General Motors recently announced large-scale plant closures and layoffs, with top executives claiming the company needs $4.5 billion in savings to stay alive. This week the legendary Lordstown manufacturing plant in Ohio will close.

But GM has given over five times as much money — $25 billion — to Wall Street hedge funds and other investors in the past four years, including over $10 billion in controversial stock buybacks.

And GM recently authorized even more stock buybacks: it’s possible that every single dollar “saved” from job cuts and plant closures will go straight into the pockets of hedge fund billionaires and Wall Street.

In 2013, GM completed the taxpayer-funded bailout that kept the company alive and saved thousands of American jobs.

Billionaire hedge fund managers have been attacking the company ever since.

Hedge funds aren’t interested in American jobs, or in the communities that will be hit by plant closures and job loss.

Hedge funds are only interested in short-term payoffs for hedge funds and their billionaire managers — and they’ve relied on one-time dividends and share buybacks to get the cash they demand.

Stock buybacks used to be illegal, and the American economy was stronger and more fair when they were.

And hedge funds have become a destructive force in the American economy by exploiting regulatory loopholes that were meant to prevent the kind of predatory exploitation they’ve made into a profitable business model.

Workers, families, communities and elected officials can do something to fight back against the hedge fund attacks on GM and American jobs.

It’s time to make stock buybacks illegal again.

And it’s time to close the loopholes and put predatory hedge funds out of business once and for all.

Hedge funds are behind GM’s plant closures and job cuts

Just days after Thanksgiving of 2018, General Motors announced that it was closing five facilities, including the Lordstown assembly located just outside Youngstown, Ohio.

The announcement of the Lordstown closure was a devastating blow to the Youngstown area. The plant provided over 1,600 jobs and $250 million in total wages in 2017 alone.

The Lordstown plant had been in operation since the 1960s, and is one of the major employers in the Mahoning Valley.

Op-eds writers and talking heads were quick to point fingers at deindustrialization, offshoring, and the commercial failure of compact sedans.

Few pointed out the real culprits: activist hedge funds demanding that companies like GM turnover most of their profits to Wall Street in the form of dividends and stock buybacks.

GM’s decision to close Lordstown was the culmination of a four-year campaign by hedge fund managers to squeeze GM for every available dollar.

Hedge fund investors repeatedly mounted pressure campaigns to prevent GM from reinvesting their profits anywhere but back into their own share price. Through paid agents, harassing proxy measures, and public threats, the hedge funds extracted billions in buybacks.

And you don’t have to look back very far to see the impetus for GM’s decision — just one month earlier, the hedge funds made a big public push for one more payout.

Short-term push for payoffs hurts GM and communities

It was October 2018 and the hedge funds were pissed.

General Motors, the automotive giant, had completed its federal bailout just five years prior, repurchasing the remaining shares that the U.S. Government had bought in 2009 under the Troubled Asset Relief Program.

Conservative estimates put the loss to taxpayers from the bailout at $10.5 billion dollars—more than the combined annual salary of all librarians in the United States.

Despite just being ten years from their bankruptcy — and the $51 billion taxpayer-funded bailout that rescued the company — General Motors had stabilized and returned to profitability.

GM had several highly profitable business lines and was holding billions in cash — enough money to weather any future downturn and prevent another expensive government bailout.

But that fiscal prudence is exactly what angered GM’s hedge fund investors.

Hedge funds focus on short-term profits that benefit billionaire hedge fund managers, period. Hedge fund attacks hurt the corporations and communities they’re targeting, and even many of the pensioners and workers who provide the cash for hedge funds.

Last October, activist hedge funds demanded that General Motors take their cash and carry out yet another buyback of GM’s existing stock. This would raise the stock value for existing shareholders, and for the hedge funds agitating for a short-term payoff. But it wouldn’t do anything for the long-term viability of GM as an ongoing enterprise.

Stock buybacks hurt companies to benefit billionaires — why are they even legal?

https://variety.com/2019/voices/columns/corporate-stock-buybacks-1203108985/

https://variety.com/2019/voices/columns/corporate-stock-buybacks-1203108985/

This practice, called a share repurchase or stock buyback, is controversial. And it used to be illegal.

For economists and long-term investors, stock buybacks are bad moves that divert profits away from innovation and investments in American workers.

But even worse, stock buybacks can be used by hedge fund managers demanding cash in a kind of protection racket.

If the company doesn’t pay the protection racket, the hedge funds start agitating, threatening to mount costly proxy battles and sometimes waging negative PR campaigns.

If a company like GM channels their profits to stock buybacks, they can fend off the possibility of hostile proposals from hedge funds and other short-term profit seekers.

But only temporarily. The hedge funds always keep coming back for more.

Hedge funds attacked GM immediately after taxpayers bailed it out

In 2015, GM spent $5 billion buying back shares to placate a hedge-fund led campaign for a short-term payoff led by failed New York comptroller candidate Harry J. Wilson.

Wilson, who served on the government taskforce that oversaw GM’s restructuring, owned a paltry 30,000 shares in GM when he learned that the company planned to a one-year no buyback break.

Despite his relatively small position in GM, Wilson was the face of a million-dollar hedge-fund-backed campaign to get him elected to the GM board.

The hedge funds behind the effort included Appaloosa Management (run by David Tepper, the billionaire hedge fund manager who recently purchased the Carolina Panthers), Taconic Capital, Hayman Capital, and HG Vora Capital. To ward off Wilson and his hedge fund backers, General Motors relented and spent $5 billion on share buybacks.

The $5 billion buyback was a boon for investors like the hedge fund managers pulling Wilson’s strings, but not for GM.

Moody’s credit agency declared the buybacks to be a “negative credit development,” taking the position that GM executives fretted about only months earlier.

And the $5 billion that evaporated from GM’s books did nothing productive for the company, its workers, consumers or the U.S. economy.

Hedge funds kept demanding cash from GM in short-term payouts

Two years later, the hedge funds were at it again. This time David Einhorn, billionaire hedge fund manager and school privatization cheerleader, had taken a long position in GM’s shares and was looking for a way to juice the share price so he could make a short-term profit.

Einhorn, who owned 3.6% of GM’s common stock, proposed splitting the company’s stock into two classes, with one paying a fixed dividend and the others appreciating with the remainder of the firm’s earnings.

Einhorn claimed the plan would “unlock value” at GM, but as one of the largest shareholders, Einhorn’s Greenlight Capital stood to earn handsomely. GM shareholders shot Einhorn’s proposal down, but GM CEO Mary Barra agreed to return $7 billion to Wall Street shareholders “through buybacks and dividends,” selling off the company’s stake in its Opel and Vauxhall divisions in the process.

Most recent hedge fund push led straight to plant closures

Which brings us back to October 2018—just a month before the announcement of the Lordstown closure— where the hedge funds were circling GM yet again.

John Levin, chair of Levin Capital Strategies, took to Reuters to intone that “somebody” could be angling for a third shareholder campaign against the company, if more wasn’t done to compensate the shareholders.

Levin wasn’t alone—Reuters reporting also cited a Douglas C. Lane & Associates partner carping about how “frustrated” he was to own 2.57 million GM shares.

By the end of 2018, GM seemed to have a solution: cuts to workers and communities to pay for all the money provided to hedge fund billionaires.

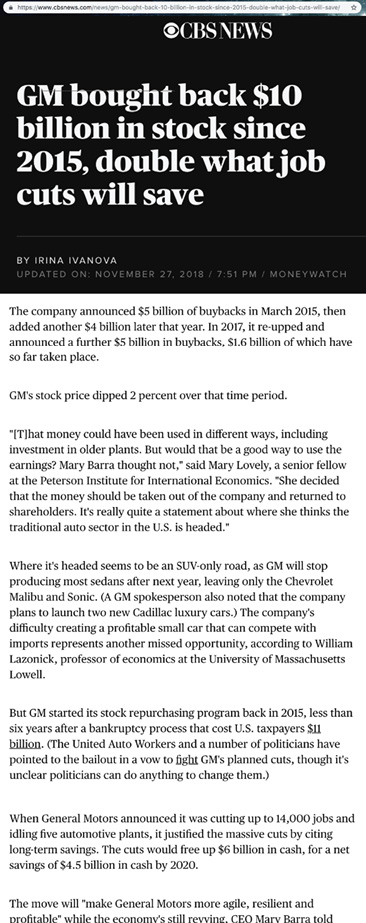

After wasting $25 billion on buybacks and dividends — including $10.6 billion in stock buybacks, the company vowed to shutter five facilitates for $4.5 billion in net savings.

Because GM management had previously authorized an additional $5bn in stock buybacks, GM actually has $4.4 billion in authorized share repurchases left unrealized.

Because GM management had previously authorized an additional $5bn in stock buybacks, GM actually has $4.4 billion in authorized share repurchases left unrealized.

That means that every dollar “saved” by plant closures and job cuts at GM could go straight into the pockets of Wall Street and billionaire hedge fund managers.

It remains to be seen whether all of the money GM is saving by shuttering these five facilities will go right into the pockets of hedge funds and other shareholders, or whether the company will reinvest any of that sum into General Motors.

MEET THE BILLIONAIRES THAT ARE KILLING JOBS AT GM

While workers, families and communities hit by plant closures at GM struggle, the billionaire hedge fund managers who have been attacking the company live in unbelievable luxury. They’re all making big bucks exploding economic inequality (and many are involved in other controversial business maneuvers).

Massive mansions in Manhattan, the Hamptons, Florida and the “hunt country” suburbs of New York, huge ranches in Texas, glitzy charity balls and pro football teams — the luxurious lives of the hedge fund managers are in stark contrast to the economic misery they’ve inflicted on thousands of Americans in Ohio, Michigan and elsewhere.

David Tepper, Appaloosa Management

- $11.6 Billion Net Worth

- Multi-million-dollar homes in Florida and the Hamptons

- Made big bucks from betting on the 2008 financial collapse

- Tepper has a net worth of $11.6 billion. He made an estimated $1.5 billion in 2017 alone.

- Appaloosa has about $15 billion in assets under management

- Tepper recently bought the Carolina Panthers for an NFL record of $2.275 billion

- Tepper paid $43 million for Jon Corzine’s Sagaponack oceanfront mansion in the Hamptons, which he promptly demolished and had an even larger mansion constructed in its place that was completed last summer.

- Tepper also purchased a glamorous home in Florida when he moved some of the offices of his hedge fund to Miami Beach

- While millions of Americans were reeling from the fallout of the 2008 financial crisis, Tepper actually profited from it. His wealth increased by nearly 500% from 2008-2015, thanks in large part to a massive bet he made on the 2008 financial collapse.

- Tepper has also been a cheerleader for school privatization. He is the founder of New Jersey education reform PAC “Better Education for Kids.”

- He is also a board member of the Robin Hood Foundation, a charity that fights poverty through a policy of “relentless monetization.”

David Einhorn, Greenlight Capital

- $1.4 billion net worth

- Makes money from toxic polluters

- Massive mansion in “horse country” outside New York City

- $1.4 billion net worth

- Greenlight Capital has $5.5 billion in assets under management

- Although he was once a high-flying hedge fund goldenboy, 2018 was a brutal year for Einhorn. His hedge fund lost 34.2%, its worst performance since Einhorn started the firm in 1996.

- Greenlight is heavily invested in CONSOL Coal Resources, a segment of coal and gas exploration company CONSOL Energy Inc. As of their last SEC filing, Greenlight owned 47% of CONSOL Coal Resources, worth about $90 million. CONSOL Energy is a fossil fuel company with a long history of environmental fines. In 2011, the Environmental Protection Agency reached a $5.5 million settlement with CONSOL Energy, over allegations “that six Consol mines violated pollution discharge limits in their Clean Water Act permits hundreds of times over the last four years.” In addition to the $5.5 million fine for the violations, CONSOL also committed $200 million to pollution controls and wastewater treatment efforts, designed to mitigate the damage their mining operations had on West Virginia waterways.

- Besides their fines for pollution, CONSOL is a member of an industry association called “American Coalition for Clean Coal Electricity” (ACCCE). The ACCCE was a major force lobbying against the EPA’s updated Mercury and Air Toxics Standards, a major update to regulations on the toxic and carcinogenic emissions from power plants, which is currently being challenged at the Supreme Court level. According to the EPA, the challenged regulations would tighten permissible emissions of methylmercury, a highly carcinogenic pollutant that is a byproduct of coal-fired power.

- Einhorn is also a school privatization cheerleader. He has contributed tens of thousands of dollars to Democrats for Education Reform

- Until his recent divorce, Einhorn lived in a 10,000 square foot home in Rye, New York.

J. Kyle Bass, Hayman Capital

- Net worth is secret

- Keeps gold bricks and platinum bars at his desk

- $60 million Texas ranch

- Dallas-based hedge fund manager J. Kyle Bass is perhaps best known for his strategies targeting the pharmaceutical industry.

- A previous Hedge Clippers investigation noted that Bass’s tactic of disputing the patents of drug stocks he is short-selling can result in even higher drug prices for everyday Americans so Bass and other billionaires can get even richer.

- Bass made hundreds of millions of dollars betting on the collapse of the U.S. housing market. That bet earned him the sobriquet “the man who sold the world.”

- Earlier last year, Bass sold his Barefoot Ranch for an undisclosed sum. It had been previously listed for $59.5 million. The ranch includes a 35,000-square-foot lodge for entertaining with a golf course, boat house on a lake, shooting ranch, paintball course and equestrian center. Each amenity at the ranch was built for entertaining residents and guests.

- He keeps gold bricks and platinum bars in his desk at Hayman.

Frank Brosens, Taconic Capital

- Net worth unknown

- Mansions in New York City and suburbs

- Vulture investor attacking Puerto Rico pushing sub-minimum wages

- Brosens was a Larry-Summers confidante and a one-time frontrunner to run the TARP program.

- Taconic Capital is one of the vulture funds seeking to profit off of Puerto Rico’s debt crisis and calling for austerity so they can get paid. Taconic was one of a handful of hedge funds that made huge purchases of subordinated bonds just after Hurricane Maria, hoping to profit from the chaos caused by the hurricane. Taconic has made an estimated $68 million off of their vulture activity in Puerto Rico.

- In 2010, Brosens and his wife Deenie bought a $6 million Sutton Place co-op from Rupert Murdoch’s ex-wife. The co-op featured 10-foot ceilings, a marble bath, a wood-paneled library and views of the city.

- Frank and his wife Deenie recently sold their 13,000 square foot Bedford, NY home for over $3 million. The house includes a tennis court and indoor pool.

Ravenel Boykin Curry IV, Eagle Capital Management

- Net worth unknown

- Currently holding 20,538,994 GM shares, valued at $687,029,000

- Multi-million-dollar apartment on Central Park South in Manhattan, glamorous Caribbean retreat in the Dominican Republic

- Boykin Curry is a major supporter of school privatization. He is a founder of Democrats for Education Reform and a former member of the Public Prep charter school network. He is the Co-Chair of Education Reform Now and a former director at of Betsy DeVos-backed Alliance for School Choice and American Federation for Children.

- Curry is one of a handful of Wall Street titans who aimed to remake New York State and aligned with Andrew Cuomo during his first run for Governor. At the time, Curry told the New York Times, ““A lot of hedge fund and finance people in New York had decided state politics was too dirty and focused on their philanthropy…I think there’s an awakening now that we can be a force in Albany, but we’ve got to play a tougher game than before.”

- Curry has an multi-million dollar apartment in the Trump Parc building at 106 Central Park South.

- Curry and his wife Celerie Kemble own Playa Grande Beach Club, a boutique hotel in the Dominican Republic, where a three-bedroom bungalow is $2,000 per night. The couple originally envision the property as a “private retreat reserved for their families, friends, and friends of friends.” Investors in the project include Charlie Rose, Fareed Zakaria, George Soros, and Mariska Hargitay.

- The couple has their own residence at the beach club, called Casa Guava. See picture from Architectural Digest below.

- “Red wine glasses were still in the sink from the previous night’s dinner party for a group that she and her husband, Ravenel Boykin Curry IV, had convened to hash out an arts program for their “creative utopia.” They are developing a planned community in the Dominican Republic that will provide weekend succor to investors like Fareed Zakaria, the editor of Newsweek International; Bronson Van Wyck, the event planner; Moby, the musician and tea shop owner; and other wealthy bohemians with an appetite for current affairs and social causes served up in a tropical paradise. Mr. Curry, a money manager and education reform advocate, and Ms. Kemble have been collecting folks like these in their Central Park South apartment for some years now, building an unlikely salon and quasi-liberal brain-and-money trust floating high above the gilt and marble of Trump Parc.”

LEGISLATIVE SOLUTIONS SECTION

New laws could outlaw stock buybacks and hedge fund attacks on American jobs

Should stock buybacks even be legal?

Should stock buybacks even be legal?

The practice of hedge funds mounting expensive campaigns to force companies into buybacks is a relatively recent phenomenon.

According to the American Prospect’s William Lazonack, the racket accelerated in the 2000s when, “[a]rmed with their huge “war chests,” these new-style corporate predators use a corrupt proxy-voting system, “wolf pack” hook-ups with other hedge funds, and once-illegal engagement with management to compel corporations to hand over profits that the hedge funds did nothing to create.”

The hedge funds that attacked GM did absolutely nothing to create the company’s profits — but they did have a huge role in destroying the 1,600 jobs in the Mahoning Valley. They also had a hand in vaporizing the $48 million in tax revenue previously contributed by the Lordstown plant alone.

And these losses of economic opportunity aren’t likely to be contained to just the workers at GM — job losses will likely ripple out from parts manufacturers who supply the plant to service jobs that depend on the salaries of those who work there.

Stock buybacks are neither an inevitable nor enduring feature of our economy — they used to be flat-out illegal.

For the majority of the last century, buybacks were deemed to be illegal market manipulation.

The ban lasted until 1982, when Ronald Regan’s SEC instituted a rule that allowed companies to legally conduct stock buybacks.

Progressive policy makers have recently revived calls to ban or restrict buybacks.

Last year, U.S. Senator Tammy Baldwin introduced the “Reward Work Act” which:

Last year, U.S. Senator Tammy Baldwin introduced the “Reward Work Act” which:

Repeals the Securities and Exchange Commission (SEC) 10b-18 rule that makes it easier for corporations to buy back their stocks…Finalized in 1982, the rule shields companies from manipulation charges when buying back their stock on the open market. In 1981, the S&P 500 spent approximately two percent of its profits on buybacks. Last year, those same companies spent 59 percent on buybacks. Now that executives are largely paid in stock, they have a direct incentive to boost prices.

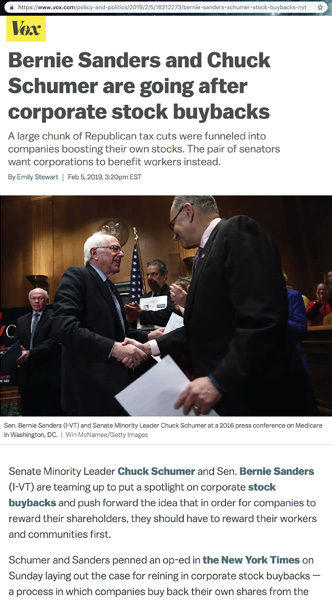

Last month, Chuck Schumer and Bernie Sanders introduced legislation that would bar companies from conducting buybacks if they didn’t provide a $15 minimum wage for their employees, paid time off, and benefits.

The Sanders-Schumer bill is an attempt to reign in the wage gap, which is a result of both stagnating worker wages and ballooning income for the very wealthy, largely generated by “stock-based pay.”

The wages of the average American are far from the only thing to suffer at the hands of buyback-obsessed corporate management and hedge fund managers. Companies also cut research and development, sacrificing long-term profitability for short-term gains.

This isn’t just the conclusion of left-leaning policymakers: Larry Fink, CEO of BlackRock, criticized this phenomenon in a 2015 letter to CEOs, urging them to reduce buybacks.

The eating of our economic seed corn has only accelerated since the Trump buybacks, which slashed corporate taxes. Take the case of Pfizer—weeks after the Trump tax cuts were announced, the company began a $10 billion buyback and dividend increase.

Weeks later, as the American Prospect pointed out, “Pfizer announced that it was halting research into drug treatments for Parkinson’s and Alzheimer’s—a move that also meant 300 layoffs.”

Should hedge funds even be legal?

Our report lays out the amazing amount of damage that hedge fund speculators have done to General Motors and to the workers and communities hit hard by GM’s plans to cut jobs and close manufacturing plants.

The Hedge Clippers campaign has previously issued 65 separate reports that explain how hedge funds have destroyed the economy, rigged the political system, hurt families and communities, exploded inequality and supported the politics of hate and division.

Senator Tammy Baldwin and other leading progressives have introduced legislation to limit hedge fund “wolf packs” like those that attacked GM, and to crack down on hedge fund abuses.

But there’s a good case to outlaw hedge funds altogether. According to journalist and author David Dayen,

Hedge funds are an artifact of history, an accident created by loophole in the 1940 Investment Company Act. It was massively expanded in the 1996 National Securities Market Improvement Act, when hedge funds got their hands on institutional money from pension funds and endowments; they grew 20-fold in the next seven years. The entire point of the New Deal reforms was to reverse giant pools of money in unregulated vehicles that don’t comply with a staggering amount of securities rules.

Legislation that amends the 1940 Investment Company Act to push super-speculative hedge fund managers back into limited business lines and the 1996 National Securities Market Improvement Act to limit investment from pension funds, endowments and other institutional investors could end the hedge funds’ reign of terror over the American economy, American workers and American communities.

********

PENSION FUND AND UNIVERSITY ENDOWMENT INVESTMENTS IN HEDGE FUNDS ATTACKING GENERAL MOTORS

The hedge funds squeezing GM rely on investments from large institutional investors–like public and private pension funds and university endowments–for capital to finance their predatory attacks. Pension funds that are meant to help public employees and other workers support themselves in retirement and university endowments that are meant to support teaching and learning may be unwittingly hurting the very people they are trying to help by investing in hedge funds responsible for plant closures and layoffs at GM.

| Hedge Fund | Known Public Pension Fund and University Endowment Investors | Known Private Pension Fund Investors |

| Eagle Capital Management LLC | (No public pension/endowment investors) | (No private pension investors) |

| Greenlight Capital | State of Delaware Board of Pension Trustees

University of Hawaii Foundation |

Berklee College of Music Retirement Plan

Intel Corporation Pension Plans American Jewish Committee Retirement Plan American Jewish Joint Distribution Committee Retirement Plan I.A.M. National Pension Fund |

| Levin Capital Strategies | (No public pension/endowment investors) | Travelers Companies Pension Plan

CNA Pension Fund Loews Corporation Pension Plan Rockwell Automation US Pension Fund |

| Douglas C. Lane & Associates | (Unknown) | (Unknown) |

| Appaloosa Management | CNA Pension Fund

Ford Pension Fund (US) Loews Corporation Pension Plan Toyota Motor Sales Pension Plan Weyerhaeuser Company Master Retirement Fund 3M Pension Plan Eli Lilly & Company Pension Plan Lorillard Tobacco Company Retirement Master Trust Orbital ATK Private Pension Fund Time Warner Pension Plan Toyota Motor Sales Pension Plan |

|

| Hayman Capital | Citigroup Pension Fund

H-E-B Investment and Retirement Plan Trust Orbital ATK Private Pension Fund |

|

| Taconic Capital | Arizona State University Foundation

Gettysburg College Endowment University of Arkansas Foundation Texas Tech University System Endowment College of Wooster Endowment Duquesne University Employees’ Retirement System of Texas Florida State Board of Administration Merced County Employees’ Retirement Association Missouri Department of Transportation & Patrol Employees’ Retirement System North Carolina Department of State Treasurer Ohio Public Employees’ Retirement System Texas County & District Retirement System Western Michigan University Foundation American University in Cairo Lewis & Clark College Endowment Massachusetts Pension Reserves Investment Management Board Missouri Local Government Employees Retirement System Stevens Institute of Technology |

Kroger Company Defined Benefit Retirement Plan

Cargill Master Retirement Trust |

- All Data obtained from Preqin