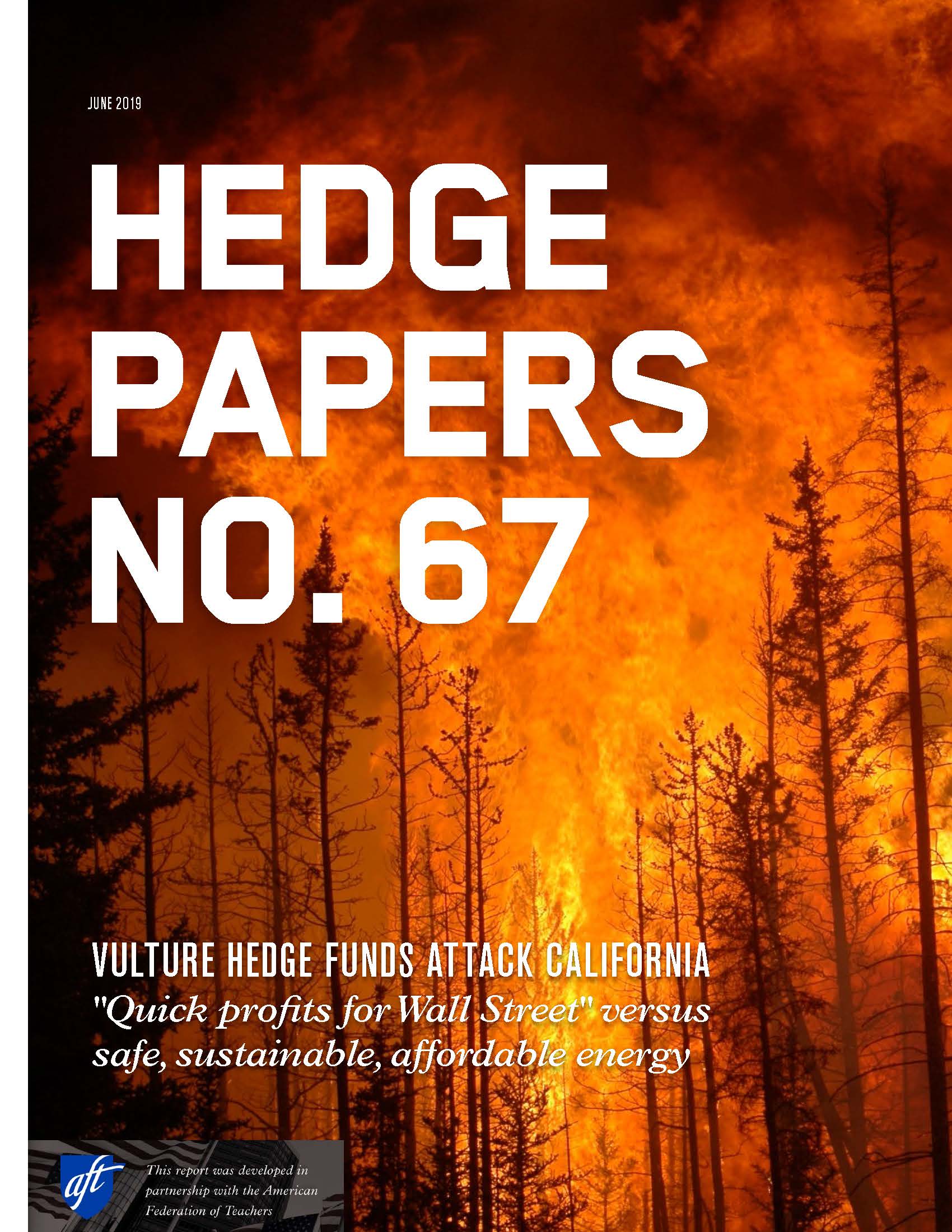

VULTURE HEDGE FUNDS ATTACK CALIFORNIA – “Quick profits for Wall Street” versus safe, sustainable, affordable energy

Dozens of hedge funds are now speculating in shares of PG&E, the huge California utility, with several high-profile vulture funds demanding seats on the board and fighting for control of the company.

PG&E was plunged into bankruptcy after decades of irresponsible corporate practices led to massive wildfires and billions in new liabilities.

Now hedge funds are circling the company, seeking to plunder and profit regardless of the impact on workers and communities — the same way they’ve attacked schools and students in Puerto Rico, and the same way they’ve attacked autoworkers from GM and their families in Lordstown, Ohio and Hamtramck, Michigan.

Hedge funds don’t have the best interests of everyday Californians in mind. They want huge, short-term profits, like they do in every deal.

Some of the most notorious vulture fund billionaires are circling around PG&E, including Dan Loeb, Paul Singer and Seth Klarman

This report will provide information showing that hedge fund control of PG&E is likely to increase the danger of more fires and more climate crises for California communities.

This report will provide information showing that hedge fund control of PG&E is likely to increase the danger of more fires and more climate crises for California communities.

Hedge fund control of PG&E almost certainly will drive up utility rates, hitting homeowners, renters and small businesses in the pocketbook.

And hedge fund control of PG&E will harm California’s efforts to move towards environmental sustainability and a clean energy future, due to their predatory, profit-driven business model.

It’s the latest example of hedge funds using their economic power to force short-term payouts that make billionaires richer but hurt regular American workers and communities.

California should be able to deal with safety, affordability and a green energy future without attacks from hedge funds.

PG&E shareholders should block hedge fund control of the company.

And Washington lawmakers should pass legislation to outlaw hedge funds once and for all, so they can’t attack our communities ever again.

IRRESPONSIBILITY ON WILDFIRES LEADS TO MASSIVE LIABILITIES

Pacific Gas & Electric is California’s largest utility, with 16 million customers in Northern and Central California.[1] The company has been implicated in a set of a set of wildfires of increasing frequency and severity over the last several years that have razed hundreds of thousands of acres and caused numerous fatalities.[2]

[IMAGES of Camp Fire — perhaps from Twitter]

According to reporting in The New York Times, “Five of the 10 most destructive fires in California since 2015 have been linked to PG&E’s electrical network. Regulators have found that in many fires, PG&E violated state law or could have done more to make its equipment safer.”[3]

In 2015, a 70,000-acre fire in the Sacramento area was caused by PG&E’s failure to maintain a tree, which fell into its power lines; the fire resulted in two deaths.[4] Over the next three years, PG&E’s lack of attention to maintaining equipment contributed to other fires much larger in scope:

- Wildfires in Northern California in 2017 that covered 245,000 acres, destroyed 8,900 structures and caused 44 deaths.[5]

- The largest wildfire in California’s history, known as the Camp fire, caused by a loose live wire that was 25 years past what the company deemed its “useful life.”[6] The Camp fire resulted in 86 deaths, and nearly 14,000 houses and 4,850 buildings destroyed. [7]

Facing liability for these 2017 and 2018 fires estimated in excess of $30 billion, PG&E announced in January, 2019 that it would file for Chapter 11 bankruptcy,[8] claiming over $50 billion in debts. [9] Chapter 11 bankruptcy allows the company to continue operating while it works with creditors to devise a plan to pay its debts—a plan that ultimately must be approved by the bankruptcy court.

BANKRUPTCY AS A WEAPON AGAINST CONSUMERS AND THE ENVIRONMENT

The bankruptcy filing by the largest utility in the most populous state has raised criticism by some shareholders, analysts and public advocates, who point to PG&E’s steady flow of income from ratepayers,[10] $1.5 billion in cash and cash equivalents on hand, its stated ability to raise significant capital, and the long horizon over which wildfire liabilities will come due.[11] Other critics suggest that PG&E is going into bankruptcy to get permission from a bankruptcy court to do things—like raise rates for consumers—that the California General Assembly and the California Public Utilities Commission wouldn’t allow. [12]

Loretta Lynch, who was President of the Public Utilities Commission in 2001 when PG&E last filed for bankruptcy, told the Los Angeles Times that the latest bankruptcy echoes the last one:

“PG&E was sitting in dough, the ratepayers were paying and paying, all the creditors were happy, everybody was a pig at the trough. And who paid? The California ratepayer. Why wouldn’t you want to try that again?…They’ve created this crisis as part of their corporate strategy.”[13]

PREDATORY HEDGE FUNDS MAKE EVERYTHING WORSE

However, PG&E’s 2019 bankruptcy filing could end up far worse for ratepayers and the people of California than the previous one, because this time dozens of predatory hedge funds are involved, using their billions and status as creditors to push for an outcome that puts the most money in their pockets—at the expense of consumers, wildfire victims, public safety and the environment.

These hedge funds are using the same playbook they’ve used in Argentina, Detroit, Puerto Rico to take advantage of a perceived crisis to extract as much wealth as possible from PG&E, with little interest in making changes at the company to benefit citizens and shareholders in the long term.

Hedge funds are designed to be complex and opaque, and are also lightly regulated—meaning that the vulture funds preying on California’s largest public utility have been able to do so largely out of sight of the public.

However, this report outlines several ways in which hedge funds are seeking to influence bankruptcy proceedings and the direction of PG&E so that creditors can profit:

As shareholders. Hedge funds make up fourteen of the top twenty shareholders in PG&E, and many more own a significant number of shares.[14] (For a more complete list of hedge fund shareholders, see Table 1 on page __).

As debt investors. While ownership of publicly-traded debt and other claims against a company are not made public, news reports suggest that a group of twenty-four investors in PG&E’s debt, called the Committee of Senior Unsecured Noteholders, includes a number of hedge funds, including Paul Singer’s Elliott Management Corp. and Jay Wintrob’s Oaktree Capital Management;[15] other news reports identify Andrew Feldstein’s BlueMountain Group and Dan Loeb’s Third Point as owning significant portions of the utility’s debt.[16]

Through insurance claims purchases. Billionaire hedge fund manager Seth Klarman of Baupost Group purchased $1 billion of legal claims in November that an insurer held against PG&E; this allows his hedge fund to recover wildfire losses against the company.[17]

As board nominees. A number of hedge funds used hostile takeover tactics to get three hedge fund representatives named to the new board of directors slate, which will be voted on by shareholders at the PG&E annual meeting on June 21, 2019. In March 2019, hedge fund investor BlueMountain, which owns about 11 million shares in PG&E,[18] announced a 13-member slate to the PG&E board. BlueMountain has publicly criticized the company’s bankruptcy filing as unneeded, stating that the move would be ultimately harmful to investors.[19]

In April, PG&E announced its own slate, composed in consultation with and approved by three hedge fund investors, Abrams Capital Management, Knighthead Capital Management and Redwood Capital Management.[20] The proposed slate includes three hedge fund managers with dubious experience in improving safety and compliance at publicly traded companies, calling into question their ability to make changes at the company that take into account public safety, consumers and the environment

Governor Newsom sounded the alarm regarding potential hedge fund leadership at PG&E, stating in a letter to PG&E CEO: “I am troubled to learn that PG&E is primed to reconstitute its board with hedge fund financiers, out-of-state executives and others with little or no experience in California and inadequate expertise in utility operations, regulation and safety. With this move, PG&E would send a clear message that it is prioritizing quick profits for Wall Street over public safety and reliable and affordable energy service.”[21]

The three hedge fund managers named to the current PG&E board slate, to be voted on at the annual shareholder meeting on June 21, 2019, are:

- Dominique Mielle, a former Partner and Senior Portfolio Manager at Canyon Capital Advisors.

- Kenneth Liang, Senior Managing Director and Head of Restructurings at Oaktree Capital.

- Richard Barrera, Co-Founder and CEO, Roystone Capital Management and former Partner, Redwood Capital Management.

It’s not a coincidence that a long list of hedge funds have set their sights on PG&E.

According to reporting in the Wall Street Journal, “[d]iscussions about PG&E became a fixture of ‘idea dinners,’ where hedge-fund managers discuss companies and markets.” At these dinners, the Journal reported, “[m]any of the funds were betting on possible legislative and regulatory action that could limit PG&E’s wildfire liability.”[22]

Among the tactics that hedge funds are promoting to minimize costs for PG&E to maximize the flow of dollars into their own pockets:

- Downplaying the costs associated with wildfire liabilities. Hedge fund BlueMountain Capital is pressing PG&E to appeal judgments for the 2017/2018 wildfire claims, dragging their feet on the firm’s responsibility for the wildfires. According to BlueMountain Capital partner Omar Vaishnavi, “[e]ven when a decision happens against the company in the future, the company could appeal that decision, which means that these cases could go on for four or five, even up to 10 years in some cases,”[23] also noting that there are “multiple avenues to reduce those liabilities from that $30 billion figure to something much lower than that.”[24] Vaishnavi’s view likely reflects the hedge fund consensus on PG&E.

- Issuing long-term debt to pay off wildfire liabilities. In their communications to shareholders, BlueMountain Capital suggested that PG&E consider “securitization for stranded costs,” i.e. spinning out some of the utility’s profitable portions and loading up PG&E with debt—which hardly seem like a good fix as far as ratepayers are concerned.[25]

This option is the result of recent legal changes allowing utilities to issue such debt starting in 2019,[26] which also created a loophole that failed to protect Californians from private equity and hedge fund profiteering. While the newly-enacted law prevents executive compensation (including bonuses) from being paid for by ratepayers, it fails to prevent share buybacks, dividends, and recapitalizations from being paid for by ratepayers,[27] all of which the hedge funds are likely to push for at PG&E to increase their profits.

PG&E has a history of irresponsible corporate behavior, and this will only be exacerbated by hedge funds using their status as shareholders, creditors and board members to exert control over the company. Ratepayers, elected officials, consumer and environmental advocates and investors have all expressed deep concerns about the various ways that hedge funds are attempting to profit from PG&E’s legal and financial woes, predicting that Wall Street’s influence will only make the company more focused on putting money in investors’ pockets.

This report will expose the hedge fund actors who are poised to profit handsomely from PG&E’s bankruptcy, and the disastrous consequences hedge fund control of PG&E will have for safety, ratepayers, wildfire victims and survivors, and the environment.

MEET THE BILLIONAIRES PREYING ON PG&E

Some of the most notorious hedge fund vultures are using their role as investors to make sure PG&E’s bankruptcy leads to big profits for their firms–at the expense of ratepayers, public safety and the environment. Meet some of the hedge funds putting their billions to work in ways that harm the people of California and communities across the globe.

Andrew Feldstein, CEO, BlueMountain Capital

Hedge fund BlueMountain Capital is one of the top ten institutional shareholders of PG&E, with over 11 million shares.[28] CEO Andrew Feldstein has a long career in the hedge fund world, but is perhaps most famous for betting against JP Morgan Chase’s $6 billion “London Whale” trading loss in 2011. The loss, tied to the same type of recklessness and speculation that caused the 2008 financial crisis, put consumers and the public at risk[29]–but Feldstein made an estimated $300 million on his bet.[30]

Hedge fund BlueMountain Capital is one of the top ten institutional shareholders of PG&E, with over 11 million shares.[28] CEO Andrew Feldstein has a long career in the hedge fund world, but is perhaps most famous for betting against JP Morgan Chase’s $6 billion “London Whale” trading loss in 2011. The loss, tied to the same type of recklessness and speculation that caused the 2008 financial crisis, put consumers and the public at risk[29]–but Feldstein made an estimated $300 million on his bet.[30]

BlueMountain has publicly criticized the company’s bankruptcy filing as unnecessary and detrimental to investors.[31] In March 2019, BlueMountain announced a 13-member slate of nominees for the PG&E board, and has laid out several possible avenues for increasing PG&E profitability, including selling some of the company’s profitable portions and loading it up with debt.[32]

ValueAct Capital, whose CEO Jeff Ubben was vying for nomination to the PG&E board under the BlueMountain slate,[33] was a member of a group named ‘Coalition to Preserve California Business,’ which sought to oppose a seventeen percent tax hike on hedge funds and private equity managers.[34] The proposed tax increase on the wealthiest individuals and enterprises in California would generate significant funds that could be deployed to prevent future wildfires, among other programs to benefit the public good.

According to a recent report by the American Federation of Teachers, BlueMountain Capital is the owner of Corizon Health, the nation’s largest correctional healthcare company which has been named in over 600 malpractice lawsuits since 2011, including serious allegations of medical neglect.[35] Corizon has paid out tens of millions of dollars in settlements over the years, including a record 2015 settlement of $8.3 million for not conducting intake health screenings, a failure to provide basic care that led to an inmate’s death.[36] Another inmate died in 2017 of a rare fungal brain infection, after Corizon ignored his reported symptoms for eight months, resulting in the inmate experiencing a “staggeringly slow, physically and mentally excruciating death.”[37]

BlueMountain Capital is also part of a group of hedge fund managers that purchased Puerto Rican debt bonds in an attempt to profit from the island’s economic crisis.[38] Feldstein serves on the board of Upper West Success Academy,[39] part of the Success Academy network of charter schools that funnels funds away from traditional public schools.

Joshua S. Friedman, Canyon Capital Partners

Former Goldman Sachs banker Joshua Friedman founded Canyon Capital Partners in 1990, and in 2014 landed on Forbes’ “ten youngest hedge fund billionaires” list.[40] Friedman has donated tens of thousands to the Republican party over the years, including $35,000 to climate change-denier Paul Ryan’s victory fund in 2016,[41] and is a national council member of the American Enterprise Institute, the largest neoconservative think tank.[42]

Former Goldman Sachs banker Joshua Friedman founded Canyon Capital Partners in 1990, and in 2014 landed on Forbes’ “ten youngest hedge fund billionaires” list.[40] Friedman has donated tens of thousands to the Republican party over the years, including $35,000 to climate change-denier Paul Ryan’s victory fund in 2016,[41] and is a national council member of the American Enterprise Institute, the largest neoconservative think tank.[42]

Canyon Capital Partners, one of the lead investors in PG&E, has plenty of experience extracting concessions from so-called distressed assets. A veteran of both the Argentinian debt crisis and the Puerto Rico COFINA bond fight, Canyon’s leadership know how to make a fortune buying troubled debt.[43] The fund also has no problem using the legal system to its advantage, having sued the city of Los Angeles in 2016 for forcing tax overpayments.[44] Earlier this year, Canyon was rebuffed in their attempt to takeover troubled student loan servicer Navient.[45]

In 2018, Canyon Capital contributed $15,000 to ‘Coalition to Preserve California Business,’ the front group opposing tax increases on hedge funds and private equity managers in California, in 2018.[46] The proposed tax increase legislation failed, effectively depriving the state of revenue that could be used to prevent wildfires and support other public safety measures.

Former Canyon Capital Partner and Senior Portfolio Manager Dominique Mielle is one of three hedge fund managers on the proposed PG&E board slate.[47] Mielle was a member of the creditors’ group of hedge fund investors in Puerto Rico that pushed for extreme austerity measures on the island so that the hedge funds, including Canyon Capital Advisors, could maximize profits.[48] Canyon Capital pursued a similar distressed debt playbook in the economic crises of Detroit, Greece and Argentina.[49]

Paul Singer, Elliott Management

Some hedge funds have built up major positions in PG&E’s debt, and are hoping to coordinate actions as an unofficial creditors committee. Leading the charge is Elliott Management, a hedge fund run by billionaire Republican financier Paul Singer. This archetypal “vulture fund” has extracted profits from the Argentine fiscal crisis, the poverty stricken Democratic Republic of Congo, and the 2005 bankruptcy of auto parts maker Delphi.[50]

Some hedge funds have built up major positions in PG&E’s debt, and are hoping to coordinate actions as an unofficial creditors committee. Leading the charge is Elliott Management, a hedge fund run by billionaire Republican financier Paul Singer. This archetypal “vulture fund” has extracted profits from the Argentine fiscal crisis, the poverty stricken Democratic Republic of Congo, and the 2005 bankruptcy of auto parts maker Delphi.[50]

Essentially, Elliott purchases debt of troubled companies or nations at a deep discount, and uses the legal system to extract a handsome profit. Describing Elliott Management’s debt investing strategy in a 2018 profile, the New Yorker noted that Elliott’s strategy required “a methodical use of the legal system, filing suits to obtain payments, or a long journey through bankruptcy court, where creditors fight over who gets paid back first.”[51]

In their fights with sovereign nations, Paul Singer’s activities have been criticized for prioritizing payouts to hedge funds above the human rights of citizens.[52] According to a February 2019 report prepared for the Human Rights Council and Advisory Committee of the United Nations High Commissioner for Human Rights, Singer’s actions in Argentina, where he demanded billions in payouts on defaulted Argentine bonds he purchased for $48.7mn, Argentina’s settlement with Elliott Management “may hinder the State in complying with its obligations in the area of economic and social rights, thereby also exacerbating inequality and financial instability.”[53]

Singer, who reportedly played keys in an all-white reggae band,[54] has earned billions by squeezing defaulted borrowers. And he’s parlayed those billions into a life of hobnobbing with Republican party elites.

Singer chairs the anti-union, climate science denying, Manhattan Institute.[55] A Republican rainmaker, Singer has been involved in several of the most gutterball campaigns of the 21st century, from Swiftboat Veterans for Truth to the 2016 Steele Dossier.[56] At a recent Manhattan Institute gala, the septuagenarian billionaire crowed about the resurgence of socialism.[57]

Dan Loeb, Third Point Capital

Another hedge fund manager reported to be piling into the debt side of the PG&E trade is Dan Loeb and his Third Point fund.[58] After a disappointing performance in 2018,[59] Loeb is likely looking to earn a healthy return on the troubled utility.

Another hedge fund manager reported to be piling into the debt side of the PG&E trade is Dan Loeb and his Third Point fund.[58] After a disappointing performance in 2018,[59] Loeb is likely looking to earn a healthy return on the troubled utility.

Like Singer, Loeb spends his billions supporting Republican political candidates. Loeb is extremely online, and has frequently taken to Facebook to compare various people he doesn’t like to the Klu Klux Klan (notable among Loeb’s KKK comparisons: public servants and Sen. Andrea Stewart-Cousins, the highest ranking black elected official in New York).[60]

Loeb might be angling to make serious money from one of California’s largest utilities, but in his private life he spends lavishly to support politicians who undermine the state’s major policy prerogatives. Since Trump’s election, Loeb has donated $2.4mn to congressional Republicans and Republican-supporting PACs. Congressional Republicans have frustrated nearly every attempt to address global warming, blocking both the formation of a climate change committee and the Green New Deal.[61]

Jay Wintrob, Oaktree Capital Management

Oaktree Capital Management is one of several investors in PG&E’s debt. Technically, Oaktree is playing both sides of the balance sheet, with a reported 1.2mn in PG&E stock and $128.8mn in bonds.[62]

Oaktree Capital Management is one of several investors in PG&E’s debt. Technically, Oaktree is playing both sides of the balance sheet, with a reported 1.2mn in PG&E stock and $128.8mn in bonds.[62]

A publicly traded private equity firm, Oaktree is no stranger to profiting from the public good—according to an analysis by Good Jobs First, Oaktree subsidiaries have received subsidies worth $22.5mn since 1992.[63] In Los Angeles, Oaktree executives have been major supporters of charter school expansion, so much so that the Alliance to Reclaim Our Schools held a teach-in at their Los Angeles offices during the UTLA strike.[64]

Oaktree Capital, whose senior managing director Kenneth Liang was nominated to the PG&E board, gave $15,000 to ‘Coalition to Preserve California Business,’[65] which sought to oppose a seventeen percent tax hike on hedge funds and private equity managers.[66]

Oaktree Capital is a Puerto Rican debt holder and pushed for the island to prioritize paying its hedge fund investors at the expense of residents.[67] Oaktree Capital also profited greatly from the U.S. foreclosure crisis by buying residential properties and renting them out;[68] a 2017 piece in the Baltimore Sun illustrated how Oaktree Capital used tactics like aggressive evictions and other tactics to profit from the foreclosure crisis.[69]

Oaktree CEO Jay Wintrob is on the board of the charter-school promoting Broad Foundation,[70] whose 2016 plan to increase the number of Los Angeles charter schools by 260 was unanimously opposed by the LA school board, on the grounds that it would significantly harm the school district’s finances.[71]

Seth Klarman, Baupost Group

Baupost Group, run by billionaire Seth Klarman, purchased $1 billion of legal claims in November that an insurer held against PG&E; the hedge fund also purchased $873 million worth of PG&E stock in 2018 as a hedge against the share value.[72]

Baupost Group, run by billionaire Seth Klarman, purchased $1 billion of legal claims in November that an insurer held against PG&E; the hedge fund also purchased $873 million worth of PG&E stock in 2018 as a hedge against the share value.[72]

Klarman is accustomed to being on both sides of a deal–in 2014, he made the naming donation to Harvard University’s conference center, while also managing funds for the university’s endowment. His donation was tax exempt, yet his hedge fund collected fees on Harvard’s invested dollars, constituting a conflict of interest at best.[73]

Baupost is also one of the main owners of Puerto Rico’s COFINA bond debt, investing nearly $1 billion and using shell companies to disguise its involvement.[74] Recent bankruptcy proceedings suggest that Baupost could profit $170 million, while Puerto Ricans must endure higher sales tax and other austerity measures.[75]

Richard Barrera, Roystone Capital Management

Barrera, CEO and Co-Founder of Roystone Capital Management and former Partner, Redwood Capital Management is one of three hedge fund managers named to the PG&E board.

Barrera, CEO and Co-Founder of Roystone Capital Management and former Partner, Redwood Capital Management is one of three hedge fund managers named to the PG&E board.

Barrera’s over two decades in the finance industry do not appear to include any experience in improving safety and compliance for troubled companies, requisite qualifications for any proposed board member. Barrera is, however, a board member of Success Academy Charter Schools,[76] a NYC-based charter school chain that has been criticized for weeding out difficult students and enforcing harsh disciplinary policies on its largely low-income, black and Hispanic student population.[77]

HOW CALIFORNIANS WILL GET HURT

Impact on public safety

PG&E’s lack of attention to safety has already been implicated in California wildfires in 2015, 2017 and 2018 that caused 132 deaths and destroyed hundreds of thousands of acres. Yet PG&E’s excruciatingly poor safety record goes back decades.

In 1996, the company paid a then-record $333 million to settle a suit brought by residents of Hinkley, California, whose groundwater was contaminated with cancer-causing chemicals stored by PG&E in nearby unlined pits in the 1960s.[78] This case, made famous in the Academy Award-winning 2000 film Erin Brockovich, did not appear to lead to safer practices by PG&E: by 2013, the toxic water had reportedly spread to more wells than before the original suit, opening PG&E to more lawsuits and rendering Hinkley a “ghost town.”[79]

In 2015, PG&E paid a record $1.6 billion fine to the Public Utilities Commission for failing to ensure the safety of its gas transmission lines. Two years later, PG&E was convicted on six felony charges and fined $3 million for not complying with gas transmission safety laws.[80] And in 2018, the Public Utilities Commission accused PG&E of falsifying safety records over a recent five-year period, stating:

“A CPUC [report] alleges that PG&E falsified locate and mark records from 2012 to 2017. Specifically the report finds that PG&E: lacked sufficient staffing to locate and mark natural gas pipelines in compliance with law; pressured supervisors and locators to complete the work resulting in PG&E staff falsifying data so requests for pipeline locating and marking would not appear as late; had common knowledge among its supervisors that locators falsified data; and received input from external parties that there were discrepancies in its late locate and mark reporting.”[81]

Clearly, much of PG&E’s financial troubles stem from the company’s failure to adequately invest in safety measures that would keep its equipment and infrastructure from causing harm, and the impact on the people of California has been profound. Wall Street investors in PG&E are largely short-term focused, raising serious concerns that the company will pay even less attention to safety under the helm of hedge fund managers.

As California Governor Gavin Newsom wrote in a recent public letter to PG&E interim CCEO John Simon, the addition of hedge fund managers and others with little safety expertise to the PG&E board “would send a clear message that it is prioritizing quick profits for Wall Street over public safety and reliable and affordable energy service.” [82]

Impact on ratepayers

One very probable outcome of the hedge fund takeover of PG&E is that ratepayers will see large increases to their utility bills.

This was the case with PG&E’s 2001 bankruptcy, which saw the utility placed under bankruptcy court protection for three years, with $7bn in costs passed to ratepayers.[83]

In the 2001 bankruptcy, PG&E was only $9bn in debt. In 2019, the utility company is staring down an estimated $30bn in wildfire-related losses, and a gaggle of hedge funds is seeking to extract significant profits.

By taking the company into bankruptcy, PG&E has created a situation where the bankruptcy court “will be obligated to prioritize the interest of PG&E’s creditors (several of whom are hedge funds) rather than ratepayers or fire victims.”[84]

Thus one very plausible outcome of the PG&E bankruptcy is rate increases for consumers. The company’s 2001 Chapter 11 bankruptcy filing left the company under U.S. bankruptcy court protection for three years.

According to Mindy Spatt of the Utility Reform Network, “Basically, what ended up happening is that our rates went up to cover PG&E’s debt,” [85] with PG&E’s $7 billion in debt being passed on to ratepayers, costing the average consumer $1,300 to $1,700.[86] Before filing for bankruptcy, PG&E asked the Public Utilities Commission for permission to raise rates 6.4 percent;[87] the bankruptcy process may make similar or larger rate increases a reality.

WHEN HEDGE FUNDS ATTACK: LESSONS FROM PUERTO RICO

A more recent example that should serve as a warning to California is the Puerto Rico Electric Power Authority (PREPA), which in April reached a deal to settle more than $8 billion in debt. Like with PG&E, hedge funds swooped into Puerto Rico during the island’s economic crisis and bought large amounts of debt, with the intention of using their wealth and power to extract settlement terms that favored creditors.

In fact, PG&E vultures Elliott Management, Canyon Capital, Baupost Group, and Oaktree Capital Management, among others,are also Puerto Rican debt holders that pushed for austerity measures on the island (where over half of all children live in poverty[88]) in order to increase their profits.

The deal between the Financial Oversight and Management Board for Puerto Rico and PREPA bondholders—including BlueMountain Capital and Knighthead Capital Management[89]— calls for customers to pay an annual per-kilowatt hour charge through 2067, which amounts to Puerto Ricans paying more than $23 billion over this period.[90]

Effectively, rates will increase 13% over the next twelve months, with the average residential household paying an extra $130 per year by 2021 and an extra $220 per year by 2043. PREPA bondholders, however, were granted a favorable lien position in the deal, ensuring that every ratepayer dollar goes to paying off the debt. [91]

In addition to astronomical rate increases designed to flow into the pockets of hedge fund vultures, the PREPA deal is also troubling because it undermines Puerto Rico’s new energy policy, crafted in response to power failures resulting from Hurricane Maria, which seeks to create a more decentralized power supply.

Under the PREPA agreement, even residents and businesses that generate their own electricity—for example, through environmentally-friendly solar panels—will have to pay the debt charge. [92] In the case of Puerto Rico’s financially troubled utility, Wall Street bondholders literally went so far as to tax the sun in order to maximize their return on investment.

Increased hedge fund control of PG&E may also impact ratepayers through tax base erosion. PG&E is a major franchise fee payer, paying municipalities for the right to use publicly owned gas and electric distribution infrastructure. It’s not unforeseeable that the bankruptcy and subsequent hedge fund takeover could result in the renegotiation of franchise fees, as well as more aggressive tax reduction strategies.[93] Should this happen, municipalities will experience a drop in revenues and may have to increase taxes on residents and/or cut services to make up for the shortfall.

Sustainability/climate

PG&E has blamed its wildfire costs, in part, on climate change, which scientists say is contributing to bigger and hotter fires in California and across the western United States.[94]

The company’s bankruptcy filing, however, means that it will be more likely to focus on returning cash to investors than on doing necessary maintenance and taking preventative measures to prevent future wildfires. [95] It will also make it less likely that PG&E will be able to increase its share of renewable energy sourcing, which currently comprises one third of the company’s electricity mix.[96] This in turn could impact California’s goal of being 100% carbon-free by 2045.[97]

Even more troubling, many of the hedge fund managers aiming to profit from PG&E’s bankruptcy proceedings have deep ties to the fossil fuel industry, with billions of dollars invested in oil, natural gas and coal companies that have had serious safety and environmental violations, and prominent positions with dirty energy-funded think tanks:

Paul Singer of Elliott Management has about 10% of his fund’s holdings invested in the energy sector.[98] His dirty energy holdings include Hess Corporation, a Fortune 100 crude oil and natural gas company. Elliott Management also owns over 11 million shares in Sempra Energy,[99] a California-based energy infrastructure firm. In 2015, the largest natural gas leak in U.S. history took place at a Sempra-owned natural gas storage field near Los Angeles, causing thousands to evacuate the area for months and costing the company an estimated $1 billion. The Public Utilities Commission issued a report finding that Sempra had not taken enough measures to prevent leaks, causing at least 60 leaks over the last few decades.[100]

Previous reporting by Hedge Clippers revealed that in 2013, Singer’s gave $200,000 to the Copenhagen Consensus Center (CCC) – a think tank run by one of the world’s most prominent climate change skeptics and fossil fuel advocates. Between 1998 and 2015, Singer and his employees gave over $1.1 million to climate change denying politicians. $95,000 came from Singer alone.[101]

Previous reporting by Hedge Clippers revealed that in 2013, Singer’s gave $200,000 to the Copenhagen Consensus Center (CCC) – a think tank run by one of the world’s most prominent climate change skeptics and fossil fuel advocates. Between 1998 and 2015, Singer and his employees gave over $1.1 million to climate change denying politicians. $95,000 came from Singer alone.[101]

Paul Singer is also a GOP megadonor who originally opposed Trump’s candidacy for President, then shortly after his election donated $1 million to the president-elect’s naugural committee.[102] Trump–who famously denied the role of climate change in the California Camp Fire, suggesting that it was caused by insufficient “raking”[103]–is also attempting to block California’s ability to regulate greenhouse gas emissions.[104] In March 2019, it was revealed that the conservative Manhattan Institute, chaired by Singer, was behind Trump’s unsupported claim that the Green New Deal would cost $100 Trillion.[105]

Dan Loeb of Third Point currently owns over $200 million worth of shares of Marathon Petroleum Corporation,[106] which has settled numerous violations with the Environmental Protection Agency over the years.[107] Residents of the zip code where its Southwest Detroit facility is located have asthma and cancer rates much higher than the rest of the U.S., yet Marathon Petroleum Corporation is seeking exemption from a city ordinance that would limit emissions at the plant.[108]

According to a previous Hedge Clippers report, in 2006, Loeb led an activist investor push in 2006 targeting Massey Energy, the largest coal producer in Central Appalachia led by CEO and infamous “Coal Baron” Don Blankenship, who in 2015 was sentenced to a year in prison for conspiring to violate federal mine safety standards related to a 2010 mine explosion that killed 29 mineworkers.[109] Loeb later joined the Massey board, a position he held for about a year. Loeb is associated with the American Enterprise Institute, an ExxonMobil-funded think tank that supports research undermining climate change, and a former Trustee of the Manhattan Institute, a conservative think tank that often advocates for the fossil fuel industry.

PROTECT CALIFORNIANS — AND ALL AMERICANS — FROM PREDATORY HEDGE FUND ATTACKS

PG&E should be run by California environmental, energy & consumer leaders — not Wall Street hedge funds

Hedge Clippers supports California Governor Gavin Newsom’s call for PG&E to assure that its directors “who have experience as regulators, safety experts and clean energy leaders.[110]”

California should impose a “carried interest fairness fee” on hedge fund and private equity managers to invest in schools, jobs and communities

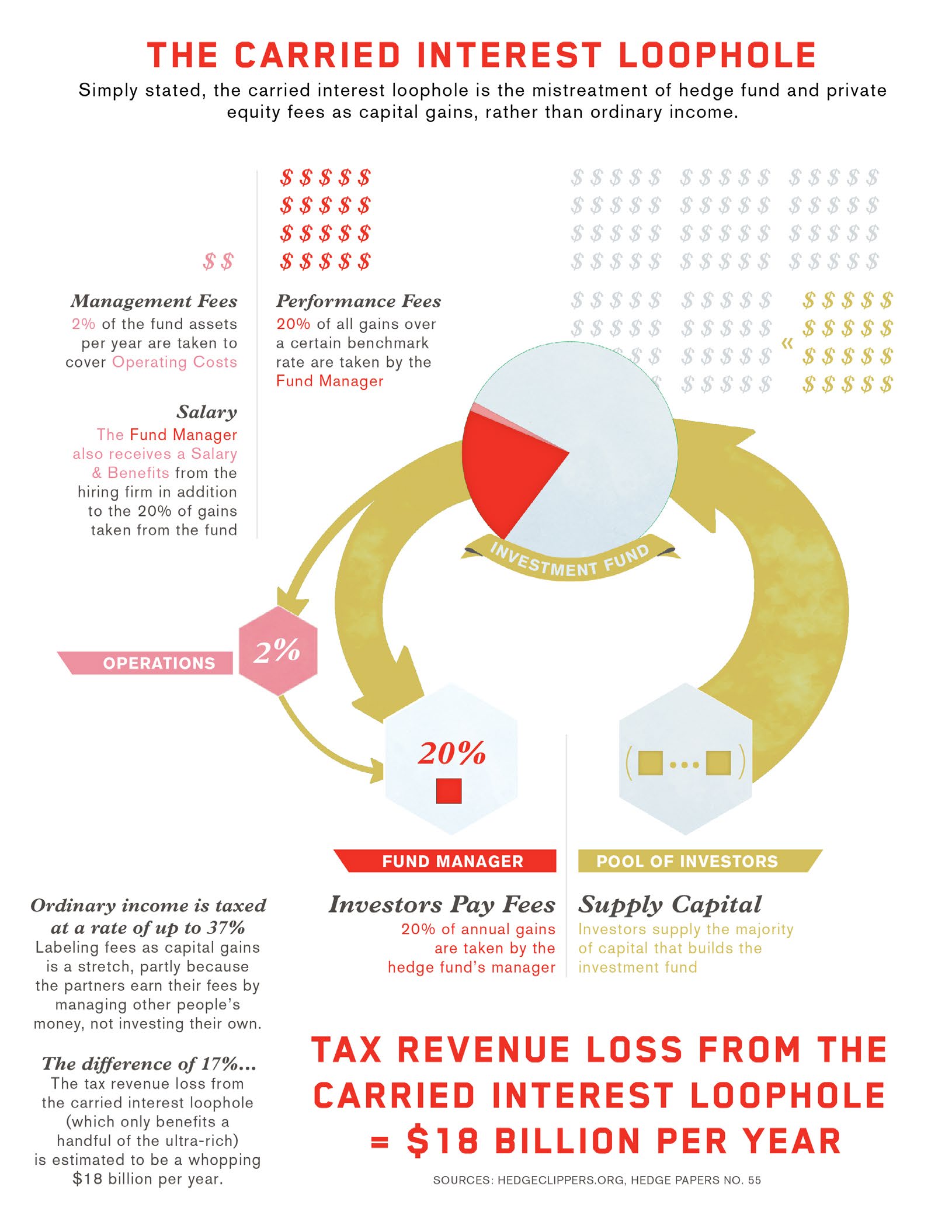

The carried interest loophole is among the most costly and wasteful tax loopholes out there.

It’s a massive giveaway to hedge fund and private equity firms that costs federal taxpayers $18 billion each year.

Here’s how it works: These firms charge their investors fees for managing their money, but rather than classifying this as income they deem it carried interest, allowing them to pay lower tax rates[111].

Despite agreement from economists and tax experts across the political system that the carried interest loophole should be closed, Trump and Republicans have refused to touch it.

Instead, in the new federal tax law, Trump and Republicans chose to increase the trillions of dollars going to billionaires and corporations while threatening vital investments in housing, education and healthcare[112].

While the GOP-controlled Washington has failed to act, California can reclaim some of that lost revenue. It’s time for a renewed push on legislation introduced last year[113] to fairly tax carried interest in California — it could raise over $1.2 billion a year for schools, jobs and community needs across the state[114].

Hedge funds should be illegal

This r eport lays out the amazing amount of damage that hedge fund speculators have done to the environment and the climate, through investments in fossil fuels, and to workers and communities, through deman ds for short-term payoffs at the expense of others.

eport lays out the amazing amount of damage that hedge fund speculators have done to the environment and the climate, through investments in fossil fuels, and to workers and communities, through deman ds for short-term payoffs at the expense of others.

The Hedge Clippers campaign has previously issued 66 separate reports that explain how hedge funds have destroyed the economy, rigged the political system, hurt families and communities, exploded inequality and supported the politics of hate and division.[115]

Senator Tammy Baldwin and other leading progressives have introduced legislation to limit hedge fund “wolf packs” like those that attacked GM, and to crack down on hedge fund abuses[116].

But there’s a good case to outlaw hedge funds altogether. According to journalist and author David Dayen,

Hedge funds are an artifact of history, an accident created by loophole in the 1940 Investment Company Act. It was massively expanded in the 1996 National Securities Market Improvement Act, when hedge funds got their hands on institutional money from pension funds and endowments; they grew 20-fold in the next seven years. The entire point of the New Deal reforms was to reverse giant pools of money in unregulated vehicles that don’t comply with a staggering amount of securities rules.[117]

Legislation that amends the 1940 Investment Company Act to push super-speculative hedge fund managers back into limited business lines and the 1996 National Securities Market Improvement Act to limit investment from pension funds, endowments and other institutional investors could end the hedge funds’ reign of terror over the American economy, American workers and American communities.

It’s time to pass legislation in Congress that will outlaw hedge funds and protect all Americans from attacks by greedy billionaires that hurt our communities, our economy, our environment and our future.

Table 1: Hedge funds that own one million or more shares of PG&E:[118]

[1] https://www.kcra.com/article/how-a-pgande-bankruptcy-could-impact-you/25897672

[2] https://www.nytimes.com/interactive/2019/03/18/business/pge-california-wildfires.html

[3] https://www.nytimes.com/interactive/2019/03/18/business/pge-california-wildfires.html

[4] https://www.nytimes.com/interactive/2019/03/18/business/pge-california-wildfires.html

[5] https://www.pge.com/pge_global/common/pdfs/about-pge/company-information/reorganization/reorganization-8-K.pdf

[6] https://www.nytimes.com/interactive/2019/03/18/business/pge-california-wildfires.html

[7] https://www.pge.com/pge_global/common/pdfs/about-pge/company-information/reorganization/reorganization-8-K.pdf

[8] https://www.cpuc.ca.gov/pgechapter11/

[9] https://www.mercurynews.com/2019/05/17/pge-sets-meeting-amid-fury-over-wildfire-woes-hefty-executive-paydays/

[10]https://www.bloomberg.com/news/articles/2019-01-29/pg-e-had-rescue-options-here-s-why-it-chose-bankruptcy-instead

[11] https://www.latimes.com/business/la-fi-does-pge-need-bankruptcy-20190124-story.html

[12] https://www.latimes.com/business/la-fi-does-pge-need-bankruptcy-20190124-story.html

[13] https://www.latimes.com/business/la-fi-does-pge-need-bankruptcy-20190124-story.html

[14] As of the most recent quarter ended March 31, 2019. SEC form 13F, filed May 16, 2019.

[15] https://www.bloomberg.com/news/articles/2019-03-06/pimco-elliott-top-list-of-pg-e-bondholders-in-bankruptcy-case

[16] https://finance.yahoo.com/news/hedge-funds-love-pacific-gas-160654527.html

[17] https://www.bloomberg.com/news/articles/2019-01-14/baupost-is-said-to-buy-1-billion-in-insurance-claims-on-pg-e

[18] As of the most recent quarter ended March 31, 2019.

[19]https://www.reuters.com/article/us-pg-e-us-bankruptcy-bluemountain/bluemountain-names-slate-for-pge-board-idUSKCN1QI4Q1

[20] https://www.nytimes.com/2019/04/03/business/pacific-gas-electric-new-ceo.html

[21]https://abc7news.com/politics/gov-newsoms-rips-pg-e-in-letter-about-its-consideration-for-new-board-of-directors-/5225160/

[22] https://www.wsj.com/articles/popular-hedge-fund-bet-on-pg-e-upended-by-californias-deadliest-fire-11547477495

[23] https://www.kqed.org/news/11719917/pge-says-bankruptcy-could-take-3-years-as-shareholders-fight-filing

[24] https://www.kqed.org/news/11719917/pge-says-bankruptcy-could-take-3-years-as-shareholders-fight-filing

[25]https://www.bluemountaincapital.com/wp-content/uploads/2019/01/BlueMountain-letter-to-PGE-Shareholders-dated-1.24.19.pdf

[26] https://www.kqed.org/news/11689873/california-legislature-passes-major-reforms-to-wildfire-law

[27] https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201720180SB901

[28] As of March 31, 2019. BlueMountain Capital SEC form 13F, filed May 16, 2019.

[29] https://www.nytimes.com/2013/03/22/opinion/after-the-london-whale.html

[30]https://www.investmentnews.com/article/20120703/FREE/120709984/ex-jpmorgan-exec-made-killing-off-whale-of-a-mistake

[31]https://www.reuters.com/article/us-pg-e-us-bankruptcy-bluemountain/bluemountain-names-slate-for-pge-board-idUSKCN1QI4Q1

[32] https://www.bluemountaincapital.com/wp-content/uploads/2019/01/BlueMountain-letter-to-PGE-Shareholders-dated-1.24.19.pdf

[33] https://www.bluemountaincapital.com/wp-content/uploads/2019/03/BlueMountain-Press-Release-3.1.19.pdf

[34] https://calmatters.org/articles/newsletters/california-taxes-child-poverty-hunger-bauer-valadao/

[35] https://www.aft.org/sites/default/files/private-prisons-invest-2019-part2.pdf

[36] https://www.aft.org/sites/default/files/private-prisons-invest-2019-part2.pdf

[37] https://www.aft.org/sites/default/files/private-prisons-invest-2019-part2.pdf

[38] https://www.vanityfair.com/news/2017/10/puerto-rico-hurricane-debt-creditors

[39] https://littlesis.org/org/128203-Upper_West_Success_Academy

[40] http://investingchannel.com/article/312713/10-Youngest-Hedge-Fund-Billionaires#.XPluaIhKjIU

[41] https://littlesis.org/person/50141-Joshua_S_Friedman

[42] https://littlesis.org/person/50141-Joshua_S_Friedman

[43] https://news.littlesis.org/2018/11/20/the-cofina-agreement-part-2-profits-for-the-few/

[44] https://www.law360.com/articles/818918

[45] https://www.cnbc.com/2019/02/19/navient-rejects-3point2-billion-takeover-bid-from-canyon-capital-and-platinum-equity.html

[46] http://cal-access.sos.ca.gov/PDFGen/pdfgen.prg?filingid=2308230&amendid=0

[47] https://www.sfchronicle.com/business/article/PG-E-names-Tennessee-utility-head-as-new-CEO-13739775.php

[48] http://inthesetimes.com/features/puerto_rico_debt_bond_holders_vulture_funds_named.html

[49] https://prospect.org/article/how-hedge-funds-are-pillaging-puerto-rico

[50] https://www.bisnow.com/london/news/capital-markets/activist-investors-in-real-estate-sure-have-changed-a-lot-92079

[51] https://www.newyorker.com/magazine/2018/08/27/paul-singer-doomsday-investor

[52] https://www.ohchr.org/Documents/HRBodies/HRCouncil/AdvisoryCom/Session22/A_HRC_AC_22_CRP.1.docx

[53] https://www.ohchr.org/Documents/HRBodies/HRCouncil/AdvisoryCom/Session22/A_HRC_AC_22_CRP.1.docx

[54] https://dealbreaker.com/2017/06/paul-singers-reputation-destroyed-by-admission-that-he-played-keys-in-an-all-white-reggae-band

[55] https://www.manhattan-institute.org/board-of-trustees

[56] https://www.institutionalinvestor.com/article/b15d9s2xbmkr99/paul-singers-fight-for-the-soul-of-the-gop

[57] https://www.cnbc.com/2019/05/03/paul-singer-goes-on-offense-against-democrats-ahead-of-2020-election.html

[58] https://seekingalpha.com/news/3458108-third-point-lists-pg-and-e-among-top-positions-bloomberg

[59] https://www.cnbc.com/2019/01/03/another-hedge-fund-all-star-struggled-last-year-with-dan-loeb-down-11percent.html

[60] https://www.cityandstateny.com/articles/opinion/dan-loeb-and-the-political-price-of-racism.html

[61] https://thehill.com/blogs/floor-action/senate/435969-senate-gop-blocks-formation-of-climate-change-committee ; https://www.npr.org/2019/03/26/705897344/green-new-deal-vote-sets-up-climate-change-as-key-2020-issue

[62] https://www.bloomberg.com/news/articles/2019-03-06/pimco-elliott-top-list-of-pg-e-bondholders-in-bankruptcy-case

[63] https://subsidytracker.goodjobsfirst.org/parent/oaktree-capital-management

[64] https://www.utla.net/news/organized-parent-power-helps-win-our-strike

[65] http://cal-access.sos.ca.gov/PDFGen/pdfgen.prg?filingid=2308230&amendid=0

[66] https://calmatters.org/articles/newsletters/california-taxes-child-poverty-hunger-bauer-valadao/

[67] https://prospect.org/article/how-hedge-funds-are-pillaging-puerto-rico

[68] http://hedgeclippers.org/hedge-papers-no-56-california-hedge-funds-and-their-billion-dollar-tax-loophole/#meet-oaktree

[69] https://www.baltimoresun.com/news/opinion/oped/bs-ed-oaktree-20170327-story.html

[70] https://www.oaktreecapital.com/people/bio/jay-wintrob

[71]http://hedgeclippers.org/hedgepapers-no-29-hidden-donations-brought-to-light-how-the-wealthy-elite-tried-to-defeat-proposition-30/

[72] https://www.bloomberg.com/news/articles/2019-01-14/baupost-is-said-to-buy-1-billion-in-insurance-claims-on-pg-e

[73] http://hedgeclippers.org/endangered-endowments/

[74] https://www.businessinsider.com/puerto-rico-seth-klarman-baupost-owns-1-billion-worth-of-bonds-2017-10

[75] https://prospect.org/article/hedge-funds-win-puerto-ricans-lose-first-debt-restructuring-deal

[76] https://www.successacademies.org/about/board-of-directors/

[77] https://www.newyorker.com/magazine/2017/12/11/success-academys-radical-educational-experiment

[78] https://www.latimes.com/local/california/la-me-hinkley-20150413-story.html

[79] https://www.sfgate.com/science/article/Toxic-plume-spreads-PG-amp-E-faces-2nd-Hinkley-4688046.php

[80] https://www.npr.org/2018/12/14/677003961/pg-e-falsified-gas-pipeline-safety-records-regulators-say

[81] https://www.npr.org/2018/12/14/677003961/pg-e-falsified-gas-pipeline-safety-records-regulators-say

[82] https://www.apnews.com/ff5a5a5ba57041ab8495e78e66ec2a80

[83] https://www.forbes.com/sites/morgansimon/2019/01/18/if-pge-goes-bankrupt-who-benefits-not-us/#61feb8192d90 ; https://www.kqed.org/news/11718176/what-does-pges-bankruptcy-mean-for-you

[84] https://slate.com/business/2019/01/pge-bankruptcy-fire-victims-corporate-responsibility-solar-energy.html Parenthetical added by author.

[85] https://www.kqed.org/news/11718176/what-does-pges-bankruptcy-mean-for-you

[86] https://www.kcbx.org/post/calmatters-what-happens-if-pge-goes-bankrupt#stream/0

[87] https://www.kqed.org/news/11718176/what-does-pges-bankruptcy-mean-for-you

[88] https://www.pewresearch.org/fact-tank/2017/03/29/key-findings-about-puerto-rico/

[89] http://periodismoinvestigativo.com/2015/07/map-of-the-players-and-their-positions-in-the-puerto-rico-debt-game/

[90]https://caribbeanbusiness.com/ieefa-update-under-prepas-new-debt-deal-electricity-prices-will-rise-13-by-next-summer-in-puerto-rico/

[91]https://caribbeanbusiness.com/ieefa-update-under-prepas-new-debt-deal-electricity-prices-will-rise-13-by-next-summer-in-puerto-rico/

[92]https://caribbeanbusiness.com/ieefa-update-under-prepas-new-debt-deal-electricity-prices-will-rise-13-by-next-summer-in-puerto-rico/

[93] http://www.pgecorp.com/corp_responsibility/reports/2017/bu01_pge_overview.html

[94] https://www.latimes.com/business/la-fi-pge-bankruptcy-filing-20190129-story.html

[95]https://www.forbes.com/sites/morgansimon/2019/01/18/if-pge-goes-bankrupt-who-benefits-not-us/#621a6d5d2d90

[96]https://www.forbes.com/sites/arielcohen/2019/02/08/part-ii-pge-negligence-jeopardizes-californias-green-energy-future/#764497767d98

[97]https://www.forbes.com/sites/arielcohen/2019/02/08/part-ii-pge-negligence-jeopardizes-californias-green-energy-future/#764497767d98

[98] As of March 31, 2019. Elliott Management SEC form 13F, filed May 15, 2019.

[99] As of March 31, 2019. Elliott Management SEC form 13F, filed May 15, 2019.

[100]https://www.bloomberg.com/news/articles/2019-05-17/corrosion-led-to-worst-u-s-gas-leak-ever-and-there-were-others

[101] http://hedgeclippers.org/wp-content/uploads/2016/03/0330-Fossil-Fuels.pdf

[102]https://www.cnbc.com/2017/03/03/former-trump-critic-paul-singer-reportedly-chipped-in-1-million-for-inauguration.html

[103]https://www.thedailybeast.com/trump-dismisses-role-of-climate-change-in-california-fires-says-raking-a-solution

[104]https://www.reuters.com/article/us-autos-emissions-california/trump-administration-ends-california-talks-on-auto-emissions-white-house-idUSKCN1QA2CD

[105]https://www.desmogblog.com/2019/03/16/manhattan-institute-paul-singer-trump-claim-green-new-deal-cost-100-trillion

[106] As of March 31, 2019. Third Point SEC form 13F, filed May 15, 2019.

[107]https://www.epa.gov/enforcement/reference-news-release-us-settles-marathon-petroleum-corporation-cut-harmful-air

[108]https://www.metrotimes.com/news-hits/archives/2019/02/20/marathon-petroleum-responds-to-history-of-environmental-violations-in-southwest-detroit

[109]https://www.nytimes.com/2016/04/07/us/donald-blankenship-sentenced-to-a-year-in-prison-in-mine-safety-case.html

[110] https://www.gov.ca.gov/2019/03/28/pge-board/

[111] Fleischer, Victor. How a Carried Interest Tax Could Raise $180 Billion. The New York Times. June 5, 2015.

[112] Cancryn, Adam; Ferris, Sarah. Tax Bill Could Trigger Historic Spending Cuts. Politico. November 30, 2017.

https://www.politico.com/story/2017/11/30/tax-bill-spending-cuts-gop-congress-274337

[113] http://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201720180AB2731

[114] http://hedgeclippers.org/hedge-papers-no-56-california-hedge-funds-and-their-billion-dollar-tax-loophole/

[115]http://hedgeclippers.org

[116] https://www.nytimes.com/2016/03/18/business/dealbook/2-senate-democrats-introduce-bill-to-curb-activist-hedge-funds.html

[117] https://tinyletter.com/DavidDayen/letters/end-hedge-funds

[118] As of March 31, 2019, as reported on SEC form 13F.