Across the country, states stand to gain billions of dollars in revenue by closing the carried interest loophole.

It’s a long overdue element of financial reform that the federal government has failed to enact, despite bipartisan support for tax fairness.

In last year’s Presidential campaign, Donald Trump, Hillary Clinton, Bernie Sanders, and Jeb Bush all called for closing a tax break known as the “carried interest loophole,” a legal fiction used by private equity firms and other members off the wealthy elite to lower their federal tax rates below those paid by many working Americans.[1]

These financiers charge a fee for investing other peoples’ money – and call it “carried interest” to get a lower tax rate than kindergarten teachers and truck drivers.[2]

Presidential candidates in both parties, experts, advocates and everyday Americans all agree that Wall Street millionaires and billionaires should not get preferential treatment on their taxes.[3]

It’s unfair and wrong. Smart reform can bring this practice to an end.

Closing the loophole would save the federal government an estimated $18 billion per year, according to an analysis by law professor Victor Fleischer.[4]

But huge sums of lobbying and campaign cash directed at Congress by hedge funds and private equity firms have stymied reform in Washington and fueled continued obstructionism.

Hedge fund and private equity managers gave millions of dollars to PACs and Super PACs that kept Congress in the hands of conservative Republicans, buying influence in this year’s tax policy discussions in Washington.[5]

And this same class of Wall Street billionaires are now taking high positions in the Trump cabinet and in regulatory agencies – in January Bloomberg said “private equity has the President-elect on speed dial,”[6] and predicted the new Trump Administration would not substantially close the lucrative loophole.

That’s why state action is crucial.

Across the country, legislatures can pass legislation to tax the carried interest income of private equity firms, hedge funds, and other financial entities headquartered in their respective states at the rate of ordinary income.

This report from Hedge Clippers uses hedge fund and private equity data from Preqin, to show that Rhode Island could raise huge sums of revenue by acting to close the carried interest loophole.

Using a conservative methodology for estimating the potential annual revenues, the analysis in this report reveals that state action on carried interest could recapture many billions of dollars across the country, with hundreds of millions or billions for each state.

In states like New York, Massachusetts, Illinois, Connecticut and California, the estimated income to be gained by taxing carried interest at the state level is enormous.

Rhode Island’s private equity and hedge funds are conservatively estimated to be earning $402 million per year in under-taxed carried interest.

A state bill to recapture this revenue at the ordinary income level was introduced this month, and it would raise an estimated $39.4 million each year for schools, health care and essential public services in Rhode Island.

CARRIED INTEREST LOOPHOLE: UNFAIR TAX BREAK FOR BILLIONAIRE HEDGE FUND MANAGERS

What is the carried interest loophole?

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income.

According to the New York Times,

Partners at private-equity firms and hedge funds typically treat a big portion of the fees they charge their clients as a capital gain — that is, as profit on the sale of an investment — so they can pay tax at the capital-gains rate of 20 percent (plus a surtax of 3.8 percent typically).

Ordinary income is taxed at a rate of up to 39.6 percent. But labeling fees as capital gains is a stretch, in part because the partners generally earn their fees by managing other people’s money, not by investing their own.[7]

Hedge fund and private equity funds are usually structured as partnerships. The fund manager is the general partner of the funds, and the investors are limited partners.

Investors often supply the majority of the capital, and the fund manager is supposed to supply investment expertise. For the services the investment manager provides, they charge certain fees.

In both hedge funds and private equity funds, the standard fee structure is “2 and 20”—two percent of the fund assets per year are taken as the management fee, which covers operating costs.

Twenty percent of all gains over a certain benchmark rate are taken by the fund manager as the performance fee.[8]

The problem comes from how that twenty percent performance fee is treated for tax purposes.

To an outsider, it may seem that this twenty percent fee is compensation for services. According to the Tax Policy Center, a joint project of the Brookings and Urban Institutes, the vast majority of tax analysts share this view.[9]

But the hedge fund and private equity industries treat “carried interest” fees as a unique type of income for tax and accounting purposes – not really service income, and definitely not investment income.

If we treated the performance fee as a fee for services, it would be federally taxed at the ordinary income level, where the highest marginal tax rate is currently 39.6%.

Instead, many fund managers treat this fee as an investment profit.

Profits on investments held longer than one year receive preferential treatment in the tax code, with the highest marginal rate on long-term capital gains set at 20%.[10]

Although fund managers using the carried interest loophole can’t take a capital loss, they do claim a capital gain.

The difference of 19.6% may not sound like a lot of money, but the academics estimate the tax revenue loss from the carried interest loophole to be $18 billion per year.[11]

State loophole-closing legislation should aim to “repatriate” the revenue lost to the loophole back to the states where “carried interest” investment fees were assessed.

States with a lot of hedge fund and private equity managers can raise hundreds of millions or billions of dollars – and all states can raise something, merely by imposing tax fairness on an out-of-control loophole.

HEDGE FUNDS RIG THE SYSTEM IN WASHINGTON, DC TO KEEP THEIR TAX BREAK

Congress won’t act – because hedge funds and private equity firms are using millions of dollars in lobbying and campaign cash to keep the loophole open.

Hedge funds and banks have spent millions of dollars in campaign cash and lobbying to protect their loopholes and special treatment, blocking action in Congress.[12]

In last year’s elections, hedge fund and private equity managers were top givers to Senate Majority Leader Mitch McConnell, House Speaker Paul Ryan, and to leadership PACs and related Super PACs that kept Congress in the hands of conservative Republicans who have protected the carried interest loophole.

Tax bills originate in the House of Representatives. Hedge fund billionaires have taken care of themselves by taking care of top leadership there.

House Speaker Ryan is the number-one recipient of hedge fund and private equity donations in the House, and hedge fund billionaire Singer is his number-one donor.[13]

Singer, Griffin, Asness and fellow hedge fund billionaires Julian Robertson, Dan Loeb, Stanley Druckenmiller, Leon Black and multimillionaire Thomas McInerney are all in the top 25 donors to the Paul Ryan Super PAC “Congressional Leadership Fund,” giving a total of $5,217,000.[14]

And the money flows on the Senate side as well — bigly.

Hedge fund and private equity billionaires Paul Singer, Ken Griffin, Stephen Schwarzman and Cliff Asness were among the top givers to McConnell’s PACs and Super PACs giving an astounding total of $8,479,425: eight-and-a-half million dollars, just from the four of them.[15]

But fund managers are playing a long game to keep their tax breaks.

Hedge fund and private equity lobbying and political spending increased dramatically in 2007 — the same year Congress took steps to close the carried interest loophole.

That effort failed, as have subsequent efforts, due to a torrent of lobbying and campaign cash.

Lobbying spending by the hedge fund and private equity industries soared 455% in 2007, from $4.1 million in 2006 to over $23 million in 2007. It has never dropped back to pre-2007 levels.[16][17]

Since 2007, the two industries have spent a combined average of $20 million per year on lobbying. By comparison, total lobbying spending from 2000 to 2006 was a mere $17.2 million ($2.5 million per year), less than the single year average since.

Industry associations have played a major role in this effort.

The Managed Funds Association, the hedge fund industry lobby, increased its lobbying spending five-fold in 2007, from $340,000 to $1.9 million.[18] The MFA has maintained this lobbying increase and spent over $4 million in 2015.

The private equity lobby, the Private Equity Growth Capital Council, was first established in 2007. It hit the ground running, spending $2.5 million on lobbying in its first year and over $20 million since.[19]

Campaign finance records show that this lobbying spending spree was coupled with an increase in campaign donations.

In 2007 and 2008, hedge funds and private equity firms increased their political giving by over three times, from $7.3 million in the 2006 cycle to $24.5 million in the 2008 cycle. In each election cycle since 2008, hedge funds and private equity have donated an average of $7.7 million and $15 million respectively.[20]

STATE-LEVEL ACTION TO CLOSE THE CARRIED INTEREST LOOPHOLE

Connecticut and other states can gain billions of dollars in new revenue by taking action where Congress won’t — by closing the carried interest loophole.

State legislatures should pass legislation to “repatriate” revenue lost to the federal-level loophole. We can tax the carried interest income of hedge fund and private equity partnerships headquartered in each state and bring the money home for investment in schools, housing, jobs and clean-energy infrastructure.

A closer look at the numbers: methodology for preparing the tax estimation

Datasets of all fund registered investment advisors were obtained from the SEC’s public database. This data was enriched with ADV Part 7(b) data, which contains private funds and their AUM.

Connecticut headquartered registered investment advisors were cross-referenced to the funds they manage by SEC file number. Combined, these funds had gross assets under management of $680.5bn and $116.2bn, respectively.

To estimate total earnings, we used private equity and hedge fund return benchmarks for a five-year period.

One uses the five-year average of leading hedge fund and private equity benchmarks, assuming that the large state sample sizes roughly track the mean. For hedge funds, we used the HFRI Fund Weighted Composite’s 60-month average.[21] For private equity, we used the Cambridge Associates U.S. Private Equity Index five-year end-to-end pooled return.[22] By multiplying the return benchmarks by the AUM, we came up with a rough estimation of expected annual earnings.

Next, the carried interest apportioned to hedge fund and private equity managers is estimated.

Carried interest applies only to the incentive fee earned by hedge fund and private equity managers. We used 15% of the total of hedge fund and private equity expected annual earnings to arrive at the expected aggregated fund manager annual earnings. We went with 15% because we believe this number to be extremely conservative.

With hedge funds, 20% is the industry standard and 17.14% was the industry average for new funds launched in 2013, as tracked by Preqin.[23] In private equity, the 20% standard is prevalent in 85% of co-mingled funds, according to a 2015 report by Preqin.[24] Separate accounts, where approximately one-third of investor capital was committed in late 2014,[25] are less likely to charge a 20% carry, although 90% charge 10% or more.[26]

To calculate the amount lost to carried interest exemptions, we halved the expected aggregate fund manager annual earnings.

This was done to reflect the individual reporting of taxes paid on partnerships interest in financial service partnerships. As Professor Victor Fleisher discovered in his work on the subject, the IRS Statistics of Income shows that roughly half of financial industry partnership income is paid at the favorable carried interest rate.[27] [28]

After halving this sum, we multiplied the remaining amount by 19.6%, the difference between the top bracket for short-term capital gains (equivalent to ordinary income, at 39.6%) and the top bracket for long-term capital gains (20%).

METHODOLOGY:

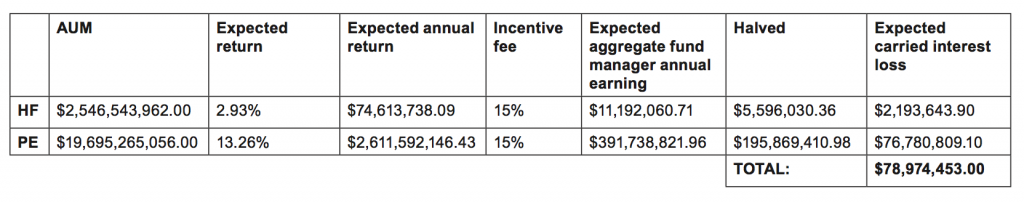

Datasets of all fund registered investment advisors were obtained from the SEC’s public database. This data was enriched with ADV Part 7(b) data, which contains private funds and their AUM. Rhode Island headquartered registered investment advisors were cross-referenced to the funds they manage by SEC le number. Asset under management data was available for 56 funds, representing four 7(b)(1) hedge funds and fifty-two 7(b)(1) private equity funds. Combined, these funds had gross assets under management of $2.5bn and $19.6bn, respectively, as of ADV filings dates received by the SEC as of October 2016. This represents a better pool of private equity and hedge funds managed by Rhode Island-headquartered advisors than was available on Preqin.

To estimate total earnings, we used private equity and hedge fund return benchmarks for a five year period. One uses the five year average of leading hedge fund and private equity benchmarks, assuming that the large state sample sizes roughly track the mean. For hedge funds, we used the HFRI Fund Weighted Composite’s 60 month average.[29] For private equity, we used the Cambridge Associates U.S. Private Equity Index 5 year end-to-end pooled return.[30] By multiplying the return benchmarks by the AUM, we came up with a rough estimation of expected annual earnings.

Next, the carried interest apportioned to hedge fund and private equity managers is estimated. Carried interest applies only to the incentive fee earned by hedge fund and private equity managers. We used 15% of the total of hedge fund and private equity expected annual earnings to arrive at the expected aggregated fund manager annual earnings. We went with 15% because we believe this number to be extremely conservative. With hedge funds, 20% is the industry standard and 17.14% was the industry average for new funds launched in 2013, as tracked by Preqin.[31] In private equity, the 20% standard is prevalent in 85% of co-mingled funds, according to a 2015 report by Preqin.[32] Separate accounts, where approximately one-third of investor capital was committed in late 2014,[33] are less likely to charge a 20% carry, although 90% charge 10% or more.[34]

To calculate the amount lost to carried interest exemptions, we halved the expected aggregate fund manager annual earnings. This was done to reflect the individual reporting of taxes paid on partnerships interest in financial service partnerships. As Professor Victor Fleisher discovered in his work on the subject, the IRS Statistics of Income shows that roughly half of financial industry partnership income is paid at the favorable carried interest rate.[35,][36]

After halving this sum, we multiplied the remaining amount by 19.6%, the difference between the top bracket for short-term capital gains (equivalent to ordinary income, at 39.6%) and the top bracket for long-term capital gains (20%).

HEDGE CLIPPERS: WHISTLEBLOWERS FOR WORKING PEOPLE

Instead of draining the swamp, Donald Trump brought it into the White House. Members of Trump’s inner circle include Wall Street billionaires with a history of destroying jobs, harming working people, and protecting the wealthiest Americans at everyone else’s expense.

Hedge Clippers unites organizations and movements to cut through Trump’s swamp, and blow the whistle on Trump’s advisors and appointees who put their own financial gain before the public good.

FOOTNOTES

[1] http://www.usatoday.com/story/opinion/2015/09/15/hedge-fund-carried-interest-donald-trump-jeb-bush-editorials-debates/72268922/

[2] http://billmoyers.com/2015/09/17/why-do-kindergarten-teachers-pay-more-taxes-than-hedge-fund-managers/

[3] http://www.usatoday.com/story/opinion/2015/09/15/hedge-fund-carried-interest-donald-trump-jeb-bush-editorials-debates/72268922/

[4] http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html?_r=0

[5] http://hedgeclippers.org/hedgepapers-no-38-hedge-fund-billionaires-attack-the-hudson-valley/

[6] https://www.bloomberg.com/news/articles/2017-01-19/with-close-trump-ties-private-equity-eyes-tax-financial-reform

[7] http://mobile.nytimes.com/2016/03/11/opinion/new-york-challenges-a-tax-privilege-of-the-rich.html?_r=0

[8] https://www.fas.org/sgp/crs/misc/RS22689.pdf

[9] http://www.taxpolicycenter.org/briefing-book/key-elements/business/carried-interest.cfm

[10] Plus a 3.8% Medicare surtax

[11] http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html?_r=0

[12] http://thehill.com/blogs/congress-blog/economy-budget/257083-what-the-carried-interest-tax-loophole-reveals-about-our

[13] https://www.opensecrets.org/politicians/industries.php?cycle=2016&cid=N00004357&type=C&newmem=N

[14] https://www.opensecrets.org/outsidespending/contrib.php?cmte=C00504530&cycle=2016

[15] http://www.jsonline.com/story/news/politics/mitch-mcconnell/2016/10/24/updated-list-mcconnells-biggest-donors/92667300/

[16] http://www.opensecrets.org/industries/lobbying.php?cycle=2016&ind=f2700

[17] http://www.opensecrets.org/industries/lobbying.php?ind=F2600

[18] http://hedgeclippers.org/hedgepapers-no-14-the-gift-of-greed-how-hedgefund-philanthropists-increase-inequality/

[19] http://www.opensecrets.org/lobby/clientsum.php?id=D000036835&year=2007

[20] http://www.opensecrets.org/industries/summary.php?ind=f2700&recipdetail=A&sortorder=U&mem=Y&cycle=2014 & http://www.opensecrets.org/industries/summary.php?ind=F2600&recipdetail=A&sortorder=U&mem=Y&cycle=2014

[21] https://www.hedgefundresearch.com/mon_register/index.php?fuse=login_bd&1448033777

[22] http://www.cambridgeassociates.com/wp-content/uploads/2015/05/Public-USPE-Benchmark-2014-Q4.pdf

[23] https://www.preqin.com/blog/0/8340/hedge-funds-fees

[24] https://www.preqin.com/docs/press/Fund-Terms-Sep-15.pdf

[25] http://www.pionline.com/article/20141222/PRINT/312229973/assets-invested-in-separate-accounts-starting-to-add-up

[26] http://www.valuewalk.com/2015/09/48-of-private-equity-separate-accounts-charge-a-20-performance-fee/

[27] 56% of the income generated by finance and insurance partnerships in 2012 was taxed at this rate.

[28] www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html

[29] https://www.hedgefundresearch.com/mon_register/index.php?fuse=login_bd&1448033777

[30] http://www.cambridgeassociates.com/wp-content/uploads/2015/05/Public-USPE-Benchmark-2014-Q4.pdf

[31] https://www.preqin.com/blog/0/8340/hedge-funds-fees

[32] https://www.preqin.com/docs/press/Fund-Terms-Sep-15.pdf

[33] http://www.pionline.com/article/20141222/PRINT/312229973/assets-invested-in-separate-accounts-starting-to-add-up

[34] http://www.valuewalk.com/2015/09/48-of-private-equity-separate-accounts-charge-a-20-performance-fee/

[35] 56% of the income generated by nance and insurance partnerships in 2012 was taxed at this rate.

[36] www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html