Pharma’s Failed Promise: How Big Pharma Hurts Workers, Dodges Taxes, and Extracts Billions in Puerto Rico

Download a version of the Spanish PDF of the report

August 2022

![]() The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy, and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org/about

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy, and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org/about

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. www.populardemocracy.org

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. www.populardemocracy.org

Executive Summary

Billion-dollar US pharmaceutical corporations like Pfizer, Johnson & Johnson, and Eli Lilly are among the dozens of pharma giants operating in Puerto Rico. Puerto Ricans produce more than half of the world’s top-selling prescription drugs used by patients with arthritis, stroke, and cancer. While pharma profits are booming, these gains do not reach Puerto Ricans. Pharma CEOs make $20 million per year on average, over 1,131 times what their lowest-paid Puerto Rican workers earn each year.

Across Puerto Rico’s nearly 50 drug manufacturing plants, US pharma corporations benefit from the services of cleaning staff, security guards, and landscaping workers who maintain and secure their facilities. A series of recent interviews with cleaning and security staff at pharmaceutical plants reveal the pharma sector’s troubling low road employment practices: minimum wages, inadequate benefits, and poor workplace safety. Occupational Safety and Health Administration data from the last decade shows around 80 violations or referrals at Puerto Rico-based pharmaceutical plants including for chemical exposures, scaldings, and amputations. Not one worker interviewed had the protection of a union, despite many global pharmaceuticals already being unionized employers in other geographies.

US pharmaceuticals extract enormous profits and wealth from Puerto Rico each year. Government officials have extended billions in lucrative tax giveaways to lure and retain these companies. Puerto Rico Treasury Department disclosures reveal corporate tax breaks to the manufacturing sector (of which pharma is a major player) will be a projected $14.568 billion in 2022 alone. These tax breaks are larger than the total operating budget of the Puerto Rican government. In total, the government is slated to give the manufacturing sector a staggering $100.5 billion between 2017-2023. These tax breaks fail to create large numbers of jobs for the archipelago’s 3.3 million people. FY2020 estimates found that tax breaks only generated 7,000 direct and indirect jobs, or 0.6% of the total labor force.

How do US pharmaceuticals maintain these lucrative tax breaks even as Puerto Rico faces a crippling debt crisis? Many point to conflicts of interest both within the Puerto Rican government and the unaccountable and unelected Fiscal Oversight and Management Board created by Congress to oversee Puerto Rico’s debt restructuring. Fiscal board member Antonio Medina is a former executive of the multinational pharmaceutical Merck who now has authority over tax abatement contracts involving the government of Puerto Rico. In addition, the fiscal control board’s key strategic advisor, McKinsey & Company, has received $100 million to advise Puerto Rico on the debt crisis but is also on the payroll of high-powered pharma clients like AbbVie.

Puerto Rican communities deserve and still lack robust public investments in quality education, renewable energy, clean air and water, quality healthcare, a reliable transit system, affordable housing, food security, waste management, and more. Instead, elected officials and the unelected fiscal control board prioritize billions in corporate tax giveaways. In light of this report’s findings, policymakers in Puerto Rico must ensure pharmaceutical corporations pay what they owe in taxes while ending their low-road employment practices by providing Puerto Rican workers a living wage, full health and other benefits, pensions, safe working conditions, job training, and more.

Pharma’s Puerto Rico Profiteering

US pharmaceutical corporations extract enormous profits and wealth from Puerto Rico. For decades, the pharmaceutical sector has dominated parts of the Puerto Rican economy. The Puerto Rican government has given away excessive tax breaks to pharmaceutical corporations like Eli Lilly, Johnson & Johnson, and Pfizer to attract them to the archipelago.[1]

The resulting economic rules unfairly favor wealthy pharmaceutical corporations over working families and small Puerto Rican-owned businesses – enriching CEOs and wealthy shareholders but exploiting Puerto Rican communities.[2]

Today Puerto Rico currently has nearly 50 FDA-approved pharmaceutical plants.[3] In fact, Puerto Ricans produce more than half of the world’s top-selling prescription drugs, which are used to treat patients with arthritis, stroke, cancer, and more.[4] Many of the working people fueling pharma’s profits in Puerto Rico face low salaries, inadequate or no benefits, unsafe working conditions, and no unions.[5]

This Hedge Clippers exposé draws on recent interviews with workers at pharmaceutical plants to reveal the pharma sector’s low road employment practices, especially among its subcontracted cleaning and security workers. The report also quantifies manufacturer tax breaks that pharmaceutical corporations take advantage of in PR─approximately $14.5 billion annually.[6] These billions in corporate tax breaks eclipse the total operating budget of the Puerto Rican government[7] and starve Puerto Rico communities of the investments in quality education, clean air and water, quality healthcare, and affordable housing that they deserve.

US pharmaceutical corporations operating in Puerto Rico pay next to nothing in taxes, amass billions in profits, enrich their CEOs and shareholders, and pay their Puerto Rican workers poverty wages.

Pharma Profits are Booming

While the COVID-19 pandemic caused unprecedented economic hardship for hundreds of millions worldwide, pharma profits boomed. Some pharma giants like Pfizer saw revenues double in 2021 to $81.3 billion (more than most countries’ Gross Domestic Product).[8]

Global 2021 Revenues for Key Pharma Players Operating in Puerto Rico

Over half of the world’s biggest global pharmaceutical corporations manufacture in Puerto Rico, including AbbVie, Amgen, Eli Lilly, and Johnson & Johnson (J&J).[16] Tens of thousands of Puerto Rican workers produce the medicines and run the facilities that fuel these profits.[17]

How does pharma amass these profits? Unfortunately, the pharma sector is notorious for price gouging and raising the cost of life-saving medicines. A recent Congressional investigation found widespread pharma price gouging that was “unsustainable, unjustified, and unfair to patients and taxpayers.”[18] Even when pharma corporations indicate they will stop raising drug prices, price hikes continue. For instance, just days after J&J CEO Alex Gorsky publicly said the pharma industry needs to improve prices, his company increased the cost of dozens of medicines.[19]

CEO Compensation Has Skyrocketed in the Pharma Sector

The CEOs of global pharmaceutical companies take home enormous salaries each year. Many corporate boards hiked up those compensation packages even higher during the pandemic. In 2021, Pfizer’s board gave CEO Albert Bourla a 15% raise, totaling $24.3 million in total compensation.[20]

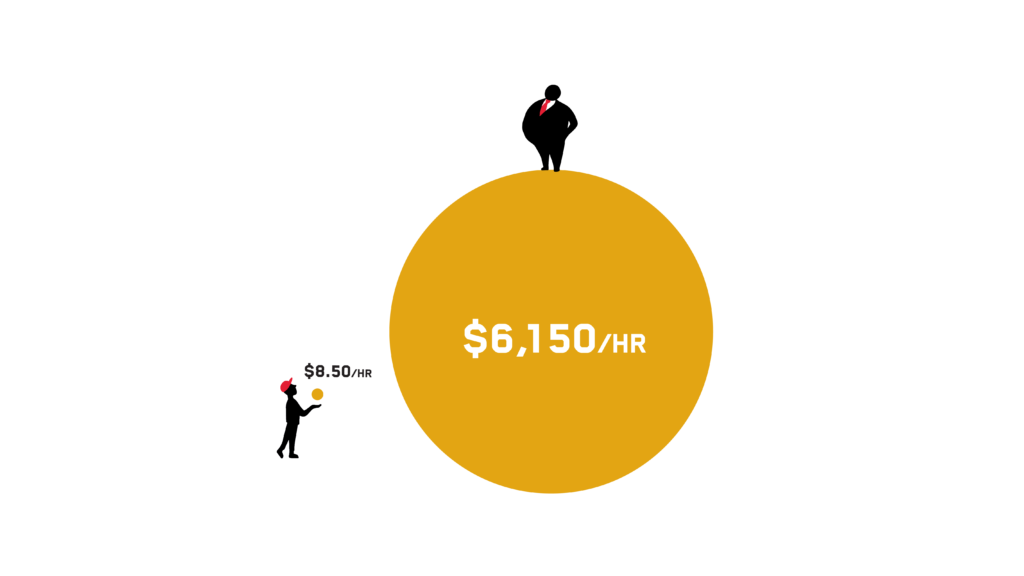

Pharma CEOs are given $20 million per year on average

CEOs seize over $6,150 PER HOUR in total compensation — a stark contrast to some people working at Puerto Rican pharmaceutical factories who report earning minimum wage, just $8.50 an hour.[25] On average, CEOs make over 1,131 times what their lowest-paid workers earn each year on the archipelago.

Alex Gorsky, Johnson & Johnson Executive Chairman (and former CEO from 2012-2021)–

Net Worth: an estimated $114 million.[26]

- Gorsky is consistently one of the highest-paid pharma CEOs, despite his company being embroiled in consumer protection lawsuits for its sale of opioids and talcum baby powder products linked to cancer.[27]

- Gorsky paid $9 million for a lavish Manhattan condo in 2016.[28]

- After 10 years as CEO, Gorsky handed the reins to Joaquin Duato in 2022.[29]

Pharma Stock Buybacks: Enriching Executives at the Expense of Patients and Workers

Pharma executives also use a “stock buyback” to further enrich themselves and their shareholders. Corporations rebuy their own shares on the open market to secure big profits for corporate executives, Wall Street firms, and rich investors.[30] In the last decade, many pharma giants have appeared on the list of top 25 corporate spenders on stock buybacks. Between 2019-2020:

-

- Pfizer spent $77 billion

- Johnson & Johnson spent $62 billion

- Amgen spent $52 billion

- Merck spent $46 billion[31]

Many corporate executives and CEOs earn the bulk of their compensation via stocks. In the short-term, they use stock buybacks to drive up the value of their company’s stock and, in the process, boost their own compensation.[32] In the US, where insulin for the uninsured retails between $4,200 to $10,800 per year, Pfizer could have redeployed that $77 billion in stock buybacks to instead provide at least seven million diabetic patients with free insulin for a year or covered the out-of-pocket expenses at least 2.4 million cancer patients incur in a given year.[33]

Pharmaceutical companies are notorious for not paying taxes

One analysis of nine pharma companies found they dodged a combined $140 billion in taxes by using offshore tax havens.[34] In some cases US pharmaceutical corporations are so effective at dodging taxes, they not only pay nothing; they actually get refunds. Puerto Rico’s excessive tax breaks are a major part of many US pharmaceuticals’ tax avoidance strategies. For instance, AbbVie’s effective income tax rate was negative nine percent in 2018 — which the company publicly attributed, in part, to generous tax incentives in Puerto Rico.[35]

Puerto Rico’s Low Road Employer: How Pharma is Hurting Working People

Billion-dollar pharmaceutical corporations currently employ tens of thousands of Puerto Rican workers on the archipelago.[36] Puerto Ricans produce more than half of the world’s top-selling prescription drugs, which are used to treat patients with arthritis, stroke, cancer, and more.[37]

Puerto Rican people working in pharma plants fill various jobs (including process and manufacturing technicians, packaging operators, quality control positions, and operations roles).[38] Puerto Rican workers are paid $23,000 per year, nearly half (and, in some cases, one third) what people in those same roles in various US states are paid.[39]

The pharmaceutical industry also relies on a less visible and even more vulnerable workforce. Across the industry’s nearly 50 PR-based drug manufacturing plants, US pharma corporations benefit from the services of cleaning staff, security guards, and groundskeeping workers who maintain and secure their facilities. In Puerto Rico, pharma corporations use third-party companies (for instance, ABM Industries, Fuller Group, and Securitas) to subcontract this workforce.

Worker Interviews Reveal Widespread Equity and Safety Issues in the Pharma Plants

A series of recent interviews with service workers at pharmaceutical plants in May and June 2022 revealed the pharma sector’s low road employment practices among its subcontracted workforce.

Among the workers interviewed, a top priority was higher wages. Workers also highlighted the need for more reliable schedules and hours, medical benefits, vacation time, and pensions. Lastly, many expressed a desire for more respect and dignity in the workplace.

Worker Interview

Kamila (pseudonym) is a mother of three who has worked as a cleaner for a US pharmaceutical corporation on the Eastern coast of Puerto Rico for the last five years. The volume of work is significant. Starting at 5am each day, she is responsible for cleaning a full building including three labs, offices, conference areas, and bathrooms. She earned $7.25 an hour until January 2022 when Puerto Rico’s new $8.50 minimum wage law went into effect. Following the minimum wage increase her hours were cut to 30 hours each week. The ~$900/month Kamila currently earns is not enough to cover her living expenses and she relies on one of her child’s hourly earnings to make ends meet. She must pay $600 in rent and, because the pharma corporation’s factory is a 45-minute drive from Kamila’s home, the rising cost of gas means she pays $400 a month to commute each month. In early 2022, Kamila contracted COVID at work.

“While I love my coworkers, this job has been hard on my health. I developed asthma two years ago because of the cleaning chemicals I work with every day. The company gives us masks and gloves but I’m still exposed to chemicals that are harming my health and my lungs. After I got COVID at work in 2022, the company told me I could take time off but I was never paid for the days I was sick.”

Low wages:

Wealthy pharmaceutical corporations refuse to pay Puerto Ricans the actual value of their work.

The minimum wage in Puerto Rico was raised from $7.25 an hour to at least $8.50 an hour starting in January 2022.[40] Among the workers interviewed, the majority reported earning minimum wage or now $8.50 an hour (except a few workers who earned $9 or $10 hourly). These wages amount to a shocking $17,680 annually for workers who can secure full-time hours.

Many workers had never received a pay increase, despite working for pharmaceutical corporations for years, and in some cases, decades. In fact, workers who had been at the same pharmaceutical site for 20 or 30 years reported never having received a raise (beyond legally mandated minimum wage increases).

Some workers interviewed live in subsidized housing and qualify for federal social safety net benefits because of their incredibly low incomes. Several workers have taken on second jobs, such as painting or working in a bakery, to make ends meet.

Among workers interviewed, all lived in rural areas that were not accessible to public transit. Workers largely drive to these jobs or carpool with others. Recent spikes in the cost of gasoline are compounding economic burdens; one worker described paying $80 in gas, which amounts to nine hours of hourly wages.

Given the soaring cost of living in Puerto Rico, even the minor recent increase in the minimum wage will do very little to lift people out of poverty.[41] Over 43% of Puerto Ricans live in poverty, and one-third of the population is food insecure.[42] Nearly one in ten people under the age of 65 do not have health insurance.[43]

Across the entire workforce, Puerto Rican workers are paid almost half as much as workers in the United States. In fact, in 2020, San Juan was 43% below the United States’ average across all wages.[44] Unfortunately, the ability to pay low wages is part of what attracts US corporations to the archipelago, while persistently low wages force Puerto Rican to migrate seeking jobs.[45] Security guards in Puerto Rico make an average of $9.21 per hour compared to $25 per hour in many US states.[46] Building maintenance and cleaning staff in Puerto Rico make an average of $9.79 per hour compared to $15 in many US states.[47]

Worker Interview

In 2007, single mother of three Sophia (pseudonym) left Puerto Rico for New York City in search of more opportunities for her children. While living in NYC for 14 years, she and her family lived in public housing. Sophia eventually secured a union job for a large and well-known security subcontractor–she immediately received a salary bump to $13.50 with guaranteed annual raises, paid time off and vacation, and 100% employer-paid family health insurance. Sophia described her time at a unionized employer as “magnificent” because the union always stood up for workers.

During the pandemic, Sophia returned to Puerto Rico to be near her family. She secured a security job at a large US pharmaceutical corporation operating in Puerto Rico. Even though she was employed by the same security subcontractor she previously worked for in NYC, her seniority was not recognized for the role in Puerto Rico. Sophia’s pay went down to $8.50 and she no longer had union protection or benefits. In Puerto Rico, some of her colleagues have worked at the company for nearly two decades but still earn minimum wage.

Despite workers consistently raising concerns and issues with management, Sophia said that management treats them like “pestes” (or pests). Subcontracted workers receive unfair treatment and are not recognized as employees by US pharmaceutical factories. After one of her coworkers became very ill with dizziness and pain, the onsite paramedic was called. However, they would not treat the ill worker because the paramedics would only treat US pharma corporation employees, not subcontractors at the same worksite.

“I don’t understand why workers don’t value themselves here. It’s unbearable to watch people get exploited and not act.”

Pharma CEOs make over 1,131 times what their lowest-paid workers earn each year. US pharma corporations amassed record profits during the pandemic and can more than afford to pay fair wages to their workers.

Several workers highlighted how chemical exposures can impact them, describing asthma symptoms or skin rashes. Some described ammonia exposures while others highlighted how pharma manufacturing areas can pose unique chemical exposure risks.

Inadequate Benefits:

Not only are pharma corporations paying minimum wage – they are offering no or meager additional benefits to their subcontracted workers. An overwhelming majority of workers interviewed received no benefits, including healthcare, pensions, and job training. While some workers indicated they didn’t qualify for benefits because of part-time hours, full-time workers also were not offered any benefits.

Across the board, healthcare was one of the most pressing issues raised by workers. Many of the people interviewed are facing enormous healthcare costs and medical debt. This has only grown more pronounced during the COVID-19 pandemic.

Government Workplace Data Shows Troubling Health and Safety Issues

A review of workplace safety data reveals a troubling pattern of injuries in factories across Puerto Rico. According to Occupational Safety and Health Administration (OSHA) records for the last ten years, Puerto Rico-based pharmaceutical plants have received around 80 complaints, accident reports, or referrals for health and safety issues. This was the highest number of instances in any US state or territory. In contrast, California, which has 3.5 times more pharmaceutical and medicine manufacturing workers than Puerto Rico, only had 67 OSHA comparable documented occurrences in the last ten years.[48]

Worker injuries ranging from chemical exposures, scaldings, and amputations:

- In 2020, Pfizer received several fines for “serious violations” impacting workers in their Barceloneta factory. The safety issues were related to the proper “control of hazardous energy,” which requires employers to ensure heavy machinery doesn’t pose a threat to workers.[49]

- In 2019, the government fined AbbVie only $3,240 after a person doing maintenance on heavy machinery lost part of their finger after a circuit closed on it in a Barceloneta factory.[50]

- In 2017, Mylan’s factory in Caguas received a government fine for a serious violation impacting ten workers for improper safety guards on heavy machines.[51] In prior years that same factory was investigated for exposing workers to stearic acid, though the government later dismissed the case.[52]

- In 2017, a worker in Janssen Cilag’s Gurabo factory was scalded with hot water from a machine and hospitalized for second-degree burns. The government ultimately did not issue a fine in this case.[53] Janssen Cilag is a subsidiary and controlled by Johnson & Johnson.[54]

Serious health and safety violations like these occurred in factories across Puerto Rico. Pfizer, AbbVie, and Baxter Healthcare had the most documented OSHA activity in the last decade. Unfortunately, the penalties pharma corporations were ultimately required to pay were comparatively minor. For instance, after 70 pharmaceutical workers in Manatí were exposed to hazardous chemicals, the company Warner Chilcott was only fined $2,275 by the government.[55]

Worker Interview

Valeria (pseudonym) is a cleaning worker who has been at the same US pharmaceutical factory for nearly 25 years. She has never been paid more than minimum wage. Valeria emigrated to Puerto Rico from a neighboring Caribbean island where she previously worked in the garment industry. When she started working as a cleaner in the pharma sector, she was paid $5.15 per hour with the promise of a stable 8-hour workday. During her time at the company, her hours have fluctuated significantly. Sometimes she can only secure 5 or 6 hours of work each day which makes it difficult to earn enough. According to Valeria, her employer made the most cuts to her hours the year after the federal minimum wage was raised to $7.25. When workers ask for raises, the company refuses even though Valeria knows they could afford living wages. She knows people need to stand up and fight for that. In her words, “you can’t clap with one hand,” meaning you can’t win big changes alone.

Despite working at the pharmaceutical site for over two decades, her seniority is not recognized by either the cleaning subcontractor or the US pharmaceutical corporation. She still receives minimum wages, no benefits or health insurance. Valeria has several colleagues with decades of seniority who also still make minimum wage. Valeria must rely on support from some of her adult children to make ends meet. After Puerto Rico raised its minimum wage, she saw a modest $1.25 per hour increase. Unfortunately, with inflation and rising costs, the small wage increase felt like nothing: “I work so hard and for so long, I feel like I’m killing myself for nothing.” According to Puerto Rican economists tracking rising inflation, Valeria would need to be earning more than double her wages–nearly $20 per hour–in 2022 to be approaching a living wage.**

Valeria’s proudest moment on this job came when she stood up to her supervisors to demand a 15 minute “breakfast/coffee” break in the morning, in addition to her 30-minute unpaid lunch break: “You know, you can’t expect people to be moving about throughout the day, doing physical exercise all of the time, and not give them a rest and a chance to get something in their system. I had that in my country, and I was happy they gave it to us here when I stood up to ask.”

**For more information see: https://www.elnuevodia.com/negocios/economia/notas/conoce-que-es-el-salario-de-subsistencia-justo-y-por-que-en-puerto-rico-deberia-ser-20-la-hora/

Puerto Rican Workers Have No Union Protection

Not one Puerto Rican worker interviewed from pharma plants had the protection of a union. Across the board, very few working people in Puerto Rico are unionized. Puerto Rico’s estimated private sector union density was below 1.7 percent, according to the most recent official survey of Puerto Rico’s union membership conducted in 2014.[56]

Workers in states across the US are far more likely to have a union. In the US, one in ten people working in building and grounds cleaning and maintenance are in unions. More than one in three people in “protective service” jobs, like security guards, are in unions.[57] While most pharmaceutical and medicine manufacturing workers in the United States are not unionized, more than 19,000 have successfully unionized or are covered by union contracts.[58]

Unions secure workers significant improvements in wages, hours, and working conditions. Unionized workers have median earnings nearly 20% higher than people who are not in a union across all sectors.[59] After a group of largely Latina immigrant janitors in New Jersey unionized, their wages went from $5.15 in 2001 to $17.70 in 2021. The union also won family healthcare benefits, pensions, and more protections from sexual harassment and assault. After a group of Washington DC-based security officers who were largely African American formed a union, they successfully increased hourly wages from $8.25 in 2007 to $19.29 in 2021, and won healthcare and retirement benefits.[60] In sharp contrast, non-unionized cleaning staff and security guards in Puerto Rico’s pharma plants make half as much with inadequate benefits and no job security.

Notably, many global pharmaceutical corporations operating in Puerto Rico are already unionized employers in other geographies. For instance, Amgen employees in Korea and Singapore are unionized, while Pfizer has a unionized workforce in Ireland and parts of the United States.[61] As of 2015, nearly one-third of Merck’s 69,000 employees worldwide had union representation.[62] In addition to its pharmaceutical manufacturing workers, many pharma subcontractors in the United States are unionized. For instance, Eli Lilly contracts with SBM Management Services and Aramark in Indianapolis for unionized janitors through the Service Employees International Union (SEIU) and Unite HERE.[63]

Many pharmaceutical corporations have public statements on the right to join a union, freedom from retaliation, and bargaining in good faith. According to Johnson & Johnson: “We require our operating companies to respect each employee’s right to decide to join or not join associations or labor unions, and to respect each employee’s ability to make an informed decision, free of coercion. We maintain constructive dialogue with employees’ freely chosen representatives and bargain with them in good faith.”[64] These types of public statements do not always reflect the reality for people seeking union representation in the pharmaceutical sector.

Worker Interview

José (pseudonym) has worked as a maintenance worker for a large US pharmaceutical since the mid-nineties. He has never earned more than minimum wage. José’s starting salary was around $4.25 per hour. José worked for several different maintenance subcontractors, as the US pharmaceutical company switched contractors over the years. While José technically is given paid vacation and sick days, he and other workers have a very difficult time getting employer approvals to use that time. No matter how much advance notice the workers give, the employer controls the process and makes it difficult for workers to actually access their benefits. In his words: “it often feels like it’s not even worth going to work. You can’t even get the vacation days off that you earned without a struggle.”

José sometimes has to ask his two adult children to help him make ends meet–something he doesn’t like doing because he’d prefer them to be able to save more and make a life for themselves. José currently earns a little over $1,000 per month at his minimum wage pharma job. Almost half of that goes to cover his housing and expensive utility costs (like electricity and water). After food and gas costs, José is barely able to break even, let alone save money.

“I have stayed for 28 years because no matter where I went they were paying the same. So, I figured I would stay closer to home and where I was familiar with the work I’m doing. But it’s time for a change.”

Pharma’s troubling and inconsistent track record with unions

The Pharmaceutical Industry Labor-Management Association (PILMA) is overseen by executives from J&J, Pfizer, Merck, and other corporations with a heavy footprint in Puerto Rico, as well as labor unions like the International Association of Sheet Metal, Air, Rail, and Transportation Workers.[65] In recent years, PILMA has come under public scrutiny for efforts to defeat drug-pricing proposals that would promote better access to lifesaving medicines.[66] While PILMA’s public relations pieces tout the industry’s use of union construction workers to build pharmaceutical facilities, there is no discussion of whether the workers inside those factories are also unionized. The harsh reality faced by workers in Puerto Rico is also absent from the conversation.[67]

Unfortunately, some US global pharmaceutical companies have a track record of union-busting. For instance, in 2017 after workers in a Kalamazoo, Michigan plant filed a formal complaint, the National Labor Relations Board admonished Pfizer, indicating the company could not force employees to give up their right to join coworkers in labor disputes.[68] According to cleaning workers represented by the SEIU, Pfizer may have switched cleaning contractors in New Jersey to avoid a union agreement.[69]

Union busting in Puerto Rico is an under-documented phenomenon; however, some evidence exists that the Puerto Rican government has enabled US pharmaceutical companies’ labor violations. For instance, during Carlos Romero Barcelo’s first term as Governor (1977-1981), Abbott Laboratory reportedly forced its workers in Barceloneta to work additional hours in violation of its union contract. These types of labor violations at the time often had the backing of the government and in many instances security forces were hired, along with scabs and local police, to harass workers in picket lines.[70] More recently, as Puerto Rico faces an unprecedented debt crisis, the government and the unelected Fiscal Control Board have devastated public and private sector unions by pushing for layoffs, cuts to benefits, and harsh austerity measures–all steps that further undermine the labor movement in Puerto Rico.[71]

Pharma’s Low Road Employment Checklist

- Low Wages

- Inadequate Benefits

- Poor Workplace Safety

- No Unions

Despite record-high profits, pharma corporations are holding down wages and denying full benefits to Puerto Ricans.

Rigging the rules to help pharma at the expense of Puerto Ricans

US pharmaceutical corporations extract vast amounts of wealth from Puerto Rico every year. Government officials have extended billions in lucrative tax giveaways to lure and retain companies to the archipelago.[72] The government has given away tens of billions in tax breaks for the manufacturing sector, of which pharma is a major player.[73] Pfizer, Abbvie, Johnson & Johnson, and Eli Lilly are among the dozens of pharma giants with manufacturing operations on the island.[74]

While the pharmaceutical sector likely exerts outsized influence over Puerto Rican elected officials, this can be hard to track. Corporate political spending in Puerto Rico elections is obscure by design. Major pharma corporations like Eli Lilly have increasingly faced public pressure to begin disclosing their lobbying activity in Puerto Rico─but the company has signaled it is unwilling to improve transparency around lobbying.[75] At the federal level, lobbyists for AbbVie, Amgen, Pfizer, Johnson & Johnson, and the industry trade group Alliance for Biopharmaceutical Competitiveness and Innovation all reported lobbying on issues related to economic activity or federal taxation regarding Puerto Rico in 2020.[76]

Excessive billion dollar corporate tax breaks–a projected $14.568B in 2022 alone–are larger than the total operating budget of the Puerto Rican government.

$100 Billion in Corporate Tax Giveaways: Quantifying Puerto Rico’s Manufacturer Tax Breaks

The Puerto Rican government is bending over backward to attract and retain corporations. It has created over 250 different benefits for businesses, including more than 85 tax credits.[77] These focus heavily on the manufacturing sector, which pharmaceuticals dominate.[78]

Our analysis of Puerto Rico’s Treasury Department disclosures reveals that corporate manufacturer tax giveaways lead to billions in lost revenue each year:

Corporate Tax Breaks for the Manufacturing Sector in Puerto Rico

-

-

- 2017: $15.691 billion

- 2018: $13.809 billion

- 2019: $13.965 billion

- 2020: $13.497 billion

- 2021: $14.164 billion

- 2022: $14.568 billion (projected)

- 2023: $14.811 billion[79] (projected)

-

In the last five years alone, this analysis shows that the manufacturing sector (of which pharma is a significant player) has taken advantage of $71.126 billion in tax breaks. In total, Puerto Rico’s government is slated to give the manufacturing sector a staggering $100.5 billion in tax breaks between 2017-2023. Foreign companies have made up the vast majority–98%– of those receiving benefits in recent years.[80]

Corporate Tax Giveaways Eclipse Puerto Rico’s Total Budget

The Puerto Rican government’s entire General Fund budget was $12.5 billion in FY2021.[81] In other words, excessive corporate tax breaks far exceed the total money the government has to operate, provide public services, and invest in local communities. Letting pharmaceutical corporations pay less than they truly owe in taxes prevents critically needed investments in education, healthcare, roads, the power grid, and elsewhere.

The Job Creation Myth: These enormous tax breaks have failed to create large numbers of jobs for the archipelago’s 3.3 million people.[82] In FY2020, estimates found that tax breaks only generated around 7,000 direct and indirect jobs, or 0.6% of the total labor force.[83]

The cost per job in Puerto Rico is also astronomical. Puerto Rico incurred $4.86 billion in direct costs for pharmaceutical tax abatements in 2012. The direct employment in pharmaceuticals at the time was 18,878 workers total, meaning Puerto Ricans paid over $250,000 in tax subsidies per job.[84]

Puerto Rico: Pharma’s Favorite Tax Haven

The US government has a long history of using tax laws to exert colonial dominance over Puerto Rico. Tax incentives serve US corporate interests while undermining Puerto Rican self-determination and weaponizing dependence on US multinationals.[85] Pharma corporations descended on Puerto Rico in the 1970s after the federal Internal Revenue Code introduced lucrative tax exemptions (Section 936) that allowed them to avoid paying corporate income tax on profits in Puerto Rico.[86]

These breaks resulted in a heavy focus on attracting large multinationals headquartered in the United States at the expense of investment in activities that would support local Puerto Rican businesses and economies.[87] This dynamic put an unfair burden on Puerto Rican taxpayers and allowed large multinationals to dominate the archipelago’s economy. According to the Treasury, pharma companies got $2.65 in federal tax benefits for every dollar they paid Puerto Rican workers in 1983.[88] Pfizer received $156,400 in tax breaks per employee by 1989.[89] The Section 936 tax break ultimately cost taxpayers $24.7 billion in unpaid tax receipts at the time.[90]

President Bill Clinton signed a bill phasing out the tax break over ten years in 1996.[91] After those corporate tax breaks were phased out and corporations sought out other tax havens, the Puerto Rican government increasingly compensated for its lack of revenues by debt-financing its growing deficits, which later shifted the burden onto Puerto Rican communities most impacted by the debt crisis.[92]

Today, pharmaceutical corporations still have an influential presence in Puerto Rico and take advantage of enormous tax exemptions. Puerto Rico overhauled its incentives code–under Act 60[93]–which created a four percent corporate income tax, exemptions on property taxes, construction, and municipal taxes, exemptions for wealthy shareholders, and benefits for manufacturing and other sectors.[94] These incentives are long-term, with companies like Amgen receiving tax incentives through (at least) 2035.[95]

“The Pharma Protector:” Fiscal Control Board Conflicts of Interest

In response to Puerto Rico’s debt crisis, the US Congress established an unelected and unaccountable Financial Oversight and Management Board (FOMB) in 2016. Since then, the colonial Board has used its power to impose devastating austerity measures and negotiate unsustainable debt restructuring plans that enrich Wall Street and hurt Puerto Ricans.[96]

In response to Puerto Rico’s debt crisis, the US Congress established an unelected and unaccountable Financial Oversight and Management Board (FOMB) in 2016. Since then, the colonial Board has used its power to impose devastating austerity measures and negotiate unsustainable debt restructuring plans that enrich Wall Street and hurt Puerto Ricans.[96]

Fiscal Control Board members and consultants have a range of serious conflicts of interest in the pharmaceutical sector.

- Known by critics as “the Pharma Protector,”[97] Antonio Medina is a fiscal control board member and a former executive of the multinational pharmaceutical Merck. Before joining the FOMB, Medina led the Puerto Rico Industrial Development Company (PRIDCO), a public corporation created to promote the manufacturing industry. PRIDCO supports businesses, especially in the pharmaceutical sector, that want to do business on the archipelago. His bio touts his role in “large scale expansion projects by Eli-Lilly, BMS, AbbVie, Coopervision,” among others. Prior to that, he spent twenty years at the pharma giant Merck.[98] Medina now runs a consulting firm, Convergent Strategies LLC, which describes itself as “dedicated to accelerate business growth, by helping companies become more competitive and achieve higher levels of financial performance.”[99]

- The FOMB has authority over tax abatement contracts involving the government of Puerto Rico. Specifically, the Board must approve any contract with an aggregate expected value of $10 million or more. It can also randomly select other contracts for review “to assure they promote market competition” and “are not inconsistent with the approved fiscal plan.”[100] Medina could be considered an asset to the pharmaceutical companies that have taken advantage of massive tax exemptions for many years while residents of Puerto Rico bear the brunt of austerity measures.[101]

Conflict of interest concerns have also been raised about the management consulting firm that won a lucrative bid to become the Fiscal control board’s strategic adviser: McKinsey & Company. By some reports, McKinsey had “virtually become a shadow agency of the government, and a powerful one at that.”[102] When the New York Times revealed that McKinsey had millions invested in Puerto Rican bonds via its internal hedge fund,[103] there was a public outcry over the conflict of interest this represented—advising on austerity measures that could pave the way for larger returns on their bonds.[104] McKinsey paid the U.S. Securities and Exchange Commission $18 million in a November 2021 settlement related to potential insider trading issues in Puerto Rico.[105]

These and other conflicts of interest prompted Congress to pass the Puerto Rico Recovery Accuracy in Disclosures Act in 2021. Now, consultants working on Puerto Rico’s debt restructuring–like McKinsey which charged $100 million in fees for work in Puerto Rico–must disclose investments and business relationships they could previously keep secret.[106]

In May 2022, new disclosures revealed that McKinsey is also on the payroll of high-powered pharma clients like AbbVie.[107] Some have raised serious questions on whether McKinsey may have advised Puerto Rico’s Fiscal Control Board to keep pharma’s corporate taxes low.[108] McKinsey’s close relationship with the pharmaceutical industry was further highlighted in 2021 when the consulting firm was forced to pay a nearly $600 million settlement for its role in helping Purdue and other pharma giants fuel the opioid crisis.[109]

Community Investments vs. Corporate Tax Giveaways

Question: What could Puerto Rico do with $14 billion instead of dolling out corporate tax breaks?

Answer: Invest in students and teachers

$14 billion would fully repair over 800 damaged and aging public schools in Puerto Rico while paying over 23,000 educators the living wages they deserve.[110]

Currently, public school teachers earn a meager base salary of $1,750 a month. Teachers have not received pay increases for over 13 years, so teachers’ unions are currently demanding $3,500 a month and for pension benefits to be restored. While the Governor recently committed to a temporary pay increase of $1,000 per month, this is still well below what teachers’ unions are demanding.[111]

If pharma began paying what they should owe in taxes, Puerto Rico could triple teacher pay and hire additional educators while helping restore teachers’ pensions.

Answer: Invest in affordable housing

Suppose pharma paid what they owe in taxes. In that case, Puerto Rico could make robust investments in affordable housing — including repairs to subsidized rental housing and over 57,000 public housing units, providing lower-income households with affordable units, renovating vacant and blighted buildings, and creating additional subsidized housing in the wake of hurricane damage.[112]

Answer: Invest in renewable energy and stable electricity

$14 billion would enable over 970,000 families to install solar panels in their homes.[113] Since the private Canadian and US company, LUMA Energy, took control of the archipelago’s grid, Puerto Ricans have experienced widespread power outages and blackouts.[114] Puerto Ricans currently pay roughly twice as much for electricity than US customers.[115] Investing in climate-resilient and renewable energy would provide the stable energy supply that Puerto Ricans deserve and urgently require.

A Path Forward: Investments in Local Communities Instead of Billions in Tax Giveaways

Puerto Rican communities have faced a series of devastating setbacks in recent years, including Hurricanes Maria and Irma in 2017, the Wall Street-fueled debt crisis and harmful austerity cuts, plus the COVID-19 pandemic with the public health and economic emergencies that followed.[116]

Puerto Rican communities deserve robust public investments in quality education, renewable and distributed energy, clean air and water, quality healthcare, a reliable transit system, affordable housing, food security, waste management, and more. Instead, their elected officials and the unelected fiscal control board prioritize billions in corporate tax giveaways.

Recommendations

In light of this report’s findings, policymakers in Puerto Rico must:

-

- Ensure all US pharmaceutical corporations operating in Puerto Rico pay what they owe in taxes by redirecting the billions in annual corporate giveaways and tax incentives towards community investments.

- Ensure all US pharmaceutical corporations operating in Puerto Rico end their low-road employment practices. This must include providing Puerto Rican workers a living wage, full health and other benefits, pensions, job training opportunities, job security, and critical workplace safety protections.

- Use any new tax revenue generated by the US pharmaceutical sector to provide the critical investments in education, affordable housing, climate resilience, and infrastructure that Puerto Rican communities urgently need and deserve.

Acknowledgments

This report was researched and written by Maggie Corser (CPD).

It was edited by Sean Kornegay, Julio López Varona, and Ericka Gómez Tejeda (CPD).

Worker interviews were conducted by Javier Andrés Córdova Sánchez, Luz Delia Pérez,

Carmen Román Cortijo, and Ericka Gómez Tejeda (CPD).

Graphic and visual design by Arom Gaang & Ange Tran (design@angetran.me).

Press and General Inquiry Contacts

Julio López Varona jlopez@populardemocracy.org

Center for Popular Democracy

He/him

Senti Sojwal ssojwal@populardemocracy.org

Center for Popular Democracy

She/her

Danielle Strasburger (she/her) danielle@newheightscommunications.com

New Heights Communications

She/her

Methodology

The Occupational Safety and Health Administration (OSHA) data featured in this report was accessed via the OSHA “Inspections within Industry” database. These records reflect NAICS code 325412 “Pharmaceutical Preparation Manufacturing,” and cover a ten-year period (01/01/2012 to 12/31/2021). https://www.osha.gov/pls/imis/industry.html. “Planned” activities and inspections were not counted in totals which tally violations, accidents and follow-up visits, and referrals.

Specifically, in Puerto Rico, there were 57 documented “referrals” (which are complaints stemming from either federal, state, or local agencies, individual worker whistleblowers, organizations, or the media); 13 worker complaints; eight unprogrammed inspections (which are designed to address imminent dangers and are often the result of employee complaints about a hazardous working condition and/or an issue identified during a prior programmed inspection); two planned inspections; and one follow-up inspection.[117]

In-person interviews were conducted with workers in Puerto Rico in May and June 2022. The interviewees are all currently working subcontracted cleaning and security roles at US pharmaceutical factories in Puerto Rico. Job tenure ranged from two to 28 years. The interviewees held a mix of full-time and part-time positions and staffed a mix of day-time and evening shifts. Interviewees were asked about their hourly wage, benefits, workplace safety issues, and general experiences at work.

Pseudonyms were used in the report to protect workers from employer retaliation.

- Lara Merling, Kevin Cashman, Jake Johnston, & Mark Weisbrot “Life After Debt in Puerto Rico: How Many More Lost Decades?” Center for Economic and Policy Research, July 2017, https://cepr.net/images/stories/reports/puerto-rico-2017-07.pdf, 1; Puerto Rico Department of Treasury, “Puerto Rico Tax Expenditure Report for Tax Year 2023,”https://hacienda.pr.gov/sites/default/files/tax_expenditure_report.pdf; 18, 44. See: Puerto Rico’s Department of Economic Development and Commerce “Public information on beneficiaries of decrees” disclosure portal: https://www.ddec.pr.gov/accesoinfo/. ↑

- Hedge Papers No. 72 “Pain and Profit: Covid-19 Profiteers in Puerto Rico,” July 2020, https://hedgeclippers.org/wp-content/uploads/2020/07/HP72_HedgePaper_PuertoRico-Covid19andVulturesPray_English.pdf; Fraiser Kansteiner “The top 15 highest-paid biopharma CEOs of 2020,” Fierce Pharma, May 24, 2021, https://www.fiercepharma.com/special-report/top-15-highest-paid-biopharma-ceos-2020; Lenore Palladino and William Lazonick, “Regulating Stock Buybacks: The $6.3 Trillion Question,” Roosevelt Institute, May 2021, https://rooseveltinstitute.org/wp-content/uploads/2021/04/RI_Stock-Buybacks_Working-Paper_202105.pdf, 24. ↑

- Rodrick T. Miller, “Puerto Rico’s Big Pharma Push,” Industry Week, June 1, 2020, https://www.industryweek.com/the-economy/article/21132824/puerto-ricos-pharma-push; “Pharma Boardroom: Puerto Rico Country Report,” Healthcare & Life Sciences Review, January 22, 2020, https://pharmaboardroom.com/country-reports/puerto-rico-pharma-report-january-2020/, 7. ↑

- Dina Spencer, “Did You Know? Puerto Rican Pharma Manufacturing,” Pharma Boardroom, September 17, 2019, https://pharmaboardroom.com/articles/did-you-know-puerto-rican-pharma-manufacturing/; David Belk, “Pharma’s 50 Best Sellers,” Accessed May 23, 2022, https://truecostofhealthcare.org/pharmas-50-best-sellers/. ↑

- See: methodology note for more information on the worker surveys that informed this report’s findings. ↑

- Puerto Rico Department of Treasury, “Puerto Rico Tax Expenditure Report for Tax Year 2023,”https://hacienda.pr.gov/sites/default/files/tax_expenditure_report.pdf, 44. ↑

- Government of Puerto Rico, “Exhibit 1 Amended Certified FY 2022 Budget,” February 21, 2022, https://drive.google.com/file/d/1-eOb3Xe2s08I4EEHAe4ojVB2MFwMYhhG/view, 3. ↑

- Julia Kollewe, “Pfizer accused of pandemic profiteering as profits double,” The Guardian, February 8, 2022, https://www.theguardian.com/business/2022/feb/08/pfizer-covid-vaccine-pill-profits-sales; “Pfizer Reports Fourth-Quarter And Full-Year 2021 Results,” Pfizer, February 8, 2022, https://s28.q4cdn.com/781576035/files/doc_financials/2021/q4/Q4-2021-PFE-Earnings-Release.pdf, 25. ↑

- “Pfizer Reports Fourth-Quarter And Full-Year 2021 Results,” Pfizer, February 8, 2022, https://s28.q4cdn.com/781576035/files/doc_financials/2021/q4/Q4-2021-PFE-Earnings-Release.pdf, 25. ↑

- “AbbVie Reports Full-Year and Fourth-Quarter 2021 Financial Results,” AbbVie, February 2, 2022, https://news.abbvie.com/news/press-releases/abbvie-reports-full-year-and-fourth-quarter-2021-financial-results.htm. ↑

- “2021 Annual Report,” Johnson & Johnson, March 2022, https://www.investor.jnj.com/annual-meeting-materials/2021-annual-report, 24. Note: this total represents J&J’s pharmaceutical segment sales in 2021. ↑

- “Merck & Co., Inc. Financial Highlights Package Fourth Quarter 2021,”https://s21.q4cdn.com/488056881/files/doc_financials/2021/q4/Supplement-to-Merck-Earnings-News-Release-4QFY-2021.pdf, 6. ↑

- “Amgen Reports Fourth Quarter And Full Year 2021 Financial Results,” February 2, 2022, https://www.amgen.com/newsroom/press-releases/2022/02/amgen-reports-fourth-quarter-and-full-year-2021-financial-results. ↑

- “AstraZeneca Full year and Q4 2021 results,” February 10, 2022, https://www.astrazeneca.com/content/dam/az/PDF/2021/full-year/Full-year-2021-results-announcement.pdf. ↑

- “Lilly Reports Solid Fourth-Quarter and Full-Year 2021 Financial Results, Recent Late-Stage Pipeline Successes Set Up Next Wave of Innovative Medicines for Patients,” February 3, 2022, https://investor.lilly.com/news-releases/news-release-details/lilly-reports-solid-fourth-quarter-and-full-year-2021-financial. ↑

- Dina Spencer, “Did You Know? Puerto Rican Pharma Manufacturing,” Pharma Boardroom, September 17, 2019, https://pharmaboardroom.com/articles/did-you-know-puerto-rican-pharma-manufacturing/. ↑

- “Pharma Boardroom: Puerto Rico Country Report,” Healthcare & Life Sciences Review, January 22, 2020, https://pharmaboardroom.com/country-reports/puerto-rico-pharma-report-january-2020/, 9. ↑

- US House of Representatives, “Drug Pricing Investigation Majority Staff Report,” December 2021,https://oversight.house.gov/sites/democrats.oversight.house.gov/files/DRUG%20PRICING%20REPORT%20WITH%20APPENDIX%20v3.pdf, iii. ↑

- Eric Sagonowsky, “First its CEO tells pharma to watch it on pricing—and then Johnson & Johnson raises them,” Fierce Pharma, January 11, 2019, https://www.fiercepharma.com/pharma/j-j-ceo-gorsky-said-pharma-should-self-police-pricing-and-then-his-company-raised-prices. ↑

- Spencer Kimball, “Pfizer CEO Albert Bourla received $24.3 million in total compensation for 2021,” CNBC, March 18, 2022 https://www.cnbc.com/2022/03/18/pfizer-ceo-albert-bourla-received-24point3-million-in-total-compensation-for-2021.html. ↑

- US Securities and Exchange Commission, “2022 Notice of Annual Meeting and Proxy Statement: Johnson & Johnson,” March 16, 2022, https://johnsonandjohnson.gcs-web.com/static-files/c5e55670-70b5-4f44-9cf1-8cb32b770b98, 68. Note: Gorsky stepped down as CEO in the beginning of 2022 and J&J is now headed by Joaquin Duato. ↑

- US Securities and Exchange Commission, “2022 Notice of Annual Meeting and Proxy Statement: Amgen,” April 5, 2022, https://investors.amgen.com/static-files/fab41106-7c41-42e9-a48b-d3b2f0e5fc4e, 73. ↑

- Fraiser Kansteiner, “AstraZeneca CEO snared more than $18M last year as his company worked through highs and lows of vaccine launch,” Fierce Pharma, February 22, 2022, https://www.fiercepharma.com/pharma/astrazeneca-ceo-snares-more-than-18m-2021-pay#:~:text=AZ%20CEO%20Pascal%20Soriot%20scored,published%20(PDF)%20this%20month; “What science can do AstraZeneca Annual Report and Form 20-F Information 2021,”https://www.astrazeneca.com/content/dam/az/Investor_Relations/annual-report-2021/pdf/AstraZeneca_AR_2021.pdf, 105. ↑

- US Securities and Exchange Commission, “2022 Notice of Annual Meeting and Proxy Statement: Eli Lilly,”https://investor.lilly.com/static-files/22a9b720-2b7a-47bb-b106-908f0e093e7c, 55. ↑

- Note: the estimate on CEO hourly compensation is based on a $20 million average annual salary. According to a Harvard study CEOs work an average of 62.5 hours a week: https://hbr.org/2018/07/how-ceos-manage-time#what-do-ceos-actually-do. ↑

- “Alex Gorsky – Director, Johnson & Johnson,” Benzinga, Updated as of February 17, 2022, https://www.benzinga.com/sec/insider-trades/jnj/alex-gorsky. ↑

- Kyle Blankenship, “J&J chief Alex Gorsky nabbed $25M pay package in year marked by legal controversy,” Fierce Pharma, March 5, 2020, https://www.fiercepharma.com/pharma/j-j-s-gorsky-nabbed-25m-pay-package-year-marked-by-legal-controversy; Roni Caryn Rabin,” Women With Cancer Awarded Billions in Baby Powder Suit,” New York Times, June 23, 2020, https://www.nytimes.com/2020/06/23/health/baby-powder-cancer.html, “Highest-Paid Pharmaceutical CEOs,” Wall Street Journal, 2018, https://graphics.wsj.com/table/CEOPAY_slice_Pharma_0606. ↑

- Eric Sagonowsky, “Spotlight On… J&J chief shells out $9M for Manhattan condo; J&J goes to court over talcum powder cancer claims; Soaring injectable insulin prices shock patients; and more…” Fierce Pharma, February 4, 2016, https://www.fiercepharma.com/pharma/spotlight-on-j-j-chief-shells-out-9m-for-manhattan-condo-j-j-goes-to-court-over-talcum. ↑

- Angus Liu, “J&J CEO Gorsky to step aside, handing reins of world’s largest pharma to COVID-19 navigator Duato,” Fierce Pharma, August 20, 2021 https://www.fiercepharma.com/pharma/j-j-ceo-gorsky-to-step-aside-handing-reins-world-s-largest-pharma-to-covid-19-navigator. ↑

- Lenore Palladino and William Lazonick, “Regulating Stock Buybacks: The $6.3 Trillion Question,” Roosevelt Institute, May 2021 https://rooseveltinstitute.org/wp-content/uploads/2021/04/RI_Stock-Buybacks_Working-Paper_202105.pdf, 3. ↑

- Lenore Palladino and William Lazonick, “Regulating Stock Buybacks: The $6.3 Trillion Question,” Roosevelt Institute, May 2021 https://rooseveltinstitute.org/wp-content/uploads/2021/04/RI_Stock-Buybacks_Working-Paper_202105.pdf, 24. ↑

- William Lazonick, “Profits Without Prosperity,” Harvard Business Review, September 2014, https://hbr.org/2014/09/profits-without-prosperity. ↑

- Joshua Cohen, “Insulin’s Out-Of-Pocket Cost Burden To Diabetic Patients Continues To Rise Despite Reduced Net Costs To PBMs,” Forbes, January 5, 2021, https://www.forbes.com/sites/joshuacohen/2021/01/05/insulins-out-of-pocket-cost-burden-to-diabetic-patients-continues-to-rise-despite-reduced-net-costs-to-pbms/?sh=74fc7eb940b2; Nicolas Iragorri, et al “The Out-of-Pocket Cost Burden of Cancer Care-A Systematic Literature Review.” Current Oncology (Toronto, Ontario) vol. 28,. March 15 2021, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8025828/, 2 1216-1248. ↑

- Khadija Sharife, “Big Pharma’s Taxing Situation” World Policy Journal Vol. 33, No. 1 (SPRING 2016), pp. 88-95 Duke University Press, https://www.jstor.org/stable/26781384?read-now=1&seq=1, 1. ↑

- “2018 Annual Report on Form 10-K, 2019 Notice of Annual Meeting & Proxy Statement: AbbVie,” https://investors.abbvie.com/static-files/47b78f29-de86-46fd-ae82-83878c1a72f1, 39. ↑

- “Pharma Boardroom: Puerto Rico Country Report,” Healthcare & Life Sciences Review, January 22, 2020, https://pharmaboardroom.com/country-reports/puerto-rico-pharma-report-january-2020/, 9. ↑

- Dina Spencer, “Did You Know? Puerto Rican Pharma Manufacturing,” Pharma Boardroom, September 17, 2019, https://pharmaboardroom.com/articles/did-you-know-puerto-rican-pharma-manufacturing/; David Belk, “Pharma’s 50 Best Sellers,” Accessed May 23, 2022, https://truecostofhealthcare.org/pharmas-50-best-sellers/. ↑

- “What Types of Jobs are there in the Pharmaceutical and Medical Device Industry?,” GetReskilled.com Webpage, Accessed May 23, 2022, https://www.getreskilled.com/types-of-pharma-jobs/. ↑

- US Bureau of Labor Statistics, “May 2021 National, State, Metropolitan, and Nonmetropolitan Area Occupational Employment and Wage Estimates,” https://www.bls.gov/oes/current/oes518091.htm. ↑

- Nicole Acevedo, “Puerto Rico’s new minimum wage: ‘Not enough, but a starting point'” NBC News, September 22, 2021, https://www.nbcnews.com/news/latino/puerto-ricos-new-minimum-wage-not-enough-starting-point-rcna2183. ↑

- Dánica Coto, “Protests grow in Puerto Rico amid demands for higher wages,” ABC News, May 23, 2022, https://abcnews.go.com/International/wireStory/protests-grow-puerto-rico-amid-demands-higher-wages-82973841. ↑

- US Census Bureau, “QuickFacts Puerto Rico” July 1, 2021, https://www.census.gov/quickfacts/PR; “Austerity on the Island,” The Bond Buyer, December 23, 2019, https://www.bondbuyer.com/collections/austerity-on-the-island. ↑

- US Census Bureau, “QuickFacts Puerto Rico” July 1, 2021, https://www.census.gov/quickfacts/PR. ↑

- US Bureau of Labor Statistics, “Occupational Employment and Wages in San Juan-Carolina-Caguas — May 2020” https://www.bls.gov/regions/new-york-new-jersey/news-release/occupationalemploymentandwages_sanjuan.htm. ↑

- Edgardo Meléndez, “Sponsored Migration: The State and Puerto Rican Postwar Migration to the United States,” Ohio State University Press https://www.jstor.org/stable/j.ctv3znx2t.14?seq=1, 186-187; Nick Brown, “How dependence on corporate tax breaks corroded Puerto Rico’s economy,” Reuters, December 20, 2016, https://www.reuters.com/investigates/special-report/usa-puertorico-economy/. Note: here and throughout, the Bureau of Labor Statistics data referring to the “United States” covers the 50 US states. This data does not include US territories, including Puerto Rico. ↑

- US Bureau of Labor Statistics, “May 2021 State Occupational Employment and Wage Estimates Puerto Rico,”https://www.bls.gov/oes/current/oes_pr.htm; US Bureau of Labor Statistics, “Occupational Employment and Wages, May 2021 33-9032 Security Guards,” https://www.bls.gov/oes/current/oes339032.htm. ↑

- US Bureau of Labor Statistics, “Occupational Employment and Wages, May 2021 37-2011 Janitors and Cleaners, Except Maids and Housekeeping Cleaners,” https://www.bls.gov/oes/current/oes372011.htm. ↑

- Occupational Safety and Health Administration data was acquired using the “Inspections within Industry” database and filtering by NAICS code 325412 “Pharmaceutical Preparation Manufacturing,” https://www.osha.gov/pls/imis/industry.html. Details on individual records are available here: https://docs.google.com/spreadsheets/d/1XU37Gk8ZDLQdaFsXfxnsIiSfdIhXVEF_zx9di54m_H4/edit#gid=1742252960; Data on the number of workers in each state, as of 2020, is available here:https://data.census.gov/cedsci/table?q=naics%203254%20puerto%20rico; https://data.census.gov/cedsci/table?q=naics%203254%20california&tid=CBP2020.CB2000CBP.Note: two out of the 81 OSHA records in Puerto Rico during this ten year period were “planned” inspections. Data was accessed in May 2022. For more information see: methods note. ↑

- OSHA record “Inspection: 1477775.015 – Pfizer Pharmaceuticals Llc,” https://www.osha.gov/pls/imis/establishment.inspection_detail?id=1477775.015; OSHA record “Inspection: 1481443.015 – Pfizer Pharmaceutical Llc,” https://www.osha.gov/pls/imis/establishment.inspection_detail?id=1481443.015; Standard Cited:19100147 D06: https://www.osha.gov/laws-regs/regulations/standardnumber/1910/1910.147. ↑

- OSHA record “Inspection: 1410015.015 – Abbvie Ltd,” https://www.osha.gov/pls/imis/establishment.inspection_detail?id=1410015.015. ↑

- OSHA record “Inspection: 1225905.015 – Mylan Llc,” https://www.osha.gov/pls/imis/establishment.inspection_detail?id=1225905.015; Occupational Safety and Health Standards “1910.212 – General requirements for all machines.,” https://www.osha.gov/laws-regs/regulations/standardnumber/1910/1910.212. ↑

- OSHA record “Inspection: 316279736 – Mylan Llc,” https://www.osha.gov/pls/imis/establishment.inspection_detail?id=316279736. ↑

- OSHA record “Inspection: 1220876.015 – Janssen Cilag Manufacturing Llc,” https://www.osha.gov/pls/imis/establishment.inspection_detail?id=1220876.015. ↑

- “Janssen-Cilag Manufacturing, Llc,” OpenCorporates, Accessed May 23, 2022, https://opencorporates.com/companies/pr/324-1532; US Securities and Exchange Commission, “Exhibit 21: Subsidiaries,” https://johnsonandjohnson.gcs-web.com/static-files/f61ae5f3-ff03-46c1-bfc9-174947884db2. ↑

- OSHA “Violation Detail: Standard Cited:19100134 G01 I A Respiratory Protection,” https://www.osha.gov/pls/imis/establishment.violation_detail?id=1155645.015&citation_id=01001. ↑

- Puerto Rico Department of Labor, “Survey on Unionized Persons: 2014,” http://www.mercadolaboral.pr.gov/lmi/pdf/Grupo%20Trabajador/2014/ESTADISTICAS%20DE%20UNIONADOS%20EN%20PUERTO%20RICO.pdf; Armando Santiago Pintado and Manuel Rodríguez Banchs “We Fight Back to Thrive, not Survive: Bargaining for the Common Good in Puerto Rico,” The Forge, March 31, 2020 https://forgeorganizing.org/article/we-fight-back-thrive-not-survive-bargaining-common-good-puerto-rico. ↑

- US Bureau of Labor Statistics, “Union Membership (Annual) News Release,” January 22, 2021, https://www.bls.gov/news.release/archives/union2_01222021.htm. ↑

- “Union Membership, Coverage, Density and Employment by Industry, 2021,” Unionstats.com analysis of Bureau of Labor Statistics’ Current Population Survey https://www.unionstats.com/. ↑

- Bureau of Labor Statistics, “Union Membership (Annual) News Release,” January 22, 2021 https://www.bls.gov/news.release/archives/union2_01222021.htm. Note: this is among full-time wage and salaried workers. ↑

- Rob Hill and Stuart Eimer, “Winning Against the Odds: The 32BJ SEIU Organizing Model,” New Labor Forum, City University of New York, https://newlaborforum.cuny.edu/2022/04/18/winning-against-the-odds-the-32bj-seiu-organizing-model/. ↑

- Kim Yun-mi, “How did Amgen Korea make key drugs reimbursable so quickly?” Korea Biomedical Review, March 25, 2021, https://www.koreabiomed.com/news/articleView.html?idxno=10768; Chemical Industries Employees Union – CIEU social media post accessed May 23, 2022:https://www.facebook.com/193461644031689/posts/we-are-proud-that-our-partner-amgen-singapore-manufacturing-is-recognised-as-one/3813114792066338/; Eric Palmer, “Pfizer workers in Ireland fight to keep old school pensions,” Fierce Pharma, January 24, 2019,https://www.fiercepharma.com/manufacturing/pfizer-workers-ireland-fight-to-keep-old-school-pensions; Riley McDermid, “Pfizer Will Lay Off 750 Workers at Pearl River Site in 2017, Inks New Land Deal,” BioSpace, May 28, 2015 https://www.biospace.com/article/pfizer-will-lay-off-750-workers-at-pearl-river-site-in-2017-inks-new-land-deal-/. ↑

- David Sell, “Merck Labor friction spills out,” Philadelphia Inquirer, August 20, 2015, https://www.inquirer.com/philly/business/20150820_Merck_labor_friction_spills_out.html. ↑

- Hayleigh Colombo, “Janitor uprising highlights tensions over outsourcing,” Indianapolis Business Journal, November 8, 2018, https://www.ibj.com/articles/71245-janitor-uprising-highlights-tensions-over-outsourcing#:~:text=The%20janitors’%20dispute%20has%20highlighted,Indianapolis%20and%20across%20the%20nation; Fatima Hussein, “How a group of food service workers formed a union underground,” IndyStar, March 30, 2017, https://www.indystar.com/story/news/2017/03/30/how-group-food-service-workers-formed-union-underground/99499038/. ↑

- “Position on Employment and Labor Rights” Johnson & Johnson, last updated June 2020, https://www.jnj.com/about-jnj/policies-and-positions/our-position-on-employment-and-labor-rights, 2. ↑

- “Pharmaceutical Industry Labor-Management Association: Trustees” webpage accessed May 23, 2022, https://pilma.org/who-we-are/trustees/. ↑

- Katie Thomas, “Labor Unions Team Up With Drug Makers to Defeat Drug-Price Proposals,” New York Times, December 3, 2019, https://www.nytimes.com/2019/12/03/health/drug-prices-pelosi-unions.html. ↑

- Russell Ormiston, “An Analysis of Construction Spending in the Pharmaceutical & Biotech Industry, 2015-2020” Pharmaceutical Industry Labor-Management Association and Institute for Construction Economic Research, June 2021, https://unionjobs.pilma.org/wp-content/uploads/2021/06/PIL-D-2106-Full-Jobs-Report_FINAL.pdf. ↑

- Kathleen O’Brien, “Pfizer loses labor case, vows to appeal,” NJ.com, January 19, 2017, https://www.nj.com/news/2017/01/pfizer_loses_labor_case_vows_to_appeal.html. ↑

- “Workers Say Pfizer Thwarted Union Drive,” Billings Gazette, July 11, 2005, https://billingsgazette.com/business/workers-say-pfizer-thwarted-union-drive/article_f1f0aca4-7adb-5023-9e59-121f0c451373.html. ↑

- Alejandro M. Schneider, “Política y conflictos laborales en Puerto Rico durante el primer gobierno de Carlos Romero Barceló (1977-1981)” Memorias: Revista Digital de Historia y Arqueología desde el Caribe, núm. 38, 2019 Universidad del Norte, https://www.redalyc.org/journal/855/85562878003/85562878003.pdf, 10-11. ↑

- Jennifer Wolff, “Pulling Out of the Quagmire: Can Puerto Rico’s Labor Movement Survive the Island’s Debt Crisis?” Center for a New Economy, January 10, 2016, https://grupocne.org/2016/01/10/pulling-out-of-the-quagmire-can-puerto-ricos-labor-movement-survive-the-islands-debt-crisis/; Armando Santiago Pintado and Manuel Rodríguez Banchs “We Fight Back to Thrive, not Survive: Bargaining for the Common Good in Puerto Rico,” The Forge, March 31, 2020, https://forgeorganizing.org/article/we-fight-back-thrive-not-survive-bargaining-common-good-puerto-ric. ↑

- Hedge Papers No. 72 “Pain and Profit: Covid-19 Profiteers in Puerto Rico,” https://hedgeclippers.org/wp-content/uploads/2020/07/HP72_HedgePaper_PuertoRico-Covid19andVulturesPray_English.pdf, 3. ↑

- Puerto Rico Department of Treasury, “Puerto Rico Tax Expenditure Report for Tax Year 2023,”https://hacienda.pr.gov/sites/default/files/tax_expenditure_report.pdf, 44. ↑

- “Pharma Boardroom: Puerto Rico Country Report,” Healthcare & Life Sciences Review, January 22, 2020, https://pharmaboardroom.com/country-reports/puerto-rico-pharma-report-january-2020/, 9, 41. ↑

- US Securities and Exchange Commission, “Notice of 2022 Annual Meeting of Shareholders and Proxy Statement Eli Lilly & Co,” “https://www.sec.gov/Archives/edgar/data/59478/000005947822000099/llydef14a2022.htm, 72-73; “Notice of Exempt Solicitation,” https://www.sec.gov/Archives/edgar/data/59478/000121465922005111/o411225px14a6g.htm; “Declaration of Voting Results by Eli Lilly and Company,” MarketScreener, May 4, 2022, https://www.marketscreener.com/quote/stock/ELI-LILLY-AND-COMPANY-13401/news/Declaration-of-Voting-Results-by-Eli-Lilly-and-Company-40295536/. ↑

- Colin Wilhelm, Alex Ruoff, Lydia O’Neal, “Supply Chain Fears Bolster Medical Manufacturing Tax Break Push,” Bloomberg Tax, June 29, 2020, https://news.bloombergtax.com/daily-tax-report/supply-chain-fears-bolster-medical-manufacturing-tax-break-push. ↑

- Puerto Rico Department of Treasury, “Puerto Rico Tax Expenditure Report for Tax Year 2023,”https://hacienda.pr.gov/sites/default/files/tax_expenditure_report.pdf, 18. ↑

- Rodrick T. Miller, “Puerto Rico’s Big Pharma Push,” Industry Week, June 1, 2020, https://www.industryweek.com/the-economy/article/21132824/puerto-ricos-pharma-push. ↑

- Puerto Rico Department of Treasury, “Puerto Rico Tax Expenditure Report for Tax Year 2023,”https://hacienda.pr.gov/sites/default/files/tax_expenditure_report.pdf, 44. Full text of Act 60 https://www.investpr.org/wp-content/uploads/2021/11/ENG_A-60-2019-Codigo-de-Incentivos.pdf, see page 133. ↑

- Puerto Rico Department of Treasury, “Puerto Rico Tax Expenditure Report for Tax Year 2023,”https://hacienda.pr.gov/sites/default/files/tax_expenditure_report.pdf, 6-7, 44. ↑

- Government of Puerto Rico, “Exhibit 1 Amended Certified FY 2022 Budget,” February 21, 2022, https://drive.google.com/file/d/1-eOb3Xe2s08I4EEHAe4ojVB2MFwMYhhG/view, 3. ↑

- US Census Bureau, “QuickFacts Puerto Rico,” July 1, 2021, https://www.census.gov/quickfacts/PR. ↑

- Puerto Rico Department of Economic Development and Commerce “Annual Report To The Honorable Governor And The Legislative Assembly Of The Government Of Puerto Rico On The Performance Of The Incentives (Tax Decrees) Granted Under The Puerto Rico Incentives Code Law Number 60 Of July 1, 2019, Fiscal Year 2019-2020,” https://www.ddec.pr.gov/images/Anno%20Fiscal%202019-2020.pdf, 35; US Bureau of Labor Statistics, “Local Area Unemployment Statistics: Puerto Rico,” Accessed May 23, 2022, https://data.bls.gov/timeseries/LASST720000000000006?amp%253bdata_tool=XGtable&output_view=data&include_graphs=true. Note: A 2015 study on Act 20 and 22 also found only around 7,000 jobs were created: https://estadisticas.pr/files/BibliotecaVirtual/estadisticas/biblioteca/DDEC_Act_20_22_Economic_Impact_Study_2015.pdf, 30. ↑

- This reflects all jobs, not just jobs created. Ramón J. Cao García, et al. “Evaluación De Beneficios Y Costos De Créditos E Incentivos Contributivos a Empresas,” Asesoría Y Consulta, Inc., 2014https://periodismoinvestigativo.com/wp-content/uploads/2016/06/EVALUACION_DE_CREDITOS_E_INCENTIVOS.pdf, 43-44. ↑

- Diane Lourdes Dick “U.S. Tax Imperialism in Puerto Rico,” American University Law Review: Vol. 65: Iss. 1 , Article 1, 2015 https://digitalcommons.wcl.american.edu/cgi/viewcontent.cgi?article=2120&context=aulr, 1, 9. ↑

- US Government Accountability Office, “Report to the Chairman, Committee on Finance, U.S. Senate“Puerto Rico and the Section 936 Tax Credit,” June 1993, https://www.gao.gov/assets/ggd-93-109.pdf, 2-4; John W. Schoen, “Here’s how an obscure tax change sank Puerto Rico’s economy,” CNBC, September 26 2017, https://www.cnbc.com/2017/09/26/heres-how-an-obscure-tax-change-sank-puerto-ricos-economy.html; ↑

- E.g., Sergio M. Marxuach & Fundación Luis Muñoz Marín “The Puerto Rican Economy: Historical Perspectives and Current Challenges,” Center for a New Economy, March 13, 2007, http://grupocne.org/wp-content/uploads/2012/02/FLMM.pdf, 24-25. ↑

- US Department of Treasury, “The Operation and Effect of the Possessions Corporation System of Taxation,” March 1989, https://home.treasury.gov/system/files/131/Report-Possessions-1989.pdf, 47. ↑

- Jesse Barron, “How Puerto Rico Became the Newest Tax Haven for the Super Rich,” GQ, September 18, 2018, https://www.gq.com/story/how-puerto-rico-became-tax-haven-for-super-rich. ↑

- Andrew Ross Sorkin, “Pfizer’s Long War on Taxation,” New York Times, November 30, 2015, https://www.nytimes.com/2015/12/01/business/dealbook/pfizers-long-war-on-taxation.html. ↑

- John W. Schoen, “Here’s how an obscure tax change sank Puerto Rico’s economy,” CNBC, September 26 2017, https://www.cnbc.com/2017/09/26/heres-how-an-obscure-tax-change-sank-puerto-ricos-economy.html. ↑

- Nick Brown, “How Dependence on Corporate Tax Breaks Corroded Puerto Rico’s Economy,” Reuters December 20, 2016, https://www.reuters.com/investigates/special-report/usa-puertorico-economy/#article-puerto-pobre; Michal Kranz, “Here’s how Puerto Rico got into so much debt,” Business Insider, October 9, 2017, https://www.businessinsider.com/puerto-rico-debt-2017-10. Natalia Renta, Maggie Corser and Saqib Bhatti “PROMESA Has Failed: How a Colonial Board Is Enriching Wall Street and Hurting Puerto Ricans,” Center for Popular Democracy and Action Center on Race and the Economy, September 2021,https://www.populardemocracy.org/PROMESAHasFailed, 11-12. ↑

- Puerto Rico Act 60 “Puerto Rico Incentives Code” Approved July 1, 2019 https://www.investpr.org/wp-content/uploads/2021/11/ENG_A-60-2019-Codigo-de-Incentivos.pdf ↑

- “Life Sciences Manufacturing Report: Puerto Rico” Jones Lang LaSalle and Invest Puerto Rico, 2020 https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/jll-puerto-rico-life-sciences-manufacturing-report.pdf, 6. ↑

- US Securities and Exchange Commission, “Form 10-K: Amgen” For the fiscal year ended December 31, 2020, https://investors.amgen.com/node/30831/html, 76. ↑

- Natalia Renta, Maggie Corser and Saqib Bhatti “PROMESA Has Failed: How a Colonial Board Is Enriching Wall Street and Hurting Puerto Ricans,” Center for Popular Democracy and Action Center on Race and the Economy, September 2021,https://www.populardemocracy.org/PROMESAHasFailed, 19; Congress of the United States, Open letter dated September 24, 2019 “To the members of the Fiscal Oversight and Management Board,” https://www.warren.senate.gov/imo/media/doc/puerto-rico-fomb-letter.pdf. ↑

- “Hedge Paper No. 73 – The New Oversight Lords,” Hedge Clippers, March 17, 2021, https://hedgeclippers.org/puerto-rico-new-oversight-lords/. ↑

- Financial Oversight and Management Board for Puerto Rico, “Antonio Medina, Member” webpage accessed May 23, 2022, https://oversightboard.pr.gov/antonio-medina/; Robert Slavin, “Antonio Medina Comas named to Puerto Rico Oversight Board,” The Bond Buyer, December 15, 2020, https://www.bondbuyer.com/news/antonio-medina-comas-named-to-puerto-rico-oversight-board.. ↑

- “Hedge Paper No. 73 – The New Oversight Lords,” Hedge Clippers, March 17, 2021, https://hedgeclippers.org/puerto-rico-new-oversight-lords/. ↑

- Financial Oversight and Management Board for Puerto Rico, “FOMB Policy: Review Of Contracts,” 2021, https://drive.google.com/file/d/1ujjQKj5z120VJ2TQ07sa8CpR9ATrObsJ/view, 2-3. ↑

- Natalia Renta, Maggie Corser and Saqib Bhatti “PROMESA Has Failed: How a Colonial Board Is Enriching Wall Street and Hurting Puerto Ricans,” Center for Popular Democracy and Action Center on Race and the Economy, September 2021, https://www.populardemocracy.org/PROMESAHasFailed, 23; “Hedge Paper No. 73 – The New Oversight Lords,” Hedge Clippers, March 17, 2021, https://hedgeclippers.org/puerto-rico-new-oversight-lords/. ↑

- Andrew Rice & Luis Valentin Ortiz, “The McKinsey Way to Save an Island: Why is a bankrupt Puerto Rico spending more than a billion dollars on expert advice?,” New York Magazine, April 17, 2019,https://nymag.com/intelligencer/2019/04/mckinsey-in-puerto-rico.html. ↑

- Mary Williams Walsh, “McKinsey Advises Puerto Rico on Debt. It May Profit on the Outcome,” New York Times, September 26, 2018, https://www.nytimes.com/2018/09/26/business/mckinsey-puerto-rico.html. ↑

- Andrew Rice & Luis Valentin Ortiz, “The McKinsey Way to Save an Island: Why is a bankrupt Puerto Rico spending more than a billion dollars on expert advice?” New York Magazine, April 17, 2019, https://nymag.com/intelligencer/2019/04/mckinsey-in-puerto-rico.html. ↑

- Alex Wolf, “McKinsey Faces Conflict Disclosure Deadline in Puerto Rico Work,” Bloomberg Law, May 9, 2022, https://news.bloomberglaw.com/bankruptcy-law/mckinsey-faces-conflict-disclosure-deadline-in-puerto-rico-work. ↑

- US Congress “H.R.1192 – Puerto Rico Recovery Accuracy in Disclosures Act of 2021,” https://www.congress.gov/bill/117th-congress/house-bill/1192/all-info; Alex Wolf, “McKinsey Faces Conflict Disclosure Deadline in Puerto Rico Work,” Bloomberg Law, May 9, 2022, https://news.bloomberglaw.com/bankruptcy-law/mckinsey-faces-conflict-disclosure-deadline-in-puerto-rico-work. ↑

- “Declaration Of Dmitry Krivin, A Partner Of Mckinsey & Company, Inc. United States, Disclosing Connections To Material Interested Parties In Connection With The Puerto Rico Recovery Accuracy In Disclosures Act” May 16, 2022, Https://Drive.Google.Com/File/D/1jde6s7ytqrodtltj1paqwfzqsczaeqts/View, 294. ↑

- E.g., Cate Long, Twitter post, May 16, 2022, 6:56 pm, https://twitter.com/cate_long/status/1526335745207717889 ↑

- Michael Forsythe and Walt Bogdanich, “McKinsey Settles for Nearly $600 Million Over Role in Opioid Crisis,” New York Times, Updated November 5, 2021, https://www.nytimes.com/2021/02/03/business/mckinsey-opioids-settlement.html. ↑

- National Center for Education Statistics, “District Name: Puerto Rico Department Of Education,” Accessed May 23, 2022, https://nces.ed.gov/ccd/districtsearch/district_detail.asp?ID2=7200030; Andrew Ujifusa, “What’s the Price Tag for Fixing Up Puerto Rico’s Schools? Try $11 Billion,” Education Week, January 13, 2019, https://www.edweek.org/education/whats-the-price-tag-for-fixing-up-puerto-ricos-schools-try-11-billion/2019/01 https://livingwage.mit.edu/counties/35045. ↑

- “Puerto Rico to Increase Teachers’ Salaries by $1K a Month,” Associated Press, February 7, 2022, https://www.usnews.com/news/us/articles/2022-02-07/puerto-rico-to-increase-teachers-salaries-by-1k-a-month. ↑

- Noreen Clancy, Lloyd Dixon, Daniel Elinoff, Kathryn Kuznitsky, Sean McKenna,” Modernizing Puerto Rico’s Housing Sector Following Hurricanes Irma and Maria,” Rand Corporation, 2020, https://www.rand.org/pubs/research_reports/RR2602.html, xvii-xviii. ↑

- “Solar panel cost San Juan: Prices & data 2022,” SolarReviews.com Updated: April 6, 2022, https://www.solarreviews.com/solar-panel-cost/puerto-rico/san-juan, ↑