Billionaire Profiteers & Big Pharma

A new analysis shows rampant speculation by hedge fund and private equity in the branded drugs that are rising fastest in price

It’s not just one highly unethical man: dozens of high-flying financial speculators at hedge funds and private equity firms are driving up the price of pharmaceuticals across the country.

The now-infamous Martin Shkreli recently became the target of extremely well deserved worldwide scorn.[1]

Shkreli, a 32-year old hedge-fund-manager-turned-pharmaceutical-executive, bought the rights to Daraprim, a toxoplasmosis drug often required by women, men and children with immune systems weakened by diseases like HIV/AIDS. After acquiring the drug rights, Shkreli increased the price by 5,000% to $750 per pill.[2]

» read more

The ensuing backlash against Shkreli has brought much needed attention to the problem of price gouging in the pharmaceutical industry.

Given the increased scrutiny, we think that it is only appropriate to point out that this problem extends far beyond the actions of just one disgraced hedge fund manager/pharmaceutical executive:

the hedge fund winner-take-all mentality and method is behind almost all of the worst, most exploitative drug price increases.

Out of the twenty-five drugs with the fastest-rising prices over the past two years, twenty are owned or have been acquired by firms with significant activity from hedge fund, private equity, or venture capital firms.

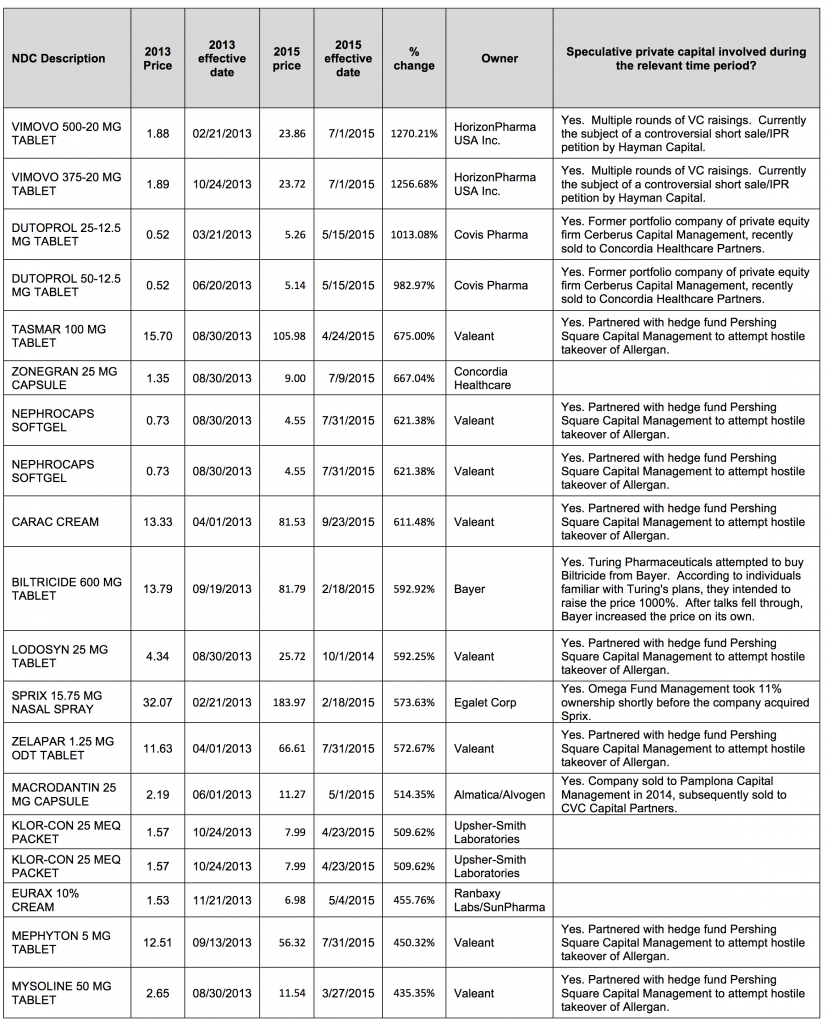

HEDGE FUND/PRIVATE EQUITY MANIPULATION LEADS TO MASSIVE DRUG-PRICE SPIKES

When looking at the top twenty-five branded drugs that have increased most in price over the past two years, a very obvious pattern emerges – and the fingerprints of exploitative hedge fund and private equity managers are clearly observable.

The table below shows the branded pharmaceuticals that have increased the most in the Medicaid National Average Drug Acquisition Cost (NADAC) survey over the previous two years.

Among the top twenty-five drugs, twenty of them have seen significant activity from hedge funds, private equity, and other deep-pocketed speculators.[3]

Out of the twenty-five drugs with the fastest-rising prices over the past two years, twenty are owned or have been acquired by firms with significant activity from hedge fund, private equity, or venture capital firms during the relevant time period.

Yes, you read that right: 80% of the drugs with the fastest-rising prices were involved in hedge fund, private equity or similar speculative attacks in the past two years.

The exact circumstances of each deal varies, but the outcome is always the same: branded pharmaceuticals — drugs for which no lower-cost generic alternative drug exists — see their prices increase many times over to satisfy the greed of speculative investors.

Often, the catalyst for price increase isn’t related to medical or productions costs. Drugs like Sprix nasal spray or Vimovo have rocketed in price after an ownership change made possible by private investment.

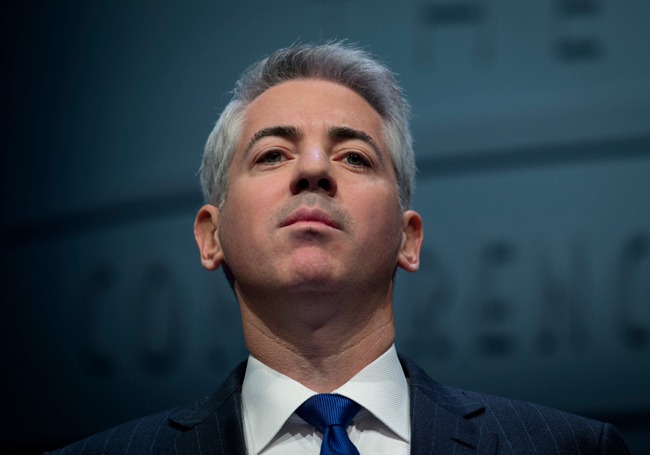

HEDGE FUND BILLIONAIRE BILL ACKMAN: HIS VALEANT/ALLERGAN PLAY EXPODES DRUG COSTS FOR ORDINARY AMERICANS

One company that stands out in all this is Valeant, a drug manufacturer that partnered in 2014 with a hedge fund called Pershing Square Capital Management to attempt the takeover of Allergan, another pharmaceutical company.

While Valeant and Pershing Square kept increasing their bids for Allergan, the price of Valeant’s branded drugs increased in near lockstep.

Billionaire hedge fund manager William “Bill” Ackman runs Pershing Square, and his manipulative moves exploded prices for medications needed by ordinary Americans – Americans who aren’t billionaires, and who can’t afford to pay billionaire prices for their medications.

Valeant produces twelve of the twenty-five branded drugs that have increase most in price over the past two years. Among the top fifty, Valeant produces twenty-seven.

Ackman’s hedge fund attack on pharmaceuticals is implicated in over half of the top fifty fastest drug price increases in America.

Given that branded drugs are essentially a license to print money, it appears that Valeant was pumping up the prices of these medications to finance the Allergan takeover attempt – and/or to ensure big profits for billionaire hedge fund manager Ackman.

THE EXPLOITATION GAME: VENTURE CAPITAL, HORIZON PHARMA AND THE 1200% PRICE INCREASE

Looking back at the data on the pharmaceuticals with the largest price increases in the past two years, Horizon Pharma’s Vimovo is at the very top of the list.

Horizon Pharma acquired the arthritis drug from AstraZeneca in November 2013 – just after Horizon partnered with a wrecking crew of voracious venture capitalists.[4]

Prior to the purchase, Horizon Pharma had done a series of venture capital raisings, beginning in 2005. By November 2013, the company had raised $204 million from FirstMark Capital, Scale Venture Partners, Sutter Hill Ventures, Essex Woodlands, TVM Capital, Kreos Capital, Oxford Finance Corporation, and Silicon Valley Bank.[5]

The Vimovo acquisition follows a pattern similar to other pharmaceutical purchases made by companies with hedge fund, private equity, or venture backing.

- Speculative private capital is used is used to acquire an existing branded drug from an established pharmaceutical company.

- Because the drug is branded, no generic exists, and the producer is granted a monopoly on the sale of the drug.

- Once the acquisition is completed, the company drastically increases the price of the pharmaceutical.

- Because no generic exists, customers who need the drug are forced to accept any price dictated by the companies.

The only winners in this game are the pharmaceutical companies and their financiers: the hedge funds, private equity firms, and the venture capitalists. These speculators stand to make fortunes.

Following the acquisition of Vimovo from AstraZeneca, the Horizon Pharma didn’t immediately begin marketing the drug. The Medicaid National Average Drug Acquisition Cost survey shows that the national average per-unit price of Vimovo stayed relatively flat, before spiking in early March 2014.

One possible reason for the delay: Horizon Pharma didn’t actually begin selling Vimovo until the first quarter of 2014.[6]

By March 2014, Vimovo was selling at an average national cost that was 600% higher than AstraZeneca was selling it for just months earlier. By early 2015, the drug had risen to 1200% of the price it sold for under AstraZeneca’s ownership.[7]

Pharmaceutical companies like to justify the existence of the twenty year monopolies granted to branded drugs like Vimovo, by pointing out that they spend “vast sums of money on research and development… and that monopolies and high prices are a ‘necessary evil’ needed to finance innovation of new medicines.”[8]

But the Vimovo case, like the other examples outlined in this paper, show that these monopolies are being exploited by financiers who see them merely as a license to print money and add to their billions in wealth — at the expense of the public, and at the expense of public health.

HEDGE FUND VS. HEDGE FUND BATTLES DRIVE DRUG PRICES EVEN HIGHER: MEET J. KYLE BASS

Before Martin Shkreli started Turing Pharmaceuticals he was a hedge fund manager who specialized in short selling, or betting that the price of a stock will decrease.

By itself, there isn’t anything wrong with this practice. But when investors take steps to drive down the share price of stocks that they are shorting, short selling can feel manipulative, even if it isn’t exactly illegal.

According to a complaint filed by Citizens for Responsibility and Ethics in Washington (CREW), Martin Shkreli’s hedge fund was aggressively smearing pharmaceutical and biotech companies on blogs and in regulatory hearings, in an attempt to drive down share prices and earn millions.[9]

Hedge fund manager J. Kyle Bass has taken this technique to its absolute extreme.

Bass, who heads Hayman Capital Management, has begun disputing the patents of drugs that he’s shorting, taking advantage of 2011 legislation aimed at stopping “patent trolls.”

The new law allows uninterested parties – including hedge fund billionaires — to petition for review of an existing patent.

Sometimes this type of review can help consumers. But in the winner-take-all economy dominated by exploitative hedge funds, it can result in even higher drug prices for everyday Americans so billionaires can get even richer.

The petition review process is now being gamed by short sellers like Hayman Capital, who can use their significant bankroll to file for an administrative “inter partes review” (IPR) hearings of drugs patents held by companies that they are shorting.

Petitioners for review in IPR hearings have something of a home court advantage, as 77% of IPR decisions have resulted in patent invalidation.[10] Sometimes, the news of the filing is enough to cause the stock price to fall.[11]

In May 2015, a non-profit connected to J. Kyle Bass filed for inter partes review against Vimovo.[12] While Hayman Capital’s short/IPR play may result in the overturning of Horizon’s Vimovo patent, it’s just as likely it stress the finances of Horizon enough to make Hayman’s maneuver profitable—and possibly enough to cause Vimovo’s price to further increase. In fact, since Bass initiated this strategy against Vimovo, the price has increased roughly 5%.[13]

HEDGE FUND BILLIONAIRE ACKMAN AND VALEANT FOCUS ON CASH BALANCE, NOT ETHICAL BALANCE

Back to Valeant: one of the firms at the center of one of the most talked-about hedge fund deals of the past decade.

In April 2014, Pershing Square Capital Management, a hedge fund founded by William Ackman, announced that it had teamed up with Valeant to attempt a hostile takeover of rival pharmaceutical company Allergan, the maker of Botox.[14]

Of the top 25 branded pharmaceuticals to increase most in price between 2013-2015, drugs produced by Valeant comprised almost half. Disturbingly, much of the increase in price occurred after the April 2014 takeover offer became public.

Since partnering with Pershing Square Capital Management, twelve branded drugs produced by Valeant were among the top 25 fastest increasing in price over the previous two years.

These twelve drugs jumped an average of 377.844% since Ackman and Pershing Square moved in to Valeant in April 2014.[15]

Expanding that list to the top 50 fastest increasing pharmaceuticals, Valeant produced drugs accounted for more than half of the list.

| Valeant drug | Sept. 2015 price | Effective | April 2014 price | Effective | Increase |

| TASMAR 100 MG TABLET | 105.98456 | 04/24/2015 | 21.99783 | 02/28/14 | 481.796% |

| NEPHROCAPS SOFTGEL | 4.55069 | 07/31/2015 | 0.89415 | 03/19/14 | 508.940% |

| NEPHROCAPS SOFTGEL | 4.55069 | 07/31/2015 | 0.89415 | 03/19/14 | 508.940% |

| CARAC CREAM | 79.7234 | 09/23/2015 | 16.13312 | 12/03/13 | 494.160% |

| LODOSYN 25 MG TABLET | 25.72063 | 10/01/2014 | 9.89255 | 01/31/14 | 260.000% |

| ZELAPAR 1.25 MG ODT TABLET | 66.60936 | 07/31/2015 | 15.12077 | 02/28/14 | 440.516% |

| MEPHYTON 5 MG TABLET | 56.31558 | 07/31/2015 | 18.44587 | 02/28/14 | 305.302% |

| MYSOLINE 50 MG TABLET | 11.54474 | 03/27/2015 | 3.46589 | 02/28/14 | 333.096% |

| MESTINON 60 MG/5 ML SYRUP | 1.99296 | 05/29/2015 | 0.64746 | 02/28/14 | 307.812% |

| MESTINON 60 MG TABLET | 11.67044 | 05/29/2015 | 3.7914 | 02/28/14 | 307.813% |

| MESTINON 180 MG TIMESPAN | 22.30385 | 05/29/2015 | 7.24595 | 02/28/14 | 307.811% |

| EDECRIN 25 MG TABLET | 21.74587 | 07/31/2015 | 7.82382 | 02/28/14 | 277.944% |

Nephrocaps are included twice because Medicaid identifies them with separate NDC numbers

Why the rapid increase in price? Two factors may help explain it.

First, while these drugs were surging in price, Valeant was raising capital to fund their hostile takeover attempt of Allergan.

Second, these are branded drugs—compounds for which no generic yet exists in the U.S. market. For pharmaceutical companies, these are essentially a license to print money.

After the initial $47bn offer by Valeant and their hedge fund partner was rebuffed, the company upped the ante to $49.4bn in March.[16] By October, Valeant was offering nearly $60bn.[17]

The company’s 10-K shows a declining cash balance during this time, leading to the question of whether or not branded drug prices were increased to raise cash for the possibility of an Allergan acquisition.[18]

When it comes to raising prices, the sky is essentially the limit for branded pharmaceuticals. As Valeant has noted in their own annual report, branded pharmaceuticals operate in markets that are entirely isolated from economic pressures.[19]

From 2013 the end of 2014, Valeant’s revenues and operating income surged, propelling the company from a $400mn loss in 2013 to a $2 billion profit.[20]

As for the takeover deal, that is something of a scandal in and of itself.

Bill Ackman, the hedge fund manager who helped Valeant finance their takeover attempt, amassed a 9.7% stake in Allergan through direct stock purchases and derivatives. Questions have been raised as to whether this acquisition was informed by material non-public information.[21]

For Valeant, Ackman’s large acquisition may have forced their offer price higher, as Allergan’s share price rose a reported 22% during Ackman’s buying frenzy.[22]

In early 2015, news of an SEC investigation into “whether some activist investors illegally teamed up to target companies without properly disclosing their alliances,” an inquiry that some speculate may be related to the Valeant/Allergan attempt.[23]

HEDGE FUNDS UP THE NOSE: SPECULATIVE INVESTMENT DRIVES 573% PRICE SPIKE

Sprix nasal spray is an NSAID painkiller produced for short-term pain relief.[24] From February 2013 through February 2015, the price of Sprix increased 573%.

Nearly the entirety of the price increase happened between November 2014, when Sprix cost $34.78 per unit, and January 2015, when it hit $177.03 per unit.[25] Understanding Sprix’s ownership is key to understanding why this increase happened.

On January 7, 2015 a company called Egalet Corporation purchased Sprix from Luitpold Pharmaceuticals.[26] Following this acquisition, Egalet stated in its investor materials that it had increased the wholesale price of Sprix “from $185 to $942 for one box of five bottles.”[27]

This is an increase of 500% in the purchase price, for what appears to be no reason other than the new company needed to repay the debts it took on to acquire this drug.

The purchase of Sprix was financed with a $15mn debt financing provided by venture debt firm Hercules Technology Growth Capital.[28] The financing agreement requires Egalet to pay Hercules Technology Growth Capital an interest rate that cannot drop below 9.40%, but can rise significantly if interest rates spike.[29]

Perhaps more suspicious is the strange timing of a sizeable investment in Egalet by Omega Fund Management, a hedge fund where a former Egalet director was a partner.

The timing of the price increase also coincides with Omega Fund Management’s disclosure that it had increased its stake in Egalet to 11%, which was disclosed as of December 31, 2014.[30] At the time of the disclosure, Egalet’s board of directors included Renee Aguiar-Lucander, a partner at Omega Fund Management.[31]

The SEC database does not appear to show Omega Fund Management as having a Form 13 ownership disclosure filing for Egalet prior to the one covering the period ending December 31, 2014.[32]

PAINFUL PRIVATE EQUITY INFECTION SENDS DRUG PRICE SOARING

Macrodantin is a branded treatment for urinary tract infections. Alvogen currently holds the trademark for the drug,[33] and the treatment has been re-popularized by its success in fighting off drug-resistant strains of certain UTI-causing bacteria.[34]

In 2014, Alovgen founder Robert Wesserman sold a majority stake in the firm to Pamplona Capital Management, a private equity firm.[35] [36]

Slightly more than two weeks later, the surveyed price of the drug hit $7.60 per pricing unit, a nearly four-fold increase over the last price reported in the NADAC database.[37]

In 2015, Pamplona sold their share in the firm to CVC Capital Partners and Temasek, two private equity firms.[38] Over the course of these transfers, the price of Macrodantin increased an additional 48%.

PRIVATE-EQUITY-DRIVEN PRICE SPIKES FOR BLOOD PRESSURE MEDS

Dutoprol is a combination medication used in the treatment of high blood pressure. The drug was purchased from Astra Zeneca in 2014, by a portfolio company of Cerberus Capital Management, a private equity firm that has been critiqued for other healthcare investments.

Since the acquisition, this private equity-backed pharmaceutical firm has increased the price of Dutoprol ten times over.

In 2010, an expose by Mark Ames detailed Cerberus’s near-monopoly on the for-profit blood plasma market.[39]

Cerberus has also made a foray into the for-profit hospital market, purchasing Caritas Christi Health Care in Massachusetts, the state’s second-largest hospital chain that was previously operated as a charity hospital.[40]

Cerberus’s activities in other industries have also been the subject of criticism. The firm invested in Chrysler in 2007, with fateful timing that saw the company enter bankruptcy the next year.[41] Cerberus is reported to have “deployed a corps of lobbyists and former government officials to secure a bailout” for Chrysler. Their success amounted to a taxpayer subsidy for the private equity firm.[42]

The firm also earned scorn for their ownership of Freedom Group, one of the nation’s largest gun manufacturers.[43]

Covis Pharmaceuticals was taken private by a consortium of private equity investors including Cerberus Capital Management, in June 2011.[44] Dutoprol was originally developed by AstraZeneca, who sold the drug to Covis in 2014.[45]

Prior to the acquisition by Covis, Dutoprol was selling for .52327 per unit, according to the Medicaid cost survey from 6/30/2013.

Post-acquisition, the drug increased tenfold in price, making it the second-fastest branded-medication price increase over the past two years. In March 2015, Cerberus sold the company to Concordia Healthcare Partners.[46]

Footnotes

[1] http://www.bbc.com/news/world-us-canada-34331761

[2] http://www.usatoday.com/story/money/business/2015/09/23/turing-pharmaceuticals-ceo-martin-shkreli-will-lower-price-of-daraprim/72670124/

[3] Taken from a comparison of NADAC weekly data from November 2013 to September 2015. Duplicate drugs appear due to different dosage levels.

http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Pharmacy-Pricing.html

[4] http://ir.horizon-pharma.com/releasedetail.cfm?releaseid=808237

[5] Preqin.com

[6] http://ir.horizon-pharma.com/releasedetail.cfm?releaseid=808237

[7] http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Pharmacy-Pricing.html

[8] http://www.theguardian.com/commentisfree/2013/feb/22/hiv-aids-deaths-pharmaceutical-industry

[9] http://www.citizensforethics.org/page/-/PDFs/Legal/Investigation/7-9-12_Shkreli_NY_US_Attorney_Letter.pdf?nocdn=1

[10] http://www.wsj.com/articles/hedge-fund-manager-kyle-bass-challenges-jazz-pharmaceuticals-patent-1428417408

[11] http://www.businessinsider.com/kyle-bass-files-first-ipr-petition-2015-2

[12] http://www.managingip.com/Article/3455945/Kyle-Bass-files-15th-IPR-targeting-patent-for-Vimovo-treatment.html

[13] http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Pharmacy-Pricing.html

[14] http://www.bloomberg.com/news/articles/2014-04-21/valeant-ackman-said-to-team-up-for-takeover-of-allergan

[15] http://www.forbes.com/sites/nathanvardi/2015/03/09/bill-ackman-is-playing-valeant-again-and-this-time-he-owns-the-stock/

[16] http://www.bloomberg.com/news/articles/2014-05-28/valeant-raises-takeover-offer-for-allergan-with-more-cash

[17] http://dealbook.nytimes.com/2014/10/07/valeant-and-pershing-square-to-raise-offer-for-botox-maker-allergan/?_r=0

[18] http://d1lge852tjjqow.cloudfront.net/CIK-0000885590/04b1aea1-4197-484b-9d0c-e4489f52839f.pdf?noexit=true See page 27

[19] “when a branded product loses its market exclusivity, it normally faces intense price competition from generic forms of the product.” Page 24, 2014 10-K

[20] http://d1lge852tjjqow.cloudfront.net/CIK-0000885590/04b1aea1-4197-484b-9d0c-e4489f52839f.pdf?noexit=true

[21] http://www.bloomberg.com/news/articles/2014-11-08/ackman-s-allergan-court-victory-may-still-cause-legal-headaches

[22] http://business.financialpost.com/news/fp-street/questions-may-open-new-chapter-on-valeant-ackmans-failed-bid-for-allergan

[23] http://www.wsj.com/articles/sec-investigating-valeant-ackmans-pursuit-of-allergan-1408037409

[24] http://egalet.com/our-products/

[25] NADAC weekly surveys from November 2014 to January 2015.

[26] http://globenewswire.com/news-release/2015/01/08/695948/10114621/en/Egalet-Acquires-Licenses-Two-Innovative-Approved-Pain-Products.html

[27] http://www.streetinsider.com/SEC+Filings/Form+8-K+Egalet+Corp+For%3A+Jan+07/10160676.html

[28] http://globenewswire.com/news-release/2015/01/08/695948/10114621/en/Egalet-Acquires-Licenses-Two-Innovative-Approved-Pain-Products.html

[29] https://www.sec.gov/Archives/edgar/data/1586105/000110465915036243/a15-7224_110q.htm

[30] http://whalewisdom.com/stock/eglt-2

[31] http://web.archive.org/web/20150224092724/http://egalet.com/about-egalet/board-of-directors/

[32] http://www.sec.gov/Archives/edgar/data/1637359/000095012315004059/0000950123-15-004059-index.htm

[33] https://trademarks.justia.com/733/41/macrodantin-73341387.html

[34] http://www.nbcnews.com/id/39504585/ns/health-infectious_diseases/t/drug-resistant-bladder-bug-raises-growing-concerns/

[35] http://www.alvogen.com/newsroom/read/pamplona-capital-management-acquires-stake-in-alvogen

[36] http://www.reuters.com/article/2015/06/22/us-alvogen-m-a-cvc-exclusive-idUSKBN0P20JF20150622

[37] Macrodantin does not appear to have been recorded in the NADAC survey between 6/1/2013 and 2/19/2014.

[38] http://www.reuters.com/article/2015/06/22/us-alvogen-m-a-cvc-exclusive-idUSKBN0P20JF20150622

[39] http://www.alternet.org/story/145044/cerberus_capital%3A_literally_blood-sucking_the_poor_to_make_their_billions

[40] http://www.boston.com/business/healthcare/articles/2010/03/25/equity_firm_set_to_buy_caritas/

[41] http://www.nytimes.com/2009/08/09/business/09cerb.html?_r=0

[42] http://money.cnn.com/2009/05/05/news/companies/chrysler_loans/

[43] http://www.huffingtonpost.com/john-rosenthal/cerberus-capital-profitin_b_4072807.html

[44] Preqin.com

[45] http://concordiarx.com/wp-content/uploads/Covis-Asset-Acquisition-.pdf

[46] http://pitchbook.com/Daily_Newsletter.html?nid=XY5CMSTGYCNC6