Across the country, states stand to gain many billions of dollars in revenue by closing the carried interest loophole. It’s a long overdue element of financial reform that the federal government has failed to enact.

In recent months, Hillary Clinton, Bernie Sanders, and Donald Trump have called for closing something known as the “carried interest loophole,” a legal fiction used by members of the wealthy elite to lower their federal tax rates below those paid by many working Americans.[1]

Financiers charge a fee for investing other peoples’ money – and call it “carried interest” to get a lower tax rate than kindergarten teachers and truck drivers.[2]

Presidential candidates in both parties, experts, advocates and everyday Americans all agree that Wall Street millionaires and billionaires should not get preferential treatment on their taxes.[3] It’s unfair and wrong. Smart reform can bring this practice to an end.

Closing the loophole would save the federal government an estimated $18 billion per year, according to an analysis by law professor Victor Fleischer.[4] But huge sums of lobbying and campaign cash directed at Congress by hedge funds and private equity firms have stymied reform in Washington and fueled continued obstructionism.

That’s why state action is crucial. Across the country, legislatures can pass bills to tax the carried interest income of private equity firms, hedge funds, and other financial entities headquartered in their respective states at the rate of ordinary income.

This report from Hedge Clippers uses hedge fund and private equity data from Preqin, to show that several starts around the country could raise huge sums of revenue by acting to close the carried interest loophole.

State action on carried interest could recapture hundreds of millions or billions for each state. Share on X

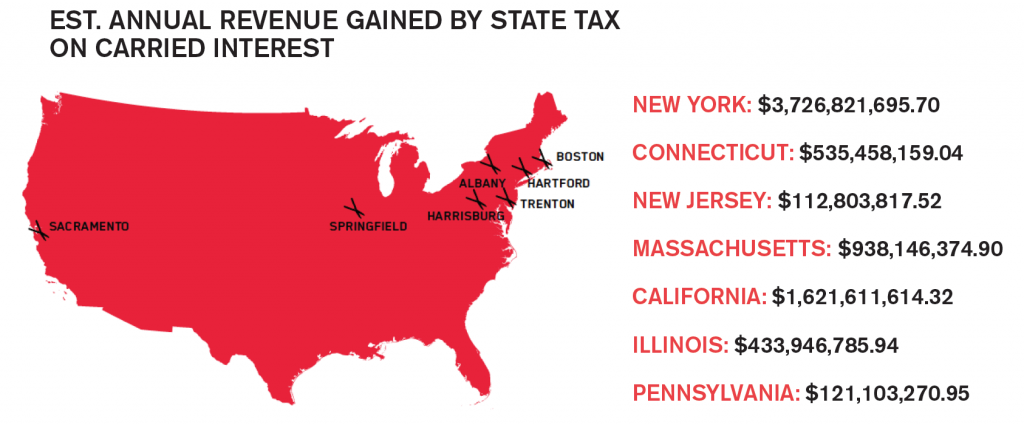

Using a conservative methodology for estimating the potential annual revenues, the analysis in this report reveals that state action on carried interest could recapture many billions of dollars across the country, with hundreds of millions or billions for each state.

In states like New York, Massachusetts, Illinois, Connecticut and California, the estimated income to be gained by taxing carried interest at the state level is enormous.

In states like New York, Massachusetts, Illinois, Connecticut and California, the estimated income to be gained by taxing carried interest at the state level is enormous.

New York’s private equity and hedge funds are conservatively estimated to be earning $15.6 billion per year in under-taxed carried interest. A state bill to recapture this revenue at the ordinary income level is being introduced this month, and it would add an estimated $3.7 billion additional dollars to New York’s coffers.

But even states with significantly smaller hedge fund and private equity sector would stand to recapture hundreds of millions of dollars per year. The chart below shows how much revenue several other states could raise by closing the carried interest loophole. In the coming weeks and months, advocates are looking at introducing state bills modeled on New York’s carried interest bill in New Jersey, Connecticut, California, Illinois, Massachusetts, and Pennsylvania.

What is the carried interest loophole?

Simply stated, the carried interest loophole is the mistreatment of hedge fund and private equity fees as capital gains, rather than ordinary income.

Hedge fund and private equity funds are usually structured as partnerships. The fund manager is the general partner of the funds, the investors are limited partners.

Investors often supply the majority of the capital, and the fund manager is supposed to supply investment expertise. For the services the investment manager provides, they charge certain fees.

In both hedge funds and private equity funds, the standard fee structure is “2 and 20”—two percent of the fund assets per year are taken as the management fee, which covers operating costs. Twenty percent of all gains over a certain benchmark rate are taken by the fund manager as the performance fee.[5]

The problem comes from how that twenty percent performance fee is treated for tax purposes.

Should a 20% fee taken by hedge fund mgr be treated as compensation? Most tax analysts think so. Share on X

To an outsider, it may seem that this twenty percent fee is compensation for services. According to the Tax Policy Center, a joint project of the Brookings and Urban Institutes, the vast majority of tax analysts share this view.[6]

If we treated the performance fee as a fee for services, it would be federally taxed at the ordinary income level, where the highest marginal tax rate is currently 39.6%. Instead, many fund managers treat this fee as an investment profit.

Profits on investments held longer than one year receive preferential treatment in the tax code, with the highest marginal rate on long-term capital gains set at 20%.[7]

That difference of 19.6% may not sound like a lot of money, but the academics estimate the tax revenue loss from the carried interest loophole to be $18 billion per year.[8]

State loophole-closing legislation should aim to “repatriate” the revenue lost to the loophole back to the states where “carried interest” investment fees were assessed.

Congress won’t act – because hedge funds and private equity firms are using millions of dollars in lobbying and campaign cash to keep the loophole open.

Hedge funds and banks have spent millions of dollars in campaign cash and lobbying to protect their loopholes and special treatment, blocking action in Congress.[9]

Hedge fund and private equity lobbying and political spending increased dramatically in 2007 — the same year Congress took steps to close the carried interest loophole.

That effort failed, as have subsequent efforts, due to a torrent of lobbying and campaign cash.

Lobbying by hedge fund/private equity soared 455% in 2007 to $23 million. It never dropped to pre-2007 levels. Share on X

Lobbying spending by the hedge fund and private equity industries soared 455% in 2007, from $4.1 million in 2006 to over $23 million in 2007. It has never dropped back to pre-2007 levels.[10][11]

Since 2007, the two industries have spent a combined average of $20 million per year on lobbying. By comparison, total lobbying spending from 2000 to 2006 was a mere $17.2 million ($2.5 million per year), less than the single year average since.

Industry associations have played a major role in this effort.

The Managed Funds Association, the hedge fund industry lobby, increased its lobbying spending five-fold in 2007, from $340,000 to $1.9 million.[12] The MFA has maintained this lobbying increase and spent over $4 million in 2015.

The private equity lobby, the Private Equity Growth Capital Council, was first established in 2007. It hit the ground running, spending $2.5 million on lobbying in its first year and over $20 million since.[13]

The revolving door purchase of members of Congress and their staffers has also played a major role in these efforts.

The Managed Funds Association is headed by former Congressman Richard Baker, who joined the organization in 2008. Baker spent 12 of his 15 years in Congress as Chairman of the Subcommittee on Capital Markets. Shortly after joining the group, Baker warned his former colleagues that closing the carried interest loophole would have “serious and negative consequences on U.S. capital markets, job growth and capital formation.”[14]

The Private Equity Growth Capital Council is led by Mike Sommer, who previously spent years on the hill as John Boehner’s Chief of Staff. Sommer also served as Special Assistant to George W. Bush at the National Economic Council and is married to Jill Sommer, a former commissioner of the Commodity Futures Trading Commission.

Campaign finance records show that this lobbying spending spree was coupled with an increase in campaign donations.

In 2007 and 2008, hedge funds and private equity firms increased their political giving by over three times, from $7.3 million in the 2006 cycle to $24.5 million in the 2008 cycle. In each election cycle since 2008, hedge funds and private equity have donated an average of $7.7 million and $15 million respectively.[15]

Close the carried interest loophole at the state level

New York and other states can gain billions of dollars in new revenue by taking action where Congress won’t — by closing the carried interest loophole.

State legislatures should pass legislation to “repatriate” revenue lost to the federal-level loophole. We can tax the carried interest income of hedge fund and private equity partnerships headquartered in each state and bring the money home for investment in schools, housing, jobs and clean-energy infrastructure.

A Closer Look at the Numbers: Methodology for preparing the tax estimation

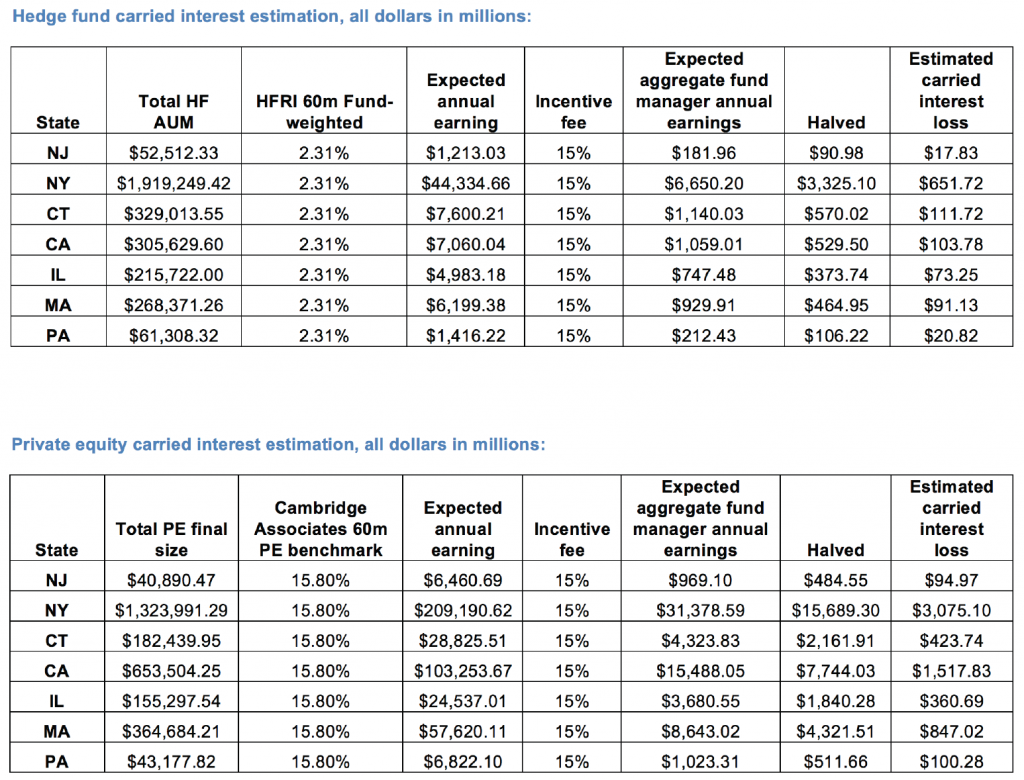

Datasets of hedge fund and private equity advisors headquartered in the U.S. Northeast were obtained from Preqin on Nov. 17th, 2015. Data for the remaining four states were pulled on January 19th, 2016. This data was sorted by geography, and isolated by state.

For hedge funds, the total of the fund AUM reported for each state was tallied. The total numbers are likely to suffer from two statistical biases.

First, academic literature suggests that hedge funds suffer from reporting biases that are likely to skew both returns and assets under management. The self-reported nature of hedge fund returns is likely the source of this bias, and Preqin is likely to include data from self-reported sources.

Second, Preqin’s hedge fund AUM is incomplete. Hedge fund AUM is missing for a significant number of the reported funds. We believe that the unreported funds are more likely to have lower AUM, as larger funds are more likely to have public investors, which provides a ready source of information for aggregators like Preqin.

We made the determination not to adjust for the missing data. We believe that the lack of full hedge fund AUM data significantly outweighs the relatively minor effects of smoothing. Our lack of compensation for the incompleteness of the Preqin data suggests that our estimates are conservative.

For private equity, we used Preqin’s “final size” for the list of funds managed by private equity firms headquartered in the three target states. The Preqin data for private equity suffers from similar sampling biases as hedge funds, with only a portion of all funds having the “final size” data field. Private equity funds that Preqin indicated had been liquidated were removed from the state tallies.

To estimate total earnings, we used private equity and hedge fund return benchmarks for a five-year period.

One uses the five-year average of leading hedge fund and private equity benchmarks, assuming that the large state sample sizes roughly track the mean.

For hedge funds, we used the HFRI Fund Weighted Composite’s 60-month average.[16] For private equity, we used the Cambridge Associates U.S. Private Equity Index 5-year end-to-end pooled return.[17] By multiplying the return benchmarks by the AUM, we came up with a rough estimation of expected annual earnings.

Next, the carried interest apportioned to hedge fund and private equity managers is estimated.

Carried interest applies only to the incentive fee earned by hedge fund and private equity managers. We used 15% of the total of hedge fund and private equity expected annual earnings to arrive at the expected aggregated fund manager annual earnings. We went with 15% because we believe this number to be extremely conservative.

With hedge funds, 20% is the industry standard and 17.14% was the industry average for new funds launched in 2013, as tracked by Preqin.[18] In private equity, the 20% standard is prevalent in 85% of co-mingled funds, according to a 2015 report by Preqin.[19] Separate accounts, where approximately one-third of investor capital was committed in late 2014,[20] are less likely to charge a 20% carry, although 90% charge 10% or more.[21]

To calculate the amount lost to carried interest exemptions, we halved the expected aggregate fund manager annual earnings. This was done to reflect the individual reporting of taxes paid on partnerships interest in financial service partnerships.

As Professor Victor Fleisher discovered in his work on the subject, the IRS Statistics of Income shows that roughly half of financial industry partnership income is paid at the favorable carried interest rate.[22][23]

After halving this sum, we multiplied the remaining amount by 19.6%, the difference between the top bracket for short-term capital gains (equivalent to ordinary income, at 39.6%) and the top bracket for long-term capital gains (20%).

FOOTNOTES

FOOTNOTES

[1] http://www.usatoday.com/story/opinion/2015/09/15/hedge-fund-carried-interest-donald-trump-jeb-bush-editorials-debates/72268922/

[2] http://billmoyers.com/2015/09/17/why-do-kindergarten-teachers-pay-more-taxes-than-hedge-fund-managers/

[3] http://www.usatoday.com/story/opinion/2015/09/15/hedge-fund-carried-interest-donald-trump-jeb-bush-editorials-debates/72268922/

[4] http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html?_r=0

[5] https://www.fas.org/sgp/crs/misc/RS22689.pdf

[6] http://www.taxpolicycenter.org/briefing-book/key-elements/business/carried-interest.cfm

[7] Plus a 3.8% Medicare surtax

[8] http://www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html?_r=0

[9] http://thehill.com/blogs/congress-blog/economy-budget/257083-what-the-carried-interest-tax-loophole-reveals-about-our

[10] http://www.opensecrets.org/industries/lobbying.php?cycle=2016&ind=f2700

[11] http://www.opensecrets.org/industries/lobbying.php?ind=F2600

[12] https://hedgeclippers.org/1464797090949/hedgepapers-no-14-the-gift-of-greed-how-hedgefund-philanthropists-increase-inequality/

[13] http://www.opensecrets.org/lobby/clientsum.php?id=D000036835&year=2007

[14] http://www.managedfunds.org/downloads/MFA%20Extenders%20Letter%20-%20W&M-House%20Leadership.pdf

[15] http://www.opensecrets.org/industries/summary.php?ind=f2700&recipdetail=A&sortorder=U&mem=Y&cycle=2014 & http://www.opensecrets.org/industries/summary.php?ind=F2600&recipdetail=A&sortorder=U&mem=Y&cycle=2014

[16] https://www.hedgefundresearch.com/mon_register/index.php?fuse=login_bd&1448033777

[17] http://www.cambridgeassociates.com/wp-content/uploads/2015/05/Public-USPE-Benchmark-2014-Q4.pdf

[18] https://www.preqin.com/blog/0/8340/hedge-funds-fees

[19] https://www.preqin.com/docs/press/Fund-Terms-Sep-15.pdf

[20] http://www.pionline.com/article/20141222/PRINT/312229973/assets-invested-in-separate-accounts-starting-to-add-up

[21] http://www.valuewalk.com/2015/09/48-of-private-equity-separate-accounts-charge-a-20-performance-fee/

[22] 56% of the income generated by finance and insurance partnerships in 2012 was taxed at this rate.

[23] www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html