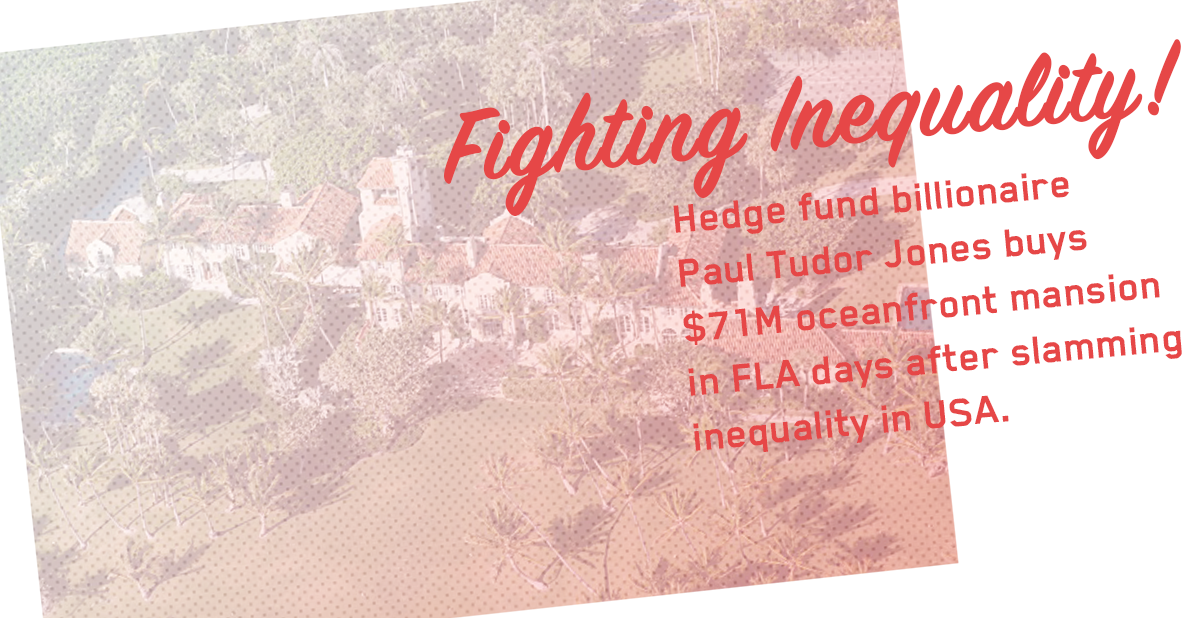

Paul Tudor Jones, self-described income inequality crusader, purchases $71.2 million mansion

Hedge fund billionaire Paul Tudor Jones, who waxed apologetic about income inequality at his recent TED Talk, has just snapped up another waterfront mansion, this time on Palm Beach Florida’s “Billionaires’ Row.”

It’s an important investment for Tudor Jones, who only owns two other waterfront mansions. The $71.2 million property is very historic, having been built originally for robber barons of a different generation—trustees of the Standard Oil fortune.

Now that Jones has his new mansion, perhaps he’ll be in the market for a few new yachts—which, thanks to his buddies in Albany, would receive an enormous tax subsidy if purchased in New York. New private jets or helicopters for the commute to Wall Street (or Albany) would be tax-free too!

Given Tudor Jones’ recent focus on combating income inequality, some may be puzzled over how he can afford to own such extravagant houses – or concerned about whether he’s at risk from blacking out due to cognitive dissonance.

Paul Tudor Jones describes himself as “global macro trader,” but that doesn’t do much to explain how he was able to amass so much wealth.

Photo credit: RobertStevens.com

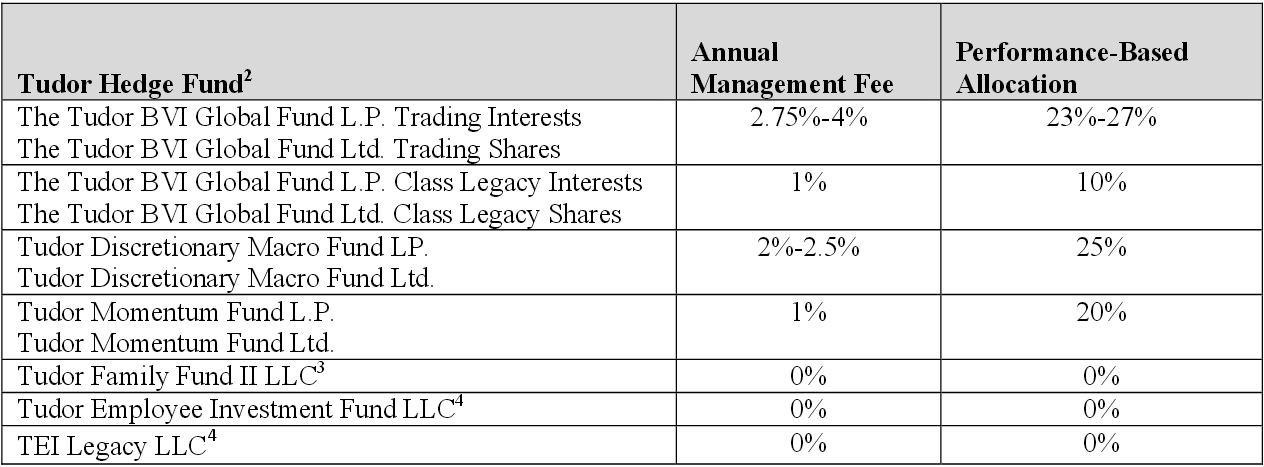

Tudor Jones made his billions by managing money of public employee retirees and other large investors, and charged them some of the highest fees in the hedge fund business.

Not content with the mere “two-and-twenty” fee structure that hedge fund managers have been using to accelerate their fortunes for the past forty years, Tudor Jones has been charging clients as much as 4% of their invested assets per year, and taking as much as 27% in performance fees.

While his clients have enjoyed varying levels of returns, Jones could rest assured that he would pull in as much as 4% of his client’s money, no matter how well he performed.

But don’t you worry, Paul Tudor Jones has a plan to solve America’s historic levels of wealth and income disparity!

In his recent TED talk, Jones bragged about his new initiative to conduct a “nationwide survey of twenty thousand Americans to find out exactly what they think are the criteria for justness in corporate behavior.”

Perhaps it’s a good thing that Tudor Jones is soliciting help from the general public to define good corporate behavior—for someone who is unironically seeking to fix the income inequality problem in America, it’s only fitting that his first step is admitting that he has a problem.