How Ohio Students, Taxpayers & Communities Suffer

The Great Recession took an immeasurable toll on Ohio’s colleges and universities–and eight years later, Ohio’s higher education system has yet to recover.

State funding was cut, tuition was increased, and university endowments lost huge amounts in market losses – and have since lost even more to exorbitant fees charged by greedy Wall Street hedge fund managers.

Per-student funding in the state remains 15 percent lower today than 2008 levels,[i] and according to a 2015 report by Policy Matters Ohio, the state budget for need-based aid is an astonishing 61 percent lower than 2008-2009 funding levels.[ii]

The impact on students, faculty, and university workers has been profound.

Students have seen in-state tuition increases,[iii] and the scarcity of need-based aid has forced students and their families to take out burdensome student loans in order to pay for college, and put a college degree out of reach financially for some low and middle income students.

Faculty have seen their jobs become more tenuous as universities seek to cut costs,[iv] and campus workers of all types have experienced hiring freezes, layoffs and wage stagnation.[v]

Ohio university endowments also took a hit during the Great Recession.

Endowments, or pooled donations to the school that are invested to generate returns for universities to spend on teaching and learning, can serve as safety nets or rainy day funds that universities can dip into in times of budget shortfalls.

However, while universities in Ohio and across the country saw their endowments shrink during the economic crisis,[vi] many simultaneously invested significant portions of their endowments in hedge funds — expensive, risky investment vehicles that take a tremendous toll on the economy, communities and the environment.

This report examines twelve Ohio four-year colleges and universities that have approximately $2.6 billion invested in hedge funds. Our research shows that hedge fund managers have charged exorbitant fees on these investments.

Moreover, hedge fund managers use their wealth to provide back door funding to companies, industries and politicians that harm Ohio communities.

Key findings include:

- Twelve Ohio colleges and universities paid about $425 million in fees to hedge fund managers since the Great Recession – enough to provide over 8,000 full in-state scholarships at Ohio public universities per year.

- Eight Ohio public universities included in our analysis paid an estimated $238 million in hedge fund fees; the four large Ohio private universities included in our analysis paid nearly as much, with an estimated $187 million in fees to hedge fund managers since 2009.

- These fees are in no way justified by returns. According to our estimates, these twelve universities on average paid an unbelievable 65 cents in fees to hedge fund managers for every dollar of net return to the endowment fund from 2009-2015.

- Ohio universities and hedge funds operate without transparency and without accountability. Hedge fund managers do not have to disclose to universities how much they are collecting in fees, and universities are not obliged to report to the public how much they have invested in hedge funds, which hedge funds they are invested in, and how these hedge funds have performed.

- High fees rip off Ohio taxpayers and colleges while hurting Ohio communities. Hedge fund managers are using the fortunes they’ve grown through exorbitant fees to fund politicians and initiatives that put Ohio communities at risk, from private prisons and immigrant detention corporations, to dirty-energy fossil fuel producers and pipelines, to price-jacking Big Pharma corporations.

- Hedge fund managers were among the biggest donors to Donald Trump’s presidential campaign and now they are helping to develop and roll out Trump’s far-right agenda: Trump nominated hedge fund managers to head the Treasury and Commerce departments, and there are a number of hedge fund managers among his top advisors.

Hedge funds pose an immediate threat to Ohio universities—and students, faculty and community members are starting to fight back.[vii]

By demanding that universities divest from hedge funds, stakeholders can ensure that endowments serve their original purpose of providing scholarships and other economic supports to faculty, students and campus workers, and cease to be piggy banks for billionaires set on destroying Ohio’s economy and environment.

OHIO UNIVERSITIES AND HEDGE FUNDS

Endowments are central to the lives of students, faculty, campus workers and community members: funded entirely by donations to the school, endowments are invested in order to generate returns, which are used to support teaching and learning.

Because of this mission to provide economic support to the campus and the community, university endowments are associated with two different types of tax exemption–donors do not pay taxes on the amount donated to the endowment, and the endowments themselves are untaxed.

Over the last two decades, however, university endowments have gradually strayed from this core mission, with administrators and board members increasingly viewing endowments as opportunities to chase high investment returns in order to grow the endowment as quickly as possible.[viii]

This drive to increase endowment returns only intensified after the Great Recession, during which the average university suffered investment losses.[ix]

Most troublingly, the principal way that many universities have attempted to grow their endowments is by investing larger and larger portions of their endowments in hedge funds—i.e. expensive, risky investment vehicles that take a tremendous toll on the economy, communities and the environment.

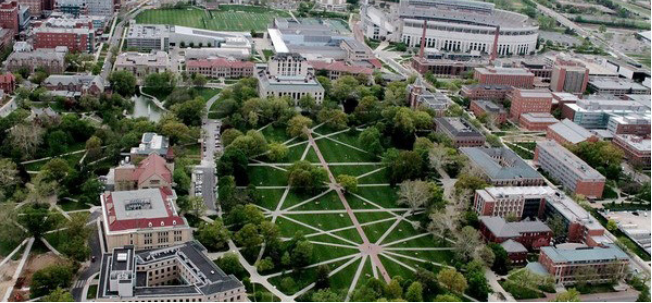

Ohio universities have followed the same trend, and now have almost $3.4 billion invested in hedge funds.[x]

The Columbus Dispatch reported on this trend back in 2007, noting that a 2002 change in state law opened the doors to public universities to invest in hedge funds, which it described as “unregulated private investment pools that critics warn use unorthodox and often risky strategies.”

The article also quoted a state representative, who expressed his concern about universities investing in hedge funds: “There’s no moral justification for that kind of (public) investment, and I don’t understand what kind of philosophy is at work. Nobody with any type of middle class values would do that with their investments. It’s like going to Las Vegas.”[xi]

The following table lists the twelve Ohio universities included in our study along with amount currently invested in hedge funds and percentage of university investments this represents.[xii]

Note that some universities report hedge fund investments for the endowment (sometimes called the foundation), and others report these investments for the university as a whole, as reflected in the table:

| University | Size of endowment (million USD) | Hedge fund investment (%) | Hedge fund investment (million USD) |

| Bowling Green State University Foundation | $200 | 10% | $20 |

| Case Western Reserve University | $2,000 | 25% | $385 |

| Denison University | $775 | 40% | $310 |

| Kent State University | $389 | 29% | $98 |

| Kenyon College | $380 | 39% | $148 |

| Miami University Foundation[xiii] | $444 | 32% | $144 |

| Oberlin College Endowment | $882 | 30% | $260 |

| Ohio State University Endowment | $3,600 | 31%[xiv] | $1,105 |

| Ohio University Foundation[xv] | $453 | 14% | $65 |

| University of Cincinnati Endowment | $1,196 | 12% | $146 |

| University of Toledo[xvi] | $236 | 14% | $32 |

| Wright State University Foundation | $120 | 10% | $12 |

| TOTAL | $11,563 | $2,590 |

Nationally, the average university allocates about 20 percent of its endowment to hedge funds; as the following snapshot makes clear, five of the universities in our studies have hedge fund allocations at least fifty percent higher than the national average.

| University | Allocation to hedge funds (%) |

| Denison University | 40% |

| Kenyon College | 39% |

| Miami University Foundation | 32% |

| Ohio State University Endowment | 31% |

| Oberlin College Endowment | 30% |

From a strict investment perspective, these universities’ choice to devote such a large proportion of the endowment to an expensive, risky asset class is questionable at best.

High allocations to hedge funds not only means that hedge fund fees represent a larger portion of the overall cost of managing the entire endowment, but also put the endowment at risk should hedge funds perform poorly, as they have over the last several years.

HEDGE FUNDS: HIGH FEES, LOW RETURNS, AND UTTER SECRECY

Clearly, Ohio universities are handing billions in endowment dollars to hedge fund managers—and they are paying a steep price for it.

Ohio universities are handing billions in endowment dollars to hedge fund managers Share on XHedge funds charge among the highest fees of any investment class, charging investors two percent of assets under management per year in management fees, along with twenty percent of any profits, in what is typically referred to as the “two-and-twenty” fee structure.

While some investors manage to negotiate slightly lower fees, hedge fund fees remain extraordinarily high, particularly compared to more traditional investments

Compounding the issue of high fees and low returns for university endowment hedge fund programs is the failure of most universities to make a detailed accounting of hedge fund fees and returns available to the public.

In fact, it is not uncommon for universities to waive their right to know this information themselves. This prevents the board of trustees, students and other stakeholders from knowing the true cost of hedge funds to the university.

Because reliable hedge fund fee and return information was not publicly available for the universities in our study, we estimated what these universities paid in hedge fund fees—and the result was troubling.

We estimate that the twelve Ohio universities we analyzed paid $425 million in hedge fund fees since the Great Recession. (For more detailed information on how we estimated these fees, please see Appendix.)

This figure is even more worrisome considering that hedge funds may have failed to deliver on their promise of market-beating returns.

In fact, a recent study of pension funds found that hedge funds provided the worst long-term gains of any investment type except cash.[xvii]

According to our estimates, the Ohio universities in our study paid 65 cents in fees to hedge fund managers for every dollar of net return to the endowment.

The following table lists the twelve Ohio universities in our sample, and the estimated fees paid to hedge fund managers from fiscal year 2009-2015. Note that the fee amounts below are intended as an informed estimate. Because only the universities and have access to the actual terms and performance of their investments, it is incumbent upon them to calculate actual fees paid to hedge fund managers, and we welcome these universities to provide annual hedge fund fee and return data and make this information available to the public.

| University | Estimated fees to hedge fund managers, FY 2009-2015 |

| The Ohio State University | $129 million |

| Bowling Green State University | $2.7 million |

| Case Western Reserve University | $76 million |

| Miami University | $19 million |

| Kent State University | $12 million |

| Ohio University | $10 million |

| University of Cincinnati | $59 million |

| Wright State University | $2.2 million |

| Oberlin College | $47 million |

| University of Toledo | $4 million |

| Denison University* | $47 million |

| Kenyon College | $17 million |

| TOTAL | $425 million |

*Data available for fiscal years 2011-2015 only

Clearly, hedge funds are preying on university endowments, siphoning funds away from higher education and into the pockets of billionaires.

The following snapshots reveal how hedge funds have impacted specific universities in Ohio:

Ohio State University

- The Ohio State University has $1.1 billion, or 31% of its endowment, invested in hedge funds according to the most recent fiscal year data available.

- According to our estimates, OSU paid $129 million in hedge fund fees over the last seven years.

- Although OSU is invested in 24 hedge funds,[xviii] it does not disclose any of these hedge funds in public documents.

- After becoming the first university in the country to take controversial step of privatizing its parking facilities in 2012,[xix] OSU is now poised to become the first university to privatize its energy services in what the university claims is an attempt to save money.[xx]

University of Cincinnati

- University of Cincinnati has $146 million, or 12% of its endowment, invested in hedge funds, according to the most recent fiscal year data available.

- However, according to the commercial database Preqin, the university’s target allocation to hedge funds is 25%, or more than double the current allocation.[xxi] This coincides with speculation that university officials will lower the endowment spending rate from the current 4.5%.[xxii]

- According to our estimates, UC paid $59 million in hedge fund fees since 2009. Among the known hedge funds that UC currently or previously invested its endowment with are Och-Ziff Capital Management, which recently paid a record $400 million fine to the SEC to settle alleged bribery of foreign dictators.[xxiii]

Wright State University

- Wright State University currently has $12 million, or 10 percent of its endowment, invested in hedge funds.

- According to our estimates, WSU paid $2.2 million in hedge fund fees since 2009.

- All of WSU’s hedge fund allocation is in hedge fund-of-funds, which are hedge funds that in turn invest in other hedge funds. Fund-of-funds thus mean that investors like WSU pay an additional layer of fees to hedge fund managers. Since we did not account for fund-of-fund fees in our estimates, it is possible that WSU paid even more in hedge fund fees than our $2.2 million estimate.

Kent State University

- Kent State University currently has $98 million, or 29 percent of its investments, allocated to hedge funds.

- According to our estimates, Kent State paid $12 million in hedge fund fees over the last seven years.

- Like Wright State University, Kent State also invests in fund-of-funds, which charge an additional layer of fees to the university.

- Kent State does not disclose the hedge funds it invests in. However, it does state in its investment guidelines “the university will make reasonable efforts to invest in ethical and socially responsible companies,”[xxiv] calling into question whether hedge fund investments align with this policy.

HEDGE FUNDS: SUPPORTING COMPANIES AND INDUSTRIES THAT HARM OHIOANS

When hedge funds siphon endowment money away in fees, it falls on students, faculty and campus workers to shoulder the burden of decreased funding.

But the harm that hedge funds wreak by preying on university funds goes well beyond the walls of campus.

Hedge funds also invest in and support a wide array of companies and industries that are harmful to working people, the economy and the environment.

The following snapshots provide examples of these industries, and the hedge fund managers involved.

FOSSIL FUELS

Hedge funds play a key role in investing in and financing the fossil fuel industry.

With the recent drop in oil prices, hedge fund managers are buying up fossil fuel stock with the expectation that prices will go up in the future, delivering them huge profits.[xxv]

Hedge funds now have a significant impact on fossil fuel expansion in the U.S. thanks to their significant ownership stakes in gas and oil companies.

Hedge fund managers involved in financing the fossil fuel industry include:

Paul Singer, Elliott Management Corporation.

According to Elliott’s December 2015 SEC filings, 14% of the fund’s holdings are invested in the energy sector, with over $1.1 billion invested in fossil fuel companies.[xxvi] Singer is also chairman of the Manhattan Institute,[xxvii] which advocates for the expansion of fossil fuels.

Seth Klarman, Baupost Group.

According to Baupost’s December 2015 SEC filings, over one third of the company’s holdings–totaling over $1.8 billion–are in the energy sector.[xxviii] Between 1998 and 2015, Klarman and his wife have donated over $50,000 to climate change denying politicians.[xxix]

PUERTO RICO

In 2012, Puerto Rico was facing an economic crisis and sold debt bonds for as little as thirty cents on the dollar. Hedge fund managers jumped at the chance to profit from the island’s struggles.

After becoming some of the island’s most significant creditors at super-low cost, the hedge funds began their attempts to make Puerto Rico repay the debt in full, with interest.[xxx]

In 2015, a group of hedge funds commissioned a report with recommendations for how Puerto Rico can repay the billionaire hedge fund managers who bought its debt; austerity-driven suggestions included lowering the minimum wage, closing schools and privatizing the electric grid.[xxxi]

Hedge funds are now suing Puerto Rico as they pursue profit off of the island’s misery.[xxxii]

One of the many hedge funds preying on Puerto Rico’s economic crisis is Och-Ziff, run by Daniel Och.

In 2014, Och-Ziff bought a significant portion of the island’s $3.5 billion debt at a steep discount, and since then has been lobbying aggressively for the island to repay the amount in full.

Och-Ziff recently made headlines for paying a record-setting $450 million fine to the SEC over allegations that it had bribed foreign dictators like Libya’s Muammar Ghaddafi.[xxxiii]

PHARMACEUTICALS

Investing in pharmaceutical companies and then drastically increasing the price of certain drugs is a popular strategy among hedge funds.

A recent analysis by Hedge Clippers found that, of the twenty-five branded pharmaceuticals that increased the most in price over the last two years, twenty had seen significant activity by hedge funds, private equity and other billionaire speculators.[xxxiv]

Among the hedge fund managers who have profited handsomely off of patients in need of medicine—sometimes life-saving—are:

Bill Ackman, Pershing Square Capital.

Nearly half of the twenty-five drugs with skyrocketing price tags included in the Hedge Clippers report are associated with Pershing Square.

For example, when Pershing partnered with pharmaceutical company Valeant to attempt to acquire Allergan, another pharma company, Valeant prices surged, and Ackman pocketed $2.6 billion in profits.[xxxv]

This prompted a series of Congressional hearings in which lawmakers expressed disbelief and disgust at Pershing’s practice of jacking up the price of necessary—and sometimes lifesaving—drugs.[xxxvi]

Martin Shkreli, MSMB Capital Management.

Shkreli made headlines in 2015 when his company increased the price of a decades-old drug that the World Health Organization considers “essential” by7,500% for the sake of collecting hundreds of millions of dollars in profit over a few short years.[xxxvii]

John Paulson, Paulson & Co.

Earlier this year, when headlines announced that Epi-Pen maker Mylan increased the price of the drug by 450% over eight years, Paulson was among those who profited, with his hedge fund being among the top five shareholders in Mylan.[xxxviii]

PRIVATE PRISONS

The two largest private prison companies—CoreCivic, formerly known as Corrections Corporation of America (CCA), and GEO Group–have more than doubled their earnings per share over the last ten years,[xxxix] and their stock value also increased dramatically on the news that Donald Trump was elected President.[xl]

In order to grow and expand, these companies relied on hedge funds to buy millions of their shares, fueling the drive to increase incarceration rates and detain immigrants–and hedge fund managers became extraordinarily wealthy in the process.

Robert Mercer, Renaissance Technologies

Robert Mercer’s Renaissance Technologies currently owns over $14 million worth of shares of CoreCivic.[xli] CoreCivic’s business model uses taxpayer dollars to profit from mass incarceration and immigration detention,[xlii][xliii] putting prisoner and community safety at risk.[xliv]

Mercer was described by Bloomberg as “one of the wealthiest, most secretive, influential, and reactionary Republicans in the country”[xlv] and “the man who out-Koched the Kochs.”[xlvi]

In 2016, Mercer and his daughter Rebekah were outed as the driving forces behind the realignment of Donald Trump’s presidential campaign into the orbit of the white nationalist media—such as Breitbart News, to which Mercer has contributed $10 million[xlvii]–and its associated think tanks, which the Mercers also fund.[xlviii]

HEDGE FUNDS FUNDING TRUMP—AND FILLING HIS CABINET

During his 2016 campaign, Donald Trump raised the issue of tax breaks for hedge fund billionaires, stating “Hedge fund guys are getting away with murder…They’re paying nothing and it’s ridiculous…These are guys that shift paper around and they get lucky.”[xlix]

Soon after his election, however, Trump nominated former hedge fund CEO Steven Mnuchin to Secretary of Treasury and Wilbur R. Ross of hedge fund WL Ross & Co. to Secretary of Commerce—and proceeded to name a host of hedge fund managers as advisors, including John Paulson and Blackstone’s Steve Schwartzman.[l]

Trump’s decision to make hedge fund managers an integral part of his administration might be connected to the fact that hedge fund managers donated to and raised millions of dollars in support of Trump’s presidential campaign, including now-presidential advisor John Paulson, who hosted a $50,000 per plate fundraiser and also donated $300,000.[li]

Eclipsing this is Robert Mercer, who was the third largest donor to conservative outside spending groups during the 2016 election cycle.[lii]

This resulted in nonpartisan watchdog group the Campaign Legal Center recently filing a complaint with the Federal Elections Commission requesting an investigation into potential improper or illegal entanglement between super PACs funded by the Mercer family and the Trump campaign.[liii]

While the rest of the country braces for massive cuts to services and an attack on civil rights, the billionaire hedge fund managers who helped usher in the Trump regime are laughing all the way to the bank.

THE PROBLEM OF UNIVERSITIES INVESTING IN HEDGE FUNDS

Clearly, unwise investments in hedge funds end up requiring colleges and universities to indirectly fund—often to the tune of tens of millions of dollars—the exact types of companies, industries and regimes that present a real threat to the values held by students, faculty and workers, and to the future of our economy, our civil rights, and our democracy.

This is especially problematic given the growing student-led movement for universities to divest their holdings in industries such as fossil fuels and private prisons.

For example, last year, Columbia University became the first university to divest its fossil fuel holdings.[liv]

However, the university currently has 34 percent of its endowment invested in hedge funds,[lv] and given the depth of hedge fund investment in the private prison industry, it is possible that Columbia is invested in hedge funds that in turn own private prison stock.

In short, hedge funds could allow Columbia to continue handing money to the private prison industry, while claiming publicly that the university has “divested.” In the absence of full disclosure by the university, students, faculty and other stakeholders cannot be sure that university dollars are not indirectly funding private prisons.

It is also important to note that universities as investors have no control over how the hedge funds they give money to ultimately invest their dollars.

For example, a hedge fund that owns shares in fossil fuel companies may sell those shares at a later date; likewise a hedge fund with no current fossil fuel holdings may obtain these shares in the future.

Therefore there is no way for a university with hedge fund investments to know with certainty that these investments are not or will not be invested in the fossil fuel industry–or any other harmful industry

RECOMMENDATIONS

University endowments are meant to serve as a source of protected funding, with modest returns that allow the university to fund teaching and learning on campuses.

Over the last decade, endowments have overwhelmingly strayed from that mission, instead chasing risky hedge fund investments in an attempt to grow the endowment as quickly as possible.

Moreover, by giving money to hedge funds, endowments are ensuring that some of the worst actors, from private prisons to pharmaceutical companies to the Trump administration itself, continue to harm communities across the globe.

In response to this, a student-led movement demanding that universities divest from problematic investments has gained traction and success at campuses across the country—and now students are adding hedge funds to the list of divestment demands.

Some endowments are heeding the call. Earlier this year, the University of California and the University of Maryland—both highlighted in Hedge Clippers reports on hedge fund fees and returns—announced that they were making significant reductions to their hedge fund portfolios. Also this year, Berea College and University of Louisville, both in Kentucky, announced that they would be divesting from hedge funds altogether. [lvi]

And just this month, Bloomberg reported that College of Wooster, located in Wooster, Ohio, decreased its hedge fund allocation over the last several years from about 50 percent of the total endowment to 25 percent currently. The school’s investment director described College of Wooster as being the “king of hedge funds” prior to decreasing its allocation, a decision made at least in part due to concerns over hedge fund fees.[lvii] (We were unable to include College of Wooster in our analysis due to lack of available data).

Now, Ohio students and other stakeholders have the chance to demand that their universities cease to do business with hedge funds that hurt communities.

We recommend that students make the following demands of their universities:

- Universities must disclose publicly all of the hedge funds in which they invest, along with net investment returns, total fees paid, and any potential conflicts of interest.

- Universities should immediately divest from all hedge funds that have holdings in companies and industries that harm students, faculty, workers, community members, and the environment.

- Universities must ensure that the interests and views of students, faculty and campus workers are adequately represented on boards of trustees and investment advisory committees.

Appendix – Methodology

Because the universities in our study do not publicly disclose fees paid on hedge fund investments, we estimated these fees on a fiscal year basis for fiscal years 2009-2015 using a conservative assumption of 1.8 percent management fee and an 18 percent performance fee on hedge fund investments. This replicates the fee estimate methodology in “All That Glitters Is Not Gold.”

While many investors claim that they have negotiated fees down form the traditional “two and twenty” fee structure, our assumption is that in these cases investors have only negotiated fees down marginally.

Additionally, many endowments utilize hedge fund-of-funds, which add a significant layer of fees for the investor, which we did not attempt to calculate in our estimates.

Furthermore, because the universities in our study do not appear to disclose on publicly available documents their net returns on hedge fund investments, we used average reported hedge fund net returns from the annual NACUBO-Commonfund Study of Endowments, years 2009-2015. The NACUBO data reports the average net returns by endowment size, providing a reliable proxy for each university in our study’s net hedge fund returns.

For each university, we adjusted performance fees for each fiscal year where a high water mark needed to be met (i.e. fiscal years following a fiscal year of estimated negative hedge fund net returns).

“All That Glitters Is Not Gold” is available at: http://rooseveltinstitute.org/all-glitters-not-gold-analysis-u-s-public-pension-investments-hedge-funds/

The NACUBO-Commonfund Study of Endowments reports are available at: http://www.nacubo.org/ Research/NACUBO-Commonfund_Study_of_Endowments.html.

The following table contains source information for assets under management (AUM) figures used for our estimates, and any additional notes, by University:

| University | Sources |

| Bowling Green State University Foundation | Bowling Green State University Foundation Annual Reports |

| Case Western Reserve University Endowment | Case Western Reserve University Financial Reports |

| Denison University | Denison University and Subsidiaries Consolidated Financial Reports. These reports are available only for fiscal years 2011-2015, so our fee estimates do not include fiscal years 2009 and 2010. |

| Kent State University | Kent State University Financial Reports. These reports did not contain hedge fund AUM data for fiscal years 2009-2014, so our analysis uses the 25.3% allocation to hedge funds reported by Preqin for FY 2015; for previous fiscal years, we used the average hedge fund allocation for universities of similar size as reported by NACUBO. |

| Kenyon College | Kenyon College Consolidated Financial Reports |

| Miami University Foundation | Miami University Foundation Financial Reports |

| Oberlin College | Oberlin College financial reports. Hedge fund AUM used for our estimates reflects either reported dollar amount, or reported target % of endowment invested in hedge funds for each fiscal year, depending on availability of data. |

| Ohio State University Endowment | The Ohio State University Financial Statements. “Long Term Investment Pool” used for endowment figures. Ohio State University does not report hedge fund AUM as a discrete category, so our analysis uses the 30.7% allocation to hedge funds reported by Preqin for FY 2015; for previous fiscal years, we used the average hedge fund allocation for universities of similar size as reported by NACUBO. |

| Ohio University Foundation | Ohio University Foundation and Subsidiaries Consolidated Financial Statements |

| University of Cincinnati Endowment | University of Cincinnati Financial Statements |

| University of Toledo | University of Toledo Annual Financial Reports. In 2009, the university did not report hedge fund AUM as a discrete category, instead reporting “hedge funds and partnerships.” We assumed that hedge funds comprised 74% of the category, based on 2013 data. |

| Wright State University Foundation | Wright State University Foundation Consolidated Financial Statements. In 2009, the university did not report hedge fund AUM as a discrete category, so we used the 2010 hedge fund percent of total endowment AUM to estimate this figure. |

Footnotes

[i] Center for Budget and Policy Priorities. “Cuts to Ohio’s Higher Education System Jeopardize Our Economic Future.”

[ii] Patton, Wendy and Halbert, Hannah. “Higher education in Ohio: High tuition, low aid, too little state investment.” Policy Matters Ohio, December 2015.

[iii] Center for Budget and Policy Priorities. “Cuts to Ohio’s Higher Education System Jeopardize Our Economic Future.”

[iv] “No Refuge: The Annual Report on the Economic Status of the Profession 2009-2010,” American Association of University Professors, March-April 2010, https://www.aaup.org/sites/default/files/files/zreport_1.pdf

[v] For example, see: http://www.cleveland.com/metro/index.ssf/2015/07/university_of_akron_layoffs_include_all_employees_in_multicultural_center_and_ua_press.html, http://www.wsaz.com/news/headlines/102522444.html, http://fortune.com/2014/12/11/student-workers-city-state-minimum-wage/

[vi] http://www.nacubo.org/Documents/research/2009_NCSE_Press_Release.pdf

[vii] For example, see: https://www.thenation.com/article/universities-are-becoming-billion-dollar-hedge-funds-with-schools-attached/

[viii] http://www.forbes.com/sites/rickferri/2012/04/16/the-curse-of-the-yale-model/#53dee1e01fc1

[ix] http://www.nacubo.org/Documents/research/2009_NCSE_Press_Release.pdf

[x] Preqin.

[xi] Bush, Bill. “Hedge funds a risk for colleges.” The Columbus Dispatch, November 26, 2007.

[xii] Unless noted otherwise, all data obtained from Preqin, last updated 2016.

[xiii] Miami University Financial Report, June 30, 2015. Obtained from Ohio Auditor of State website, https://ohioauditor.gov/auditsearch/Search.aspx

[xiv] As reported by Preqin, last updated September 16, 2016.

[xv] The Ohio University Foundation and Subsidiaries Consolidated Financial Statements for Fiscal Years Ended June 30, 2015 and June 30, 2014, obtained from Ohio Auditor of State website, https://ohioauditor.gov/auditsearch/Search.aspx

[xvi] University of Toledo does not disclose the hedge fund investment amounts of its endowment and foundation on an annual basis; these figures refer to the University of Toledo. University of Toledo 2015 Annual Financial Report, https://www.utoledo.edu/offices/controller/accounting_reporting/pdfs/University_of_Toledo_15-Lucas.pdf

[xvii] http://www.bloomberg.com/news/articles/2016-07-01/hedge-funds-provide-worst-long-term-gains-to-u-s-pension-plans

[xviii] Preqin.

[xix] http://thelantern.com/2013/12/50-year-agreement-osus-483m-parking-deal-stands-alone-among-schools-year-1/

[xx] http://www.bizjournals.com/columbus/news/2016/10/19/worlds-leading-experts-in-energy-conservation.html

[xxi] Unless noted otherwise, all data obtained from Preqin. Preqin data for all universities last updated in 2016.

[xxii] http://www.dispatch.com/content/stories/local/2016/10/10/osu-endowment-fundraising-cant-offset-losses-from-investments.html

[xxiii] https://www.nytimes.com/2016/09/30/business/dealbook/och-ziff-bribery-settlement.html

[xxiv]https://www.kent.edu/policyreg/university-policy-regarding-university-investments

[xxv] http://www.cnbc.com/2015/01/29/as-oil-prices-crater-hedge-funds-dive-in.html

[xxvi] From Elliott Associates’ 12/31/2015 filings here: http://whalewisdom.com/filer/elliott-management-corp

[xxvii] https://www.manhattan-institute.org/board-of-trustees

[xxviii] From Baupost’s 12/31/2015 filings here: http://whalewisdom.com/filer/baupost-group-llc-ma

[xxix] Calculated using Organizing for Action’s list of climate deniers, found here: https://www.barackobama.com/climate-change-deniers/#/

[xxx] http://prospect.org/article/how-hedge-funds-are-pillaging-puerto-rico

[xxxi] https://www.theguardian.com/world/2015/jul/28/hedge-funds-puerto-rico-close-schools-fire-teachers-pay-us-back

[xxxii] http://www.nytimes.com/2016/07/21/business/hedge-funds-sue-puerto-ricos-governor-claiming-money-grab.html

[xxxiii] https://www.nytimes.com/2016/09/30/business/dealbook/och-ziff-bribery-settlement.html?_r=0

[xxxiv] http://hedgeclippers.org/hedgepapers-no-22-hedge-funds-attack-american-health-care/

[xxxv] https://dealbook.nytimes.com/2014/11/17/no-allergan-deal-but-a-2-6-billion-profit-for-ackman/

[xxxvi] http://www.businessinsider.com/live-bill-ackman-and-valeant-execs-get-grilled-by-angry-senators-2016-4

[xxxvii] http://www.nytimes.com/2016/02/03/business/drug-makers-calculated-price-increases-with-profit-in-mind-memos-show.html?_r=0

[xxxviii] http://www.thedailybeast.com/articles/2016/08/24/top-trump-backer-bets-big-on-overpriced-epipens.html

[xxxix] Morningstar.com

[xl] http://www.cnbc.com/2016/11/09/prison-stocks-are-flying-on-trump-victory.html

[xli] Renaissance Technologies SEC form 13F, filed November 14, 2016.

[xlii] https://www.aclu.org/banking-bondage-private-prisons-and-mass-incarceration

[xliii] https://www.washingtonpost.com/business/economy/inside-the-administrations-1-billion-deal-to-detain-central-american-asylum-seekers/2016/08/14/e47f1960-5819-11e6-9aee-8075993d73a2_story.html?utm_term=.0162ba9a36af

[xliv] See: https://www.aclu.org/blog/speakeasy/corrections-corporation-americas-loss-ohios-gain, http://www.motherjones.com/politics/2016/06/cca-private-prisons-corrections-corporation-inmates-investigation-bauer, http://www.afscme.org/news-publications/publications/privatization/pdf/Prison-1.pdf

[xlv]http://www.bloomberg.com/politics/features/2016-01-20/what-kind-of-man-spends-millions-to-elect-ted-cruz-

[xlvi] http://www.bloomberg.com/politics/articles/2014-10-23/the-man-who-outkoched-the-kochs

[xlvii]http://www.newsweek.com/2016/12/02/robert-mercer-trump-donor-bannon-pac-523366.html

[xlviii] http://www.nytimes.com/2016/08/19/us/politics/robert-mercer-donald-trump-donor.html?_r=0

[xlix] http://www.cbsnews.com/news/donald-trump-the-hedge-fund-guys-are-getting-away-with-murder/

[l] http://hedgeclippers.org/trumps-billionaire-cabinet-how-they-harm-working-people-and-take-americas-wealth-for-themselves/

[li] https://theintercept.com/2016/11/22/hedge-fund-managers-expect-a-return-on-their-investment-in-donald-trump/

[lii] http://www.newsweek.com/2016/12/02/robert-mercer-trump-donor-bannon-pac-523366.html

[liii] http://www.newsweek.com/2016/12/02/robert-mercer-trump-donor-bannon-pac-523366.html

[liv] http://www.cnn.com/2015/06/23/us/columbia-university-prison-divest/

[lv] Preqin.

[lvi] http://www.zerohedge.com/news/2016-11-15/pensions-slash-hedge-fund-allocations-after-decade-subpar-returns

[lvii] https://www.bloomberg.com/news/articles/2017-02-10/once-king-of-hedge-funds-college-of-wooster-becomes-a-skeptic