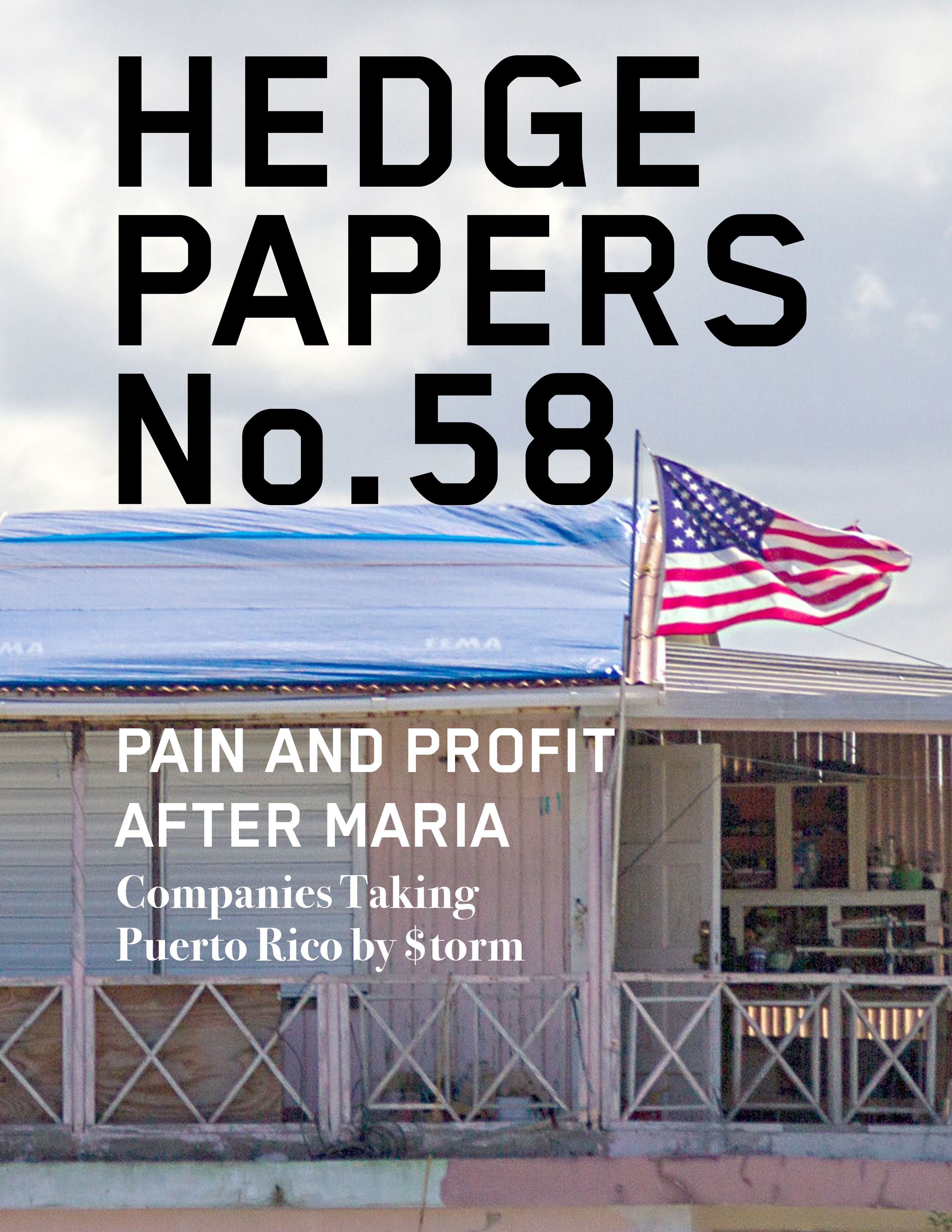

Pain and Profit After Maria

Companies Taking Puerto Rico by $torm

Five months after Hurricane Maria, and amid a continuing austerity crisis, conditions in Puerto Rico remain dire. More than 1,000 people died from the hurricane, although the official estimate is only 64. The government of Puerto Rico estimates that another 200,000 people (about 5 percent of the population) could leave the island by the end of 2018, adding to the massive wave of out-migration over the past decade.[1] A quarter of the population stills lacks electricity.[2]

Relief efforts have been marked by corruption. The most notorious example was Whitefish Energy, the obscure Montana company from Interior Secretary Ryan Zinke’s hometown that was awarded a $300 million contract (which has since been canceled) to rebuild the island’s electric grid.[3] Aid that was promised to the island has gone undelivered. The Federal Emergency Management Agency awarded one U.S. company $156 million to deliver 30 million meals to Puerto Rico; only 50,000 were provided.[4]

On top of all this, private companies (many of which helped originate the island’s debt crisis) are now—in collaboration with Gov. Ricardo Rosselló’s administration—swooping in to profit off the ongoing climate and humanitarian crises by way of privatization efforts.

The island is becoming a testing ground for privatization and a playground for the unrestricted power of the financial and tech industries.The island is becoming a testing ground for privatization and a playground for the unrestricted power of the financial and tech industries. Share on X

While the crisis in Puerto Rico is often blamed on “natural” disaster or the “free” market, the harsh conditions imposed on the island are entirely manmade. This report names some of the key firms and individuals behind the crisis—and some who are now trying to cash in on the recovery effort. Key findings include:

- Some hedge funds that are speculating on Puerto Rican debt and are parties to Puerto Rico’s bankruptcy dispute went on bond buying sprees in the wake of Hurricane Maria. We identified 2 firms that appear to have actually bought up significant amounts of debt since the hurricane. Tilden Park Capital’s holdings in COFINA debt increased by $284 million to nearly $785 million – a 55% increase – from October 2017 to March 2018.[6] GoldenTree Asset Management’s holdings in COFINA debt increased by $368 million to $1.2 billion—43% increase—from October 2017 to March 2018.[7] Tilden Park’s massive, post-hurricane bond purchases are being reported here for the first time.Some hedge funds that are speculating on Puerto Rican debt and are parties to Puerto Rico’s bankruptcy dispute went on bond buying sprees in the wake of Hurricane Maria. Share on X

- Vulture funds that own Puerto Rico’s debt are continuing the push for austerity measures. They are issuing public calls for austerity to ensure the island prioritizes paying its creditors over paying for vital infrastructure and services residents need in the wake of the hurricane. The COFINA senior bondholders issued a letter in mid-February calling on the Puerto Rican government and Financial Oversight and Management Board to “exhibit fiscal discipline” and ramp up reductions in government expenses, i.e. implement even more severe austerity budgets to ensure bondholders get paid.[8] In December, Autonomy Capital sent a letter to its investors that revealed its priorities, harshly criticizing the island’s political elite for a failure to “regain credibility with the markets.”[9] Translation: Essential services have not been cut deeply enough, Wall Street bondholders have not been paid enough, and the current program of austerity needs to be accelerated. Vulture Funds: Essential services have not been cut deeply enough, Wall Street bondholders have not been paid enough, and the current program of austerity needs to be accelerated. Share on X

- A number of firms that were involved in originating the debt crisis in Puerto Rico—such as AECOM/URS, Citigroup and Santander—are now seeking to profit from conditions they helped create. Citigroup, for example, is advising the Fiscal Control Board on the privatization of the Puerto Rico Electric Power Authority (PREPA) after underwriting billions in PREPA debt—in other words, it is profiting off of a restructuring process that was caused by the debt crisis it helped create and profit from in the first place.

- Conflicts, controversies and astounding incompetence have surrounded the lucrative recovery contracts awarded after Hurricane Maria. For example, Adjusters International, which has a top executive with ties to President Trump, was awarded a $133 million contract only to have it rescinded after the company failed to meet basic qualifications, while an official investigation showed that AECOM/URS, which has been awarded a $122 million recovery contract, helped to sell PREPA bonds while also serving as a PREPAs performance auditor—a conflict of interest.

Rosselló’s privatization spree

Nearly every major sector of Puerto Rican society remains in deep crisis, facing the brunt of austerity. In response, Gov. Rosselló has proposed a wave of privatization. In February, Rosselló also announced a major plan for the privatization of K-12 education with a move toward student vouchers for charter schools—and all this with the help of Trump Education Secretary Betsy DeVos. Share on X

The governor recently proposed shutting down 266 public schools—more than a third of all public schools on the island—which could result in a loss of 27,500 students and 7,300 teachers by 2022. This comes after an announcement last year of 167 public school closures, and 150 other school closures between 2010 and 2015.[10] In February, Rosselló also announced a major plan[11] for the privatization of K-12 education with a move toward student vouchers for charter schools[12]—and all this with the help of Trump Education Secretary Betsy DeVos.[13]

As of January, around 450,000 people—close to a third of all electricity users—were still without power.[14] Meanwhile, Rosselló is leading the charge to privatize PREPA, the island’s public electric company, opening its ownership up to outside investors to turn a profit. Puerto Rico also faces a massive housing collapse, with a third of homeowners behind on their mortgage payments.[15] FEMA hotel vouchers, which were given to people displaced by the hurricane expired on March 20, likely leaving some families without shelter.[16]

Wooing Wall Street

On top of all this, Rosselló is attempting to woo Wall Street and tech firms to come to the island to help drive its reconstruction. Rosselló and several Cabinet members were featured at a recent New York City conference jointly organized by the Financial Times and Puerto Rico’s Department of Economic Development and Commerce. The governor touted the island’s recent labor-law reform that cut wages, benefits and job security—though this didn’t go far enough for some conference attendees. He also raved about his plans to “right-size”—i.e., impose austerity on and privatize—education, healthcare, the university system, and municipal governance as well as bring in more private investment.

In short, Rosselló is telling corporate investors that Puerto Rico is wide open for business.

After the hurricane, debt vultures continue to circle

Before Hurricane Maria, Puerto Rico was already mired in a severe debt crisis. The government had implemented extreme austerity budgets to free up resources to pay predatory hedge funds, mutual funds, bond insurers and other creditors. Despite the now-intensified humanitarian crisis and clear lack of financial resources to rebuild Puerto Rico, these creditors continue to speculate on the island’s debt and battle it out in court to squeeze profits from the island.

Several vulture funds and banks have continued to wage aggressive campaigns to force Puerto Rico to pay Wall Street instead of paying for the vital infrastructure and services residents need in the wake of the hurricane.

Moreover, these efforts to extract repayments, while egregious after the hurricane since the funds are so badly needed on the island, are nothing new. Before the hurricane, for example, the COFINA bondholders coalition and general obligation debt holders sued Puerto Rico for its attempts to cut the island’s debt, while Ambac, which insures $2.2 billion in the island’s bonds, filed a slew of lawsuits. In short, Wall Street efforts to strong-arm Puerto Rico to make payments are nothing new.[17]

Tilden Park Capital

Unlike most of the other hedge funds that are parties to the Puerto Rican bankruptcy dispute, Tilden Park Capital went on a bond buying spree in the wake of the hurricane. Its holdings in COFINA debt increased by $284 million to nearly $785 million – a 55% increase – from October 2017 to March 2018.[18]

This increase is accounted for by large purchases of uninsured COFINA subordinate debt in early 2018, just before COFINA bond prices started surging. Tilden Park Capital went from owning just $9 million worth of that class of debt in October 2017 to owning over $268 million in March 2018.

These massive, post-hurricane bond purchases are being reported here for the first time.

Tilden Park Capital has kept a low profile in recent years. But while it is not exactly a household name, it grew out of a highly-profitable bet that helped sow the seeds for a disaster that ripped apart households across the United States and helped accelerate the collapse of the Puerto Rican economy.

Tilden Park Capital was founded by Josh Birnbaum, a former trader at Goldman Sachs.[19] At Goldman, Birnbaum engineered the bank’s “big short” on housing before the 2008 crisis. The bank dumped billions in toxic mortgage-backed securities and derivatives onto its customers, while Birnbaum and his team quietly placed large bets that the housing market would fail. These actions are analogous to buying insurance on a home and then setting it ablaze for the settlement money, except in this case, millions of homes were at stake. The trades further inflated the housing bubble, deepened the subsequent crisis, and made Goldman billions.[20]

Birnbaum got a $10 million bonus in 2007 for his role in executing part of this scheme, but it wasn’t enough to keep him at Goldman; he set out on his own to found Tilden Park Capital in 2008.[21] In 2010, he was called to testify before Congress about his role in the trade.[22]

In ramping up his holdings in COFINA debt, Birnbaum is speculating that public funds needed for a just recovery will instead line the pockets of bondholders like himself.

He is effectively gambling, once again, on millions of families losing the place they call home. This time, that place is Puerto Rico.

GoldenTree Asset Management

GoldenTree Asset Management is one of the other few firms that appears to have actually bought up more debt after Hurricane Maria hit the island. From October 2017 to March 2018, the firm increased its COFINA debt holdings by approximately 43 percent, from $852.58 million[23] to $1.22 billion.[24] The increase likely represents new purchases.

GoldenTree is led by Steven A. Tananbaum, a seasoned distressed debt investor. Tananbaum got his start on Wall Street in junk-bond investing at MacKay Shields in the early 1990s. In 2000, he founded GoldenTree, which now has more than $16 billion in assets under management.[25] He has described his investment strategy as “trying to buy a dollar for 50 cents.”[26] Tananbaum has also said he views oil, gas and coal companies as ripe investment targets for distressed debt firms.[27] As of December 2017, 50 percent of GoldenTree’s equity holdings were in energy companies—primarily oil, gas and coal companies.[28]

Oaktree Capital Management

Like other creditors, the Employee Retirement System (ERS) bondholders have shown no sign of tempering their legal strategy to make the island pay. As recently as Feb. 2, the ERS Secured Creditors group filed a motion to alert the court that their Jones Day lawyer would appear as their representative at the Feb. 7 omnibus hearing on Puerto Rico debt.[29] For the bondholders, it’s clearly business as usual, even though millions of Puerto Ricans’ lives have been disrupted.

Oaktree Capital Management is a Los Angeles-based private equity giant managing over $100 billion in assets. As of December 2017, Oaktree owned nearly $411.8 million in ERS bonds—making it the largest disclosed owner of this particular type of Puerto Rican debt.[30]

ERS bonds were first issued in 2008, when the Employee Retirement System, which serves the island’s public sector retirees, faced massive budget shortfalls. Desperate for cash, ERS began issuing bonds backed by future employee contributions. In the beginning, only residents of Puerto Rico could purchase the bonds, but eventually their value plummeted, opening the door for vulture funds to buy up the bonds at a significant discount. Vulture funds, including Oaktree, now own one-third of the pension system’s debt.[31] Eight of these funds, including Oaktree, formed the ERS Secured Creditors group, an alliance of bondholders that filed a complaint in federal bankruptcy court requesting that ERS divert employer contributions to the pension fund to pay bondholders, thereby jeopardizing retirees.[32]

Oaktree’s leadership has not made a public statement in response to calls for cancellation of the island’s debt.

Oaktree is headed by co-founders and co-chairmen Howard Marks and Bruce Karsh, who are worth $3.9 billion combined.[33] While families on the island face a mounting foreclosure crisis[34] and families who have fled to the mainland wait to see if FEMA will provide shelter for them as their hotel vouchers expire,[35] Marks and Karsh have numerous estates where they can spend their time. In 2015, Marks purchased his Beverly Hills mansion for $23.7 million[36] after selling his Malibu estate for a record-breaking $75 million.[37] He also owns a $23.8 million vacation home in one of Hawaii’s most exclusive gated communities[38] and a $52.2 million New York City co-op in the famous 740 Park Avenue building.[39] Karsh also has numerous houses, including a $21 million Benedict Canyon mansion[40] complete with tennis courts, a pool house, and an entertaining building with a theater, virtual golf course and recording studio.[41]

Autonomy Capital

As of November 2017, Autonomy Capital owned more than $1 billion in general obligation bonds, making it one of the biggest known vulture funds in Puerto Rico.[42] Autonomy has also reportedly played an outsize role in the Ad Hoc Group of General Obligation Bondholders. After Hurricane Maria, Autonomy showed no signs of backing down from its attempts to wrestle payments from the island. Indeed, in the wake of a devastating hurricane, in the middle of a humanitarian crisis, Autonomy Capital sent a letter that revealed its priorities, harshly criticizing the island’s political elite for a failure to “regain credibility with the markets.”[43] Translation: Essential services have not been cut deeply enough, Wall Street bondholders have not been paid enough, and the current program of austerity needs to be accelerated. The letter makes no mention of the ongoing humanitarian crisis on the island.

The Baupost Group

The Baupost Group, a Boston-based hedge fund run by billionaire Seth Klarman, is one of the biggest speculators in Puerto Rican debt with $933 million in COFINA bonds.[44] Until relatively recently, the firm hid its involvement in the debt speculation.

Even after Hurricane Maria struck the island, Klarman rejected calls to cancel the debt.[45] Baupost is part of the COFINA Senior Bondholder Coalition, which—together with several other creditor alliances—issued a letter in mid-February calling on the Puerto Rican government and Financial Oversight and Management Board to “exhibit fiscal discipline” and ramp up reductions in government expenses, i.e., implement even more severe austerity budgets to ensure bondholders get paid. [46]

Baupost began purchasing Puerto Rico debt in 2015 under the guise of 10 shell companies named Decagon Holdings 1-10 LLC and did not reveal itself as the ultimate owner—even as the Decagon entities became parties to litigation. Baupost was identified as the owner of the shell companies in October 2017.[47] CEO Klarman later admitted that he “hid” Baupost’s ownership of Puerto Rico debt because “the world tends to follow” and “copycat” his firm, while also saying, “I don’t like to be attacked.”[48] Baupost has increased its bond holdings by about $22 million since it was first exposed.

While Klarman uses every tool at his disposal to extract a profit from Puerto Rico, he is also promoting climate change denial and financing fossil fuels. This is particularly egregious considering hurricanes like Maria are becoming more frequent and intense due to climate change.[49] Klarman is a trustee at the American Enterprise Institute, a highly influential conservative think tank with a long record of trafficking in climate change denial.[50] Under Klarman, Baupost invests big in fossil fuels and fracking. As of December 2017, about 23 percent of Baupost’s public equity investments were in oil and gas—totaling about $2.3 billion. The hedge fund was the second-largest shareholder in Cheniere Energy, a liquefied natural gas export firm, with an 8.7 percent stake.[51] It also owns a $469.7 million stake in oil and gas fracking firm Antero Resources—around 7.8 percent of the company’s shares.[52]

Paulson & Co.

Although Paulson & Co. has not been revealed to currently hold Puerto Rican debt, President John Paulson has been perhaps the most outspoken advocate of financial firms moving to Puerto Rico to take advantage of tax breaks.[53] In the wake of Hurricane Maria, as hundreds of thousands of Puerto Ricans are fleeing their island home,[54] Puerto Rico’s public and private sector leaders are aggressively trumpeting those same tax breaks to lure finance and tech companies to the island.[55] Paulson has also invested hundreds of millions of dollars in Puerto Rican real estate, primarily in luxury properties including La Concha Resort and the Condado Vanderbilt, two beachfront hotels in San Juan.[56]

A few days after Hurricane Maria struck the island, Paulson flew to San Juan on his company’s 23-seat Bombardier jet to check on several of his real estate investments.[57] According to the New York Times, Paulson “traveled when commercial air traffic to the devastated island was limited and most private jets landing in San Juan were required to bring badly needed emergency supplies.”[58] After his trip, Paulson & Co. released a statement saying, “We look forward to welcoming guests as early as the winter season.”[59]

As of October, Paulson had found some guests; his San Juan properties were at full occupancy, housing hurricane relief workers. According to Bloomberg, “That’s a lot more business than they normally would be doing in the off-season, even if the $167 government rate is below what the Condado Vanderbilt charges at this time of year—from $200 a night for the cheapest room to $5,125 for a three-bedroom oceanfront suite.”[60]

TPG and Blackstone: Private equity firms hoping to profit off of Puerto Rico’s escalating foreclosure crisis

As Hedge Clippers has previously reported,[61] private equity firms including TPG Capital and The Blackstone Group are playing a key role in driving the foreclosure crisis that has intensified in Puerto Rico since Hurricane Maria. Even before the hurricane, the island was dealing with unprecedented foreclosures. In June 2017, an average of 18 families lost homes every day to foreclosure in Puerto Rico, more than double the rate a decade ago during the global financial crisis. A record 5,424 homes were foreclosed last year, up 130 percent from nearly a decade ago, when the government first began tracking those numbers.[62] With hundreds of thousands of Puerto Ricans fleeing the island for the mainland in the months since the hurricane, the foreclosure crisis is intensifying.[63]

In December, the New York Times spotlighted Blackstone portfolio company Finance of America for its role in the island’s housing crisis. The company specializes in reverse mortgages, a type of home loan guaranteed by the federal government. The Times reported, “There are 10,000 reverse mortgages in Puerto Rico, and Finance of America controls about 40 percent of the market. …Court records show that the Blackstone-controlled company is aggressive in its pursuit of—and foreclosures on—borrowers.”[64]

TPG Capital affiliates own a portfolio of several thousand residential mortgages and hundreds of commercial (i.e., small-business) mortgages in Puerto Rico, primarily in the San Juan area. Hedge Clippers and El Nuevo Día investigations show that TPG affiliates, including Rushmore Loan Management Services[65] and Roosevelt Cayman Asset Company,[66] have been aggressively foreclosing on Puerto Ricans.[67]

Both Finance of America and TPG affiliates continued to take action against homeowners after Hurricane Maria struck the island. Finance of America filed at least two foreclosure suits between Sept. 26 and 29, just days after the hurricane devastated Puerto Rico. In the subsequent months, the companies have pursued a variety of actions against homeowners to advance foreclosure suits in court, including service by publication (i.e., publishing a foreclosure notice in the newspaper because a homeowner cannot be found to accept delivery of legal documents), seeking default judgments, and filing for eviction. Finance of America has pursued about 40 actions, while TPG affiliates Roosevelt Cayman and Bautista Cayman have pursued over 300 actions.[68]

In December 2017, following public pressure and protests at its offices, TPG affiliate Roosevelt Cayman stayed hundreds of foreclosure suits through March 2018 and implemented a foreclosure moratorium (the terms of which have not been made public). In February 2018, TPG affiliate Bautista Cayman stayed dozens of commercial foreclosure cases—the majority of open cases—for four to six months. TPG is expected to extend its moratorium and announce new measures over the next month. Through continued conversations with Hedge Clippers, Puerto Rican diaspora groups and other advocates, TPG has the opportunity to take even bolder action and set an example for what companies can do to support the needs of Puerto Ricans after the hurricane.

Santander (which is discussed more in the next section) is also a key player driving the island’s foreclosure crisis.

Banking on the crisis in Puerto Rico

A slew of big banks underwrote billions in Puerto Rican bonds while charging high fees and exorbitant interest rates.[69] Now some of these same banks are being brought in to advise on the privatization and restructuring of basic sectors of Puerto Rican society—in other words, they’re profiting further off of a crisis they helped originate in the first place.

Citi: underwriting the crisis—and now advising on privatization

Citigroup Global Markets—or Citi, as it’s commonly called—underwrote significant portions of the $9 billion in Puerto Rico’s PREPA debt.[70] Citi is the fourth-largest bank in the U.S.,[71] and it has been on a mission to extract profits from the island through fees and interest payments.

Alongside JPMorgan Chase, Citi was a key underwriter of the Series XX Power Revenue Bond issued by PREPA in 2010. The bond had an $822 million principal, of which $191 million was pegged to paying banks that issued the lines of credit.[72] Alongside a range of other banks, Citi also underwrote a variety of different bonds between 2003 and 2008 and then 2012 and 2013.[73] In 2015, Citi sold $146 million of its PREPA debt to Solus Alternative Asset Management—a hedge fund that manages $5.7 billion in assets—profiting handsomely at a time of deep crisis in Puerto Rico.[74]

But there’s more. Citi was an underwriter of eight capital appreciation bonds that total $2.7 billion in their principal amount. However, the interest on them is $22.8 billion—which translates into an astounding 718 percent interest rate.[75] Citi also reaped additional fees—$302 million from 2000 to 2016—through scoop-and-toss deals that delayed debt payments.[76]

On top of all that, Citi helped create the COFINA bonds through which the government of Puerto Rico borrowed another $17 billion. The creation of these COFINA bonds was conditional on making it illegal for the government to take any measures that would interfere with their collection.[77]

And now—though it played a major role in originating and intensifying the island’s debt crisis through its sale of predatory loans—Citi is again profiting off Puerto Rico as a main adviser to the Fiscal Control Board in the privatization of PREPA.[78] All this is another example of corporate privatizers seeking to exploit the destruction caused by Hurricane Maria to take control of public goods for private profit.

Citi is headed by Michael Corbat, who has been CEO since 2012. In that time he’s profited handsomely from his bank’s role in Puerto Rico debt crisis. From 2014 to 2016, Corbat raked in over $42 million in compensation.[79] On top of that, he just received a 48 percent raise, meaning he’ll go from earning $14 million to up to $23 million.[80] Corbat’s pay has nearly doubled since right before he became CEO at the end of 2012—a time period in which Puerto Rico descended further and further into debt and despair.

Corbat lives a lush life. Just before being named CEO, he spent a year in London heading up Citi’s European, Middle East and Africa business. In addition to taking in $12.4 million that year, Citi gave him a $54,000 monthly allowance.[81] Back in the U.S., he also fared well—a 2012 story reported that he owns a Central Park West apartment in New York City that he rented out for $33,000 a month, as well as a $3.7 million, 6,300 square foot home in Wyoming.[82] In addition to juggling multiple lavish homes, Corbat is known to make his way around New York City’s elite cultural scene. Bloomberg reports how Corbat fretted over what to wear to a 2014 gala that featured Prince William and Kate Middleton at the Metropolitan Museum of Art. “I haven’t even thought about it,” said Corbat. “What am I supposed to wear?”[83]

Any hesitation Corbat feels about his wardrobe choices, however, doesn’t spill into his role as CEO at Citi, where he’s been ruthless. As soon as he came on as CEO, Corbat slashed 11,000 jobs—4 percent of the Citi workforce.[84] Part of the rationale for these firings came from the economic downturn during the Great Recession, to which Citi was a key contributor. Indeed, in 2014—two years into Corbat’s tenure as CEO—the bank agreed to pay a $7 billion settlement for the toxic loans it doled out that contributed to the housing crash.[85]

It’s reported that Citi gave a $325 million loan to Jared Kushner in spring 2017—coincidentally, right after Corbat met with Kushner in the White House, which raises ethics questions.[86]

Santander strikes again, and again, and again and again …

Like TPG and Blackstone, Santander is playing a significant role in Puerto Rico’s foreclosure crisis and could take bolder action to ensure the island’s families are able to stay in their homes. Banco Santander Puerto Rico and its subsidiary Santander Financial Services Inc. were the fourth-largest owner of foreclosed properties in Puerto Rico in June 2017. Eighty percent of these properties were residential.[87] The Oficina del Comisionado de Instituciones Financieras has not released updated reports after the hurricane, but searches of local and district court records show Santander continues to foreclose on homes at significant rates. What’s more alarming is that foreclosures in Puerto Rico constitute 61 percent of the bank holding company’s total foreclosures.[88]

Santander also played a role in originating the island’s debt crisis by participating in underwriting more than $60 billion in often predatory bond deals, in which it shared in over $1 billion in underwriting fees.[89] But Santander, now the “king of the euro zone,”[90] went one step further. Through regulatory capture, former Santander executives played crucial roles as public officials and advised the government to pass regulations they devised that drove Puerto Rico into insolvency.

In 2009, as Puerto Rico’s depressed economy struggled through the Great Recession, Carlos M. Garcia, president and COO of Santander, was appointed to head the Puerto Rico Government Development Bank (GDB). Jose Ramon Gonzalez, former president and CEO of Santander, was appointed to the CAREF, a council tasked with making recommendations to fix Puerto Rico’s fiscal problems.

In the previous decade, Garcia and Gonzalez had built up Santander Securities, the bank’s municipal bond business in Puerto Rico.

Garcia brought a team with him from Santander, including Fernando Batlle (whose brother Juan Carlos remained at Santander), Jesus F. Mendez Rodriguez, David Alvarez Castanedo, Victor G. Feliciano Arroyo and George Joyner Kelly.[91] While the government relied on the Santander GDB administration for their market knowledge, they abused their public positions by devising regulations that caused the Puerto Rico municipal bond market to become further characterized by banks’ extensive and predatory rent-seeking behavior.[92]

Garcia’s team doubled the amount of sales tax revenue set aside for COFINA bonds, increasing the sales and use tax (SUT) to 11.5 percent to finance more debt, making Puerto Rico’s sales tax the highest in the country.[93] Public Law 7, passed in March 2009, permitted the treasury secretary to refinance debt without considering whether it would actually save Puerto Rico money.[94] And the CAREF council “advised” the GDB to use Puerto Rico’s once ring-fenced infrastructure fund to finance more bad debt.[95]

The Santander GDB administration began a trend of accelerated privatization of public assets as it attempted to provide stimulus through public-private partnerships and tax cuts. In concert with the government, it forced austerity policies on Puerto Rico that laid off tens of thousands of public sector employees and unilaterally suspended union contracts, denying job protections to union workers.[96]

During the Santander administration, the GDB issued toxic bond deals that it is difficult to imagine they genuinely believed would be repaid at maturity. In one deal with the Employee Retirement System, it assigned $162.5 million made available from the infrastructure fund to the ERS.[97] The pension fund was made to invest in a COFINA capital appreciation bond series that would be worth $1.65 billion at maturity, a gain of more than 10 times the original amount.

Santander took a step further and exploited a loophole that allows financial firms to both underwrite and sell Puerto Rico’s triple tax-exempt municipal bonds. As Garcia left the GDB and returned to Santander,[98] the bank accelerated its sale of investment funds with high exposure to Puerto Rican municipal bonds,[99] while still buying bonds from the GDB and selling them to clients.[100]

It was at this point that Santander’s Batlle brothers literally traded places—Juan Carlos, who had headed Santander Securities, and Fernando, who was an executive at the GDB, switched roles. Fernando moved to head up Santander Securities, and Juan Carlos became head of the GDB. Later in 2015, the Financial Industry Regulatory Authority fined Santander for failing to inform its clients who were sold these bonds of their markets risks.[101]

In December 2016, Gov. Rosselló named Gerardo José Portela Franco to take over the direction of the Fiscal Agency and Financial Advisory Authority (AAFAF). Portela was vice president and director of Investment Banking at Santander Securities from 2011 to 2016,[102] where he helped finance more than $5 billion in municipal debt and structure securities to sell to clients—during the period it failed to inform customers of the risk.[103] Portela’s executives at the AAFAF, Jesus D. Mattei Perez[104] and Alejandro Camporreale Mundo,[105] also came from Santander. The AAFAF took over the functions of the GDB, and is the agency in charge of negotiations with organized bondholders and the Fiscal Control Board. Carlos M. Garcia and Jose Ramon Gonzalez are two of seven members of the Fiscal Control Board.

Today, the Puerto Rican population could as easily be living in an alternate reality—one where a strong and resilient Puerto Rico could have swiftly responded to a natural disaster. The island’s social and economic and fiscal crises were avoidable. But Puerto Rico will not recover until megabanks—especially Santander—stop abusing their power through regulatory capture.

Exploiting the hurricane recovery: contract profiteers cash in

It’s not just the underwriters and bondholders that are profiting from Puerto Rico’s crisis. A host of other corporate interests are now scrambling for the lucrative federal contract to rebuild the island’s infrastructure and bring humanitarian relief. Many of these contracts have been awarded on a noncompetitive, no-bid basis. Indeed, during the last fiscal year that ended on Sept. 30, 2017, FEMA gave out $200 million in these kinds of single-source contracts—the most since 2008.[106]

A range of major corporations have profited from these no-bid contracts. For example, FEMA awarded $17 million to Verizon, $6 million to AT&T, $7.9 million to IBM, and $8 million to a subsidiary of insurance giant Marsh & McLennan Companies.[107]

But some of the major awards—contracts that stretch into nine-digit territory—have been surrounded by controversy and cronyism.

AECOM

AECOM has been a big winner in the no-bid contract game. It’s subsidiary, Disaster Solutions Alliance LLC, was awarded a whopping $122 million to provide food to hurricane survivors. Disaster Solutions is a joint venture between AECOM and a subsidiary of SNC-Lavalin Group Inc., a Canadian engineering and construction company. The firm has some powerful friends in Puerto Rico—Elías Sánchez, Gov. Rosselló’s former liaison to the financial control board, advises AECOM.[108]

AECOM is a global behemoth, with $17.5 billion in sales last year, that offers a range of technological, managerial, consulting and construction services.[109] Its CEO, Michael S. Burke, was paid an astounding $50 million from 2015 to 2017.[110]

One of AECOM’s board members is Bill Frist, who served as a longtime Republican senator from Tennessee and was the U.S. Senate majority leader from 2003 to 2007. As an AECOM director, Frist earns $281,898, and all this while running his own private investment firm. Frist made it onto the board in 2014, when URS Corp.—which he had been a director of since 2009—was acquired by AECOM.[111] Given that Frist was one of the most powerful national politicians in recent U.S. history, his presence on the board of AECOM—a massive for-profit corporation fighting for government contracts—raises concerns.

There are major concerns surrounding the role of URS Corp.—which, again, was acquired by AECOM—in Puerto Rico. URS worked as the performance auditor for PREPA in 2013 while it was also involved in both the commodification process of—i.e., the selling of —its Power Revenue Bonds as well as the oversight of PREPA facilities. According to a report published by the Puerto Rico Commission for the Comprehensive Audit of the Public Credit, URS participated in PREPA’s bond issue financing through its role in preparing official statements, and also participated in most bond rating agency presentations. It also provided professional services to PREPA “in connection with the construction of the San Juan 5 and 6 combined cycle generating units completed during fiscal year 2009 and the restoration of the Palo Seco plant following the fires in December 2006.” All this, the commission said, created an environment “in which the revenue obtained by the URS Corporation was directly tied to the outcome of the sale of the financial instruments of the corporation (PREPA) that it was employed to analyze.”[112]

This raises serious conflict-of-interest concerns since URS was involved in playing an oversight role for the same company whose bonds it was helping to sell—meaning its role as an auditor was in conflict with its potential to profit from the performance of the company it was auditing—and specifically, around the issuing of the company’s bonds, whose worth were in part determined by URS’s auditing role as well as its professional services for PREPA facilities.[113]

On top of this, AECOM is now being brought in to profit off of a humanitarian crisis that has been created in part by the debt that was created by the bonds that URS had advised on.

Adjusters International

Another big winner of the Puerto Rico disaster corporate sweepstakes has been Adjusters International, or so we thought.

Adjusters is an insurance company based in Utica, N.Y. It was awarded a $133 million contract last December to oversee 75,000 potential home repairs.[114] However, the huge award raised controversy for two reasons.

First, an Adjusters executive, Daniel Craig, was nominated by Donald Trump to the number-two position in FEMA, which indicates that Craig, and thereby Adjusters, may have special ties to the administration. Craig is the founder of Tidal Basin Group, who was acquired by Adjusters in 2016. But Craig withdrew from consideration for FEMA when it was revealed that a federal investigation showed he had falsified government travel and timekeeping records while he served in the Bush administration in 2005.[115]

Second, the massive contract to Adjusters raised the ire of one of its chief rivals—AECOM—for whom the $122 million contract mentioned above was apparently not enough. AECOM argued that Adjusters did not have a sufficient line of credit to accept the contract and that it wasn’t legally qualified to do business in Puerto Rico; AECOM also said it might take the grievance to court.[116]

In February 2018, in a victory for AECOM, Puerto Rico suspended the $133 million contract to Adjusters, with a review board saying it should have been disqualified for the reasons AECOM raised. While the housing department that was involved in issuing the contract disagreed with the review board’s conclusions, AECOM praised the decision, saying that it was “ready and able to start working immediately.”[117]

While it’s not yet clear which firm the contract will be redirected to, AECOM stands to potentially profit even more from the Puerto Rico recovery corporate bonanza.

- https://www.washingtonpost.com/national/exodus-from-puerto-rico-grows-as-island-struggles-to-rebound-from-hurricane-maria/2018/03/06/b2fcb996-16c3-11e8-92c9-376b4fe57ff7_story.html?utm_term=.ac5b35e9eab8 ↑

- https://www.nytimes.com/2018/02/14/opinion/remember-puerto-rico.html ↑

- https://www.nytimes.com/2018/02/08/us/puerto-rico-disaster-relief.html ↑

- https://www.nytimes.com/2018/02/06/us/fema-contract-puerto-rico.html ↑

- https://www.thenation.com/article/for-investors-puerto-rico-is-a-fantasy-blank-slate/ ↑

- Figures based on those reported in COFINA group verified statements filed as part of the bankruptcy proceeding. Tilden Park Capital reported owning $501,292,880 in COFINA debt on October 25, 2017, and $784,985,816 in COFINA debt on March 5, 2018, an increase of $283,692,936 over that period. The increase largely came in the form of uninsured, COFINA subordinate bonds – the value of Tilden Park’s holdings in that class of debt increased from $9,223,136 to $268,156,505 during that period. A small percentage of the overall increase during this period is likely attributable to the increase in the “accreted value” of the debt, which incorporates. October 25, 2017 filing: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzExNDA0&id2=0 and March 5, 2018 filing: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzE4MTUz&id2=0 ↑

- https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzE4MTU0&id2=0 ↑

- https://www.prnewswire.com/news-releases/puerto-ricos-creditors-unite-to-call-for-a-credible-pro-growth-fiscal-plan-300598668.html ↑

- https://hfm.global/absolutereturn/news/autonomy-capital-large-puerto-rican-creditor-criticizes-hurricane-response/ ↑

- http://www.newsweek.com/puerto-rico-plans-close-hundreds-schools-794171 ↑

- https://www.reuters.com/article/us-usa-election-texas/u-s-primaries-start-with-democratic-push-in-texas-idUSKCN1GI17E ↑

- https://www.npr.org/2018/03/02/590136994/puerto-rico-and-its-teachers-unions-clash-over-proposed-charter-schools ↑

- https://theintercept.com/2018/02/22/puerto-rico-schools-betsy-devos/ ↑

- https://www.theatlantic.com/photo/2018/01/after-four-months-much-of-puerto-rico-still-dark-and-damaged/551756/ ↑

- https://www.nytimes.com/2017/12/16/business/puerto-rico-housing-foreclosures.html ↑

- http://www.orlandosentinel.com/news/puerto-rico-hurricane-recovery/os-fema-housing-direct-lease-evacuees-puerto-rico-20180213-story.html ↑

- https://www.reuters.com/article/us-puertorico-debt-lawsuit/puerto-rico-sued-by-spate-of-creditors-in-latest-blow-to-teetering-island-idUSKBN17Y0G3 ↑

- Figures based on those reported in COFINA group verified statements filed as part of the bankruptcy proceeding. Tilden Park Capital reported owning $501,292,880 in COFINA debt on October 25, 2017, and $784,985,816 in COFINA debt on March 5, 2018, an increase of $283,692,936 over that period. The increase largely came in the form of uninsured, COFINA subordinate bonds – the value of Tilden Park’s holdings in that class of debt increased from $9,223,136 to $268,156,505 during that period. A small percentage of the overall increase during this period is likely attributable to the increase in the “accreted value” of the debt, which incorporates. October 25, 2017 filing: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzExNDA0&id2=0 and March 5, 2018 filing: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzE4MTUz&id2=0 ↑

- http://www.tildenparkcapital.com/management.html ↑

- http://www.rollingstone.com/politics/features/the-vampire-squid-occupies-trumps-white-house-w456225 ↑

- http://www.businessinsider.com/josh-birnbaum-10-million-goldman-2011-4 ↑

- https://www.cbsnews.com/news/goldman-sachs-on-capitol-hill-testimony-of-josh-birnbaum/ ↑

- https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzExNDA2&id2=0 ↑

- https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzE4MTU0&id2=0 ↑

- https://www.barrons.com/articles/SB50001424053111904706204578002261936955692 ↑

- https://www.barrons.com/articles/SB50001424053111904706204578002261936955692 ↑

- https://www.cnbc.com/2015/04/28/vulture-investor-steve-tananbaum-circles-indebted-tech-companies.html ↑

- https://whalewisdom.com/filer/goldentree-asset-management-lp#tabsummary_tab_link ↑

- http://caribbeanbusiness.com/omnibus-hearing-to-discuss-puerto-rico-power-utility-loan-other-matters-for-feb-7/ ↑

- https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzEzNjEw&id2=0 ↑

- http://inthesetimes.com/features/union_pensions_puerto_rico_debt_bondholders.html ↑

- https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzEzNjEw&id2=0 ↑

- https://www.forbes.com/profile/howard-marks/ and https://www.forbes.com/profile/bruce-karsh/ ↑

- https://www.nytimes.com/2017/12/16/business/puerto-rico-housing-foreclosures.html ↑

- http://www.orlandosentinel.com/news/puerto-rico-hurricane-recovery/os-fema-housing-direct-lease-evacuees-puerto-rico-20180213-story.html ↑

- http://variety.com/2015/dirt/real-estalker/nick-vanoff-estate-sells-to-billionaire-financier-1201518757/ ↑

- https://www.forbes.com/sites/morganbrennan/2013/01/07/billionaire-howard-marks-sells-75-million-malibu-mansion-in-record-breaking-deal/#5816cd8fab7f ↑

- https://www.forbes.com/sites/erincarlyle/2014/04/18/hawaiis-most-exclusive-community-inside-the-billionaire-getaway-kukio/#257d986f7925 ↑

- http://www.businessinsider.com/meet-the-billionaires-of-740-park-avenue-2016-5 ↑

- https://losangeles.netronline.com/la-index.php?path=2015\03\20\20150302270.tif ↑

- https://www.clarkandkarsh.com/projects/tower-grove-drive.aspx ↑

- https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzExNjUw&id2=0 ↑

- https://hfm.global/absolutereturn/news/autonomy-capital-large-puerto-rican-creditor-criticizes-hurricane-response/ ↑

- From verified statement filed March 5, 2018, by the Senior COFINA bondholders’ coalition; Decagon entities own $933,682,417 in total: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=NzE4MTU0&id2=0 ↑

- https://www.cnbc.com/2017/10/20/hedge-fund-billionaire-klarman-says-puerto-rico-should-pay-its-debts.html ↑

- https://www.prnewswire.com/news-releases/puerto-ricos-creditors-unite-to-call-for-a-credible-pro-growth-fiscal-plan-300598668.html ↑

- https://theintercept.com/2017/10/03/we-can-finally-identify-one-of-the-largest-holders-of-puerto-rican-debt/ ↑

- http://www.institutionalinvestorsalpha.com/Article/3770666/Hedge-Funds-and-the-Hurricane.html?ArticleId=3770666 ↑

- https://www.theguardian.com/environment/2017/oct/06/climate-change-in-the-caribbean-learning-lessons-from-irma-and-maria ↑

- http://www.greenpeace.org/usa/global-warming/climate-deniers/front-groups/american-enterprise-institute-aei/ ↑

- https://whalewisdom.com/stock/lng ↑

- https://whalewisdom.com/filer/baupost-group-llc-ma#tabholdings_tab_link ↑

- http://money.cnn.com/2016/02/12/investing/puerto-rico-john-paulson/index.html ↑

- https://www.nbcnews.com/news/latino/over-200-000-puerto-ricans-have-arrived-florida-hurricane-maria-n825111 ↑

- http://businessinpuertorico.com/pathwaytothefuture/ ↑

- https://www.forbes.com/pictures/flhm45geee/inside-billionaire-john-paulsons-puerto-rico-real-estate-investments/#72d940d0d5b5 ↑

- https://www.nytimes.com/2017/10/09/business/wall-street-paulson-puerto-rico-hedge-funds.html ↑

- https://www.nytimes.com/2017/10/09/business/wall-street-paulson-puerto-rico-hedge-funds.html ↑

- https://www.nytimes.com/2017/10/09/business/wall-street-paulson-puerto-rico-hedge-funds.html ↑

- https://www.bloomberg.com/news/articles/2017-10-05/paradise-lost-as-paulson-s-puerto-rico-bet-is-blown-off-course ↑

- http://hedgeclippers.org/report-no-53-private-equity-and-puerto-rico/ ↑

- https://www.nbcnews.com/news/latino/puerto-rico-grapples-foreclosure-crisis-thousands-lose-homes-n775021 ↑

- https://www.washingtonpost.com/national/exodus-from-puerto-rico-grows-as-island-struggles-to-rebound-from-hurricane-maria/2018/03/06/b2fcb996-16c3-11e8-92c9-376b4fe57ff7_story.html ↑

- https://www.nytimes.com/2017/12/16/business/puerto-rico-housing-foreclosures.html ↑

- https://www.moodys.com/research/Moodys-assigns-an-SQ-assessment-of-SQ3-to-Rushmore-Loan–PR_352399 and https://www.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=436789 ↑

- https://www.elnuevodia.com/negocios/economia/nota/eldolordeperderlacasa-2342742/ and https://www.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=436789 ↑

- https://www.elnuevodia.com/negocios/economia/nota/eldolordeperderlacasa-2342742/ and https://theintercept.com/2017/12/22/puerto-rico-foreclosures-hurricane-maria/ ↑

- Compiled from U.S. District—Puerto Rico court records ↑

- https://www.scribd.com/document/338702218/Beware-of-Bankers-Bearing-Gifts ↑

- https://theintercept.com/2018/02/21/citigroup-citi-puerto-rico-debt/ ↑

- https://www.bankrate.com/banking/americas-top-10-biggest-banks/#slide=1 ↑

- https://theintercept.com/2018/02/21/citigroup-citi-puerto-rico-debt/ ↑

- https://theintercept.com/2018/02/21/citigroup-citi-puerto-rico-debt/ ↑

- https://www.reuters.com/article/usa-puertorico-prepa/citi-sells-146-mln-loan-in-puerto-ricos-power-authority-sources-idUSL1N0XY44120150508 ↑

- https://theintercept.com/2018/02/21/citigroup-citi-puerto-rico-debt/ ↑

- https://theintercept.com/2018/02/21/citigroup-citi-puerto-rico-debt/ ↑

- https://theintercept.com/2018/02/21/citigroup-citi-puerto-rico-debt/ ↑

- https://juntasupervision.pr.gov/wp-content/uploads/wpfd/49/5a83181ed757c.pdf ↑

- http://www.citigroup.com/citi/investor/quarterly/2017/ar17p.pdf?ieNocache=157 ↑

- https://www.wsj.com/articles/citigroup-gives-ceo-corbat-a-bigraise-up-48-to-23-million-1518790380 ↑

- https://news.efinancialcareers.com/uk-en/139764/citis-big-pay-for-corbat-included-54k-monthly-london-allowance ↑

- http://fortune.com/2012/10/16/citigroups-new-ceo-has-a-lot-to-tackle/ ↑

- https://www.bloomberg.com/news/articles/2014-12-05/corbats-prepare-for-duke-and-duchess-of-cambridge-visit ↑

- https://www.huffingtonpost.com/2012/12/05/citigroup-job-cuts_n_2243975.html ↑

- https://www.theatlantic.com/business/archive/2014/07/citibank-will-pay-7-billion-over-mortgage-crisis/374154/ ↑

- https://www.marketwatch.com/story/kushners-business-got-big-loans-after-white-house-meetings-report-2018-02-28 ↑

- http://www.ocif.gobierno.pr/documents/Q2-2013/Analisis%20Hipotecas%20sobre%20Foreclosure.pdf ↑

- https://www.sec.gov/Archives/edgar/data/811830/000081183017000037/santanderholdingsq32017.htm#sE0A077BDFD4657C694EE33B1884DE86A p. 126 ↑

- Taken from an original analysis of official statements prepared in connection with new issues of Puerto Rican municipal securities, 2000 to present, with addition of several AFICA bonds issues Santander underwrote from the late 1990s. See https://emma.msrb.org/ and http://www.bgfpr.com/index.html ↑

- https://www.economist.com/news/business/21737258-europes-banking-champion-took-unique-approach-globalisation-has-it-been-vindicated ↑

- http://www.gdb-pur.com/PRCC/documents/Jan.292009CBFront-PageStory.pdf ↑

- http://espaciosabiertos.org/wp-content/uploads/2018/01/Final-Report-DSA-2018.01.pdf ↑

- https://www.forbes.com/sites/scottbeyer/2015/08/17/puerto-rico-at-11-5-has-americas-highest-sales-tax/#5f48366b308f ↑

- Law 7, Chapter IV, Section 47. Refinancing bonds were exempted from the requirements of Section 3 (f)(3) of 13 L.P.R.A. § 141b, which states that “no refinancing bonds shall be issued unless the Secretary of the Treasury shall have first determined that the present worth of the aggregate principal and interest on the refinancing bonds is less than the present worth of the aggregate principal and interest on the outstanding bonds to be refinanced; for the purposes of this limitation…” ↑

- https://aflcio.org/sites/default/files/2017-05/Looting%20of%20PR%20Infrastructure%20Fund%20Report_5.15.pdf ↑

- https://nacla.org/article/puerto-rico-crisis-government-workers-battle-neoliberal-reform ↑

- http://abrepr.org/sites/default/files/PR%20FINANCIAL%20REPORT%202011.pdf p. 119-120 ↑

- http://democrats-naturalresources.house.gov/imo/media/doc/garcia_testimony_updated_2_3_16.pdf ↑

- https://www.santander.pr/SecuritiesFamFunds/pdf/Prospectus/Prospectus2013_Q4/Tarsan%20III%20Fund%20Final%20Prospectus%20(with%2012-18-13%20Sticker).pdf ↑

- https://www5.fdic.gov/crapes/2015/20828_150527.PDF ↑

- https://www.reuters.com/article/us-finra-banco-santander/santander-securities-to-pay-6-4-million-over-puerto-rican-bonds-finra-idUSKCN0S71TH20151013 ↑

- http://www.camarapr.org/Pres-Lamboy/PROMESA/bios/Bio-Gerardo-Portela-English-2018.pdf ↑

- http://www.camarapr.org/Presentaciones-Calaf/Energia/Energia-Inclan.pdf ↑

- Analyst and manager of investment portfolios at Santander Asset Management 2011-17; investment portfolio analyst for UBS 2007-11; and administrator of mutual funds in Banco Popular 2004-07. ↑

- He was director of mortgages at Banco Santander de Puerto Rico 2014-17. ↑

- https://www.bloomberg.com/news/articles/2017-11-02/as-fema-faults-puerto-rico-contract-it-ramps-up-no-bid-awards ↑

- https://www.bloombergquint.com/business/2017/11/02/as-fema-faults-puerto-rico-contract-it-ramps-up-no-bid-awards ↑

- http://www.radioisla1320.com/elias-sanchez-trababa-empresa-impugno-contrato-hogar-renace/ ↑

- https://www.forbes.com/companies/aecom-technology/ ↑

- http://investors.aecom.com/mobile.view?c=131318&v=202&d=3&id=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTExOTkwMjM1JkRTRVE9MCZTRVE9MCZTUURFU0M9U0VDVElPTl9FTlRJUkUmc3Vic2lkPTU3 ↑

- http://investors.aecom.com/mobile.view?c=131318&v=202&d=3&id=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTExOTkwMjM1JkRTRVE9MCZTRVE9MCZTUURFU0M9U0VDVElPTl9FTlRJUkUmc3Vic2lkPTU3 ↑

- http://www.auditoriayapr.org/wp-content/uploads/2016/09/Second-Interim-Pre-Audit-Report-on-2013-PREPA-debt-emission-con-anejos.pdf ↑

- http://icsepr.org/portfolio/joint-press-release-with-ieefa/ ↑

- https://www.bloomberg.com/news/articles/2018-01-12/puerto-rico-deal-to-rebuild-homes-unfairly-awarded-rival-says ↑

- https://www.nbcnews.com/politics/white-house/trump-fema-nominee-withdraws-after-nbc-questions-falsified-records-n800856 ↑

- https://www.bloomberg.com/news/articles/2018-01-12/puerto-rico-deal-to-rebuild-homes-unfairly-awarded-rival-says ↑

- https://www.nbcnews.com/politics/politics-news/puerto-rico-suspends-133m-contract-awarded-firm-trump-s-failed-n848161 ↑