Diminishing Returns: How Chris Christie Is Wasting Billions on Bad Hedge Fund Investments

Introduction: The Failed Experiment of Investing Public Pensions in Hedge Funds

In 2007, the state of New Jersey began an experiment in which it invested billions of public pension dollars in hedge funds. However, since Governor Christie took office in 2010, the state’s public investment in hedge funds has doubled, resulting in his hedge fund friends and donors collecting an estimated $1 billion in fees from New Jersey public pension funds. During Governor Christie’s administration, underperformance of hedge fund investments have cost the state nearly $1.1 billion—and New Jersey taxpayers and public employees have picked up the tab.

Despite promises of better and more consistent returns and protection from market downturns, our analysis suggests that hedge funds have failed to deliver on these promises. Instead, hedge funds have collected billions in management fees and performance fees, enriching themselves at the expense of the New Jersey Pension Fund and taxpayers. Furthermore, the state’s failure to report fees and failure to compare hedge fund performance to cheaper alternatives may represent a violation of principles of good stewardship and fiduciary responsibility.

» read more

This report provides an analysis of New Jersey’s eight-year[i] experiment investing pensioners’ savings in hedge funds. Using published investment council and pension fund reports, we conducted a simple year-by-year comparison of hedge fund returns and total fund returns for fiscal years 2007-2014. Because the New Jersey State Investment Council fails to disclose fees paid to managers over the period considered in this report, this analysis uses a conservative methodology to estimate hedge fund fees that calculates management and performance fees each year, and accounts for high water marks following negative performance and the additional layer of fees paid through hedge funds of funds, private investment vehicles consisting of a portfolio invested in multiple hedge funds.[ii]

Key Findings: Hedge Funds Responsible for More than $1 Billion in Lost Returns

Our findings suggest that the state’s hedge fund investment has failed to deliver any significant benefits for the citizens of New Jersey.

Specifically, our analysis found that:

- The state’s hedge fund net returns lagged behind the total fund for seven of the eight years we reviewed—and, critically, failed to deliver any downside protection for the fund during the 2009 economic crisis

- Hedge funds cost the pension system an estimated $1.27 billion in lost returns over just eight years

- Despite poor performance, hedge fund managers collected an estimated $1.33 billion in fees from New Jersey taxpayers and public employees during the same period

This report also examines how the New Jersey State Investment Council, under the direction of Governor Christie, has been less than transparent with the public regarding costs and returns associated with hedge funds, including the administration’s apparent under-reporting of fees paid to Wall Street from public pension funds. Additionally, we review the numerous potential conflicts of interest and questionable investments associated with Governor Christie’s oversight of the pension fund—which, like the exorbitant fees the hedge funds collect, should be of concern to fiduciaries, public employees and taxpayers.

The Financial Impact of Hedge Funds on New Jersey’s Pension System

For the last decade, hedge funds have aggressively pursued U.S. public pension dollars, claiming to offer pension funds volatility reduction and absolute return in exchange for the high performance and management fees that they charge. However, our analysis suggests that, in the case of New Jersey, hedge funds failed to deliver on these promises, providing no protection for the fund during economic downturns, serving as a drag on total fund performance, and costing public employees and taxpayers billions through disproportionately high fees that do not appear to be justified by performance.

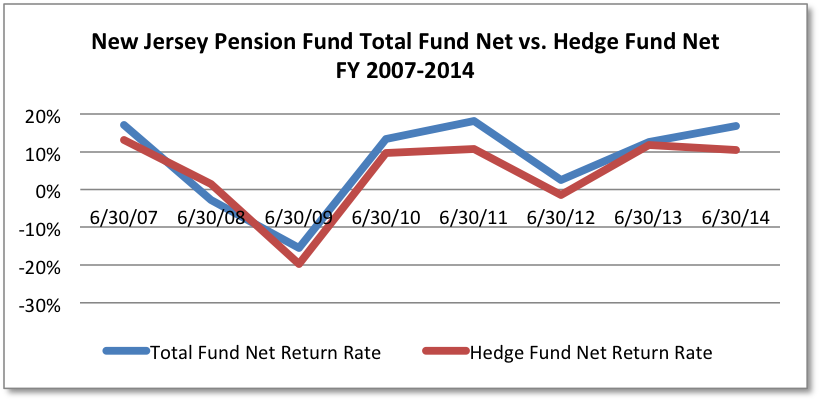

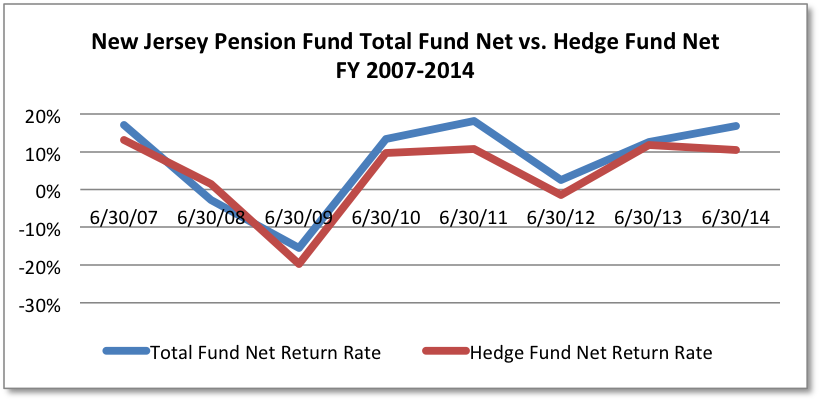

Hedge funds failed to deliver promised diversification during the Great Recession—and continue to underperform to this day.

Proponents of hedge funds claim that hedge fund exposure decreases pension fund volatility. However, our analysis of hedge fund and total fund net returns during the Great Recession suggests that hedge funds offered no downside protection to the fund during this period.

During fiscal year 2009 (July 1, 2008 to June 30, 2009)–the height of the Great Recession, when hedge funds were supposed to deliver protection from market downturns—the state’s hedge fund investments lost 19.75 percent, while the total fund lost only 15.48 percent. As a result, pension assets allocated to hedge funds eroded at a much greater extent than did the total fund in 2009. In each subsequent year, hedge fund returns continued to underperform, trailing general fund returns by a significant margin while the economy recovered and U.S. stock markets rebounded.

Overall, our analysis suggests that New Jersey’s hedge fund program failed to deliver on promises of diversification and downside risk protection while dragging down total fund investment returns by $1.27 billion during fiscal years 2007-2014. In other words, had the New Jersey pension system never invested in hedge funds, it would have $1.27 billion more in its general fund today, providing more security for public employees and demonstrating better stewardship to taxpayers.

Fig. 1

Hedge Fund Managers Make Billions Despite Underperformance:

A Closer Look at Hedge Fund Fees Compared to New Jersey’s Total Fund Costs

A recent analysis by the Financial Times found that, from 2008 to mid-2014, U.S. public pension plans invested about $450 billion in hedge funds, and received about $95 billion in returns. However, over the same period, the hedge funds collected $68 billion in fees, meaning that public pension funds paid 72 cents in fees for every dollar they received in returns.[iii]

The experience of New Jersey with hedge fund fees is strikingly similar. From fiscal year 2007 through fiscal year 2014, our analysis suggests that New Jersey paid significantly more proportionately to manage its hedge fund investments than it paid to manage the total fund—and that these fees are in no way justified by hedge fund returns. Comparing a total fund portfolio (same size assets under management as hedge funds, year by year), our analysis of this period suggests the following:

- The pension fund paid over $1.33 billion in fees to hedge fund managers, whereas it spent a little over $150 million in all other external and internal investment costs combined using the same-sized total fund portfolio

- The pension fund paid nearly eight times as much in fees for its hedge fund investments as it spent for all other investments

- Net returns over this period were $2.3 billion for hedge funds compared to $3.6 billion for the total fund (same-sized portfolio); taking fees into account, hedge fund managers captured nearly 59 cents for every net dollar returned to the total fund (see Fig. 2)

In other words, if the assets dedicated to hedge funds had been allocated to other general fund investments, net returns would have been $3.6 billion, rather than $2.3 billion. These data suggest that hedge fund managers are producing huge returns for themselves while producing poor returns for New Jersey.

Fig. 2

Too Cozy with Christie? Transparency and Pay-To-Play Concerns

The state’s hedge fund investments have come under additional scrutiny in recent months, as allegations of misrepresentation of fees paid to hedge fund managers, serious conflicts of interest, and possible pay-to-play involving hedge fund managers and contributions to Governor Christie have surfaced.

Since Governor Chris Christie took office in January 2010, the New Jersey State Investment Council nearly doubled its allocation to hedge funds, to over 10 percent of assets under management. Total hedge fund fees from July 1, 2010 through June 30, 2014 were likely more than $1 billion; meanwhile, hedge fund returns lagged same-sized portfolio of total fund returns by $1.1 billion over the same period.

In June 2015, the International Business Times reported that, while claiming that the state did not pay enough money to fully fund its obligations to public employees, the Christie administration did not fully disclose how much the fund paid in fees to hedge fund managers. According to the report, the administration allegedly misclassified $335 million in performance fees paid to Wall Street investment managers, claiming that the state paid less than average for its investment—when in fact it paid far higher than the national median.[iv]

There also appear to be many troubling connections between pension system hedge fund allocations and donations to the governor. As the Philadelphia Inquirer reports, many of the hedge fund firms selected by the New Jersey State Investment Council were donors to the Republican Governors Association (RGA), of which Christie became vice-chair in 2011 and chair in 2013,[v] and which spent $1.7 million supporting Christie in 2013.[vi] Due to a jurisdictional technicality, this indirect support of Christie does not violate New Jersey’s ethics law—and a bill to correct this, which gained support in both sides of the New Jersey legislature, was vetoed by the governor in May 2015.[vii]

Hedge fund investments by the New Jersey pension system that are connected to donors are worthy of further review. Some of these include:

- KSL Capital – On March 25 of this year, the New Jersey State Investment Council approved a $100 million allocation to this firm,[viii] whose chairman donated $2.5 million to the RGA between 2013 and 2014.[ix]

- Lazard Rathmore – A senior advisor with this firm, Herbert Gullquist, donated $75,000 to the RGA from 2012-2014;[x] in 2012, the state committed $150 million to this fund.[xi]

- Canyon Capital – In 2011, the New Jersey State Investment Council made a $100 million allocation to a Canyon Capital fund five months after Canyon invested in Atlantic City’s Revel hotel and casino—the same month that New Jersey handed the casino $260 million in tax incentives.[xii]

- Chatham Asset Management – In 2012, the firm’s principal, Anthony Melchiorre, along with Andrea Melchiorre residing at the same address, made donations totaling $58,300 to the Republican National Committee,[xiii] an organization that helped fund voter turnout for Christie’s reelection campaign in 2013.[xiv] In November, 2013, the state proposed investing $300 million in this fund;[xv] the following year, potential conflicts also surfaced surrounding Chatham’s reported interest in a major casino in Atlantic City.[xvi]

- Third Point Management – The CEO of this company, Daniel Loeb, donated $1.25 million to the RGA between 2012 and 2014;[xvii] in 2011, Third Point was awarded a $100 million contract by the State Investment Council.[xviii]

- Elliot Associates – This company – whose CEO, Paul Singer, donated $3.85 million to the RGA between 2012 and 2014[xix]– also manages $200 million of New Jersey pension fund assets.[xx]

Recommendations for Reform

According to our analysis, the estimated $1.27 billion drag on total fund performance, $1.33 billion in fees, and worse than zero protection from market downturns should prompt fiduciaries and legislators to question whether the New Jersey pension system would be better off having never invested in hedge funds. As the state struggles with meeting its pension funding obligations, replacing hedge funds with less costly alternatives that actually provide meaningful diversification should be seen as a necessary course of action.

Considering the failure of New Jersey’s eight-year hedge fund experiment, and ethical concerns regarding Governor Christie’s relationships with hedge fund donors, we recommend the following:

- The New Jersey State Investment Council should end its experiment with hedge funds by divesting as soon as possible, to ensure that New Jersey taxpayers and public employees receive the best returns and lowest costs on their pension investment.

- The New Jersey State Investment Council should provide and make accessible to the public a full accounting of all fees—management, incentive and otherwise —paid by the pension system, along with annual hedge fund net return data over the fund’s entire history of hedge fund investment.

- The New Jersey State Investment Council should demand political contribution disclosure and immediately divest from all investment and advisory firms that contributed directly or indirectly to Governor Christie and other elected officials. Furthermore, New Jersey’s ethics law should be strengthened to prevent such conflicts of interest in the future.

Notes and Methodology

The New Jersey Investment Council has failed to disclose fees captured by managers over the eight-year period considered in this report; therefore, this analysis uses the following methodology to estimate those costs:

- Gross hedge fund returns are calculated using the following assumptions:

- Hedge fund management fees are calculated conservatively at 1.8 percent of assets under management (AUM).

- Hedge fund incentive fees are calculated conservatively at 18 percent of gross return less management fees.

- Hedge funds of funds were estimated to average 25 percent of hedge fund AUM for all years based on public reports.

- A modest increase in management (.2 percent), and incentive (2 percent) fees were included to account for New Jersey’s 25 percent investment in hedge fund of funds where added fees above and beyond underlying hedge fund fees are paid.Total fund cost is estimated conservatively at 40 basis points (bp) of AUM. The average total fund cost for U.S. pension funds including hedge fund fees is 46.8bp. 40bp is used assuming no hedge fund fees. See: http://www.top1000funds.com/news/2015/01/14/do-pension-funds-add-value/

- 2008 hedge fund net return rate was missing from the publicly available sources. A proxy rate of 1.39 percent was used, representing the average hedge fund net return of the Illinois Teachers Pension Fund, MassPRIM, and Alaska PERS — all pension funds invested in hedge funds and hedge fund of funds, and reporting net hedge fund returns for FY 2008.

- Performance fees for 2010 and 2013 were adjusted to account for high water marks needing to be met in 2009 and 2012. High water marks were accounted for based on the entire hedge fund portfolio because individual fund high water marks are not public.

Footnotes

[i] July 1, 2007 through June 30, 2014.

[ii] See “Notes and Methodology” for details on how we calculated these estimates.

[iii] Johnson, Miles. “Profits at a price in the world of hedge funds.” Financial Times, May 26, 2015. Retrieved July 17, 2015 from http://www.ft.com/intl/cms/s/2/6252febe-b150-11e4-831b-00144feab7de.html#axzz3gBEiQYrG

[iv] The administration made these claims in both official testimony and a letter to one of New Jersey’s largest newspapers. Cunningham-Cook, Matthew and Sirota, David. “Chris Christie’s Administration Omitted Wall Street Fees From State Pension Analysis.” International Business Times, June 4, 2015. Retrieved June 10, 2015 from http://www.ibtimes.com/chris-christies-administration-omitted-wall-street-fees-state-pension-analysis-1951744

[v] Hamby, Peter. “How Chris Christie Took Over the Republican Governors Association,” CNN.com, November 22, 2013. Retrieved June 30, 2015 from http://www.cnn.com/2013/11/21/politics/christie-rga-chairman/

[vi] Confessore, Nicholas. “Donors’ Funds Sidestep Law, Aiding Christie.” The New York Times, September 17, 2013. Retrieved June 10, 2015 from http://www.nytimes.com/2013/09/18/nyregion/donors-funds-sidestep-law-aiding-christie.html?_r=0

[vii] Garrahan, Andrew. “Christie Vetoes Controversial New Jersey Pay-to-Play Provision,” Inside Political Law, May 7, 2015. Retrieved July 17, 2015 from http://www.insidepoliticallaw.com/2015/05/07/christie-vetoes-controversial-pay-to-play-provision/

[viii] Steyer, Robert. “New Jersey commits $250 million to 2 managers, will review pay-for-play rules.” Pensions and Investments, March 25, 2015. Retrieved June 10 from

[ix] According to Center for Responsive Politics data, “Mike and Mary Sue Shannon” made the following contributions to the RGA: $500,000 on March 25, 2013; $1 million on March 7, 2014; and $1 million on July 25, 2014. Retrieved June 24, 2015 from http://www.opensecrets.org/527s/527cmtedetail_donors.php?url=527cmtedetail_donors.php%3Fcycle%3D2012%26ein%3D113655877&cname=shannon&ein=113655877&cycle=2012

[x] According to Center for Responsive Politics data, Herbert Gullquist made three $25,000 donations to the RGA on October 4, 2012, October 24, 2013 and May 19, 2014, respectively. Retrieved June 24, 2015 from http://www.opensecrets.org/527s/527cmtedetail_donors.php?url=527cmtedetail_donors.php%3Fcycle%3D2012%26ein%3D113655877&cname=gullquist&ein=113655877&cycle=2012 See also: Sirota, David. “Exclusive: We name the political donors whose firms got $14bn of pension cash from New Jersey.” Pandodaily.com, May 22, 2014. Retrieved June 10, 2015 from http://pando.com/2014/05/22/exclusive-we-name-the-political-donors-whose-firms-got-14bn-of-pension-cash-from-new-jersey/

[xi] Steyer, Robert. “New Jersey Division of Investment hikes alternatives target allocation,” Pensions and Investments, May 25, 2012. Retrieved July 20, 2015 from

[xii] Renshaw, Jarrett. “Hedge fund’s risky ties to Revel casino shine light on N.J.’s investing habits.” The New Jersey Star Ledger, September 9, 2012. Retrieved June 10, 2015 from

http://www.nj.com/news/index.ssf/2012/09/hedge_funds_risky_ties_to_reve.html

[xiii] According to Center for Responsive Politics data, Anthony Melchiorre and Andrea Melchiorre of New Jersey made a total of four donations to the Republican National Committee in 2012, totaling $58,300. Retrieved July 17, 2015 from http://www.opensecrets.org/indivs/search.php?name=anthony+melchiorre&cycle=All&sort=R&state=&zip=&employ=&cand=&submit=Submit+Query and https://www.opensecrets.org/indivs/search.php?name=andrea+melchiorre&cycle=All&sort=R&state=&zip=&employ=&cand=&submit=Submit+Query

[xiv] Portnoy, Jenna. “Republican National Committee foots the bill for Christie’s voter turnout operation.” The New Jersey Star-Ledger, September 8, 2015. Retrieved June 23, 2015 from http://www.nj.com/politics/index.ssf/2013/09/christie_rnc.html

[xv] “Proposed Investment in Chatham Asset High Yield Separate Account,” Memorandum to New Jersey State Investment Council from Christopher McDonough, Acting Director, November 15, 2013.

[xvi] Sirota, David. “Chris Christie’s $300m pension proposal broke state anti-corruption laws (And now the intended recipient threatens to sue Pando).” Pando.com, April 18, 2014. Retrieved June 10, 2015 from http://pando.com/2014/04/18/chris-christies-300m-pension-proposal-broke-state-anti-corruption-laws-and-now-the-intended-recipient-threatens-to-sue-pando/

[xvii] According to Center for Responsive Politics data, Daniel Loeb made five $250,000 donations to the RGA between 2012 and 2014. Retrieved July 17, 2015 from http://www.opensecrets.org/527s/527cmtedetail_donors.php?url=527cmtedetail_donors.php%3Fcycle%3D2012%26ein%3D113655877&cname=loeb&ein=113655877&cycle=2012

[xviii] Fang, Lee. “Pensiongate? Christie Campaign Donors Won Huge Contracts.” The Nation, March 18, 2014. Retrieved June 24, 2015 from http://www.thenation.com/article/178862/pensiongate-christie-campaign-donors-won-huge-contracts#

[xix] According to Center for Responsive Politics data, Paul Singer of New York made six separate donations to the RGA between 2012 and 2014, totaling $3.85 million. Retrieved July 17, 2015 from https://www.opensecrets.org/527s/527cmtedetail_donors.php?url=527cmtedetail_donors.php%3Fcycle%3D2014%26ein%3D113655877&cname=singer&ein=113655877&cycle=2014

[xx] Denmark, Frances. “Chris Christie Takes Heat for Hedge Fund Donations.” Institutional Investor, May 25, 2015. Retrieved June 24, 2015 from http://www.institutionalinvestor.com/article/3456477/asset-management-hedge-funds-and-alternatives/chris-christie-takes-heat-for-hedge-fund-donations.html#.VYre0edkxQR