Insurance rates soar,

corporations profit,

campaign cash floods in

May 2023

Contributors

American Federation of Teachers

American Federation of Teachers

The American Federation of Teachers is a union of professionals that champions fairness; democracy; economic opportunity; and high-quality public education, healthcare and public services for our students, their families and our communities. We are committed to advancing these principles through community engagement, organizing, collective bargaining and political activism, and especially through the work our members do. https://www.aft.org/

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. www.populardemocracy.org

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. www.populardemocracy.org

Florida Rising is a statewide voting rights and grassroots organizing group in Florida working to build power in Black and Brown communities. We organize multi-racial movements to win elections, change laws, and create a state where everyone can be safe, happy, healthy and whole. We’re a people-powered organization made up of members advancing economic and racial justice across Florida. https://floridarising.org/

Florida Rising is a statewide voting rights and grassroots organizing group in Florida working to build power in Black and Brown communities. We organize multi-racial movements to win elections, change laws, and create a state where everyone can be safe, happy, healthy and whole. We’re a people-powered organization made up of members advancing economic and racial justice across Florida. https://floridarising.org/

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org/about

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org/about

Overview:

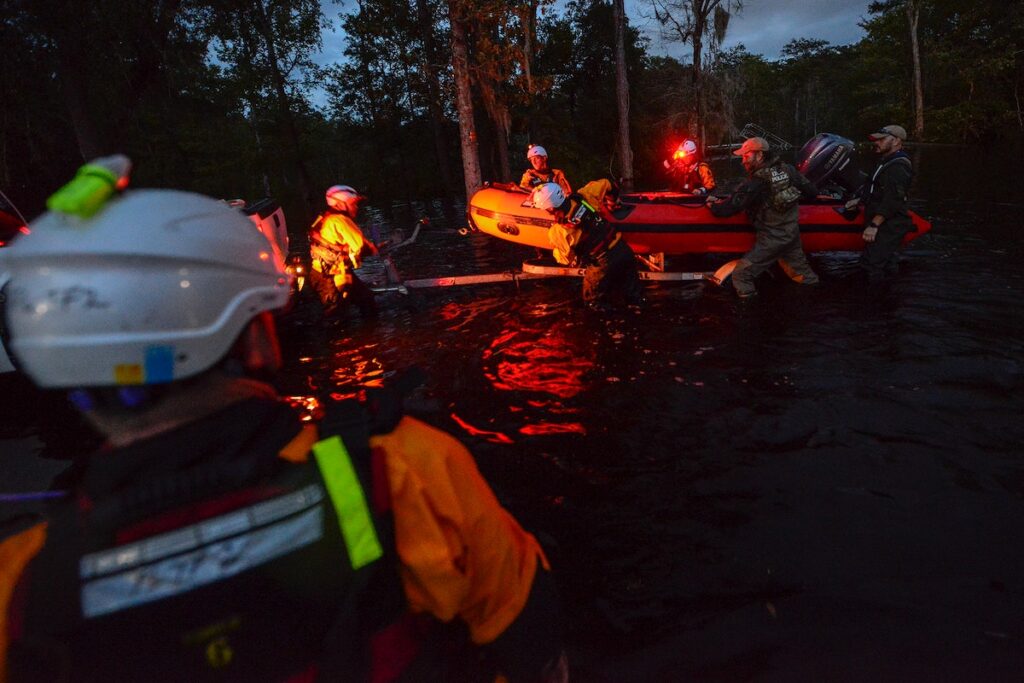

Floridians are suffering. The Sunshine State’s homeowner insurance rates are nearly triple the national average, and rapid increases have forced homeowners to forego insurance at almost twice the national rate.[1] Home insurance is particularly critical in Florida, where communities vulnerable to climate change face increasingly frequent and severe hurricanes and other weather events, like the recent storms that flooded some Fort Lauderdale neighborhoods for more than a week.[2]

Communities of color and low-income neighborhoods with significant climate risks face crumbling infrastructure, soaring insurance premiums, and a lack of public investment. Florida cities like Jacksonville (where one in three residents is Black) and Orlando (where one in three is Latino) are at the highest risk nationally, based on the number of properties at substantial climate risk.[3] In the aftermath of Hurricane Ian, homeowners faced record levels of property damage. Even among those who could afford home insurance, insurance companies wrongfully denied and delayed paying Florida homeowners claims that were critical to rebuilding.[4]

The DeSantis administration accelerated this crisis, with insurance price hikes expected to average 40% this year.[5] This year’s increase comes after years of price increases, which DeSantis’s Office of Insurance Regulation has approved at greater rates and for higher overall increases than the prior administration. Florida residents’ complaints regarding consumer and commercial property casualty insurance–the property insurance types carried by homeowners to avoid catastrophic losses from hurricanes– have jumped under DeSantis’s tenure. This spike in complaints filed against non-paying insurers indicates that Floridians may be paying more and getting less.

The DeSantis administration has handed the insurance companies two significant wins:

1) Creating a $2 billion taxpayer-funded reinsurance fund. Reinsurance funds function as insurance for insurance companies, preventing them from being wiped out during a catastrophic event.[6] Usually, insurance companies purchase reinsurance coverage on the open market; but in Florida, DeSantis decided to use tax dollars to provide access to a state-subsidized insurance fund.

2) DeSantis also stripped Floridians of their ability to recover attorney fees when suing insurance companies that refuse to honor claims. As reporting in The Lever has noted, the loss of recovering attorney fees from insurers who do not pay out is a “momentous” departure from something that had been Florida state law since 1893.[7] Moreover, with the law repealed concerning property insurance, it is only a matter of time before other types of insurers seek similar treatment.

According to S&P Global, these industry handouts are projected to have little effect on driving down overall consumer costs–a prediction borne seemingly in the substantial price increases in 2022 and projected for 2023.[8]

Why have these insurance industry handouts not translated to better rates for Floridians? The answer may lie in who is underwriting DeSantis’s political ambitions.

- Ron DeSantis and the “Friends of Ron DeSantis”political committee have taken a combined $3.9 million in contributions for insurance industry players–not counting the tidy $125,000 that went to Ron’s 2022 inaugural committee.[9]

Including their donations to the Republican Party of Florida since January 1st, 2019 (days before DeSantis took his oath of office), campaign money from the insurance industry balloons to more than $9.9 million.[10]

- Evidence is mounting that big insurance has blocked proposals that would have lowered costs for consumers.

A 2022 proposal by state senator Jeff Brandes claimed to reduce insurance and save Floridians “$750 million to $1 billion a year” by allowing smaller insurance companies to access the catastrophic reinsurance fund.[11] The insurance-heavy business lobby reportedly blocked the plan.[12]

- The insurance industry is writing big checks to DeSantis, and industry cronies are landing big jobs in the offices that oversee Florida’s insurance markets.

Of the three DeSantis appointees to the Board of Governors of Citizens Insurance Corporation–Florida’s insurer of last resort–one is an insurance company executive, one is an executive at an insurance-bankrolled non-profit, and the last is a director of a bank that underwrites mortgages in Florida.[13]

As governor, Ron DeSantis could have easily walked a different path by adequately regulating the industry and bringing rates down for homeowners.

Governors in other states, and even prior governors in Florida, have acted to support homeowners. When insurers threatened to pull out of the state and massively hike rates following Hurricane Andrew, then-Governor Lawton Chiles devised a solution that included a freeze on rate increases.[14] Louisiana has a significantly more robust property casualty insurance market despite similar hurricane risks. A 2023 Insurance Journal article mentions that the “insurance market largely consists of strong national insurers” while Florida has “responded to past periods of heavy catastrophe losses by welcoming thinly capitalized, highly leveraged startup insurers to the peninsula.”[15] Unlike DeSantis’s insurance industry handouts, Louisiana conditions its subsidies to the insurance industry on increased participation in the state property insurance market.[16] Alabama has a policy that incentivizes its Gulf Shore residents to mitigate their homes against wind damage in exchange for lower rates, a strategy replicated in California for wildfire risks.[17]

Ron DeSantis’s coziness with the insurance industry begs the question: Who benefits? Certainly not Florida’s renters and homeowners.

THE PROBLEM:

FLORIDIANS CRUSHED BY HOMEOWNERS INSURANCE PRICE EXPLOSIONS THAT DOUBLED PREMIUMS

Everyday Floridians are getting absolutely crushed by insurance rate hikes. In 2023, rate increases are expected to average 40%, according to the Insurance Information Institute.[18] That projected increase comes on the heels of a reported 50% climb during the DeSantis administration, according to industry analyst John Rollins.[19]

The massive rate increases are forcing some Floridians to leave the state, while others are choosing to forego coverage–something Florida homeowners do at nearly twice the national rate.[20] Foreclosure rates have ticked up in the state in recent years, even as they fall across the country.[21] Property insurance payments are usually rolled into a monthly mortgage payment, and the anomalous increase in foreclosures across the state could be due to the massive hikes in insurance costs.

When homeowners are forced out of their homes, they must navigate the state’s parallel housing crisis which has seen skyrocketing rents.[22] DeSantis received sizable donations from the Florida Realtors, the state’s largest industry trade group, as landlords across the state are pushing harmful policies to raise rents and erode tenant protections.[23]

[pull quote with Tampa Bay Times logo:

“In 2019, when DeSantis was sworn in, Floridians paid an average premium of $1,988. This year, it’s now $4,231, triple the national average, according to an Insurance Information Institute analysis.”

A resident holds a sign warning passersby to slow down to reduce wakes that exacerbate flooded streets in a suburb of Houston, Texas, as U.S Border Patrol riverine agents evacuate residents in the aftermath of Hurricane Harvey August 30, 2017.

More:

U.S. Customs and Border Protection photo by Glenn Fawcett. Original public domain image from Flickr

Florida’s homeowners worse off under DeSantis by multiple metrics

Property casualty insurance rate increases are regulated in Florida and require approval from the Florida Office of Insurance Regulation. Under the DeSantis administration, proposals to increase homeowner multi-peril insurance rates (the state term for property casualty policies that protect homeowners from storm damage) have reached approval rates that exceed the already rubber-stamp rates from Rick Scott’s administration:[24]

Insurance Rate Hikes Have Skyrocketed Since DeSantis took office in 2019

| Total Insurance Rate Increases in Florida (2015-2022) | |||

|---|---|---|---|

| Year | Proposed Insurance Rate Increases | Approved Rate Increases (Total) | Percent Approved |

| 2015 | 419 | 228 | 54% |

| 2016 | 351 | 228 | 65% |

| 2017 | 403 | 254 | 63% |

| 2018 | 360 | 242 | 67% |

| 2019 | 399 | 291 | 73% |

| 2020 | 427 | 337 | 79% |

| 2021 | 430 | 293 | 68% |

| 2022 | 399 | 203 | 51% |

Red = DeSantis in office

Note that slightly more than a quarter of rate change requests were pending as of March 2023 and that the DeSantis administration likely approved some of the 2018 filings after he formally took office in 2019.

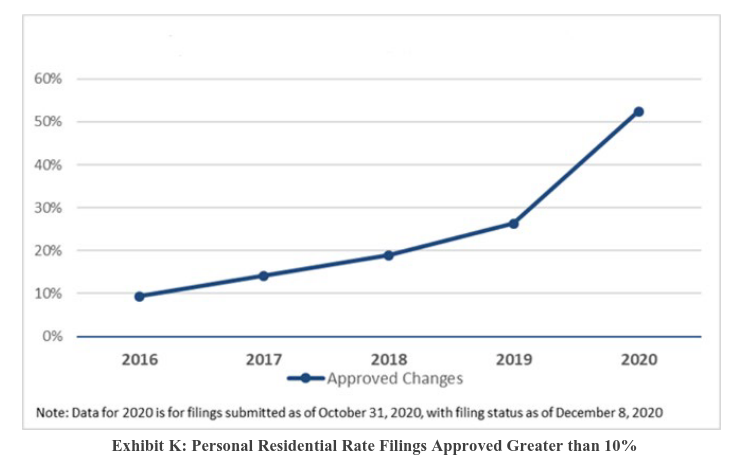

While rate increases sought are not readily available, a 2021 document prepared in advance of testimony by former Florida Insurance Commissioner David Altmaier before the Florida House Commerce Committee shows a significant increase in the number of approvals of increases greater than 10% during the DeSantis administration:[25]

Under DeSantis rate increases greater than 10% have shot up

The number of Florida homeowners filing complaints to initiate lawsuits against insurance companies shot up after DeSantis took office

The total number of complaints filed over property casualty insurance claims provides another metric that quantifies the adversity Floridians have faced under the DeSantis administration. In Florida, a policyholder who intends to initiate litigation against any insurance company must file a “Civil Remedy Notice” with the Florida Department of Financial Services. These claims are available online in a publicly-accessible database.[26]

| Total Florida complaints to initiate lawsuits against insurance companies

(2015-2023) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 (YTD) | |

| Residential property-casualty complaints | 2,654 | 3,516 | 4,910 | 14,563 | 18,344 | 25,046 | 26,118 | 20,711 | 6,575 |

| Commercial property-casualty complaints | 544 | 607 | 722 | 1,661 | 1,499 | 1,583 | 1,236 | 1,044 | 384 |

| Total Complaints Filed | 3,198 | 4,123 | 5,632 | 16,224 | 19,843 | 26,629 | 27,354 | 21,755 | 6,959 |

Red = DeSantis in office

Ron DeSantis assumed office in January 2019. Under his leadership, one major hurricane struck Florida–Hurricane Ian, which made landfall as a Category 4 hurricane, striking Florida in late September 2022. Additionally, the start of the DeSantis administration likely coincided with claims filed for 2018’s Hurricane Michael, which hit Florida in October 2018.

Even in a down year (2021, when Hurricane Ida missed Florida), insurance “Civil Remedy Notices” shot up during the DeSantis administration.

CAMPAIGN CASH AND INSIDER DEALING DRIVE PRICE-HIKING POLICIES

Insurance industry donors have lavished money on Ron DeSantis:

The overall insurance industry (which includes property casualty and other types of insurance) has been a top underwriter of DeSantis’s political efforts since he announced his run for Florida governor. The campaign finance support has taken many forms: 1) An analysis by Florida Watch found that insurance industry donors of $5,000 or more contributed $9.9 million to “Friends of Ron DeSantis” and the Republican Party of Florida since January 1st, 2019–days before DeSantis assumed office.[27] Filings show that the Republican Party of Florida has contributed significantly to DeSantis.[28] 2) Looking just at candidate contributions to Ron DeSantis and contributions to his “Friends of Ron DeSantis” political committee, DeSantis has pulled in a total of $3.9 million from insurance donors since the date of their incorporation (through March 20th, 2023). 3) This includes more than $150,000 contributed in one day by hundreds of State Farm insurance agents or their firms.[29] According to reporting by Florida reporter Jason Garcia, State Farm was one of the key firms opposing a 2021 plan to reduce insurance rates. Garcia speculated that the opposition may have derived from State Farm’s ownership of a competing reinsurance firm, RenaissanceRe.[30] 4) Two property casualty insurance firms–a subsidiary of Heritage Insurance and People’s Trust Insurance–donated a combined total of $125,000 to DeSantis’s 2023 inaugural celebration, which marked the beginning of his final term as governor in a term-limited state. According to reporting in the Washington Post, both companies participated in the $2 billion “taxpayer-financed relief program for property insurers” that DeSantis signed months earlier in a 2022 special session.[31]

Industry ties in the DeSantis administration:

The DeSantis administration and Ron’s orbit are stacked with insurance industry veterans. Most have received little scrutiny over their possible conflicts of interest in the state. Everyone DeSantis appointed to the Citizens Property Insurance Corporation Board of Governors appears to either have current ties to the insurance industry or related industries impacted by insurance rate changes: The Citizens Property Insurance Corporation is Florida’s captive insurer (self-operated insurance company), created to act as a last-resort insurer for Floridians unable to find open market coverage. Its Board of Governors includes people appointed by Florida’s governor, its legislature, and some key administrators.[32] “Citizens” functions as a state-subsidized competitor to for-profit insurance companies and is where nearly 1 million Florida residents access insurance. Weakening Citizens has been an expressed goal of the Florida property casualty insurance industry.[33] Some DeSantis policies appear to have achieved those goals. According to a Florida Phoenix analysis of the 2022 insurance handouts passed during Florida’s legislative Special Session, DeSantis’s policy changes “would drive customers of Citizens Property Insurance Corp., Florida’s insurer of last resort, into significantly pricier policies on the private market.”[34] DeSantis has appointed three people to the board; they all appear to have current ties to the insurance industry or, in the case of Erin Knight, ties to businesses which can be negatively impacted by rising insurance rates: 1) DeSantis appointee Jilian Hasner is a paid executive at a non-profit funded by property casualty insurers. Hasner is the president/CEO of TSIC, Inc., a Florida educational non-profit operating as “Take Stock in Children.” Hasner was compensated $247,500 for her role in 2020, the most recent year for which non-profit tax returns are available.[35] The TSIC website includes Brown & Brown, the Florida-based property casualty insurance company, on its donor list.[36] Brown & Brown EVP Matt Montgomery also serves on the TSIC board.[37] PeoplesTrust and StateFarm were also donors, according to 2022’s Taking Stock in Children annual report.[38] The Southern Group, a Tallahassee lobbying firm that counts several insurance companies among their clients (and which recently hired former DeSantis insurance commissioner David Altmaier), is also a donor.[39] 2) DeSantis appointee Nelson Telemaco is a board member at a property casualty insurance company licensed to do business in Florida. The 2021 press release announcing Telemaco’s appointment does not disclose his board member position at Cimarron Insurance Company, Inc.[40] According to Telemaco’s LinkedIn account, he has been a Cimarron Insurance Company board member since 2020.[41] Cimarron Insurance Company appears on a Florida Property Insurance Regulation document listing licensed Florida property insurers.[42] 3) DeSantis appointee Erin Knight is a board member at a Florida bank that calls rising insurance rates a risk factor for their business: Knight is a director of Amerant Bank, a publicly traded bank holding company operating in Florida and Texas.[43] According to the bank’s corporate disclosures, their Florida market residential lending business could be adversely impacted by the affordability of property casualty insurance, writing “higher property and casualty insurance premiums which may adversely affect the value and sales of real estate in the markets we operate.”[44] Pull quote: DeSantis is filling the state’s most powerful regulatory and consumer protection roles with pro-insurance industry insiders. This behavior raises serious concerns about the explicit and perceived conflicts of interest among DeSantis’s appointees. Florida’s homeowners stand to lose as the agendas and profits of the insurance lobby are prioritized over their own.

THE PAYOFFS:

INSURANCE INDUSTRY INSIDERS GET HUGE BENEFITS WHILE REGULAR PEOPLE SUFFER

Instead of fixing problems with Florida’s property insurance industry, DeSantis has lavished the industry with favors and benefits while everyday Floridians suffer.

Favors for the insurance industry

Instead of fixing Florida’s insurance problems to reduce costs to homeowners, the DeSantis administration has done favors for the property casualty insurance industry. Some of these changes, as have been noted in prior reporting in The Lever, are likely to be sought by other types of insurers in the future. “HOLY GRAIL” FOR INSURANCE LOBBYISTS HURTS HOMEOWNERS At DeSantis’s urging, the Florida legislature passed a bill limiting the ability of policyholders to sue insurance companies when they failed to pay on legitimate claims. The policy change eliminated the “one-way” attorney fee provision in Florida law, which requires insurance companies to pay lawyer fees to litigants who successfully sue over non-payment.[45] DeSantis trumpeted the signing of this bill on his official webpage.[46] The move, long-sought by insurance companies and their lobby, came after DeSantis had previously signed two bills tweaking litigation rules, limiting advertisements “that encourage Floridians to make an insurance claim for roof damage” and restricting the use of the “assignment of benefits” process, often used to streamline home repair after storms damage a home.[47] The Lever News called the 2023 “one-way” fee elimination a “Holy Grail” for industry lobbyists.[48] Meanwhile, with four of its seven members appointed by DeSantis, the Florida Supreme Court recently granted the Florida Realtors and Florida Apartment Associations the right to recover attorney fees in lawsuits at the taxpayers’ expense in April 2023. The powerful real estate interests successfully sued Orange County to overturn the state’s first rent stabilization measure, which 59% of voters approved in 2022.[49] TWO-BILLION-DOLLAR CORPORATE SUBSIDY FOR THEM, NOTHING FOR US DeSantis did far more than change lawsuit rules to benefit insurance companies. In a 2022 special session (called by DeSantis), lawmakers passed a $2 billion reinsurance subsidy, criticism of which was described by the Financial Times as “a sticking-plaster solution that would not address the market’s larger problems.”[50] The $2 billion giveaway program, which used taxpayer funds to subsidize industry risks, was called ”Reinsurance to Assist Policyholders,” but there is little evidence that it lived up to its name. Costs for policyholders rose after the passage of the taxpayer-funded subsidy, with S&P Global publishing an article titled ‘Florida’s new reinsurance program to pass little savings to homeowners.’[51]

THE SAD PART:

REAL LEADERS CAN AND HAVE DONE WAY BETTER THAN DESANTIS

Other states, and even prior Florida governors, knew how to fix the industry:

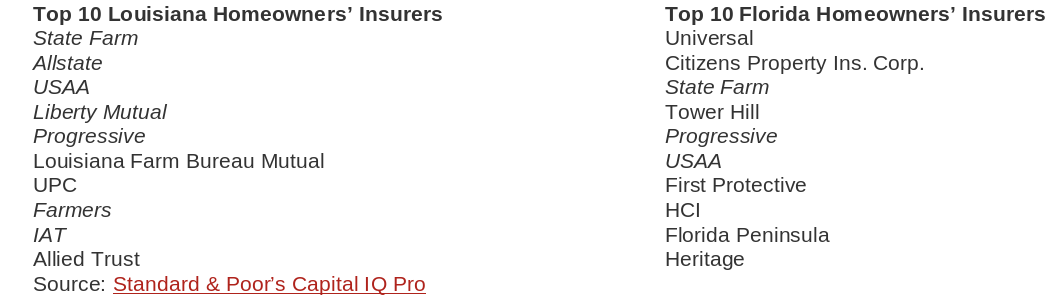

Prior administrations in Florida have reigned in costs for homeowners, even after catastrophic storms have slammed the state. When insurers threatened to pull out of the state and massively hike rates following Hurricane Andrew, then-Governor Lawton Chiles devised a solution that included a freeze on rate increases.[52] Damage from the 2004/2005 storms compelled “Governor Charlie Crist and Commissioner Kevin McCarty to put a layer of state reinsurance in place at actuarial rates, lowering homeowners insurance premiums by 20 percent and earning tens of billions of dollars for the state.”[53] Alabama and California use homeowner incentives: In 2011, the Alabama State Legislature established the Strengthen Alabama Homes Act, which led to the Strengthen Alabama Homes program (SAH). Legislators designed the act to help Alabama homeowners improve their homes with updated building modifications that reduce property damages caused by hurricanes or other catastrophic windstorm events. SAH provides $10,000 grants to Alabama residents for residential wind mitigation on existing, owner-occupied, single-family homes. Funding for this program comes from the insurance industry in Alabama–not from the state’s general budget nor a federally funded program. Homes with a FORTIFIED™ designation in Alabama receive discounts on the wind portion of their homeowner’s insurance premium, and SAH ensures that homeowners receive the appropriate insurance discount.[54] Research by the University of Alabama estimates that FORTIFIED designated homes sell for a nearly 7% increase when compared to non-improved homes.[55] Another study by the University of Alabama concluded that loss mitigation like FORTIFIED would reduce premiums and could improve insurance availability.[56] In 2022, California implemented a model similar to the one used in Alabama, requiring insurers to consider fire-proofing improvements made to homes in the state when calculating premiums.[57] Neighboring Louisiana has a stronger market, despite facing similar challenges: A 2023 article in the Insurance Journal describes Louisiana’s insurance market as more reliable than Florida’s, noting that the state’s “insurance market largely consists of strong national insurers” while Florida has “responded to past periods of heavy catastrophe losses by welcoming thinly capitalized, highly leveraged startup insurers to the peninsula.”[58] The notion that Louisiana’s insurance companies are stronger than Florida’s is bolstered by our independent review of top insurance agencies in the state (by premium), which shows national large national companies italicized:  Photo caption: Insurance Journal, 2023 Differing from Florida under DeSantis, industry handouts in Louisiana are tied to requirements that companies increase their presence in the state. To bolster the insurance market in the state, Louisiana provides grants to qualified insurance companies with a requirement that the insurance company writes new insurance policies in the state.[59] Instead of providing “no strings attached” reinsurance subsidies, the Louisiana Insurance Guaranty Association pays policyholder claims when their insurer becomes insolvent.[60]

Photo caption: Insurance Journal, 2023 Differing from Florida under DeSantis, industry handouts in Louisiana are tied to requirements that companies increase their presence in the state. To bolster the insurance market in the state, Louisiana provides grants to qualified insurance companies with a requirement that the insurance company writes new insurance policies in the state.[59] Instead of providing “no strings attached” reinsurance subsidies, the Louisiana Insurance Guaranty Association pays policyholder claims when their insurer becomes insolvent.[60]  What’s at Stake: This report reveals that the insurance industry has bankrolled the DeSantis campaign with $3.9M since he took office in 2019. DeSantis, and the powerful insurance lobby, have blocked proposals that would lower insurance costs for Florida residents. He pushed billion-dollar insurance industry giveaways while making it harder for Florida’s homeowners to hold insurance companies accountable. DeSantis has appointed insurance industry insiders to powerful political positions overseeing Florida’s insurance markets. DeSantis is not only failing to hold the insurance industry accountable. Critically, he is failing to bring down rates for Florida homeowners who face insurance rates triple the national average and are expected to increase a staggering 40-50% in June 2023.[61] Communities of color and low-income communities across Florida–especially vulnerable to the growing threat of climate disaster–face a home insurance affordability crisis. The state’s collapsing home insurance market leaves many uninsured or struggling to afford skyrocketing premiums. Florida’s homeowners are experiencing these massive insurance rate increases because Ron DeSantis chooses to prioritize the profits and agenda of insurance companies over his constituents. Policy Recommendations In light of the home insurance affordability crisis facing Floridians, the DeSantis administration must take immediate steps to:

What’s at Stake: This report reveals that the insurance industry has bankrolled the DeSantis campaign with $3.9M since he took office in 2019. DeSantis, and the powerful insurance lobby, have blocked proposals that would lower insurance costs for Florida residents. He pushed billion-dollar insurance industry giveaways while making it harder for Florida’s homeowners to hold insurance companies accountable. DeSantis has appointed insurance industry insiders to powerful political positions overseeing Florida’s insurance markets. DeSantis is not only failing to hold the insurance industry accountable. Critically, he is failing to bring down rates for Florida homeowners who face insurance rates triple the national average and are expected to increase a staggering 40-50% in June 2023.[61] Communities of color and low-income communities across Florida–especially vulnerable to the growing threat of climate disaster–face a home insurance affordability crisis. The state’s collapsing home insurance market leaves many uninsured or struggling to afford skyrocketing premiums. Florida’s homeowners are experiencing these massive insurance rate increases because Ron DeSantis chooses to prioritize the profits and agenda of insurance companies over his constituents. Policy Recommendations In light of the home insurance affordability crisis facing Floridians, the DeSantis administration must take immediate steps to:

- Cap home insurance rates at a percentage of the assessed value of the home

- Prevent future rate hikes by holding insurers accountable to the promise they made when they availed themselves of these incentives, and resolve to use the state’s power to deny rate increases.

- Create an insurance industry-funded homeowner incentives program–similar to Alabama and California programs–that will enable Florida families to invest in home resiliency improvements. Critically, these investments will reduce property damage caused by hurricanes and other catastrophic wind events.

- Require that companies receiving any insurance industry incentives increase their presence in the state to bolster Florida’s struggling insurance market–a model that has seen solid success in Louisiana to date.

- Reinstate attorneys fees for homeowners who sue their insurers and win.

Methodology This report highlights an original analysis of campaign finance data from the FL Department of State Campaign finance database (filing periods 1/1/2018 to 12/31/2022) for Ron Desantis’s Committee and the “Friends of Ron DeSantis” PAC. Totals reflect all donors who self-reported “Insurance” under “Industry” and thus might reflect a conservative undercount of total insurance giving. Data accessed March 2023. Reported totals on “Insurance Rate Increases in Florida (2015-2022)” use the Florida Office of Insurance Regulation IRFS Forms & Rate Search tool, rate change filings for homeowner multi-peril property and casualty insurance were requested by year according to the filing date. https://irfssearch.fldfs.com/ Reported totals on “Florida complaints to initiate lawsuits against insurance companies (2015-2023)“ were accessed on March 16th, 2023 via the Civil Remedy Notice of Issuer Violations database. The database was searched for the ‘Type of Insurance’ (both Residential Property Casualty and Commercial Property Casualty) and submission dates of one calendar year, from 2015 through 2023 (January 1st, 2023 through March 16th, 2023). The total number of returned cases is presented in the table above. https://apps.fldfs.com/CivilRemedy/SearchFiling.aspx

- https://www.abcactionnews.com/news/price-of-paradise/florida-homeowners-pay-nearly-3x-national-average-for-homeowners-insurance; https://www.tampabay.com/news/florida-politics/2022/12/13/with-floridas-high-property-insurance-rates-many-are-forced-go-bare/. ↑

- https://yaleclimateconnections.org/2019/07/how-climate-change-is-making-hurricanes-more-dangerous/; https://wsvn.com/news/local/broward/fort-lauderdale-residents-continue-struggling-as-historic-flooding-persists-despite-efforts-to-drain-water-provide-aid/. ↑

- https://www.census.gov/quickfacts/jacksonvillecityflorida; https://www.census.gov/quickfacts/orlandocityflorida; https://assets.firststreet.org/uploads/2020/06/first_street_foundation__first_national_flood_risk_assessment.pdf, page 13; https://news.climate.columbia.edu/2022/11/03/with-climate-impacts-growing-insurance-companies-face-big-challenges/; https://time.com/6183489/hurricane-season-florida-insurance-industry/. ↑

- https://www.levernews.com/in-climate-change-ravaged-florida-ron-desantis-insurance-giveaway/; https://www.cnbc.com/2022/12/01/hurricane-ian-was-costliest-disaster-on-record-after-katrina-in-2005.html#:~:text=Between%20%2450%20billion%20and%2065,torrential%20rain%20and%20storm%20surge. ↑

- https://www.nbcmiami.com/responds/florida-homeowners-will-likely-continue-to-face-challenging-property-insurance-market-in-2023/2954488/. ↑

- https://www.ft.com/content/6d1d05ec-032d-492b-8f08-698f5515029f; https://www.flgov.com/2022/05/26/governor-ron-desantis-signs-bipartisan-property-insurance-and-condominium-safety-reforms/. ↑

- https://www.levernews.com/desantis-leaves-floridians-at-the-mercy-of-his-insurance-industry-donors/ ↑

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/florida-s-new-reinsurance-program-to-pass-little-savings-to-homeowners-71209189. ↑

- Based on original analysis of campaign finance data from the FL Department of State Campaign finance database (filing periods 1/1/2018 to 12/31/2022). See methods note for more details. ↑

- https://desantiswatch.org/influence-watch/. ↑

- https://www.sun-sentinel.com/business/fl-bz-cat-fund-reform-proposal-20220129-kzf3ydpr3rhbrluou6xnd54ml4-story.html. ↑

- https://jasongarcia.substack.com/p/ron-desantis-and-the-florida-legislature; https://thefloridachannel.org/videos/1-27-22-senate-committee-on-appropriations/. ↑

- https://www.linkedin.com/in/ntelemaco/details/experience/; https://investor.amerantbank.com/board-member/erin-knight/; https://www.takestockinchildren.org/who-we-are/ ; https://floridapolitics.com/archives/594759-big-get-the-southern-group-lands-david-altmaier-for-new-insurance-advisory-practice/. ↑

- https://www.sun-sentinel.com/news/fl-xpm-1993-05-27-9302140145-story.html; https://consumerfed.org/press_release/consumers-get-fair-claims-payments-wake-hurricane-irma/. ↑

- https://www.insurancejournal.com/blogs/right-street/2023/02/06/706330.htm ↑

- https://louisianarecord.com/stories/639266480-louisiana-special-legislative-session-aims-to-lure-more-property-insurers-to-state; https://apnews.com/article/louisiana-new-orleans-climate-and-environment-government-politics-78c865af74ae1f8d12184edd4490b32b. ↑

- https://strengthenalabamahomes.com/; https://www.usnews.com/news/best-states/california/articles/2022-02-25/new-california-rules-aim-to-lower-property-insurance-rates. ↑

- https://www.nbcmiami.com/responds/florida-homeowners-will-likely-continue-to-face-challenging-property-insurance-market-in-2023/2954488/. ↑

- https://www.wfla.com/news/florida/florida-property-insurance-rates-expected-to-jump-40-to-50-in-june/. ↑

- https://www.tampabay.com/news/florida-politics/2022/12/13/with-floridas-high-property-insurance-rates-many-are-forced-go-bare/. ↑

- https://www.wfla.com/news/florida/florida-foreclosures-increased-71-from-2021/; https://www.bizjournals.com/orlando/news/2023/03/13/florida-2023-home-foreclosure-housing-sales-prices.html. ↑

- https://floridataxwatch.org/Research/Full-Library/economic-commentary-an-update-on-floridas-housing-rental-market; https://mycbs4.com/news/local/florida-homelessness-continues-to-grow-according-to-new-data-released. ↑

- https://www.politico.com/news/2022/04/20/making-a-lot-of-money-desantis-campaign-taps-red-hot-florida-real-estate-industry-00025515; ↑

- Methodology: Using the Florida Office of Insurance Regulation IRFS Forms & Rate Search tool, rate change filings for homeowner multi-peril property and casualty insurance were requested by year according to the filing date. https://irfssearch.fldfs.com/ ↑

- https://www.floir.com/siteDocuments/CommerceCommitteeDataRequest.pdf, see page 11. ↑

- Methodology: On March 16th, 2023 the Civil Remedy Notice of Issuer Violations database was searched for the ‘Type of Insurance’ (both Residential Property Casualty and Commercial Property Casualty) and submission dates of one calendar year, from 2015 through 2023 (January 1st, 2023 through March 16th, 2023). The total number of returned cases is presented in the table. https://apps.fldfs.com/CivilRemedy/SearchFiling.aspx ↑

- https://desantiswatch.org/influence-watch/. ↑

- According to Follow the Money, the FL Republican Party gave DeSantis at least 3,131 contributions totaling $11,413,739: https://www.followthemoney.org/show-me?dt=1&c-t-eid=17657831&d-eid=1009#[{1|gro=f-s,f-eid,c-t-id,d-eid,d-id. ↑

- https://subscriber.politicopro.com/article/2022/08/desantis-gets-150k-one-day-haul-from-state-farm-agents-00051890. ↑

- https://jasongarcia.substack.com/p/ron-desantis-and-the-florida-legislature. ↑

- https://www.washingtonpost.com/politics/2023/01/18/desantis-inauguration-donors/; https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/florida-s-new-reinsurance-program-to-pass-little-savings-to-homeowners-71209189. ↑

- https://www.citizensfla.com/who-we-are; https://www.cnn.com/2022/09/30/business/florida-homeowners-insurance-ian/index.html. ↑

- https://jasongarcia.substack.com/p/ron-desantis-and-the-florida-legislature ↑

- https://floridaphoenix.com/2022/12/14/fl-gop-and-insurance-companies-won-big-in-this-weeks-special-session-dems-call-it-a-bailout/. ↑

- https://projects.propublica.org/nonprofits/organizations/593331584. ↑

- https://www.takestockinchildren.org/who-we-are/. ↑

- http://www.takestockinchildren.org/wp-content/uploads/2022/02/2022-Accountability-Report-Email-Version.pdf. ↑

- http://www.takestockinchildren.org/wp-content/uploads/2022/02/2022-Accountability-Report-Email-Version.pdf. ↑

- https://www.takestockinchildren.org/who-we-are/; https://floridapolitics.com/archives/594759-big-get-the-southern-group-lands-david-altmaier-for-new-insurance-advisory-practice/. ↑

- https://www.flgov.com/2021/05/14/governor-ron-desantis-appoints-three-to-the-citizens-property-insurance-corporation-board-of-governors/; https://www.linkedin.com/in/ntelemaco/details/experience/. ↑

- https://www.linkedin.com/in/ntelemaco/details/experience/. ↑

- https://www.floir.com/siteDocuments/FLPropertyCompaniesContact.pdf. ↑

- https://investor.amerantbank.com/board-member/erin-knight/. ↑

- https://investor.amerantbank.com/static-files/5bf26c21-6b22-492c-a4a0-9302116af0ed. ↑

- https://wusfnews.wusf.usf.edu/economy-business/2023-03-25/desantis-signs-sweeping-reforms-limiting-lawsuits-against-businesses. ↑

- https://www.flgov.com/2023/03/24/governor-ron-desantis-signs-comprehensive-legal-reforms-into-law/. ↑

- https://www.flgov.com/2021/06/11/governor-desantis-signs-legislation-to-continue-insurance-reform-in-florida/. ↑

- https://www.levernews.com/desantis-leaves-floridians-at-the-mercy-of-his-insurance-industry-donors/. ↑

- https://www.clickorlando.com/news/politics/2023/04/17/orange-county-rent-control-case-turned-away-by-florida-supreme-court/; https://www.orlandosentinel.com/news/orange-county/os-ne-orange-rent-control-appeal-fees-20221117-j5i4yeaonbgo7i2heutw3k3lvq-story.html; https://www.cityandstatefl.com/personality/2023/03/justice-ricky-polston-stepping-down-florida-supreme-court/384210/. ↑

- https://www.ft.com/content/6d1d05ec-032d-492b-8f08-698f5515029f. ↑

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/florida-s-new-reinsurance-program-to-pass-little-savings-to-homeowners-71209189. ↑

- https://www.sun-sentinel.com/news/fl-xpm-1993-05-27-9302140145-story.html; https://consumerfed.org/press_release/consumers-get-fair-claims-payments-wake-hurricane-irma/. ↑

- https://consumerfed.org/press_release/consumers-get-fair-claims-payments-wake-hurricane-irma/. ↑

- https://strengthenalabamahomes.com/. ↑

- https://alabama.app.box.com/s/etb6y83kdadxy8mydcftvfoevo9grk3x. ↑

- https://alabama.app.box.com/s/4w8bahzwqgettjzayw9zo9989h9k95wm. ↑

- https://www.usnews.com/news/best-states/california/articles/2022-02-25/new-california-rules-aim-to-lower-property-insurance-rates. ↑

- https://www.insurancejournal.com/blogs/right-street/2023/02/06/706330.htm. ↑

- https://louisianarecord.com/stories/639266480-louisiana-special-legislative-session-aims-to-lure-more-property-insurers-to-state. ↑

- https://apnews.com/article/louisiana-new-orleans-climate-and-environment-government-politics-78c865af74ae1f8d12184edd4490b32b. ↑

- https://www.wfla.com/news/florida/florida-property-insurance-rates-expected-to-jump-40-to-50-in-june/. ↑