With national attention focused on populist anger over Wall Street’s role in rigging the economy, more and more Americans are taking a growing interest in the business practices of billionaire investors and money managers.

Wall Street multimillionaires and billionaires have captured unprecedented wealth, even as the rest of the economy sputters and working families see their incomes stagnate or decline.

Job cuts, wage cuts, outsourcing, special tax breaks for the rich, elimination of pensions and benefits and the way connected insiders have benefitted from the economic destruction suffered by our communities didn’t come from nowhere: it’s the result of the actions of powerful men like Stephen Schwarzman and Leon Black.

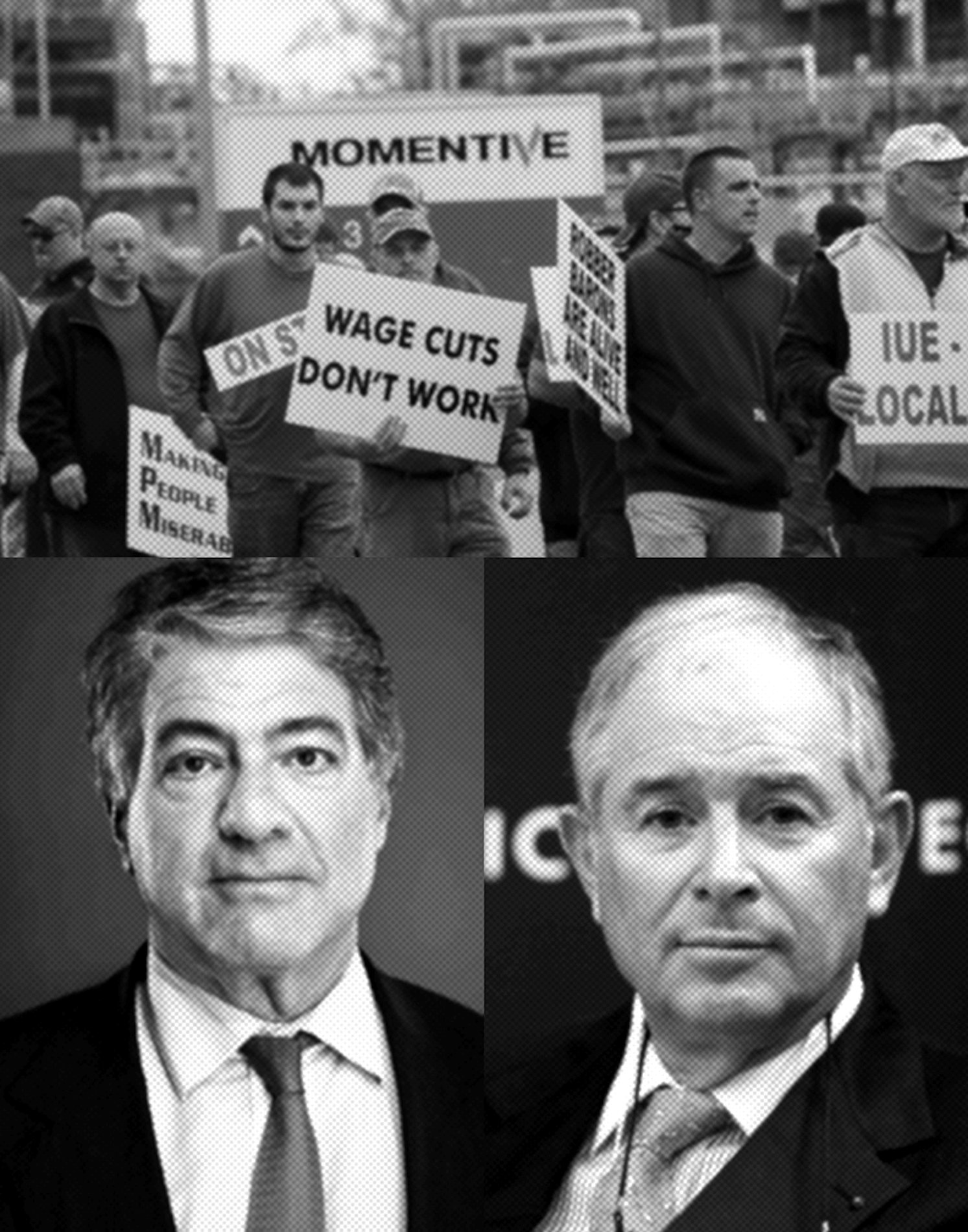

Black and Schwarzman are the billionaire Wall Street fund managers who’ve taken over Momentive Performance Materials in Waterford, New York and driven down pay, wages and benefits for workers and their families over the past decade.

Billionaire Stephen Schwarzman and Leon Black

Now workers at the plant have gone out on strike – and the Hedge Clippers campaign is working to help New Yorkers understand how billionaire-driven inequality is pushing regular people and their families over the edge.

Since Momentive was bought by billionaires in 2006, workers have seen their standard of living destroyed:

- In 2009, Momentive slashed pay for production workers by 25 to 50 percent and outsourced dozens of jobs

- In 2013, the company froze pensions for workers younger than 50.

- Now Momentive wants to slash health care coverage for active employees, and to eliminate all health and life insurance for retired workers, many of whom are suffering from job-related illnesses caused by exposure to dangerous chemicals.

Meanwhile, these billionaire owners of the company have gotten enormously wealthy.

Leon Black, the head of huge hedge fund Apollo Global Management (the majority owner of Momentive), has grown his personal wealth to $5.1 billion and bought a $50 million Manhattan mansion, Tom Cruise’s $40 million Beverly Hills estate, and a $16.5 million Miami condo to add to his 100-acre Westchester estate and his oceanfront compound in the Hamptons.

Stephen Schwarzman, the head of giant private equity fund Blackstone Group (which owns a big chunk of Momentive) got even richer – his personal fortune is estimated at over $11.1 billion, and his personal pay last year was an astounding $811 million.

Black and Schwarzman are ‘the guys behind the guys’ – the puppet masters loading up Momentive with unsustainable levels of debt, extracting huge management and interest payments and working the angles on tax and bankruptcy laws while demanding that their lap-dog executives hit workers with job, pay and benefit cuts.

And now that President-elect Donald Trump has named Schwarzman as the Chair of his “Strategic and Policy Forum,” charged with providing advice on new jobs and economic growth, there’s a real question about whether the billionaire corporate raider that helped destroy jobs at Momentive can turn over a new leaf.

Trump should be extremely concerned about the preservation of good jobs in New York State, just as he has been in Indiana and Michigan.

But hurting workers and outsourcing jobs seems to come easily to the hedge fund class, and trashing companies while extracting wealth is their basic business model.

The Wall Street billionaires at Apollo loaded Momentive with debt, adding nearly $3 billion in new debt to the company in a single month and increasing debt service costs by over 1000 percent.

And hedge fund managers at Apollo made a fortune from fees: an estimated $642.7 million in “management fees” charged to their investors and to Momentive.

The truth is that Momentive crisis includes many of the worst aspects of today’s billionaire-driven inequality economy:

- The hedge fund/private equity takeover of an American industrial firm to get big profits for billionaire fund managers, no matter the cost to our local economy;

- Mind-boggling wealth for the billionaires, including mansions, villas, estates, yachts and a three-million-dollar birthday party;

- Savage cuts to jobs, wages, health benefits and pensions for working-class families who need decent jobs to survive

- Dangerous costs for communities, including exposure to dangerous cancer-causing industrial chemicals and increasing levels of accidents

- Lucrative loopholes for investment managers that let them save billions of dollars on taxes and end up paying a lower tax rate than many teachers and truck drivers

- Wasteful corporate welfare grants to the billionaire-owned companies that got bipartisan criticism as “an utter farce” and “another pork-barrel scam.”

We join the call on New York lawmakers and leaders, including Governor Andrew Cuomo, and on President-elect Donald Trump, to block the billionaires and stand up for working families in New York who need decent jobs with good pay and benefits to survive.

Leon Black and Stephen Schwartzman are rich enough already. They should stop the pay and benefit cuts, restore the jobs and run their company responsibly.

HEDGE FUND BILLIONAIRES ATTACK MOMENTIVE WORKERS & UPSTATE NEW YORK FAMILIES

Momentive workers out on strike fighting savage cuts

More than 700 hard-working members of IUE-CWA Locals 81359-81380 made the difficult decision to go on strike against Momentive Performance Materials in Waterford, New York on November 2, 2016.

They have been walking the picket line day and night since then, fighting for good jobs in Upstate New York.

Billionaire hedge fund managers including Leon Black of Apollo Global Management and Stephen Schwarzman of the Blackstone Group own controlling stakes in the company.

Billionaire hedge fund managers including Leon Black of Apollo Global Management and Stephen Schwarzman of the Blackstone Group own controlling stakes in the company.

Right now, the billionaires are ordering their puppet CEO Jack Boss to:

- Slash health benefits for current workers,

- Eliminate health and life insurance coverage for future retirees, and

- Slash pension benefits for workers and their families.

These outrageous demands come on top of enormous cuts inflicted on the Momentive workers since it was spun off from GE a decade ago: 25 to 50% cuts in production workers’ wages, outsourcing of dozens of jobs, and freezing pensions for workers under 50.

It’s not the first time workers took big cuts while Black and Apollo profited: the New York Times exposed their takeover of Hostess Brands in a huge investigatory piece titled “How the Twinkie made the Superrich Even Richer.” [1]

Replacement workers increase environmental risks to neighbors in Upstate New York

And it’s not enough to hurt their own workers: the billionaires that own Momentive are now putting the health and safety of thousands of families in Upstate New York at risk.

They’re running the plant with scab workers who are mishandling dangerous chemicals, according to state data and local news reports.[2]

There’s been a 100 percent increase in the rate of chemical spills during the strike, as untrained workers handle dangerous industrial chemicals.

And it’s not the first time Leon Black and Apollo have been irresponsible with environmental damage: in 2010 they took advantage of bankruptcy laws to escape $5 billion in federal environmental fines for a company they owned which caused a massive catastrophic chemical spill in the Kalamazoo River in Michigan.[3]

Here in Upstate New York, families and communities in Waterford and nearby Troy, Albany and Hoosick Falls are already reeling from the toxic damage caused by PFOA (Perfluorooctanoic Acid) contamination in public and private wells linked to Saint-Gobain Performance Plastics .[4]

Wall St. billionaires like Black & Schwarzman are adding to the environmental dangers faced by Upstate NY workers Share on XIt’s outrageous that Wall Street billionaires like Leon Black and Stephen Schwarzman are adding to the environmental dangers faced by Upstate workers, families and kids with new dangers from Momentive chemical spills, while they concentrate their closest attention on making themselves even richer.

HEDGE FUND BILLIONAIRES LOADED MOMENTIVE WITH DEBT, PULLED OUT MILLIONS IN FEES, SHAFTED WORKERS AND GOT EVEN RICHER

General Electric sold its Advanced Materials division to the massive hedge fund Apollo Global Management on December 3, 2006 (with GE Equity retaining a 10% stake) for $3.8 billion.

Massive billionaire-inflicted debt load

Apollo loaded the company with $2,879,000,000 in additional debt by the end of the year[5] — that’s $2.8 billion in new debt in just one month — and this billionaire-inflicted debt load helped destroy a profitable company and push it towards bankruptcy.

Two items weakened Momentive – the debt load and the impairment of goodwill. Annual average debt service increased an astonishing 1,010% from before the purchase.

And in 2008, Momentive wrote down $858.5 million in goodwill. Basically, accountants booked the fact that Apollo overpaid for the now-impaired asset, further weakening the company.

But the hedge fund billionaires got rich from fees charged to the company and its investors

Leon Black and his hedge fund team made tons of money despite their manipulation of the company, thanks to exorbitant fees charged to the company and Apollo investors.

Immediately after it bought the company, Apollo took out $40 million in fees from Momentive.[6] And in the next eight years, they charged the company another $42 million in “management and consulting” fees[7].

But when you add in the “2 and 20” carried interest profits earned by hedge fund and private equity managers as service fees for using other people’s money to raid corporations, the take gets even bigger.

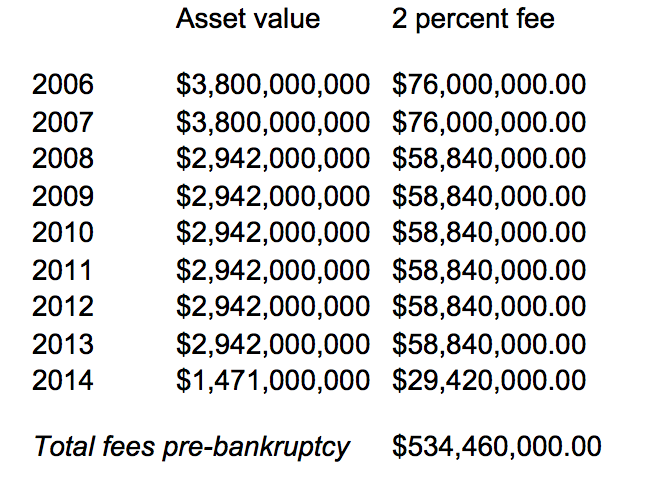

In both hedge funds and private equity funds, the standard fee structure is “2 and 20”—two percent of the fund assets per year are taken as the management fee, which covers operating costs. Twenty percent of all gains over a certain benchmark rate are taken by the fund manager as the performance fee.

The Apollo fund that bought Momentive (Apollo Investment Fund VI, L.P.) charged its limited partners a management fee in general for this and other assets. For hedge fund deals like this one, the customary fee is 2% of asset value.

Since the asset was valued originally at $3.8 billion, it is likely that Apollo charged its limited partners roughly $534 million to manage the asset prior to bankruptcy.[8]

Estimated Apollo management fees from Momentive (pre-bankruptcy)

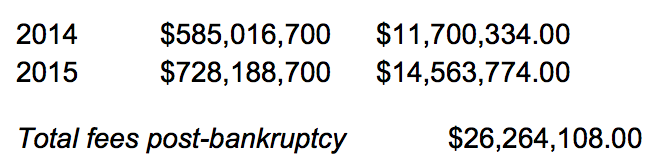

It is uncertain exactly how Apollo would price the post-bankruptcy asset, but using their current ownership stake of 39.77% of the asset value would result in another $26 million in management fees.[9]

Estimated Apollo management fees from Momentive (post-bankruptcy)

Based on this estimate, Leon Black and Apollo charged their investors $560.7 million dollars and charged Momentive $82 million for a total of $642.7 million in fees from 2006 to 2015.

As other funds like Blackstone/GSO moved into Momentive after the bankruptcy, it’s very likely that millions more in fees are being taken out of the company by more billionaire fund managers like Stephen Schwarzman and his wrecking crew.

Billionaires keep control of Momentive through wild bankruptcy court schemes

It’s no surprise that Leon Black and Apollo drove Momentive into bankruptcy in 2014 — but it’s outrageous that they used an obscure consumer loan ruling from the Supreme Court to upend the traditional outcome in bankruptcy court

Bankruptcy typically wipes out shareholders, while senior creditors get most of the company, and junior creditors get pennies on the dollar.

After April 2014, Apollo bought a large chunk of the junior debt. The bankruptcy judge approved a plan that crammed down fees on the senior bondholders, cut debt by $3 billion by paying off senior bondholders at below market interest rates, and gave equity to the junior creditors.[10]

The bankruptcy case got a lot of attention in Wall Street circles, largely because the senior bondholders litigated and tried (unsuccessfully) to overturn the bankruptcy ruling.[11]

Cuts and austerity for workers, more money for millionaires and billionaires

Damage to the balance sheet at Momentive helped create the rationale for cuts to jobs, pay, pensions and health benefits for workers and their families.

But Momentive never stopped spinning off millions of dollars in fees and charges for Black, Schwarzman and the other Wall Street fund managers who’ve ‘managed’ to get richer and richer while workers and their families struggled.

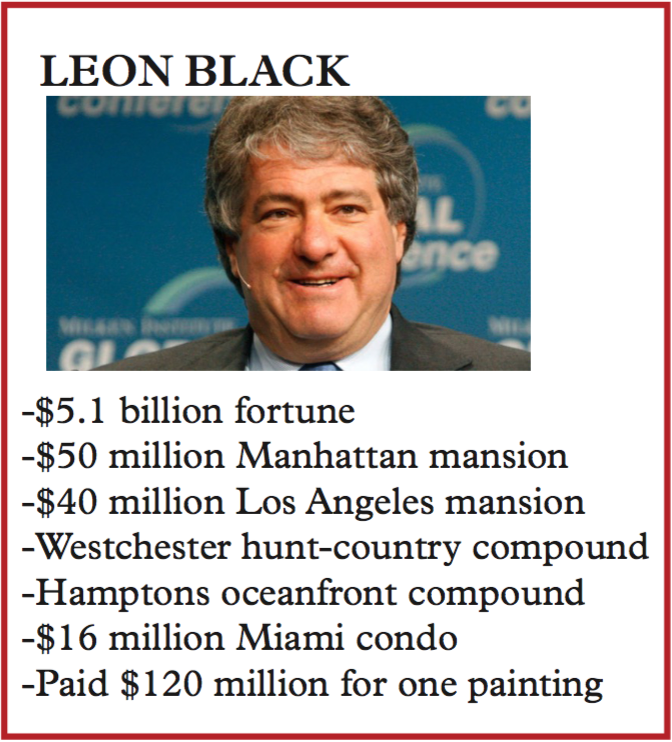

MEET HEDGE FUND BILLIONAIRE LEON BLACK

Leon Black is currently the CEO of Apollo Global Management, which owns nearly 40% of Momentive.

Billionaire wealth

According to Forbes Magazine, Black is now worth $5.1 billion[12].

Massive mansions

Black owns a 100-acre estate in the Westchester County hamlet of Bedford[13], and a multi-residence compound in Southampton[14] listed in the “most lavish billionaire homes of the Hamptons.”[15]

During the period when he was cutting jobs, pay and benefits for workers at Momentive, Black went on a real estate shopping spree.

In Manhattan, he bought a massive $50 million mansion on the Upper East Side, just steps away from Central Park off Fifth Avenue.[16]

In Los Angeles, he bought a $40M Beverly Hills estate from actor Tom Cruise[17] rumored to have been previously owned by a Mexican mafia family.[18]

According to Variety magazine, the posh spread provides a 10,286-square-foot multi-winged manor house with seven bedrooms and nine bathrooms plus a motor court that circles up around a fountain, lighted tennis court with basketball hoops, lap-length swimming pool, children’s playground, and a couple of ancillary apartments for guests and/or staff.[19]

And the real estate portfolio of a billionaire corporate raider wouldn’t be complete without a luxurious place in Miami.

In 2015 Black purchased a $16.5 apartment in Faena House, a Miami “ultra-luxe condo tower” favored by his fellow hedge fund billionaires[20] but he’s said to be looking to sell it for a quick two-million-dollar profit.

Extravagant luxury purchases while workers suffer

And real estate isn’t the only place where Leon Black has been spending tons of cash obtained by squeezing workers and trashing the environment.

In 2012, after the job cuts and pay cuts but before the pension freeze, Black spent $120 million dollars on a single painting: “The Scream” by Edvard Munch.[21]

And in 2013, he paid $48 million for a single drawing by Renaissance master Raphael[22].

“Greed is good”

Black worked at investment bank Drexel, Burnham & Lambert (the famous “greed is good” junk bond firm) through the 80s, ultimately moving on when the corporation folded following a securities-fraud scandal.[23]

Black was a member of the CEO fiscal leadership council at pro-austerity group “Fix the Debt.” Of the corporate tax cut-loving CEOs backing Fix the Debt, Black reaped the highest windfall from Bush-era tax cuts, saving almost $10 million in 2011.[24]

Buying politicians nationwide

Black is a major political donor, often splitting his contributions between Republicans and Democrats, but putting big money into the personal PACs and Super PACs of Republican leaders in the House and Senate in the last cycle.[25]

He’s given over a million dollars to federal-level candidates since 2000, including $150,000 to defeat populist democrat Zephyr Teachout in the Hudson Valley.[26] And he’s spent $140,000 on state-level campaigns here in New York during the same period.[27]

Puerto Rican debt vulture

Black’s hedge fund Apollo Global Management, is involved in the Puerto Rico debt crisis. Press reports have indicated that Apollo, along with Fortress Investment Group and Aurelius Capital, are looking to take on a “more activist role” as the debt restructuring continues.[28]

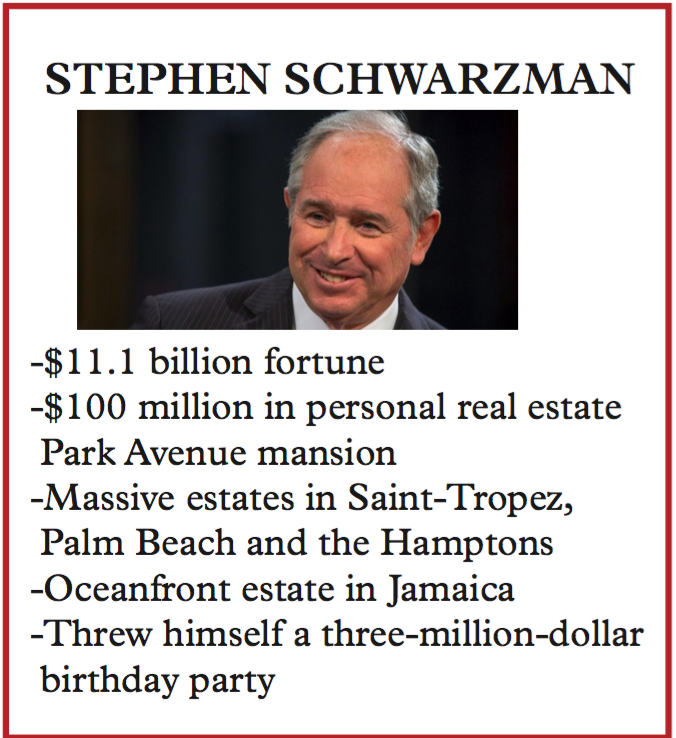

MEET PRIVATE EQUITY BILLIONAIRE STEPHEN SCHWARZMAN

GSO Partners, an arm of the giant Blackstone Group, also owns a significant chunk of Momentive.

March 2007: Fortune magazine hailed Stephen Schwarzman as “The New King of Wall Street.”

Billionaire wealth

Blackstone was co-founded and run by Stephen Schwarzman, whose fortune is currently estimated at $11.1 billion according to Forbes.[29] Last year Blackstone paid him (or he paid himself) a salary of $811 million.[30]

Multiple mansions and real estate

As for real estate, Schwarzman told The New Yorker; “I love houses. I’m not sure why.”[31]

The billionaire has acquired over $100 million in personal property around the world including estates in East Hampton and Saint-Tropez,, a beachfront villa in Jamaica, and a sprawling 35-room Park Avenue apartment that was once owned by John D. Rockefeller Jr., where his neighbors include Steven Mnuchin, Trump’s nominee for Treasury Secretary.[32]

Schwarzman’s sprawling estate in Eastern Hampton. He also has a 11,000 square foot mansion in Palm Beach, a favorite location among his finance industry colleagues, where he was busted for using 7.4 millions gallons of water during a record dry season in the region.

Luxury consumption and a three-million-dollar birthday party

One media feature on Schwarzman – titled “The Golden Ass” – described him as a “titan of self indulgence” and detailed his love of $400 stone crabs and his strict no-squeaky-rubber-soled-shoes policy for his house staff.

Employees in his 11,000-square-foot Palm Beach residence must avoid rubber-soled shoes lest the squeaking sounds they make impinge upon his poolside bliss. And his personal chef “often spends $3,000 for a weekend of food for Mr. Schwarzman and his wife, including stone crabs that cost $400, or $40 per claw.”[34]

When he threw an infamously luxurious party for his 60th birthday party, Donald and Melania Trump were among the guests. The $3 million dollar affair treated guests to performances by Rod Stewart and Patti LaBelle and a large portrait of Schwarzman, which usually hangs in his living room, was on display.[35]

Harsh job, pay and benefit cuts for workers in Blackstone deals

Schwarzman will soon be serving as the Chair of President-elect Trump’s “Strategic and Policy Forum,” which has been charged with advising the incoming President on public policies to generate new jobs and economic growth.[36]

In this capacity, he should be extremely concerned about the preservation of good jobs in New York State.

But throughout his career as a corporate raider, Schwarzman has repeatedly destroyed jobs, cut pay, eliminated benefits and raided pension funds.

“These investments are helping the fat cats by hurting the little guys,” said one laid-off worker interviewed by the Wall Street Journal. “It’ll make you sick.”[37]

Millions in campaign cash to buy political influence

Like his fellow billionaire Leon Black, Schwarzman spends big to win political influence: over $1.4 million in campaign cash to federal-level candidates and another $61,000 to state-level politicians here in New York.[38]

And like Black, Schwarzman benefits big-time from a special tax break available only to hedge fund and private equity managers: the carried interest loophole.

CARRIED INTEREST: THE BILLIONAIRES’ LUCRATIVE LOOPHOLE

What is the carried interest loophole?

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income.

Hedge fund and private equity funds are usually structured as partnerships. The fund manager is the general partner of the funds, and investors like pension funds or endowments are limited partners.

Investors often supply the majority of the capital, and the fund manager is supposed to supply investment expertise.

For the services the investment manager provides, they charge certain fees.

In both hedge funds and private equity funds, the standard fee structure is “2 and 20”—two percent of the fund assets per year are taken as the management fee, which covers operating costs. Twenty percent of all gains over a certain benchmark rate are taken by the fund manager as the performance fee.

The problem comes from how that twenty percent “performance fee” is treated for tax purposes.

To an outsider, it may seem that this twenty percent fee is compensation for services. According to the Tax Policy Center, a joint project of the Brookings and Urban Institutes, the vast majority of tax analysts share this view.

If we treated the performance fee as a fee for services, it would be federally taxed at the ordinary income level, where the highest marginal tax rate is currently 39.6%. Instead, many fund managers treat this fee as an investment profit.

Profits on investments held longer than one year receive preferential treatment in the tax code, with the highest marginal rate on long-term capital gains set at 20%.

That difference of 19.6% may not sound like a lot of money, but the academics estimate the tax revenue loss from the carried interest loophole to be $18 billion per year.

Congress — bought and paid for by the billionaires

Congress won’t act – because hedge funds and private equity firms are using millions of dollars in lobbying and campaign cash to keep the loophole open.

Hedge funds and banks have spent millions of dollars in campaign cash and lobbying to protect their loopholes and special treatment, blocking action in Congress.

Hedge fund and private equity lobbying and political spending increased dramatically in 2007 — the same year Congress took steps to close the carried interest loophole.

That effort failed, as have subsequent efforts, due to a torrent of lobbying and campaign cash.

Lobbying spending by the hedge fund and private equity industries soared 455% in 2007, from $4.1 million in 2006 to over $23 million in 2007. It has never dropped back to pre-2007 levels.

Since 2007, the two industries have spent a combined average of $20 million per year on lobbying.

Campaign finance records show that this lobbying spending spree was coupled with an increase in campaign donations.

In 2007 and 2008, hedge funds and private equity firms increased their political giving by over three times, from $7.3 million in the 2006 cycle to $24.5 million in the 2008 cycle.

In each election cycle since 2008, hedge funds & private equity have donated an avrg of $7.7 million Share on XIn each election cycle since 2008, hedge funds and private equity have donated an average of $7.7 million and $15 million respectively — buying power and control in Congress and blocking action to close the carried interest loophole.

Black and Schwarzman benefit from unfair carried interest loophole — Albany action could bring fairness

As billionaire investment managers who charge their investors fees in the form of “carried interest,” Black and Schwarzman are likely among the biggest beneficiaries of this special tax break.

It adds insult to injury that these billionaire corporate raiders who have trashed Momentive as a company, cut jobs, pay and benefits for Momentive workers, exposed neighboring families and communities to dangerous chemicals and gotten fabulously rich while doing it also probably pay a lower tax rate that the small business owners in Waterford, Troy and Albany.

It adds insult to injury that these billionaire corporate raiders who have trashed Momentive as a company, cut jobs, pay and benefits for Momentive workers, exposed neighboring families and communities to dangerous chemicals and gotten fabulously rich while doing it also probably pay a lower tax rate that the small business owners in Waterford, Troy and Albany.

The new GOP-controlled Congress is unlikely to close “the billionaires’ loophole,” but it’s possible that Albany lawmakers and Governor Andrew Cuomo will.

New legislation introduced in the State Legislature would close the loophole for New York hedge-funders like Black and corporate raiders like Schwarzman, and raise over $3 billion for schools, healthcare and property tax relief for working families like those in Waterford.[39]

It would be only just if populist rage against the destructive actions of billionaires like Black and Schwarzman built support for fair-share taxes that could hit them hard and bring a measure of fairness to the communities they’ve already hurt badly.

Momentive also got boondoggle state tax breaks

The billionaires behind Momentive also benefitted from a four-million-dollar gift from New York State taxpayers, in the form of an Empire Zone tax break.[40]

The wasteful Empire Zone program was attacked by the Albany Times-Union as “an utter farce” and by the New York Times as a “pork-barrel scam,”[41] but the greedy billionaires behind Momentive were happy to take the pork.

Footnotes

[1] https://www.nytimes.com/2016/12/10/business/dealbook/how-the-twinkie-made-the-super-rich-even-richer.html

[2] http://www.timesunion.com/tuplus-business/article/Spills-up-at-Waterford-s-Momentive-chemical-plant-10833590.php

[3] https://www.bloomberg.com/news/articles/2013-06-25/apollo-fueled-by-9-6-billion-profit-on-debt-beats-peers

[4] http://news10.com/tag/hoosick-falls-water-contamination-crisis/

[5] This figure is from S&P Capital IQ and is consistent with the $2.885 billion in long-term debt disclosed by MPM in its SEC Form S-4 Registration Statement, filed September 14, 2007, p. 47. See p. F-23 for the holders of the debt. https://www.sec.gov/Archives/edgar/data/1405041/000119312507201528/ds4.htm#rom99298_6

[6] SEC Form 10-K for 2007, March 31, 2008

https://www.sec.gov/Archives/edgar/data/1405041/000119312508070864/d10k.htm

page 68

[7] SEC Form S-4, September 14, 2007, Exhibit 10.4 https://www.sec.gov/Archives/edgar/data/1405041/000119312507201528/dex104.htm

[8] Based on Momentive corporate data from S&P Capital IQ database.

[9] Id.

[10] http://www.law360.com/articles/778799/noteholders-fight-momentive-bankruptcy-plan-in-2nd-circ

[11] http://www.law360.com/articles/807782/apollo-momentive-defend-controversial-ch-11-plan

[12] http://www.forbes.com/billionaires/list/#version:realtime_search:leon%20black

[13] http://variety.com/2016/dirt/real-estalker/tom-cruise-sells-beverly-hills-estate-1201777173/; http://www.nytimes.com/1997/05/15/nyregion/stars-flock-to-a-new-york-suburb-that-is-wealthy-but-unassuming.html

[14] http://www.forbes.com/sites/chloesorvino/2016/05/25/inside-the-hamptons-most-lavish-billionaire-homes/#29349aba656e

[15] Id.

[16] http://nypost.com/2014/08/13/finance-guru-leon-black-buying-50m-ues-townhouse/

[17] http://variety.com/2016/dirt/real-estalker/tom-cruise-sells-beverly-hills-estate-1201777173/

[18] http://www.yolandaslittleblackbook.com/blog-1/2016/06/25/2016624tom-cruise-sells-his-former-mexican-mafia-princess-house-to-leon-black-for-38-million/

[19] http://variety.com/2016/dirt/real-estalker/tom-cruise-sells-beverly-hills-estate-1201777173/

[20] http://therealdeal.com/miami/2016/05/09/leon-black-lists-faena-unit-for-18-5m-negotiations-underway/

[21] http://www.wsj.com/articles/SB10001424052702304373804577521240470769420

[22] http://www.wsj.com/articles/SB10001424127887324577904578555612965650352

[23] http://www.bloomberg.com/bw/stories/1996-07-28/leon-black-wall-streets-dr-dot-no-intl-edition

[24] http://www.ips-dc.org/ceo-campaign-to-fix-the-debt/

[25] https://www.opensecrets.org/usearch/?q=leon+black&cx=010677907462955562473%3Anlldkv0jvam&cof=FORID%3A11

[26] http://hedgeclippers.org/hedgepapers-no-38-hedge-fund-billionaires-attack-the-hudson-valley/

[27] http://hedgeclippers.org/hedgepapers-no-38-hedge-fund-billionaires-attack-the-hudson-valley/

[28] http://www.debtwire.com/info/2014/07/15/puerto-rico-bondholders-mobilize-hedge-funds-tap-morrison-foerster/

[29] http://www.forbes.com/profile/stephen-schwarzman/

[30] http://www.businessinsider.com/r-blackstone-ceo-took-home-8106-million-in-2015-2016-2

[31] http://www.newyorker.com/magazine/2008/02/11/the-birthday-party-2

[32] http://www.crainsnewyork.com/article/20150308/FINANCE/150309874/how-stephen-schwarzman-spends-his-cash

[33] http://www.wsj.com/articles/SB10001424052702304803104576428183030837332

[34] http://www.wsj.com/articles/SB118169817142333414; http://www.slate.com/articles/business/moneybox/2007/06/the_golden_ass.html

[35] http://www.wsj.com/articles/SB118169817142333414

[36] https://www.blackstone.com/media/press-releases/article/president-elect-trump-establishes-the-president-s-strategic-and-policy-forum

[37] http://www.wsj.com/articles/SB118549984636779837

[38] https://littlesis.org/person/14997/Stephen_Schwarzman/recipients

[39] http://www.wsj.com/articles/democrats-push-bill-in-new-york-senate-to-end-tax-break-1458693961

[40] http://www.saratogacountyny.gov/upload/eddec112006.pdf; http://www.alignny.org/wp-content/uploads/2013/12/RegionalReviewReportALIGN_FINAL.pdf

[41] http://www.cbcny.org/sites/default/files/report_ez_12012009.pdf