Washington Dc / Maryland / Virginia Billionaires & their Lucrative Loophole

This report uses hedge fund and private equity data from Preqin to show that Washington D.C.—along with Maryland and Virginia—could raise huge sums of revenue by acting to close the carried interest loophole.

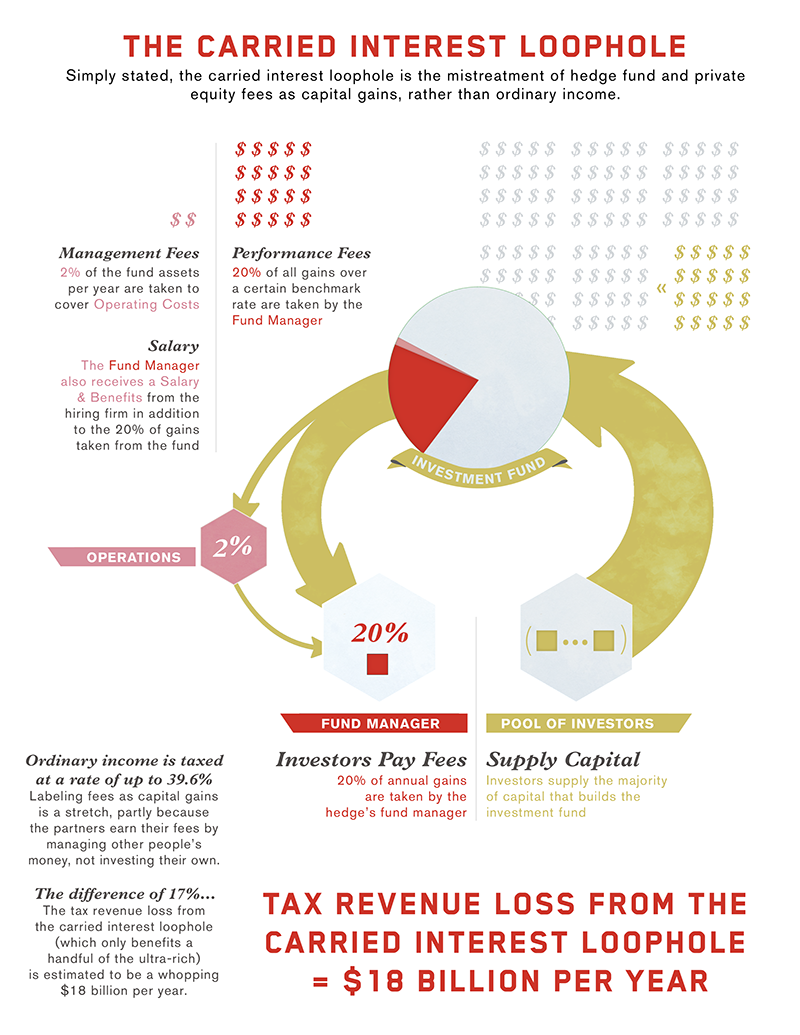

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income. Share on X

Introduction

One Washington – the Washington of Trump and McConnell and Ryan – has done nothing to close the carried interest loophole, a massive tax giveaway to hedge fund billionaires that is widely criti-cized as an unfair, unreasonable tax break.

Instead, the GOP tax bill left the loophole intact and funneled additional trillions to billionaires and corporations.

But another Washington—Washington, DC— might be able to take action.

The District of Columbia can join states around the country in closing the loophole and raising much-needed revenue to fund schools, hospitals, and vital infrastructure.

The carried interest tax loophole refers to a maneuver used by billionaire Wall Street investment firms like hedge funds and private equity firms to pay lower taxes than kindergarten teachers and truck drivers. These firms charge their investors fees for managing their money, but rather than classifying this as income they deem it carried interest, allowing them to pay lower tax rates.

Economists and tax experts across the political spectrum agree that the loophole should be closed. Share on X

According to University of San Diego law professor Victor Fleischer, closing the loophole would save an estimated $18 billion each year on the federal level. Share on X

During his presidential campaign, President Donald Trump pledged to close the loophole, saying that “the hedge fund guys are getting away with murder…I have hedge fund guys that are making a lot of money that aren’t paying anything.”

During his presidential campaign, President Donald Trump pledged to close the loophole, saying that “the hedge fund guys are getting away with murder…I have hedge fund guys that are making a lot of money that aren’t paying anything.”

Now, of course, many of those “hedge fund guys” are in the Trump administration or otherwise advising or funding Trump.

Former hedge fund and private equity fund billionaires in the Trump administration include Commerce Secretary Wilbur Ross and Treasury Secretary Steven Mnuchin. Trump advisor Stephen Schwarzman, the billionaire CEO of private equity firm the Blackstone Group, hosted a fundraiser for Trump the day after the Senate first passed the tax bill, in November.

Besides occupying key positions in the Trump administration, the industry also spends enormous amounts of money lobbying on the federal level and funding members of Congress to keep the tax break in place. Share on XAccording to the Center for Responsive Politics, this cycle Schwarzman’s Blackstone Group is the #1 donor to Senate majority leader Mitch McConnell,[1] the #2 donor to Paul Ryan,[2] and the #3 donor to Senate minority leader Chuck Schumer.[3]

Thanks to all this influence, the carried interest loophole survived in the GOP tax bill – and Trump and Congress even delivered more goodies for the industry.

While the bill required that investments be held three years in order to qualify for the tax break, it included an additional loophole that appears to exempt LLCs from the requirement. This prompted many hedge funds to rush to set up Delaware LLCs, according to Bloomberg.[4]

Steven Rosenthal, a tax expert at the Urban-Brookings Tax Policy Center, summed up the failures of the bill for Bloomberg: “Carried interest was a key litmus test of whether the bill can be called tax reform, and it failed. This legislation was a Swiss cheese.”

The bill delivered major new giveaways for billionaire investment managers – the Wall Street Journal called the legislation a “shot in the arm” for private equity and quoted a managing director at private equity firm Hamilton Lane saying the industry “is very much a big winner out of the reform.”[5]

Regular, everyday Americans were the losers in the federal tax bill. But there’s still a chance to change that.

As hedge fund and private equity billionaires increasingly call the shots on the federal level, state and local action is crucial.

Legislatures across the country can pass legislation to tax the carried interest of hedge funds, private equity firms, and other investment vehicles headquartered in their jurisdictions at ordinary rates – and raise money to fund schools, hospitals, and vital infrastructure.

In New York State, Governor Andrew Cuomo included a fairness tax on carried interest income in his 2018 budget. Similar legislation has been proposed in Connecticut, Illinois, and Rhode Island, and last year passed the Illinois State Senate. The legislation would raise billions or hundreds of millions of dollars in much-needed revenue in all of these states.

This report from Hedge Clippers uses hedge fund and private equity data from Preqin to show that Washington DC – along with Maryland and Virginia – could raise huge sums of revenue by acting to close the carried interest loophole.

Using a conservative methodology for estimating the potential annual revenues, the analysis in this report reveals that state action on carried interest could recapture many billions of dollars across the country, with hundreds of millions or billions for each state.

Washington, DC alone could raise $152 million. Maryland could raise $32 million, and Virginia could raise $39 million. Share on X

What Is The Carried Interest Loophole?

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income. Share on XAccording to the New York Times,

Partners at private-equity firms and hedge funds typically treat a big portion of the fees they charge their clients as a capital gain — that is, as profit on the sale of an investment — so they can pay tax at the capital-gains rate of 20 percent (plus a surtax of 3.8 percent typically).[6]

Ordinary income is taxed at a rate of up to 39.6 percent. But labeling fees as capital gains is a stretch, in part because the partners generally earn their fees by managing other people’s money, not by investing their own.

Hedge fund and private equity funds are usually structured as partnerships. The fund manager is the general partner of the funds, and the investors are limited partners.

Investors often supply the majority of the capital, and the fund manager is supposed to supply investment expertise. For the services the investment manager provides, they charge certain fees.

In both hedge funds and private equity funds, the standard fee structure is “2 and 20”—two percent of the fund assets per year are taken as the management fee, which covers operating costs.

Twenty percent of all gains over a certain benchmark rate are taken by the fund manager as the performance fee.[7]

The problem comes from how that twenty percent performance fee is treated for tax purposes.

To an outsider, it may seem that this twenty percent fee is compensation for services. According to the Tax Policy Center, a joint project of the Brookings and Urban Institutes, the vast majority of tax analysts share this view.[8]

But the hedge fund and private equity industries treat “carried interest” fees as a unique type of income for tax and accounting purposes – not really service income, and definitely not investment income.

If we treated the performance fee as a fee for services, it would be federally taxed at the ordinary income level, where the highest marginal tax rate is currently 39.6%.

Instead, many fund managers treat this fee as an investment profit.

Profits on investments held longer than one year receive preferential treatment in the tax code, with the highest marginal rate on long-term capital gains set at 20%.[9]

Although fund managers using the carried interest loophole can’t take a capital loss, they do claim a capital gain.

The difference of 19.6% may not sound like a lot of money, but the academics estimate the tax revenue loss from the carried interest loophole to be $18 billion per year.[10]

State loophole-closing legislation should aim to “repatriate” the revenue lost to the loophole back to the states where “carried interest” investment fees were assessed.

States with a lot of hedge fund and private equity managers can raise hundreds of millions or billions of dollars – and all states can raise something, merely by imposing tax fairness on an out-of-control loophole.

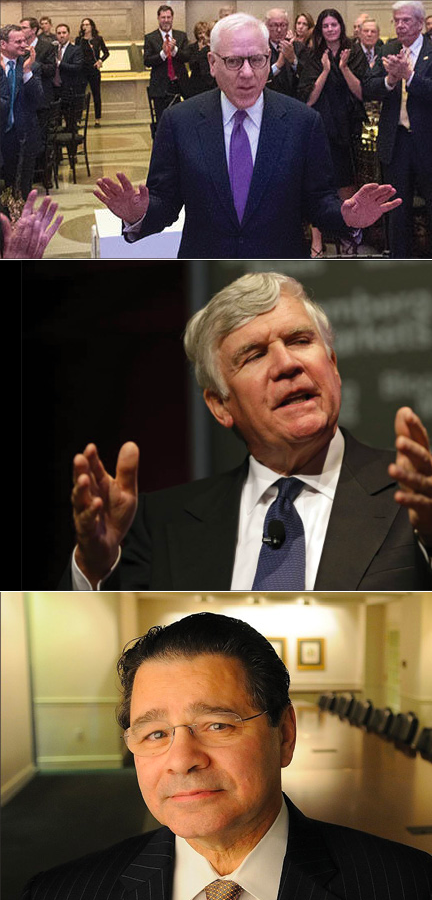

The Washington, D.C., area is home to a small set of ultra-wealthy private equity and hedge fund managers who are padding their pockets with millions of dollars each year thanks to the carried interest loophole.

More than similar firms elsewhere in the country, the private equity firms and hedge funds in the Washington, DC area tend to leverage revolving door connections for profit – bringing on well-connected Washington insiders to help them land business, lobby government, and get the inside scoop.

Meet the Billionaires & Washington Heavyweights Benefitting from the Carried Interest Loophole

The Washington, D.C., area is home to a small set of ultra-wealthy private equity and hedge fund managers who are padding their pockets with millions of dollars each year thanks to the carried interest loophole. Share on XMore than similar firms elsewhere in the country, the private equity firms and hedge funds in the Washington, DC area tend

to leverage revolving door connections for profit – bringing on well-connected Washington insiders to help them land business, lobby government, and get the inside scoop.

The people and firms profiled in this section are the following:

- The Carlyle Group: Co-founders David Rubenstein, William Conway, Daniel D’Aniello, and new top executives Peter Clare, Kewsong Lee, and Glenn Youngkin

- EJF Capital: Emanuel “Manny” Joshua Friedman

- DC Capital Partners: Thomas J Campbell

- Quantitative Investment Management: Jaffray Woodriff; Michael Geismar

- Rock Creek Group: Afsaneh Beschloss, founder; Alan Greenspan, advisor; Wells Fargo, owner

- Revolution: Steve Case (net worth $1.3 billion) and Ted Leonsis (net worth $1 billion)

- Interprise Partners: Ben Carson, Jr.

The Carlyle Group

Who’s benefiting:

David Rubenstein, William Conway, Daniel D’Aniello, and many other executives.

The Carlyle Group is largest private equity firm in the Washington, DC area, by far, with $195 billion in assets under management[11] and profits of $1.5 billion over the three most recent fiscal years.

Since the Carlyle Group is publicly-traded, we can get a sense of how little these types of funds pay in taxes–due in part to the carried interest loophole–from their filings with the SEC. On those massive earnings of $1.5 billion, Carlyle has paid paltry federal taxes ($4.3 million) and state and local taxes ($12.7 million) – over three years.

In the most recent year for which financial data is available, Carlyle’s state and local taxes were negative: In FY 2016, while the private equity behemoth pulled in $45.3m in pre-tax profits and $2.2bn in gross income, they managed to receive state and local tax refunds totaling $400,000.[12]

Carlyle’s co-founders, David Rubenstein, William Conway, and Daniel D’Aniello, recently stepped back from co-CEO positions at the firm. They can definitely afford their retirements: all three are worth an estimated $2.8 billion.[13] The trio collectively took home $750 million in 2013 alone.[14] All three co-founders also have their own private planes, which they lease back to the Carlyle Group at cost.

David Rubenstein, the founder credited with coming up with Carlyle’s magic formula (described as “combin[ing] capital with politically connected people whose phone calls are accepted around the world.”[15] In retirement, Rubenstein will continue to host an online talk show where he interviews other high-powered CEOs and billionaires.[16]

Billionaire Rubenstein has played an important role in preserving the carried interest loophole. Share on XIn both 2007 and 2010, Rubenstein was trotted out by the private equity lobby to charm legislators away from federal efforts to close the loophole. Rubenstein, a former Carter administration staffer, apparently performed his duties with such aplomb that one private equity lobbyist called him “the perfect good guy.”

In 2010, Rubenstein is said to have bragged about single handedly saving the carried interest loophole, stepping off stage at the DC Economic Club to persuade a wavering senator (Rubenstein has denied this account).[17]

It remains to be seen whether Rubenstein, now in retirement, will continue these lobbying efforts. Carlyle will now be run by a

younger group of executives, including co-CEOs Glenn Youngkin and Kewsong Lee and chief investment officer Peter Clare.

EJF Capital

Who’s benefiting:

Emanuel “Manny” Joshua Friedman

E.J.F. is a $6 billion hedge fund headquartered in Washington, DC.

EJF’s CEO and majority shareholder Emanuel Joshua Friedman has a long history of shadiness around regulatory issues, but still makes tons of money. Share on XIn 2006, his old firm, Friedman, Billings & Ramsey, settled charges with the Securities and Exchange Commission alleging that the firm had traded on material non-public information in connection with a private investment in public equity (“PIPE”) deal it executed with CompuDyne in 2001.

According to the SEC, Friedman, Billings & Ramsey shorted CompuDyne’s stock prior to the public announcement of the PIPE deal.[18] The firm earned a tidy $343,773 in profit on the transaction, and was fined $3,755,839 by the SEC as part of their settlement.[19] Friedman was personally fined $1.2m.[20]

EJF’s second largest shareholder is COO Neal Wilson, who served as senior managing director of alternative investments at Friedman, Billings & Ramsey from 2000-2005.[21] (Wilson served as a branch chief at the SEC in the early 1990s, and is a card-carrying member of the revolving-door club in Washington).

The fiasco at Friedman, Billings & Ramsey wasn’t Manny Friedman’s first run-in with the regulators. Friedman was censured and suspended by the National Association of Securities Dealers in 1983 for “deposit[ing] his personal funds into the account of a customer for the purpose of satisfying margin calls.” The suspension lasted 15 days.[22] In connection with the 2006 SEC settlement, Friedman was barred from supervising any broker or dealer. He was able to reapply to lift the bar after two years.[23]

Emanuel 'Manny' Friedman leans Democratic, but is financing a PAC to unseat Senator Elizabeth Warren. Share on XFriedman leans Democratic, but is financing a PAC to unseat Sen. Elizabeth Warren. Friedman and EJF’s Neal Wilson have each donated $50,000 to Wake Up Washington, a recently registered independent expenditure committee. Wilson and Friedman are the only two donors to the committee.[24] Wake Up Washington is supporting Republican John Kingston in his challenge of Sen. Elizabeth Warren.[25]

DC Capital Partners

Who’s benefiting:

Thomas J. Campbell

DC Capital Partners is a Alexandria, VA-based private equity firm that acquires or invests in “battlefield contractors,” or intelligence and government services companies.

Thomas J. Campbell, the firm’s founder and managing partner, is known for hatching one of the more lucrative deals of the Iraq and Afghanistan wars, a leveraged buyout of DynCorp International, with his former business partner Richard McKeon at Veritas Capital. The deal drove the two apart when McKeon took the entire investment opportunity for himself, and Campbell was forced out of Veritas in 2007.[26]

Thomas J. Campbell, the firm’s founder and managing partner, is known for hatching one of the more lucrative deals of the Iraq and Afghanistan wars, a leveraged buyout of DynCorp International, with his former business partner Richard McKeon at Veritas Capital. The deal drove the two apart when McKeon took the entire investment opportunity for himself, and Campbell was forced out of Veritas in 2007.[26]

Campbell founded DC Capital Partners in 2008 as a firm that resembles Veritas and in its decade of existence DC Capital Partners has raised over $650 million USD. The Advisory Board is stocked with former military like Generals Anthony C. Zinni, USMC (ret.) and Michael V. Hayden, USAF (ret.), and former Deputy Secretary of State Richard Armitage.[27]

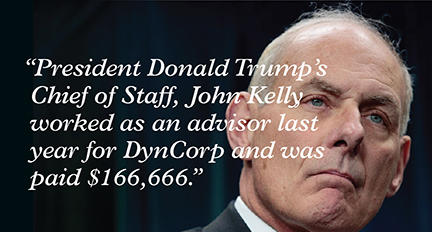

President Donald Trump’s Chief of Staff, John Kelly, worked as an advisor last year for DynCorp and was paid $166,666. Kelly was also paid $37,500 in his duty as a board member of Michael Baker International, a federal engineering contractor, which is owned by DC Capital Partners, and served on its board.[28]

President Donald Trump’s Chief of Staff, John Kelly, worked as an advisor last year for DynCorp and was paid $166,666. Kelly was also paid $37,500 in his duty as a board member of Michael Baker International, a federal engineering contractor, which is owned by DC Capital Partners, and served on its board.[28]

Ambassador Henry Crumpton, former coordinator for counterterrorism at the U.S. State Department, joined the board in 2015. Crumpton, a CIA spy, penned the memoir “The Art of Intelligence: Lessons from a Life in the CIA’s Clandestine Service.”[29]

The firm’s most recent buyout was of Janus Global, a de-mining specialist that also provides risk management, security and other services in “austere” environments.[30]

Campbell is Chairman of four major battlefield contractors somewhat reminiscent of Blackwater, like Michael Baker, Sallyport, SC3, and the SPECTRUM Group. Campbell is Vice Chairman to the Board of Governors of the Middle East Institute, a Board member of USO Metro, which aids veterans, and a Director on the Board at the Center for New American Security.[31]

Individuals at DC Capital Partners have made almost $500,000 in political contributions over the years, including to (top) recipient Donald Trump, Hillary Clinton, Tim Kaine and Ted Cruz.[32]

Campbell has spent millions on luxurious properties. He purchased two properties in New Canaan, Connecticut for over $10 million, and another seaside property for $1.55 million in East Quogue, NY. He appears to have another home in Delray Beach, FL.[33]

Quantitative Investment Management

Who’s benefiting:

Jaffray Woodriff, Michael Geismar

Quantitative Investment Management (QIM) is a $3.1 billion hedge fund and commodity pool operator and trader founded in 2003 by Jaffray Woodriff, Michael Geismar and Greyson Williams. Based in Charlottesville, VA, the hedge fund’s $4 billion “Tactical Aggressive Fund” was the star of 2017, which used short-term stock bets to score a 68.3% gain.[34]

The firm’s strategies are based on Woodriff’s programs that are sometimes referred to as “the third way,” that assemble thousands of mathematical formulas with quant inputs through machine learning.[35]

The firm’s strategies are based on Woodriff’s programs that are sometimes referred to as “the third way,” that assemble thousands of mathematical formulas with quant inputs through machine learning.[35]

Woodriff was among the top 40 highest-earning hedge fund managers in 2014, earning $90 million. He grew up on a farm in Charlottesville and after a few stints with banks like Societe Generale, he moved back to Charlottesville with his former roommate, Michael Geismar, and set up QIM.[36]

Woodriff is often referred to as a “boy wonder” and “investment whiz.” Hs co-founder, Michael Geismar, made headlines when he made $710,000 on a blackjack run at the Bellagio from $300 and a $10,000 line of credit. Geismar applied math theory and QIM’s “gambler’s mentality” to win.[37]

Woodriff has a private Quantitative Foundation that recently endowed $10 million to the University of Virginia to create the Data Science Institute.[38] He also donated over $12 million to the university to open the McArthur Squash Center.[39] In March 2017, with Taliaferro Junction, LLC, he purchased Charlottesville’s Main Street Arena for $5.7 million to create a technology center.[40]

Woodriff bought “Merifields Farm” for $14.6 million, one of the top six most expensive homes sold in Charlottesville in recent years. A country estate designed by famous architect Boris Baranovich, the home is on 325 acres and includes over 14,000 square feet of living space.[41]

Rock Creek Group

Who’s benefiting:

Afsaneh Beschloss, founder;

Alan Greenspan, advisor;

Wells Fargo, owner

The Rock Creek Group is a fund of funds – managing investments in private equity firms and hedge funds on behalf of clients. It was originally part of the Carlyle Group but was spun out of it in 2004 by its founder, Afsaneh Beschloss, a former chief investment officer at the World Bank.[42] Rock Creek Group oversees $12 billion for a range of clients, including pension funds and sovereign wealth funds.

Rock Creek Group bets heavily on the business and profits that revolving door connections can bring, hiring many well-connected Washington insiders as advisors. Share on XCurrent advisors include Alan Greenspan, the former chair of the Federal Reserve, Laura Tyson, former Clinton Treasury official, and Liaquat Ahamed, another former World Bank investment chief.

Greenspan, who famously found a “flaw” in his Ayn Rand-inspired libertarian ideology during the 2008 financial crisis, did very little to regulate big banks during his tenure as Fed chair and deserves not a small share of credit for the disastrous housing crash that resulted from it.

Now, Rock Creek Group is actually majority-owned by one of the most scandal-plagued of those big banks, Wells Fargo.[43]

Wells Fargo Asset Management took an initial stake of 35% in the Rock Creek Group in 2012[44], and increased its stake to 65% in 2014.[45] Greenspan’s successor at the Federal Reserve, Janet Yellen, levied a historic punishment on Wells Fargo just prior to her departure, instituting a limit on total assets which prompted its stock price to plunge (and may have triggered a larger drop in the Dow Jones Industrial Average).[46]

Beschloss is a major donor to the Democratic Party – she has given tens of thousands of dollars to the DNC, Clinton, and Obama campaigns, as well as other Democratic candidates – and is extremely well-connected, serving on the boards of organizations such as PBS and the World Wide Web Foundation.

Revolution

Who’s benefiting:

Steve Case (net worth $1.3 billion) &

Steve Case (net worth $1.3 billion) &

Ted Leonsis (net worth $1 billion)

Revolution is a Washington-based venture capital firm focused on investing in tech startups outside Washington, DC. Venture capital firms like Revolution can also benefit from the carried interest loophole. It was founded by AOL founder Steve Case and former AOL executives Ted Leonsis and Donn Davis.

Steve Case’s net worth is $1.3 billion. His estate in McLean, VA is valued at around $50 million, making it the most expensive residential property in the DC area.[47] It was the childhood home of Jacqueline Kennedy Onassis.

Ted Leonsis has an estimated net worth of $1 billion. As the founder and CEO of Monumental Sports & Entertainment, he owns the NBA’s Washington Wizards, the NHL’s Washington Capitals, the WNBA’s Washington Mystics and the Verizon Center. In addition to his $8 million historic waterfront mansion in Potomac, Maryland[48], he also owns a $7 million estate in Nantucket complete with ocean views, 5 bedrooms, 5 baths, and a pool.

He told the Washington Post that he purchased the house in 2012, after a stay just down the road at the place owned by his friend David Rubenstein, the billionaire co-founder of the Carlyle Group.[49]

Interprise Partners

Who’s benefiting:

Ben Carson, Jr.

Interprise Partners is a Columbia, MD-based private equity firm co-founded by Ben Carson, Jr. – the son of Trump HUD Secretary Ben Carson.[50]

Interprise and the Carsons have recently been ensnared in scandal. As HUD Secretary, the older Carson enlisted his son to help organize an agency tour of Baltimore last year. In doing so, the younger Carson invited people with whom he potentially had business interests, including wealthy Baltimore developers.[51]

Interprise and the Carsons have recently been ensnared in scandal. As HUD Secretary, the older Carson enlisted his son to help organize an agency tour of Baltimore last year. In doing so, the younger Carson invited people with whom he potentially had business interests, including wealthy Baltimore developers.[51]

HUD deputy general counsel Linda M. Cruciani issued a series of warnings to Secretary Carson that he may be running afoul of ethics rules in his enlistment of his son. “I expressed my concern that this gave the appearance that the Secretary may be using his position for his son’s private gain,” she wrote in a July 2017 memo detailing her warnings.[52]

The Carsons ignored these warnings. According to the memo from Cruciani, “the Secretary said that it would be difficult to have a Listening Tour in Baltimore without his son’s involvement as his son was the largest employer in Maryland.”

It is unclear how Secretary Carson came to this conclusion – his son’s company does not appear to be a large employer in Maryland, much less the largest employer. Though Interprise has made some investments, including in construction firm Argo Systems, they appear to be a relatively small firm in the early stages of existence.

Unlike the other private equity firms and hedge funds covered in this report, the firm’s registration Form ADV is not available in the SEC’s investment adviser public disclosure database, suggesting that it registered recently, is in the process of registering, or has not registered.[53]

Unlike the other private equity firms and hedge funds covered in this report, the firm’s registration Form ADV is not available in the SEC’s investment adviser public disclosure database, suggesting that it registered recently, is in the process of registering, or has not registered.[53]

In fact, the SEC database entry for Carson Jr shows that he was registered with another investment advisory firm, The L Warner Companies, until December 2017, overlapping his employment at Interprise.[54]

Methodology

Overview

- Our revenue-assessment methodology uses public and private data services to map out investment partnerships located in each state and locality

- We make a conservative estimate of profits and carried interest fees based on standard financial industry benchmarks

- We make a conservative estimate of fees that can be attributed to hedge fund and private equity managers, using reports and standards from Prequin, the alternative investment industry’s leading private source of data and analysis

- We apply a “carried interest fairness fee” — a 17% state or district-level surtax on carried interest — to generate revenue for state and local needs and to address the failure to close the carried interest loophole at the federal level

- Most state legislatures that have generated their own revenue estimates have found our estimates to be conservative, and reported that significantly more revenue could be raised from the fairness fee

Methodology

Datasets of all fund registered investment advisors were obtained from the SEC’s public database. This data was enriched with ADV Part 7(b) data, which contains private funds and their AUM. Registered investment advisors in DC/MD/VA were cross-referenced to the funds they manage by SEC file number. Combined, these funds had gross assets under management of $11.7bn and $11.6bn, respectively, as of ADV filings dates received by the SEC as of October 2016.

To estimate total earnings, we used private equity and hedge fund return benchmarks for a five year period. One uses the five year average of leading hedge fund and private equity benchmarks, assuming that the large state sample sizes roughly track the mean. For hedge funds, we used the HFRI Fund Weighted Composite’s 60 month average.[55] For private equity, we used the Cambridge Associates U.S. Private Equity Index 5 year end-to-end pooled return.[56] By multiplying the return benchmarks by the AUM, we came up with a rough estimation of expected annual earnings.

Next, the carried interest apportioned to hedge fund and private equity managers is estimated. Carried interest applies only to the incentive fee earned by hedge fund and private equity managers. We used 15% of the total of hedge fund and private equity expected annual earnings to arrive at the expected aggregated fund manager annual earnings. We went with 15% because we believe this number to be extremely conservative. With hedge funds, 20% is the industry standard and 17.14% was the industry average for new funds launched in 2013, as tracked by Preqin.[57] In private equity, the 20% standard is prevalent in 85% of co-mingled funds, according to a 2015 report by Preqin.[58] Separate accounts, where approximately one-third of investor capital was committed in late 2014,[59] are less likely to charge a 20% carry, although 90% charge 10% or more.[60]

To calculate the amount lost to carried interest exemptions, we halved the expected aggregate fund manager annual earnings. This was done to reflect the individual reporting of taxes paid on partnerships interest in financial service partnerships. As Professor Victor Fleisher discovered in his work on the subject, the IRS Statistics of Income shows that roughly half of financial industry partnership income is paid at the favorable carried interest rate.[61][62]

After halving this sum, we multiplied the remaining amount by 19.6%, the difference between the top bracket for short-term capital gains (equivalent to ordinary income, at 39.6%) and the top bracket for long-term capital gains (20%).

District of Columbia carried interest loss

| AUM | Expected return rate | Expected annual return | Incentive fee | Expected aggregate fund manager annual earning | Halved | Expected carried interest loss | |

|---|---|---|---|---|---|---|---|

| HEDGE FUND | $7,585,125,871.00 | 4.95% | $375,463,730.61 | 15.00% | $56,319,559.59 | $28,159,779.80 | $5,519,316.84 |

| PRIVATE EQUITY | $73,395,004,014.00 | 13.60% | $9,981,720,545.90 | 15.00% | $1,497,258,081.89 | $748,629,040.94 | $146,731,292.02 |

| Total: | $152,250,608.86 |

Maryland carried interest loss

| AUM | Expected return rate | Expected annual return | Incentive fee | Expected aggregate fund manager annual earning | Halved | Expected carried interest loss | |

|---|---|---|---|---|---|---|---|

| HEDGE FUND | $11,709,826,324.00 | 4.95% | $579,636,403.04 | 15.00% | $86,945,460.46 | $43,472,730.23 | $8,520,655.12 |

| PRIVATE EQUITY | $11,628,892,418.00 | 13.60% | $1,581,529,368.85 | 15.00% | $237,229,405.33 | $118,614,702.66 | $23,248,481.72 |

| Total: | $31,769,136.84 |

Virginia carried interest loss

| AUM | Expected return rate | Expected annual return | Incentive fee | Expected aggregate fund manager annual earning | Halved | Expected carried interest loss | |

|---|---|---|---|---|---|---|---|

| HEDGE FUND | $35,943,465,417.00 | 4.95% | $1,779,201,538.14 | 15.00% | $266,880,230.72 | $133,440,115.36 | $26,154,262.61 |

| PRIVATE EQUITY | $6,622,615,798.00 | 13.60% | $900,675,748.53 | 15.00% | $135,101,362.28 | $67,550,681.14 | $13,239,933.50 |

| Total: | $39,394,196.11 |

Key Findings

The loophole is only relevant to a small set of ultra-wealthy fund managers.

Regular people can’t use the controversial carried interest tax loophole — the only people who benefit are a small number of private equity and hedge fund managers who can afford to pay their fair share. Those private equity and hedge fund managers use the carried interest tax loophole to pay a lower tax rate than teachers and truck drivers.

Carried Interest Losses…

The small set of ultra-rich private equity and hedge fund managers that benefit from the carried interest loophole aren’t contributing their fair share of tax revenue to any level of government. Closing the carried interest loophole at state level and local levels would be a small offset to the billions in new and old tax breaks they’ve rigged—tax breaks regular people don’t get.

State and local laws can close the carried interest loophole

State and local laws can close the loophole, by imposing a 17% surtax on carried interest fees.

In Washington DC, Maryland and Virginia, the tax would be paid by a small set of ultra-wealthy fund managers

In DC, Maryland and Virginia, the tax would be paid by a small set of ultra-wealthy fund managers: the founders and partners of the Carlyle Group, EJF Capital, DC Capital Partners, Quantitative Investment Management, Rock Creek Group, Revolution and Interprise Partners.

In this report from Hedge Clippers we analyze hedge fund and private equity deal data to show that Washington DC, Maryland and Virginia could raise $223 million or more in new revenue by acting to close the carried interest loophole by passing new state and local laws.

$223 MILLION IN NEW REVENUE:

- Washington, DC could raise $152 million.

- Maryland could raise $32 million.

- Virginia could raise $39 million.

THIS REPORT:

- Outlines the extraordinary wealth of this small group of people.

- Explains how they benefit from an unfair tax break that Congress failed to close in last year’s tax law.

- Details how hedge fund and private equity lobbying and campaign cash got Paul Ryan and Mitch McConnell to protect the loophole.

- Shows that action on the state and local level can accomplish what Trump and Congress couldn’t do.

Carried Interest Bills by State

| STATE | TITLE OF BILL(S) | SPONSOR(S) | LINK(S) | REVENUE ESTIMATED |

|---|---|---|---|---|

| NY | “An act to amend the tax law, in relation to investment management services to a partnership or other entity” | Governor: Andrew Cuomo Assembly: Jeff Aubry Senate: Jeff Klein | Governor Assembly Senate | $3.5B/Yr |

| NJ | “An Act concerning the taxation of certain investment management services provided to a partnership, amending N.J.S.54A:5-8 and P.L.1945, c.162, and supplementing Title 54A of the New Jersey Statutes and P.L.1945, c.162 (C.54:10A-1 et seq.)” | Governor: Philip Murphy Senate: Troy Singleton, Shirley K. Turner Assembly: Gary S. Schaer | Governor Senate Assembly | $87M/Yr |

| CT | “An act imposing a surcharge on income derived from investment management services.” | House of Representatives Finance, Revenue and Bonding Committee Committee | Bill | $520M/Yr |

| IL | “An Act Concerning Revenue” | Senate Sponsors: Sen. Daniel Biss, Ira I. Silverstein, Jacqueline Y. Collins, Iris Y. Martinez, Emil Jones, III, Omar Aquino, Cristina Castro, Mattie Hunter House Sponsors: Rep. Emanuel Chris Welch, Mary E. Flowers | House Assembly | $1.7B/Yr (calculated by the Illinois Department of Revenue) |

| MD | “An Act Concerning Income Tax - Carried Interest - Additional Tax” | Senate: Paul Pinsky House: Rep Jimmy Tarlau | Senate House | $79M/Yr (calculated by the Legislature) |

| DC | “Closing The Carried Interest Tax Loophole Act Of 2018” | Councilman: David Grusso | Bill | $152M/Yr |

| CA | ”An act to add Section 17044 to the Revenue and Taxation Code, relating to taxation, to take effect immediately, tax levy” | Assembly Member: Mike A Gipson | Bill | $891M/Yr |

| RI | “An Act Relating to Taxation — Personal Income Tax” | Senators: Adam J. Satchell, William J. Conley, Stephen Archambault, Joshua Miller | Bill | $39M/Yr |

| MA | “An Act Closing An Unfair Tax Loophole” | Senator: Patricia Jehlen | Bill | $564M/Yr |

Footnotes

[1] Opensecrets.org; Members Of Congress https://www.opensecrets.org/members-of-congress/contributors?cid=N00003389&cycle=2018

[2] Opensecrets.org; Members Of Congress https://www.opensecrets.org/members-of-congress/contributors?cid=N00004357&cycle=2018

[3] Opensecrets.org; Members Of Congress https://www.opensecrets.org/members-of-congress/contributors?cid=N00001093&cycle=2018

[4] Bloomberg.com; New Hedge-Fund Tax Dodge Triggers Wild Rush Back Into Delaware,

by Miles Weiss. February 14, 2018, 4:00 AM EST https://www.bloomberg.com/news/articles/2018-02-14/new-hedge-fund-tax-dodge-triggers-wild-rush-back-into-dela- ware?utm_campaign=news&utm_medium=bd&utm_source=applenews

[5] Bloomberg.com; Private Equity Expected to Benefit From Tax Overhaul,

by Miriam Gottfried. Updated Jan. 24, 2018 9:54 a.m. ET https://www.wsj.com/articles/private-equity-expected-to-benefit-from-tax-overhaul-1516802400

[6] Nytimes.com; New York Challenges a Tax Privilege of the Rich

by The Editorial Board. March 11, 2016 https://www.nytimes.com/2016/03/11/opinion/new-york-challenges-a-tax-privilege-of-the-rich.html

[7] Fas.org; Congressional Research Service; Taxation of Hedge Fund and Private Equity Managers by Donald J. Marples, Specialist in Public Finance. March 7, 2014 https://www.fas.org/sgp/crs/misc/RS22689.pdf

[8] Taxpolicycenter.org; http://www.taxpolicycenter.org/briefing-book/key-elements/business/carried-interest.cfm

[9] Plus a 3.8% Medicare Surtax

[10] Nytimes.com;HowaCarriedInterestTaxCouldRaise$180BillionStandardDeduction

by Victor Fleischer. June 5, 2015 http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html

[11] https://www.carlyle.com/corporate-overview

[12] http://files.shareholder.com/downloads/AMDA-UYH8V/5978922423x0xS1527166%2D17%2D8/1527166/filing.pdf

[13] As of February 13, 2018, according to Forbes: https://www.forbes.com/profile/david-rubenstein/

[14] https://dealbook.nytimes.com/2014/02/27/for-carlyles-founders-a-750-million-payday/?_r=0

[15] https://www.newyorker.com/magazine/2016/03/14/david-rubenstein-and-the-carried-interest-dilemma

[16] https://www.youtube.com/watch?v=jvaCkHhklgc

[17] https://www.newyorker.com/magazine/2016/03/14/david-rubenstein-and-the-carried-interest-dilemma

[18] https://www.sec.gov/litigation/complaints/2006/comp19950.pdf

[19] https://www.sec.gov/litigation/litreleases/2006/lr19950.htm

[20] https://www.thestreet.com/story/10329068/1/fbr-founder-fined-barred.html

[21] https://www.linkedin.com/in/neal-wilson-64a5528/

[22] SEC LAPB: VOL. 49, NO. 2 ; https://brokercheck.finra.org/individual/summary/214565#disclosuresSection

[23] https://brokercheck.finra.org/individual/summary/214565#disclosuresSection

[24] https://www.fec.gov/data/committee/C00651976/?tab=raising

[25] https://www.fec.gov/data/committee/C00651976/?tab=filings

[26] https://www.forbes.com/forbes/2009/0803/iraq-afghanistan-obama-wall-street-goes-to-war.html#e706e252f9b1

[27] http://www.dccapitalpartners.com/pdf/DC_Capital_Fact_Sheet.pdf

[28] https://www.washingtonpost.com/business/economy/trumps-new-chief-of-staff-did-work-for-company-with-federal-contracts/2017/08/04/58d949e6-7607-11e7-8839-ec48ec4cae25_story.html?utm_term=.e1b6d3b10756

[29] https://sophyanempire.wordpress.com/2012/08/16/the-art-of-intelligence-lessons-from-a-life-in-the-cias-clandestine-service-henry-a-crumpton-penguin-press-2012-penguin-audio-david-colacci/; http://www.dccapitalpartners.com/news/releases/04.20.2015.html

[30] https://www.janusgo.com/2016/05/04/rebranded-and-expanded-janus-global-operations-seeks-to-boost-sales/

[31] https://www.cnas.org/press/press-release/cnas-welcomes-three-new-board-members

[32] https://www.opensecrets.org/orgs/summary.php?id=D000045888ID=D000045888&cycle=2016

[33] Nexis Property Records, Deeds

[34] https://www.reuters.com/article/us-hedgefunds-performance/the-20-percent-club-hedge-fund-stars-of-an-industry-rebound-idUSKBN1DA2IW

[35] https://www.bloomberg.com/news/articles/2017-06-07/a-1-2-billion-equity-quant-fund-run-by-qim-is-up-55-this-year

[36] https://www.forbes.com/pictures/mdg45ghlg/jaffray-woodrifft-2/#46fdb4e73afb

[37] http://www.c-ville.com/The_Investors_Moneys_top_players/#.Wo4Cd6gbPcs

[38] https://www.insidephilanthropy.com/home/2014/2/6/the-hedge-fund-wizard-betting-big-on-big-data-research.html

[39] http://thecollegevoice.org/2017/02/15/squash-teams-efforts-fruitless-without-resources/

[40] http://www.nbc29.com/story/34650309/charlottesvilles-main-street-arena-purchased-for-57-million

[41] http://charlottesville.avenuerealtygroup.com/the-top-6-most-expensive-homes-sold-in-charlottesvilleva-in-the-last-few-years

[42] https://www.barrons.com/articles/rock-creeks-winning-bet-on-hedge-funds-emerging-markets-1498277410

[43] https://www.adviserinfo.sec.gov/IAPD/content/viewform/adv102012/Sections/iapd_AdvScheduleASection.aspx?ORG_PK=125409&FLNG_PK=0425401E0008019002E2386100A120A9056C8CC0

[44] https://www.ft.com/content/da0cb50c-4966-11e2-b25b-00144feab49a

[45] http://www.pionline.com/article/20140319/ONLINE/140319823/wells-fargo-asset-management-increasing-stake-in-rock-creek-group

[46] http://money.cnn.com/2018/02/05/news/companies/wells-fargo-stock/index.html

[47] https://www.bizjournals.com/washington/news/2017/06/21/steve-case-is-meeting-with-president-trump-heres.html

[48] http://www.businessinsider.com/ted-leonsis-owner-washington-capitals-washington-wizards-house-2011-1

[49] https://www.washingtonpost.com/blogs/reliable-source/post/surreal-estate-ted-and-lynn-leonsis-buy-nantucket-home/2012/04/24/gIQALuTBfT_blog.html?utm_term=.08792fb8b7f9

[50] http://www.interprisepartners.com/new-page/

[51] https://www.washingtonpost.com/politics/using-his-position-for-private-gain-hud-lawyers-warned-ben-carson-risked-running-afoul-of-ethics-rules-by-enlisting-son/2018/01/31/bb20c48e-0532-11e8-8777-2a059f168dd2_story.html?utm_term=.915c0480717a

[52] http://apps.washingtonpost.com/g/documents/investigations/hud-memo-about-ben-carson-jrs-role-in-baltimore-event/2738/

[53] https://www.adviserinfo.sec.gov/

[54] https://www.adviserinfo.sec.gov/Individual/5618762

[55] https://www.hedgefundresearch.com/mon_register/index.php?fuse=login_bd&1448033777

[56] https://www.cambridgeassociates.com/benchmark/us-pe-vc-benchmark-commentary-second-quarter-2017/

[57] https://www.preqin.com/blog/0/8340/hedge-funds-fees

[58] https://www.preqin.com/docs/press/Fund-Terms-Sep-15.pdf

[59] http://www.pionline.com/article/20141222/PRINT/312229973/assets-invested-in-separate-accounts-starting-to-add-up

[60] http://www.valuewalk.com/2015/09/48-of-private-equity-separate-accounts-charge-a-20-performance-fee/

[61] 56% of the income generated by finance and insurance partnerships in 2012 was taxed at this rate.

[62] www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html