 was a mere $17.2 million ($2.5 million per year), less than the single year average since.

Industry associations have played a major role in this effort.

The Managed Funds Association, the hedge fund industry lobby, increased its lobbying spending five-fold in 2007, from $340,000 to $1.9 million.[54] The MFA has maintained this lobbying increase and spent over $4 million in 2015.

The private equity lobby, the Private Equity Growth Capital Council, was first established in 2007. It hit the ground running, spending $2.5 million on lobbying in its first year and over $20 million since.[55]

Campaign finance records show that this lobbying spending spree was coupled with an increase in campaign donations.

In 2007 and 2008, hedge funds and private equity firms increased their political giving by over three times, from $7.3 million in the 2006 cycle to $24.5 million in the 2008 cycle. In each election cycle since 2008, hedge funds and private equity have donated an average of $7.7 million and $15 million respectively.[56]

STATE-LEVEL ACTION TO CLOSE THE CARRIED INTEREST LOOPHOLE

Connecticut and other states can gain billions of dollars in new revenue by taking action where Congress won’t — by closing the carried interest loophole.

State legislatures should pass legislation to “repatriate” revenue lost to the federal-level loophole. We can tax the carried interest income of hedge fund and private equity partnerships headquartered in each state and bring the money home for investment in schools, housing, jobs and clean-energy infrastructure.

A closer look at the numbers: methodology for preparing the tax estimation

Datasets of all fund registered investment advisors were obtained from the SEC’s public database. This data was enriched with ADV Part 7(b) data, which contains private funds and their AUM.

Connecticut headquartered registered investment advisors were cross-referenced to the funds they manage by SEC file number. Combined, these funds had gross assets under management of $680.5bn and $116.2bn, respectively.

To estimate total earnings, we used private equity and hedge fund return benchmarks for a five-year period.

One uses the five-year average of leading hedge fund and private equity benchmarks, assuming that the large state sample sizes roughly track the mean. For hedge funds, we used the HFRI Fund Weighted Composite’s 60-month average.[57] For private equity, we used the Cambridge Associates U.S. Private Equity Index five-year end-to-end pooled return.[58] By multiplying the return benchmarks by the AUM, we came up with a rough estimation of expected annual earnings.

Next, the carried interest apportioned to hedge fund and private equity managers is estimated.

Carried interest applies only to the incentive fee earned by hedge fund and private equity managers. We used 15% of the total of hedge fund and private equity expected annual earnings to arrive at the expected aggregated fund manager annual earnings. We went with 15% because we believe this number to be extremely conservative.

With hedge funds, 20% is the industry standard and 17.14% was the industry average for new funds launched in 2013, as tracked by Preqin.[59] In private equity, the 20% standard is prevalent in 85% of co-mingled funds, according to a 2015 report by Preqin.[60] Separate accounts, where approximately one-third of investor capital was committed in late 2014,[61] are less likely to charge a 20% carry, although 90% charge 10% or more.[62]

To calculate the amount lost to carried interest exemptions, we halved the expected aggregate fund manager annual earnings.

This was done to reflect the individual reporting of taxes paid on partnerships interest in financial service partnerships. As Professor Victor Fleisher discovered in his work on the subject, the IRS Statistics of Income shows that roughly half of financial industry partnership income is paid at the favorable carried interest rate.[63] [64]

After halving this sum, we multiplied the remaining amount by 19.6%, the difference between the top bracket for short-term capital gains (equivalent to ordinary income, at 39.6%) and the top bracket for long-term capital gains (20%).

Connecticut carried interest calculations:

| AUM | Expected return | Expected annual return | Incentive fee | Expected aggregate fund manager annual earning | Halved | Expected revenue from carried interest surtax | |

| HF | $680,542,987,693 | 2.93% | $19,939,909,539.40 | 15% | $2,990,986,430.91 | $1,495,493,215.45 | $293,116,670.2292 |

| PE | $116,249,008,503 | 13.26% | $15,414,618,527.49 | 15% | $2,312,192,779.12 | $1,156,096,389.56 | $226,594,892.35 |

| TOTAL: | $ 519,711,562.58 |

footnotes

[1] http://www.usatoday.com/story/opinion/2015/09/15/hedge-fund-carried-interest-donald-trump-jeb-bush-editorials-debates/72268922/

[2] http://billmoyers.com/2015/09/17/why-do-kindergarten-teachers-pay-more-taxes-than-hedge-fund-managers/

[3] http://www.usatoday.com/story/opinion/2015/09/15/hedge-fund-carried-interest-donald-trump-jeb-bush-editorials-debates/72268922/

[4] http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html?_r=0

[5] http://hedgeclippers.org/hedgepapers-no-38-hedge-fund-billionaires-attack-the-hudson-valley/

[6] https://www.bloomberg.com/news/articles/2017-01-19/with-close-trump-ties-private-equity-eyes-tax-financial-reform

[7] http://mobile.nytimes.com/2016/03/11/opinion/new-york-challenges-a-tax-privilege-of-the-rich.html?_r=0

[8] https://www.fas.org/sgp/crs/misc/RS22689.pdf

[9] http://www.taxpolicycenter.org/briefing-book/key-elements/business/carried-interest.cfm

[10] Plus a 3.8% Medicare surtax

[11] http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html?_r=0

[12] https://www.nytimes.com/2016/01/09/business/dealbook/sec-and-steven-cohen-reach-settlement-in-insider-trading-case.html and https://www.bloomberg.com/view/articles/2016-01-08/steve-cohen-will-be-back-in-2018-that-s-good-

[13] http://www.cnbc.com/2016/06/06/billionaire-hedge-fund-manager-steve-cohen-tore-down-62-million-mansion.html

[14] http://fortune.com/steve-cohen-billionaire-point72-hedge-fund/

[15] http://fortune.com/2016/10/22/steve-cohen-art-billionaire-point72/

[16] http://www.cci.com/about-us/our-history, http://www.prnewswire.com/news-releases/castleton-commodities-international-llc-acquires-certain-east-texas-assets-from-edf-trading-resources-llc-300129413.html http://www.reuters.com/article/2013/01/15/castleton-natgas-idUSL2N0AKJ8T20130115 and http://www.reuters.com/article/2013/01/15/castleton-natgas-idUSL2N0AKJ8T20130115

[17] http://www.pionline.com/article/20161123/ONLINE/161129934/puerto-rico-bondholder-groups-square-off-in-court

[18] http://hedgeclippers.org/paul-tudor-jones/

[19] http://hedgeclippers.org/paul-tudor-jones/

[20] http://www.forbes.com/profile/c-dean-metropoulos/

[21] https://www.nytimes.com/2016/12/10/business/dealbook/how-the-twinkie-made-the-super-rich-even-richer.html

[22] https://www.nytimes.com/2016/12/10/business/dealbook/how-the-twinkie-made-the-super-rich-even-richer.html

[23] http://www.forbes.com/sites/derekxiao/2016/06/10/billionaires-son-is-buying-playboy-mansion-for-a-reported-105-million-about-half-its-listed-price/#5ecc424639a0

[24] https://www.nytimes.com/2016/07/31/fashion/playboy-mansion-daren-metropoulos-hugh-hefner.html

[25] http://www.forbes.com/richest-in-state/#31c96d553125

[26] https://www.bloomberg.com/news/articles/2016-05-27/bridgewater-billionaire-led-hedge-fund-lands-connecticut-aid

[27] https://www.nytimes.com/2016/05/28/business/dealbook/biggest-hedge-fund-set-to-get-22-million-from-connecticut.html

[28] https://www.nytimes.com/2016/07/27/business/dealbook/bridgewater-associates-hedge-fund-culture-ray-dalio.html

[29] http://dealbreaker.com/2016/08/bridgwater-associates-videos/

[30] https://www.nytimes.com/2016/07/27/business/dealbook/bridgewater-associates-hedge-fund-culture-ray-dalio.html

[31] https://www.nytimes.com/2016/07/27/business/dealbook/bridgewater-associates-hedge-fund-culture-ray-dalio.html

[32] https://www.nytimes.com/2016/07/27/business/dealbook/bridgewater-associates-hedge-fund-culture-ray-dalio.html

[33] https://www.nytimes.com/2016/07/27/business/dealbook/bridgewater-associates-hedge-fund-culture-ray-dalio.html

[34] https://www.nytimes.com/2016/07/27/business/dealbook/bridgewater-associates-hedge-fund-culture-ray-dalio.html

[35] http://www.greenwichtime.com/news/article/Greenwich-reaps-conveyance-tax-windfall-after-5447027.php

[36] http://www.forbes.com/sites/morganbrennan/2013/05/19/asking-190-million-this-is-americas-new-most-expensive-home-for-sale/#4f3cc15ad506

[37] http://www.forbes.com/lists/2008/54/400list08_William-Macaulay_GZ4F.html

[38] https://www.yahoo.com/news/coal-firm-pay-record-fine-water-pollution-210635139–finance.html?ref=gs

[39] http://www.pionline.com/article/20160919/ONLINE/160919840/first-reserve-management-settles-with-sec-over-conflict-of-interest-charges

[40] https://www.managedfunds.org/about-mfa/member-directory/founders-council/

[41] http://hedgeclippers.org/hedgepapers-no-14-the-gift-of-greed-how-hedgefund-philanthropists-increase-inequality/

[42] http://www.forbes.com/sites/nathanvardi/2015/06/17/the-new-money-masters-cliff-asness/#565e44c4103a

[43] http://www.insidermonkey.com/hedge-fund/aqr+capital+management/71/

[44] https://whalewisdom.com/filer/aqr-capital-management-llc#/tabholdings_tab_link

[45] http://www.bloombergview.com/articles/2015-03-15/cliff-asness-should-manage-money-not-the-plane

[46] https://www.wsj.com/articles/SB10001424052970203889904577201043455977600

[47] http://www.courant.com/politics/capitol-watch/hc-got-an-extra-41-000-for-dinner-20160919-story.html

[48] http://thehill.com/blogs/congress-blog/economy-budget/257083-what-the-carried-interest-tax-loophole-reveals-about-our

[49] https://www.opensecrets.org/politicians/industries.php?cycle=2016&cid=N00004357&type=C&newmem=N

[50] https://www.opensecrets.org/outsidespending/contrib.php?cmte=C00504530&cycle=2016

[51] http://www.jsonline.com/story/news/politics/mitch-mcconnell/2016/10/24/updated-list-mcconnells-biggest-donors/92667300/

[52] http://www.opensecrets.org/industries/lobbying.php?cycle=2016&ind=f2700

[53] http://www.opensecrets.org/industries/lobbying.php?ind=F2600

[54] http://hedgeclippers.org/hedgepapers-no-14-the-gift-of-greed-how-hedgefund-philanthropists-increase-inequality/

[55] http://www.opensecrets.org/lobby/clientsum.php?id=D000036835&year=2007

[56] http://www.opensecrets.org/industries/summary.php?ind=f2700&recipdetail=A&sortorder=U&mem=Y&cycle=2014 & http://www.opensecrets.org/industries/summary.php?ind=F2600&recipdetail=A&sortorder=U&mem=Y&cycle=2014

[57] https://www.hedgefundresearch.com/mon_register/index.php?fuse=login_bd&1448033777

[58] http://www.cambridgeassociates.com/wp-content/uploads/2015/05/Public-USPE-Benchmark-2014-Q4.pdf

[59] https://www.preqin.com/blog/0/8340/hedge-funds-fees

[60] https://www.preqin.com/docs/press/Fund-Terms-Sep-15.pdf

[61] http://www.pionline.com/article/20141222/PRINT/312229973/assets-invested-in-separate-accounts-starting-to-add-up

[62] http://www.valuewalk.com/2015/09/48-of-private-equity-separate-accounts-charge-a-20-performance-fee/

[63] 56% of the income generated by finance and insurance partnerships in 2012 was taxed at this rate.

[64] www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html