Download as PDF or read below

Across the country, states stand to gain billions of dollars in revenue by closing the carried interest loophole.

It’s a long overdue element of financial reform that the federal government has failed to enact, despite bipartisan support for tax fairness.

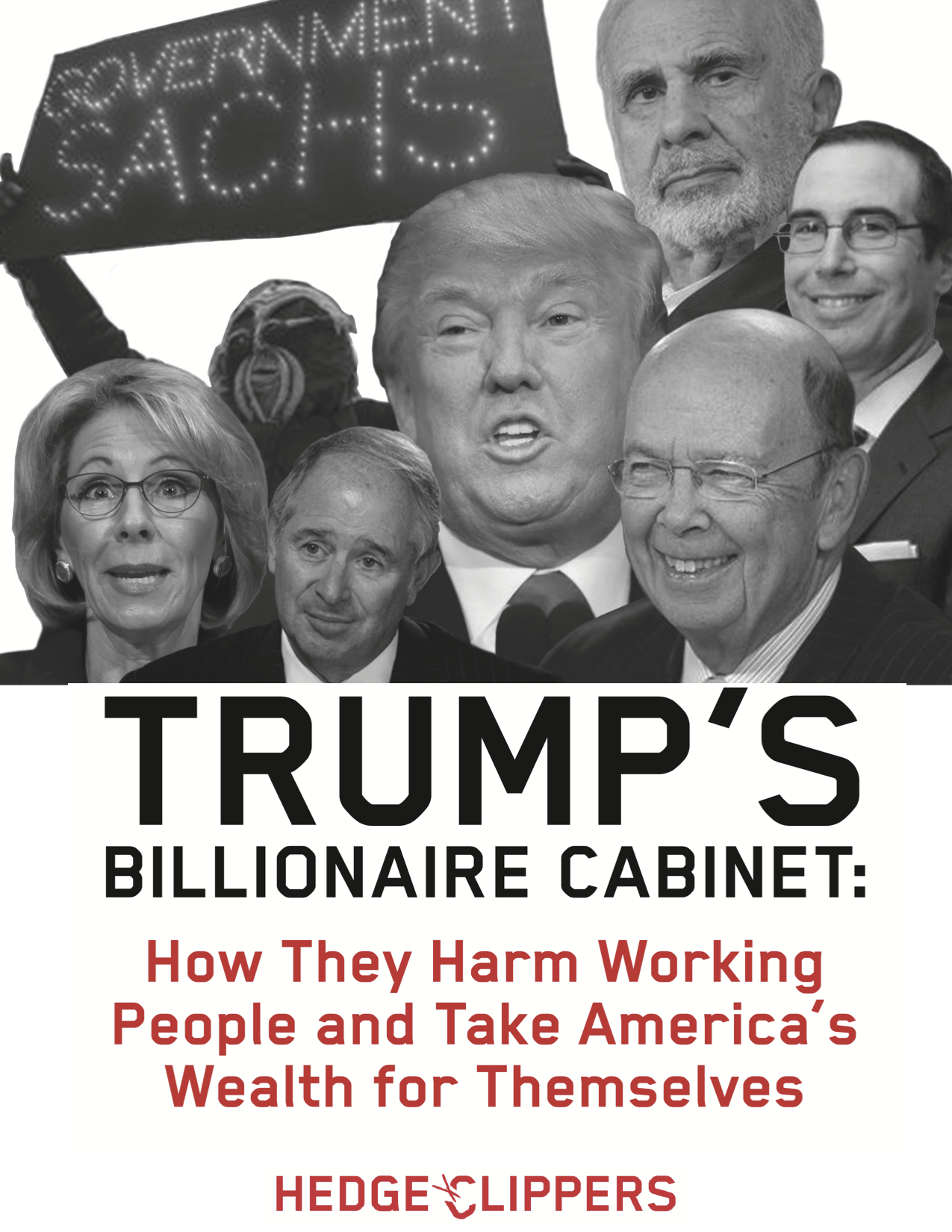

In last year’s Presidential campaign, Donald Trump, Hillary Clinton, Bernie Sanders, and Jeb Bush all called for closing a tax break known as the “carried interest loophole,” a legal fiction used by private equity firms and other members off the wealthy elite to lower their federal tax rates below those paid by many working Americans.[1]...