Paul Singer—market master or litigious vulture?

The mythos of the hedge fund manager is defined by a perceived mastery over market forces. Commentators often ascribe supernatural powers that hedge fund managers supposedly have over the market. Titles like “Hedge Fund Market Wizards” and “Money Mavericks” are typical. Paul Singer is decidedly not a master of the markets. Paul Singer is just an opportunistic lawyer who has found a niche doing something that most people couldn’t stomach—suing some of the poorest nations in the world. Singer is the pioneer of a strategy called debt vulturism, which does not require a savvy understanding of the markets. Indeed, Singer’s fund has been swindled by a fraudster selling fictitious securities.[1] read more »

A hedge fund billionaire who calls income inequality “a wedge issue”

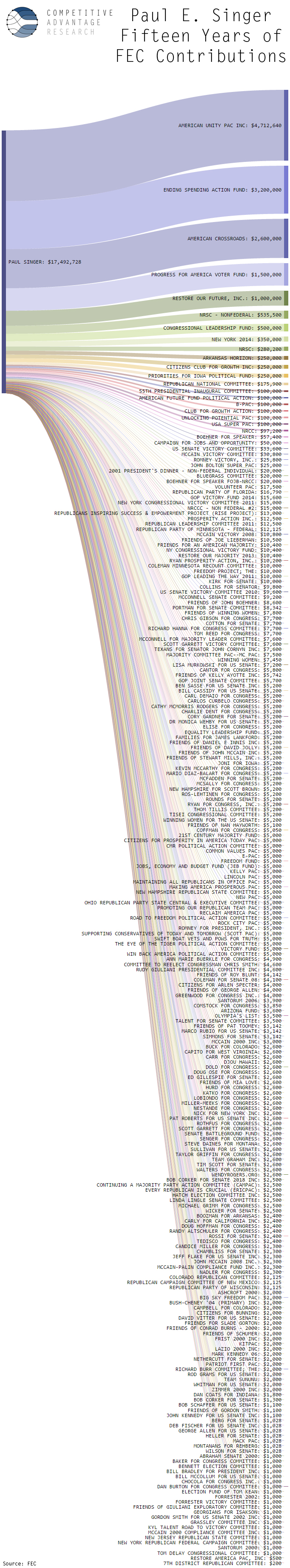

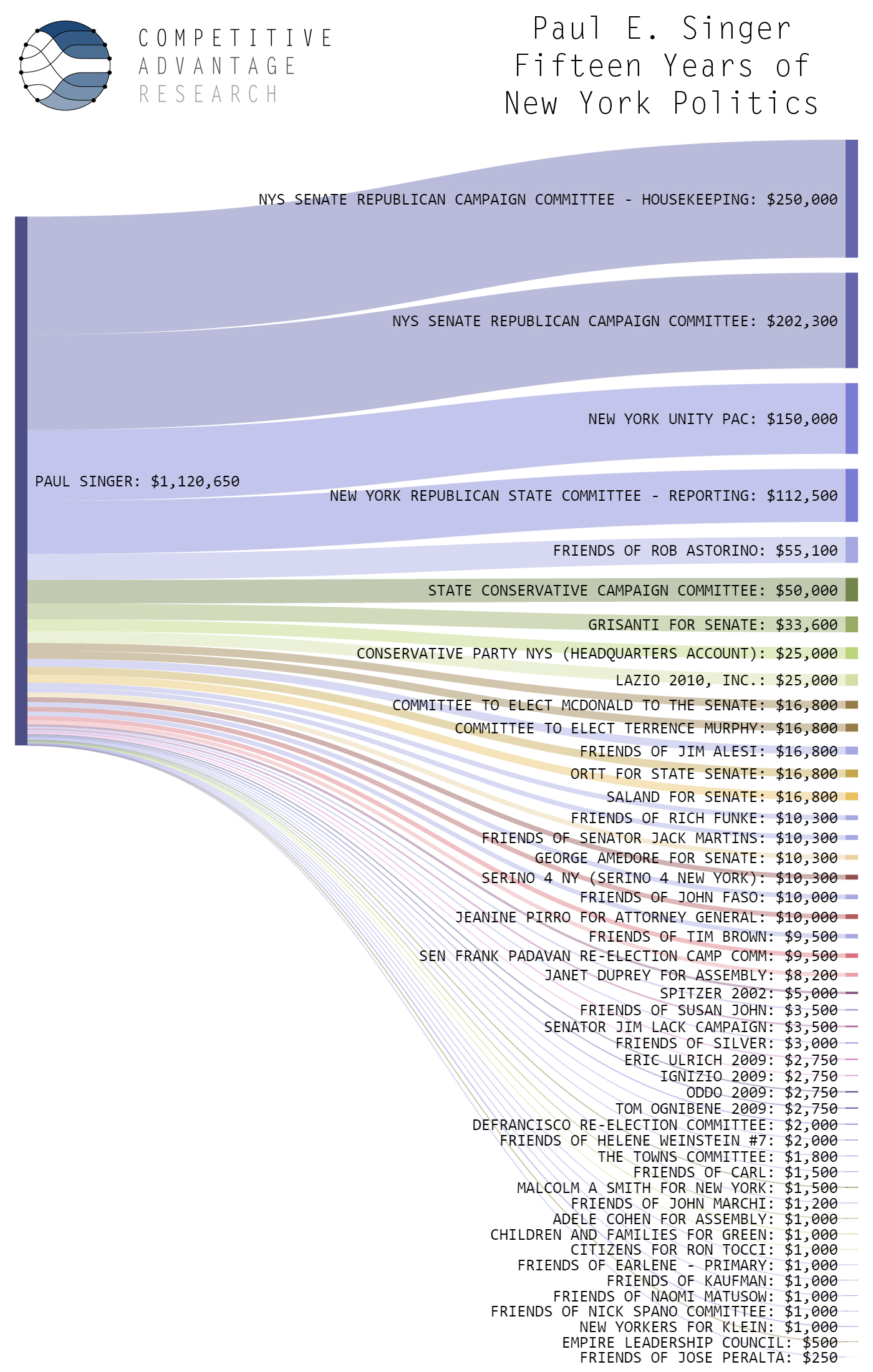

Paul Singer is a hedge fund billionaire and prominent New York-based philanthropist. Singer’s net worth is worth $1.92 billion, according to Forbes—easily making him one of the wealthiest New Yorkers.[2] Singer is the founder and CEO of hedge fund Elliott Management Corporation, controlling over $23 billion in assets. A leading Republican donor, Singer has contributed heavily to GOP candidates including to former presidential candidate Mitt Romney.[3] Singer’s fund, Elliott Management, was the top ranked contributor to the 2012 Republican vice presidential candidate Paul Ryan’s campaign committee and PAC in the 2012 cycle, contributing $40,000.[4]

“income inequality has become a wedge issue”

A 2012 Fortune profile called Singer “Mitt Romney’s hedge fund kingmaker” and described him as “a passionate defender of the 1% and a rising Republican power broker.” The article reported that in a confidential Jan. 23, 2012 report to his investors, Singer wrote that “income inequality has become a wedge issue.” The Fortune profile continued, “The billionaire shows little sympathy for the plight of the 99%. ‘Resentment is not morally superior to earning money,’ writes Singer.”[5]

Perhaps not surprisingly, recipients of Paul Singer’s cash have gone to bat for him on various legislative issues. Recently, twelve members of Congress signed a letter to Attorney General Eric Holder,[6] urging him to side with Singer’s hedge fund in their battle to extract profits from Argentina. The signatories of that letter received a combined $200,000 from Singer and his connected PACs.[7]

“To the right of Attila the Hun” Paul Singer bankrolls rightwing causes

“To the right of Attila the Hun” Paul Singer bankrolls rightwing causes

Singer has a long history of funding some of the most conservative organizations in the country. Singer’s political reputation earned him the reputation, only half made in jest, of being “to the right of Attila the Hun.”[8] Singer is the chairman of the Manhattan Institute, a Koch-funded rightwing think tank with a regrettable history of shilling for big tobacco,[9] giving voice to climate change denialists,[10] and hosting controversial social Darwinist Charles Murray as a fellow.[11] Through his family foundation, Singer has contributed to conservative think tanks like the American Enterprise Institute, the Koch-backed Atlas Economic Research Foundation, and the Center for Individual Rights. Singer was recently revealed to be a funder of intractable climate change denialist Bjørn Lomborg, having provided nearly a third of Lomborg’s foundation’s revenue in 2013.[12]

The vulture fund business model: Profiting hugely from struggling companies and countries

The vulture fund business model: Profiting hugely from struggling companies and countries

“‘Do you know you are causing babies to die all over Liberia?” — Liberian diplomat Winston Tubman, asked what he would tell vulture fund managers.[13]

Singer’s hedge fund, and others like it, are often called “vulture funds” in a reference to their business model: Buying up the debt of bankrupt or struggling countries and companies at a deep discount (often for pennies on the dollar), and then demanding that the debt be paid in full. Vulture funds often become “hold outs”—refusing to agree to debt restructuring and other compromises proposed by often-desperate debtor companies and countries. Then they collect by taking their debtors to court—in the case of debtor nations, sometimes to courts all over the world. Vulture funds can reap huge profits—400 percent in the case of Peru’s eventual settlement with Singer’s Elliott Associates.[14]

Bloomberg noted, “Singer has repeatedly been labeled a ‘vulture investor’ by the emerging-market countries whose bonds he has bought and by development organizations such as Oxfam International that back forgiveness of poor countries’ debt.”[15] The Guardian described the debt vulture model this way: “Vulture funds operate by buying up a country’s debt when it is in a state of chaos. When the country has stabilized, vulture funds return to demand millions of dollars in interest repayments and fees on the original debt. … It has been 16 years since most of the world began writing off the debts of the world’s poorest countries, but the vulture funds, a club of between 26 and 35 speculators, have ignored the debt concerts by pop stars such as Bono and pleas from the likes of the World Bank and International Monetary Fund to give the countries a break and a chance to get back on their feet.”[16]

The Guardian noted that “according to the World Bank, the top 26 vultures have managed to collect $1bn from the world’s poorest countries and still have a further $1.3bn to collect. … The World Bank has described vulture funds as “a threat to debt relief efforts” and the former, Bush-era US treasury secretary Henry Paulson said: “I deplore what the vulture funds are doing” in testimony before the House of Representatives’ financial committee in 2007.”

Putting vulture fund profits in perspective, The Guardian pointed out that “The $1bn collected by the funds is equivalent to more than double the International Committee of the Red Cross’s entire budget for Africa in 2011. $1bn could fund the entire UN appeal for the famine in Somalia and is more than twice the amount of money raised by Save the Children last year.”[17]

Vulture funds destabilize financial markets, keep poor countries poor just as they are attempting to get out from under debt, and scare off new investors from a country, critics point out. Debt vulturism has been condemned by the United Nations,[18] the governments of the United States, France, Mexico, Brazil, Belgium and Germany, and various religious organizations.[19]

Former Prime Minister Gordon Brown has described vulture-fund payouts as “morally outrageous.” Britain passed groundbreaking laws in 2010 reining in vulture practices.

Keeping the world’s poorest countries crushed by debt

Keeping the world’s poorest countries crushed by debt

Outcry over vulture funds has focused particularly on their practice of buying up debt in some of the world’s poorest countries. Such debts, The Nation notes, “are usually forgiven when the countries are granted relief by wealthy nations like the United States and multilateral institutions like the World Bank.”[20] The Nation reported, “Since the end of 2005, more than a third of the countries receiving debt relief have been targeted by at least thirty-eight hedge funds, which have gotten judgments in excess of $1 billion. This reverse Robin Hood scheme has drawn criticism around the globe, including from Nelson Mandela and British Prime Minister Gordon Brown.”[21]

A Singer subsidiary’s actions in the Republic of Congo fit this sovereign-debt-acquisition script. Bloomberg reported that “In the late 1990s, Elliott Associates, through another of its subsidiaries, Cayman Islands-based Kensington International Inc., bought $30 million of defaulted Congolese debt at a significant discount, according to legal documents filed by the Congolese government.”[22] Kensington has litigated in courts around the world to try to claim Congolese assets in payment of the debt. By The Nation’s tally, “Kensington has filed at least fifteen separate lawsuits against Congo and its business partners, in places ranging from the British Virgin Islands to Hong Kong to the United States.” In November 2005, Bloomberg reported, Kensington was awarded $39 million when the U.K.’s High Court ruled that Glencore International AG, the world’s largest commodity trader, should pay the company for two consignments of Congolese oil rather than pay a Congolese government-controlled company.[23]

While Singer was trying to strong-arm the Congolese government for significant profit, the country was in the throes of one of the most significant food shortages in the world, twice ranking top ten in the World Food Programme’s list of Hunger Crises.[24]

As The Nation has commented previously, “Singer is unapologetic about the hardball tactics he pioneered.” Singer disregards the unspeakable damage his fund does to citizens. “Every country has poverty, including the USA,” he told The Nation via e-mail. “Our disputes have always been with sovereigns who can pay but refuse.” He dismisses his critics as “debtors who attempt to curry populist favor by paying just what they feel like paying” and “ideologically driven people and groups who do not realize that capital goes where it is welcome.”[25]

Paul Singer’s destruction of Delphi devastates thousands of families, earns him over $1 billion

Paul Singer is reported to have earned more than $1.5 billion on his play at Delphi, the troubled auto parts manufacturer that was bailed out by the U.S. government in 2009.[26] Singer’s Elliott Management, along with Silver Point Capital and Dan Loeb’s Third Point, blocked an earlier sale proposed by the Treasury Department, which would have saved 15 of 29 Delphi plants and countless jobs.[27] Holding Delphi at financial gunpoint, the hedge funds were able to extract additional compensation by shuttering additional factories across the country. Dan Loeb, whose hedge fund also got in on the deal, boasted that “virtually no North American unionized labor” remained after the hedge funds rampaged through the company. In the final bankruptcy deal, Delphi’s 20,000 retirees lost up to 70% of their pensions,[28] an estimated 8,500 workers lost their jobs nationwide,[29] and all but four factories were shuttered.[30]

FOOTNOTES

FOOTNOTES

[1] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aaBs_ulML67w

[2] http://www.forbes.com/profile/paul-singer/

[3] http://fortune.com/2012/03/26/mitt-romneys-hedge-fund-kingmaker/

[4] http://www.opensecrets.org/politicians/contrib.php?cycle=2012&type=C&cid=N00004357&newMem=N&recs=2

[5] http://fortune.com/2012/03/26/mitt-romneys-hedge-fund-kingmaker/

[6] http://www.ipsnews.net/documents/holder_letter.pdf

[7] http://www.ipsnews.net/2013/07/u-s-hedge-funds-paint-argentina-as-ally-of-iranian-devil-part-two/

[8] http://fortune.com/2012/03/26/mitt-romneys-hedge-fund-kingmaker/

[9] http://legacy.library.ucsf.edu/tid/ntl01d00

[10] http://mediamatters.org/blog/2012/11/28/meet-the-climate-denial-machine/191545#manhattan

[11] http://shameproject.com/profile/charles-murray/

[12] http://www.desmogblog.com/2015/02/05/exclusive-bjorn-lomborg-think-tank-funder-revealed-billionaire-republican-vulture-capitalist-paul-singer

[13] http://news.bbc.co.uk/2/hi/programmes/world_news_america/8546628.stm

[14] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a28yFQW._1bY

[15] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a28yFQW._1bY

[16] http://www.theguardian.com/global-development/2011/nov/15/vulture-funds-jersey-decision

[17] http://www.theguardian.com/global-development/2011/nov/15/vulture-funds-jersey-decision

[18] http://www.ohchr.org/EN/Issues/Development/IEDebt/Pages/Debtrestructuringvulturefundsandhumanrights.aspx

[19] http://jubileedebt.org.uk/campaigns/stop-vulture-funds

[20] http://www.thenation.com/article/rudys-bird-prey?page=full

[21] http://www.thenation.com/article/rudys-bird-prey?page=full

[22] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a28yFQW._1bY

[23] http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a28yFQW._1bY

[24] https://www.globalpolicy.org/component/content/article/104/46292.html & https://www.globalpolicy.org/component/content/article/104/46289.html

[25] http://www.thenation.com/article/rudys-bird-prey?page=full

[26] http://nypost.com/2010/10/26/hedgie-paul-singer-to-reap-1-5b-on-delphi-auto-stake/

[27] http://www.gregpalast.com/romney-co-shipped-every-single-delphi-uaw-job-to-china/

[28] http://investigations.nbcnews.com/_news/2012/11/04/14921926-delphi-retirees-say-obama-administration-betrayed-them

[29] http://www.wthr.com/story/4708383/delphi-to-keep-kokomo-plant-anderson-uncertain

[30] http://www.nytimes.com/2007/06/30/business/30auto.html?_r=0