BILLIONAIRE CORPORATE LANDLORDS ARE EXACERBATING CALIFORNIA’S HOUSING CRISIS

Acknowledgements

This report was researched and written by Eli Vitulli (Center for Popular Democracy). Additional research and writing support was

This report was researched and written by Eli Vitulli (Center for Popular Democracy). Additional research and writing support was  provided by Sofia Lopez (Action Center on Race & the Economy). It was edited by Amy Schur and Anya Svanoe (Alliance of

provided by Sofia Lopez (Action Center on Race & the Economy). It was edited by Amy Schur and Anya Svanoe (Alliance of  Californians for Community Empowerment), Michael Kink (Hedge Clippers), and Emily Gordon and Connie Razza (Center for Popular Democracy).

Californians for Community Empowerment), Michael Kink (Hedge Clippers), and Emily Gordon and Connie Razza (Center for Popular Democracy).

California is in the midst of a housing crisis that threatens the health and well-being of millions of people. The crisis is particularly acute in low-income communities, who overwhelmingly pay a large portion of their already-small income on housing,[1] and communities of color, who have faced decades of legal and extra-legal residential segregation, housing discrimination, predatory lending, and exclusionary lending practices, such as redlining.[2] While hundreds of thousands of Californians experience housing instability or have to make the choice between paying rent and buying basic necessities like food and medicine,[3] corporate landlords are profiting from this crisis.[4]

Equity Residential is one of the largest corporate landlords in California and the third largest apartment owner in the U.S., with 36,805 apartments across 150 properties in Southern California and San Francisco and nearly 80,000 apartments nationwide.[5] Equity Residential is a Real Estate Investment Trust (REIT), which is an investment company that owns and often operates income-producing real estate assets. REITs get extremely favorable tax treatment, often paying little to no corporate taxes as they pass at least 90%, if not all, of their profits to their investors, who often receive tax breaks on the dividends they receive.[6]

Invitation Homes is another one of the largest corporate landlords in California, with 12,822 primarily single family rentals in the state and nearly $16.7 billion in properties nationwide at the end of 2018.[7] Also set up as a REIT, it is a single-family rental company controlled by The Blackstone Group, one of the largest private equity and asset management firms in the world. During the Great Recession, Blackstone bought up tens of thousands of foreclosed homes and turned them into rentals.[8] Blackstone is one of a number of Wall Street firms that have profited from the foreclosure crisis, increasingly concentrating rentals among large corporate owners and crowding out “mom and pop” landlords.[9]

Wall Street landlords, including private equity firms and REITs, are primarily accountable to their investors who demand returns that increase each year, resulting, in many cases, in large annual rent increases, frequent fees and high utility costs, high rates of evictions, and maintenance and habitability problems.[10]

Moreover, the federal tax code allows these corporate landlords to avoid paying their fair share in taxes. Meanwhile, many have poured millions of dollars into California, as they do in other states, to elect politicians friendly to their interests, support legislation that furthers their interests, and defeat tenant protection legislation at the expense of millions of Californians.[11]

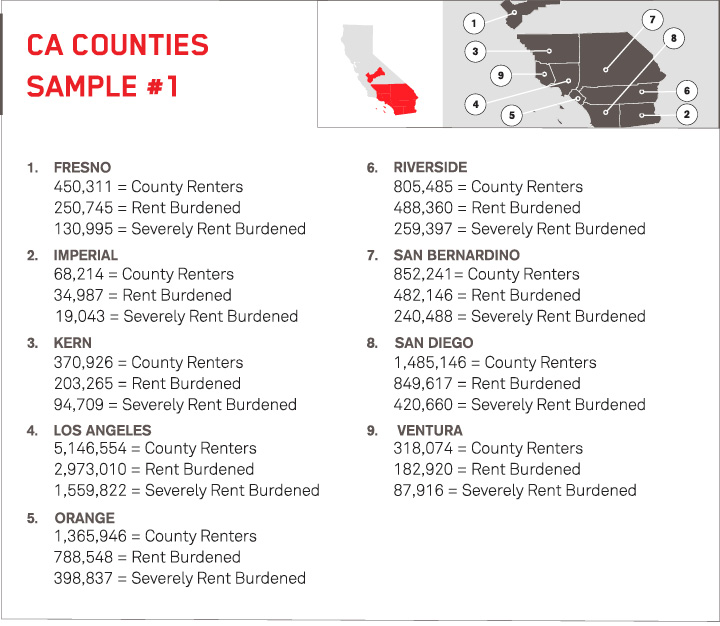

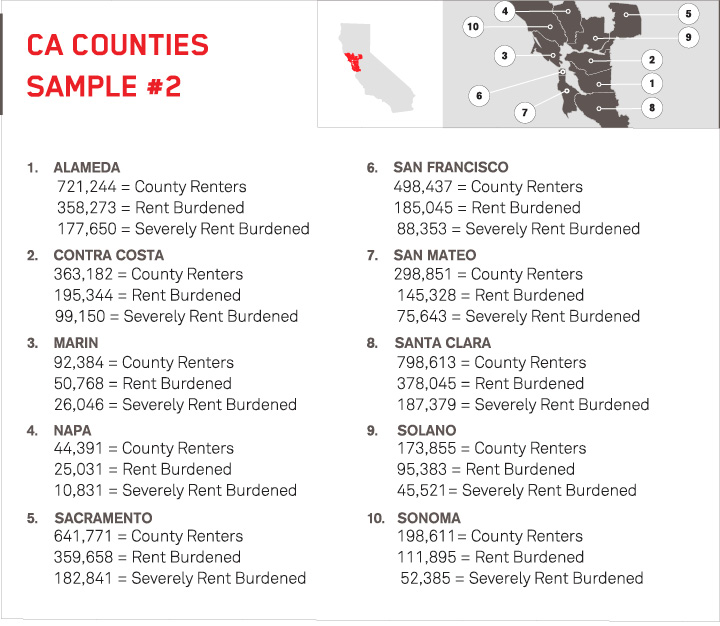

Over 3 million California renter households are “rent burdened,” or paying over 30% of their income on rent, while nearly 1.6 million of those 3 million renter households are “severely rent burdened” (paying over 50% of their income on rent). In other words, over half of California tenant households are rent burdened, and one in four are severely rent burdened.[12]

Nearly 130,000 Californians are homeless, including over 12,000 unaccompanied youth.[13]

| Total number of renters | Number of renters that are rent burdened | Percentage of renters that are rent burdened | Number of renters that are severely rent burdened | Percentage of households that are severely rent burdened | |

| California | 17,112,143 | 9,451,005 | 55.2% | 4,799,261 | 28.0% |

| Alameda | 721,244 | 358,273 | 49.7% | 177,650 | 24.6% |

| Contra Costa | 363,182 | 195,344 | 53.8% | 99,150 | 27.3% |

| Fresno | 450,311 | 250,745 | 55.7% | 130,995 | 29.1% |

| Imperial | 68,214 | 34,987 | 51.3% | 19,043 | 27.9% |

| Kern | 370,926 | 203,265 | 54.8% | 94,709 | 25.5% |

| Los Angeles | 5,146,554 | 2,973,010 | 57.8% | 1,559,822 | 30.3% |

| Marin | 92,384 | 50,768 | 55.0% | 26,046 | 28.2% |

| Napa | 44,391 | 25,031 | 56.4% | 10,831 | 24.4% |

| Orange | 1,365,946 | 788,548 | 57.7% | 398,837 | 29.2% |

| Riverside | 805,485 | 488,360 | 60.6% | 259,397 | 32.2% |

| Sacramento | 641,771 | 359,658 | 56.0% | 182,841 | 28.5% |

| San Bernardino | 852,241 | 482,146 | 56.6% | 240,488 | 28.2% |

| San Diego | 1,485,146 | 849,617 | 57.2% | 420,660 | 28.3% |

| San Francisco | 498,437 | 185,045 | 37.1% | 88,353 | 17.7% |

| San Mateo | 298,851 | 145,328 | 48.6% | 75,643 | 25.3% |

| Santa Clara | 798,613 | 378,045 | 47.3% | 187,379 | 23.5% |

| Solano | 173,855 | 95,383 | 54.9% | 45,521 | 26.2% |

| Sonoma | 198,611 | 111,895 | 56.3% | 52,385 | 26.4% |

| Ventura | 318,074 | 182,920 | 57.5% | 87,916 | 27.6% |

Source: 2017 American Community Survey, 1-Year Estimates

Housing instability and ever-increasing rents contribute to economic instability,[14] decrease job security,[15] complicate healthcare access,[16] and interfere with children’s schooling.[17] In the midst of this housing insecurity crisis, Invitation Homes reported $139 million funds from operations (FFO)[18] in the first quarter of 2019,[19] and Equity Residential reported $311 million FFO, which “exceeded [their] expectations,” in the first quarter of 2019.[20] Invitation Homes also has a record of threatening tenants with eviction notices, implementing large rent increases, and ignoring maintenance requests, which likely lead to these increased revenues.[21]

Wall Street landlords of single-family rentals increase rents at nearly twice the rate of other landlords competing in the same markets.[22] These landlords also often pursue greater revenue by charging fees beyond rent (such as high late fees or service charges for “smart home” features), a practice that tends to disadvantage cash-strapped low-income tenants. Some companies, including Starwood Waypoint (now merged with Blackstone’s Invitation Homes), shift the responsibility and cost of routine maintenance and minor repairs onto their tenants.[23]

Many of these companies also pursue evictions at a higher rate than smaller landlords.[24] A 2016 Federal Reserve Bank of Atlanta study of evictions in Fulton County (Atlanta) found that large corporate single-family rental companies evict tenants at higher rates than smaller, mom and pop landlords and that these high eviction rates were concentrated in predominantly Black neighborhoods. It also found that some large private equity investors have “uniquely” high eviction rates.[25] Starwood Waypoint (now merged with Blackstone’s Invitation Homes) had the highest eviction rate, giving eviction notices to nearly one-third of their tenants in 2015.[26] Moreover, Wall Street’s entrance into the single-family home rental market has contributed to housing market trends–including decreases in homeownership and increases in rent–that hurt renters and potential homeowners in many of the markets in which they operate.[27] For example, Invitation Homes focuses on acquiring houses with three or more bedrooms that are priced between $100,000 and $400,000—the same houses that are often attractive to first-time homeowners—and in markets where there is greater housing demand. Because Invitation Homes and other Wall Street investors can offer cash to sellers, prospective family home buyers rarely win bids over them.[28]

While similar data is unavailable for multi-family rentals, Equity Residential describes its operating and investing strategy as relying on, at least in part, raising rents. They explain that they operate in markets which “generally feature [certain] characteristics that allow us to increase rents” and “maximize income and capital appreciation,” such as an extremely tight housing supply and limited homeownership opportunities.[29] At Woodland Park Apartments, a rent-controlled apartment complex of over 1,800 units in East Palo Alto, tenants have accused the company of unfair eviction and late-fee practices, poor maintenance, and other violations of the city’s rent stabilization ordinance.[30] Owned by Equity Residential from 2011 to 2016,[31] Woodland Park primarily housed residents who were low-income and/or people of color, many of whom worked as service providers to the rich employees and wealthy owners of the tech industry that has contributed to the increasing unaffordability of the Bay Area’s housing market.[32] The company allegedly served hundreds of eviction notices to residents each month, giving them three days to pay rent or face eviction, and some residents alleged that the landlord was evicting tenants in order to raise rents to market rate.[33]

****

Cecilia and Carlos Reyna’s Story – “When we rented our small house from Waypoint Homes in Compton years ago, we were excited about the opportunity to have a stable, decent place to live at a reasonable cost. That changed as Waypoint raised our rent over $300 per month and refused to pay for some basic repairs, which caused us to cover the cost ourselves. I work as a garment worker; my husband Carlos works in a furniture factory; and, together we work incredibly hard. Waypoint merged with Invitation Homes, which continues to operate similarly. Recently, we were hit again with another $400 per month rent increase—and we just can’t afford it. It’s impossible to find any comparable housing that is affordable around here—leaving us facing the possibility of becoming homeless this year. The stress is killing us.”

Cecilia and Carlos Reyna’s Story – “When we rented our small house from Waypoint Homes in Compton years ago, we were excited about the opportunity to have a stable, decent place to live at a reasonable cost. That changed as Waypoint raised our rent over $300 per month and refused to pay for some basic repairs, which caused us to cover the cost ourselves. I work as a garment worker; my husband Carlos works in a furniture factory; and, together we work incredibly hard. Waypoint merged with Invitation Homes, which continues to operate similarly. Recently, we were hit again with another $400 per month rent increase—and we just can’t afford it. It’s impossible to find any comparable housing that is affordable around here—leaving us facing the possibility of becoming homeless this year. The stress is killing us.”

Merika Reagan’s Story – “I was born and raised in San Francisco. Thanks to high rents, I was priced out of the city. Six years ago, my wife and I moved into our current home as renters. When we moved into our home it was owned by a company called Waypoint Homes. It seemed so positive and promising. The company had a point system and even talked about working with us to one day own the property. After the first two-year lease was up, the only rent increase we received was for $50. But after Colony Starwood merged with Waypoint in early 2016 and then again with Invitation Homes in 2017, things began to change, the point system disappeared and our path to eventually owning our home disappeared also. When our last lease expired in May 2017,we were not offered a 2-year lease. Instead, we were only given the option to go month-to-month with a $1000 a month rent increase or sign another one year lease with an increase of $350 per month—neither of which we could come anywhere close to affording. I wanted to stay because I have no other options. When I have done housing searches for a home similar to the one I am in, the rent is way too high! My wife and I know that if we leave this home we would have to leave Oakland entirely—leave our home, my business, our community and our life. I have already been displaced from one city – and to be faced with the threat of being displaced from Oakland felt like a disaster. For me to work 12-14 hour days and barely have enough to pay skyrocketing rents to a billion dollar Wall Street landlord, is like share cropping all over again.”

Merika Reagan’s Story – “I was born and raised in San Francisco. Thanks to high rents, I was priced out of the city. Six years ago, my wife and I moved into our current home as renters. When we moved into our home it was owned by a company called Waypoint Homes. It seemed so positive and promising. The company had a point system and even talked about working with us to one day own the property. After the first two-year lease was up, the only rent increase we received was for $50. But after Colony Starwood merged with Waypoint in early 2016 and then again with Invitation Homes in 2017, things began to change, the point system disappeared and our path to eventually owning our home disappeared also. When our last lease expired in May 2017,we were not offered a 2-year lease. Instead, we were only given the option to go month-to-month with a $1000 a month rent increase or sign another one year lease with an increase of $350 per month—neither of which we could come anywhere close to affording. I wanted to stay because I have no other options. When I have done housing searches for a home similar to the one I am in, the rent is way too high! My wife and I know that if we leave this home we would have to leave Oakland entirely—leave our home, my business, our community and our life. I have already been displaced from one city – and to be faced with the threat of being displaced from Oakland felt like a disaster. For me to work 12-14 hour days and barely have enough to pay skyrocketing rents to a billion dollar Wall Street landlord, is like share cropping all over again.”

****

BILLIONAIRE FUND MANAGERS ARE THE NEW CORPORATE LANDLORDS

The wealth of these corporate landlords and their top executives comes at the expense of many renters in California.

The numbers:

- Stephen Schwarzman, Chairman and CEO of Blackstone, has a net worth of $14.9 billion[34] and made $567.8 million in 2018.[35]

- Jonathan Gray, Blackstone President and Chief Operating Officer and Schwartzman’s appointed successor, has a net worth of $3.1 billion[36] and made $145.7 million in 2018.[37]

- Dallas B. Tanner, Invitation Homes Co-Founder, President, CEO, and Director, received over $3.3 million in compensation in 2018.[38]

- As of 2015, Schwarzman owned at least five homes, together worth over $100 million. These included a $31 million apartment on Park Avenue in New York City, a beachfront property in Jamaica, and “estates” in East Hampton (worth over $21 million), Palm Beach, and Saint-Tropez.[39] The New Yorker estimates that he spent at least $125 million to buy and renovate the five properties.[40] Schwartzman told The New Yorker, “I love houses…I’m not sure why.”[41]

- Invitation Homes owns nearly $16.7 billion in properties nationwide and reported total assets of over $18 billion at the end of 2018.[42]

- Blackstone managed $472 billion in assets at the end of 2018, while paying out $34 billion to their investors during that same year. In his 2018 Chairman’s Letter, Schwarzman boasted of “strong growth” and that they could “thrive in any market.”[43]

- Sam Zell, Founder and Chairman of Equity Residential, has an estimated net worth of $5.6 billion.[44]

- Zell owns multiple multimillion dollar homes, including a penthouse in Chicago and houses in Malibu and Sun Valley, Utah. He also owns a private jet and a large fleet of motorcycles.[45] Zell is known for throwing himself lavish birthday parties that feature famous musicians, such as the Eagles, Elton John, Aretha Franklin, Bette Midler, and Fleetwood Mac.[46]

- Equity Residential reported over $20 billion in assets, including over $6.3 billion in California, and was valued at over $34 billion at the end of 2018.[47] They reported a net operating income of nearly $1.8 billion, including nearly $771 million from California, in 2018.[48]

AVOIDING THEIR FAIR SHARE OF TAXES THROUGH SPECIAL LOOPHOLES

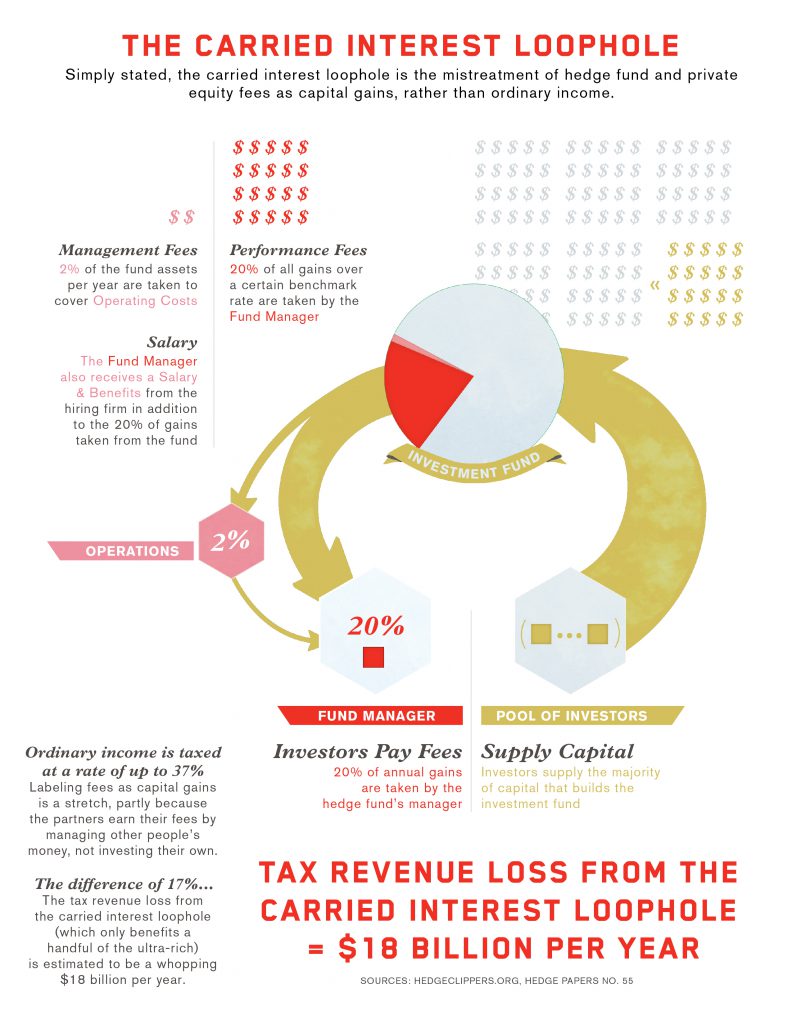

Blackstone is structured as a pass-through partnership, which allows the company to avoid corporate taxes, and its executives take advantage of the carried interest tax loophole, which allows them to pay the capital gains tax rate of 20% instead of the top rate of 39.6% on income.[49]

Between 2015 and 2018, as part of his much larger compensation, Stephen Schwarzman collected nearly $325 million in carried interest for his role at Blackstone.[50] That money would have qualified for the 20% carried interest tax rate rather than the 39.6% top income rate on that, meaning he may have personally avoided paying just over $63.7 million in federal income taxes.[51]

(In 2010, Schwarzman famously compared the Obama administration’s pledge to close the carried interest loophole to Hitler invading Poland.[52])

As a Real Estate Investment Trust (REIT), Equity Residential is also a pass-through entity. REITs do not have to pay corporate tax on any taxable income that they pay out to their shareholders—and most pay out 100% of such income.[53] Shareholders pay taxes on dividends and any capital gains.[54] While in the past those dividends were generally treated as ordinary income and not entitled to the reduced tax rates on other types of corporate dividends, the 2017 tax reform mandated a 20% reduction on pass-through income, including REIT dividends, which means that an investor paying the top marginal income tax rate would pay 29.6% on REIT dividends, rather than 39.6%.[55] REITs may also establish opportunity zone funds to acquire and develop real estate, which provides other favorable tax treatment, including deferring and potentially reducing capital gains taxation to zero on the sale of qualified assets.[56]

CORPORATE LANDLORDS: RIGGING THE SYSTEM WITH CAMPAIGN CASH

Corporate landlords, like Invitation Homes and Equity Residential, use this vast wealth to maintain a rigged system that permits ever-increasing rents, burdening renters and leaving them with few protections. Since 2008, California’s largest real estate lobbying groups have spent $110.3 million in direct campaign contributions to state legislative candidates and in lobbying to influence legislation.[57] Moreover, during the 2018 election cycle alone, just one of those lobby groups, the California Apartment Association (CAA), contributed $250,000 to the California Republican Party and $145,000 to the California Democratic Party.[58] These parties then made direct contributions to a variety of political action committees and candidates and independent expenditures.[59] These contributions speak to the presence of real estate money in both parties. CAA and other real estate lobby groups are among the biggest political spenders in California each year, and tenants and tenants’ rights groups cannot come anywhere near matching them financially.[60]

Contributions to PACs and independent expenditures (IEs) are often the sources of campaign spending by the real estate industry that are not subject to campaign contribution limits.[61] IEs are not contributions to campaigns or candidates but are direct expenditures on behalf of or against a campaign or issue. Examples of these kinds of expenditures include website, newspaper, TV or radio ads, or direct mailers. IEs cannot be made to specific candidates, and the entity making the expenditure is not legally allowed to work in coordination with a campaign.[62] There are no limits on independent expenditure amounts thanks largely to the Supreme Court’s Citizens United ruling.[63]

For example, in the 2018 campaign to pass California’s Proposition 10, which would have allowed localities to enact rent control, those opposing its passage spent over $72.1 million while those supporting the initiative spent a little over $25.6 million.[64] Blackstone and its affiliated entities and Equity Residential were among the top five largest donors to anti-Prop 10 PACs. Blackstone and its affiliated entities contributed $5 million to one PAC, No on Prop 10 – A Flawed Initiative, and Equity Residential contributed $5.2 million to another PAC, Californians for Responsible Housing.[65] Californians for Responsible Housing,[66] which was sponsored by the California Apartment Association,[67] was the best funded PAC opposing Prop 10, having raised $54 million.[68] Californians for Responsible Housing and the other largest anti-Prop 10 PACs were primarily backed by three of the largest corporate landlords in the US, including Illinois-based Equity Residential, Illinois-based Essex Property Trust and affiliated entities, and Virginia-based AvalonBay Communities, Inc.[69] One of Equity Residential’s Executive Vice Presidents, Barry Altshuler, was an outspoken critic of Proposition 10 and now is the President of the Board of Directors of the California Apartment Association.[70] Speaking at a real estate industry conference in 2018, Altshuler called rent control “an existential threat to cities around the country.”[71]

Through vulturous practices and the exertion of political influence through campaign contributions and political spending, Blackstone’s Invitation Homes and Equity Residential, like other private equity and Wall Street landlords, profit from and exacerbate California’s housing crisis, pushing more people into housing instability. When these companies and their executives further enrich themselves through tax loopholes, they contribute to the underfunding of public housing, housing voucher programs, and other public support services to address the housing crisis for those most in need.[72] Blackstone’s Invitation Homes, Equity Residential, and other Wall Street landlords profit at the expense of the same people burdened by their business practices. Private equity and Wall Street landlords then use that ill-gotten wealth to maintain a status quo that leaves renters largely unprotected.

To protect renters in California now and keep families in their homes, the state legislature must curb the profiteering of these corporate landlords by passing stronger tenant protections.

At the time of this report release, the Tenant Protection Act of 2019 (Assembly Bill 1482, authored by Assemblyman David Chiu, D-San Francisco), which would cap rent increases statewide to 7% plus the Consumer Price Index and provide just cause eviction protections, has been voted out of the Assembly and is moving through the Senate. The bill sunsets in three years and will exempt certain small landlords.

We strongly recommend the California Senate and Governor Newsom support this bill to curb the greed of corporate landlords acting in California.

California State Policy Recommendations:

- Protect tenants and preserve housing affordability by establishing strong rent control and just cause eviction rules that cover occupants of single family rental housing as well as multi-family properties. This includes repealing the Costa Hawkins Rental Act, which prohibits local cities and counties from including single-family homes, condos, and buildings built after 1995 in their local rent control ordinances or vacancy control.

- Prohibit discrimination based on source of income—such as Section 8 vouchers and other types of rental subsidy or support—and ensure these protections apply to single-family as well as multi-family renters.

- Prohibit abusive and hidden fees and ancillary charges, require landlords to provide basic services required to make apartments habitable, and maintain a clear and level playing field on included operating and maintenance costs.

- Provide additional resources for local governments to maintain single-family rental housing when landlords fail to do so by imposing a modest additional fee on large scale purchasers / owners of such properties.

- Require public disclosure and reporting to city / county government by large scale single-family rental property owners, including information on the business and financial plans for the operation and maintenance of the assets; on income and expenses each year; and on rent increases, evictions, and attempted evictions on a regular basis.

- Create a “right of first refusal” if and when single-family properties are sold, so that tenants have the first opportunity to purchase, along with appropriate supports for low and moderate income tenants in particular, including housing counseling and alignment of down-payment assistance and other funding programs. Mission-driven not-for-profit developers, community land trusts, and tenant associations should have the second “right of first refusal” if tenants do not purchase.

- Create local and state municipal funds to support local land trusts and limited equity housing cooperatives to buy properties, taking them off the speculative market entirely and making them permanently affordable and in community control. Ensuring properties are preserved as affordable is far less expensive than constructing new housing and allows for residents to regain ownership of their homes from outside speculators and keep them affordable.

[1] Californians in All Parts of the State Pay More Than They Can Afford for Housing (California Budget and Policy Center, September 2017), https://calbudgetcenter.org/resources/californians-parts-state-pay-can-afford-housing/.

[2] On the history of redlining in Los Angeles, for example, see Ryan Reft, “Segregation in the City of Angels: A 1939 Map of Housing Inequality in L.A.,” KCET, November 14, 2017, https://www.kcet.org/shows/lost-la/segregation-in-the-city-of-angels-a-1939-map-of-housing-inequality-in-la. On current predatory and discriminatory lending practices and lending disparities in California, see Vedika Ahuja and Jason Richardson, State of Gentrification: Home Lending to Communities of Color in California (The Greenlining Institute, December 6, 2017), http://greenlining.org/wp-content/uploads/2017/12/State-of-Gentrification-Home-Lending-to-Communities-of-Color-in-California.pdf. On the history of race and housing policy more broadly, see john a. Powell and Kaloma Cardwell, “Homeownership, Wealth, and the Production of Racialized Space,” Joint Center for Housing Studies of Harvard University, October 2013, https://www.jchs.harvard.edu/sites/default/files/hbtl-07.pdf. On the disparate impact of the housing crisis across racial groups, see Sarah Burd-Sharps and Rebecca Rasch, Impact of the US Housing Crisis on the Racial Wealth Gap Across Generations (Social Science Research Council and the American Civil Liberties Union, June 2015), https://www.aclu.org/sites/default/files/field_document/discrimlend_final.pdf.

[3] Jeff Larrimore and Jenny Schuetz, “Assessing the Severity of Rent Burden on Low-Income Families,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, December 22, 2017 ,https://www.federalreserve.gov/econres/notes/feds-notes/assessing-the-severity-of-rent-burden-on-low-income-families-20171222.htm.

[4] Irina Ivanova, “U.N. blasts Blackstone Group for worsening the U.S. housing crisis,” CBS News, March 26, 2019, https://www.cbsnews.com/news/blackstone-group-is-making-u-s-housing-crisis-worse-the-un-says/; Irina Ivanova, “After the crash: How Wall Street is driving up homelessness,” CBS News, February 25, 2019, https://www.cbsnews.com/news/housing-crash-wall-street-homelessness-profits-over-people/; Matt Morrison, “High rents create a new class of hidden homeless in Los Angeles,” CBS News, February 22, 2019, https://www.cbsnews.com/news/los-angeles-hidden-homeless-priced-out-cbsn-originals/.

[5] Liam Dillon, “How California Has Become a National Battleground for Rent Control as Money Flows in from Landlords,” Los Angeles Times, October 31, 2018, https://www.latimes.com/politics/la-pol-ca-rent-control-campaign-spending-20181031-story.html; Equity Residential, ERP Operating Limited Partnership, Form 10-K 2018, 28, http://investors.equityapartments.com/Cache/396831640.pdf.

[6] “Fast Answers: Real Estate Investment Trusts (REITS),” U.S. Securities and Exchange Commission, accessed July 17, 2019, https://www.sec.gov/fast-answers/answersreitshtm.html; Libin Zhang and Michael S. Grisolia, “Through a Glass Darkly: REIT

Earnings and Profits,” Tax Notes 161, no. 3, October 15, 2018, https://www.robertsandholland.com/siteFiles/Articles/REIT-Earnings-and-Profits.pdf; Rebecca Lake, “Tax Reform Is a Windfall for REIT Investors,” U.S. News, April 13, 2018, https://money.usnews.com/investing/real-estate-investments/articles/2018-04-13/tax-reform-is-a-windfall-for-reit-investors.

[7] Invitation Homes Inc., Form 10-K 2018, 51, https://www.sec.gov/Archives/edgar/data/1687229/000168722919000014/a123118ihinc10kdocument.htm; Earnings Release and Supplemental Information, First Quarter 2019 (Invitation Homes, 2019), 8, http://www.invh.com/Cache/1001252362.PDF?O=PDF&T=&Y=&D=&FID=1001252362&iid=4426247.

[8] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 5-6, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955.

[9] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 5-6, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955; Alana Semuels, “When Wall Street is Your Landlord,” The Atlantic, February 13, 2019, https://www.theatlantic.com/technology/archive/2019/02/single-family-landlords-wall-street/582394/.

[10] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 5, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955; Rob Call, Renting from Wall Street: Blackstone’s Invitation Homes in Los Angeles and Riverside (Right to the City, July 2014), 7-12, https://homesforall.org/wp-content/uploads/2014/07/LA-Riverside-Blackstone-Report-071514.pdf; Michelle Conlin, “Spiders, Sewage and a Flurry of Fees – The Other Side of Renting a House from Wall Street,” Reuters, July 27, 2018, https://www.reuters.com/investigates/special-report/usa-housing-invitation/.

[11] Liam Dillon, “How California has become a national battleground for rent control as money flows in from landlords,” Los Angeles Times, October 31, 2018, https://www.latimes.com/politics/la-pol-ca-rent-control-campaign-spending-20181031-story.html; Adam Brinklow, “Wall Street firm tapping public worker funds for anti-rent control campaign,” Curbed San Francisco, October 24, 2018, https://sf.curbed.com/2018/10/15/17980380/prop-10-rent-control-housing-wall-street-blackstone.

[12] 2017 American Community Survey, 1 year estimates.

[13] HUD 2018 Continuum of Care Homeless Assistance Programs Homeless Populations and Subpopulations, California (U.S. Department of Housing and Urban Development, 2018), https://files.hudexchange.info/reports/published/CoC_PopSub_State_CA_2018.pdf.

[14] Martha Galvez, et al., Housing as a Safety Net: Ensuring Housing Security for the Most Vulnerable (The Urban Institute, September 2017), 1-8, https://www.urban.org/sites/default/files/publication/93611/housing-as-a-safety-net_1.pdf.

[15] Matthew Desmond and Carl Gershenson, “Housing and Employment Insecurity Among the Working Poor,” Social Problems 63, no. 1 (2016): 46-67, https://scholar.harvard.edu/files/mdesmond/files/desmondgershenson.socprob.2016.pdf.

[16] Sarah A. Burgard, Kristin S. Seefeldt, and Sarah Zelner, “Housing Instability and Health: Findings from the Michigan Recession and Recovery Study,” Social Science and Medicine 75, no. 12 (December 2012): 2215-2224, https://www.sciencedirect.com/science/article/abs/pii/S0277953612006272?via%3Dihub; Megan Sandel, et al., “Unstable Housing and Caregiver and Child Health in Renter Families,” Pediatrics 141, no. 2 (February 2018), http://pediatrics.aappublications.org/content/early/2018/01/18/peds.2017-2199.

[17] Martha Galvez and Jessica Luna, Homelessness and Housing Instability: The Impact on Education Outcomes (Urban Institute, December 2014), https://tacomahousing.net/sites/default/files/print_pdf/Education/Urban%20Institute%20THA%20Homelessness%20and%20Education%202014-12-22.pdf.

[18] Funds from Operations (FFO) refers to net income excluding depreciation and amortization of real estate, gains or losses related to the sale of certain real estate or changes in control, and “impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity.” Nareit Funds From Operations White Paper – 2018 Restatement, Financial Standards White Paper (Nareit, December 2018), 2, https://www.reit.com/sites/default/files/2018-FFO-white-paper-(11-27-18).pdf.

[19] Earnings Release and Supplemental Information, First Quarter 2019 (Invitation Homes, 2019), 10, http://www.invh.com/Cache/1001252362.PDF?O=PDF&T=&Y=&D=&FID=1001252362&iid=4426247.

[20] Equity Residential, First Quarter 2019: Earnings Release and Supplemental Financial Information (2019), 6, 1, http://investors.equityapartments.com/Cache/1001252120.PDF?O=PDF&T=&Y=&D=&FID=1001252120&iid=103054.

[21] Jason McGahan and Hillel Aron, “What Happens When Wall Street Is Your Landlord?,” LA Weekly, November 29, 2017, https://www.laweekly.com/news/invitation-homes-and-other-corporate-landlords-are-squeezing-tenants-with-rent-increases-8901051.

[22] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 18, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955; Todd C. Frankel and Dan Keating, “Eviction Filings and Code Complaints: What Happens When a Private Equity Firm Becomes One City’s Biggest Homeowner,” The Washington Post, December 25, 2018, https://www.washingtonpost.com/business/economy/eviction-filings-and-code-complaints-what-happened-when-a-private-equity-firm-became-one-citys-biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-0aa5c2fcc9e4_story.html?utm_term=.b58d3ef8349d.

[23] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 23, 25, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955.

[24] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 21, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955.

[25] Elora Raymond, et al., “Corporate landlords, Institutional Investors, and Displacement: Eviction Rates in Single-Family Rentals,” Community and Economic Development Discussion Paper, no. 04-16 (Federal Reserve Bank of Atlanta, December 2016), https://www.frbatlanta.org/-/media/documents/community-development/publications/discussion-papers/2016/04-corporate-landlords-institutional-investors-and-displacement-2016-12-21.pdf,

[26] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 22, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955; Michelle Conlin, “Spiders, Sewage and a Flurry of Fees – The Other Side of Renting a House from Wall Street,” Reuters, July 27, 2018, https://www.reuters.com/investigates/special-report/usa-housing-invitation/.

[27] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 15-21, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955.

[28] Maya Abood, et al., Wall Street Landlords Turn American Dream Into a Nightmare (ACCE Institute, Americans for Financial Reform, and Public Advocates, 2018), 17, https://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/attachments/original/1516388955/WallstreetLandlordsFinalReport.pdf?1516388955.

[29] Equity Residential, ERP Operating Limited Partnership, Form 10-K 2018, 6, http://investors.equityapartments.com/Cache/396831640.pdf.

[30] “Inside Sam Zell’s Low-Rent Silicon Valley Housing Strategy,” Crain’s Chicago Business, April 7, 2014, https://www.chicagobusiness.com/article/20140407/NEWS12/140409789/silicon-valley-cooks-housekeepers-face-housing-evictions-from-sam-zell-s-equity-residential; Lauren Hepler, “East Palo Alto Renter Fight Boils Over in New Equity Residential Class Action Lawsuit,” Silicon Valley Business Journal, September 12, 2014, https://www.bizjournals.com/sanjose/news/2014/09/12/east-palo-alto-renter-fight-boils-over-in-new.html?page=3.

[31] Nathan Donato-Weinstein, “East Palo Alto’s Woodland Park Apartments Changing Hands in Blockbuster Deal,” Silicon Valley Business Journal, February 16, 2016, https://www.bizjournals.com/sanjose/news/2016/02/16/exclusive-east-palo-altos-woodland-park-apartments.html.

[32] Alexis C. Madrigal, “Who’s Really Buying Property in San Francisco?” The Atlantic, April 19, 2019, https://www.theatlantic.com/technology/archive/2019/04/san-francisco-city-apps-built-or-destroyed/587389/.

[33] “Inside Sam Zell’s Low-Rent Silicon Valley Housing Strategy,” Crain’s Chicago Business, April 7, 2014, https://www.chicagobusiness.com/article/20140407/NEWS12/140409789/silicon-valley-cooks-housekeepers-face-housing-evictions-from-sam-zell-s-equity-residential; Nathan Donato-Weinstein, “East Palo Alto’s Woodland Park Apartments Changing Hands in Blockbuster Deal,” Silicon Valley Business Journal, February 16, 2016, https://www.bizjournals.com/sanjose/news/2016/02/16/exclusive-east-palo-altos-woodland-park-apartments.html.

[34] “#100 Stephen Schwarzman,” Forbes, accessed May 23, 2019, https://www.forbes.com/profile/stephen-schwarzman/#493dffda234a.

[35] Anders Melin, “Blackstone’s Schwarzman Collects $568 Million in Dividends, Pay,” Bloomberg, March 1, 2019, https://www.bloomberg.com/news/articles/2019-03-01/blackstone-s-schwarzman-collects-568-million-in-dividends-pay.

[36] “#804 Jonathan Gray,” Forbes, accessed May 23, 2019, https://www.forbes.com/profile/jonathan-gray/#3d1309371f8d.

[37] Anders Melin, “Blackstone’s Schwarzman Collects $568 Million in Dividends, Pay,” Bloomberg, March 1, 2019, https://www.bloomberg.com/news/articles/2019-03-01/blackstone-s-schwarzman-collects-568-million-in-dividends-pay.

[38] “Executive Profile: Dallas B. Tanner,” Bloomberg, accessed May 23, 2019, https://www.bloomberg.com/research/stocks/people/person.asp?personId=415836050&privcapId=415395909.

[39] Aaron Elstein, “How Stephen Schwarzman Spends His Cash,” Crain’s New York Business, March 7, 2015, https://www.crainsnewyork.com/article/20150308/FINANCE/150309874/how-stephen-schwarzman-spends-his-cash; https://littlesis.org/person/14997-Stephen_Schwarzman#; James B. Stewart, “The Birthday Party,” The New Yorker, February 4, 2008, https://www.newyorker.com/magazine/2008/02/11/the-birthday-party-2.

[40] James B. Stewart, “The Birthday Party,” The New Yorker, February 4, 2008, https://www.newyorker.com/magazine/2008/02/11/the-birthday-party-2.

[41] James B. Stewart, “The Birthday Party,” The New Yorker, February 4, 2008, https://www.newyorker.com/magazine/2008/02/11/the-birthday-party-2.

[42] Earnings Release and Supplemental Information, First Quarter 2019 (Invitation Homes, 2019), 8, http://www.invh.com/Cache/1001252362.PDF?O=PDF&T=&Y=&D=&FID=1001252362&iid=4426247.

[43] Stephen A. Schwarzman, Performance and Innovation: Blackstone Chairman’s Letter 2018 (Blackstone, 2018), 1, https://s1.q4cdn.com/641657634/files/doc_financials/2018/ANNUAL-CHAIRMAN%E2%80%99S-LETTER-2018_v15.pdf.

[44] “#317 Sam Zell,” Forbes, accessed July 17, 2019, https://www.forbes.com/profile/sam-zell/#3e221ca919df.

[45] Katherine Clarke, “Sam Zell,” The Real Deal, September 21, 2017, https://therealdeal.com/closings/sam-zell/; Carla Hall, “His Malibu Home Serves Mogul Well,” Los Angeles Times, April 3, 2007, https://www.latimes.com/archives/la-xpm-2007-apr-03-fi-zell3-story.html; Dennis Rodkin, “Check out the Mies va der Rohe Condo that Just Sold for $2 Million,” Chicago Real Estate, July 22, 2013, https://www.chicagomag.com/Radar/Deal-Estate/July-2013/Way-to-Go-Mies-van-der-Rohe/.

[46] Jan Parr, “Elton John plays Sam Zell’s birthday,” Crain’s Chicago Business, October 1, 2016, https://www.chicagobusiness.com/article/20161001/NEWS07/160939980/sam-zell-s-75th-birthday-party-in-chicago.

[47] Equity Residential, ERP Operating Limited Partnership, Form 10-K 2018, F-56, http://investors.equityapartments.com/Cache/396831640.pdf; Equity Residential, 2018 Annual Report, 1, http://investors.equityapartments.com/Cache/397618771.PDF?O=PDF&T=&Y=&D=&FID=397618771&iid=103054;

[48] Equity Residential, ERP Operating Limited Partnership, Form 10-K 2018, F-55, http://investors.equityapartments.com/Cache/396831640.pdf.

[49] The Blackstone Group L.P., Form 10-K 2016, https://www.sec.gov/Archives/edgar/data/1393818/000119312516481948/d129194d10k.htm; Form 10-K 2017, https://www.sec.gov/Archives/edgar/data/1393818/000119312517056300/d280098d10k.htm#tx280098_18; Form 10-K 2018, https://www.sec.gov/Archives/edgar/data/1393818/000119312518067079/d522506d10k.htm. On pass-through partnerships, see “Pass-Through Deduction Benefits Wealthiest, Loses Needed Revenue, and Encourages Tax Avoidance,” Center on Budget and Policy Priorities, May 10, 2018, https://www.cbpp.org/research/federal-tax/pass-through-deduction-benefits-wealthiest-loses-needed-revenue-and-encourages; James B. Stewart, “A Tax Loophole for the Rich that Just Won’t Die,” New York Times, November 9, 2017, https://www.nytimes.com/2017/11/09/business/carried-interest-tax-loophole.html. Note that Blackstone announced that it will restructure into a standard corporation (or C corporation), effective July 1, 2019. Michael J. de la Merced, “Blackstone Will Ditch Partnership Structure to Draw More Investors,” The New York Times, April 18, 2019, https://www.nytimes.com/2019/04/18/business/dealbook/blackstone-corporate-structure.html.

[50] The Blackstone Group L.P., Form 10-K 2016, 243, https://www.sec.gov/Archives/edgar/data/1393818/000119312516481948/d129194d10k.htm; Form 10-K 2017, 240, https://www.sec.gov/Archives/edgar/data/1393818/000119312517056300/d280098d10k.htm#tx280098_18; Form 10-K 2018, 240, https://www.sec.gov/Archives/edgar/data/1393818/000119312518067079/d522506d10k.htm; Anders Melin, “Blackstone’s Schwarzman Collects $568 Million in Dividends, Pay,” Bloomberg, March 1, 2019, https://www.bloomberg.com/news/articles/2019-03-01/blackstone-s-schwarzman-collects-568-million-in-dividends-pay.

[51] This amount is the difference he would have paid between the 39.6% tax rate and the 20% rate on $258 million of carried interest and incentive fee compensation.

[52] Jonathan Alter, “Schwarzman: ‘It’s a War’ between Obama, Wall St.,” Newsweek, August 15, 2010, https://www.newsweek.com/schwarzman-its-war-between-obama-wall-st-71317.

[53] “Fast Answers: Real Estate Investment Trusts (REITS),” U.S. Securities and Exchange Commission, accessed July 17, 2019, https://www.sec.gov/fast-answers/answersreitshtm.html.

[54] “Real Estate Investment Trusts (REITS),” Investor.gov, U.S. Securities and Exchange Commission, accessed July 17, 2019, https://www.investor.gov/introduction-investing/basics/investment-products/real-estate-investment-trusts-reits.

[55] Rebecca Lake, “Tax Reform Is a Windfall for REIT Investors,” US News, April 13, 2018, https://money.usnews.com/investing/real-estate-investments/articles/2018-04-13/tax-reform-is-a-windfall-for-reit-investors.

[56] Kelly Phillips Erb, “Taxes from A to Z 2019: R Is for Real Estate Investment Trust (REIT),” Forbes, April 3, 2019, https://www.forbes.com/sites/kellyphillipserb/2019/04/03/taxes-from-a-to-z-2019-r-is-for-real-estate-investment-trust-reit/#7857ef941545.

[57] Sofia Lopez, Leveling the Playing Field: How California Lawmakers Can Stand Up to the Real Estate Industry to Protect Tenants (Action Center on Race and the Economy, April 2019), 1, https://static1.squarespace.com/static/58d8a1bb3a041137d463d64f/t/5cbdf851ec212d6e01214bf2/1555953747813/Leveling+the+Playing+Field+-+Apr+2019.pdf.

[58] “Advanced Search,” Search for: contributor: California Apartment Association; recipient committees: California Republican Party and California Democratic Party; and Election cycles 2017-2018, Cal-Access: Power Search, California Secretary of State, accessed July 23, 2019, http://powersearch.sos.ca.gov/advanced.php.

[59] “Campaign Finance: California Republican Party,” Cal-Access Search, California Secretary of State, accessed July 23, 2019, http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1030435&view=contributions&session=2017; “Campaign Finance: California Democratic Party,” Cal-Access Search, California Secretary of State, accessed July 23, 2019, http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1018392&session=2017&view=contributions.

[60] Sofia Lopez, Leveling the Playing Field: How California Lawmakers Can Stand Up to the Real Estate Industry to Protect Tenants (Action Center on Race and the Economy, April 2019), 1, https://static1.squarespace.com/static/58d8a1bb3a041137d463d64f/t/5cbdf851ec212d6e01214bf2/1555953747813/Leveling+the+Playing+Field+-+Apr+2019.pdf.

[61] “Independent Expenditures,” National Conference of State Legislatures, July 21, 2017, http://www.ncsl.org/research/elections-and-campaigns/independent-expenditures635425050.aspx.

[62] “Campaign Rules,” California Fair Political Practices Commission, State of California, accessed August 2, 2019, http://www.fppc.ca.gov/learn/campaign-rules.html.

[63] “Rules for Independent Expenditures and Communications Costs,” Open Secrets, accessed July 24, 2019, https://www.opensecrets.org/orgs/indexp_rules.php?id=.

[64] “California Proposition 10, local Rent Control Initiative (2018),” Ballotpedia, accessed May 24, 2019, https://ballotpedia.org/California_Proposition_10,_Local_Rent_Control_Initiative_(2018).

[65] “Campaign Finance: Proposition 010 – Expands Local Governments’ Authority to Enact Rent Control on Residential Property. Initiative Statute” Cal-Access, California Secretary of State, accessed July 23, 2019, http://cal-access.sos.ca.gov/Campaign/Measures/Detail.aspx?id=1400991&session=2017.

[66] The PAC’s full name is No on Prop 10 – Californians for Responsible Housing; a Coalition of Veterans, Seniors, Affordable Housing Providers, Social Justice Groups, Taxpayer Associations, and Labor.

[67] “Californians for Responsible Housing, Sponsored by the California Apartment Association,” Follow the Money, accessed July 24, 2019, https://www.followthemoney.org/entity-details?eid=45387632&default=ballotcom.

[68] “Campaign Finance: Proposition 010 – Expands Local Governments’ Authority to Enact Rent Control on Residential Property. Initiative Statute,” Cal-Access, California Secretary of State, accessed July 23, 2019, http://cal-access.sos.ca.gov/Campaign/Measures/Detail.aspx?id=1400991&session=2017.

[69] “Home,” No on Prop 10, accessed July 24, 2019, https://noprop10.org/.

[70] “Board,” California Apartment Association, accessed July 17, 2019, https://caanet.org/board/.

[71] Joseph Pimentel, “Possible Repeal of Rent Control Limitations Not Just a California Issue, It’s a National Issue,” Bisnow, July 19, 2018, https://www.bisnow.com/los-angeles/news/multifamily/possible-repeal-of-costa-hawkins-not-just-a-california-issue-its-a-national-issue-90873.

[72] Douglas Rice, Ehren Dohler, and Alicia Mazzara, How Housing Vouchers Can Help Address California’s Rental Crisis (Center on Budget and Policy Priorities, February 12, 2016), https://www.cbpp.org/research/housing/how-housing-vouchers-can-help-address-californias-rental-crisis; Douglas Rice, Cuts in Federal ASsistance Have Exacerbated Families’ Struggles to Afford Housing (Center on Budget and Policy Priorities, April 12, 2016), https://www.cbpp.org/research/housing/chart-book-cuts-in-federal-assistance-have-exacerbated-families-struggles-to-afford.