[ENGLISH] Vulture Fund Power Players Hedge Clippers Report Feb 2023 FINALDownload

[SPANISH] LOS CABECILLAS DE LOS FONDOS BUITRES Hedge Clippers Report Feb 2023 FINALDownload

February 2023

Contributors

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country....

[ENGLISH] Vulture Fund Power Players Hedge Clippers Report Feb 2023 FINALDownload

[SPANISH] LOS CABECILLAS DE LOS FONDOS BUITRES Hedge Clippers Report Feb 2023 FINALDownload

February 2023

Contributors

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country....

Hedgepaper 76: Pharma’s Failed Promise: How Big Pharma Hurts Workers, Dodges Taxes, and Extracts Billions in Puerto Rico

Download as PDF or read below

Pharma’s Failed Promise: How Big Pharma Hurts Workers, Dodges Taxes, and Extracts Billions in Puerto Rico

Download a version of the Spanish PDF of the report

August 2022

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power....

HEDGE FUND BILLIONAIRES TO CONNECTICUT: DROP DEAD

In January, Democratic lawmakers in Connecticut introduced legislation to close the “carried interest loophole” and generate $520 million in tax revenue for the state, which is facing a big, real, right-now budget crisis.

Without significant new revenue, Connecticut state politicians will make big cuts to education, higher education, childcare, children’s services and safety net programs that benefit millions of regular people....

“The hedge fund guys are getting away with murder…”

– Donald Trump on August 23rd, 2015 on how hedge fund managers only pay 20% on some of their income by using the carried interest loophole. A tax rate that is lower than the rate what middle class families pay.

President Donald Trump on Wednesday is planning to unveil a proposal to cut corporate taxes on U.S....

HEDGE PAPERS NO. 45: CLOSING A LUCRATIVE LOOPHOLE TO HELP OUR COMMUNITIES

Download as PDF or read below

How Maryland Can Raise Millions by Taxing Carried Interest

Across the country, states stand to gain billions of dollars in revenue by closing the carried interest loophole.

It’s a long overdue element of financial reform that the federal government has failed to enact, despite bipartisan support for tax fairness.

In last year’s Presidential campaign, Donald Trump, Hillary Clinton, Bernie Sanders, and Jeb Bush all called for closing a tax break known as the “carried interest loophole,” a legal fiction used by private equity firms and other members off the wealthy elite to lower their federal tax rates below those paid by many working Americans.[1]...

HEDGE PAPERS NO. 44: HOW HEDGE FUNDS RIP OFF OHIO UNIVERSITY ENDOWMENTS

Download as PDF or read below

How Ohio Students, Taxpayers & Communities Suffer

The Great Recession took an immeasurable toll on Ohio’s colleges and universities–and eight years later, Ohio’s higher education system has yet to recover.

State funding was cut, tuition was increased, and university endowments lost huge amounts in market losses – and have since lost even more to exorbitant fees charged by greedy Wall Street hedge fund managers....

HEDGE PAPERS NO. 43: CONNECTICUT BILLIONAIRES AND THEIR LUCRATIVE LOOPHOLE

Download as PDF or read below

How We Can Raise Hundreds of Millions by Taxing Carried Interest

Across the country, states stand to gain billions of dollars in revenue by closing the carried interest loophole.

It’s a long overdue element of financial reform that the federal government has failed to enact, despite bipartisan support for tax fairness....

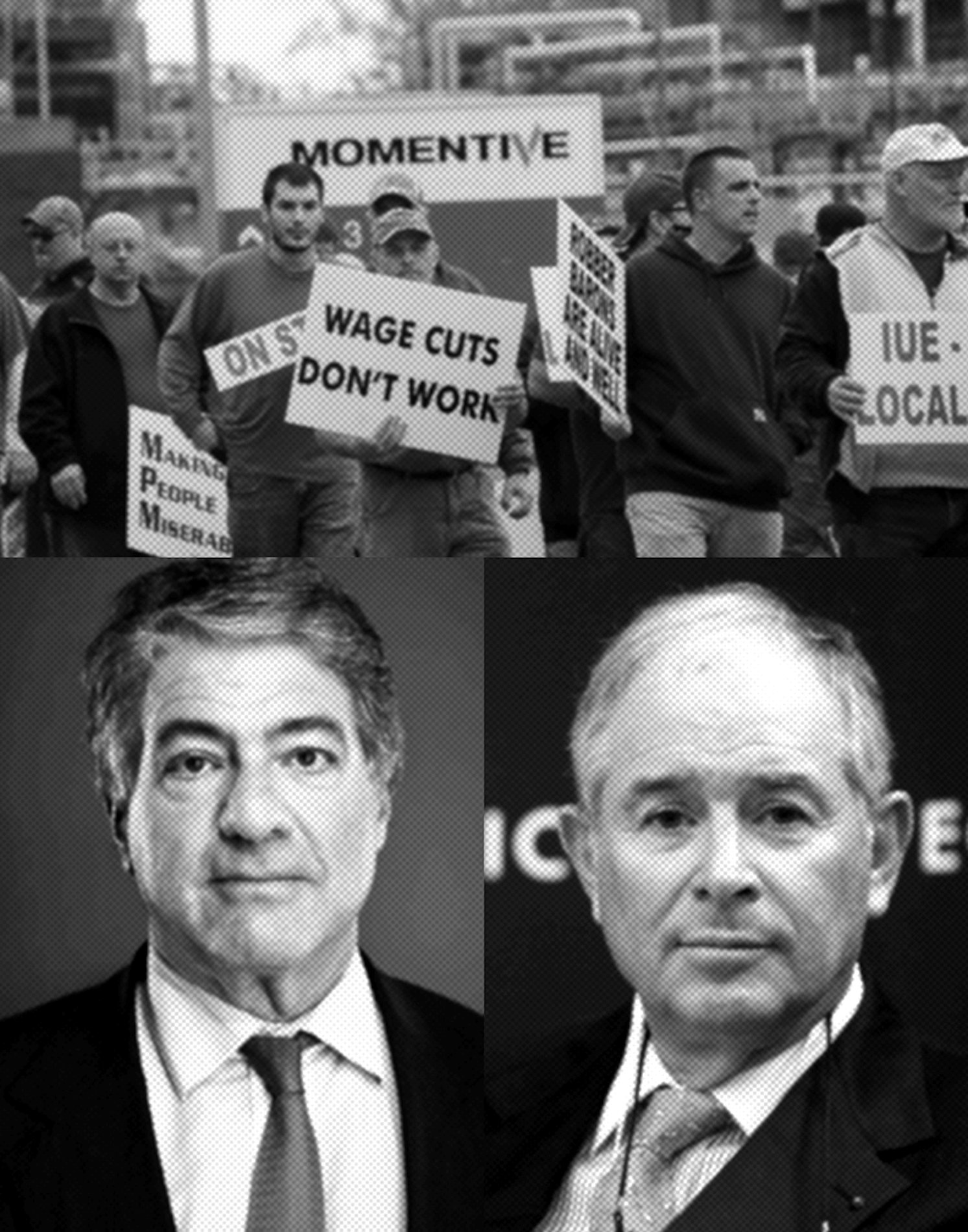

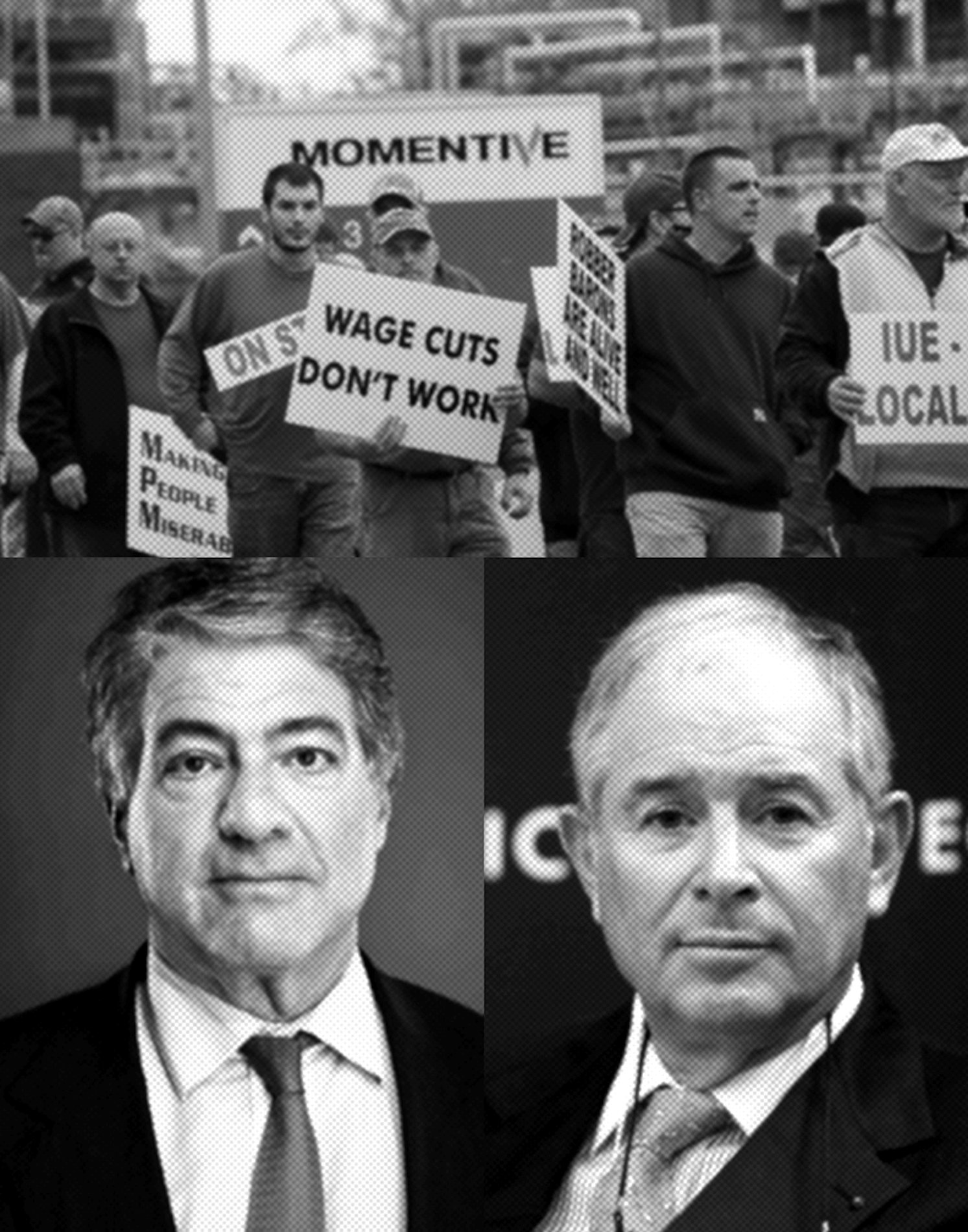

Hedge Papers No. 42: BILLIONAIRES LEON BLACK & STEPHEN SCHWARZMAN ATTACK MOMENTIVE AND UPSTATE NEW YORK

Download as PDF or read below

With national attention focused on populist anger over Wall Street’s role in rigging the economy, more and more Americans are taking a growing interest in the business practices of billionaire investors and money managers.

Wall Street multimillionaires and billionaires have captured unprecedented wealth, even as the rest of the economy sputters and working families see their incomes stagnate or decline....

UPDATE: Pirates of the Caribbean: How Santander’s Revolving Door with Puerto Rico’s Development Bank Exacerbated a Fiscal Catastrophe for the Puerto Rican People

Download as PDF or read below

UPDATE: Carlos García Fails to Report CommoLoCo in Financial Disclosure

García’s business makes small loans to desperate Puerto Ricans at extremely high interest rates

The following is an update concerning the business interests and apparent conflicts of Carlos García, who is serving as a board member of the Financial Oversight and Management Board for Puerto Rico (aka “Fiscal Control Board,” “Junta”)....

#Hedgepapers No. 41-BILLIONAIRES ATTACK NEW YORK STATE ELECTIONS

Download as PDF or read below

BILLIONAIRES BUYING ALBANY LAWMAKERS TO WIN NEW TAX BREAKS AND PROTECT OLD ONES

More and more New Yorkers are outraged over corruption and influence-pedaling in Albany, disgusted with a state government that seems to prioritize special deals for the wealthy and well-connected over the needs of regular people.

Dozens of Albany lawmakers and top officials have been arrested and prosecuted for criminal violations in recent years, but state government corruption has continued – including the “legal” corruption that’s caused by massive campaign contributions from individuals and corporations seeking special benefits from state government, or seeking to keep special benefits they’ve already got....