Released in partnership with

With national attention focused on populist anger over Wall Street’s role in rigging the economy, Americans are taking a growing interest in the business practices of billionaire investors and money managers.

Wall Street multimillionaires and billionaires have seen their wealth reach unprecedented peaks even as the rest of the economy sputters and working families see their incomes stagnate or decline.

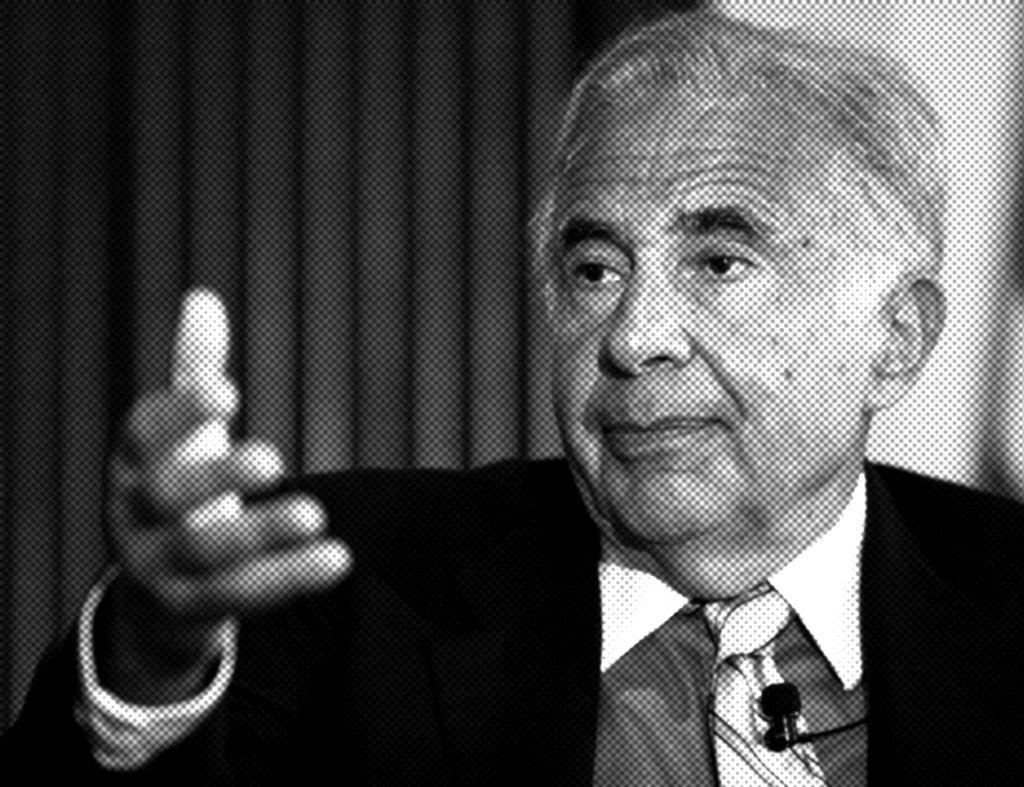

Populist anger over job cuts, wage cuts, outsourcing, special tax breaks for the rich, elimination of pensions and benefits and the way connected insiders have benefitted from the economic destruction suffered by our communities didn’t just happen: it’s the result of the actions of powerful men like Carl Icahn and of policies that enable those actions.

Icahn is among the most visible of Wall Street’s current “activist investors,” and is the man who first brought the practice to prominence nearly three decades ago when it was called — perhaps more appropriately — “corporate raiding.”

In the 1980s and 90s, Carl Icahn was the poster child for Wall Street’s take-no-prisoners approach to investing: so much so that he inspired the character of Gordon Gekko in the Oliver Stone film Wall Street who famously declared “greed is good!”

Today, Icahn remains one of Wall Street’s most notorious vulture capitalists, with a consistent pattern and practice of extracting enormous wealth from companies in which he invests while leaving a trail of layoffs and lost benefits in his wake.

Among Icahn’s more recent ventures is his acquisition of the Trump Taj Mahal casino in Atlantic City where workers threatened with the loss of pensions and health benefits have recently voted to authorize strikes.

It was also through his dealings in Atlantic City that Icahn developed a business relationship with presumptive Republican Presidential nominee Donald Trump, who said last summer that he would offer Icahn the role of Treasury Secretary in his administration.[1]

A clear body of evidence and numerous public statements from both men confirm that Trump and Icahn are personal friends, talk frequently, and share many perspectives.

Icahn has even been profiled as “the Donald Trump of Finance.”[2]

When Trump celebrated his primary win in New York in April, he gave a shout out to Icahn. That same night he told CNBC: “we just like each other.”[3]

Icahn has continued to operate as a vocal champion ofTrump’s presidential candidacy, defending him in the national media while skewering the Republican elite.

He has said that “Trump is the only candidate who can stop the terrible gridlock in Washington and make Congress work again.”[4]

Referring specifically to Trump’s economic plans and agenda, Icahn has said: “He’s going to do for this economy what should be done.”[5]

overview: Examining Icahn’s Record and The Connection to Trump

All of these connections to the presumptive Republican nominee – and their evident mutual admiration – make it particularly important to look at what Icahn’s business practices have wrought. Trump has said repeatedly that one of his main priorities is bringing jobs back to the United States.[6] Icahn, as this report lays out, has in fact made billions of dollars by destroying thousands of American jobs and harming an even larger number of American workers.

This report is the first of its kind to examine the scope and severity of Icahn’s record of destroying American jobs. It sheds fresh light on his destructive business practices.

In the ten deals reviewed below, Carl Icahn made money by driving the destruction of more than 35,000 American jobs in key industries across the country, as well as the elimination of pensions and/or health benefits for more than 126,000 American families.

In 10 deals, Icahn shed 35k jobs & elimination of pensions and/or health benefits for >126k families. Share on X

In fact, he pioneered the practice of “corporate raiding,” a strategy that involves acquiring large stakes in companies and then forcing their executives to take on massive amounts of debt, sell off divisions, ship jobs overseas, lay off workers, and slash workers’ benefits–all to ensure massive profits for himself.

These days, Icahn refers to himself by the friendlier title of “activist investor” instead of “corporate raider,” but his playbook remains the same, prompting a former company chairman to simply summarize him as “one of the greediest men on earth.”[7]

Trump frequently points to his business success as a qualification for the Presidency and Icahn regularly defends Trump’s vision for the economy. Given the close relationship between Icahn and Trump, it’s important to scrutinize Icahn’s record and consider the implications for Trump’s economic agenda and American workers.

Below we look at Icahn’s deals over the past three decades, noting how he has again and again transferred wealth from workers to himself.

carl Icahn’s weapons of mass economic destruction

An abridged history of Carl’s most Icahn-ic corporate raids

TWA Airlines

Icahn first earned his reputation as a corporate raider in the 1980s, when he targeted Trans World Airlines (TWA).

In 1985, he bought more than 20% of the airline’s stock, essentially buying himself the position of Chairman at the company. He pushed TWA to make a series of controversial decisions that his critics said made him hundreds of millions of dollars but ultimately resulted in TWA declaring bankruptcy multiple times, being bought out by American Airlines, and laying off and cutting the pension of thousands of pilots and flight attendants.

Ichan profited & pushed TWA to multiple TWA bankruptcies, layoffs & pension cuts. Share on X

Indeed, Larry Summers – no populist – described Icahn’s TWA profits as “essentially a transfer of wealth from existing flight attendants…to Icahn.”[8]

After investing in TWA in 1985, Icahn took the company private in 1988. He made $469 million on the deal, but TWA emerged saddled with $540 million in debt.[9] 4,000 flight attendants lost their jobs.[10] At the time, the head of the flight attendants’ union argued that Icahn used sexist logic when dealing with her 85% female union when he said flight attendants were not “breadwinners” like mechanics and could therefore afford to take deeper cuts.[11]

Icahn’s subsequent strategic decisions raised eyebrows about whether he prioritized the health of the company and its workers – or whether he put a higher priority on his own bank account and profits.

In 1991, he sold TWA’s lucrative London routes to American Airlines, for what many said was an undervalued $445 million.[12]

A year later, TWA filed for bankruptcy. The company emerged from bankruptcy with creditors owning 55% of the company. One of those creditors? Carl Icahn, who owned $190 million of the company’s debt.[13]

Amid growing criticism of his leadership, Icahn resigned as Chairman in 1993, but soon became impatient for his $190 million to be repaid. To appease him, TWA came up with a deal called “the Karabu ticket agreement,” which allowed Icahn to buy any ticket that connected through St. Louis for 55 cents on the dollar and resell them at a discount on his website, Lowestfare.com. The deal allowed Icahn to bleed TWA dry by making it compete against itself.[14]

In 2001, TWA announced its third bankruptcy and that it was accepting a purchase offer from American Airlines. With the merger, came massive job cuts for TWA workers. Some employees were laid off and others were permanently furloughed.[15]

Two years after the merger was announced, American Airlines said only 10,000 of the 20,000 TWA employees at the time of the merger remained at American.[16] The employees who kept their jobs faced other challenges, as their seniority at TWA was not recognized, which adversely affected their salaries and benefits.[17]

Around the same time, Icahn announced that he would terminate two TWA pension plans covering 36,500 participants, including 15,000 active workers.[18] In 1991, Congress had passed a law forcing him to take personal responsibility for the airline’s underfunded pensions in order to disincentivize him “from selling [TWA’s] assets, shutting the carrier down, and walking away.”[19]

Icahn announced he would terminate two TWA pension plans covering 36.5k, including 15k active workers. Share on X

In 2001, the Pension Benefit Guaranty Corporation assumed responsibility for the pensions, essentially shifting the pension responsibilities from Icahn to a public entity.

During his raid of TWA, Icahn earned a reputation as a callous opponent of the airline’s pilots, flight attendants, and ground crews. He infamously told a a TWA worker “If you want a friend, get a dog,” a line later adopted by Gordon Gekko in the movie Wall Street.[20]

twa jobs destroyed under icahn’s watch: 22,075 [21]

TWA workers affected by pension benefit terminations under Icahn’s watch: 36,500 [22]

Time warner

In 2005, Icahn built a stake in Time Warner Inc. and began a battle with CEO Richard Parsons with the goals of putting directors on the board, splitting the company up into four different companies, and executing a $20 billion share buyback.[23]

Icahn called out Time Warner’s leadership for the company’s “egregious expenses and perks.”[24]

In the media, Icahn focused on the company’s fleet of corporate airplanes and the expensive Time Warner Center headquarters. But behind closed doors, reducing the company’s “bloated cost structure” meant layoffs.

Soon after Icahn launched his campaign against Time Warner, massive layoffs began. Share on X

Soon after Icahn launched his campaign against Time Warner, massive layoffs began.

Warner Brothers Entertainment Division fired 250 to 300 employees at its Burbank studio, amounting to at least 5% of the 4,500 Warner employees there.[25] 100 people in the studio’s international operation division were also laid off. ¬Simultaneously, Time Warner’s AOL division laid off more than 700 employees.[26]

Icahn was ultimately unsuccessful in splitting up Time Warner into 4 divisions, but in early 2006 the company and Icahn reached a truce that included several concessions to Icahn: the company instituted a $20 billion share buyback, appointed two new independent directors to the board in consultation with Icahn, and agreed to take an extra $500 million out of its cost base.[27]

time warner layoffs under icahn’s watch: 1,100

yahoo

In 2008 Icahn began scooping up Yahoo stock, amassing a massive 5.5% stake by October.[28] Per his slash and burn style, he quickly began using his shareholder status to push for a sale to Microsoft, a move that put thousands of jobs in peril while promising to secure huge profits for himself.[29]

Incensed when his Microsoft deal dissolved,[30] Icahn attempted to oust key members of the company’s board in order to pave the way for another attempt, eventually offering to curb his coup in exchange for three board seats.[31]

Once on the board Icahn continued to push for an agreement with Microsoft, which had returned to the table seeking to purchase Yahoo’s search capabilities.[32]

During negotiations, Yahoo revised their severance program in the event of a takeover, making it harder for workers laid off in a takeover to claim severance.[33]

Microsoft ultimately did purchase Yahoo’s search capabilities, a deal that lead to worker layoffs.[34]

Not long after the deal, Icahn dumped his much of his Yahoo stock and resigned the board, saying that it was no longer “necessary” to have an activist at Yahoo.[35]

During Icahn’s tenure on the company’s board, Yahoo laid off 1,500 workers, or 10% of its workforce.[36]

yahoo layoffs under icahn’s watch: 1,500

yahoo employees affected by benefits cuts under icahn’s watch: 15,000

Family Dollar and Dollar Tree

In 2014, Icahn joined the fray of Wall Street investors fighting over the dollar-store industry, which has been booming since the 2008 financial crisis “attracted tens of millions of new customers in search of bargain prices on household essentials.”[37] Competing with Wal-Mart locations across the country, dollar stores including Family Dollar and Dollar General make their profits by appealing to the country’s lowest-income residents and paying their employees poverty wages.[38]

In June 2014, Carl Icahn bought a 9.4% stake in Family Dollar Stores and quickly set to pressuring CEO Levine to sell off the North Carolina-based company. Fortune’s recounting of the meeting between Icahn and Levine revealed Icahn’s hard-fisted tactics:

When Levine, 56, stepped out of the elevator into Icahn’s 11,000-square-foot duplex, he and fellow Family Dollar board member George Mahoney were escorted by a butler to the expansive balcony. There they found Icahn mixing a batch of martinis—Ketel One vodka, up with a lemon twist—for himself and two lieutenants. “Can I get you a drink?” Icahn asked Levine. “I’d love one,” replied Levine, “but I’ll say no, since I want to keep my wits about me.” Icahn didn’t miss a beat. “Not drinking isn’t going to help you,” he fired back, “so you might as well drink.”[39]

By July 2014 Dollar Tree shareholders voted to purchase Family Dollar for $8.5 billion ($74.50 per share). Typical of his short-term, raider style, Carl moved to dump his stocks before the ink was dry on the deal, netting $265.8 million in profit.[40]

While Icahn made his millions, employees in the dollar store industry continued to make poverty wages and were forced to work long hours of demanding physical labor without overtime pay.[41]

During Icahn’s tenure on the company’s board, Yahoo laid off 1,500 workers, or 10% of its workforce. Share on X

The merger also put 1,300 jobs at Family Dollar’s corporate headquarters in limbo as operations merged into a single corporate management structure.[42] As of earlier this year, employees at the company’s North Carolina headquarters were still waiting to see if they would lose their jobs after Family Dollar CEO Howard Levine resigned.[43]

Family dollar jobs cut: Potentially 1,300

Atlantic City Casinos

In February 2016, the Trump Taj Mahal casino, the last Atlantic City casino to bear the Trump name, was bought out of bankruptcy by none other than Carl Icahn.[44]

In fact, Icahn has worked with Trump in Atlantic City for years. Just six years ago he was the sole lender to Trump Entertainment, which proved to be an unnecessarily expensive deal for the future presidential candidate.

Master dealmaker Trump was paying Icahn 12% interest, a rate much higher than the 6.2% he’d enjoyed pre-bankruptcy.[45] The high interest rate cost Trump an additional $70 million over four years.[46]

Since 2010, Icahn has extracted $350.5 million out of the Trump casinos in Atlantic City and sent that money back to Icahn Enterprises in New York, while forcing workers to take deep cuts.

The 1,100 workers at the Trump Taj Mahal have suffered under Icahn’s control. During his tenure, the casino has:

- Implemented an overall 35% reduction in compensation for workers who average less than $12.50 per hour in wages.

- Eliminated the health insurance plan that all of the rest of the casinos use and which workers have sacrificed wage increases to maintain for the last decade.

- Eliminated more than $3 million in pension contributions.[47]

-

Paid employees less, including eliminating a paid lunch break (loss of about $1,600 annually)

-

Decreased job security for its workers by permitting unlimited subcontracting for Food and Beverage service.

-

Increased employees’ workloads. For example, housekeepers now clean 16 rooms a day, up from 14 rooms a day.

Since 2010, Icahn took $350.5 million out of the Trump casinos in AC while forcing workers to take deep cuts. Share on X

Icahn threatened to close the casino, and cut 3,000 jobs in the process,[48] if the workers’ union did not capitulate to his drastic cuts. Naturally Icahn attempted to redirect the scrutiny onto the union saying that he was “baffled by how they don’t see that their destructive efforts may well result in 3,000 less jobs.”[49]

The union appealed the terms of the Taj Mahal’s 2014 bankruptcy, arguing that cuts to health insurance benefits and pension fund payments were illegal due to their previous collective bargaining agreements. The case went the way to the Supreme Court, which recently declined to hear it.[50]

Taj mahal jobs cut: 3,000 jobs threatened

Taj mahal employees’ health coverage and pensions cut: 1,100

aig

Icahn’s 3% stake in insurance giant AIG has also drawn attention recently. And, as usual, where Icahn goes, layoffs follow.

In January 2016, in response to pressure from Icahn to shrink the company and increase profits, AIG announced a massive plan to layoff employees and cut their benefits.

The plan included laying-off 400 senior level employees and closing all but 4 of its U.S. financial network offices, which has led to at least 380 more layoffs.[51]

By the end of 2016, 6,300 jobs will be shipped overseas,[52] to “lower-cost centers” including Manila, Philippines and Kuala Lumpur, Malaysia.[53] AIG also froze their pension plan to save $100 million annually.

In Jan 2016, Icahn's pressure to increase profit led AIG to a massive layoff plan & benefit cuts. Share on X

American jobs eliminated (layoffs and jobs shipped overseas) at AIG under Icahn’s watch: 7,080

Apple

Icahn led a successful campaign to increase shareholder dividends and buybacks from Apple.

In making these demands Icahn positions himself as a hero to the shareholder class, but Apple’s horded cash could be used more effectively to benefit the company’s underpaid workers around the world or, as pointed out in the Wall Street Journal, to move jobs back to the United States:

Mr. Moas, founder of Miami-based Standpoint Research, says one reason Apple has so much cash is that it underpays its labor in Asia to build its products. He recently made news for “blacklisting” Apple in his research report—making the controversial suggestion that more of Apple’s cash go to the workers who make its products.

Apple has already announced a three-year plan to return $100 billion to shareholders through stock buybacks and dividends. If Apple coughed up, say, $10 billion to pay workers, who knows, it might even be able to afford to create jobs in the U.S.

Nobody would even notice the money was missing.

Except Mr. Icahn. He thinks he deserves it. He’s smarter.[54]

Icahn’s Dirty Energy Investments

In recent years, Icahn has bet big on fossil fuels, investing heavily in energy and railway companies that have benefited from the shale oil and gas boom.[55] According to the most recent SEC filings, Icahn owns almost 14% of Cheniere Energy,[56] a Houston, Texas based oil and gas company that has been an aggressive leader in pushing for increased export of liquid natural gas, including converting liquid natural gas import facilities to liquid natural gas export facilities.[57]

He also owns more than 10% of Chesapeake Energy,[58] one of the earliest Marcellus Shale drillers that helped start the fracking boom. In Pennsylvania, Texas, and other parts of the country where the company operates, landowners have alleged Chesapeake has cheated them out of royalty money.[59] Chesapeake’s biggest recent settlement covered over 400 lawsuits representing 13,000 plaintiffs in East Texas. They settled for $52.4 million to avoid going to trial.[60]

Icahn also owns almost 9% of Freeport McMoran,[61] a major oil and gas driller in Los Angeles. South L.A. residents have been protesting the effects of drilling in residential areas.[62]

Over several decades, Carl Icahn has come to epitomize the “greed is good” mentality of Wall Street. His actions have led to the elimination of tens of thousands of jobs and lost benefits for tens of thousands of other employees, on his way to accumulating a net worth just shy of $20 billion.

Whether one considers his take-over of now defunct Trans-World Airlines or his current conflict with Atlantic City Casino workers, Icahn’s model remains one of extracting wealth by outsourcing, downsizing, and squeezing employees, including often those who can least afford it.

Donald Trump’s close relationship with Icahn and his statement that he would want to make him Secretary of the Treasury make scrutiny of Icahn’s past all the more important.; a full understanding of “Icahn-omics” can help shed light on what economic policy would look like under a President Trump.

Total American jobs eliminated[63] under Icahn’s watch: 35,000+

Total workers affected by benefit terminations[64] under Icahn’s watch: 126,100+

About Take on Wall Street

The Take on Wall Street campaign is a coalition representing more than 25 million Americans that is advancing a set of ambitious policies to ensure that Wall Street is the servant rather than the master of the Main Street economy, and to reverse the staggering increase in inequality in our country. By channeling populist energy towards specific policies, Take on Wall Street seeks to reduce the size and complexity of mega-banks, generate revenue from taxing Wall Street speculation as an alternative to austerity, put in place tough consumer protections against predatory financial services coupled with public “high-road” banking services, and end to obscene tax loopholes that benefit the wealthiest .1%. The campaign unites labor unions, community groups, consumer advocates, faith leaders, and progressive political organizations to form a powerful national voice to re-write the rules of a rigged political and economic system.

FOOTNOTES

[2] http://fortune.com/2016/03/14/carl-icahn-donald-trump/

[3] http://www.cnbc.com/2016/04/28/icahn-republicans-dont-understand-economics-and-its-killing-the-country.html

[4] http://www.cnbc.com/2016/04/28/icahn-republicans-dont-understand-economics-and-its-killing-the-country.html

[5] http://www.cnbc.com/2016/04/28/icahn-republicans-dont-understand-economics-and-its-killing-the-country.html/

[6] https://www.washingtonpost.com/politics/trump-decries-outsourced-labor-yet-he-didnt-seek-made-in-america-in-2004-deal/2016/03/13/4d65a43c-e63a-11e5-b0fd-073d5930a7b7_story.html

[7] https://www.google.com/url?hl=en&q=http://wapo.st/24N1axf&source=gmail&ust=1465953412294000&usg=AFQjCNFBgKlxqtxaqM_LKyC4-3j-n8SCMg

[8] http://time.com/money/3450877/activist-investors-raiders/

[9] https://www.stlmag.com/TWA-Death-Of-A-Legend/

[10] http://www.nytimes.com/1986/06/22/business/carl-icahn-s-wild-ride-at-twa.html?pagewanted=all/

[11] http://fortune.com/2013/08/18/the-comeuppance-of-carl-icahn-fortune-1986/ and https://www.youtube.com/watch?v=KdFCeC6rOZs at 4:00

[12] https://www.stlmag.com/TWA-Death-Of-A-Legend/

[13] https://www.stlmag.com/TWA-Death-Of-A-Legend/

[14] https://www.stlmag.com/TWA-Death-Of-A-Legend/

[15] https://www.stlmag.com/TWA-Death-Of-A-Legend/

[16] http://usatoday30.usatoday.com/travel/news/2003/07/21-aa-twa.htm

[17] http://aviationblog.dallasnews.com/2014/06/ex-twa-flight-attendants-sue-american-airlines-association-of-professional-flight-attendants-over-seniority.html/

[18] http://www.plansponsor.com/MagazineArticle.aspx?id=6442460501

[19] http://www.nytimes.com/1991/11/28/business/congress-moves-to-force-icahn-to-insure-twa-pensions.html

[20] http://www.thetimes.co.uk/tto/business/columnists/article2620474.ece

[21] Number compiled for 1985-2001 from numerous sources: http://articles.latimes.com/1985-10-15/business/fi-16340_1_twa-spokeswoman; http://www.nytimes.com/1986/06/22/business/carl-icahn-s-wild-ride-at-twa.html?pagewanted=all;http://www.nytimes.com/1990/10/06/business/company-news-450-to-500-face-twa-layoffs.html;http://articles.latimes.com/1991-01-21/business/fi-535_1_flight-attendants;http://www.upi.com/Archives/1992/08/28/TWA-to-close-New-York-reservations-center-lay-off-450/6693714974400/;http://www.joc.com/twa-prepares-2000-layoff-notices_19921004.html;https://www.newspapers.com/newspage/139549801/;https://www.questia.com/newspaper/1P2-32877324/layoff-plans-in-the-air-at-twa; https://www.questia.com/newspaper/1P2-32886999/twa-layoffs-may-reach-3-000;http://archive.columbiatribune.com/2003/Jul/20030719News007.asp

[22] http://www.plansponsor.com/MagazineArticle.aspx?id=6442460501

[23] http://www.cnn.com/2015/08/21/us/carl-icahn-fast-facts/

[24] http://www.wsj.com/articles/SB113841602299059005

[25] http://articles.latimes.com/2005/nov/02/business/fi-warner2

[26] http://articles.latimes.com/2005/nov/02/business/fi-warner2

[27] http://www.economist.com/node/5541064

[28] http://www.forbes.com/2008/12/01/yahoo-yang-icahn-tech-enter-cx_bc_1201yahoo.html

[29] http://allthingsd.com/20091023/goodbye-to-all-that-icahn-leaves-yahoo-board/

[30] http://www.computerweekly.com/news/2240086045/Icahn-attempts-to-depose-Yahoo-board-over-failed-Microsoft-takeover

[31] http://www.nytimes.com/2008/07/22/technology/22yahoo.html

[32] http://www.computerweekly.com/news/2240087792/Shareholders-press-for-Microsoft-deal-as-Yahoo-slashes-1500-jobs

[33] http://abcnews.go.com/Technology/story?id=6449113&page=112

[34] http://searchengineland.com/microsoft-yahoo-search-deal-simplified-23299

[35] http://allthingsd.com/20091023/goodbye-to-all-that-icahn-leaves-yahoo-board/

[36] http://fortune.com/2008/10/22/at-yahoo-job-cuts-are-the-good-news/

[37] http://fortune.com/how-dollar-store-war-was-won/

[38] http://fightfor15.org/april14/main/atlanta-family-dollar-workers-join-the-fight-for-15/

[39] http://fortune.com/how-dollar-store-war-was-won/

[40] http://dealbook.nytimes.com/2014/07/29/icahn-cuts-his-stake-in-family-dollar/?_r=0

[41] http://www.huffingtonpost.com/2013/08/29/dollar-stores-work_n_3786781.html

[42] http://www.charlotteobserver.com/news/business/article20050002.html

[43] http://matthewsminthillweekly.com/news/2016/01/family-dollar-employees-in-limbo-after-ceos-resignation/

[44] http://www.wsj.com/articles/trump-taj-mahal-casino-out-of-bankruptcy-into-carl-icahns-hands-145654545

[45] http://www.businesswire.com/news/home/20141107005859/en/Carl-Icahn-350-million-Trump-Entertainment-Atlantic

[46] http://www.businesswire.com/news/home/20141107005859/en/Carl-Icahn-350-million-Trump-Entertainment-Atlantic

[47] http://www.motherjones.com/politics/2016/05/supreme-court-considering-case-against-trump-taj-mahal

[48] http://www.foxbusiness.com/markets/2015/06/17/casino-union-soon-to-be-taj-mahal-owner-carl-icahn-is-malignancy-in-atlantic.html

[49] http://www.nbcphiladelphia.com/news/local/Casino-Union-Carl-Icahn-is-a-Malignancy-in-Atlantic-City-307929191.html

[50] http://www.npr.org/2016/05/31/480156824/supreme-court-declines-trump-resorts-case-that-stripped-workers-benefits

[51] http://www.ibamag.com/news/aig-slashes-hundreds-of-jobs-as-it-shuts-financial-network-offices-27529.aspx;http://www.ibamag.com/news/aig-slashes-hundreds-of-jobs-as-it-shuts-financial-network-offices-27529.aspx; http://www.insurancejournal.com/news/national/2016/03/23/402774.htm/

[52] http://www.aig.com/content/dam/aig/america-canada/us/documents/investor-relations/investor-update-presentation-1-26-16-brochure.pdf

[53] https://www.doleta.gov/tradeact/taa/taa_search.cfm

[54] http://www.wsj.com/articles/SB10001424052702303947904579339041047857338

[55] https://www.washingtonpost.com/news/wonk/wp/2015/09/29/donald-trumps-first-cabinet-pick-is-just-as-controversial-as-he-is-and-a-lot-richer//

[56] http://whalewisdom.com/filer/icahn-carl-c-et-al#/tabholdings_tab_link

[57] http://www.forbes.com/sites/christopherhelman/2013/04/17/first-mover-how-cheniere-energy-is-leading-americas-lng-revolution/

[58] http://whalewisdom.com/filer/icahn-carl-c-et-al#/tabholdings_tab_link

[59] https://stateimpact.npr.org/pennsylvania/2013/06/17/landowners-dispute-chesapeake-royalty-payments-in-bradford-county/

[60] http://www.star-telegram.com/news/business/article79291012.html

[61] http://whalewisdom.com/filer/icahn-carl-c-et-al#/tabholdings_tab_link

[62] http://www.latimes.com/local/california/la-me-oil-drilling-jefferson-20160125-story.html

[63] Jobs eliminated” includes layoffs, jobs shipped overseas, potential layoffs that have been announced but not yet carried out, and jobs Icahn has publicly threatened to eliminate (e.g. at the Trump Taj Mahal)

[64] “Benefit terminations” includes cuts to or eliminations of healthcare, pension, and severance benefits