Rahm’s top backers — high-frequency traders critiqued in the New York Times bestseller “Flash Boys”

When looking at the top donors to Rahm Emanuel’s campaign, a theme eventually emerges out of the dark pools of campaign cash.

Many of Rahm’s top contributors are heads of “high-frequency trading” funds—a murky and controversial trading strategy that is currently the subject of several class-action lawsuits.

Two of the largest high-frequency trading funds in Chicago—Ken Griffin’s Citadel LLC and Donald Wilson’s DRW Trading Group— have poured over a million dollars into Rahm’s campaign.

But their combined contributions pale in comparison to what these funds have gotten from Rahm: a mayor who has (a) lobbied for loosening regulations on high-frequency traders, (b) landed a $55 million TIF subsidy for a high-end convention center hotel managed by a company in which Griffin has a major investment, and (c) secured a huge tax break for a major trading partner.[1] read more »

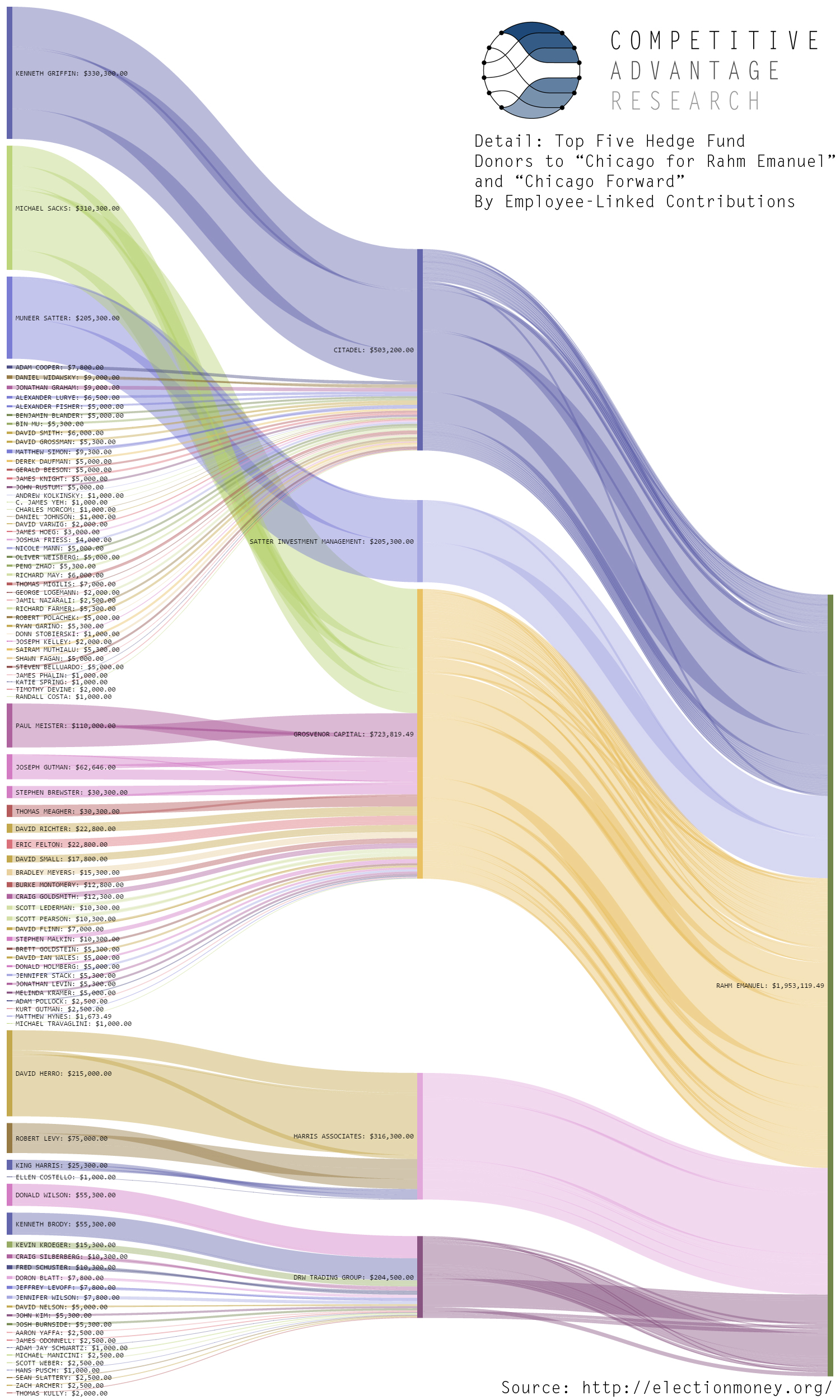

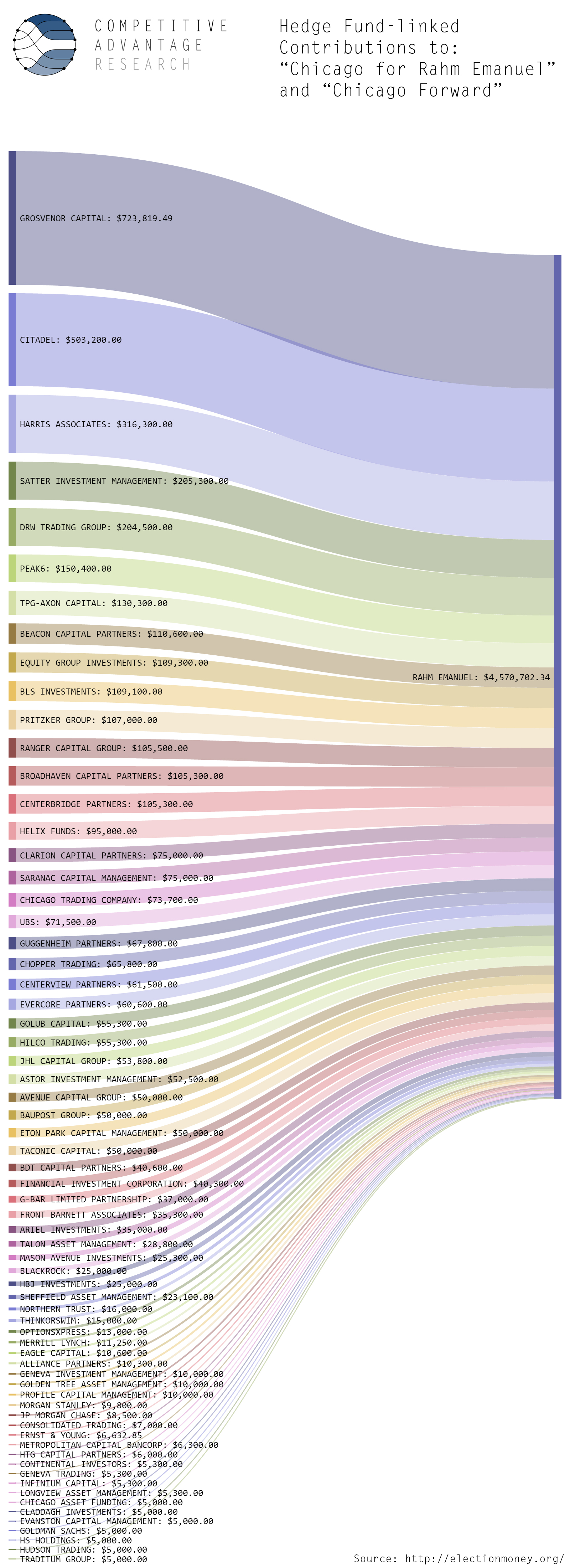

Rahm’s hedge fund haul: $4,623,716.63 and counting

Rahm Emanuel and political funds backing his campaign have raked in millions of dollars from high-frequency traders, including $900,000 from Ken Griffin, the CEO of Chicago’s largest high-frequency trading firm, Citadel LLC.[2]

Rahm has also taken $270,300 from employees and principals of DRW Trading, another high-frequency trading firm with a big Chicago footprint.

An analysis of contributions to Rahm and Chicago Forward shows that Rahm has raised at least $4,623,716.63 from hedge fund managers, with much of that cash coming from high-frequency traders.

An analysis of contributions to Rahm and Chicago Forward shows that Rahm has raised at least $4,623,716.63 from hedge fund managers, with much of that cash coming from high-frequency traders.

One hand washes the other — hedge fund managers support the Rahm agenda on schools & fiscal policy

One hand washes the other — hedge fund managers support the Rahm agenda on schools & fiscal policy

Besides the hundreds of thousands in campaign cash these high-frequency traders have lavished on Rahm’s campaign, they have also spent untold millions backing components of Rahm’s agenda, particularly in the areas of education and finance.

Donald Wilson’s name is emblazoned on a Nobel Street campus, a network of schools often touted by Rahm despite controversial disciplinary practices.[3] [4]

Griffin and Donald Wilson are both major funders of Stand for Children, which is strongly aligned with the mayor’s education platform, and has lobbied to limit the right of Chicago teachers to strike.[5]

By his own admission, Griffin is “one of the largest contributors” to DFER in Chicago,[6] the organization that gave Rahm political cover during the 2012 Chicago teachers strike.[7]

In the municipal finance arena, Citadel’s Ken Griffin bankrolled the creation of a fiscally conservative website, Reboot Illinois, in 2012.[8] Less than a year later, Rahm installed Citadel’s Dan Widawsky as the city’s comptroller.[9]

What are high-frequency traders?

Michael Lewis’ bestselling book Flash Boys exposed the world of “high frequency traders”— hedge funds who use ultrafast computers to rapidly execute millions of trades. Lewis’ book exposed how these high-frequency traders have used private trading markets and ultra-fast computers to race their orders in ahead of movements in the markets.

High-frequency traders are always trading ahead of the ordinary market participants—retirees, pension funds, and personal investors—and thus extracting a hidden “tax” on the other market participants.

High-frequency traders are always trading ahead of the ordinary market participants—retirees, pension funds, and personal investors—and thus extracting a hidden “tax” on the other market participants.

This is not a productive market activity—high-frequency traders do not create jobs or make long-term investments in companies in Illinois or elsewhere. Bottom line: what high-frequency traders do is generate obscene wealth for themselves.

While pension funds[10] and other jilted investors[11] are launching class-action lawsuits to recover the money they believe to have been swindled away by high-frequency traders, one Illinoisan can’t seem to get enough.

Meet Ken Griffin: Rahm’s hedge fund “Flash Boy” Number One

“Rahm has done a fantastic job of engaging the business community in Chicago.” – Ken Griffin [12]

One of Rahm Emanuel’s top donors is rightwing Chicago billionaire Kenneth Griffin, founder of Citadel, a hedge fund that specializes in high frequency trading. Griffin is also reported to be a close friend of Rahm’s.[13]

Griffin —who is literally the wealthiest man in Chicago[14]— spends much of his obscene fortune bankrolling far-right Republicans across the nation. When he isn’t stuffing cash into Republican campaign coffers, Griffin indulges in excesses on a par with the trust kings of the Gilded Age, snapping up a network of luxury homes, including a reported $135 million spread in Palm Beach, Florida and a $13.3 million penthouse at the Waldorf-Astoria in Manhattan.[15] [16]

(Griffin is also legendary for sending his chauffeur on 200-mile roundtrip journeys to Wisconsin to fetch his favorite milkshake.[17])

Griffin’s extravagant lifestyle was thrust into the limelight during his recent divorce from his wife, hedge fund manager Anne Dias-Griffin.

Documents filed in the divorce alleged that the Griffins spent $1 million per month in expenses related to their three children, including $300,000 per month in intercontinental jet travel, $6,800 per month on groceries, $7,200 per month on restaurant food, and $8,000 per month on gifts.[18]

Ken Griffin: Conservative Republican mega-donor

Ken Griffin: Conservative Republican mega-donor

“I’ve known Charles and David for a number of years. I couldn’t actually tell you where I first met them. I don’t recall.” – Ken Griffin on his first-name basis friendship with the Koch brothers [19]

For all the personal fortune that Griffin has amassed, he apparently feels like society is not giving him his due.

Take the political sphere, where Griffin has groused that the ultra-wealthy “actually have an insufficient influence.”[20] Despite his stated dissatisfaction, Griffin has not shied away from lavish political spending.

Griffin has repeatedly tossed big donations into political efforts led by the Koch brothers,[21] dumping a reported $1.5 million into the coffers of Koch-connected PACs.[22]

In Illinois, Griffin gave an astonishing $8 million to the gubernatorial campaign of Bruce Rauner,[23] and helped finance the creation of Reboot Illinois, an Illinois commentary website with a distinct rightward slant.[24]

Citadel’s high-frequency trading operations

In November 2009, Citadel filed a comments with the SEC regarding proposed extension of the “flash order” ban to options trading.[25] Citadel objected to the proposed ban of flash order trades, also called “step-up” orders,[26] a practice that essentially allows high-frequency traders to take advantage of orders placed by other market participants.[27]

In its comments to the SEC, Citadel explicitly argued that flash orders “do not pose a risk of front running.”[28] Other commenters disagreed, including Global Electronic Trading Company,[29] another high frequency trading firm.[30]

Citadel had good reason to worry about stricter regulation of flash orders in the options market: Citadel is a major market maker, and advertises itself as executing 28% of U.S. retail equities volume, on average, for any given trading day.[31]

Citadel formerly owned a large stake in E*Trade, convincing the retail brokerage to route 40% of its orders through their market making desk as part of a 2007 bailout by Citadel.[32] Griffin initial sought to route 97.5% of E*Trade order flow through Citadel,[33] a deal which was not approved by the Office of Thrift Supervision.[34]

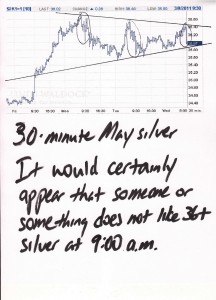

Some circumstances raise questions about Citadel’s high-frequency trading fund, Citadel Tactical Trading.

When the former head of Citadel Tactical Trading, Mikhail Malyshev, was recruited away to start his own quantitative trading firm, Citadel lawyers called the new venture a “veritable pirate ship of illegal activity.”[35]

Malyshev’s fund was the only one of Citadel’s major offerings to end 2008 in the black, gaining 40%[36] while Citadel’s flagship funds lost 55%.[37]

This feature of high-frequency trading funds—that they never seem to have bad days, let alone down years—features prominently in class-action litigation challenging the trading strategies.

Citadel’s operations have been hit with numerous fines from regulatory authorities

According to documents filed with the Financial Industry Regulatory Authority (FINRA), Citadel Securities LLC has been fined or censured an astonishing 28 times.

The firm’s disclosure events statement, where fines and sanctions are reported, runs 70 pages in length.[38]

Many of Citadel’s fines relate to trade order issues, which are especially concerning given that high-frequency traders have the opportunity to essentially “front-run” or trade ahead of customer orders.

Citadel’s “flash crash”

At least one fine has the characteristics that invoke another pitfall of algorithmic trading: the “flash crash” brought on by computer trading strategies.

In a June 2014 regulatory action, Citadel was fined for computer-based trading where “a market-making desk erroneously sold short, on a proprietary basis, 2.75 million shares of an entity, causing the share price of the entity to fall by 77% in an eleven-minute period.”

Citadel’s mistake, for which they were fined $800,000.00, bares a strong resemblance to the so-called “Flash Crash” of 2010, when stock prices fell swiftly before correcting, an event often blamed on high-frequency traders.

Benefits for Billionaires: How Citadel benefits from access to Rahm

In April 2014, the Chicago City Council voted to approve Rahm Emanuel’s plan for the South Loop, which included a $55 million TIF subsidy to build a Marriott hotel. [39] The TIF money—over half of which should have gone to Chicago’s hard-pressed public schools[40]—amounted to a significant subsidy for Citadel, a major investor in Marriott whose stake was valued at nearly $90 million.[41]

And that isn’t the only benefit that Griffin’s firm received. Former Citadel managing director Dan Widawsky was selected by Rahm to serve as the City’s comptroller in 2013.[42]

Meet Donald R. Wilson, Jr. of DRW Trading Group: Rahm’s hedge fund “Flash Boy” Number Two

Meet Donald R. Wilson, Jr. of DRW Trading Group: Rahm’s hedge fund “Flash Boy” Number Two

DWR Trading Group is another Chicago-based high-frequency trading firm, founded by Donald R. Wilson, Jr. Wilson and his employees donated at least $270,300 to Rahm Emanuel’s campaign. I

It’s a steep figure for sure, but Rahm has provided some critical help with federal regulators. Mayor Emanuel doesn’t just rake in campaign cash from Wilson and the DRW Trading Group folks; he’s also helped Wilson out with federal regulatory issues.

Rahm goes to bat in Washington for his flash boys

In 2011, Rahm flew to Washington, DC on Wilson’s private jet to meet with regulators from the Commodity Futures Trading Commission (CFTC), in one of his first Washington, DC trips after being elected mayor.[43]

Rahm’s 2011 trip to visit federal regulators with his high-speed trading pals had to do with the firm’s reluctance to be subjected to capital reserve requirements — a financial stability measure that was strengthened after the 2009 recession.

Rahm’s influence in Washington must have helped: DRW and similar firms were not subjected to these regulations.

And this was a good thing, because the very next year DRW Securities LLC was fined $20,000 by the Chicago Board of Options Exchange for failing to maintain capital reserves at the level of a paltry quarter of a million dollars.[44]

DRW Trading Group was also investigated by the CFTC for using high-speed trades to manipulate a reference rate that was used to calculate the value of a bet $350 million bet made by DRW.[45] The investigation is on-going.

Another high-frequency trading firm who sent representatives to lobby the CFTC with Rahm was Chopper Trading LLC, which was acquired by DRW in early 2015.[46]

Chopper is one of several firms reported to have been subpoenaed by New York Attorney General Eric Schneiderman, as part of an investigation into whether such firms use high frequency trading to gain an unfair market advantage.[47]

Rahm’s big haul, after his flight with the flash boys

After Rahm helped out his high-frequency trading buddies, their generosity to the mayor only increased. Records show that Rahm has even visited Wilson’s house—a move that appears to have paid off big.

The Chicago Tribune reports that Emmanuel raise $50,000 from DRW employees and spouses within two days of the visit.[48]

Flash Boys Mash-Up: Rahm pushes for state subsidies to CME Group — a Citadel and DRW partner

Flash Boys Mash-Up: Rahm pushes for state subsidies to CME Group — a Citadel and DRW partner

Is it any wonder that Rahm would be one of the top supporters of CME Group getting huge tax breaks from the Illinois Senate?[49] After all, CME is a core partner of his hedge fund “flash boys,” and a big Rahm donor.

CME Group, which operates the Chicago Mercantile Exchange, was the single largest contributor to Rahm’s 2011 mayoral race, ponying up $200,000 before the state campaign finance rules were changed to prohibit such mammoth contributions.[50]

CME Group is also a key business partner of DRW Trading Group and Citadel, which earn significant returns through their low-cost access to CME’s markets.

Citadel’s business relies on access to CME Group’s trading platforms

In many ways, Citadel and CME Group are joined at the hip – just like Rahm and his “flash boys.”

In 2008, Citadel and CME Group began a partnership to create the CMDX Platform, an electronic trading platform for credit default swaps.[51] [52]

The CMDX exchange was abandoned in 2009, after failing to secure interest from other traders.[53]

Four years before the abortive attempt to start a new exchange, CME named Citadel one of six market makers for its e-Mini options platform, allowing Citadel additional bandwidth on the platform.[54]

Citadel does such a high volume of trading on CME Group’s Chicago Mercantile Exchange, that they are reportedly paying the lowest per-contract rate offered by that exchange.[55]

Class action lawsuit by former traders alleges that CME Group is giving lucrative perks to high frequency trading firms & turning a blind eye to trader abuses

A recent class action lawsuit, filed by three former traders, accuses the CME Group of profiting from high-frequency trades, while allowing high-frequency trading firms to occupy an “exclusive position by which to profit from peeking at everyone else’s orders and price data and to act on this price and order information.”[56]

The complaint also alleges that CME Group is giving rebates to high-frequency traders for their trading volume, specifically naming DRW: “Defendants have entered into clandestine incentive/rebate agreements in established and heavily traded contract markets with favored firms such as DRW Trading Group and Allston Trading, paying up to $750,000.00 per month in one of the most heavily traded futures contracts in the world.”[57]

(Hedge Clippers has not yet been able to determine whether Rahm is ready to fly to Washington to defend his “flash boys” from these latest charges.)

A progressive revenue agenda to combat the out-sized influence of hedge fund managers in Chicago politics:

A progressive revenue agenda to combat the out-sized influence of hedge fund managers in Chicago politics:

The ability of high-frequency trading firms to buy political influence is a serious problem.

If Chicago’s high-frequency traders can afford to pay such high contributions for such high levels access, maybe they shouldn’t be getting such high tax subsidies.

Maybe they should be paying a larger share of our City’s tax bills.

It’s just common sense: the City of Chicago should repeal policies that subsidize the wealthiest people in our City at the expense of the poor, and implement progressive taxes that make the richest Chicagoans pay their fair share.

We propose three financial reforms that will help make our City’s wealthiest residents contribute their fair share to the cost of essential public services:

FAIR-SHARE CME/CBOE FINANCIAL TRANSACTIONS TAX

The City of Chicago should levy a financial transaction tax on all options, futures and derivatives traded on the Chicago Mercantile Exchange (CME) and Chicago Board of Options Exchange (CBOE).

The Chicago Teachers Union estimates that this tax would raise between $10 billion and $12 billion annually for the state – and the cost would make up only 2/1000ths of the estimated value of trades placed on Chicago’s exchanges.[58]

There is reason to believe that a significant share of this tax would be borne by Citadel itself, which claims to trade 20% of all U.S. listed equity options volume.[59] As a designated primary market maker for the CBOE, Citadel surely makes up a significant portion of the futures volume on that exchange, and would pay a significant portion of the taxes.[60]

FAIR-SHARE PROGRESSIVE STATE INCOME SURCHARGE ON THE WEALTHY FEW

The State of Illinois should make the tax code fairer with a tax surcharge on wealthy Chicagoans making more than a million dollars in a single year.

If the State tacked on an additional 3% surcharge on incomes over $1 million, as has been proposed this legislative season,[61] Ken Griffin alone would pay an additional $30 million at last year’s income level.

ELIMINATE UNFAIR SUBSIDIES TO WEALTHY CORPORATIONS

The City of Chicago should eliminate Tax Increment Financing subsidies to wealthy corporations.

As the Roosevelt Institute’s Saqib Bhatti recently suggested in a blog post[62] and Refund America report,[63] Chicago should end the practice of distributing tax increment financing (TIF) subsidies to wealthy corporations, and claw-back subsidies previously given to companies that have not met job creation goals.

FOOTNOTEs

[1] http://www.chicagoreader.com/chicago/south-loop-hotel-benefits-rahm-donor-griffin/Content?oid=13056486

[2] http://chicago.suntimes.com/chicago-politics/7/71/445392/billionaire-ken-griffin-throws-another-500000-rahm-re-election

[3] http://articles.chicagotribune.com/2014-04-07/news/ct-charter-noble-discipline-met-20140407_1_noble-students-charter-chicago-public-schools

[4] http://chicago.cbslocal.com/tag/noble-street-charter-network/

[5] http://www.huffingtonpost.com/2012/09/14/chicago-teachers-stand-for-children_n_1885421.html

[6] http://www.chicagobusiness.com/article/20130521/BLOGS02/130529949/ken-griffins-rant-very-instructive-for-those-who-care-to-learn#ixzz2U1d0mAYf

[7] http://www.dfer.org/2012/06/group_airs_radi.php

[8] http://www.chicagobusiness.com/article/20121119/BLOGS03/121119797/anne-griffin-launches-reboot-illinois-today

[9] http://articles.chicagotribune.com/2013-12-06/news/chi-emanuel-picks-hedge-fund-director-as-new-comptroller-20131206_1_hedge-fund-director-comptroller-amer-ahmad

[10] http://dealbook.nytimes.com/2014/09/08/pension-funds-join-lawsuit-on-high-frequency-trading/

[11] http://www.reuters.com/article/2014/11/04/us-highfrequencytrading-lawsuit-idUSKBN0IO1O420141104

[12] http://articles.chicagotribune.com/2012-03-11/business/ct-biz-0311-confidential-griffin-web-version-20120311_1_american-crossroads-politics-republicans-and-democrats/2

[13] http://www.chicagomag.com/Chicago-Magazine/March-2015/Power-100/Power-Smackdowns/

[14] http://www.bizjournals.com/chicago/news/2015/03/02/ken-griffin-is-illinois-wealthiest-billionaire-per.html

[15] http://variety.com/2013/dirt/real-estalker/did-ken-griffin-spend-130-million-in-palm-beach-1201234721/

[16] http://www.chicagotribune.com/business/ct-ken-griffin-elite-street-1231-biz-20141230-story.html

[17] http://www.businessinsider.com/henry-blodget-ken-griffin-used-to-send-driver-400-miles-to-pick-up-milk-shakes-2009-11

[18] http://www.cnbc.com/id/102447335

[19] http://articles.chicagotribune.com/2012-03-11/business/ct-biz-0311-confidential-griffin-web-version-20120311_1_american-crossroads-politics-republicans-and-democrats/3

[20] http://articles.chicagotribune.com/2012-03-10/business/ct-biz-0310-ken-griffin-interview_1_chicago-casino-citadel-political-contributions

[21] http://www.motherjones.com/politics/2014/02/koch-brothers-palm-springs-donor-list

[22] http://articles.chicagotribune.com/2012-03-11/business/ct-biz-0311-confidential-griffin-web-version-20120311_1_american-crossroads-politics-republicans-and-democrats

[23] http://chicago.suntimes.com/chicago-politics/7/71/445392/billionaire-ken-griffin-throws-another-500000-rahm-re-election

[24] http://www.huffingtonpost.com/kyle-hillman/reboot-illinois_b_2162190.html

[25] http://www.sec.gov/comments/s7-21-09/s72109-80.pdf

[26] http://www.investopedia.com/terms/f/flash-trading.asp

[27] http://www.cnbc.com/id/101537874

[28] http://www.sec.gov/comments/s7-21-09/s72109-80.pdf (see page 9)

[29] http://www.sec.gov/comments/sr-nasdaq-2009-043/nasdaq2009043-3.pdf

[30] http://online.wsj.com/news/articles/SB125133123046162191?mg=reno64-wsj

[31] http://www.citadelsecurities.com/ces-retail/ measured based on publicly reported trades in Q1 2014

[32] http://online.wsj.com/news/articles/SB10001424052970203707604578094632231507790

[33] http://www.zerohedge.com/article/citadel-set-control-975-e-trades-order-flow

[34] http://www.advfn.com/commodities/CommoditiesNews.asp?article=39080230&headline=ots-suspends-e-trade-citadel-order-flow-deal-application

[35] http://uk.reuters.com/article/2009/10/09/citadel-lawsuit-idUSN096855520091009

[36] http://www.toomre.com/Citadel_Investment_Group_Seeks_To_Raise

[37] http://online.wsj.com/news/articles/SB125444025346057763

[38] FINRA Broker Check report for Citadel Securities LLC, CRD#: 116797, accessed March 2015.

[39] http://www.chicagoreader.com/chicago/south-loop-hotel-benefits-rahm-donor-griffin/Content?oid=13056486

[40] http://www.chicagoreader.com/chicago/city-council-advances-mayors-south-loop-deal/Content?oid=12970622

[41] http://www.chicagoreader.com/chicago/south-loop-hotel-benefits-rahm-donor-griffin/Content?oid=13056486

[42] http://articles.chicagotribune.com/2013-12-07/news/ct-emanuel-new-comptroller-met-1207-20131207_1_hedge-fund-manager-finance-post-comptroller

[43] http://www.chicagotribune.com/news/local/politics/ct-rahm-emanuel-washington-connections-met-20150202-story.html#page=1

[44] FINRA BrokerCheck report for DRW Securities LLC, CRD # 45908, referencing docket number 11-0042

[45] http://www.cftc.gov/ucm/groups/public/@lrenforcementactions/documents/legalpleading/enfdrwcomplaint110613.pdf

[46] http://www.law360.com/articles/611545/drw-buys-high-speed-trading-rival-amid-industry-scrutiny

[47] http://www.law360.com/articles/528940

[48] http://www.chicagotribune.com/news/local/politics/ct-rahm-emanuel-washington-connections-met-20150202-story.html#page=2

[49] http://www.chicagobusiness.com/article/20111128/BLOGS02/111129874/illinois-house-panel-oks-tax-breaks-for-cme-cboe-sears

[50] http://articles.chicagotribune.com/2011-11-09/business/ct-biz-1109-cme-lobbying-confidential–20111109_1_cme-group-madigan-getzendanner-chicago-mercantile-exchange

[51] http://investor.cmegroup.com/investor-relations/releasedetail.cfm?ReleaseID=338884

[52] http://investor.cmegroup.com/investor-relations/releasedetail.cfm?ReleaseID=370773

[53] http://www.ft.com/cms/s/0/ed5247fa-a476-11de-92d4-00144feabdc0.html#axzz3UwubDRgd

[54] http://files.shareholder.com/downloads/CME/0x0x114878/06ed29cb-1788-4e6a-9bd0-7d485bf8e9f0/CME_News_2004_9_30_General.pdf

[55] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aH6GSee4L_cI

[56] http://www.desilvalawoffices.com/documents/HFT-Braman-filed-.pdf see page 4

[57] http://www.desilvalawoffices.com/documents/HFT-Braman-filed-.pdf see page 31

[58] http://www.ctunet.com/blog/ctu-president-calls-for-lasalle-street-tax-to-lift-pension-burden-in-chicago

[59] https://www.citadelsecurities.com/ces-retail/

[60] http://ir.cboe.com/~/media/Files/C/CBOE-IR-V2/press-release/2010/CBOE_News_2010_9_23_CFE.pdf

[61] http://www.sj-r.com/article/20140325/NEWS/140329582/10511/NEWS?tag=1

[62] http://www.forbes.com/pictures/mdg45ehmel/4-ken-griffin/

[63] http://capitolfax.com/2015/02/25/madigan-school-groups-renew-call-for-millionaire-surcharge/

[64] http://www.nextnewdeal.net/seven-ways-chicago-can-put-working-families-wall-street

[65] http://www.refundproject.org/#chicago