A Spanish version of the paper is available for download.

April 2024

Executive Summary

In an effort to attract wealthy investors to Puerto Rico, the Puerto Rican government passed the “Act to Promote the Relocation of Individual Investors to Puerto Rico” (known as Act 22 and later amended into Act 60) in 2012. Wealthy people relocating to the archipelago received an unprecedented 100% tax exemption on all income and investments.[1] Since the law passed, cryptocurrency billionaires, Wall Street executives, and wealthy developers have flocked to Puerto Rico.[2] Community groups are sounding the alarm on numerous ways this law negatively affects Puerto Ricans.[3] The wealthy Act 22 beneficiaries are hoarding properties and speculating in the real estate market,[4] leading to soaring housing costs and rapid displacement. They are evicting and pricing out long-term residents to make way for investors and short-term vacation rentals.[5]

This report explores an essential but often overlooked aspect of the program: how these wealthy individuals adopt questionable charitable giving practices to maintain their Puerto Rico tax breaks. Act 22 beneficiaries must donate $10,000 to local charities yearly to retain their lucrative tax exemption. Our investigation reveals that the people taking advantage of these tax breaks appear to be creating loopholes and founding their own tax-exempt charities to meet the charitable giving requirement on paper.

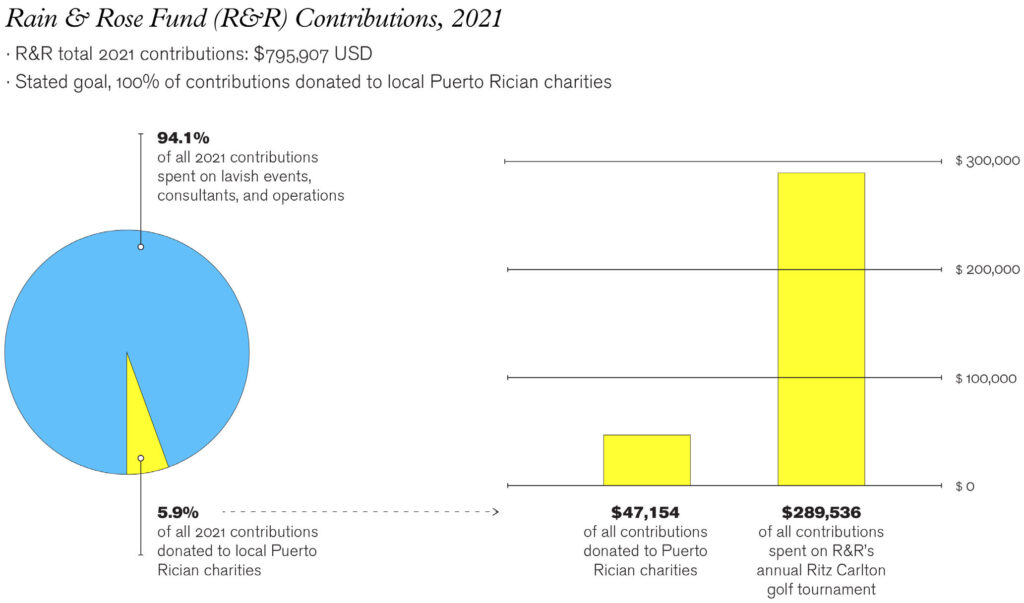

This investigation profiles two tax-exempt organizations founded and led by Act 22 beneficiaries. First, the Rain & Rose Fund: This organization hosts lavish parties, including an annual golf event at the Ritz Carlton Dorado Beach, for wealthy investors to attend. The group’s “Ambassadors” list includes at least ten confirmed Act 22 beneficiaries. According to the Rain & Rose Fund, “the goal is that 100 percent of donations go directly to fighting poverty.”[6] However, a deep dive into the group’s financial statements and IRS tax filings shows a different picture.[7] In 2021, the group’s annual Ritz Carlton golf tournament cost $289,536.[8] While the organization received $795,907 in contributions in 2021, it only donated $47,154 to Puerto Rican charities per financial statements.[9] That means only 6% of its revenues went to local charities that year.[10]

The investigation also profiles the Act 20/22 Society, another group started by an Act 22 beneficiary that qualifies for the $10,000 charitable giving requirement.[11] The group’s mission is helping Act 22 beneficiaries understand “the requirements and clarifying misinformation [to] help prevent undue and unwelcome scrutiny.”[12] They claim to provide a “unified voice” to Act 22 beneficiaries “as an effort to preserve the benefits granted.”[13] In practice, the Act 20/22 Society functions more like a powerful trade association or lobbying group than a non-profit. The group uses advocacy, litigation, and media appearances to pressure local elected officials to maintain their tax status and advance their financial interests.[14] With the Act 20/22 Society, tax-exempt beneficiaries are effectively allowed to donate to a group designed to bring together fellow wealthy individuals and still satisfy their requirement to donate to a “local” charity.

In light of these findings, the report calls on the Puerto Rican government to amend Act 22/60 charity donation requirements to exclude charities owned, founded, or led by other Act 22 beneficiaries, improve monitoring and transparency by both the DDEC and the Puerto Rico Treasury Department, and ultimately, to abolish Act 22/60 which has failed to deliver on its promise of economic development for Puerto Rican communities, while further enriching Act 22/60 beneficiaries themselves.

Introduction

The Puerto Rican government passed the “Act to Promote the Relocation of Individual Investors to Puerto Rico” (known as Act 22, and later amended into Act 60) in 2012 to attract wealthy individuals to the archipelago. The government offered an unprecedented 100% tax exemption on all income and investments to people relocating.[15] Since the law passed, cryptocurrency billionaires, Wall Street executives, and wealthy developers have flocked to Puerto Rico.[16] Community groups, journalists, and policymakers are sounding the alarm on the numerous ways this law is negatively affecting Puerto Ricans.[17]

Act 22 is affecting Puerto Rican community members across the archipelago who face soaring housing costs and rapid displacement. The wealthy individuals granted tax exemption in Puerto Rico are hoarding properties and speculating in the real estate market.[18] They are evicting and pricing out long-term residents–including those who live in public housing–to make way for investors and short-term vacation rentals.[19] These investors’ rapid development projects are also harming coastal communities, damaging beaches while fueling deforestation of protected mangroves and wetlands.[20]

In 2023, dozens of Puerto Rican community-based groups across the archipelago and diaspora formed the Not Your Tax Haven coalition. Under the banner “Puerto Rico No Se Vende/Puerto Rico Not for Sale,” these groups are calling for Act 22 to be repealed.[21]

This report explores an important but often overlooked aspect of the program: how these wealthy individuals adopt questionable charitable giving practices to maintain their tax exemption in Puerto Rico. As outlined below, Act 22 beneficiaries must donate to a local charity annually to retain their lucrative tax exemption. Our investigation reveals a troubling track record of suspicious charitable giving by Act 22 beneficiaries who are founding and then donating to each other’s tax-exempt charities, often with modest tangible benefits to local Puerto Ricans.

Requirements for Act 22/Act 60 tax exemption

The main requirements to receive the 100% tax exemption on all income and investments include:

- Not being a resident of Puerto Rico between 2006-2012;

- Residing in Puerto Rico for at least six months each tax year;

- Donating at least $10,000 to a non-profit organization in Puerto Rico

- Buying a house in Puerto Rico during a two-year period after gaining tax-exempt status and not having a taxable home outside PR.[22]

In 2019, the government consolidated many financial incentive programs into Act 60 of 2019, which made some changes to the original Act 22 tax break program.[23] Act 22 is used as a shorthand in this report but refers to people with tax exemption under both Act 22 and its parallel program, Act 60.

Questionable Charitable Giving Practices by Act 22 Beneficiaries

Proponents of Act 22 often argue it provides tangible benefits to Puerto Rican communities, citing the fact that Act 22 holders must donate $10,000 to local charities each year.[24] However, it is unclear if or how the Puerto Rican government verifies compliance with the Act’s charity donation requirement. In practice, the people taking advantage of these tax breaks appear to be creating loopholes and founding their own tax-exempt charities to meet the charitable giving requirement on paper.

This investigation profiles two organizations founded and led by Act 22 beneficiaries that host lavish parties, including an annual golf event at the Ritz Carlton, for wealthy investors to attend. These organizations can claim tax exemption under the IRS and the Puerto Rican government and technically meet the requirement for charitable giving under Act 22.

The Rain & Rose Charitable Fund

Act 22 beneficiary Michael Basile, who is a Managing Partner at Summit Investment Group, founded the Rain and Rose Charitable Fund in 2018.[25] Michael Basile is listed as “President,” and Basile’s wife Victoria is “Director” of Rain and Rose Fund according to charitable tax filings.[26] The group’s stated mission is to “empower under-resourced Puerto Ricans through education, youth development, and relief efforts to rise above poverty.”[27]

The group is a tax-exempt private foundation under the IRS and Puerto Rican charity laws.[28]

The Rain & Rose Charitable Fund’s “Ambassadors” list is stacked with at least ten confirmed Act 22 beneficiaries

According to their website, “The Rain & Rose Fund is grateful to have a variety of professionals to drive and support our organization.” This list includes Act 22 beneficiaries:

- Happy Walters (CEO of Catalyst Sports & Media) & spouse Lindsay Walters[29]

- David Weibe (Chairman of Stonecrest Partners) & spouse Marissa Weibel [30]

- Steve Wiggins (Chairman of Remedy Partners) & spouse Melissa Kerr, N.D.[31]

- Carlos Beltrán (Retired MLB Player) & spouse Jessica Beltrán[32]

An additional eight “Rain and Rose Ambassador” names also appear on the DDEC Act 22/Act 60 disclosure list.[33]

Rain & Rose often highlights how donations to the group will satisfy the Act 22/Act 60 charitable giving requirement – its website outlines “The Requirements for the Act 22 and 60 Donation” for donors and documents showing the group is a Section 1101.01 (a) (2)–certified nonprofit.”[34]

Rain & Rose hosts lavish parties for Act 22 beneficiaries, including an annual golf tournament at the Ritz Carlton in Dorado Beach

The Rain & Rose Fund describes its annual golf tournament as an “opportunity to mix and mingle with celebrities, sports stars, business leaders, and other VIP guests while giving back to the people of Puerto Rico.”[35] It’s billed as “two days of championship golf, top-notch entertainment, and gourmet dining.”[36]

Tickets can cost as much as $25,000 to attend, which was more than the median household income for families in Puerto Rico last year.[37]

Rain & Rose boasts, “90% attendance are comprised [sic] of high net worth individuals, entrepreneurs, investors whose income ranges from 5-15 million dollars a year.”[38] In 2023, the rapper Ludacris performed, and tickets were advertised as tax deductible.[39] Past sponsors of this event include pharma giant Abbvie, Discover Puerto Rico, Popular Bank, and more.[40] These corporate sponsors have the option of having their logo appear on golf carts, merchandise, or even cigars in the event’s cigar bar.[41]

Hayden Bowles, a YouTuber and Act 60 beneficiary,[42] described Act 22 charitable giving schemes in a video: “You have to donate $10,000 a year, one time, in one transaction to a non-profit Puerto Rican charity. Now what a few creative people inside the program did a long time ago, they created their own non-profit charity that basically just funds events for tax people there. So they’ll go rent a big boat, big conference hall, get together and meet people. I think they do excursions and help clean up stuff on the islands. They do a little bit. Little bit shady there.”[43] |

|---|

Rain & Rose Fund’s financials reveal how little is going to Puerto Rican charities

According to the Rain & Rose Fund, “the goal is that 100 percent of donations go directly to fighting poverty.”[44] However, a close look at the group’s financial statements and IRS tax filings shows a different picture.[45]

- In 2021, the group’s annual Ritz Carlton golf tournament was reported to the IRS to cost $289,536.[46]

- While the organization received $795,907 in contributions in 2021, it only donated $47,154 to Puerto Rican charities per financial statements.[47]

- That means only 6% of its revenues went to local charities that year.

- While the group gave out $295,000 in grants the next year (2022), it received $850,124 in contributions and reported having $588,641 in net assets that year.

- Spending 65% of its revenue on lavish events, consultants, and operations stands in stark contrast to its stated goal to have 100% of donations go to local charities.[48]

While the Rain & Rose Fund does list local charities that received money on its website, it’s clear the organization only awards a small percent of its revenues to charities each year. It also appears to pride itself on its “oversight” of local charities: “We monitor the continuing operations of our grantees. Each one is aware that their funding is merit-based and can be rescinded at any point that their organization ceases to optimally perform.”[49]

Concerns raised about crypto-currency “charitable” giving

In the wake of Hurricane Fiona in 2022, a crypto-fundraising Twitter account called Puerto Rico DAO was created, claiming to raise money for Puerto Rican charities. Wealthy crypto investors were sharing information on the group widely. Puerto Rico DAO “claimed that it would send money to three local organizations, including the Foundation for Puerto Rico and the Puerto Rico Community Foundation,” but those organizations reported receiving no funds, sparking public outcry.[50] According to Libni Sanjurjo at the Puerto Rico Community Foundation, “We don’t know who they are or about this initiative they have.” According to Alexandra Lúgaro, former Executive Director of the Center for Strategic Innovation of Foundation for Puerto Rico, the group had not received a “single cent or cryptocurrency from said organization.”[51] |

|---|

The 20/22 Act Foundation & Society

The 20/22 Act Foundation is another group started by an Act 22 beneficiary that qualifies for the $10,000 charitable giving requirement.[52] The group was founded in 2013 by Act 22 beneficiary Robb Rill.[53] His wife and fellow Act 22 beneficiary, Tara Rill, is listed as Vice President of the group on IRS tax forms.[54]

The 20/22 Act Foundation is a registered 501c3 public charity, while its sister organization, the 20/22 Act Society, is a 501c4 that is allowed to lobby under the law.[55]

Robb Rill was featured in a GQ profile where he said, “I was one of the first ten people to actually move under Act 22 […] There was literally nobody here.”[56] There were already 3.6 million people living in Puerto Rico the year Rill arrived.[57]

The GQ profile says that Rill “made his money in private equity. In 2011 he and his wife, then a securities trader, went looking for tax havens. At first, they settled on the Virgin Islands, selecting a house on the edge of a cliff. The house turned out to be a metaphor: Immediately after they found it, a dispute with a local official blew up their plan. A Google search led them to Puerto Rico and Act 22, and by 2013 they were here.”[58]

Stated mission

According to Relocate Puerto Rico “The 20/22 Act Society was formed by one of the first individuals to take advantage of Puerto Rico’s tax incentives as a way to unify those interested in relocating to the island and those who have already made the move.”[59] The group describes its mission as helping Act 22 beneficiaries understand “the requirements and clarifying misinformation [to] help prevent undue and unwelcome scrutiny.”[60] They also present their mission as providing a “unified voice” to Act 22 beneficiaries “as an effort to preserve the benefits granted.”[61]

Through the 20/22 Act Foundation, tax-exempt beneficiaries are effectively allowed to donate to a group designed to bring together fellow wealthy individuals but still satisfy their requirement to donate to a “local” charity.

The 20/22 Act Foundation functions more like a powerful trade association than a non-profit

Act 22 holders join as members of the group, which then works to advance their interests: “The 20/22 Act Society is a membership-based organization composed of individuals from various places throughout the world who have relocated to Puerto Rico due to the benefits provided under Puerto Rico Acts 20 and 22 of 2012.”[62] Founder Robb Rill hosts events like “Cocktails and Compliance,” where people seeking tax breaks can learn tips and tricks while mingling with one another.[63]

The group uses advocacy, litigation, and media appearances to pressure local elected officials to maintain their tax status and to advance their financial interests.

Not surprisingly, the group has a 501c4 organization that is allowed to lobby on pieces of legislation.[64] In a promotional video on its website, the group says it “has developed an ongoing feedback relationship with the governmental, private, and entrepreneurial sectors. We make sure our concerns, objectives, and recommendations are heard in order to preserve the benefits granted.”[65] Interestingly, the 20/22 Act Society, the registered 501c4 that is allowed to lobby under the law, has filed no forms with the IRS because it received less than $50,000 in donations.[66] It is unclear how much activity the society is undertaking.

In 2023, the group sued the Puerto Rican government Departamento de Desarrollo Económico y Comercio (DDEC)[67] over an increase in the fees being charged to Act 22 tax-exempt beneficiaries while filing annual reports.[68] The group was fundraising for a “special litigation fund” to cover its legal expenses.[69] Founder Robb Rill also uses media appearances and op-eds to warn of the “negative impact of ongoing changes to incentive programs.”[70]

Financials

Act 20/22 Society reported over $2 million in revenues to the IRS in 2022[71] – a massive, six-fold increase from the $326,000 reported in 2016 shortly after its founding.[72] The organization has reported sizable gifts, grants, contributions, and membership fees in recent years–$2.063M in 2022 and 1.885M in 2021. However, the group does not disclose their donors.[73] According to the 2021 IRS filings, “the organization did not make its governing documents, conflict of interest policy, and financial statements available to the public during the year.”[74]

| Fahad & Glenda Ghaffar Foundation

Wall Street asset manager Fahad Ghaffar has been an Act 22 beneficiary since 2014.[75] He started the Fahad & Glenda Ghaffar Foundation in 2017, “which allows him to support causes that he believes will have the most significant impact.” The foundation claims it has donated over ten million dollars to date.[76] However, recent allegations of misconduct have come to light. In 2023, Ghaffar was sued by his former boss, billionaire John Paulson, for allegedly fraudulently charging Paulson for private jets, luxury shopping, and nightclubs.[77] The two men had worked together to acquire Puerto Rican hotels like St. Regis Bahia Beach and the Condado Vanderbilt Hotel.[78] According to a lawsuit filed by billionaire investor John Paulson in 2023: “Ghaffar’s charity, the F&G Family Foundation, was also a scam, Paulson claims. According to the suit, the foundation was never legally established and instead served as a funnel for Ghaffar’s personal expenses, including a $360,732 down payment on a friend’s apartment and a $100,000 to his father-in-law for purchasing homes.”[79] The foundation does not appear on the Hacienda’s website of registered charities in Puerto Rico,[80] or on the IRS list of 501c3 organizations registered in Puerto Rico.[81] |

|---|

| “Feel good about your mandatory ACT 22 Donation today!”[82] – the Karma Honey Project

The Karma Honey Project–a non-profit actively seeking Act 22 beneficiary donations–was embroiled in a set of controversies in 2022. In 2022, a volunteer for the Karma Honey Project, Conor Vincent D’Monte (who lived under the alias Johnny Williams after relocating to Puerto Rico), was arrested by US marshals just one week after visiting Governor Pierluisi’s residence on behalf of the non-profit. He faced extradition from Puerto Rico on murder charges in Canada. The Karma Honey Project’s founder, Candice Galek, former model and founder of Bikini Luxe, said Williams was no longer associated with the group. The Miami Herald reported the Karma Honey Project, whose stated mission was to protect bees on the island, “encouraged people on its website to take advantage of Act 22 and donate, either with lump sums or monthly installment payments of $500.”[83] On social media, the group advertised, “We [sic] fully Act 22 compliant!” and tagged the groups “Act 20/22 Puerto Rico Tax Incentive Forum,” “Act 20/22 Club of Puerto Rico,” and “Puerto Rico Act 20/22 Resource Group Service Providers and Jobs Board” among others.[84] In 2020, the 20/22 Act Society listed them as a grantee.[85] Shortly after, Karma Honey Project initiative announced plans to convert an abandoned school in Canóvanas into an education center, focused on bee conservation, that would also offer courses on finance and cryptocurrency. The mayor of Canóvanas backed out of the plan following D’Monte’s arrest.[86] The Karma Honey Project faced scrutiny by the Puerto Rican Treasury Department. However, the group ultimately maintained its tax-exempt status.[87] |

|---|

The Stark Realities of Act 22

A growing body of evidence has shown the negative effects of Act 22 on Puerto Rico’s budget, economy, housing market, and environment.

Lost Tax Revenue: Puerto Rico is losing a staggering amount of tax revenue yearly. According to Puerto Rico’s 2023 tax expenditure report, the government lost approximately $2.22 billion of revenues related to Act 22 from 2017-2023.[88] Proponents of the bill say it will grow the economy and lead to investments; however, Puerto Rico will lose an estimated $4.4 billion in revenues related to Act 22 between 2020 and 2026.[89]

Soaring Housing Prices: Wealthy investors are fueling the housing crisis by buying up homes and flipping them into short-term vacation rentals and “Airbnb corridors.”[90] After Giovanni Feroce received Act 22 status in 2021,[91] he reportedly displaced tenants in Quebradillas.[92] A former Rhode Island Republican State Senator, Feroce is a notorious tax avoider who owes Rhode Island $1.4M, according to the Rhode Island Division of Taxation.[93] Act 22 beneficiaries often appear to get preferential treatment in the housing market. In Cabo Rojo, long-term residents were denied construction permits to fix homes after Hurricane Maria and were forced to sell. Wealthy investors then bought those properties and were granted all the required permits to remodel homes to create short-term rentals.[94]

Environmental Harms The influx of investors has also caused severe environmental impacts. Act 22 beneficiaries are buying up properties near the coast and other natural settings. These beneficiaries, along with other wealthy developers, are harming beaches and leading to the deforestation of mangroves and wetlands in places like Salinas.[95] In the face of these housing and environmental impacts, community groups and residents across the archipelago, from San Juan and Vieques to Rincón and Luquillo, are calling for Act 22 to be repealed.[96]

Lack of Transparency

The Department of Economic Development and Commerce (DDEC) is the Puerto Rican government agency responsible for awarding and overseeing Act 22/Act 60 tax breaks. In the past, the DDEC has failed to perform adequate audits to monitor whether tax break holders are meeting the law’s requirements.[97] The government launched a compliance audit of Act 22 in 2021. However, the government has failed to disclose audit findings to date. While Act 22 holders must submit annual reports to show they are meeting the requirements, the DDEC has refused to share that information with the public in recent years (or has shared heavily redacted content) despite receiving court orders they must share that information.[98]

Policy Recommendations

In light of these report findings, we call on the Puerto Rican government to take the following steps:

- Abolish Act 22/60 – The self-dealing with charity donations described in this report is just one aspect in which Act 22/60 has failed to deliver on its promise of economic development for Puerto Rican communities while further enriching Act 22/60 beneficiaries themselves.

- Immediately clarify Act 22/60 charity requirements – that in order to be eligible, donations must be made to already established local charities. This change would help avoid conflicts of interest and ensure funds are going to the local community as intended.

- Improve monitoring and transparency by both the DDEC and the Puerto Rico Treasury Department to ensure compliance with the charity donation requirement for Act 22/60 beneficiaries. Greater transparency would help the public better understand who is actually benefiting from their charitable contributions. Specifically, agencies must disclose:

- A historical record of all beneficiaries and applicants (by name, date of application, date of approval, and date of termination);

- A copy of the agreement/award between the beneficiaries and DDEC (and Treasury, if involved in the agreement); and

- Names of businesses associated with the applicant’s award/agreement

Call to action for individuals: Learn more and join our advocacy efforts at prnosevende.com (more information on the coalition below).

Contributors

Puerto Rico No Se Vende is a coalition of non-profit and community-based organizations directly affected by the results of the excessive granting of tax decrees that have resulted in increased housing costs and the displacement of families and communities.

Puerto Rico No Se Vende is a coalition of non-profit and community-based organizations directly affected by the results of the excessive granting of tax decrees that have resulted in increased housing costs and the displacement of families and communities.

The PR No Se Vende coalition currently includes more than a dozen community and nonprofit organizations, both in Puerto Rico and the diaspora: the Center for Popular Democracy + CPD Action, Ayuda Legal Puerto Rico, Construyamos Otro Acuerdo, VAMOS Puerto Rico, Proyecto Metamorfosis, Revive PR Project, Puerta de Tierra No se Vende, Residentes de Puerta de Tierra, Old San Juan Residents Association, La Tejedora, Escambrón Unido, Condominium Owners Association, Machuchal Revive Residents Association, Puerta de Tierra se Defiende, Diaspora in Resistencia, Boricuas Unidos en la Diáspora PR, CASA, Make the Road Family, Churches United for Fair Housing, New York Communities for Change, Action NC, & Florida Rising. https://prnosevende.com/about-us/

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and an inclusive, multiracial democracy in partnership with 48 affiliates in over 200 cities and 33 states, Puerto Rico, and Washington, DC. www.populardemocracy.org

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and an inclusive, multiracial democracy in partnership with 48 affiliates in over 200 cities and 33 states, Puerto Rico, and Washington, DC. www.populardemocracy.org

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy, and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org/about

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy, and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org/about

Acknowledgments

This report was written and researched by Maggie Corser (Center for Popular Democracy), with supplemental research and writing by Iris Figueroa. The report was reviewed by Marlyn Goyco-García, Iris Figueroa, and Julio López Varona (Center for Popular Democracy). Copyedit by Sean Kornegay.* Graphic design by Ange Tran.

- https://bvirtualogp.pr.gov/ogp/Bvirtual/leyesreferencia/PDF/2-ingles/60-2019.pdf; https://www.mcvpr.com/practices-Puerto-Rico-Act-60. Specifically 100% tax exemption for all income, dividends and interests, as well as 100% tax exemption for capital gains. ↑

- https://periodismoinvestigativo.com/2022/06/court-of-appeals-also-orders-delivery-of-act-22-beneficiaries-reports/; https://prospect.org/power/2023-08-21-gringo-go-home-puerto-rico-not-for-sale/; https://time.com/5955629/puerto-rico-tax-haven-opposition/ ↑

- https://9millones.com/organizations-unite-to-repeal-act-22/; https://time.com/5955629/puerto-rico-tax-haven-opposition/; https://economichardship.org/2023/05/the-puerto-ricans-illegally-occupying-land-to-resist-displacement/ ↑

- https://grupocne.org/2022/12/12/the-impact-of-short-term-rentals-in-puerto-rico-2014-2020/; https://periodismoinvestigativo.com/2022/08/la-ola-del-desplazamiento/; https://time.com/5955629/puerto-rico-tax-haven-opposition/; https://9millones.com/why-are-puerto-ricans-being-displaced/#:~:text=Fewer%20affordable%20housing%20units&text=According%20to%20Habitat%20Puerto%20Rico,adequate%20housing%20in%20our%20archipelago; ↑

- https://grupocne.org/2022/12/12/the-impact-of-short-term-rentals-in-puerto-rico-2014-2020/; https://www.taxnotes.com/research/federal/other-documents/irs-tax-correspondence/lawmakers-warn-that-puerto-rican-law-is-exploited-by-tax/7hkyp#7hkyp-0000003; https://www.metro.pr/noticias/2022/03/22/denuncian-que-beneficiarios-de-la-ley-22-estan-acaparando-propiedades-en-puerta-de-tierra/. ↑

- https://rainandrosefund.org/#our-mission ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/65ca295eb37dd13613143adf/1707747682313/Activities+statement+2018-2023.pdf ↑

- https://irs-efile-renderer.instrumentl.com/render?object_id=202310279349100001, See: summary of direct charitable activities. ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/65ca295eb37dd13613143adf/1707747682313/Activities+statement+2018-2023.pdf ↑

- Note: these report findings are based on analysis of the Rain & Rose Fund’s IRS 990’s, as well as financial statements published on the group’s website and archived here: https://drive.google.com/file/d/1reBtsL63UzAZqOvsQevGELBc7rchQSW8/view?usp=sharing ↑

- https://cecflpr.org/search-list-view///, See “Access list of service providers” to download full list; https://suri.hacienda.pr.gov/_/ See: “Searches” box then “View Approved Non-Profit Organizations” https://www.the2022actsociety.org/; PR tax exempt number 2014-1101.01-211; IRS EIN: 66-0823462. ↑

- https://www.the2022actsociety.org/ ↑

- https://www.the2022actsociety.org/ ↑

- See: promotional video on the group’s website: https://www.the2022actsociety.org/;; https://projects.propublica.org/nonprofits/organizations/660823462/202343129349302969/full,%20see%20schedule%20R%20part%20II;%20; https://www.courtlistener.com/opinion/9385565/the-2022-act-society-inc-v-departamento-de-desarrollo-economico/; https://www.elnuevodia.com/negocios/economia/notas/inversionistas-de-ley-22-impugnaran-alza-de-5000-a-la-tarifa-por-radicar-sus-informes-anuales/; https://www.the2022actsociety.org/special-litigation-fund/;%20; https://newsismybusiness.com/op-ed-negative-impact-of-ongoing-changes-to-incentive-programs/ ↑

- https://bvirtualogp.pr.gov/ogp/Bvirtual/leyesreferencia/PDF/2-ingles/60-2019.pdf; https://www.mcvpr.com/practices-Puerto-Rico-Act-60. Specifically 100% tax exemption for all income, dividends and interests, as well as 100% tax exemption for capital gains. ↑

- https://prospect.org/power/2023-08-21-gringo-go-home-puerto-rico-not-for-sale/; https://time.com/5955629/puerto-rico-tax-haven-opposition/; https://periodismoinvestigativo.com/2022/06/court-of-appeals-also-orders-delivery-of-act-22-beneficiaries-reports/ ↑

- https://9millones.com/organizations-unite-to-repeal-act-22/; https://time.com/5955629/puerto-rico-tax-haven-opposition/; https://economichardship.org/2023/05/the-puerto-ricans-illegally-occupying-land-to-resist-displacement/ ↑

- https://grupocne.org/2022/12/12/the-impact-of-short-term-rentals-in-puerto-rico-2014-2020/; https://periodismoinvestigativo.com/2022/08/la-ola-del-desplazamiento/; https://time.com/5955629/puerto-rico-tax-haven-opposition/; https://9millones.com/why-are-puerto-ricans-being-displaced/#:~:text=Fewer%20affordable%20housing%20units&text=According%20to%20Habitat%20Puerto%20Rico,adequate%20housing%20in%20our%20archipelago; ↑

- https://grupocne.org/2022/12/12/the-impact-of-short-term-rentals-in-puerto-rico-2014-2020/; https://www.taxnotes.com/research/federal/other-documents/irs-tax-correspondence/lawmakers-warn-that-puerto-rican-law-is-exploited-by-tax/7hkyp#7hkyp-0000003; https://www.metro.pr/noticias/2022/03/22/denuncian-que-beneficiarios-de-la-ley-22-estan-acaparando-propiedades-en-puerta-de-tierra/. ↑

- https://canadianinquirer.net/2022/06/17/coastal-gentrification-in-puerto-rico-is-displacing-people-and-damaging-mangroves-and-wetlands/; https://periodismoinvestigativo.com/2023/11/act-22-investors-attracted-to-coastal-development-amid-climate-crisis/. ↑

- https://prnosevende.com/ ↑

- https://www.goldinglawyers.com/tax-overview-puerto-rico-act-60/; https://www.mcvpr.com/practices-Puerto-Rico-Act-60. Specifically not being a resident between January 17, 2006, and January 17, 2012; residing in Puerto Rico at least 183 days each tax year; the original Act 22 charitable giving requirement was $5,000 per tax year but increased to $10,000 with the passage of Act 60 in 2019. ↑

- https://bvirtualogp.pr.gov/ogp/Bvirtual/leyesreferencia/PDF/2-ingles/60-2019.pdf ↑

- https://www.theweeklyjournal.com/business-gallery/the-act-20-22-society-donates-over-1-million-to-nonprofits/article_0602bc96-4aea-11eb-9efc-17aa8f8958df.html; https://www.the2022actsociety.org/; ↑

- Note: to access the latest list of Act 22/Act 60 beneficiaries, visit the Puerto Rican Department of Development and Economic Trade’s website, “Access to Information” –> “Reports” –> “Beneficiaries of Decrees” https://www.desarrollo.pr.gov/acceso-informacion. An archived version of the beneficiary data, updated as of January 2024, is available here: https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0 According to DDEC data Basile received Act 22 status on June 16, 2014; https://www.linkedin.com/in/michael-basile-b98b3645/;; https://irs-efile-renderer.instrumentl.com/render?object_id=202343199349102404, Part VII. ↑

- https://irs-efile-renderer.instrumentl.com/render?object_id=202343199349102404, Part VII; https://www.gofundme.com/f/hurricane-maria-rebuild-effort-pr; https://www.pacermonitor.com/public/case/51363216/Davis_v_The_Summit_Investment_Group,_LLC_et_al ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/64807d56d87bca53a3010efd/1686142307825/RR-GolfersDeck-2023.pdf ↑

- PR exemption number 2018-1101.01-336; IRS EIN 66-0897142 https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/60ed84723489b768f171e2c0/1626178677228/IRS+501c3+Approval+Letter.pdf; https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/60ed859767dd777ebfc2954a/1626178967915/Hacienda+1101.01%28a%29%282%29+Approval+Letter+%28unofficial+translatation+to+english%29.pdf; https://rceweb.estado.pr.gov/en/entity-information/?c=408099-1521 ↑

- https://rainandrosefund.org/partners; https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0; https://www.fieldhousefiles.com/p/happy-walters-on-joining-pacers. ↑

- https://www.linkedin.com/in/david-weibel-31097014/?originalSubdomain=pr; https://www.linkedin.com/in/marissa-weibel-5b284910/?originalSubdomain=pr; David Weibel received tax exemption in 2018 on the same day as Marissa Awtry (spouse’s maiden name according to public wedding registry https://www.blueprintregistry.com/registry/david-marissa-wedding-registry-9-30-2018). https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0). ↑

- https://www.businesswire.com/news/home/20230814015874/en/Oxford-Health-Founder-Steve-Wiggins-launches-a-new-type-of-health-insurance-plan-with-nirvanaHealth%E2%80%99s-Aria-platform-on-Microsoft-Azure; https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0 ↑

- https://rainandrosefund.org/partners Carlos I Beltran and Jessica L Beltran both received tax decrees in 2021: https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0 ↑

- See also: Greg & Lauren Powel CEO of Money Group; John Addison CEO of Addison Holdings; John & Peggy Bader Former Chairman and CEO of Halcyon Capital Management; Tom & Tiffany Miles CEO of TM Consulting LLC; Jay & Clare Walker CEO of J.A. Walker Associates, Inc.: https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0 ↑

- https://rainandrosefund.org/donor-information ↑

- https://rainandrosefund.org/events; https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/64807d56d87bca53a3010efd/1686142307825/RR-GolfersDeck-2023.pdf ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/64807d56d87bca53a3010efd/1686142307825/RR-GolfersDeck-2023.pdf, 3 ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/64807d56d87bca53a3010efd/1686142307825/RR-GolfersDeck-2023.pdf; https://www.census.gov/quickfacts/fact/table/PR/PST045223. ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/64807d56d87bca53a3010efd/1686142307825/RR-GolfersDeck-2023.pdf ↑

- https://www.rainandrose2023.com/ ↑

- https://www.rainandrose2023.com/ ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/64807d56d87bca53a3010efd/1686142307825/RR-GolfersDeck-2023.pdf, 13. ↑

- Act 22 + Act 60 DDEC Disclosure Portal Data Pull January 2024 ↑

- https://www.youtube.com/watch?v=rAvCM02OeHc ↑

- https://rainandrosefund.org/#our-mission ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/65ca295eb37dd13613143adf/1707747682313/Activities+statement+2018-2023.pdf ↑

- https://irs-efile-renderer.instrumentl.com/render?object_id=202310279349100001, See: summary of direct charitable activities. ↑

- https://static1.squarespace.com/static/5b2557cbcc8fedb17f92a727/t/65ca295eb37dd13613143adf/1707747682313/Activities+statement+2018-2023.pdf ↑

- https://irs-efile-renderer.instrumentl.com/render?object_id=202343199349102404, Part II, page 2. ↑

- https://rainandrosefund.org/#our-mission ↑

- https://time.com/6216212/puerto-rico-crypto-fiona/ ↑

- https://time.com/6216212/puerto-rico-crypto-fiona/ ↑

- https://cecflpr.org/search-list-view///, See: “Access list of service providers” to download full list; https://suri.hacienda.pr.gov/_/ See: “Searches” box then click “View Approved Non-Profit Organizations” https://www.the2022actsociety.org/; PR tax exempt number 2014-1101.01-211; IRS EIN: 66-0823462. ↑

- https://www.the2022actsociety.org/, See: promotional video; https://projects.propublica.org/nonprofits/organizations/660823462/202343129349302969/full, Part VII, page 7; https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0 ↑

- https://independentspeculator.com/board-bios; https://projects.propublica.org/nonprofits/organizations/660823462/202343129349302969/full, Part VII, page 7; https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0 ↑

- Note, in IRS tax filings the legal name of the c3 is listed as “2022 Act Foundation Inc” (https://apps.irs.gov/app/eos/details/) and the c4 is listed as “2022 Act Society Inc” https://apps.irs.gov/app/eos/details/. The group publicly refers to itself as “The 20/22 Act Society.” https://projects.propublica.org/nonprofits/organizations/660823462; https://projects.propublica.org/nonprofits/organizations/660880120. ↑

- https://www.gq.com/story/how-puerto-rico-became-tax-haven-for-super-rich ↑

- https://data.census.gov/table/ACSSPP1Y2013.S0201PR?q=total%20population&g=040XX00US72 ↑

- https://www.gq.com/story/how-puerto-rico-became-tax-haven-for-super-rich ↑

- https://relocatepuertorico.com/the-requirements-for-the-act-22-and-60-donation/ ↑

- https://www.the2022actsociety.org/ ↑

- https://www.the2022actsociety.org/ ↑

- https://www.the2022actsociety.org/ ↑

- https://www.gq.com/story/how-puerto-rico-became-tax-haven-for-super-rich ↑

- https://projects.propublica.org/nonprofits/organizations/660823462/202343129349302969/full, See: schedule R part II ↑

- https://www.the2022actsociety.org/, See: promotional video ↑

- https://apps.irs.gov/app/eos/details/ EIN: 66-0880120; https://projects.propublica.org/nonprofits/organizations/660880120 ↑

- https://www.courtlistener.com/opinion/9385565/the-2022-act-society-inc-v-departamento-de-desarrollo-economico/ ↑

- https://www.elnuevodia.com/negocios/economia/notas/inversionistas-de-ley-22-impugnaran-alza-de-5000-a-la-tarifa-por-radicar-sus-informes-anuales/ ↑

- https://www.the2022actsociety.org/special-litigation-fund/ ↑

- https://newsismybusiness.com/op-ed-negative-impact-of-ongoing-changes-to-incentive-programs/; https://www.theweeklyjournal.com/business/act-20-22-still-going-strong-numbers-climbing/article_027b6ac2-6848-11e9-9d71-87057165c539.html; https://www.theweeklyjournal.com/business/act-20-22-investors-share-suggestions-to-rev-up-puerto-rico-economy/article_974be51e-e70e-11ea-acbc-4bb937d8175b.html; https://www.bloomberg.com/news/articles/2023-07-12/irs-probes-puerto-rico-tax-breaks-that-lured-crypto-traders-fund-managers; https://www.elnuevodia.com/opinion/punto-de-vista/matar-a-la-gallinita-de-los-huevos-de-oro/ ↑

- https://projects.propublica.org/nonprofits/organizations/660823462; While the organization discloses what organizations they grant to (see: IRS 990, Schedule I “Additional Data”), they do not disclose their contributors. ↑

- https://projects.propublica.org/nonprofits/display_990/660823462/01_2018_prefixes_61-68%2F660823462_201612_990PF_2018013015153476 ↑

- https://projects.propublica.org/nonprofits/organizations/660823462/202343129349302969/full, Schedule A, Part II, page 2 ↑

- https://projects.propublica.org/nonprofits/organizations/660823462/202330419349301593/full, Schedule O ↑

- https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0; https://fahadghaffarpr.com/about-fahad-ghaffar/; https://www.camarapr.org/Pres-Kenneth/3PROMESA/bios/Bio-Fahad-Ghaffar.pdf ↑

- https://fahadghaffarpr.com/about-fahad-ghaffar/ ↑

- https://www.bloomberg.com/news/articles/2023-10-16/paulson-accuses-ex-partner-of-racketeering-in-190-million-suit ↑

- https://fahadghaffarpr.com/about-fahad-ghaffar/ ↑

- https://www.thedailybeast.com/john-paulson-claims-partner-fahad-ghaffar-used-his-money-for-luxe-life ↑

- https://suri.hacienda.pr.gov/_/ See: “Searches” box then click “View Approved Non-Profit Organizations” ↑

- https://docs.google.com/spreadsheets/d/1aKKnomIy65fluY4SU6J1jz1DVUDzEEyqticNY7kilbg/edit#gid=0 ↑

- https://www.facebook.com/KarmaHoneyProject/posts/feel-good-about-your-mandatory-act-22-donation-today-httpswwwkarmahoneyprojectco/1043472346045129/ ↑

- https://www.miamiherald.com/news/local/crime/article260860027.html; https://projects.propublica.org/nonprofits/organizations/833290066 ↑

- https://m.facebook.com/KarmaHoneyProject/posts/1023696714689359/ ↑

- https://newsismybusiness.com/20-22-act-society-donates-1m-to-30-puerto-rico-nonprofits/ ↑

- https://www.miamiherald.com/news/local/crime/article260860027.html ↑

- https://www.telemundopr.com/noticias/puerto-rico/hacienda-podria-investigar-empresa-vinculada-a-profugo-canadiense/2311279/; https://www.miamiherald.com/news/local/crime/article260860027.html;https://suri.hacienda.pr.gov/_/ See: “Searches” box then click “View Approved Non-Profit Organizations” PR Tax Exempt number 2019-1101.01-130 ↑

- https://hacienda.pr.gov/sites/default/files/ter23_version_final_5-abril-2022.pdf, 33 (See: “TEB 90” on page 33, shows revenue foregone 2017-2023). ↑

- https://hacienda.pr.gov/sites/default/files/pr_tax_expenditure_report_for_tax_year_v_section_iii_d_06.28.23_f_copy_1.pdf, 31. ↑

- https://www.nytimes.com/es/2022/01/31/espanol/puerto-rico-gentrificacion.html?smid=tw-share ↑

- https://docs.google.com/spreadsheets/d/1SkCikySBUxNyDzTCUk9M_65U5V-xz326iLgnG0voiks/edit#gid=0; https://youtu.be/YGXtWpCOiC8 ↑

- https://www.latimes.com/world-nation/newsletter/2022-01-13/latinx-files-puerto-rico-gentrification-latinx-files ↑

- https://tax.ri.gov/guidance/reports/top-100/top-100-income-tax-delinquents; https://youtu.be/YGXtWpCOiC8; https://www.browndailyherald.com/article/2018/03/giovanni-feroce-joins-rhode-island-gubernatorial-race-candidates ↑

- https://laislaoeste.com/la-gentrificacion-arropa-el-oeste-de-puerto-rico/ ↑

- https://time.com/5955629/puerto-rico-tax-haven-opposition/; https://www.latimes.com/world-nation/story/2022-05-06/illegal-building-making-puerto-rico-more-vulnerable-to-climate-change-critics-warn; https://canadianinquirer.net/2022/06/17/coastal-gentrification-in-puerto-rico-is-displacing-people-and-damaging-mangroves-and-wetlands/; https://www.npr.org/transcripts/1168231830; https://thehill.com/opinion/finance/4319700-tax-cheats-are-taking-advantage-of-puerto-rico-the-us-government-can-stop-them/ ↑

- E.g., https://9millones.com/organizations-unite-to-repeal-act-22/; https://jayfonseca.com/comunidades-reclaman-derogar-ley-22-en-pro-de-vivienda-asequible-documentos/ ↑

- https://periodismoinvestigativo.com/2021/06/puerto-rico-act-22-fails/; https://prospect.org/power/2023-08-21-gringo-go-home-puerto-rico-not-for-sale/; https://periodismoinvestigativo.com/2023/09/more-than-21-million-in-taxes-in-jeopardy-due-to-lack-of-oversight-of-act-22-beneficiaries/ ↑

- https://periodismoinvestigativo.com/2022/06/court-of-appeals-also-orders-delivery-of-act-22-beneficiaries-reports/; https://periodismoinvestigativo.com/2022/11/reports-filed-by-act-22-beneficiaries-are-public-records-pr-supreme-court-says/; https://www.bloomberg.com/opinion/articles/2023-09-22/puerto-rico-is-being-far-too-generous-with-rich-investors?embedded-checkout=true; https://velazquez.house.gov/sites/evo-subsites/velazquez.house.gov/files/evo-media-document/final-letter-urging-the-irs-to-expedite-foia-re-auditing-efforts-on-act-22-beneficiaries-rep.-velazquez-002_0.pdf ↑