Corporate America to SEC: Trump is Bad for Business

Since Donald Trump came down the golden staircase inside Trump Tower to announce his candidacy on June 16th, part of his core economic argument has rested on the fact that he’s “really rich” and he’s going to “make the country rich.”

At the debates, he argued in simplistic terms that his economic program would spur economic and job creation. Trump declared his intent to “cut regulations” and “cut taxes big league,” and boasted that his economic plan “will create tremendous numbers of new jobs.”

Since assuming office, the Trump administration has cut regulations and signaled its openness to huge tax cuts for the super wealthy. CEO and other emissaries of American corporations started filling up advisory councils, meeting with the administration in public — and in secret.

Trump’s own public schedule in the spring included regular roundtable meetings with CEOs intended to project an image that Trump was serving businesses interests while in government.

Workers, communities, the environment and the public welfare were largely left out of Trump’s day-to-day work in any meaningful way — he spouted rhetoric about restoring jobs but didn’t do much to make it happen.

The big corporations he courted mostly ignored his repeated attacks on Muslims, immigrants and the environment, tacitly standing by the President’s rhetoric in the hope that they could use their access to advocate for policies and regulations that they wanted.

Trump’s Charlottesville response, and the corporate revulsion that followed, marked the first widely publicized break of big corporations from support for the Trump administration.

But SEC filings reviewed by Hedge Clippers demonstrate that many leading American corporations had previously acknowledged to their investors that Trump would be bad for business.

Our review of SEC filings was designed to help Americans understand how big, publicly traded corporations assess the impact of Trump’s policies on the economy and on their companies.

Since corporate communications with the public through CEO statements or press releases have often been opaque, and sometimes geared toward not offending Trump, we examined the 10K forms that companies must file with the SEC to inform investors or potential investors on their businesses.

SEC Form 10-K is a yearly report filed by every publicly traded corporation and many private companies with significant assets. These reports include information many corporations would never put into a press release, including problems and vulnerabilities for businesses due to social or political events.

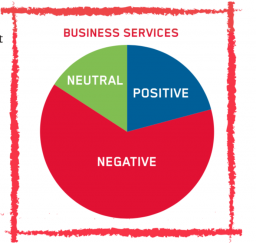

The Hedge Clippers research team reviewed all 10K forms filed with the SEC since the 2016 election and searched for any references to the Trump administration. References were then coded based on whether the filing suggested that Trump and his proposed policies would be positive, neutral or negative for the company.

Our findings:

In their legal filings with the government, when American corporations are required to tell the truth to their investors about the Trump administration, they are overwhelmingly negative and skeptical.

Overall, the data showed a consistent trend – corporate America is wracked with uncertainty and fear over President Trump’s economic agenda.

Specifically, the results indicated that

- Half of all companies said Trump was bad for business, and eight out of ten companies were negative or neutral.

- 193 (50.80%) of 380 companies viewed the Trump Administration as a negative force on their business

- 134 (35.26%) companies viewed the Administration neutrally, and

- Only 53 (13.95%) companies indicated that the Trump Administration’s policies would benefit their business.

WHO SAYS TRUMP IS BAD FOR BUSINESS? MAJORITY OF CORPORATE AMERICA

WHO SAYS TRUMP IS BAD FOR BUSINESS? MAJORITY OF CORPORATE AMERICA

The largest consensus we found in SEC 10K reports is that Trump is creating fear and uncertainty in the business community, with more than half of companies describing the Trump Administration as a direct threat to their business success and predicting devastating effects on the future of their profitability.

This list was dominated by healthcare and pharmaceutical companies; comprising 27% of the list, who were largely anticipating damaging consequences to their business due to Trump administration’s plans to undermine and repeal the 2010 Affordable Care Act.

The list includes companies like Healthcare Corp, a family owned business providing care for senior citizens in South Carolina, indicated that their business could face adverse effects due to the administration’s planned changes to Medicaid coverage and repeals to the Affordable Care Act.

Several other healthcare service providers (such as Healthsouth Corp), medical equipment producers, (such as Corindus Vascular Robotics and Insulet), and medical research companies (such as Juno Therapeutics), have also expressed concern about the negative impact repeal efforts would have on their ability to provide healthcare services to their customers.

Diffusion Pharmaceuticals, producer of drugs that target treatment-resistant cancers, seemed to question whether President Trump’s attacks on companies on Twitter and other public forums might impact their supply chain, writing that it was “uncertain what impact the election of Donald Trump as President will have on our third-party suppliers in light of his public statements.” In their SEC filings, ViewRay, Inc, which produces MRI-guided radiation therapy machines, pondered the detrimental effects of a possible ACA repeal and cautioned that “[a]n under-staffed FDA could result in delays in FDA’s responsiveness or in its ability to review submissions or applications, issue regulations or guidance, or implement or enforce regulatory requirements in a timely fashion or at all.”

Some financial and real estate companies also see their investments as threatened by the political and economic uncertainty surrounding Trump’s Administration and his inconsistent policy decisions.

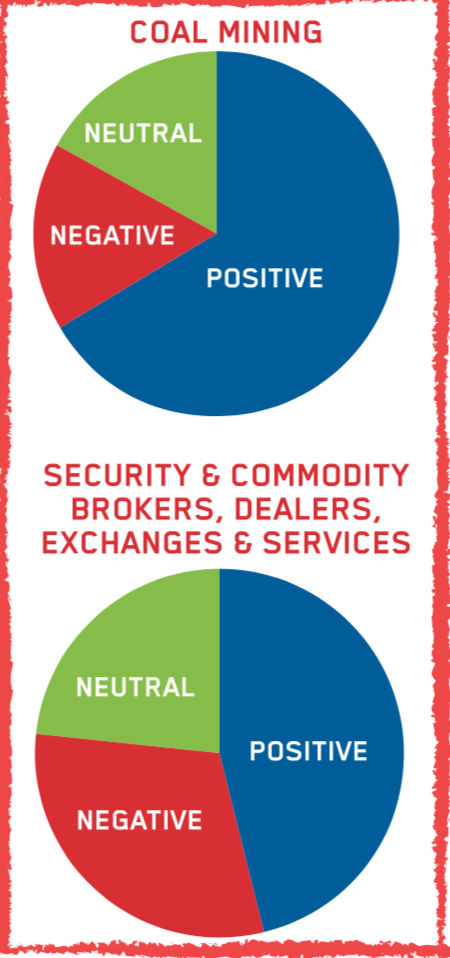

WHO LIKES TRUMP? WALL STREET AND FOSSIL FUEL INDUSTRY

The only industries solidly backing Trump in their truth-telling filings with the SEC are:

The only industries solidly backing Trump in their truth-telling filings with the SEC are:

Big banks, which are looking at a $27 billion windfall from Trump’s planned deregulation.

Fossil-fuel firms, who’ve filled the Trump campaign coffers this year to help push elimination of regulations and rules that protect the environment

Two industries, banks, and fossil energy, held a friendly view of Trump. Nineteen percent of positive expectations came from coal and oil companies, and 17% came from banks.

Many of these companies are relying on President Trump’s efforts to scale back environmental protections and climate change regulations.

Such companies include American Midstream Partners, a pipeline company that is closely connected to the controversial Dakota Access Pipeline, and Peabody Energy Corp and Arch Coal, the two largest coal companies and polluters in the country.

Some private equity firms, bank holding companies, and financial institutions see the election of Trump as a loosening of Obama era regulations such as the Dodd–Frank Wall Street Reform and Consumer Protection Act, which increased regulation of banks deemed ‘too big to fail,’ curtailed predatory mortgages, and limited the speculative investment capabilities of financial institutions.

Firms such as Banc of California, which has seen massive resignations after an SEC investigation into insider trading and connection to fraud, support President Trump’s lax attitude towards banks. Multiple other banks expressed similar views in their reporting, supporting Trump’s attempts to roll bank “burdensome regulations” meant to protect consumers.

In fact, financial service companies used their resources to make sure these policies would come to light. Federated Investors Inc. donated over $400,000 to Republican Committees during the election, while Prudential Financial Inc., Genworth Financial Inc., and AXA Equitable Life Insurance Co., donated a combined total of $500,000 to a variety of Republican groups during the 2016 election cycle.

CONTROVERSIAL CONFLICTED BILLIONAIRE CARL ICAHN

A notable business expressing positive hopes for the Trump Administration is Icahn Enterprises, a holding company owned by Carl Icahn.

A notable business expressing positive hopes for the Trump Administration is Icahn Enterprises, a holding company owned by Carl Icahn.

Icahn, a close friend of Trump, supported Trump throughout his campaign and left his victory party early to bet on the futures market, making $1 billion in profit. Icahn stated in May 2017, “We need a president that can move Congress. And I think Donald Trump could do it.”

Icahn’s controversial role as a formal advisor to Trump on regulatory policy was the subject of a recent bombshell expose in The New Yorker and may be the subject of investigation by government ethics and lobbying regulators.

[IMAGE: SCREENSHOTS OF COVERAGE OF THE NEW YORKER ARTICLE]

Icahn has benefitted extensively from President Trump; Carl Icahn has exploited his insider status and knowledge as an advisor to President Trump for self-interest, influencing credit prices to increase the profits of his company, CVR energy.

Additionally, Icahn influenced Trump to alter biofuel laws in ways that would benefit Icahn’s oil refinery. His actions present a clear conflict of interest in his role under President Trump’s administration.

NOTABLE NEUTRAL –

BLACKSTONE IS NEUTRAL EVEN AS TRUMP BILLIONAIRE BUDDY STEPHEN SCHWARZMAN GREASES WHEELS

Interestingly enough, companies such as private equity giant Blackstone were decidedly ambivalent about the consequences of a Trump Administration on their business, stating that they have no idea of what policies Trump would implement.

It seems that Blackstone told the SEC one thing, while its billionaire CEO, Stephen Schwarzman, the former chairman of Trump’s now-disbanded Strategic and Policy Forum and a member of his also-disbanded business advisory council, was telling Trump and the public a completely different story.

[IMAGE: TRUMP & SCHWARZMAN]

Contrary to the company’s filings, Schwarzman himself seems to have high hopes and expectations for the economy (if not a direct influence on it himself), saying he was “bullish on Trump’s effect on the economy” and predicting “‘higher growth rates… and a stronger dollar” in the United States.

Far from being a passive recipient of Trump Administration policies, Schwarzman seems to be exerting a significant amount of influence over a wide range of economic and political decisions, such as discouraging Trump from being tough on China in order to alleviate risk from Blackstone’s profits.

In fact, Schwarzman has advised Trump on many issues, ranging from foreign policy to management structure inside the White House, to his upcoming plan for tax reform. According to the NY Times Blackstone was awarded the Saudi Arabia infrastructure fund after he started advising President Trump. The decision was announced in the royal palace in Riyadh as Donald Trump and Jared Kushner looked on.

The conflicts of interest posed by Schwarzman stand in direct contrast to SEC filings that say Blackstone has no way of predicting Trump’s economic and regulatory policies.

PRIVATE EQUITY SCARE ABOUT CARRIED INTEREST TAX COULD EXPLAIN RECENT TRUMP FLIP FLOP

Some companies, including Schwarzman-run Blackstone, expressed worry over Trump’s indecisive back and forth stance on closing the carried interest tax loophole, which allows private equity firms to make millions.

Blackstone’s SEC filing included this interesting statement:

If federal, state or local legislation to treat carried interest as ordinary income rather than as capital gain for tax purposes were to be enacted, we and possibly our unitholders would be required to pay a materially higher amount of taxes, thereby adversely affecting our ability to recruit, retain and motivate our current and future professionals.

Wall Street’s influence inside the Trump administration and Schwarzman’s counsel may help explain why the Trump administration has been signaling that they are not going to be closing the carried interest loophole.

NEUTRAL ON TRUMP: UNCERTAIN ON ANY POSSIBLE ACCOMPLISHMENTS

Many of the companies that viewed the Trump Administration neutrally largely stated that it was too soon to predict the impact that the presidency would have on their companies.

Many of the companies that viewed the Trump Administration neutrally largely stated that it was too soon to predict the impact that the presidency would have on their companies.

Companies that indicated neutrality towards the Trump Administration were varied, with 7% of companies comprising the list representing crude petroleum and gas companies, 9% representing pharmaceutical manufacturers, 8% representing commercial banks, 8% representing life insurance companies, and 8% representing Real Estate Investment Trusts (REITs).

Companies in the petroleum and pharmaceutical industries expressed uncertainty over President Trump’s future policies concerning environmental measures and the Affordable Care Act, respectively.

Companies in the financial industry were unclear about the tax reform that the Trump Administration is planning to undertake, and furthermore, were unsure of his stances towards carried interest tax loopholes and other financial regulatory issues.

CONCLUSION

The Trump administration far right social and economic policy are a huge threat to the larger economy that even corporations are starting to acknowledge when they need to be candid to their investors.

While Trump ran on a platform to help the working class, his policies have largely focused on destabilizing the economic programs put in by the Obama administration and crafting policies that greatly benefit a few donors.

The concerted campaign to undermine the Affordable care act is a cautionary tale about whether corporations are willing to stand up for what’s right even when it matches their interest. Many of the negative prospects in the 10-K’s dealt with the instability from repealing the healthcare law. While grassroots energy helped stop repeal efforts in the summer of 2016, the corporations that listed repeal as a significant impediment to their business across the economy stayed mostly on the sideline.

That only began to change after business leaders left advisory committees formed by the White House after President Trump refused equivocated on denouncing White Supremacists in Charlottesville.

If businesses are telling their investors that Trump’s immigration, health care policies are bad for their sector of the economy they should stop enabling these policies for a seat at the table.

WHO ARE THE HEDGE CLIPPERS?

Whistleblowers for Working People

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power.

We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected.

Instead of draining the swamp, Donald Trump brought it into the White House. Members of Trump’s inner circle include Wall Street billionaires with a history of destroying jobs, harming working people, and protecting the wealthiest Americans at everyone else’s expense. Hedge Clippers unites organizations and movements to cut through Trump’s swamp, and blow the whistle on Trump’s advisors who put their own financial gain before the public good.

We’re giving Americans the tools and infrastructure to fight, and win a multi-year battle against Trump’s agenda in Washington, and in states, cities, and towns across America.

The Hedge Clippers campaign includes leadership and collaborative contributions from labor unions, community groups, coalitions, digital activists and organizing networks around the country, including the the American Federation of Teachers, Strong Economy for All Coalition, New York Communities for Change, Alliance for Quality Education, VOCAL-NY and Citizen Action of New York; Make the Road Connecticut; New Jersey Communities United; the Alliance of Californians for Community Empowerment (ACCE) and Courage Campaign; the Grassroots Collaborative in Illinois; the Ohio Organizing Collaborative; ISAIAH in Minnesota; Organize Now in Florida; Rootstrikers, Every Voice, Color of Change, 350.org, Greenpeace, the ReFund America Project and United Students Against Sweatshops; the Center for Popular Democracy and the Working Families Party; the United Federation of Teachers and New York State United Teachers, the National Education Association, and the Communication Workers of America.