Daniel Loeb: BAD BEHAVIOR, BAD POLITICS, BAD KARMA

A yoga devotee is calm, spiritual and concerned about the welfare of others—unless the yoga devotee in question is Dan Loeb, who is known for publicly excoriating executives and relentlessly pursuing the accumulation of more wealth than most people could spend in a hundred lifetimes.

Is there some a quest for cosmic karma behind Loeb’s penchant for yoga? Does he need spiritual cover to offset an excess of materialism? Does the search for inner peace stem from an incident in Cuba in which he was detained for striking a child with a car?[1]

Or does Loeb, whose wife is a former yoga instructor, approach yoga the way his hedge funds approach corporate operations? You take some elements of yoga and dump the inconvenient ones, you split apart a company and jettison some jobs. » read more

BAD KARMA: A LAVISH LIFE OF LUXURY (OFF THE NOBLE PATH)

BAD KARMA: A LAVISH LIFE OF LUXURY (OFF THE NOBLE PATH)

A rising member of the Forbes list of “The World’s Billionaires,” Loeb’s net worth is now estimated at $2.5 billion.[2]

If it seems hard to reconcile this unbelievable fortune with Loeb’s enlightened persona, take this quote from Loeb himself:[3]

“Going around India with a begging bowl is the easy way out… It’s an excuse for not doing anything with your life, and that’s not my style. … Companies are short, management’s trying to defraud us, and I’m like Rambo in the office, headset on, three computers in front of me, mowing them all down… Yoga is all about focus and perfect aim.”

To reconcile his yoga interest and his cutthroat approach to business, Loeb must invoke logical contortions that require far more flexibility than any yoga position.

However, it’s hard to square Loeb’s actions and words with the teachings of his former yogi,[4] Pattabhi Jois, who said, “Yoga is universal…but don’t approach yoga with a business mind looking for worldly gain.”[5]

Otherworldly materialism

Otherworldly materialism

Dan Loeb’s 200-foot megayacht Samadhi is named for the last element of Ashtanga Yoga’s Noble Eight-Limbed Path.[6] Perhaps not surprisingly, Loeb chose not to name his yacht for the first element, Yama, or moral code.

At a reported purchase price of $50 million,[7] the Samadhi is such an odious display of extravagance that it’s difficult to tell if the naming was ironic.

The behemoth vessel holds crew of seventeen, and expo materials brag that hidden passages allow the staff —servants might be the better word— to “quickly and efficiently serve guests while being virtually unnoticeable.”[8]

The superyacht isn’t the only example of Loeb’s excess.

He previously owned a $100 million penthouse at 15 Central Park West, and currently summers in a Southampton beach house designed by Rafael Viñoly.

Through an aviation holding company, Big Dog Aviation LLC, Loeb owns a 2013 Gulfstream G650 GVI, a luxury jet with a reported price of $65.4 million.[11]

Through an aviation holding company, Big Dog Aviation LLC, Loeb owns a 2013 Gulfstream G650 GVI, a luxury jet with a reported price of $65.4 million.[11]

BAD BEHAVIOR: INTIMIDATION, BULLYING & JOB DESTRUCTION

BAD BEHAVIOR: INTIMIDATION, BULLYING & JOB DESTRUCTION

How did Dan Loeb amass this wealth?

As a yoga devotee, Dan Loeb is surely committed to earning money in ways that “do no harm,” right? A review of court records, news reports, and SEC filings paints a very clear picture of how Dan Loeb and Third Point have badgered executives, called for thousands of layoffs across the country, and strong-armed companies all in the name of profit-taking.

Bullying executives and intimidation

Which Sanskrit mantra is the one where you’re taught that it’s okay to publicly insinuate that an executive is a pedophile? Where in the Torah, which Loeb spent six years studying, does it greenlight taking such joy in the impending destruction of a company that you can gleefully compare it to rape?

Whatever it is that guides Dan Loeb’s moral compass, it’s in need of serious recalibration.

Insinuating that a corporate executive of a company he was betting on was a pedophile:

Loeb was sued in 1999 by PR executive John Liviakis, for imitating Liviakis online with the following statement: “I have registered 1.7 million shares to sell and these will soon flood the market. Hopefully I will sell these before the company loses its Nasdaq listing. . . . Then I will laugh at you fools for buying my shares and I will celebrate with a bottle of grappa, some fresh feta, and a nice young boy—just like in the old country.” This case was ultimately settled.

Participating in a dirty tricks campaign against the CEO of Fairfax Financial Holdings:

Matt Taibbi’s The Divide[12] describes Loeb’s involvement in a group of hedge fund managers who attempted to influence the share price of Fairfax, an insurance company based in Canada.

According to legal documents reviewed by Taibbi, Dan Loeb’s hedge fund hired a shadowy actor named Spiros Contogorious, who employed a variety of methods to try and drive down the price of Fairfax’s stock—including making crank phone calls to the CEO’s home late at night.

Loeb appears to have taken great joy in this endeavor, telling Contogorious: “PREM WATSA BEND OVER THE HEDGE FUNDS HAVE SOMETHING SPECIAL FOR YOU.”

Loeb also called Watsa, who is on Indian descent, a “shvartze,” a Yiddish term for African American that Erika Davis, writing in the Jewish Forward, has labeled “the Jewish n-word.”[13]

In a civil racketeering lawsuit filed against the ex-wife of one of Loeb’s top staffers, Jeffrey Perry, it was alleged that “Perry’s career has been marked by repeated criminal activity in his quest to amass his fortune.”[14]

Perry’s ex-wife cited Jeffrey Perry’s involvement in “a scheme to destroy Fairfax Financial Holdings Limited” while working for Dan Loeb at Third Point. The case was settled shortly after the complaint was filed.

Accused of spreading rumors that a Florida executive was a felon convicted of insurance fraud:

Dan Loeb’s hedge fund, Third Point, was one of two defendants sued in the U.S. District Court for the Southern District of Florida for defamation.[15] According to the complaint, the plaintiff alleged that an employee of Third Point distributed materials to a journalist which misidentified insurance executive Gary Carroll as a felon and disparaged his company—which Third Point was making a “short” bet against. The parties, including Carroll and Third Point, voluntarily stipulated to dismiss the case in 2014. Email exhibits from this case show that Third Point hired a private investigator to compile reports on Carroll.[16]

Extracting wealth from companies and destroying jobs

Loeb’s business model is not terribly sophisticated; it has at times invovled intimidation, bullying and wildly hostile open letters to executives of target corporations that demand large-scale job cuts, pay cuts and pension-and-benefits cuts that have helped incinerate thousands of middle-class jobs across the country.

Sotheby’s

Dan Loeb made an aggressive play for control of Sotheby’s in late 2013, blasting the company’s leadership in a public letter,[17] and vowing to wage “holy jihad” on the vaunted New York auction house.[18]

After Loeb’s hedge fund gained board seats at the company, Sotheby’s engaged in layoffs as part of a restructuring,[19] and spent more than $20 million defending itself from Loeb’s takeover attempt,[20] an amount that represented half of the company’s net income for the first 9 months of 2014.[21]

Of that $20 million, half of it went to reimburse Loeb for attorneys’ fees he incurred while battling with the company.

Yahoo!

After snapping up a large stake in the former web giant, Loeb spent months penning nasty missives to the Yahoo board and top executives,[22] ultimately digging up enough dirt on former CEO Scott Thompson to force his resignation.[23]

Loeb then joined the board of Yahoo!, appointed a new CEO, and called for “mass layoffs” at the company, seeking to fire “between 20 percent and 30 percent of Yahoo!’s roughly 12,000 workers,” according to news reports.[24]

Business Insider estimated that Loeb earned $1 billion on his play with Yahoo!, while multiple stories have pondered whether Yahoo!’s leadership change will benefit the company in the long term.[25] [26] [27]

Amgen

According to his Q3 2014 investor letter, Loeb believes that Amgen should be split into two companies—one that focuses on the cash-generating existing product line, and one which aggressively pursues new product development.[28]

The investor letter also mentions Third Point’s approval of Amgen’s cost-cutting measures: “While we applauded Amgen’s first steps in July to target the company’s inflated cost structure by rationalizing its US facilities foot print.”

That last bit about “rationalizing” a “US facilities footprint” is hedgie-speak for big American layoffs.

Loeb’s hedge fund also lauded Amgen’s decision to layoff 2,900 employees.[29] An October, 2014 article in the Los Angeles Times noted that Amgen, “bowing to hedge fund pressure,” announced layoffs of 1,100 additional workers.[30]

Offshore drilling: Energean Oil & Gas

Loeb made a series of investments in Greece, hoping to capitalize on oversold assets after the Greek financial crisis. Loeb’s hedge fund made a few major plays, buying a bank in Cyprus and an energy exploration company called Energean.

Energean was recently approved to drill in the Sara and Myra offshore licenses, located in the Mediterranean Sea off of the Israeli shore.[31] At a maximum water depth of 1,450 meters, these wells are in water only a few hundred feet shallower than the Deepwater Horizon well.[32]

BAD KARMA: DODGING TAXES & MANIPULATING LAWS

BAD KARMA: DODGING TAXES & MANIPULATING LAWS

Minimizing taxes

Income earned by hedge fund managers, as we have previously written about, is taxed at a much lower rate than wages earned by regular working people.[33] But that is not the only tax loophole that Dan Loeb is exploiting.

Why merge a biofuel company with a home builder?

In 2014, hedge fund manager David Einhorn created a home construction company by merging BioFuel Energy, a troubled ethanol producer, with JBGL Builder Finance. According to a Form 4 filed in October 2014, Dan Loeb and David Einhorn control a majority of the shares in Green Brick Builders.

Why such a mismatched shotgun marriage? The reason for this strange merger appears to be the large federal net operating loss carryforwards held by BioFuel Energy Corp.[34] The $181.3mn in retained carryforwards may allow the new company to offset future taxable income of the new, essentially unrelated venture.

How can you use tax losses at a BioFuel Company to offset future earnings of a homebuilder?

The IRS has attempted to prevent companies from being acquired simply for the value of their carryforwards by enacting regulations contained in Section 382 of the Internal Revenue Code, which invalidates carryforwards obtained by significant ownership change.[35]

To circumvent this restriction, Greenlight and Third Point are using something called a “Section 382 Rights Agreement,” which minimizes the risk of triggering the Section 382 provision.

This complicated provision appears to be legal, but it’s hard to see how making a biofuel company into a publicly-traded home building company does not constitute a “significant ownership change.”

The company’s initial securities registration filing makes it clear that they intend to use these carryforwards to offset future taxes through 2029:[36]

The net operating loss carryforwards do not begin to expire until 2029. Our ability to utilize our net operating loss carryforwards will depend on the amount of taxable income we generate in future periods. Based on JBGL’s 2013 and year-to-date 2014 taxable income results, management expects that JBGL should generate sufficient taxable income to utilize substantially all of the net operating loss carryforwards before they expire.

Loeb’s Bermuda-based reinsurance company defends itself as Senator calls for IRS scrutiny:

Many hedge funds, including Dan Loeb’s Third Point, have recently set up Bermuda-based reinsurance companies.

These firms claim to be substantially engaged in insurance underwriting, but are conveniently set up, as Bloomberg Business noted, [37]with the potential to minimize taxes paid by hedge fund investors.

Third Point Re, a reinsurance company that was the largest single investor in Third Point according to documents filed by the fund in 2012, recently found itself defending accusations that it wasn’t a “real” insurance underwriter.[38]

Senator Ron Wyden is currently pressing the IRS to close the reinsurance loophole.[39]

BAD POLITICS: EMPOWERING RIGHT-WING REPUBLICANS IN ALBANY AND WASHINGTON

BAD POLITICS: EMPOWERING RIGHT-WING REPUBLICANS IN ALBANY AND WASHINGTON

How does a simple yoga devotee choose to spend his massive wealth?

Besides glitzy apartments and mega-yachts, Dan Loeb has developed a penchant for supporting right-wing politicians and other officials who put Wall Street’s interests ahead of Main Street’s interests.

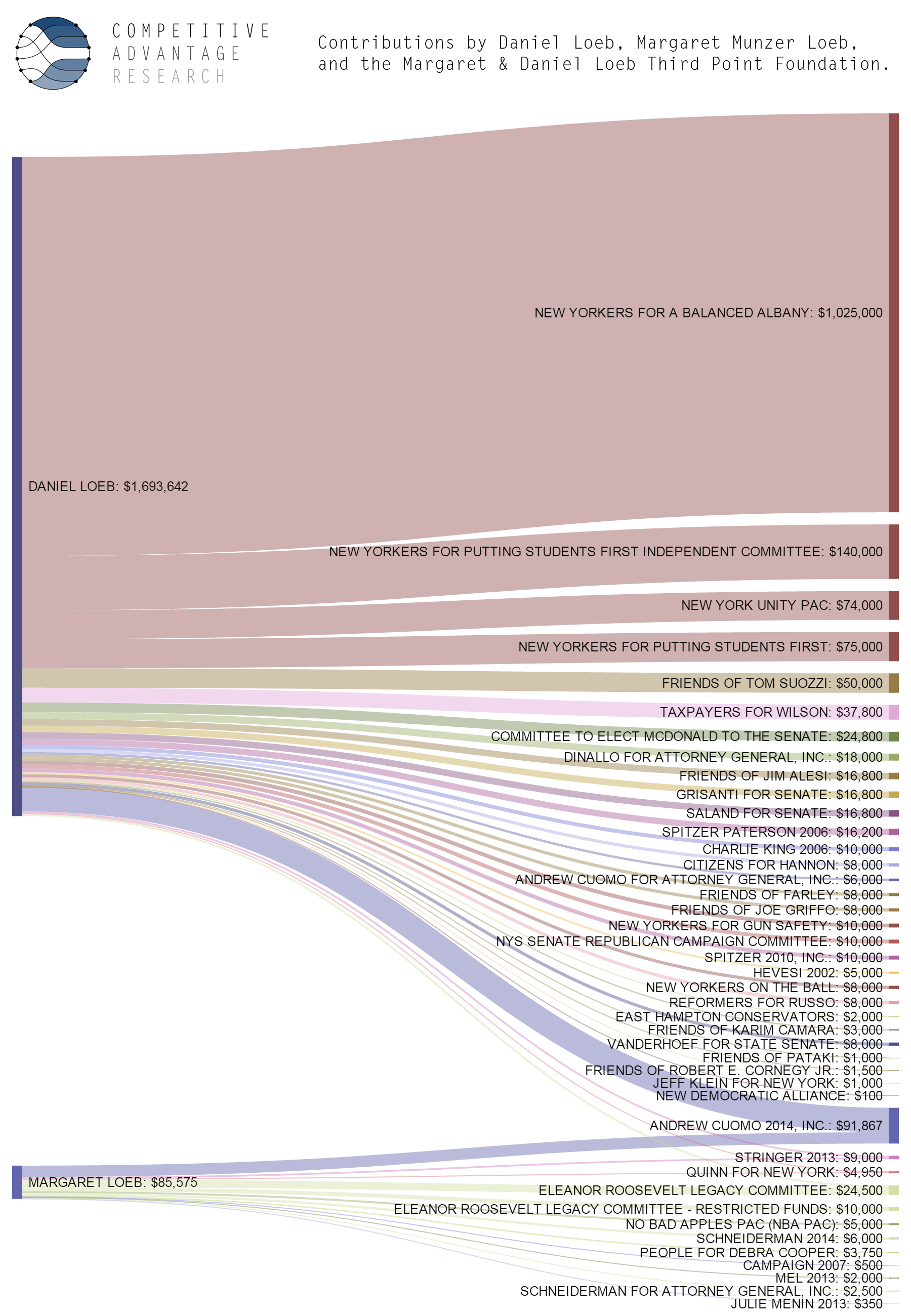

Loeb and his wife, Margaret Loeb, have donated $1,786,717 to political candidates and PACs in New York State. Most of this support has come in the form of contributions to Andrew Cuomo and to PACs dedicated to protecting the Republican majority in the New York State Senate.

Since 2012, Loeb has contributed $1,314,000 to these PACs; he and his wife have donated $97,687 to Andrew Cuomo – $91,687 to his gubernatorial campaigns and $6,000 to his campaigns for Attorney General.

Loeb-fueled SuperPAC explosion wins the State Senate for the GOP

In 2014, Loeb donated $1,025,000 to New Yorkers for a Balanced Albany, a pro-charter school super PAC through which Loeb and a small set of hedge fund managers purchased Republican control of the New York State Senate.

The unified hedge fund billionaires managed to overcome a 6:1 statewide Republican enrollment disadvantage through multi-million dollar media buys designed to gin up fears of progressive reforms, such as the public financing of elections, that would limit the wealth and power of hedge fund managers like Loeb.

This kind of political investment pays off for Loeb – the Republican-led Senate blocks all efforts to close the carried interest loophole, levy a “Robin Hood” tax on financial speculators’ stock transactions, or assess other taxes and fees on hedge fund managers and billionaires that would shrink the inequality gap in New York State.

Supporting State Senators that have strayed off the noble path

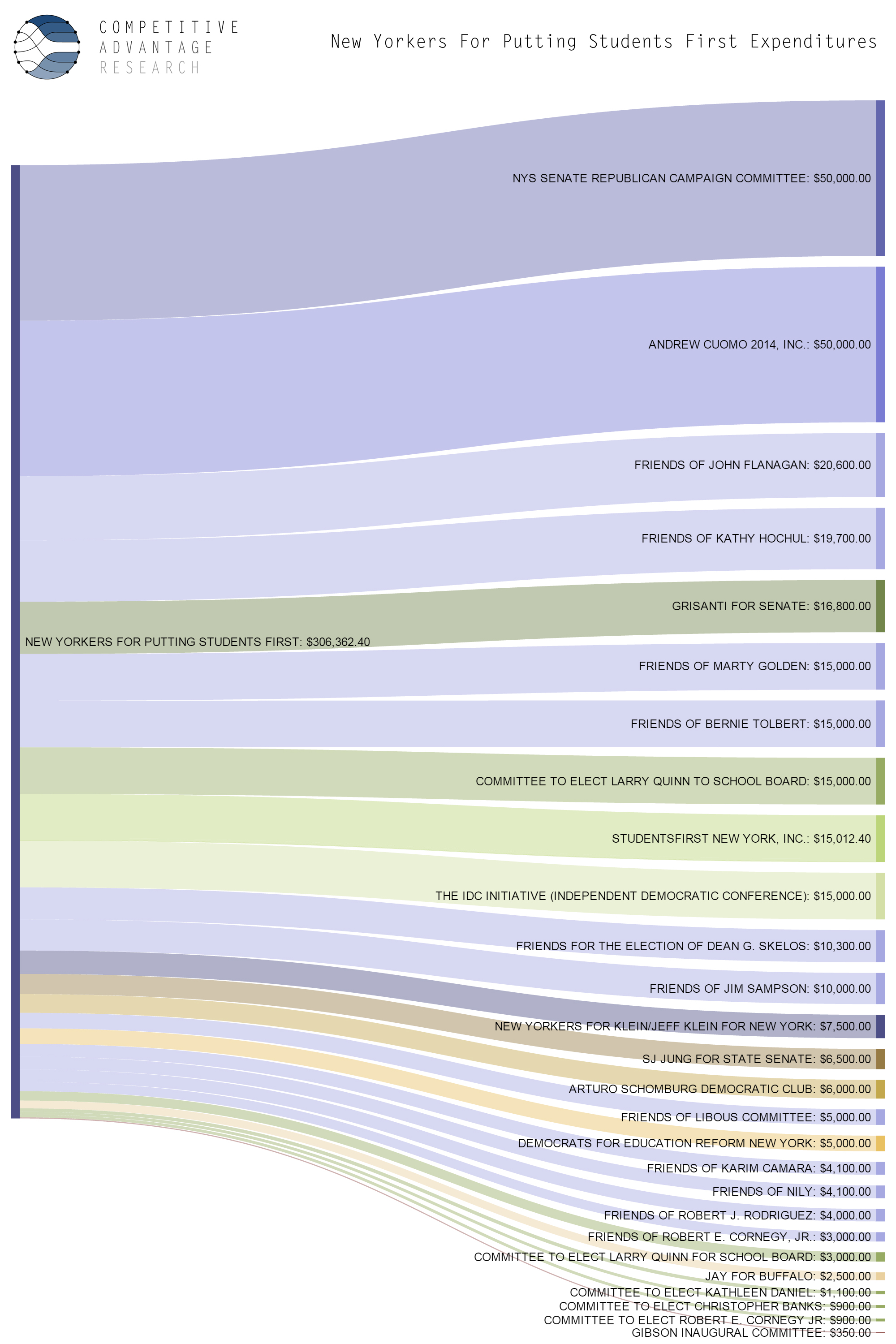

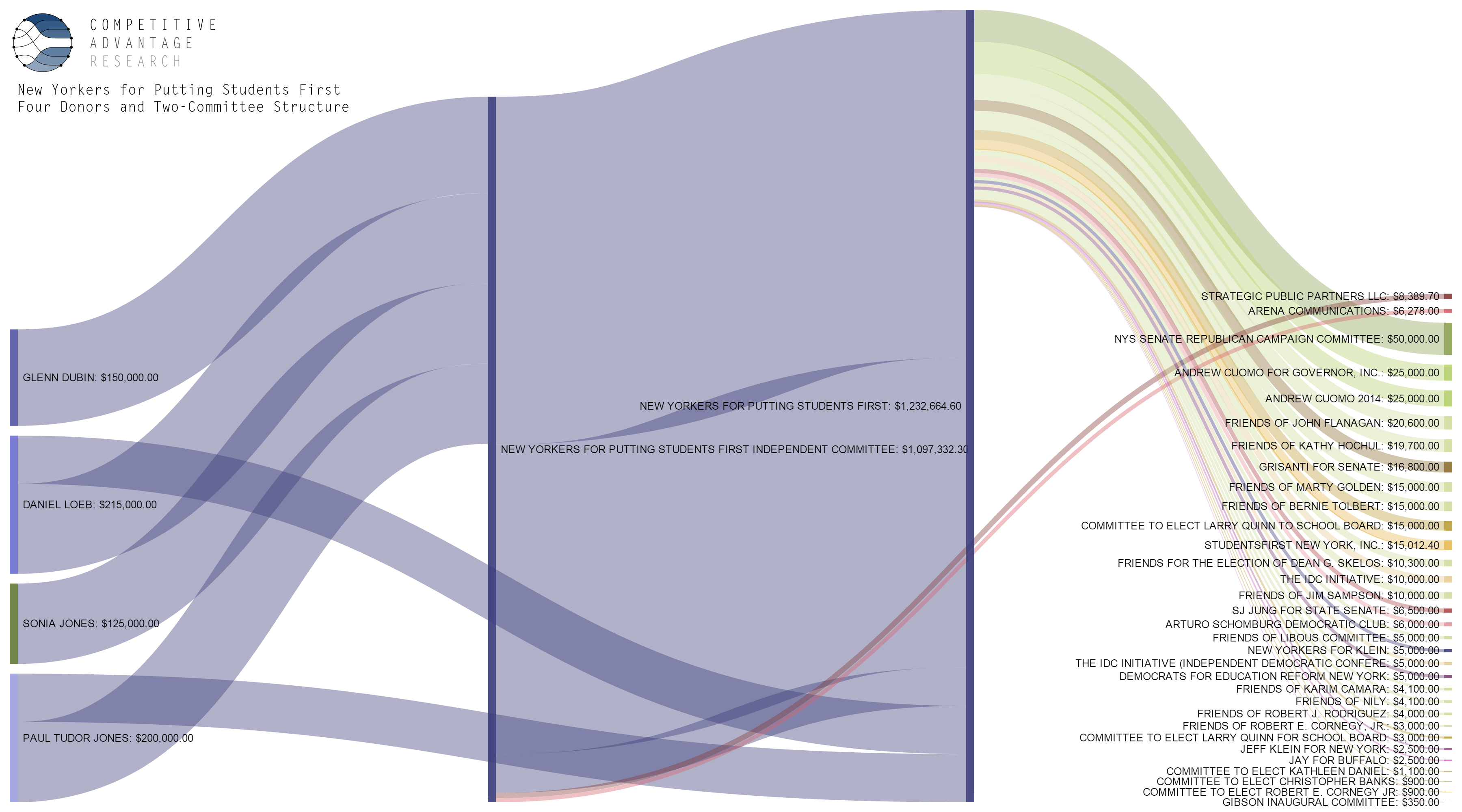

In 2012 and 2013, Loeb donated $215,000 to pro-charter PACs that have backed three Senators – Republican majority leader Dean Skelos, Tom Libous, and Marty Golden – that are under indictment or investigation. The “New Yorkers for Putting Students First” PACs, like New Yorkers for a Balanced Albany, were organized by pro-charter group Students First New York and mainly backed by hedge fund managers like Loeb. Libous, who received $5,000 from the PAC, is under indictment for lying to the FBI.[40] Skelos, who received $10,300 from the PAC, and Golden, who received $15,000 from the PAC, are under investigation by US Attorney Preet Bharara.[41][42]

The PAC also gave $10,300 to John Flanagan, a Long Island senator who has recently come under scrutiny for voting on bills that have benefited Wall Street clients of his law firm.[43]

All four of these Senators also voted against marriage equality in 2011, a cause that Loeb supported through a range of political contributions. Of course, these contributions – including $75,000 to the New York Unity PAC – came with the added benefit of protecting the Republican Senate majority, and thereby protecting hedge fund managers from policies designed to address inequality and poverty in New York State.

Manipulating state education policy? It’s all cool, man…

Loeb’s habit of funneling dollars to ethically-challenged political candidates can be seen out-of-state, as well. In 2012 he joined other plutocrats in contributing significantly to the re-election effort of Tony Bennett, the Republican superintendent of schools in Indiana. Loeb donated $25,000 to Bennett, a star of the charter school movement. Bennett lost, and was subsequently named head of the Florida schools.

In 2013, Bennett resigned from that position after it was reported that as Indiana schools chief he had directed staff to change the rating of an Indianapolis charter school from “C” to “A.”[44] The school, Christel House Academy, was founded by a major Bennett donor. A subsequent investigation of Bennett by the state Inspector General recommended that prosecutors bring federal wire fraud charges, but so far he has not faced prosecution.[45]

A full-on right-wing Congress, brought to you by billionaires

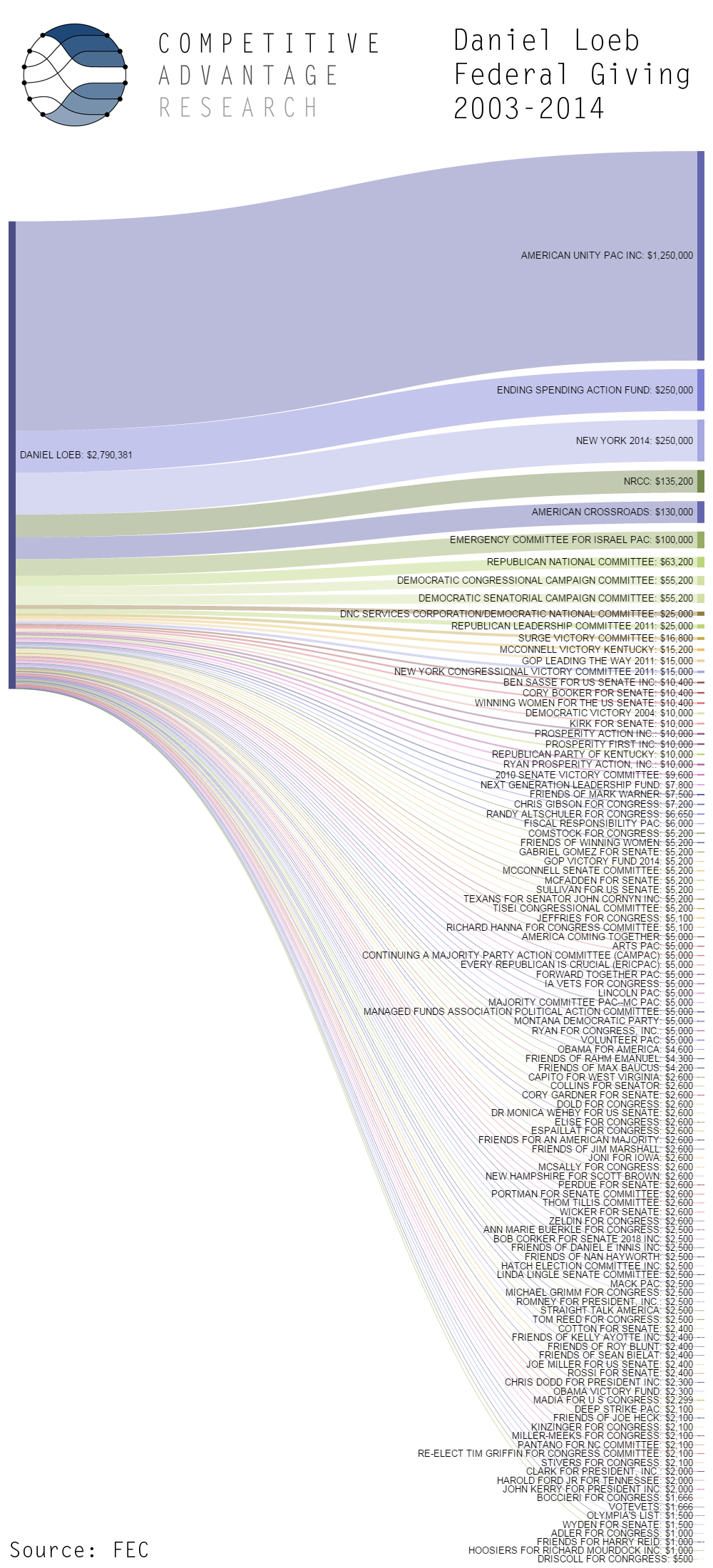

At the federal level, Loeb is a big player in right-wing Super PACs, with a total of $2,790,381 in federal campaign cash.

His largesse helped put Congress under total Republican control in last year’s mid-term elections, with a monster $1,250,000 donation to the American Unity Super PAC and big blasts of cash to American Crossroads and the Ending Spending Action Fund, along with large donations to Mitch McConnell, the Kentucky Republican Party, and an assortment of successful right-wing GOP Senate candidates.

FOOTNOTES

[1] http://www.vanityfair.com/news/2013/12/dan-loeb-cuba-car-accident

[2] http://www.forbes.com/profile/daniel-loeb/

[3] http://nymag.com/nymetro/health/fitness/features/5394/index1.html

[4] http://www.businessinsider.com/yoga-makes-dan-loeb-a-better-investor-2014-2

[5] http://www.ashtanga-yoga-victoria.com/k-pattabhi-jois.html

[6] http://www.yachtcharterfleet.com/luxury-charter-yacht-22997/samadhi.htm

[7] http://www.cnbc.com/id/100646741

[8] http://united-yacht.com/yacht-transport/press/yacht-transport-united-yacht-transport-top-superyachts-youll-see-fort-lauderdale-international-boat-show-flibs-2014/

[9] https://twitter.com/easyspotting/status/459954087619211264

[10] http://www.superyachttimes.com/yachts/details/219/

[11] http://corporatejetinvestor.com/articles/flipping-g650s-speculating-on-business-jets-908/

[12] Matt Taibbi’s ‘The Divide: American Injustice in the Age of the Wealth Gap’, pages 246-311.

[13] http://blogs.forward.com/sisterhood-blog/159773/no-more-jewish-n-word/

[14] http://ia601201.us.archive.org/14/items/gov.uscourts.nysd.398980/gov.uscourts.nysd.398980.1.0.pdf

[15] http://ia601700.us.archive.org/18/items/gov.uscourts.flsd.389048/gov.uscourts.flsd.389048.23.0.pdf

[16] http://ia601700.us.archive.org/18/items/gov.uscourts.flsd.389048/gov.uscourts.flsd.389048.23.3.pdf

[17] http://www.sec.gov/Archives/edgar/data/823094/000119312513388165/d605390dex993.htm

[18] http://nypost.com/2015/01/04/loebs-holy-jihad-defeated-sothebys/

[19] http://hyperallergic.com/138425/sothebys-lays-off-staff-amid-restructuring/

[20] http://www.cnbc.com/id/102169882

[21] http://nypost.com/2015/01/04/loebs-holy-jihad-defeated-sothebys/

[22] http://danloebletters.blogspot.com/2012/08/dan-loebs-yahoo-inc-involvement.html

[23] http://money.cnn.com/2012/05/13/technology/yahoo-ceo-out/

[24] http://nypost.com/2013/08/02/yahoo-board-strife-as-dan-loeb-splits-from-board/

[25] http://www.businessinsider.com/marissa-mayer-biography-2013-8?op=1

[26] http://www.bloomberg.com/bw/articles/2013-08-01/can-marissa-mayer-save-yahoo

[27] http://www.nytimes.com/2014/12/21/magazine/what-happened-when-marissa-mayer-tried-to-be-steve-jobs.html?ref=magazine&_r=0

[28] http://www.thirdpointpublic.com/wp-content/uploads/2014/10/Third-Point-Q3-2014-Investor-Letter-TPOI.pdf

[29] http://www.latimes.com/business/la-fi-amgen-layoffs-20140730-story.html

[30] http://www.latimes.com/business/la-fi-amgen-job-cuts-20141029-story.html#page=1

[31] http://www.offshoreenergytoday.com/energean-farms-into-sara-myra-blocks-offshore-israel/

[32] http://www.bbc.com/news/10370479

[33] https://hedgeclippers.org/1464797090949/hedge-funds-albany/

[34] http://www.sec.gov/Archives/edgar/data/1373670/000114420414055321/v388714_s1a.htm see prospectus summary

[35] http://www.law.cornell.edu/uscode/text/26/382

[36] http://www.sec.gov/Archives/edgar/data/1373670/000114420414055321/v388714_s1a.htm see ‘3. Deferred Tax Asset’

[37]http://www.bloomberg.com/bw/articles/2013-02-21/a-hedge-fund-tax-dodge-uses-bermuda-reinsurers

[38] http://www.insuranceinsider.com/-1253900/23

[39] http://www.insuranceinsider.com/-1253900/23

[40] http://www.nytimes.com/2014/07/02/nyregion/state-senator-thomas-libous-indicted-on-charges-of-lying-to-fbi.html?_r=0

[41] http://www.nydailynews.com/news/politics/skelos-investigated-bharara-report-article-1.2097399

[42] http://nypost.com/2014/10/09/bharara-investigating-goldens-campaign-finances/

[43] http://www.nydailynews.com/news/politics/long-island-state-senator-voted-bills-benefit-clients-article-1.2150383

[44] http://www.washingtonpost.com/local/education/tony-bennett-resigns-florida-education-post-amid-scandal/2013/08/01/3082416a-faef-11e2-a369-d1954abcb7e3_story.html

[45] http://www.huffingtonpost.com/2014/12/02/tony-bennett-violates-federal-law_n_6257880.html