February 2023

Contributors

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. www.populardemocracy.org

The Center for Popular Democracy is a nonprofit organization that promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. www.populardemocracy.org

Churches United for Fair Housing CUFFH is a grassroots organization that works towards community empowerment through community organizing, youth engagement, and by providing sophisticated social services. CUFFH organizes towards preserving and creating vibrant communities that are not exclusive and are really affordable to working families in New York City. https://www.cuffh.org/

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org

The Hedge Clippers are working to expose the mechanisms hedge funds and billionaires use to influence government and politics in order to expand their wealth, influence, and power. We’re exposing the collateral damage billionaire-driven politics inflicts on our communities, our climate, our economy and our democracy. We’re calling out the politicians that do the dirty work billionaires demand, and we’re calling on all Americans to stand up for a government and an economy that works for all of us, not just the wealthy and well-connected. https://hedgeclippers.org

![]()

LittleSis is a grassroots watchdog network connecting the dots between the world’s most powerful people and organizations. We bring transparency to influential social networks by tracking the key relationships of politicians, business leaders, lobbyists, financiers, and their affiliated institutions. https://littlesis.org/

New York Communities for Change is one of the largest grassroots, membership-driven, community-based organizations in New York. NYCC uses community organizing, direct action and legislative advocacy to advance the cause of social, economic and environmental justice in low and moderate income communities. https://www.nycommunities.org/

New York Communities for Change is one of the largest grassroots, membership-driven, community-based organizations in New York. NYCC uses community organizing, direct action and legislative advocacy to advance the cause of social, economic and environmental justice in low and moderate income communities. https://www.nycommunities.org/

The Strong Economy for All Coalition fights for fair taxes and fair budgets, more jobs and better wages, investments in education and higher education for our future, a strong safety net and public financing of elections. We are made up of some of New York’s most engaged and effective unions and community organizations. https://strongforall.org/

The Strong Economy for All Coalition fights for fair taxes and fair budgets, more jobs and better wages, investments in education and higher education for our future, a strong safety net and public financing of elections. We are made up of some of New York’s most engaged and effective unions and community organizations. https://strongforall.org/

Introduction

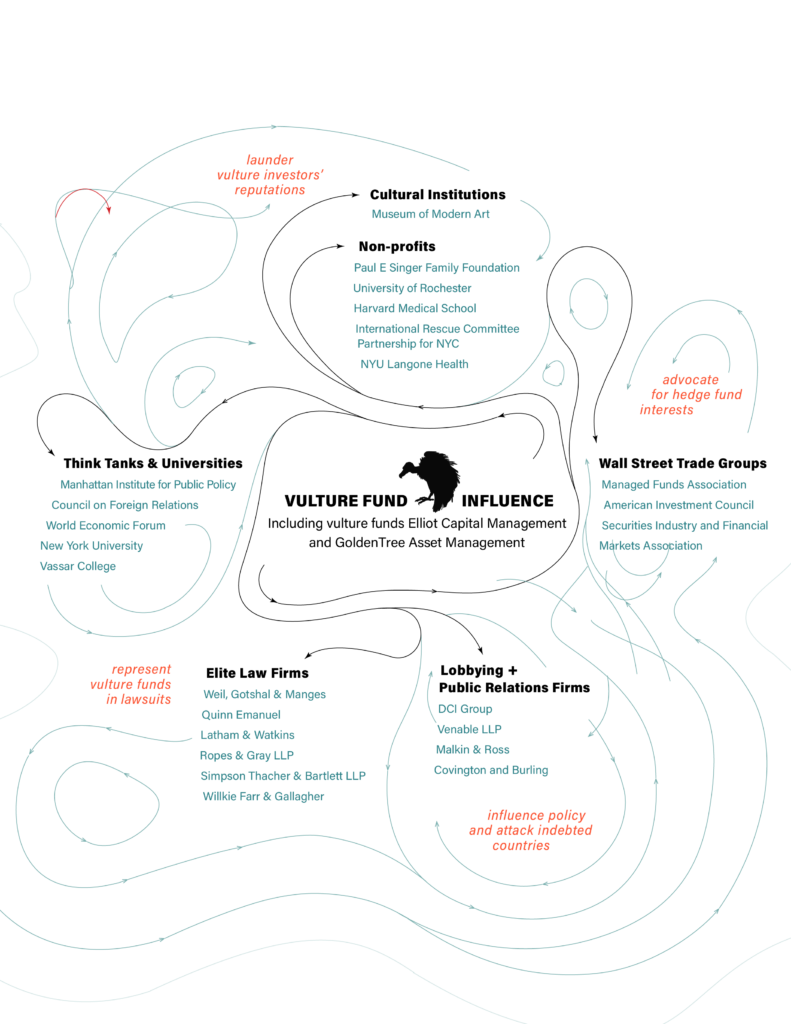

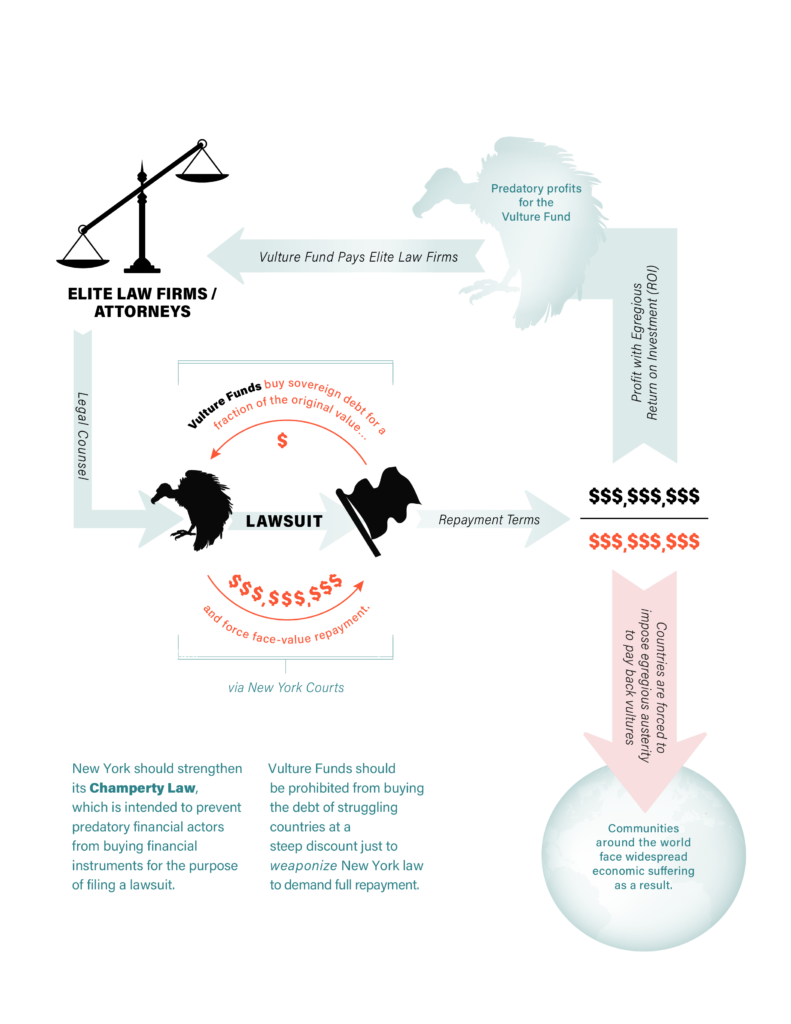

Predatory Wall Street investors have created a multibillion-dollar business buying debts owed by struggling governments at steep discounts. They hold out in debt renegotiations and block restructuring deals, then sue to drain countries’ resources and force debt repayment at face value. These investors, called “vulture funds” for their strategy of targeting countries that cannot make sovereign debt payments, frequently leave crushing austerity in the form of regressive taxes, gutted public services, and the privatization of public goods and services in their wake.

Vulture funds’ predation on indebted countries is not a naturally-occurring phenomenon. Instead, it feeds off of a political and economic power structure that favors the profits of a few unscrupulous investment managers over the well-being of millions of people. In our December 2021 report, “Pain and Profit in Sovereign Debt: How New York Can Stop Vulture Funds from Preying on Countries,”[1] we detailed the vulture fund playbook and the role that federal courts in New York State play in their strategy. Vulture funds rely heavily on favorable legal judgments from federal courts in New York because most sovereign debt contracts around the world are governed by New York or English law.[2]

Beyond a compromised legal system that allows vulture funds to buy sovereign debt for the express purpose of suing to collect on it, networks of attorneys, lobbyists, trade groups, think tanks, and cultural institutions facilitate the vulture fund investment strategy and reap profits from debt predation.

In this report, we examine these networks surrounding vulture funds, including:

- Elite law firms that represent vulture funds in their lawsuits to maximize payments from indebted countries;

- Wall Street trade groups that spend millions of dollars advocating for laws that prioritize vulture fund profits;

- Lobbying and public relations firms paid by vulture funds to influence United States policy and attack countries targeted for debt predation;

- Think tanks, cultural organizations, and other non-profits vulture investors use to bolster their reputations and manipulate culture and policy.

| Law firms often secure significant wins and rulings in NY courts that unfairly favor vulture funds.

Paul Singer, and other vulture funds, rely on slippery legal arguments to force sovereign nations to pay vulture funds before being able to pay other creditors. Vulture funds consistently prevail in New York courts.[3] For instance, vulture funds and other holdouts in Argentina’s debt restructuring brought 11 lawsuits in federal courts in New York and won every single one. A judge in the Southern District of New York went so far as to prohibit Argentina from paying any creditors who agreed to the deal unless the vulture funds received $4.65 billion from Argentina first.[4] Vulture funds snatched up Argentinian bonds for pennies on the dollar after the country defaulted on over $100 billion in debt in 2001. During negotiations with Argentina, Elliott Capital and other hedge funds refused the proposed restructuring deal—even though 93% of the country’s creditors had committed to signing. Argentina’s 2001 default affected nearly half a million creditors while just a handful of vulture funds held those creditors hostage.[5] During this time, the International Monetary Fund called on Argentina to impose harsh austerity measures before issuing aid.[6] That year, the Argentinian economy went into freefall with tens of thousands of businesses closing, skyrocketing unemployment, and many people falling below the poverty line.[7] Vulture funds’ unscrupulous legal tactics resulted in enormous payments, despite widespread suffering in Argentina. Singer’s firm received a $2.4 billion payout from Argentina in 2016, a 1,270-per-cent return on its initial investment.[8] |

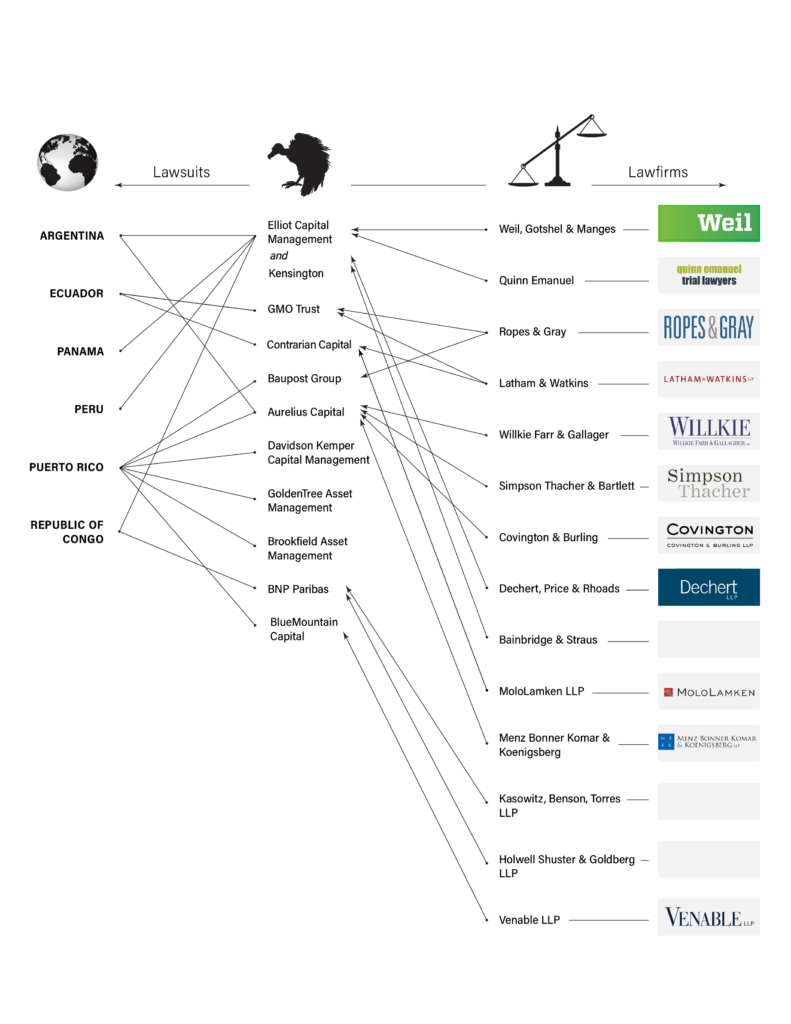

Vulture Funds’ BigLaw Attorneys Take Struggling Countries to Court

After buying a county’s distressed debt at a steep discount and refusing to negotiate, vulture funds use high-powered lawyers to take countries to court. Vulture funds sue countries – primarily through New York courts – forcing debt repayment at face value even though they sometimes purchased the debt for pennies on the dollar. Filing these lawsuits is a key component of the vulture fund investment strategy. For vulture funds, who stand to earn billions of dollars from favorable judgments, and their attorneys, protracted lawsuits can be incredibly profitable. For struggling countries facing bankruptcy, litigation can take years, and expenses can drain the already-stretched resources of debtor countries. By refusing to negotiate—or to accept any proposed debt restructuring agreements—vulture funds can disrupt the process for all creditors while preventing a country from accessing international capital markets for years, as was the case in Argentina and Puerto Rico.[9]

|

Billionaire Paul Singer, Elliott Management, and His Go-To Lawyers

Billionaire Paul Singer runs one of the most notorious vulture funds and has extracted exorbitant profits using a predatory and exploitative business model. Singer’s hedge fund Elliott Management has consistently tapped the same lawyers for several high-profile cases:

When Singer sued the governments of Peru and Panama, he was represented by:[10]

When Singer sued the governments of Peru and Panama, he was represented by:[10]

- Otto G. Obermaier from the law firm Weil, Gotshal & Manges.

- When Obermaier served as a U.S. Attorney for the Southern District of New York, headlines said he took a “kindler, gentler approach to white-collar crime.”[11]

- After the investment firm Salomon, Inc. admitted to manipulating the government securities market and was fined $290 million in civil penalties, Obermaier refused to indict, saying “there was no need to punish innocent employees and shareholders.”[12]

Before acting as chief trial counsel for the Securities and Exchange Commission’s New York Office, Obermaier built a career in defending white-collar criminals and Wall Street brokerages.[13] He wrote the book on white collar defense, co-authoring “White Collar Crime: Business and Regulatory Offenses.”[14]

Before acting as chief trial counsel for the Securities and Exchange Commission’s New York Office, Obermaier built a career in defending white-collar criminals and Wall Street brokerages.[13] He wrote the book on white collar defense, co-authoring “White Collar Crime: Business and Regulatory Offenses.”[14]- According to the New York Times: “Early in his career, Otto G. Obermaier prosecuted Mafia dons, drug kingpins and nefarious Wall Street schemers. Later, he defended people accused of insider-trading, tax evasion and other white-collar crimes. In the lawyer’s parlance, he has walked both sides of the street.”[15]

- Otto G. Obermaier from the law firm Weil, Gotshal & Manges.

- When Singer’s subsidiary Kensington sued the Republic of Congo, the vulture fund was represented by:

- Kevin Samuel Reed from Quinn Emanuel.[16] His bio touts his expertise in “trade secrets, sovereign debt, employment, defamation, securities and deal-related disputes.”[17] This lawsuit was brought by Kensington against the Republic of Congo during a period when the country was facing incredibly high rates of poverty, over 42%, and a struggling post-conflict health infrastructure and rising rates of maternal mortality.[18]

GMO Trust & Contrarian Capital used NY Courts to Thwart Debt Negotiations with Ecuador

When Ecuador sought to restructure $17.4 billion in sovereign debt in July 2020, it reached a deal with a committee representing owners of a majority of its bonds.[19] Unfortunately, a hold-out group representing owners of a minority of bonds opposed the deal.[20] Two members of the steering committee representing these minority bondholders—hedge funds Contrarian Capital and GMO Trust—sued Ecuador in the Southern District of New York to try to block the deal.[21]

These unscrupulous vulture fund tactics have had countless negative effects on people in Ecuador. The government of Ecuador has imposed crushing austerity measures, and destabilized the economy, in order to pay back vulture funds and appease the IMF. In some cases the scale of the cuts is staggering–Ecuador’s government cut public investment in healthcare by almost two-thirds from 2017-2019. These harsh measures are disproportionately affecting Indigenous, people of Afro-descent, women, and older people in Ecuador.[22]

These unscrupulous vulture fund tactics have had countless negative effects on people in Ecuador. The government of Ecuador has imposed crushing austerity measures, and destabilized the economy, in order to pay back vulture funds and appease the IMF. In some cases the scale of the cuts is staggering–Ecuador’s government cut public investment in healthcare by almost two-thirds from 2017-2019. These harsh measures are disproportionately affecting Indigenous, people of Afro-descent, women, and older people in Ecuador.[22]

![]() During this legal battle with Ecuador, Contrarian and GMO received counsel from Latham & Watkins, a “powerhouse in the capital markets space.”[23]

During this legal battle with Ecuador, Contrarian and GMO received counsel from Latham & Watkins, a “powerhouse in the capital markets space.”[23]

Notably, the legal team included Latham & Watkins partner Christopher J. Clark, who (according to his bio) was also heavily involved in Argentina debt crisis negotiations and “successfully negotiated a number of creditor-favorable restructurings.”[24]

Notably, the legal team included Latham & Watkins partner Christopher J. Clark, who (according to his bio) was also heavily involved in Argentina debt crisis negotiations and “successfully negotiated a number of creditor-favorable restructurings.”[24]- Clark has also represented high-profile clients like billionaires Elon Musk and Mark Cuban in SEC investigations for alleged wrongdoing.[25]

- Latham & Watkins is the second highest-grossing law firm in the world and serves Big Tech, fossil fuel, pharma, and other corporate clients in addition to its vulture fund clientele. A recent Revolving Door Project report documented “Latham’s corporate legal work and its well-cultivated revolving door to influential government jobs, which has enabled the firm to secure favorable outcomes for its powerful clients.”[26]

![]() When GMO Trust previously sued Ecuador in 2014 over the country’s default on sovereign debt,[27] they retained legal representation from C. Thomas Brown with the Boston firm Ropes & Gray:

When GMO Trust previously sued Ecuador in 2014 over the country’s default on sovereign debt,[27] they retained legal representation from C. Thomas Brown with the Boston firm Ropes & Gray:

- In addition to powerful vulture fund clients, Thomas Brown also represented Bill Koch recently, including in a dispute with investors over his $2.5 billion natural gas company.[28]

- Ropes & Gray also has links to hedge funds like Baupost. An Intercept investigation revealed that Ropes & Gray worked with the Boston-based hedge fund, which allegedly used one of their lawyers’ addresses to register shell companies to purchase the debt of the Puerto Rican government. Baupost Group founder and president Seth Klarman owned nearly $1 billion of Puerto Rico’s debt as of 2017.[29]

When Aurelius Capital sued Argentina in 2009 and 2010, the vulture fund retained counsel from:

Mark T. Stancil, from Willkie Farr & Gallagher, who has built a career representing hedge funds and asset managers.[30] In addition to the vulture fund’s notorious legal action against Argentina, Stancil is a key lawyer representing general obligation bondholders in Puerto Rico’s debt negotiations.

Mark T. Stancil, from Willkie Farr & Gallagher, who has built a career representing hedge funds and asset managers.[30] In addition to the vulture fund’s notorious legal action against Argentina, Stancil is a key lawyer representing general obligation bondholders in Puerto Rico’s debt negotiations.

He argued in court that Wall Street bondholders, including Aurelius Capital, deserve the first claim over any “available resources” and that “it’s up to the court to define” where funds go, rather than Puerto Rico’s legislature. In response, the presiding Judge Swain argued, “How is the court in position to determine whether babies should eat or traffic lights get turned on … before bondholders get paid?”[31]

He argued in court that Wall Street bondholders, including Aurelius Capital, deserve the first claim over any “available resources” and that “it’s up to the court to define” where funds go, rather than Puerto Rico’s legislature. In response, the presiding Judge Swain argued, “How is the court in position to determine whether babies should eat or traffic lights get turned on … before bondholders get paid?”[31]

Kimberly Ann Hamm, who was previously at law firm Simpson Thacher & Bartlett, provides an overt example of the revolving door between BigLaw vulture fund firms, government regulatory roles, and Wall Street.

Kimberly Ann Hamm, who was previously at law firm Simpson Thacher & Bartlett, provides an overt example of the revolving door between BigLaw vulture fund firms, government regulatory roles, and Wall Street.

- From 2003 to 2014, she worked at Simpson Thacher & Bartlett, a Manhattan law firm specializing in Wall Street and banking.[32] During this time, Hamm represented vulture funds like Aurelius in sovereign debt matters. She then joined the Office of General Counsel of the U.S. House of Representatives, where she advised members of Congress on their oversight activities. Hamm then served as Chief Counsel at the U.S. Securities and Exchange Commission–the federal agency tasked with regulating and holding Wall Street accountable.[33] After a brief stint in the Senate Rules Committee, she joined the world’s largest asset manager BlackRock in 2022 as the Director of Global Public Policy.[34]

Vulture Fund Lobbyists and Public Relations Firms Influence Policy and Attack Indebted Countries

Vulture funds also spend millions of dollars hiring lobbyists and public relations firms to aid their efforts to block debt restructuring agreements and exert pressure on indebted countries to maximize payouts to vulture investors. These lobbying and public relations contractors engage in traditional lobbying – i.e., contacting lawmakers and regulators to support or oppose policies aligned with vulture funds’ interests – and efforts to manipulate public opinion against governments that vulture funds are targeting.

Vulture funds hire multitudes of lobbying firms in pursuit of profit from their vulture investments, policies that benefit the securities and investment industry as a whole, and policies that impact corporations connected to their interests.

DCI Group

One of vulture funds’ critical allies in winning federal government support and favorable public opinion support has been the DCI Group – a shadowy, Washington-based lobbying and public relations firm. DCI Group has become well-known for using front groups and marshaling coalitions of sometimes unwitting participants to advocate for its corporate clients, including tobacco companies, the oil industry, and telecommunications firms, in addition to vulture funds.

One of vulture funds’ critical allies in winning federal government support and favorable public opinion support has been the DCI Group – a shadowy, Washington-based lobbying and public relations firm. DCI Group has become well-known for using front groups and marshaling coalitions of sometimes unwitting participants to advocate for its corporate clients, including tobacco companies, the oil industry, and telecommunications firms, in addition to vulture funds.

DCI Group was integral to Elliott Management’s vulture campaign to extract debt payments from Argentina. According to an article in Bloomberg, on behalf of Singer and Elliott, “DCI mounted an influence campaign that would stretch a decade and target all three branches of government,” getting paid at least $16 million for this work over one four-year period.[35]

- DCI manufactured a “coalition” called American Task Force Argentina. The coalition shifted attention away from Singer, presenting organizations like the National Grange and the Colorado American Association of University Professions as the debt dispute’s real victims. (Both denied being members of the coalition.)

- DCI coordinated public statements and letters targeting lawmakers: DCI orchestrated Congressional testimony supporting Elliott and other vulture funds’ position without disclosing its hand behind the scenes. They coordinated “a motley consortium–ranging from a Tea Party-aligned group to the National Black Chamber of Commerce” to write letters to lawmakers and issue public statements against Argentina.

- DCI staged protests, reports, op-eds in support of vulture funds. The group also staged a protest outside a conference with the president of Argentina scheduled to speak that featured a giant inflatable rat commonly associated with labor actions holding an Argentine flag and a sign reading “I’m the rat in the G20.” DCI then arranged a report from the National Taxpayers Union and op-ed columns with the same message.[36]

Unlike traditional lobbying, which is regulated at the state and federal level and requires payment disclosures, the bulk of DCI’s advocacy happens in the dark. Payments funnel through layers of front groups and subsidiaries to allied think tanks and advocacy groups that obscure DCI and its clients’ involvement, as well as how much money vulture funds and other DCI clients are paying for advocacy. According to Bloomberg Businessweek, former DCI employees say the company “maintains ties with dozens of nonprofits and advocacy groups, regularly contributing money and then requesting their assistance on projects.” The employees also claim “many Washington-area nonprofit staffers, policy experts, and even journalists were secretly fed lines” by DCI.[37]

Based on its success with the Argentina campaign, DCI eventually found work for other vulture funds targeting other countries in sovereign debt disputes with hedge funds running the same playbook.

DCI has also worked for Autonomy Capital. They used an affiliated Tea Party group to create a Facebook page advocating for vulture funds with Icelandic debt, placed op-ed columns attacking Iceland in the Wall Street Journal and Bloomberg View, and ran ads in Icelandic newspapers suggesting misconduct at Iceland’s central bank.[38]

DCI’s vulture playbook in Puerto Rico

From The Intercept:

On behalf of Doral Bank, which was seeking $229 million dollars from the commonwealth’s government, DCI launched what Puerto Rico’s largest paper dubbed a “smear campaign” against the Puerto Rican government in 2014. As part of the campaign, the American Future Fund, a dark-money group out of Iowa, published full-page ads in the Wall Street Journal and Politico, claiming a debt plan by former Puerto Rico Gov. Alejandro García Padilla would stiff seniors and retirees. For another group of bondholders, DCI paid Puerto Rican political figures to influence public opinion, according to El Nuevo Día. DCI also had a hand in a campaign by an astroturf group called Main Street Bondholders, according to reporting by the New York Times, cast as ordinary bond-holding retirees who stood to lose their life savings due to Puerto Rico’s fiscal irresponsibility.[39]

Thanks to former President Donald Trump, DCI’s behind-the-scenes influence has reached new heights in Puerto Rico. In 2020, Trump appointed Justin Peterson, a managing director at DCI who works in the firm’s energy practice, to the Federal Oversight and Management Board (FOMB).[40] The FOMB, also known as “la junta,” is an undemocratic body created by the United States government to oversee Puerto Rico’s finances.[41]

Venable LLP

Washington-based law firm Venable LLP lobbied on behalf of six different vulture investors in their efforts to block legislation granting Puerto Rico the same bankruptcy protections available in the U.S. and on restructuring the debt of PREPA, Puerto Rico’s electric utility from 2015 through 2020.[42]

Washington-based law firm Venable LLP lobbied on behalf of six different vulture investors in their efforts to block legislation granting Puerto Rico the same bankruptcy protections available in the U.S. and on restructuring the debt of PREPA, Puerto Rico’s electric utility from 2015 through 2020.[42]

Venable reported earning more than $4.5 million from BlueMountain Capital, DE Shaw Galvanic Capital, Franklin Advisors, Knighthead Capital Management, Marathon Asset Management, and Angelo, Gordon & Co in the six year period from 2015 through 2020 (according to data from Open Secrets).[43] These firms all owned PREPA bonds, and some owned other government debts.

Many vulture fund lobbyists at Venable passed through the revolving door with the US government, including:[44]

- Daris Meeks has moved back and forth between government and lobbying for over two decades. He served as a principal policy advisor to former Texas Congressman Jeb Hensarling, who chaired the House Financial Services Committee.[45] Meeks then worked as a lobbyist at Patton Boggs, followed by Venable, during which time he lobbied for the vulture funds in Puerto Rico.[46] In 2017, Meeks joined the Trump administration as Director of Domestic Policy for then-Vice President Mike Pence before leaving for Venable again in 2018. Meeks co-founded the firm Butera, Israel & Becker in 2020.[47]

- Andrew Olmem was counsel to former Senator George Voinovich and Deputy Staff Director and Chief Counsel to the Senate Committee on Banking, Housing, and Urban Affairs before joining Venable in 2013.[48] In 2017, Olmem joined the Trump administration, serving as Special Assistant to the President for Financial Policy and then Deputy Assistant to the President and Deputy Director of the National Economic Council.[49] Olmem joined the firm Mayer Brown as a partner in 2020.[50]

- Former Congressman Bart Stupak was a Democratic Representative from Michigan from 1993 through 2011[51], during which time he chaired the Oversight and Investigations Subcommittee of the Energy and Commerce Committees.[52] Immediately after leaving Congress, Stupak joined Venable as a partner in 2011.[53] Stupak began lobbying for the six vulture funds in 2019.[54]

BlueMountain and the other vulture investors mentioned above first hired Venable in 2015, when Puerto Rico’s then resident commissioner Pedro Pierluisi (a non-voting member of the US House of Representatives) introduced a bill that would provide Puerto Rico with greater bankruptcy protections. The lobbying funds vulture funds gave to Venable skyrocketed, increasing fivefold from $300,000 in 2015[55] to $1.44 million in 2016[56] as they successfully killed the bill. In all, from 2015 through 2020 Venable earned $4.54 million from the six vulture funds.

This lobbying contributed to an ongoing disaster at PREPA, Puerto Rico’s electric utility, whose debt the vultures were targeting. Amidst the vultures’ lobbying campaign, then Governor of Puerto Rico Ricardo Rossello announced a plan to privatize PREPA because of the burden of the authority’s debt in 2018.[57] After Rossello’s resignation, his successor Wanda Vázquez Garced turned over the operation of Puerto Rico’s electrical grid to the private operator LUMA Energy.[58] So far, LUMA’s operation of the grid has been a disaster, marked by explosions and wide-scale blackouts.[59]

Additional key lobbying firms in NY and DC

Other lobbyists and lobbying firms utilized by vulture funds include:

Other lobbyists and lobbying firms utilized by vulture funds include:

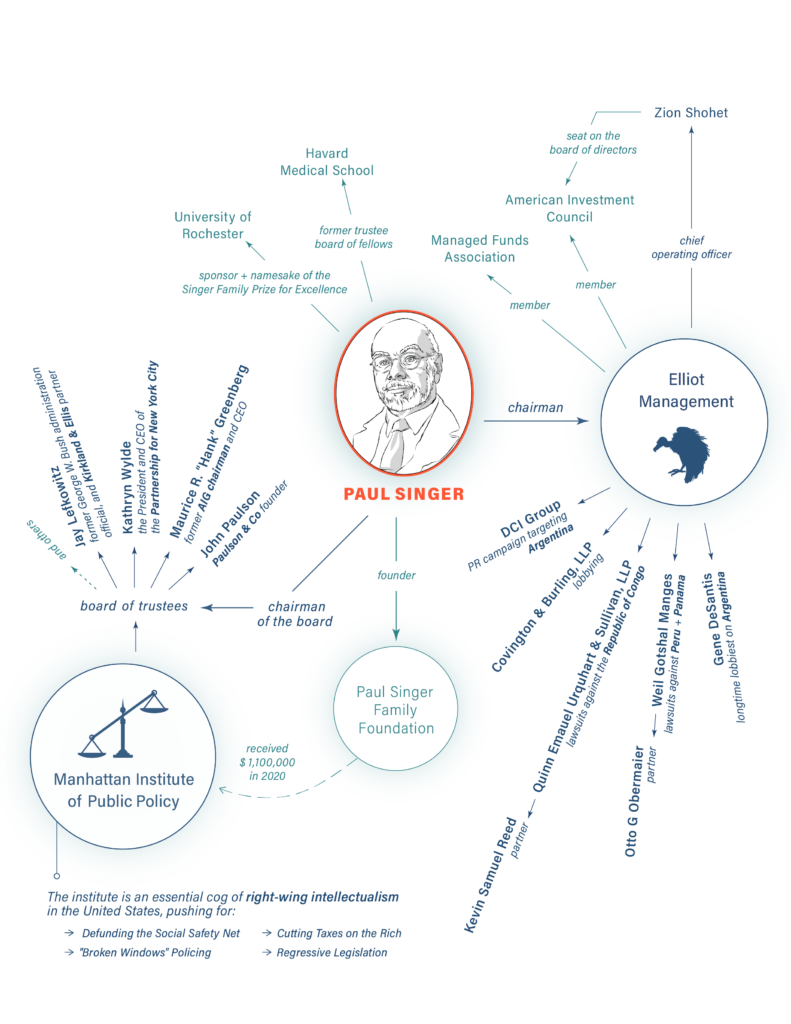

- Gene DeSantis, a former partner at Malkin and Ross, lobbies for Elliott Management in New York and in Washington. DeSantis has lobbied for vulture fund Elliott Management since 2009, according to Open Secrets and the New York State Commission on Ethics and Lobbying in Government. Elliott reported paying Malkin & Ross $435,000 for federal lobbying from 2009 through 2017[60] and $722,865 for New York State lobbying from 2014 through 2021.[61] Elliott reported paying DeSantis $490,000 for New York State lobbying from 2018 through 2022. DeSantis has lobbied for Elliott on many issues, including the Judgment Evading Foreign States Accountability Act to force Argentina to pay debts Elliott had purchased.[62]

Covington and Burling is a large, international law firm headquartered in Washington, D.C. Over the years, they have worked for vulture fund clients, including Aurelius Capital in its effort to extract debt payments from an Irish bank in 2011[63] and for Elliott Management in 2010.[64] In both these cases, the Covington and Burling attorney representing the vulture funds was Stuart Eizenstat. Eizenstat has held a number of federal government positions, most recently as Deputy Secretary of the Treasury before joining Covington and Burling in 2001.[65]

Covington and Burling is a large, international law firm headquartered in Washington, D.C. Over the years, they have worked for vulture fund clients, including Aurelius Capital in its effort to extract debt payments from an Irish bank in 2011[63] and for Elliott Management in 2010.[64] In both these cases, the Covington and Burling attorney representing the vulture funds was Stuart Eizenstat. Eizenstat has held a number of federal government positions, most recently as Deputy Secretary of the Treasury before joining Covington and Burling in 2001.[65]

Vulture Fund Trade Groups

Vulture funds, and other Wall Street interests, depend on favorable laws and regulations in the United States to protect their business strategy. Just like many other industries, hedge funds have organized powerful trade groups that advance their interests in Washington and in state governments.

These trade groups enable vulture funds, and the hedge fund industry, to flex their collective power and influence over policy and regulation.

Participation in these trade groups also serves to normalize the vulture fund strategy as these firms blend with other members from firms that do not employ these specific tactics. This association helps insulate vulture funds from the reputational damage that may accompany their tactics and instead validates their strategies as simply another financial strategy within the industry.

Participation in these trade groups also serves to normalize the vulture fund strategy as these firms blend with other members from firms that do not employ these specific tactics. This association helps insulate vulture funds from the reputational damage that may accompany their tactics and instead validates their strategies as simply another financial strategy within the industry.

While these trade groups primarily work to strengthen and defend the interests of Wall Street, vulture funds have a lot to gain from joining their ranks.

While these trade groups primarily work to strengthen and defend the interests of Wall Street, vulture funds have a lot to gain from joining their ranks.

Managed Funds Association

The Managed Funds Association (MFA) is a trade group representing the hedge fund sector. According to MFA’s filings with the IRS, the group’s purpose is “to enable hedge fund and managed futures firms in the alternative investment industry to participate in public policy discourse, share best practices and learn from peers, and communicate the industry’s contributions to the global economy.”[66]

Representatives of several vulture funds sit on the MFA board of directors[67], including:

- Susanne Clark, General Counsel and Senior Managing Director at Centerbridge Partners, which has made vulture investments in Puerto Rico’s retirement system[68];

- Eric Epstein, President of Davidson Kempner Capital Management, a hedge fund with vulture investments in Puerto Rico[69];

- Chris Hayward, President of GoldenTree Asset Management, which has made vulture investments in all kinds of Puerto Rico bonds; and

- Zion Shohet, Chief Operating Officer of Elliott Management, Paul Singer’s vulture fund, which has targeted countries around the world, including Argentina and the Republic of Congo[70]

In 2020, the most recent year for which records are available, the MFA reported bringing in more than $19.4 million in revenue, primarily from member dues, with a smaller amount from conference revenues.[71]

The Managed Funds Association spends millions of dollars on federal lobbying yearly –more than $16.8 million from 2019 through the third quarter of 2022 according to Open Secrets.[72] Their lobbying has targeted the Short Sale Transparency and Market Fairness Act, the Insider Trading Prohibition Act, and the Ending the Carried Interest Loophole Act.[73]

In New York, the Managed Funds Association reported spending $281,731 on compensation for in-house lobbyists and lobbying by the firm Bogdan and Lasky from 2019 through June of 2022.[74] The Managed Funds Association’s lobbying in New York has focused on state budgets, the stock transfer tax, and the carried interest loophole.[75]

Beyond lobbying spending, the Managed Funds Association reported spending more than $1.1 million in 2020 on communication services from Global Strategy Group, domestic and international legal services from Sidley Austin, and domestic legislative and regulatory services from Ernst and Young and Fierce Government Relations.[76]

American Investment Council

The American Investment Council (AIC) is a trade group that represents private equity firms and hedge funds. The American Investment Council describes itself as “established to develop and provide information about the private investment industry and its contributions to the long-term growth of the U.S. economy and retirement security of American workers.”[77]

The council’s membership includes the vulture fund Elliott Management as well as Brookfield Asset Management, which has targeted Puerto Rico for vulture investment.[78] Several law firms highlighted above are also members of AIC, including Latham & Watkins, Ropes & Gray, Weil, Gotshal & Manges, and Simpson Thacher & Bartlett.[79]

The American Investment Council brings in millions of dollars annually from membership dues. In the past five years for which records are available, AIC’s revenue has skyrocketed, more than tripling from $7.8 million in 2016 to nearly $25 million in 2020.[80]

Using this money, AIC retains highly-paid staff to advocate for its members’ interests. According to AIC’s most recent tax filing with the IRS, the council paid more than $2.3 million to President & CEO Drew Maloney.[81] Maloney has spent his career bouncing back and forth between government and corporate advocacy, most recently serving as the Assistant Secretary for Legislative Affairs at the Department of the Treasury during the first years of the Trump administration before joining AIC in 2018.[82]

The American Investment Council also spends a considerable amount of money on lobbying. According to Open Secrets, AIC’s federal lobbying expenditures have totaled over $2 million in the past three years, focused on areas like retaining the carried interest loophole, the Stop Wall Street Looting Act, and the Securities Fraud Enforcement and Investor Compensation Act, among others.[83] The council also regularly issues public comment letters on U.S. Securities and Exchange Commission rules connected to Wall Street regulation.[84] In New York State, the American Investment Council has spent an additional $575,000 on lobbying from 2019 through June 2022, with the firm Greenberg Traurig targeting several bills, including proposed regulations on carried interest and mezzanine debt.[85]

AIC also pours millions of dollars into influencing public and government opinion. In 2020, AIC reported spending more than $8.4 million on its top five highest-paid contractors.[86] AIC’s top independent contractors that year: strategic communications firm Sard Verbinnen & Co ($4,180,778), data science company Project Applecart ($2,045,018), digital marketing firm Targeted Victory LLC ($862,278), professional services conglomerate Ernst & Young ($830,000), and political journalism outlet Politico ($517,470).[87]

Other trade groups

The Managed Funds Association and the American Investment are two of the major trade groups that lobby for the hedge fund and private equity industry, including for vulture funds, However, there are several similar associations advocating for these kinds of firms as well. Other securities and financial industry trade groups include the Securities Industry and Financial Markets Association, the Institutional Limited Partners Association, the Alternative Investment Association, the Emerging Markets Trade Association, the Hedge Fund Association, the Investment Company Institute, the National Venture Capital Association, the Structure Finance Association, and the National Association of Investment Companies.

Debt Vultures Use Think Tanks, Universities, and Cultural Institutions for Credibility and to Improve their Public Image

The wealth accumulated by vulture fund managers allows them to bankroll – and obtain governance positions at – favored civil society institutions, thus affording them political and cultural influence and burnishing their reputations as philanthropists. Vulture fund managers hold positions at various institutions, from colleges and universities to influential think tanks to museums and art galleries. These relationships bolster the power and influence of vulture fund managers – and provide cover for their efforts to extract wealth from debt-saddled nations – by serving as markers of prestige that reward vulture investors with access to powerful networks of prominent people and positive publicity as charitable donors and patrons of the arts.

Paul Singer

Elliott Management chairman Paul Singer is the chairman of the board of trustees of the prominent right-wing think tank, the Manhattan Institute for Public Policy.[88] The Manhattan Institute is an essential cog in the production and dissemination of right-wing intellectualism in the United States, founded by Reagan administration CIA director William Casey.

Elliott Management chairman Paul Singer is the chairman of the board of trustees of the prominent right-wing think tank, the Manhattan Institute for Public Policy.[88] The Manhattan Institute is an essential cog in the production and dissemination of right-wing intellectualism in the United States, founded by Reagan administration CIA director William Casey.

In addition to Singer, the Manhattan Institute’s board of trustees houses executives from Wall Street and the corporate world, including Paulson & Co founder John Paulson, former AIG chairman and CEO Maurice R. “Hank” Greenberg, former George W. Bush administration official and Kirkland & Ellis partner Jay Lefkowitz, and Kathryn Wylde – the President and CEO of the Partnership for New York City.[89]

Led by Singer and the other powerful elites on its board, the Manhattan Institute pushes for harmful policies like “broken windows” policing[90], defunding the social safety net[91], and cutting taxes on the rich.[92] The institute has also driven moral panics around around critical race theory[93] and “gender ideology”[94] that has resulted in a wave of regressive legislation[95], as well as threats and harassment targeted at schools[96] and at hospitals that offer gender-affirming care.[97]

Led by Singer and the other powerful elites on its board, the Manhattan Institute pushes for harmful policies like “broken windows” policing[90], defunding the social safety net[91], and cutting taxes on the rich.[92] The institute has also driven moral panics around around critical race theory[93] and “gender ideology”[94] that has resulted in a wave of regressive legislation[95], as well as threats and harassment targeted at schools[96] and at hospitals that offer gender-affirming care.[97]

Singer also leads the Paul E. Singer Family Foundation, a private charity he uses to dispense money to favored causes. Singer’s foundation made $11.7 million in grants and contributions in 2020, the most recent year for which records are available.[98] Recipients include the Manhattan Institute ($1,100,000) and the Success Academies charter school network ($300,000)[99]

Singer also leads the Paul E. Singer Family Foundation, a private charity he uses to dispense money to favored causes. Singer’s foundation made $11.7 million in grants and contributions in 2020, the most recent year for which records are available.[98] Recipients include the Manhattan Institute ($1,100,000) and the Success Academies charter school network ($300,000)[99]

He is also the sponsor and namesake of the Singer Family Prize for Excellence in Secondary School Teaching at the University of Rochester (his alma mater) and a former trustee at Harvard Medical School.[100]

Steven Tananbaum

Steven Tananbaum is a founding partner and the chief investment officer of GoldenTree Asset Management – a vulture fund that has aggressively targeted Puerto Rico and earned hundreds of millions of dollars in profit from its investments in Puerto Rican debt.[101]

Steven Tananbaum is a founding partner and the chief investment officer of GoldenTree Asset Management – a vulture fund that has aggressively targeted Puerto Rico and earned hundreds of millions of dollars in profit from its investments in Puerto Rican debt.[101]

Tananbaum is an art collector who reportedly spent $10.9 million on two sculptures by Jeff Koons.[102] He sits on the board of trustees of New York’s Museum of Modern Art (MOMA).[103] and the museum has come under fire for its relationship with Tanenbaum. In 2019, activists highlighted GoldenTree’s predation on Puerto Rico and demanded Tananabaum’s removal from MOMA board.[104]

MOMA’s board of trustees includes other vultures: Daniel Och, who founded Puerto Rico debt vulture Och-Ziff Capital Management and served as CEO and then chairman until March 2019, and Larry Fink, the chairman and CEO of BlackRock.

Tananbaum is also a member of the Council on Foreign Relations – an elite, Wall Street-backed think tank that profoundly influences United States foreign policy.[105] Tananbaum has endowed CFR’s Steven A. Tananbaum Chair in International Economics “to ensure that international economics remains a point of focus for the Council in perpetuity.”[106]

Tananbaum is also a former trustee of Vassar College, a private liberal arts school in Poughkeepsie, New York.[107]

Larry Fink

Larry Fink is the CEO of BlackRock, the world’s largest asset manager with nearly $8 trillion in assets under management[108]. Fink’s seat at the top of the largest asset manager in the world has granted him profound influence in global affairs. As mentioned above, BlackRock has made vulture investments targeting various countries, including Zambia – where in September 2022, a group of economists called on BlackRock and other bondholders to agree to a restructuring deal as continuing to pay would be “economically inefficient and morally wrong.”[109]

Larry Fink is the CEO of BlackRock, the world’s largest asset manager with nearly $8 trillion in assets under management[108]. Fink’s seat at the top of the largest asset manager in the world has granted him profound influence in global affairs. As mentioned above, BlackRock has made vulture investments targeting various countries, including Zambia – where in September 2022, a group of economists called on BlackRock and other bondholders to agree to a restructuring deal as continuing to pay would be “economically inefficient and morally wrong.”[109]

As mentioned above, Fink sits on the board of trustees of the Museum of Modern Art alongside fellow debt vultures Steven Tananbaum and Daniel Ochs. Fink’s position on the MOMA board of trustees has also caused controversy for the museum due to BlackRock’s investments in private prisons.[110]

![]() Fink also holds seats at educational institutions. Fink is a member of the board of trustees of New York University[111] and NYU Langone Health,[112] the university-affiliated healthcare network. Additionally, Fink sits on the advisory board of the Tsinghua University School of Economics and Management, a top business school in Beijing.[113]

Fink also holds seats at educational institutions. Fink is a member of the board of trustees of New York University[111] and NYU Langone Health,[112] the university-affiliated healthcare network. Additionally, Fink sits on the advisory board of the Tsinghua University School of Economics and Management, a top business school in Beijing.[113]

Fink also sits on the board of directors of think tanks such as the Council on Foreign Relations[114] and the advisory council of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.[115] Fink is also a trustee of the World Economic Forum, the corporate-backed global

Fink also sits on the board of directors of think tanks such as the Council on Foreign Relations[114] and the advisory council of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.[115] Fink is also a trustee of the World Economic Forum, the corporate-backed global ![]() think tank best known for its lavish annual meeting in Davos, Switzerland, which attracts attendees from the commanding heights of business and government.[116]

think tank best known for its lavish annual meeting in Davos, Switzerland, which attracts attendees from the commanding heights of business and government.[116]

Fink is also on the executive committee of the Partnership for New York City’s board of directors,[117] an elite chamber of commerce representing major multinational corporations such as JPMorgan Chase, Pfizer, and IBM, as well as private equity firms and hedge funds.

Fink is also on the executive committee of the Partnership for New York City’s board of directors,[117] an elite chamber of commerce representing major multinational corporations such as JPMorgan Chase, Pfizer, and IBM, as well as private equity firms and hedge funds.

Conclusion

Vulture funds that invest in sovereign debt issued by countries in financial distress, extracting billions of dollars in profit from the pain and suffering of people living in those countries, cannot pursue this investment strategy on their own. These predatory investors rely on a more extensive system comprising armies of high-powered lawyers, networks of trade associations, lobbyists, and public relations experts with connections to the highest levels of government. They use think tanks, universities, and cultural institutions to win favorable treatment in the formal legal system, through regulatory policy, and inside the court of public opinion.

Because the State of New York hears federal vulture fund lawsuits so frequently, New York lawmakers can uniquely disrupt the vulture fund network. They can help hold these bad actors accountable by giving countries a framework to restructure their unsustainable debt, strengthening the champerty doctrine to prevent debt purchasing for the purpose of filing a lawsuit, and eliminating the carried interest loophole to ensure that vulture funds pay their fair share of taxes.

Policy Recommendations: New York State Must Act Now

Most sovereign debt contracts are governed by either New York or English law.[118] This means that New York is uniquely positioned to step in and disrupt the predatory playbook that has allowed vulture funds to profiteer at the expense of countries in financial trouble.

In the past few decades, New York law has played a key role in enabling the vulture fund playbook. In the absence of a uniform and binding international sovereign debt restructuring framework, vulture funds have weaponized New York law in their quest to extract as much wealth as possible from struggling countries. New York can act to stop this practice and change course by passing laws that would disrupt the vulture fund playbook.

1. Provide a Framework for Restructuring Unsustainable Sovereign and Subnational Debt

New York must pass a law to provide a framework for countries to restructure their unsustainable debt.

This framework would create a process where an indebted government could restructure its debt by reaching an agreement with most of its creditors, without being held hostage by a small minority of creditors. If the requisite number of creditors agree to the terms of a debt restructuring agreement, they could bind a minority of dissenting vulture fund creditors to the agreed terms.

This framework would disincentivize vulture funds from holding out on debt restructuring negotiations.[119]

During the last New York State legislative session, both the Senate and the Assembly[120] introduced legislation that would create this framework. Both chambers are expected to reintroduce the bill during the 2022 legislative session.

2. Bar the Purchase of Sovereign Debt for the Purpose of Filing a Lawsuit by Strengthening New York’s “Champerty” Law

New York should strengthen its champerty law, which is intended to prevent predatory financial actors from buying financial instruments for the purpose of filing a lawsuit.[121] In theory, this should mean that vulture funds are prohibited from buying the debt of struggling countries at a steep discount just to weaponize New York law to demand full repayment (and reap sky-high profits).

In practice, two important developments have unfortunately gotten in the way of the intended effect of existing law:

● First, a Court of Appeals decision gutted its intended impact by finding that a vulture fund did not violate the champerty law because filing a lawsuit was not the sole purpose of buying the discounted debt—filing a lawsuit was contingent on not being paid in full.[122]

However, the vulture fund could not have reasonably expected a country to pay them in full once it had already defaulted on its debt, unless it was forced to do so by a court.[123]

● Second, following intense lobbying efforts by Elliott Capital, the New York state legislature created a loophole that exempts debt transactions of over $500,000 from the law’s grasp.[124]

New York should strengthen its champerty law and make clear that it is unlawful for vulture funds to use New York law to profiteer from the distressed debt of struggling countries.

Additionally, the $500,000 loophole should be eliminated so that debt transactions of any amount are covered by the law.

3. Eliminate One of the Vulture Funds’ Favorite Tax Loopholes

In addition to engaging in predatory practices, vulture funds and their investors do not pay their fair share of taxes. Hedge fund managers are compensated in two ways: a fee defined by a percentage of the money being managed (usually 2%), and a percentage of the returns they obtain from investing their clients’ money (usually 20%).[125] The vast majority of their profits are obtained through the latter arrangement, but since the returns are considered capital gains, they are taxed at a much lower rate than wages.

In New York, both the Senate and the Assembly have introduced bills that would address this inequity. One bill would zero in on the 20% of returns that hedge fund managers pocket, taxing them as the wages they are;[126] the other would tax all capital gains as wages.[127]

|

|---|

Press and General Contacts

Julio López Varona

jlopez@populardemocracy.org

Center for Popular Democracy

He/him

Alicé Nascimento

ANascimento@nycommunities.org

New York Communities for Change

She/her

José González

jgonzalez@nycommunities.org

New York Communities for Change

He/him

Michael Kink

mkink@populardemocracy.org

Strong Economy For All Coalition/Hedge Clippers/Center for Popular Democracy

He/him

Whitney Hu

whu@cuffh.org

Churches United for Fair Housing

She/her

Robert Galbraith

rob@littlesis.org

Public Accountability Initiative/LittleSis

He/him

Acknowledgments

This report was written and researched by Robert Galbraith (Little Sis) and Maggie Corser (CPD). Supplemental research conducted by Abby Ang (CPD). Report was edited by Julio López Varona (CPD), Michael Kink (Strong for All), Whitney Hu (CUFFH), and Alicé Nascimento (NYCC). The report was copyedited by Sean Kornegay (CPD). Graphic and visual design by Ange Tran (AngeTran.net).

Appendix I – Key Vulture Fund Lawyers & Law Firms

According to court records accessed via Public Access to Court Electronic Records (PACER), the following lawyers and law firms played key roles representing vulture funds in New York courts. While not an exhaustive list, these law firms have confirmed involvement with vulture fund lawsuits against struggling countries in the Global South, including the Republic of Congo, Argentina, Ecuador, Venezuela, Peru, and Panama.

Elliott Associates/Kensington

- Robert A. Cohen, Dechert, Price & Rhoads

- Otto G. Obermaier, Weil, Gotshal & Manges LLP

- Michael Straus, Bainbridge & Straus,

- Ross Lawrence Hirsch, Dechert LLP (NYC)

- Kevin Samuel Reed, Quinn Emanuel

BNP Paribas

- Alycia Regan Benenati Kasowitz, Benson, Torres LLP

- Dwight A. Healy Holwell Shuster & Goldberg LLP

Contrarian Capital

- Elizabeth Kathleen Clarke, MoloLamken LLP

- Lauren F. Dayton, MoloLamken LLP

- Justin M Ellis, MoloLamken LLP (NYC)

- Steven Francis Molo, MoloLamken, LLP

- Michael Scott Bosworth Latham & Watkins LLP

- Christopher J. Clark Latham & Watkins LLP

- Robert Henry Hotz, Jr Latham & Watkins LLP

- Elizabeth Anna Parvis Latham & Watkins LLP

GMO Trust

- C. Thomas Brown, Ropes & Gray LLP

Aurelius

- Mark T. Stancil, Willkie Farr & Gallagher LLP

- Kimberly Ann Hamm, Simpson Thacher & Bartlett LLP

- Tyler Brooks Robinson, Simpson Thacher & Bartlett LLP (NY)

- Laura Denise Murphy, Simpson Thacher & Bartlett LLP (NY)

- Barry Robert Ostrager, Simpson Thacher & Bartlett LLP (NY)

- Melissa Kelly Driscoll, Menz Bonner Komar & Koenigsberg L.L.P.

- Eric Justin Finkelstein, Friedman Kaplan Seiler & Adelman LLP

- Edward A. Friedman, Friedman Kaplan Seiler & Adelman LLP

- Andrew W. Goldwater, Friedman, Kaplan, Seiler and Adelman

- Chad Michael Leicht, Friedman Kaplan Seiler & Adelman LLP

- Daniel Benjamin Rapport, Friedman, Kaplan, Seiler and Adelman

- Walter Rieman, Paul Weiss (NY)

- Lawrence Saul Robbins, Robbins, Russell, Englert, Orseck, Untereiner & Sauber LLP

- Emily Anne Stubbs, Friedman, Kaplan, Seiler and Adelman

- Michael Stephen Palmieri, Friedman Kaplan Seiler & Adelman LLP

- Maggie Corser, Robert Galbraith, and Natalia Renta, “Pain and Profit in Sovereign Debt: How New York Can Stop Vulture Funds from Preying on Countries,” Center for Popular Democracy, Churches United for Fair Housing, New York Communities for Change, Strong for All Economy, Public Accountability Initiative/LittleSis, December 2021, https://hedgeclippers.org/pain-and-profit-in-sovereign-debt-how-new-york-can-stop-vulture-funds-from-preying-on-countries/. ↑

- Steven L. Schwarcz, “A Model-law Approach to Restructuring Unsustainable Sovereign Debt,” Centre for International Governance Innovation, Policy Brief No. 64 — August 2015, Updated October 2017, https://www.cigionline.org/static/documents/documents/PB%20no.64%20Updated_1.pdf, 3. ↑

- Jonathan Blitzer, “Argentina’s Unending Debt,” New Yorker, April 24, 2014,https://www.newyorker.com/business/currency/argentinas-unending-debt; Daniel Fisher, “Paul Singer Wins Long Battle With Argentina; Have Emerging Market Bonds Hit Bottom?,” Forbes, February 29, 2016 https://www.forbes.com/sites/danielfisher/2016/02/29/paul-singer-wins-long-battle-with-argentina-have emerging-market-bonds-hit-bottom/?sh=181143051b8e. ↑

- Martin Guzman and Joseph E. Stiglitz, “How Hedge Funds Held Argentina for Ransom,” New York Times, April 1, 2016 https://www.nytimes.com/2016/04/01/opinion/how-hedge-funds-held-argentina-for ransom.html; Daniel Fisher, “Paul Singer Wins Long Battle With Argentina; Have Emerging Market Bonds Hit Bottom?,” Forbes, February 29, 2016,https://www.forbes.com/sites/danielfisher/2016/02/29/paul-singer-wins-long-battle-with-argentina-have-emerging-market-bonds-hit-bottom/?sh=4235872351b8. ↑

- Renae Merle, “How One Hedge Fund Made $2 Billion from Argentina’s Economic Collapse,” Washington Post, March 29, 2016, https://www.washingtonpost.com/news/business/wp/2016/03/29/how-one-hedge-fund-made-2-billion-from-argentinas-economic-collapse/; Mark Weisbrot and Luis Sandoval, “Argentina’s Economic Recovery Policy Choices and Implications,” Center for Economic and Policy Research, October 2007, https://www.issuelab.org/resources/711/711.pdf, 2; Martin Guzman and Joseph E. Stiglitz, “How Hedge Funds Held Argentina for Ransom,” New York Times, April 1, 2016, https://www.nytimes.com/2016/04/01/opinion/how-hedge-funds-held-argentina-for-ransom.html; “#261 Paul Singer,” Forbes, Accessed November 15, 2021 https://www.forbes.com/profile/paul singer/?sh=5b1623e8795e; Stephen Kim Park, and Tim R Samples, “Towards Sovereign Equity,” Stanford Journal of Law, Business & Finance, Vol. 21, No 2 (2016). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2630772, 251, 253-254. ↑

- “IMF may help bail out Argentina,” CNN, December 27, 2001, http://edition.cnn.com/2001/WORLD/americas/12/27/argentina.imf/index.html. ↑

- Daniel Schweimler, “How Argentina survived economic meltdown,” BBC, July 11, 2011https://www.bbc.com/news/world-latin-america-14102858. ↑

- “#261 Paul Singer,” Forbes, Accessed November 7, 2022 https://www.forbes.com/profile/paul singer/?sh=5b1623e8795e; Sheelah Kolhatkar, “Paul Singer, Doomsday Investor,” New Yorker, August 20, 2018, https://www.newyorker.com/magazine/2018/08/27/paul-singer-doomsday-investor. ↑

- Lucas Wozny, “National Anti-Vulture Funds Legislation: Belgium’s Turn,” Columbia Business Law Review (2017), Vol. 697 No. 2https://journals.library.columbia.edu/index.php/CBLR/article/view/1722/743, 715; D. Andrew Austin, “Puerto Rico’s Public Debts: Accumulation and Restructuring,” Congressional Research Service, May 18, 2021, https://sgp.fas.org/crs/row/R46788.pdf, 7-8; Liz Moyer “Argentina’s Debt Settlement Ends 15-Year Battle,” New York Times, February 29, 2016, https://www.nytimes.com/2016/03/01/business/dealbook/argentinas-debt-settlement-ends-15-year-battle.html. ↑

- Information on representing attorneys accessed via Public Access to Court Electronic Records (PACER) September 2022; “Elliott Associates, LP v. Republic of Panama, 975 F. Supp. 332 (S.D.N.Y. 1997),” Justia, https://law.justia.com/cases/federal/district-courts/FSupp/975/332/1458911/; Elliott Associates, LP v. Republic of Peru, 12 F. Supp. 2d 328 (S.D.N.Y. 1998), Justia, https://law.justia.com/cases/federal/district-courts/FSupp2/12/328/2499011/; “Elliott Associates, L.P. v. Banco de la Nacion,” Casetext, https://casetext.com/case/elliott-associates-lp-v-banco-de-la-nacion. Additional vulture fund attorneys representing Singer’s firm include Robert A. Cohen, Brian S. Rosen, Eli Gottesdiener, Steven M. Shebar, Paul M. Tarr, Ross Morrison, https://law.justia.com/cases/federal/district-courts/FSupp2/12/328/2499011/. ↑

- Vera Haller, “Wall Street Scandals V Life After Giuliani: Kindler, Gentler Approach to White-Collar Crime,” AP News, November 15, 1989, https://apnews.com/article/65408ddb352fc551f5edafb25589d694; “Ex-Prosecutor Joins Manhattan Law Firm,” New York Times, March 24, 1993https://www.nytimes.com/1993/03/24/nyregion/ex-prosecutor-joins-manhattan-law-firm.html. ↑

- Michele Galen, “Otto Obermaier Is No Rudy Giuliani,” Bloomberg, July 27, 1992, https://www.bloomberg.com/news/articles/1992-07-26/otto-obermaier-is-no-rudy-giuliani; Department of Justice, “Department Of Justice And Sec Enter $290 Million Settlement With Salomon Brothers In Treasury Securities Case,” May 20, 1992https://www.justice.gov/archive/atr/public/press_releases/1992/211182.htm. ↑

- Vera Haller, “Wall Street Scandals V Life After Giuliani: Kindler, Gentler Approach to White-Collar Crime,” AP News; Michele Galen, “Otto Obermaier Is No Rudy Giuliani,” Bloomberg. ↑

- US Department of Justice, “White Collar Crime: Business and Regulatory Offenses,” 1990, https://www.ojp.gov/ncjrs/virtual-library/abstracts/white-collar-crime-business-and-regulatory-offenses. ↑

- Robert D. McFadden, “MAN IN THE NEWS: Otto George Obermaier; Defender Who Would Be Prosecutor,” New York Times, January 21, 1989, https://www.nytimes.com/1989/01/21/nyregion/man-in-the-news-otto-george-obermaier-defender-who-would-be-prosecutor.html. ↑

- Information on representing attorneys accessed via Public Access to Court Electronic Records (PACER) September 2022. ↑

- “Kevin S. Reed,” accessed November 10, 2022, https://www.quinnemanuel.com/attorneys/reed-kevin-s/ ↑

- “Republic of Congo: Poverty Assessment Report,” World Bank Group, May 2017, https://openknowledge.worldbank.org/bitstream/handle/10986/28302/114706-v2-Republic-of-Congo-ENG-7-17-17-M2.pdf?sequence=1&isAllowed=y; “Congo Republic,” Organisation for Economic Co-operation and Development, https://www.oecd.org/dev/36746391.pdf, 213. ↑

- “Ad Hoc Group of Ecuador Bondholders announces support for the restructuring terms in the Republic of Ecuador’s Consent Solicitation and Invitation to Exchange relating to its outstanding sovereign bonds,” PR Newswire, July 20, 2020 https://www.prnewswire.com/news-releases/ad-hoc-group-of-ecuador-bondholders-announces-support-for-the-restructuring-terms-in-the-republic-of-ecuadors-consent-solicitation-and-invitation-to-exchange-relating-to-its-outstanding-sovereign-bonds-301096043.html. ↑

- Tom Arnold, Karin Strohecker, “UPDATE 1-Ecuador bondholders make counter offer in $17.4 bln debt revamp,” Reuters, July 13, 2020, https://www.reuters.com/article/ecuador-debtrenegotiation/update-1- ecuador-bondholders-make-counter-offer-in-17-4-bln-debt-revamp-idUKL5N2EK5M5?edition-redirect=uk ↑

- “The Republic of Ecuador Responds to Legal Action Filed by Contrarian Capital Management and GMO,” PR Newswire, July 30, 2020, https://www.prnewswire.com/news-releases/the-republic-of-ecuador-responds-to-legal-action-filed-by-contrarian-capital-management-and-gmo-301102747.html. ↑

- Allison Corkery, Andrés Chiriboga-Tejada, Jayati Ghosh, Demba Moussa and Adrian Falco, “Austerity is killing Ecuador. The IMF must help end this disaster,” The Guardian, August 29, 2020, https://www.theguardian.com/commentisfree/2020/aug/29/ecuador-austerity-imf-disaster ↑

- According to PACER records accessed October 2022 this included Michael Scott Bosworth; Christopher J. Clark; Robert Henry Hotz, Jr and Elizabeth Anna Parvis; “Latham & Watkins Named Capital Markets Law Firm of the Year,” June 3, 2021, https://www.lw.com/en/news/2021/06/latham-watkins-named-capital-markets-law-firm-chambers. ↑

- “Christopher J. Clark,” Accessed November 2022, https://www.lw.com/en/people/chris-clark. ↑

- “New York Partner Christopher Clark Named Crisis Leadership Trailblazer,” September 2, 2021, https://www.lw.com/en/news/2021/09/christopher-clark-crisis-leadership-trailblazer. ↑

- Vishal Shankar, “BigLaw Revolving Door Report,” Revolving Door Project, People’s Parity Project, July 21, https://therevolvingdoorproject.org/wp-content/uploads/2021/07/Latham-Watkins-BigLaw-Report.pdf, 4-5. ↑

- Katia Porzecanski and Nathan Gill, “GMO Settles With Ecuador Over Bonds That Defaulted in 2009,” Bloomberg, April 1, 2015, https://www.bloomberg.com/news/articles/2015-04-01/gmo-settles-with-ecuador-over-bonds-defaulted-on-six-years-ago. ↑

- “C. Thomas Brown,” https://www.ropesgray.com/en/biographies/b/c-thomas-brown; “Court Overturns Forced Sale of West Palm’s Oxbow Carbon,” Law.com, January 17, 2019, https://sports.yahoo.com/court-overturns-forced-sale-west-054800006.html. ↑

- David Dayen, “We Can Finally Identify One Of The Largest Holders Of Puerto Rican Debt,” The Intercept, October 3 2017, https://theintercept.com/2017/10/03/we-can-finally-identify-one-of-the-largest-holders-of-puerto-rican-debt; Kevin Connor, “How Seth Klarman, One of Puerto Rico’s Biggest Debt Vultures, Was Exposed,” Eyes on the Ties, October 10, 2017, https://news.littlesis.org/2017/10/10/how-seth-klarman-one-of-puerto-ricos-biggest-debt-vultures-was-exposed/. ↑

- “Trial and appellate litigator joins Wilkie’s Washington office,” Hedge Week, February 14, 2020, https://www.hedgeweek.com/2020/02/14/282991/trial-and-appellate-litigator-joins-wilkies-washington-office. ↑

- Nick Brown, “Puerto Rico’s warring creditors duel over sales tax revenue,” Reuters, April 10, 2018, https://www.reuters.com/article/puertorico-debt-bankruptcy/puerto-ricos-warring-creditors-duel-over-sales-tax-revenue-idINL1N1RN1UE; “Aurelius Capital Master, Ltd. v. Commonwealth of Puerto Rico, No. 18-1108 (1st Cir. 2019),” Justia, https://law.justia.com/cases/federal/appellate-courts/ca1/18-1108/18-1108-2019-03-26.html. ↑

- “Department profile: Simpson Thacher & Bartlett LLP,” Chambers & Partners, https://chambers.com/department/simpson-thacher-bartlett-llp-banking-finance-usa-5:6:12806:1:3655; “Kimberly Hamm, BlackRock, Global Public Policy Group,” Linkedin, https://www.linkedin.com/in/kimberly-hamm/. ↑

- US Securities and Exchange Commission, “Kimberly Hamm, Chief Counsel to SEC Chairman, to Conclude Tenure,” November 20, 2021, https://www.sec.gov/news/press-release/2021-11; “Kimberly Hamm,” Legistorm, https://www.legistorm.com/person/bio/227473/Kimberly_Ann_Hamm.html. ↑

- “Kimberly Hamm,” Legistorm; “BlackRock, world’s largest asset manager, loses record $1.7 trillion in one year,” QRIUS, https://qrius.com/blackrock-worlds-largest-asset-manager-loses-record-1-7-trillion-in-one-year/. ↑

- Zachary Mider and Ben Elgin, Bloomberg Businessweek, “How Hedge Funds (Secretly) Get Their Way in Washington,” January 25, 2018, https://www.bloomberg.com/news/features/2018-01-25/how-hedge-funds-secretly-get-their-way-in-washington. ↑

- Id. ↑

- Id. ↑

- Id. ↑

- Alleen Brown and Ryan Grim, “Inside the Scramble for Power in the Board Controlling Puerto Rico’s Financial Future”, The Intercept, December 22, 2020, https://theintercept.com/2020/12/22/trump-puerto-rico-debt-board-vulture/. ↑

- “Justin Peterson,” Financial Oversight & Management Board for Puerto Rico: https://oversightboard.pr.gov/justin-peterson/. ↑

- Natalia Renta, Maggie Corser, and Saqib Bhatti, “PROMESA Has Failed: How a Colonial Board is Enriching Wall Street and Hurting Puerto Ricans”, Center for Popular Democracy, September 2021, https://www.populardemocracy.org/sites/default/files/%5BENGLISH%5D%20PROMESA%20Has%20Failed%20Report%20CPD%20ACRE%209-14-2021%20FINAL.pdf. ↑

- Jack Casey, “Lobbying on Puerto Rico Bankruptcy Bill More Than Doubles in 2Q,” Bond Buyer, August 12, 2015, https://www.bondbuyer.com/news/lobbying-on-puerto-rico-bankruptcy-bill-more-than-doubles-in-2q. ↑

- Venable’s lobbying payments from these six firms can be seen by viewing each of the years from 2015 through 2020 at Venable’s lobbying profile at Open Secrets: https://www.opensecrets.org/federal-lobbying/firms/summary?id=D000022306. ↑

- Other vulture fund lobbyists at Venable are William R. Nordwind, Robert L. Smith Jr., and David A. Mullon Jr. See “Lobbyists” tab for years 2015-2020 at Venable’s lobbying profile at Open Secrets: https://www.opensecrets.org/federal-lobbying/clients/summary?cycle=2015&id=D000044215. ↑

- “Capitol Hill Veteran Daris Meeks Rejoins Venable’s Legislative and Government Affairs Practice,” Venable, February 12, 2018, https://www.venable.com/about/news/2018/02/capitol-hill-veteran-daris-meeks-rejoins-venables. ↑

- “Employment History – Meeks, Daris,” Open Secrets, https://www.opensecrets.org/revolving/rev_summary.php?id=77650. ↑

- Id. ↑

- “Andrew Olmem,” LinkedIn, https://www.linkedin.com/in/andrew-olmem-b0b4b21/details/experience/. ↑

- Id. ↑

- Id. ↑

- “Employment History – Stupak, Bart” Open Secrets, https://www.opensecrets.org/revolving/rev_summary.php?id=76618. ↑

- “The Honorable Bart Stupak,” Venable, https://www.venable.com/professionals/s/the-honorable-bart-stupak. ↑

- “Bart Stupak, Former Congressman and Chair of House Energy and Commerce Subcommittee, Joins Venable”, Venable, April 11, 2011, https://www.venable.com/about/news/2011/04/bart-stupak-former-congressman-and-chair-of-house. ↑

- “Lobbyist Profile, Bart Stupak, 2019”, Open Secrets, ttps://www.opensecrets.org/federal-lobbying/lobbyists/summary?cycle=2019&id=Y0000046398L. ↑

- “Lobbying Firm Profile: Venable LLP, 2015,” Open Secrets, https://www.opensecrets.org/federal-lobbying/firms/summary?cycle=2015&id=D000022306. ↑

- “Lobbying Firm Profile: Venable LLP, 2016,” Open Secrets, https://www.opensecrets.org/federal-lobbying/firms/summary?cycle=2016&id=D000022306. ↑

- Vann R. Newkirk II, “The Peril of Privatizing Prepa”, The Atlantic, January 24, 2018, https://www.theatlantic.com/politics/archive/2018/01/puerto-rico-will-privatize-prepa/551342/. ↑

- Darren Sweeney, “Joint venture wins 15-year contract to run Puerto Rico electric grid”, S&P Global Market Intelligence, June 22, 2020, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/joint-venture-wins-15-year-contract-to-run-puerto-rico-electric-grid-59143354. ↑

- Gloria Gonzalez, “Fiona’s outages rekindle anger over Puerto Rico’s privatized electric grid,” Politico, September 22, 2022, https://www.politico.com/news/2022/09/19/fiona-puerto-rico-electric-grid-00057637. ↑

- Elliott Management’s federal lobbying spending can be seen by viewing each of the years from 2009 through 2017 at Elliott’s lobbying profile at Open Secrets: https://www.opensecrets.org/federal-lobbying/clients/hired-firms?id=D000021972. ↑

- Elliott Management’s lobbying spending in New York can be seen by viewing lobbying reports at the New York Commission on Ethics and Lobbying in Government. See reports from 2014 through 2018 at: https://reports.ethics.ny.gov/LegacyPublicQuery/Administration/LB_QReports.aspx?x=EKBxOlaXwvRwIVErbG6%2bVKZ4D97AXGmMAoZasmsgGE0HXp2vNFVR9yQEYGF%2bZqEUDJBsbjVctV4NgAGa%2fRTI7uOMPftTC8MqADQkBYlTJ4Du8yQs7UEdemlV2ipIOjAO5DFjX3iF7fUbSS3KrnFaizQGGiEFl31%2fLizWKEIf2b9u; reports from 2019 through 2020 at: https://reports.ethics.ny.gov/publicquery//ViewSingle/MTAwNDEyMXxFTExJT1RUIE1BTkFHRU1FTlQgQ09SUE9SQVRJT041; and reports from 2021 through 2022 at: https://reports.ethics.ny.gov/publicquery//ViewSingle/MTAwNDEyMXxFTExJT1RUIE1BTkFHRU1FTlQgQ09SUE9SQVRJT041. ↑

- Lobbying Report – Q2 2011, Malkin & Ross, July 5, 2011, https://lda.senate.gov/filings/public/filing/98719364-8404-46cc-ae73-d80ae6e9192c/print/. ↑

- Lobbying Report – Q2 2011, Covington & Burling, July 18, 2011, https://lda.senate.gov/filings/public/filing/b8960d16-333f-4e00-9a42-1d284c192a2e/print/. ↑

- Lobbying Report – Q4 2010, Covington & Burling, January 1, 2011, https://lda.senate.gov/filings/public/filing/e2f8b87b-2683-4bde-9129-fc383e34e7b4/print/. ↑

- “Employment History – Eisenstat, Stuart E,” Open Secrets: https://www.opensecrets.org/revolving/rev_summary.php?id=19277. ↑

- Form 990, Managed Funds Association, July 30, 2021, https://projects.propublica.org/nonprofits/organizations/770277826/202132119349300003/full, 1. ↑

- “Board,” Managed Funds Association, https://www.managedfunds.org/about-mfa/board-of-directors/. ↑

- Joel Cintrón Arbasetti, “Uncovered: Two of the Ghost Companies Claiming Retirement System Debt in Puerto Rico,” Centro de Periodismo Investigativo, December 3, 2017, https://periodismoinvestigativo.com/2017/12/uncovered-two-of-the-ghost-companies-claiming-retirement-system-debt-in-puerto-rico/. ↑

- Abner Dennis, “The 21 Vulture Funds Stalking Puerto Rico’s Central Government: Legal Challenges, Investments, Insider Trading,” Public Accountability Initiative, August 5, 2020, https://public-accountability.org/report/the-21-vulture-funds-stalking-puerto-ricos-central-government-legal-challenges-investments-insider-trading/. ↑

- “Paul Singer: Vulture Fund Pioneer,” Hedge Clippers, April 2015, https://hedgeclippers.org/wp-content/uploads/2015/04/HP8-1.pdf. ↑

- Form 990, Managed Funds Association, July 30, 2021, 9. ↑

- Managed Funds Association’s federal lobbying spending can be seen by viewing each of the years from 2019 through 2022 at MFA’s lobbying profile at Open Secrets: https://www.opensecrets.org/federal-lobbying/clients/summary?id=D000022096. ↑

- Bills that Managed Funds Association lobbied on can be seen by viewing each of the years from 2019 through 2022 in the “Bills” tab of MFA’s lobbying profile at Open Secrets: https://www.opensecrets.org/federal-lobbying/clients/summary?id=D000022096. ↑

- Managed Funds Association’s New York lobbying spending can be seen by viewing reports from 2019 through 2022 at the New York State Commission on Ethics and Lobbying in Government: https://reports.ethics.ny.gov/publicquery//ViewSingle/MTAwMzU4NHxNQU5BR0VEIEZVTkRTIEFTU09DSUFUSU9O0. ↑

- See, e.g. July-August 2020 Bimonthly Report (lobbying on stock transfer tax): https://reports.ethics.ny.gov/publicquery/ViewFiling/BIMO/Mjg4NzUz0; January-February 2021 Bimonthly Report (lobbying on carried interest tax): https://reports.ethics.ny.gov/publicquery/ViewFiling/BIMO/MjQ3MTYw0; and March-April 2021 Bimonthly Report (lobbying on stock transfer tax and state budget): https://reports.ethics.ny.gov/publicquery/ViewFiling/BIMO/MjU3NTAy0. ↑

- Form 990, Managed Funds Association, July 30, 2021, 8. ↑

- “About the AIC,” American Investment Council, https://www.investmentcouncil.org/the-council/about-the-council/. ↑

- Abner Dennis, “The 21 Vulture Funds Stalking Puerto Rico’s Central Government: Legal Challenges, Investments, Insider Trading,” Public Accountability Initiative, August 5, 2020. ↑

- “About the AIC – Our Members”, American Investment Council, https://www.investmentcouncil.org/about-the-aic/#our-members. ↑

- “American Investment Council,” ProPublica Non-Profit Exlporer, https://projects.propublica.org/nonprofits/organizations/870792910. ↑

- Form 990, American Investment Council, March 4, 2021, https://projects.propublica.org/nonprofits/organizations/870792910/202102659349300510/full, 8. ↑

- “Employment History – Maloney, Drew,” Open Secrets, https://www.opensecrets.org/revolving/rev_summary.php?id=24689. ↑

- American Investment Council’s lobbying spending and targeted bills can be viewed in the “Lobbying” tab of AIC’s profile on Open Secrets: https://www.opensecrets.org/orgs/american-investment-council/lobbying?id=D000036835. ↑

- “Comment Letters,” American Investment Council, https://www.investmentcouncil.org/category/comment-letters/. ↑

- American Investment Council’s New York State lobbying spending at targets can be seen in reports to the New York Commission on Ethics and Lobbying in Government from 2019 through 20202: https://reports.ethics.ny.gov/publicquery//ViewSingle/MTAyMDY3NHxBTUVSSUNBTiBJTlZFU1RNRU5UIENPVU5DSUw1. ↑

- Form 990, American Investment Council, March 3, 2021, 8. ↑

- Id. ↑

- “Board of Trustees,” Manhattan Institute, https://www.manhattan-institute.org/board-of-trustees. ↑

- Id. ↑

- John Ketcham, “Broken Windows Policing Is Exactly What NYC Needs Now,” Manhattan Institute, March 26, 2022, https://www.manhattan-institute.org/ny-oped-broken-windows-nyc-adams-nypd. ↑

- Brian Riedl, “Fix Social Security And Medicare To Protect Other Priorities,” Peter G. Peterson Foundation, https://www.pgpf.org/expert-views/americas-fiscal-and-economic-outlook/fix-social-security-and-medicare-to-protect-other-priorities. ↑

- Allison Schrager and Beth Akers, “Issues 2020: What’s Wrong with a Wealth Tax,” October 8, 2020, https://www.manhattan-institute.org/whats-wrong-with-a-wealth-tax. ↑

- Sarah Jones, “How to Manufacture a Moral Panic,” New York, July 11, 2021, https://nymag.com/intelligencer/2021/07/christopher-rufo-and-the-critical-race-theory-moral-panic.html. ↑

- Trip Gabriel, “He Fuels the Right’s Cultural Fires (and Spreads Them to Florida),” New York Times, April 24, 2022, https://www.nytimes.com/2022/04/24/us/politics/christopher-rufo-crt-lgbtq-florida.html. ↑

- Tegann Finn, “DeSantis pushes bill targeting critical race theory in schools,” NBC News, December 15, 2021, https://www.nbcnews.com/politics/politics-news/desantis-pushes-bill-targeting-critical-race-theory-schools-n1286049. ↑

- Gabriella Borter, Joseph Ax, and Joseph Tefani, “School boards get death threats amid rage over race, gender, mask policies,” Reuters, February 15, 2022 https://www.reuters.com/investigates/special-report/usa-education-threats/. ↑

- Brandy Zadrozny and Phil McCausland, “Boston Children’s Hospital warns employees over far-right online harassment campaign,” NBC News, August 16, 20221, https://www.nbcnews.com/tech/internet/boston-childrens-hospital-warns-employees-far-right-online-harassment-rcna43376. ↑

- Form 990, Paul E. Singer Foundation, September 28, 2021, https://projects.propublica.org/nonprofits/display_990/272009342/download990pdf_04_2022_prefixes_26-33%2F272009342_202011_990PF_2022042019905537. ↑

- Id. ↑

- “Singer Family Prize for Excellence in Secondary School Teaching,” University of Rochester, http://www.rochester.edu/college/singerprize/. ↑

- “Pain and Profit – Rosselló is gone but vultures still prey on Puerto Rico”, Hedge Clippers, August 2019, https://hedgeclippers.org/hedge-papers-no-68-pain-and-profit-rossello-is-gone-but-vultures-still-prey-on-puerto-rico/. ↑

- Eileen Kinsella, “‘Something Is Rotten in the State of Denmark’: Collector Sues Jeff Koons and Gagosian for Failure to Deliver Promised Sculptures,” Art Net, April 19, 2018, https://news.artnet.com/art-world/collector-sues-jeff-koons-and-gagosian-gallery-1269605. ↑

- “Officers and trustees,” The Museum of Modern Art, https://www.moma.org/about/trustees. ↑

- Zachary Small, “Protesters call for removal of MoMA trustee linked to Puerto Rican debt crisis,” The Art Newspaper, October 17, 2019, https://www.theartnewspaper.com/2019/10/17/protesters-call-for-removal-of-moma-trustee-linked-to-puerto-rican-debt-crisis. ↑

- “Steven A. Tananbaum Chair in International Economics,” Council on Foreign Relations, https://www.cfr.org/steven-tananbaum-chair-international-economics. ↑

- Id. ↑

- Form 990, Vassar College, May 13, 2016, https://projects.propublica.org/nonprofits/organizations/141338587/201641349349307109/full. ↑