HEDGE FUNDS ATTACK BALTIMORE: Billionaire financiers want huge profits from tax liens on Baltimore’s poorest residents

Baltimore is one of the only cities in the country to auction off tax liens originating from unpaid residential water bills, and it allows residents to have their debts sold when they accumulate to a mere $250, significantly less than other major cities.[1]

Baltimore also takes the lead when it comes to penalty interest rates, which the City allows to run as high as 18% per annum.

This past May, Baltimore held its annual tax sale, where debts from some of the city’s poorest residents were auctioned off to the highest bidder. Baltimore residents who owed as little as $250 in back taxes, or $350 in unpaid water bills, had those debts auctioned off to a small pool of professional speculators.

» read more

Once the debts are in their hands, the speculators can charge extremely high interest rates—a maximum of 18% per year—for two years. It’s a difficult proposition for low-income families to keep up with much higher payments – but the alternative is even worse.

If Baltimore homeowners don’t pay up on these rapidly accelerating debts within two years, the speculators can take their homes away from them through the tax lien foreclosure process.[2]

The result: families lose their homes, neighborhoods lose their pillars, and speculators make big bucks.

In a city with tens of thousands of vacant buildings, this process further destabilizes thousands of families each year and further undermines struggling neighborhoods.[3]

The highly flawed tax sale process has been the subject of in-depth policy white papers, activist criticism, and burgeoning reform efforts.[4] [5] [6] There’s a fight going on in Baltimore, and it’s really worth fighting.

But the truth is that families and reformers are struggling against hugely powerful interests: hedge fund and private equity investors are pouring money into Baltimore’s tax sale, trying to grab big profits from some of the City’s poorest residents.

This paper examines two bidders who were highly active in the 2015 tax sale: Los Angeles-based Imperial Capital, and “DBW TL HoldCo 2015 LLC” — an anonymous limited liability company that appears to be linked to the New York-based Fortress Investment Group.

HELICOPTER-SKIING BILLIONAIRES CALL FOR A “MORAL REVOLUTION” TO HELP THE WORKING CLASS WHILE ATTACKING LOW-INCOME BALTIMORE:

Meet the Fortress Investment Group and “DBW TL HOLDCO 2015 LLC”

Fortress Investment Group describes itself as a “garbage collector,” purchasing distressed assets across the world and trying to squeeze profits from struggling debtors.[7]

A publicly traded behemoth boasting $67.5 billion in “fee paying” regulatory assets under management,[8]

Fortress executives are some of the wealthiest human beings on Planet Earth.

Michael Novogratz, a principal and director of the company, has an estimated net worth of over one billion dollars.[9] [10] Interviewed about the growth of wealth inequality in the United States, Novogratz bristled at the idea that the wealthy are profiting from the poor, insisting that exploitation by the wealthy was “not the root cause of the inequity.”[11]

Novogratz actually called for a “moral revolution” among executives like him that would “give the working and middle class a better shot.”[12]

Yet, time and time again, Fortress Investment Group has found itself preying on the financial resources of average US citizens.

Whether it involved literally betting on the deaths of everyday Americans,[13] operating retirement communities that screwed workers out of wages and overtime pay, or failing to issue WARN Act notices to casino workers who lost their jobs during bankruptcy, Fortress Investment Group has a long history of producing big profits for billionaires from the misery and impoverishment of everyday Americans.[14] [15]

Fortress Seeks to Profit from A&P Grocery Stores, Workers and Shoppers

Most recently, Fortress Investment Group has become a distressed lender to the 156-year old parent company of A&P grocers, which employs 28,500 people.

Thanks to heavy representation by the United Food and Commercial Workers union, A&P employees enjoy decent wages and benefits.[16] Fortress, which is providing “debtor in possession” financing for the struggling grocer, gets to charge hefty interest rates \.[17] At the same time, Fortress has set a timeline for the disposition of A&P’s assets that makes it nearly impossible to avoid the liquidation of more than half the stores, many of which might be viable if more time were allowed to find buyers.

This strategy could result in more than 150 store closings, the disappearance of thousands of good union jobs, and the loss of treasured community resources.

Fortress Seeks to Profit from Baltimore Families With A Shadowy Holding Company

Given its propensity to extract profit from marginalized companies and individuals, it isn’t really surprising that a shadowy limited-liability company (LLC) apparently related to Fortress Investment Group snapped up Baltimore tax liens attached to millions of dollars of property in the 2015 tax sale.

The actual purchaser of the tax liens is a Delaware-based LLC called “DBW TL HOLDCO 2015 LLC,” incorporated by a corporate registration service.[18] A tax lien redemption resolution from Ringwood, NJ shows the company’s address as a post office box in Morristown, NJ.[19]

Almost nothing exists that ties this anonymous limited liability company to Fortress Investment Group, save for a single Delaware uniform commercial code filing, where DBW TL Holdco 2015 LLC provides their address as “c/o Fortress Investment Group, 1345 Avenue of the Americas, 46th Floor, New York, NY.”[20]

Another investment firm, Tower Capital Management, a “tax lien monetization” firm, commonly uses that post office box. A 2013 article in Fortune magazine describes Tower as an affiliate of Fortress,[21] and business registrations for other limited liability companies beginning with “DBW TL Holdco” often list Fortress’s Manhattan office as their mailing address.[22]

The Fortune article describes a market that is as lucrative as it is secretive – and it’s clear why Fortress may be taking steps to obscure its role in this predatory practice.[23]

Tower Capital’s chief executive, John Garzone, ran Xpand, the J.P. Morgan tax-lien unit that received grand-jury subpoenas in 2010 as part of the federal bid-rigging probe. By the time J.P. Morgan JPM 0.00% said it had exited the lien business in 2011, Garzone and other former Xpand executives, including Neil Harreveld, had joined Tower and stepped into the breach. Reached for comment, an unidentified Tower employee said, “We’re not interested in talking,” and hung up the telephone.

Said one investor who declined to be identified: “We don’t want other hedge funds to know” about this industry.[24]

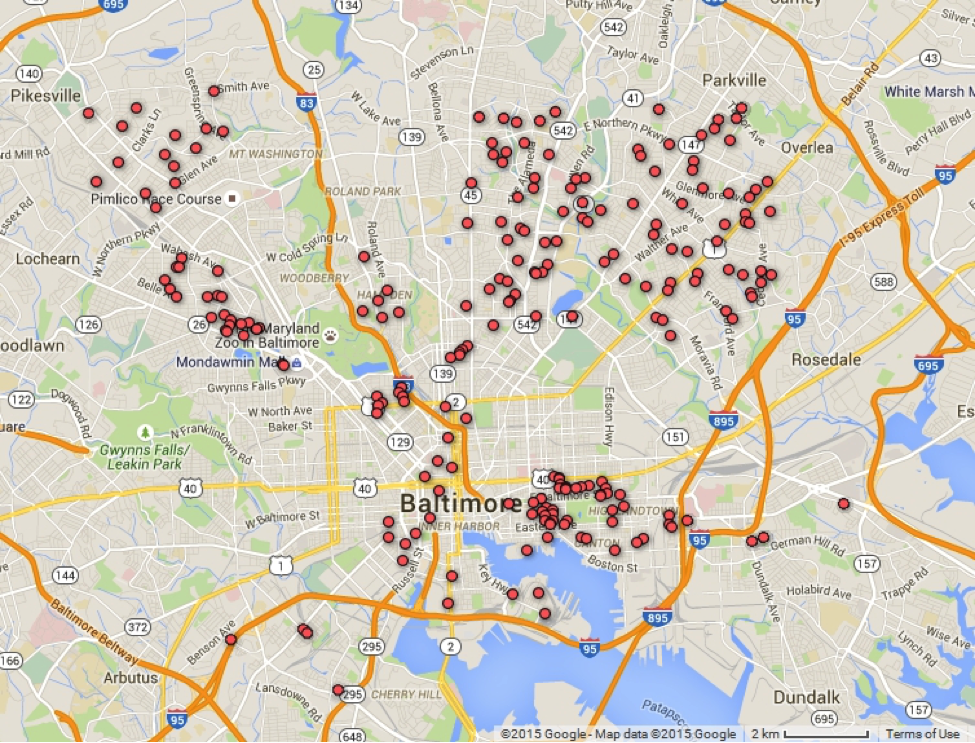

In the 2015 tax lien sale, the Fortress affiliate purchased 225 liens, secured by Baltimore city property worth an estimated $39.42 million.[25]

Of the 225 liens acquired, only six properties were listed as vacant.[26]

Fortress Investment Group tax liens:

Fortress Execs Enjoy Luxury Homes in Tribeca and Greenwich

While an entity apparently related to Fortress Investment Group snaps up properties in one of the nation’s poorest cities, Fortress’s top brass laid their heads at some of the poshest addresses in the country.

Michael Novogratz, the Fortress principal who just can’t believe that the wealthy are driving inequality, owns a $12.5 million, 4,600 square foot Tribeca loft formerly owned by Robert De Niro.[27] A review of campaign finance contributions shows that Novogratz has been a major Democratic donor, contributing approximately $340,000 to Democratic candidates since 2000.[28]

Peter Briger, the Fortress president, prefers an extensive spread in Greenwich, CT, and commutes to New York City. Both men have access to a Fortress-controlled hunting lodge and estate in the Canadian Rockies for helicopter-skiing and other pursuits.[29] Briger, who has doled out $437,000 in federal and state political donations since 2000, leans Democratic.[30]

BEVERLY HILLS MANSION DWELLERS ATTACK LOW-INCOME BALTIMORE: Meet Imperial Capital and “Wood’s Cove III “

Imperial Capital LLC is an investment bank and registered investment advisor operating out of Los Angeles, CA.

In 2014, a subsidiary of Imperial Capital called Woods Cove III, LLC purchased debts owned by 174 Baltimore debtors, snapping up the rights to liens for as little as $1,889.15.[31]

Woods Cove III LLC bid $2.78 million for the tax liens that, if converted, could give the company title to property valued at a total of $43,968,434.00.[32]

While a handful of the properties had valuations over $1 million, thirty of the properties were valued at less than $100,000, and the median property value for tax liens purchased by Woods Cove III, LLC was just $142,400.[33]

Tax liens purchased by Imperial Capital’s Wood’s Cove III LLC in 2014

Imperial Capital is run by Jason Reese—a wealthy Angeleno who has made attempts at purchasing both the LA Dodgers and the New York Mets— and Randall Wooster.[34] [35]

When Reese isn’t making bids to buy sports teams, he’s likely to be found lounging in his $9.2 million mansion in Pacific Palisades.

Jason Reese’s Pacific Palisades mansion. Photo credit: Bing Maps

On the political front, Reese has not been particularly active. He “maxed out” to George W. Bush during his 2004 presidential race, and has given small sums to a handful of federal Republican candidates.[36]

His business partner, Randy Wooster shares his proclivity for expensive California real estate, owning a $4 million mansion in Beverly Hills, and donating to Republican political candidates.[37]

Randy Wooster’s Beverly Hills mansion. Photocredit: Bing Maps

Imperial Capital has been in the center of controversy before. Another of their affiliated companies, Woods Cove II, LLC was criticized for aggressive collections practices after purchasing a large block of tax liens in Cuyahoga County (OH).[38]

Two former attorneys for Woods Cove II, who, at the time, were suing the firm for breach of contract, publicly alleged that Woods Cove was charging usurious interest rates as high as 450% to debtors in Cleveland and the surrounding area.[39] The attorneys, who have since settled their lawsuit against Woods Cove, prompted an investigation by the County Inspector General.[40]

Woods Cove was also criticized by the Vacant and Abandoned Property Action Council, whose 2015 report noted that the company “is not meeting its stated objectives. Redemption rates county-wide are significantly below the rates Woods Cove projected for investing in Cuyahoga County.”[41]

The report also finds that Woods Cove “has not demonstrated the commitment, capacity, and systems to deal with unredeemed properties that become abandoned in the more distressed communities in Cuyahoga County.”

CONDEMNED BY THE NAACP:

Cuyahoga’s tax lien sale, which puts tax lien collections in the hands of Woods Cove, has been condemned by the NAACP, who called on the county to end its tax sale practice in 2014.[42]

The NAACP, in a letter calling for the abolition of the tax sale, called out Woods Cove for charging excessive attorney fees to debtors, a practice which contributed to a system that, the NAACP has charged, “unfairly and unnecessarily deprived residents of their homes.”[43]

Footnotes

[1] http://www.abell.org/sites/default/files/publications/ec-taxsale1014.pdf

[2] http://www.abell.org/sites/default/files/publications/ec-taxsale1014.pdf (see page 11)

[3] http://www.abc2news.com/news/region/baltimore-city/baltimore-officials-working-to-reform-tax-sale-policies

[4] http://www.thentla.com/news/220683/Baltimore-officials-working-to-reform-tax-sale-policies.htm

[5] http://on.aol.com/video/baltimore-working-to-reform-tax-sale-policies-518686136

[6] http://www.abell.org/sites/default/files/publications/ec-taxsale1014.pdf

[7] http://www.fortress.com/PublicShareholders/InsightsViewpoints/fortress-investment-groups-garbage-collectors/_res/id=File1/II%20Mag_Nov_2011%20Fortress%20Credit%20Team.pdf

[8] Fortress ADV Part 2A, dated March 31, 2015

[9] http://www.fortress.com/AboutFortress/Leadership/Board.aspx?id=9

[10] http://www.forbes.com/lists/2008/10/billionaires08_Michael-Novogratz_WJ39.html

[11] http://fortune.com/2013/09/27/a-billionaires-solution-to-income-disparity/

[12] Id.

[13] http://www.wsj.com/articles/SB10001424052702304331204577353831460351586

[14] http://www.law360.com/articles/196543/fortress-settles-gambling-cruise-workers-warn-suit

[15] http://seniorhousingnews.com/2013/11/05/judge-approves-7-5m-holiday-settlement-in-overtime-lawsuit/

[16] http://www.usatoday.com/story/money/2015/07/20/p-grocery-chain-files-bankruptcy-again/30404517/

[17] http://www.thedeal.com/content/restructuring/ap-gets-green-light-to-tap-fortress-dip.php

[18] http://www.bizapedia.com/de/DBW-TL-HOLDCO-2015-LLC.html

[19] http://www.ringwoodnj.net/filestorage/2345/2767/2404/7380/2015-129.pdf

[20] See Delaware UCC filing # 20151675866

[21] http://fortune.com/2013/05/01/the-lucrative-investment-trend-hedge-funds-dont-want-you-to-know-about/

[22] See here https://www.okaloosa.county-taxes.com/public/real_estate/parcels/261S22461D00000350?year=2010 and http://www.connecticutcorps.com/corp/404723.html and http://revenue.ky.gov/NR/rdonlyres/0CFDF024-2414-46D6-A64C-FBA32B507D7E/0/THIRDPARTY…

[23] http://fortune.com/2013/05/01/the-lucrative-investment-trend-hedge-funds-dont-want-you-to-know-about/

[24] Id.

[25] Source: BidBaltimore.com 2015 tax lien sale report, generated 7/30/2015 for buyer number 191.

[26] Ibid.

[27] http://observer.com/2006/06/balazs-neighbors-follow-lead/

[28] http://data.influenceexplorer.com/contributions/#Y29udHJpYnV0b3JfZnQ9TWljaGFlbCUyME5vdm9ncmF0eiU1RCZnZW5lcmFsX3RyYW5zYWN0aW9uX3R5cGU9c3RhbmRhcmQ=

[29] http://fortune.com/2015/05/18/how-wall-street-got-into-the-wild-world-of-bitcoin/

[30] http://data.influenceexplorer.com/contributions/#Y29udHJpYnV0b3Jfc3RhdGU9TlkmY29udHJpYnV0b3JfZnQ9UGV0ZXIlMjBCcmlnZXI=

[31] Compiled from BidBaltimore.com’s 2014 tax lien sale data for buyer “Woods Cove III”

[32] Ibid.

[33] Ibid.

[34] http://www.nytimes.com/2011/03/31/sports/baseball/31mets.html?_r=0

[35] http://usatoday30.usatoday.com/sports/baseball/nl/dodgers/story/2012-01-23/rich-famous-bidders-line-up-to-buy-dodgers/52780200/1

[36] http://data.influenceexplorer.com/contributions/#b3JnYW5pemF0aW9uX2Z0PUltcGVyaWFsJmNvbnRyaWJ1dG9yX2Z0PUphc29uJTIwUmVlc2UmZ2VuZXJhbF90cmFuc2FjdGlvbl90eXBlPXN0YW5kYXJk

[37] http://data.influenceexplorer.com/contributions/#b3JnYW5pemF0aW9uX2Z0PUltcGVyaWFsJmNvbnRyaWJ1dG9yX2Z0PVJhbmRhbGwlMjBXb29zdGVyJTdDUmFuZHklMjBXb29zdGVyJmdlbmVyYWxfdHJhbnNhY3Rpb25fdHlwZT1zdGFuZGFyZA==

[38] https://treasurer.cuyahogacounty.us/pdf_treasurer/en-US/2012PurchaseAgreement%28web%29.pdf

[39] http://www.cleveland.com/cuyahoga-county/index.ssf/2013/12/county_inspector_general_to_investigate_allegations_against_tax_lien_buyer.html

[40] http://www.naacpldf.org/news/working-end-tax-lien-sales

[41] http://povertycenter.case.edu/wp-content/uploads/2015/03/Cuyahoga_Tax_Liens_Sales_3-1-15.pdf

[42] http://www.cleveland.com/cuyahoga-county/index.ssf/2014/03/naacp_calls_on_cuyahoga_county_to_suspend_tax_lien_sales.html

[43] https://s3.amazonaws.com/s3.documentcloud.org/documents/1086660/naacp.pdf