“Consider this … your Yom Kippur. You’re going to donate a lot of money. Not enough, obviously, to offset all the s- you’ve done, but a lot.” – Jon Stewart at Robin Hood Foundation gala in 2009[1]

The governing boards of the Robin Hood Foundation, an anti-poverty charity, are a picture of the extreme and growing concentration of wealth in American society. Nineteen billionaires are represented on the foundation’s various leadership boards and committees.

» read more

The foundation was founded by billionaire hedge fund manager Paul Tudor Jones, and its leadership ranks are dominated by hedge fund managers.

These hedge fund managers, billionaires, and other Robin Hood Foundation donors will be gathering on May 12 for the foundation’s annual gala, a star-studded affair that has been called “Wall Street’s biggest charity event.”[2] The gala regularly raises over $50 million for the foundation and its poverty-fighting efforts.

The foundation is well known for its use of grantee evaluations, cost-benefit analyses, and performance measures, including a metrics system called “relentless monetization.”

In preparation for the Robin Hood Foundation gala, Hedge Clippers is adopting this analytical approach and applying it not to the foundation’s grantees, but to the foundation’s major hedge fund backers.

This paper evaluates the extent to which Paul Tudor Jones and other hedge fund managers backing the Robin Hood Foundation are actually fueling poverty and inequality.

In other words, how much are these hedge fund managers robbing from the poor?

To address this question, the paper focuses in large part on tax avoidance, anti-tax advocacy, and advocacy for social safety net cuts, and specifically on the activities of the Managed Funds Association (MFA), a hedge fund industry lobbying group that is closely linked to the Robin Hood Foundation.

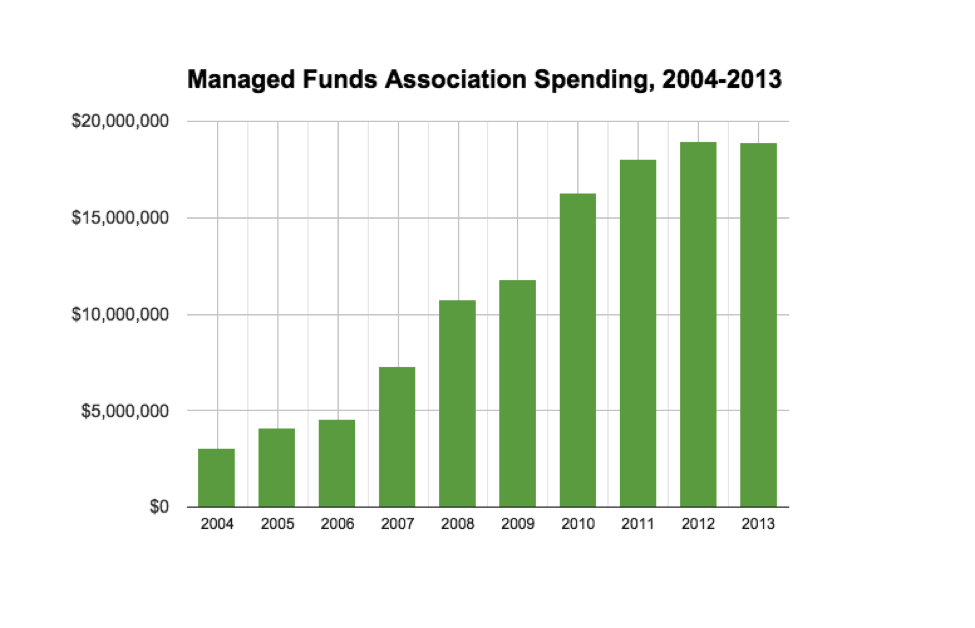

Two of Paul Tudor Jones’ deputies oversee the MFA, and 31 Robin Hood leaders have ties to it through their hedge funds and financial firms. The MFA ramped up spending dramatically in recent years – by five times since 2006 – and has led the fight against sensible tax reforms, like closing the carried interest loophole, that target hedge fund billionaires.

The paper estimates a cost-benefit ratio of 44:1 for one set of hedge fund managers at Robin Hood – that is, for every dollar they give to the antipoverty efforts of the Robin Hood Foundation, this particular set of billionaires are robbing at least $44 from the public in the form of tax avoidance and anti-tax advocacy. Because this analysis is limited in various ways, the figure is likely much higher.

Poverty indicators show that Robin Hood’s leaders are doing quite well for themselves, if not the poor.

“Poverty is a growth business.”

– Robin Hood Foundation founder Paul Tudor Jones[3]

Key points:

- Failure: The New York City poverty rate has increased over the course of the Robin Hood Foundation’s history, from 20% in 1990 to 21.2% in 2012.

- Success: The total wealth of the 19 billionaires on the Robin Hood Foundation’s boards has skyrocketed 93% since 2008, to $164 billion.

- Neither statistic appears in the Robin Hood Foundation’s 142-page document spelling out its rigorous evaluation system, which has been dubbed “relentless monetization.”

The Robin Hood Foundation’s obsession with measuring its success and evaluating its grantees is well publicized and widely lauded. In 2006, for instance, Fortune called the foundation “one of most innovative and influential philanthropic organizations of our time” and described it as “an early practitioner of using metrics to measure the effectiveness of grants.”[4]

The foundation’s system of metrics is dubbed “relentless monetization,” a bizarre but appropriate name for a foundation founded and controlled by hedge fund managers.[5] 163 “metric equations” covering everything from asthma treatment to job training are spelled out in a 142-page document on the foundation’s website. The metrics are used as part of the foundation’s “Benefit-Cost Analysis,” which measures, in part, how much of an income boost individuals get as a result of the foundation’s spending.[6]

The foundation’s system of metrics is dubbed “relentless monetization,” a bizarre but appropriate name for a foundation founded and controlled by hedge fund managers.[5] 163 “metric equations” covering everything from asthma treatment to job training are spelled out in a 142-page document on the foundation’s website. The metrics are used as part of the foundation’s “Benefit-Cost Analysis,” which measures, in part, how much of an income boost individuals get as a result of the foundation’s spending.[6]

The foundation’s metrics may be more about marketing than actual substance.

In 2009, Holden Karnofsky, co-executive director of charity evaluator GiveWell, published an article titled “What we know about Robin Hood (almost nothing).”[7] He described failed attempts to get the foundation to provide information on its evaluation system, and said that the foundation appeared more interested in “quantifying good” than in “real impact.” He closed the article by writing,

“Robin Hood has essentially no transparency, and essentially no accountability, to the public and to its donors (at least the smaller donors, i.e., those giving tens of thousands of dollars).”

Despite the foundation’s opacity, it is actually relatively easy to evaluate its performance based on publicly available statistics.

The foundation advertises a single, ambitious objective on its website: to end poverty in New York City. A decreasing poverty rate in New York City would indicate that the foundation had enjoyed some degree of success in working towards this goal.

In fact, the overall poverty rate in New York City has increased over the course of the foundation’s history, from 20% in 1990 (it was founded in 1988) to 21.2% in 2012.[8]

As founder Paul Tudor Jones has described it, poverty has been a “growth business” in New York, despite all of the foundation’s efforts.

The Robin Hood billionaires’ wealth has skyrocketed 93% since 2008.

While the foundation has failed to make any progress in lowering New York City’s poverty rate, its board has a remarkable record of success in growing its own wealth.

There are nineteen billionaires and close family members of billionaires on the Robin Hood Foundation leadership boards, according to a review of Forbes data.[9] While Robin Hood Foundation board member and billionaire Ken Langone has described this data on billionaires as “the most destructive thing in the world,” it is one of the best public sources of metrics on billionaire wealth.[10]

Since 2008, prior to the financial crisis, the collective wealth of the Robin Hood billionaires rose 93%, from $85 billion to $164 billion.

Table: Robin Hood billionaires’ wealth skyrockets, 2008-present.

| Billionaire | Occupation/billionaire tie | Wealth in 2008 | Wealth now | % Change, 2008-present |

| David Tepper | Hedge fund manager | $1,800,000,000 | $10,400,000,000 | 477.78% |

| Jacklyn Bezos | Mother of Jeff Bezos | $8,700,000,000 | $40,100,000,000 | 360.92% |

| Ken Langone | Home Depot co-founder | $1,000,000,000 | $2,700,000,000 | 170.00% |

| William Ackman | Hedge fund manager | $1,000,000,000 | $2,500,000,000 | 150.00% |

| Larry Robbins | Hedge fund manager | $1,000,000,000 | $2,200,000,000 | 120.00% |

| Lachlan Murdoch | Son of Rupert Murdoch | $6,800,000,000 | $13,900,000,000 | 104.41% |

| Emma Bloomberg | Daughter of Michael Bloomberg | $20,000,000,000 | $37,000,000,000 | 85.00% |

| Eric Schmidt | Google chairman | $5,900,000,000 | $9,300,000,000 | 57.63% |

| Glenn Dubin | Hedge fund manager | $1,300,000,000 | $2,000,000,000 | 53.85% |

| David Einhorn | Hedge fund manager | $1,300,000,000 | $1,920,000,000 | 47.69% |

| Emanuel Stern | Son of Leonard Stern | $3,700,000,000 | $5,400,000,000 | 45.95% |

| Steven A Cohen | Hedge fund manager | $8,000,000,000 | $11,400,000,000 | 42.50% |

| Paul Tudor Jones | Hedge fund manager | $3,300,000,000 | $4,600,000,000 | 39.39% |

| Dirk Ziff | Hedge fund manager | $3,700,000,000 | $4,900,000,000 | 32.43% |

| Laura Arnold | Spouse of hedge fund manager John Arnold | $2,500,000,000 | $2,600,000,000 | 4.00% |

| Daniel Och | Hedge fund manager | $3,900,000,000 | $4,000,000,000 | 2.56% |

| Richard Chilton | Hedge fund manager | $1,400,000,000 | $1,240,000,000 | -11.43% |

| Stanley Druckenmiller | Hedge fund manager | $3,500,000,000 | $3,100,000,000 | -11.43% |

| Marie-Josée Kravis | Spouse of Henry Kravis of KKR | $6,500,000,000 | $5,100,000,000 | -21.54% |

| Total | $85.3 billion | $164.36 billion | 92.68% |

Note: Each individual serves on a Robin Hood board or leadership committee. Figures are drawn from Forbes’ 2008 list of billionaires, the 2008 Forbes 400, and real-time Forbes wealth profiles. *For individuals who did not appear on Forbes lists in 2008, wealth was estimated at $1 billion for the purpose of calculating the increase over the period studied.

The group is dominated by hedge fund managers – 12 of the 19 are in the hedge fund industry.

Hedge fund manager David Tepper saw his wealth increase 477% during the period following the financial crisis, from $1.8 billion in 2008 to $10.4 billion, more than any other billionaire at Robin Hood.

Robin Hood’s top executives make nowhere near as much as the billionaires on the board, though their salaries place them squarely among New York City’s one percent. Executive Director David Saltzman received $703,423 in compensation from the Robin Hood Foundation in 2013.<[11] He also made $125,004 as a new board member of New Residential Investment Corp in 2014, bringing his total reported compensation to $828,427.[12] This represents a 54% increase from his reported income from Robin Hood in 2008, $539,293.[13]

Over roughly the same period, 2008-2013, median family income in New York City actually decreased 5.2%.[14]

These sobering metrics suggest that the Robin Hood Foundation’s backers will have a lot of surplus wealth to spend at the annual gala, but not a whole lot to celebrate in terms of actual success in achieving their ostensible mission.

One big reason why this is the case? Taxes.

The Robin Hood Foundation has a shadow advocacy organization, and it is leading the fight against hedge fund taxes.

“Your contributions are completely tax deductible, which might be of interest to you, if you actually paid taxes.” – Triumph the Comic Insult Dog at Robin Hood Foundation gala[15]

Key points:

- The hedge fund lobbying group Managed Funds Association has extremely close ties to the Robin Hood Foundation through Paul Tudor Jones and over 30 other Robin Hood leaders.

- Since 2007, MFA has led the fight against the hedge fund tax break known as the “carried interest tax loophole.” Closing the loophole at the federal level would have raised $17 billion per year.

- MFA increased its lobbying and overall spending by nearly five times between 2007, when Congress first began targeting the tax loophole, to 2013.

- Just five of the hedge fund managers serving on Robin Hood leadership boards made $3.8 billion in 2014.

- If this income were taxed at the same rate as ordinary income, they would owe an additional $745 million in taxes.

According to its “Get Funding” FAQ page, the Robin Hood Foundation does not fund “advocacy work” or “protest,” and anti-hunger advocates have described being rejected by the foundation because they do not hew to a model of direct service.[16]

But it seems that Paul Tudor Jones and other hedge fund backers of the Robin Hood Foundation are fine with a certain kind of advocacy: they are deeply engaged in anti-tax advocacy that lines their pockets at public expense – Robin Hood in reverse.

Much of this advocacy is carried out by the Managed Funds Association (MFA), a hedge fund industry lobbying group.

In many ways, the MFA is a Robin Hood Foundation shadow lobby – Paul Tudor Jones’ hedge fund plays a leading role at the group and there is extensive overlap between the two:

- Paul Tudor Jones’ top deputy, John Torell, chairs the MFA and has since 2013; he has served on the board for longer. Torell is managing director and CFO at Jones’ hedge fund Tudor Investment. [17]

- Tudor Investment is the only hedge fund with more than one representative on the MFA board. Christopher Greene, managing director and chief administrative officer at Tudor Investment, serves on the board alongside Torell.[18]

- 31 members of Robin Hood’s governing board and leadership committees are executives at firms that belong to the highest membership levels of the Managed Funds Association.

Table: Robin Hood Foundation leaders with ties to Managed Funds Association

| Name | Tie(s) to Robin Hood Foundation | Hedge fund/firm | firm tie-in to MFA |

| Tony Davis | committee | Anchorage Capital | sustaining member |

| Clifford Asness | founding leadership council | AQR Capital | founders council |

| Laurence Fink | governing board | BlackRock | sustaining member |

| Jes Staley | governing board | BlueMountain Capital | founders council |

| Derek Kaufman | leadership council | Citadel | founders council |

| Philippe Laffont | governing board | Coatue Management | sustaining member |

| Anne Dinning | vice chair of governing board | DE Shaw | founders council |

| Dan Michalow | leadership council member | DE Shaw | founders council |

| Julius Gaudio | emeritus board | DE Shaw | founders council |

| Max Stone | governing board | DE Shaw | founders council |

| Larry Robbins | governing board | Glenview Capital | sustaining member |

| David M Solomon | governing board | Goldman Sachs | strategic partner |

| Lloyd C Blankfein | emeritus board | Goldman Sachs | strategic partner |

| Tony Pasquariello | leadership council | Goldman Sachs | strategic partner |

| David Einhorn | chair, governing board | Greenlight Capital | sustaining member |

| Alan D Schwartz | governing board | Guggenheim Partners | sustaining member |

| Glenn Dubin | governing board | Highbridge Capital | founders council |

| Purnima Puri | leadership council | Highbridge Capital | founders council |

| Kristin Lemkau | leadership council | JPMorgan Chase | strategic partner; board |

| Priscilla Almodovar | advisory board | JPMorgan Chase | strategic partner; board |

| Alexander Navab | governing board | KKR | sustaining member |

| Kenneth B Mehlman | advisory board | KKR | sustaining member |

| Marie-Jose Kravis | emeritus board | KKR (wife of Henry Kravis) | sustaining member |

| Lee S Ainslie III | governing board | Maverick Capital | board; sustaining member |

| Daniel Och | governing board | Och-Ziff Capital | sustaining member |

| Peter Muller | founding leadership council | PDT Partners | sustaining member |

| William Ackman | committee | Pershing Square Capital | board; founders council |

| David Puth | governing board | State Street | strategic partner |

| Paul Tudor Jones II | governing board | Tudor Investment | 2 board seats, including chair; founders council |

| David Siegel | advisory board | Two Sigma Investments | founders council |

| John Overdeck | governing board | Two Sigma Investments | founders council |

For a long time, the Managed Funds Association was a relatively small industry association with a limited budget and Washington lobbying presence. That all changed in 2007, when Congress began targeting the carried interest tax loophole.

The carried interest loophole means that hedge fund managers’ compensation is taxed as capital gains, rather than ordinary income – at 20%, as opposed to 39.6% – saving them billions of dollars.

There appears to be no economic rationale for the tax break, and economists ranging from Greg Mankiw to Dean Baker have criticized its continued existence.[19] Closing the carried interest loophole would raise billions of dollars in revenue – around $17 billion a year, according to one Congressional Research Service estimate.[20]

In 2007, when the loophole was first targeted by Congress, MFA spending on federal lobbying jumped by five times, from $340,000 to $1.9 million.[21] The MFA now consistently spends close to $4 million on lobbying.

This increase was also reflected in MFA’s overall budget: spending has increased from $4.6 million in 2006 to nearly $19 million in 2013.[22] A healthy portion of this budget is spent on the MFA’s president, Richard Baker, who made over $2.5 million in 2013 – nearly five times the president of the organization prior to the ramp-up in activity. The MFA purchased Baker in early 2008, straight out of Congress, where he had chaired the capital markets subcommittee of the House Financial Services committee. [23]

The MFA regularly lobbies against the closure of the carried interest tax break.[24] Baker has warned Congress that closing the loophole would have “serious and negative consequences on U.S. capital markets, job growth and capital formation in the United States.”[25]

Standing behind Baker, of course, are Paul Tudor Jones and the numerous other Robin Hood hedge funds that drive the advocacy agenda at the Managed Funds Association.

Case study: five billionaire Robin Hood leaders and the taxes they don’t pay

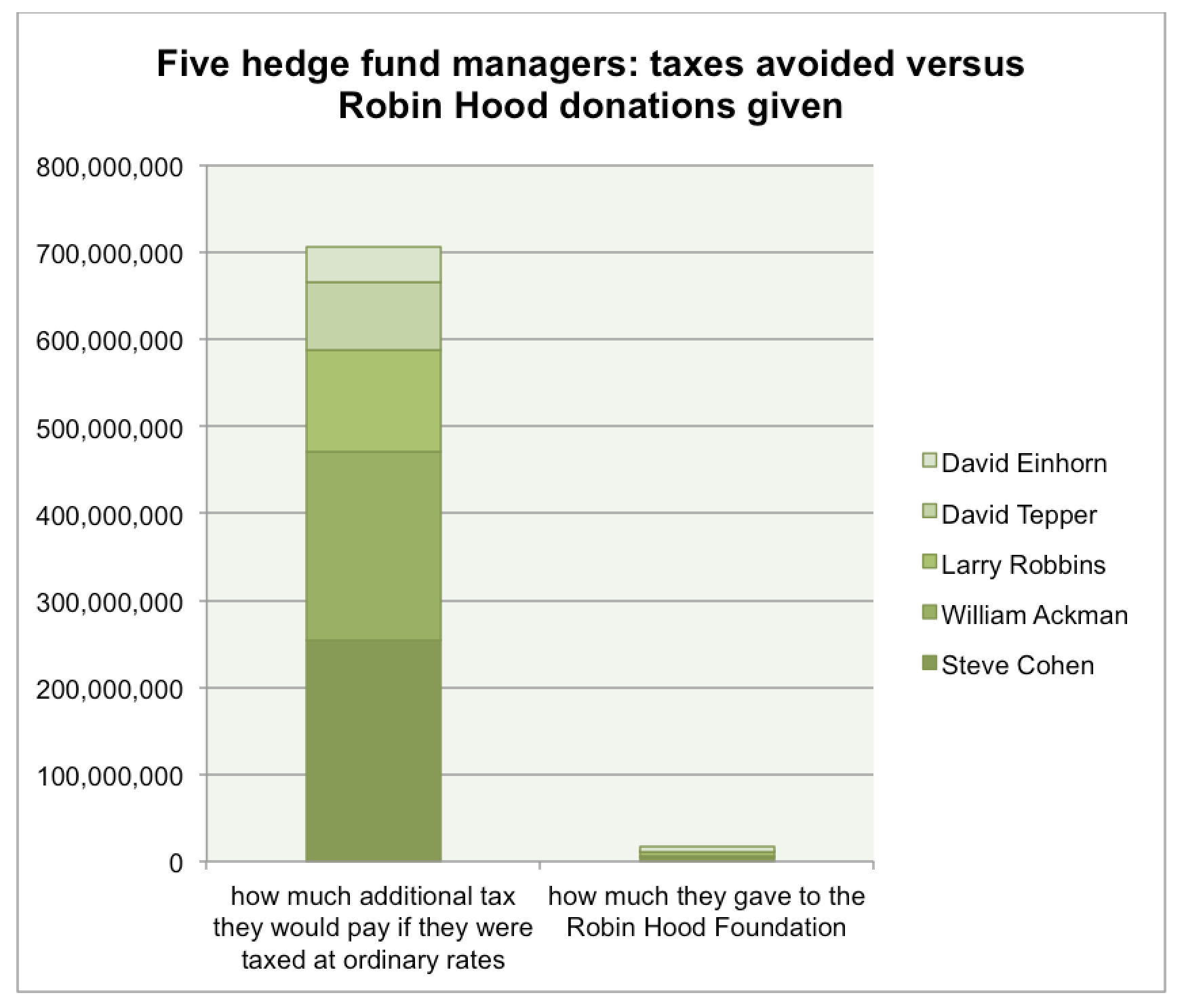

In the spirit of Robin Hood’s “relentless monetization,” the table below sets forth key metrics: the 2014 earnings for five hedge fund managers serving on leadership boards of the Robin Hood Foundation, an estimate of the additional tax the hedge fund managers would pay if their income was taxed at the ordinary rate, and, to put these numbers in perspective, data on their recent donations to the Robin Hood Foundation.

Collectively, these five hedge fund managers earned $3.8 billion in 2014, according to Forbes estimates. If this income were taxed at the ordinary income tax rate, they would have paid an additional $745 million in taxes.

| Hedge fund manager | Robin Hood tie | 2014 earnings (Forbes) | Additional tax they would pay at ordinary rates | Recent donations to Robin Hood Foundation |

| Steve Cohen | emeritus board | $1,300,000,000 | $254,800,000 | $4,850,000[26] |

| William Ackman | prize board | $1,100,000,000 | $215,600,000 | $2,000,000[27] |

| Larry Robbins | board | $600,000,000 | $117,600,000 | $3,787,500[28] |

| David Tepper | board | $400,000,000 | $78,400,000 | $943,170[29] |

| David Einhorn | chair | $200,000,000 | $39,200,000 | $5,276,000[30] |

| Paul Tudor Jones | founder | $200,000,000 | $39,200,000 | unknown |

| Total | $3,800,000,000 | $744,800,000 | $16,856,670 |

Note: Figures for earnings are drawn from Forbes estimates in 2015. Recent donation data is drawn for 990s for the foundations of each hedge fund manager. In cases where the foundation donated a substantial sum two years ago but not last year, the larger sum was included.

Performing the same kind of cost-benefit analysis the foundation applies to its grantees, this chart compares the five hedge fund managers’ most recent significant donations to the Robin Hood Foundation to estimates of taxes avoided.

If the taxes that the hedge fund managers avoid are considered a public cost, and the donations they give to Robin Hood are considered a public benefit, these figures yield an abysmal cost-benefit ratio of 44:1.

In other words, these five hedge fund managers are robbing $44 from the public for every dollar they invest in the poor.

Even when all of their charitable giving through family foundations is considered, the five hedge fund managers are still giving away far less than what they would pay in taxes at ordinary rates.

Tax returns for their family foundations show total giving of $108 million, which is approximately 3% of their total earnings in 2014 and 15% of the estimated additional taxes they would pay at ordinary rates.[31]

Lobbying against fair-share taxes across the board

The Managed Funds Association has also lobbied against other progressive tax reforms that would tax wealthy hedge fund managers and financial firms.

In 2014, for instance, the MFA lobbied aggressively against the “Inclusive Prosperity Act,” which would have levied a small tax on financial transactions like stock trades.[32] This tax is often proposed but is then killed by the advocacy efforts of wealthy financiers like Paul Tudor Jones – or more specifically, the lobbyists who do their dirty work.

The tax has been endorsed by leading economists. UMass economists Robert Pollin and James Heintz have estimated potential revenues generated by the tax at $352 billion.[33]

The financial transactions tax has been dubbed the “Robin Hood Tax.”[34]

According to the bill text, revenue from the bill would have funded a range of programs, from low-income housing assistance to student debt relief to public transit.[35] Though this would have delivered significant benefits for low-income New Yorkers, Robin Hood’s backers, through the MFA, forcefully opposed the bill.

It would have been taking the whole Robin Hood thing a bit too far.

To put the amount of money potentially raised by this tax in perspective, this dot represents how much the Robin Hood Foundation spent on antipoverty programs in 2013 ($210 million[36]):

.

These dots represent how much revenue a Robin Hood Tax would potentially raise each year ($352 billion):

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

They’re not just pocketing billions in tax breaks – they’re also waging an assault on the social safety net, the minimum wage, and worker protections.

On one hand, the Robin Hood Foundation seems to recognize the importance of the social safety net.

One of its largest grantees, for instance, is Single Stop USA, which helps low-income people access various state and federal support services more efficiently and easily. Single Stop’s CEO has argued that the social safety net can be an important job creation tool.[37] The anti-poverty organizations in Robin Hood’s grantee pool also tend to rely heavily on public funding.

And yet, many of the Robin Hood Foundation’s leaders and backers support organizations that are advocating significant cuts to the social safety net.

For instance, several hedge fund managers involved with the Robin Hood Foundation are key supporters of the Manhattan Institute. AQR’s Cliff Asness, a member of the foundation’s founding leadership council is on its board, and Robin Hood donors Dan Loeb and Paul Singer also serve on its board.[38]

The Manhattan Institute and its fellows publish frequent screeds against various aspects of the social safety net.[39] Its recent issue brief, “Welfare in America” argues for what amounts to trillions of dollars in cuts to future social safety net spending – the author estimates that the recommendations in the brief would have cut $1.3 trillion in social spending on programs like Medicaid and SNAP from 1998-2013.[40]

Many key Robin Hood backers are also involved with the Partnership for New York City, the voice of big business in New York City.

Hedge fund managers Lee Ainslie and Alan Schwartz sit on both boards, alongside Larry Fink, the CEO of BlackRock and Lloyd Blankfein, CEO of Goldman Sachs (who is on Robin Hood’s emeritus board).[41]

The Partnership was a powerful opponent of paid sick leave in New York City for years.[42] Shortly before the reform passed, Partnership CEO Kathy Wylde told Crain’s “We don’t support paid sick leave, period.” Wylde reversed her position after it went through.

The Partnership has also vocally opposed policies that would increase wages for workers in New York City. For instance, in 2012 it opposed a $10 minimum wage for workers in subsidized developments, and in 2014 it opposed a $15 minimum wage for fast food workers.[43] In 2015, it came out against Mayor Bill de Blasio’s minimum wage proposal, which would increase New York City’s minimum wage to $15 an hour.

The Partnership is also a perennial opponent of taxes on the wealthy and supporter of cuts to public spending. In 2011, for instance, the group opposed the extension of the millionaires’ tax in New York State, in effect arguing for cuts to healthcare and education.[44]

At the same time, it played a key role in the formation of the Committee to Save New York,[45] which staged one of the most expensive lobbying efforts in New York State history for a budget that proposed $9 billion in cuts to a range of public services, including homeless shelters and hospitals.[46]

Robin Hood Foundation housing advisory committee member Rob Speyer led that effort on behalf of the Partnership and the Real Estate Board of New York, which also has ties to several Robin Hood backers.

Many Robin Hood leaders serve in the leadership of Fix the Debt, a corporate austerity campaign advocating lower tax rates on the wealthy and cuts to Social Security and Medicare.[47]

Hedge fund managers Alan Schwartz, Scott Bommer, Lee Ainslie, and Bill Ackman serve on the Robin Hood boards and in the ranks of Fix the Debt’s business leadership, as do GE CEO Jeff Immelt, BlackRock CEO Larry Fink, and Goldman Sachs CEO Lloyd Blankfein.

These ongoing efforts to slash the social safety net have worked over the years – just ask the Robin Hood Foundation. A foundation pitch from 2009 informed donors that “During previous hard times, government offered a far more comprehensive safety net than it does today” before making the case for a gift to Robin Hood.[48]

The Robin Hood Foundation – antipoverty organization or hedge fund fraternity?

“If you are on Wall Street, particularly in hedge funds, you have to be here.”

– Anonymous attendee of 2006 Robin Hood Foundation gala[49]

The seminal analysis of the Robin Hood Foundation’s annual gala was published by noted excess-chronicler Tom Wolfe, who attended the 2006 edition. Taking in the sights, Wolfe noted that the Robin Hood Foundation is as much a charity as it is a vehicle for new-moneyed hedge fund managers to break into New York’s high-status charity scene.

Jones, whom Wolfe called “the real draw” of the event, had managed to develop the gala into “the party of the year in the hedge fund fraternity.”[50]

The foundation’s leadership likely has a lot of experience with fraternity parties. In fact, its founder (Paul Tudor Jones), its current chair (David Einhorn), and its past chair (Lee Ainslie) were all members of the same fraternity, Sigma Alpha Epsilon (SAE) – at UVA, Cornell, and UVA respectively.[51] SAE has gained notoriety in recent months because members of a chapter in Oklahoma were caught on video singing a racist song that celebrated the fraternity’s exclusion of African Americans.

Jones is reportedly also a member of Wall Street fraternity Kappa Beta Phi, along with three other financiers on Robin Hood’s boards – Ken Langone, Larry Fink, and Jon Harris.[52]

The chummy nature of the board is on display in its tax return, which discloses a host of business relationships among board members, several of which involve Jones – according to the return, he has business relationships with board members Glenn Dubin and John Overdeck, as well as the executive director of the foundation, David Saltzman.[53]

This coziness has caused some trouble for the foundation in the past.

In 2007, it attracted Congressional scrutiny for investing with hedge funds operated by board members, including Tudor Investment. In 2005, this had translated into at least $1 million in fees for these funds. The hedge fund investments prompted Senator Chuck Grassley to remark,

“I don’t remember Robin Hood keeping two and 20 as his cut.”[54]

Following Grassley’s remarks, executive director David Saltzman announced that the foundation would end the practice of investing the Foundation’s assets with hedge funds run by donors and board members.[55]

Unfortunately, however, a much bigger Robin Hood Foundation scandal continues to unfold. When will Paul Tudor Jones and his hedge fund buddies start paying their fair share in taxes?

Footnotes

[1] http://www.wsj.com/articles/SB124226570171218003

[2] http://www.cnbc.com/id/100736771

[3] http://archive.fortune.com/magazines/fortune/fortune_archive/2006/09/18/8386204/index.htm

[4] http://archive.fortune.com/magazines/fortune/fortune_archive/2006/09/18/8386204/index.htm

[5] https://www.robinhood.org/metrics

[6] https://www.robinhood.org/sites/default/files/2009_Metrics_Book.pdf

[7] http://blog.givewell.org/2009/12/08/what-we-know-about-robin-hood-almost-nothing/

[8] http://www.manhattan-institute.org/html/cr_88.htm#.VUeeW2TBzGc

[9] All Robin Hood board and leadership information is drawn from this page: https://www.robinhood.org/governance

[10] http://www.forbes.com/sites/afontevecchia/2011/05/25/billionaire-ken-langone-calls-lists-like-forbes-400-destructive/

[11] http://www.guidestar.org/FinDocuments/2013/133/441/2013-133441066-0b091be6-9.pdf

[12] http://www.sec.gov/Archives/edgar/data/1556593/000119312515134659/d885551ddef14a.htm

[13] http://990s.foundationcenter.org/990_pdf_archive/133/133441066/133441066_200812_990.pdf

[14] http://fiscalpolicy.org/nyc-median-family-income-up-for-first-time-since-great-recession

[15] http://www.bloomberg.com/news/articles/2011-05-10/scene-last-night-at-robin-hood-bundchen-lady-gaga-einhorn-cohen-och

[16] https://www.robinhood.org/programs/get-funding-faq https://books.google.com/books?id=7et-DBBRMiYC&lpg=PA139&pg=PA139#v=onepage&q&f=false

[17] http://www.ctaintelligence.com/tudor-cfo-elected-as-mfa-chair/

[18] https://www.managedfunds.org/about-mfa/people/mfa-board/

[19] http://gregmankiw.blogspot.com/2007/07/taxation-of-carried-interest.html http://www.truth-out.org/opinion/item/23074-the-hedge-fund-managers-tax-break-because-wall-streeters-want-your-money

[20] https://www.fas.org/sgp/crs/misc/RS22689.pdf

[21] http://www.opensecrets.org/lobby/clientsum.php?id=D000022096&year=2015

[22] Spending figures from 990s linked here: https://projects.propublica.org/nonprofits/organizations/770277826

[23] See 990s for the Managed Funds Association, covering 2006 and 2012 calendar years. Retrieved via Guidestar, http://www.guidestar.org/FinDocuments/2007/770/277/2007-770277826-0449e727-9O.pdf and http://www.guidestar.org/FinDocuments/2013/770/277/2013-770277826-0a903c57-9O.pdf

[24] See lobbying filings: http://www.opensecrets.org/lobby/client_reports.php?id=D000022096&year=2015

[25] http://www.managedfunds.org/downloads/MFA%20Extenders%20Letter%20-%20W&M-House%20Leadership.pdf

[26] http://www.guidestar.org/FinDocuments/2013/061/627/2013-061627638-0a87927f-F.pdf

[27] http://www.guidestar.org/FinDocuments/2012/208/068/2012-208068401-08fd7616-F.pdf

[28] http://www.guidestar.org/FinDocuments/2012/261/578/2012-261578481-09be5ae8-F.pdf

[29] http://www.guidestar.org/FinDocuments/2013/223/500/2013-223500313-0a636216-F.pdf

[30] http://www.guidestar.org/FinDocuments/2013/226/921/2013-226921358-0b04c575-F.pdf

[31] These figures are drawn from the tax returns cited in the above table.

[32] http://soprweb.senate.gov/index.cfm?event=getFilingDetails&filingID=D675842E-2844-4806-9391-05252F63D10C&filingTypeID=78

[33] http://www.peri.umass.edu/fileadmin/pdf/ftt/Pollin–Heintz–Memo_on_FTT_Rates_and_Revenue_Potential_w_references—-6-9-12.pdf

[34] http://www.robinhoodtax.org/press-release/rep-ellison%E2%80%99s-inclusive-prosperity-act-hr-1579-reintroduced-broad-public-backing

[35] https://www.govtrack.us/congress/bills/113/hr1579/text

[36] http://www.guidestar.org/FinDocuments/2013/133/441/2013-133441066-0b091be6-9.pdf

[37] http://www.huffingtonpost.com/elisabeth-mason/from-safety-net-to-spring_b_1770966.html

[38] http://www.manhattan-institute.org/html/trustees.htm

[39] Food stamps: http://www.manhattan-institute.org/html/miarticle.htm?id=11422#.VUkEYtpViko http://www.manhattan-institute.org/html/ir_23.htm#.VUkEetpViko

[40] http://www.manhattan-institute.org/pdf/e21_03.pdf

[41] http://www.pfnyc.org/reports/pfnyc_brochure.pdf

[42] http://www.pfnyc.org/reports/2010-Paid-Sick-Leave.pdf

[43] http://www.wsj.com/articles/SB10001424052970204542404577159291673477470 http://www.nacsonline.com/News/Daily/Pages/ND0418144.aspx#.VUkd69pViko

[44] http://www.pfnyc.org/reports/2011-Personal-Income-Tax.pdf

[45] http://public-accountability.org/2012/06/the-committee-to-save-1-percent-ny/

[46] http://nypost.com/2011/02/02/gov-goes-on-9b-chopping-spree/

[47] http://www.fixthedebt.org/core-principles http://www.nytimes.com/2012/12/31/opinion/krugman-brewing-up-confusion.html?gwh=0720AE22F3BF633F60C78C991E02FF8E&gwt=pay&assetType=opinion&_r=0

[48] https://www.robinhood.org/sites/default/files/q3%202009.pdf

[49] http://archive.fortune.com/magazines/fortune/fortune_archive/2006/09/18/8386204/index.htm

[50] http://upstart.bizjournals.com/executives/features/2007/04/16/The-Pirate-Pose.html?page=all

[51] http://www.businessinsider.com/wall-street-frats-2013-2#sigma-alpha-epsilon–13

[52] http://nymag.com/daily/intelligencer/2014/02/revealed-members-of-kappa-beta-phi.html

[53] http://www.guidestar.org/FinDocuments/2013/133/441/2013-133441066-0b091be6-9.pdf

[54] www.bloomberg.com/apps/news?pid=newsarchive&sid=acXKQZJS1wYs

[55] www.crainsnewyork.com/article/20070719/FREE/70719008/robin-hood-stops-controversial-investmentsIn